Using media to manipulate the future, what exactly is a16z up to?

TechFlow Selected TechFlow Selected

Using media to manipulate the future, what exactly is a16z up to?

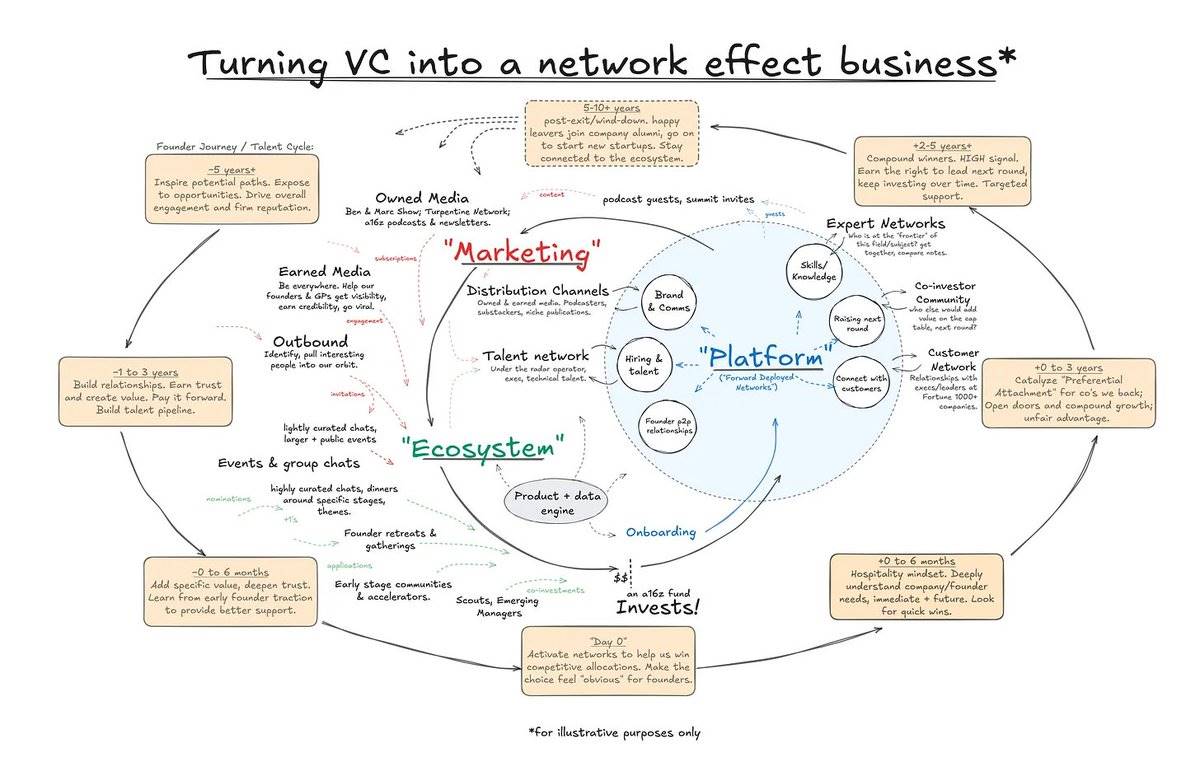

a16z is building a sophisticated media infrastructure.

Author: @aaronjmars

Translation: TechFlow

Andreessen Horowitz (commonly known as @a16z) is undergoing a fundamental transformation. Once regarded as one of Silicon Valley's premier venture capital firms, it is now evolving into a more ambitious organization—an engine fully coordinating technology with political reality.

In August 2025, the clearest signal emerged: Alex Danco (@Alex_Danco) joined a16z as Editor-at-Large to lead the firm’s entire written content output. This appointment was not merely a public relations role. Danco views writing as a "technology of power transfer," believing legitimacy is not unilaterally "granted" by institutions but achieved through "mutual illumination" between authors and readers.

Yet Danco’s arrival is only one piece of this vast machine. In November 2025, a16z released its New Media Manifesto, revealing an operational model far beyond traditional venture capital. The firm now explicitly offers a service called "Timeline Takeover"—coordinated content across video, podcasts, articles, and social media aimed at helping portfolio companies “win a day on the internet.”

Building a Media Machine: a16z’s Narrative Revolution

a16z is constructing a sophisticated media infrastructure. Led by Erik Torenberg (@eriktorenberg), the New Media team brings together internal creators dubbed “online legends,” and “forward-deployed New Media” staff who embed directly within portfolio companies during product launches. Additionally, they’ve built a high-impact talent network to amplify selected narratives.

In October 2025, David Booth (@david__booth) joined a16z as Partner and Head of Ecosystem, focusing on building what he calls a “preferential attachment” mechanism. This system aims to channel resources, talent, and attention toward a16z portfolio companies rather than competitors. As Marc Andreessen (@pmarca) explained when announcing Booth’s hiring, startups need entry into a “virtuous cycle of accumulation… from qualified executives and technical employees, to future follow-on funding, brand momentum, public perception, customers, revenue, and even influence in government.”

To further strengthen its media presence, a16z plans to launch an eight-week New Media Fellowship in January 2026, training operators, creators, and storytellers and placing them within portfolio companies. This is not mere consulting—it’s a parallel talent pipeline specifically designed for narrative warfare.

The operational capacity a16z has demonstrated is staggering. The team publishes five times per week across multiple channels, runs an in-house video production unit trained on-site by figures inspired by “New Media legends” like MrBeast, and maintains “group chats, dinners, events, and hidden networks” that help talented and trusted individuals connect.

One portfolio company illustrates the logical endpoint of this media machine: DoubleSpeed (@rareZuhair). This company uses AI to control thousands of social media accounts, ensuring their behavior is “as human-like as possible.” Its tagline is blunt and bold: “Never hire people again.”

The Twitter Front Lines

a16z’s media infrastructure ambitions trace back to 2022, when the firm invested $400 million to support Elon Musk’s acquisition of Twitter. By September 2024, that investment had reportedly lost $288 million—but financial loss was not the point. Ben Horowitz (@bhorowitz) stated at the time: “Elon is the only person we know—and possibly in the world—with the courage, intelligence, and capability to solve these problems and build the kind of public square we all want and deserve.”

a16z quickly embedded personnel into the Twitter team. Sriram Krishnan (@sriramk), an a16z general partner focused on crypto, publicly announced he was “temporarily helping Elon Musk run Twitter with other great folks,” adding: “I (and a16z) believe this is an exceptionally important company that can have a massive impact on the world.”

Infrastructure for Prediction Markets

Yet the media machine is only part of a16z’s strategy. In his essay “Prediction: The Successor to Postmodernism,” Alex Danco argues prediction markets represent a foundational reordering of civilization—comparable in significance to modernism and postmodernism.

In October 2025, a16z co-led a $300 million Series D round for Kalshi, a prediction market platform, at a $5 billion valuation. Partner Alex Immerman said prediction markets have the “opportunity to become the largest and most important financial markets of the future.”

a16z attempted to place its executive and Kalshi board member Brian Quintenz (@CFTCquintenz) as head of the U.S. Commodity Futures Trading Commission (CFTC), the agency regulating prediction markets. However, amid major controversy over conflicts of interest and opposition from figures in the crypto space including the Winklevoss brothers, the White House withdrew Quintenz’s nomination in September or October 2025. This failed nomination revealed both a16z’s ambition to shape regulatory outcomes and its current limitations.

Meanwhile, trading volume in prediction markets has exploded. From early June 2024 through election week, volume grew 42-fold, with platforms like Polymarket and Kalshi reaching monthly trading volumes in the billions. During the 2024 election, journalists and Wall Street traders began relying on prediction markets—which “outperformed polls”—as “signals the world could follow.”

When CEOs like Brian Armstrong begin referencing specific cryptocurrencies in investor communications based on market signals, the feedback loop becomes clear: markets are not just predictive tools—they are coordinating reality.

Even a16z’s own market design expert, Scott Kominers (@skominers), acknowledges, “prediction markets aren’t always ideal information aggregators: even for global ‘macro’ events, they may not be reliable; and for ‘micro’ questions, the prediction pool might be too small to yield meaningful signals.” Yet Kalshi’s annualized trading volume has grown to over $50 billion—more than 25 times since early 2024. At this scale, the line between prediction and coordination blurs.

Restructuring the Political Landscape

Marc Andreessen supported Hillary Clinton in 2016, even tweeting “I’m with her.” But by 2024, his stance had completely shifted. He and Ben Horowitz donated over $5 million to pro-Trump groups, with Andreessen alone contributing up to $33.5 million to pro-crypto political organizations—more than six times what he gave directly to Trump.

Andreessen said Biden’s proposal to tax unrealized capital gains was the “straw that broke the camel’s back,” as it would force startups to pay taxes on valuation growth. He criticized the Biden administration for pursuing a “soft authoritarian social revolution” and cited direct government pressure and censorship targeting tech companies.

This coordinated effort extends into more covert layers. Andreessen organized WhatsApp group chats that became “meme sources for mainstream discourse,” described as the modern equivalent of samizdat—underground publications—that drove a nationwide “vibe shift.” These encrypted, self-destructing chat groups are referred to as the “dark matter of American politics and media,” where “an astonishing political pivot toward Trump was shaped and negotiated.”

Erik Torenberg, current head of a16z’s New Media team, played a key role in organizing these groups. The same person coordinating a16z’s “Timeline Takeover” service is also shaping the political group chats that influenced the 2024 election narrative.

a16z’s Legitimacy Architecture

a16z sees itself as a “legitimacy bank,” where entrepreneurs can “draw legitimacy on credit or make deposits of legitimacy.” This is more than metaphor. In their essay “How to be Legitimate,” Alex Danco and former Microsoft executive Steven Sinofsky outline the history of legitimacy-building in tech—from 1960s Special Interest Groups, to 1980s PC Magazine reviews, to today’s ecosystem of coordinated influence.

The central insight: once a legitimacy architecture is established, you’re no longer selling products—you’re selling visions of the future. As Sinofsky explains, when Microsoft sold to enterprises, “they just wanted to hear my ten-year plan.” Legitimacy comes from your ability to “credibly predict the future.”

This is precisely what a16z is building: by controlling the infrastructure on which we rely to understand what’s possible, certain futures come to seem inevitable.

Integration of the Tech Ecosystem

In April 2025, a16z formally launched the American Innovators Network alongside Y Combinator and several AI companies, positioning itself as “America’s small tech ecosystem” and claiming leadership in the next wave of innovation. Their public stance: “If a candidate supports an optimistic, technology-driven future, we support them. If they want to kill important technologies, we oppose them.”

Consider the ecosystem a16z has already built:

-

Media Infrastructure: A New Media team led by Torenberg offering “timeline takeover as a service,” in-house production capabilities, and frontline narrative experts.

-

Talent Pipeline: Training teams via the New Media Fellowship placed within portfolio companies.

-

Platform Play: A $400 million investment in Twitter/X, with personnel embedded during transition.

-

Market Infrastructure: Major investor in Kalshi ($5B valuation), betting on prediction markets as coordination mechanisms.

-

Coordination Networks: Including WhatsApp groups, dinners, and “hidden networks that connect talented and trusted individuals.”

-

Political Alliances: Direct ties to the Trump administration, with political donations exceeding $40 million.

-

Regulatory Influence Attempts: Though Quintenz’s nomination failed, it reveals both ambition and current limits.

F1 Pit Stop Theory

a16z uses an F1 racing metaphor to describe itself. General Partners are the drivers, but “the race is won long before it starts—by the team that designs the best chassis, hires top engineers, trains the pit crew, and builds a fanbase to sustain sponsorship.”

As David Booth wrote: “Adrian Newey never won a race, but his arrival as CTO at Red Bull transformed them from a money-burning mid-tier team into a generation-defining world champion. The top VCs of the next decade will need not just the best ‘drivers,’ but deliberate investment in the ‘machines on the track.’”

The machine a16z is building has multiple engines: one manufacturing legitimacy through coordinated media; one aligning capital and attention via prediction markets; one shaping political outcomes through encrypted chats and strategic donations; one directing talent flow through fellowships and “ecosystem” infrastructure.

What Does This Mean?

When prediction markets are widely adopted and integrated with media machines, they cease to be mere forecasting tools. Markets generate “a real-time probability more disciplined than polls, pundits, or headlines”—and when journalists, traders, and corporate leaders act on these probabilities, the markets become self-fulfilling.

According to a16z’s own framework, “prediction” is emerging as the new paradigm after postmodernism—a new way to organize human attention, capital, and action. a16z has positioned itself at every critical node:

-

They invest in platforms that set odds;

-

They employ media teams that decide which issues matter;

-

They organize group chats that coordinate political strategy;

-

They train the next generation of talent startups will need;

-

They attempted (but temporarily failed) to place their people in regulatory bodies.

This is not conspiracy, but a complex institution designed by those who deeply understand that “controlling the infrastructure of belief is more valuable than controlling the infrastructure of production.”

The failure of Quintenz’s nomination shows this strategy still has limits. Internal opposition from the crypto community, concerns over conflicts of interest, and complex political dynamics can still block overt attempts at “regulatory capture.”

But the broader machine continues running. The New Media team keeps expanding, prediction markets keep growing, coordination networks deepen, and fellowship programs begin placing trained narrative operatives into portfolio companies.

The goal of this game is not to predict the future—but to build the infrastructure that determines which futures are intelligible, which questions get asked, and which answers appear authoritative.

a16z is openly constructing this infrastructure and displaying remarkable transparency about what it’s doing—while most are still debating whether prediction markets are “more accurate than polls.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News