Analyzing M^0: A Rising Stablecoin Startup with $50 Million in Funding

TechFlow Selected TechFlow Selected

Analyzing M^0: A Rising Stablecoin Startup with $50 Million in Funding

The M^0 protocol could have a significant impact on the stablecoin industry by offering a more transparent and decentralized product.

Written by: Global Coin Research

Translated by: Luffy, Foresight News

M^0 is a decentralized stablecoin protocol where permissioned participants can mint M tokens backed by collateral approved by the protocol. Users of M^0 can earn yield from held collateral while using dollar-pegged stablecoins. The protocol was initially launched on Ethereum and will expand to other L1 and L2 networks. Core team members of M^0 come from projects such as MakerDAO and Circle.

Vision of M^0

The current stablecoin market is dominated primarily by two fiat-backed stablecoins: USDT and USDC. However, neither allows direct on-chain verification of reserves, leading to opacity. If any bank holding reserves encounters issues, the entire reserve system faces contagion risk. On the other hand, algorithmic stablecoins have failed to gain significant traction due to mechanism flaws causing de-pegging events. In contrast, crypto-collateralized stablecoins have operated successfully for some time but suffer from high volatility in their underlying collateral.

To address these issues, M^0 aims to provide infrastructure for issuing self-custodied stablecoins based on blockchain technology. The protocol ensures fungibility of every minted M stablecoin, with custodians operating independently to avoid contagion risk. To ensure trust and transparency, the protocol will conduct regular on-chain validation of reserves backing the M supply, ensuring M tokens maintain stable value.

Ecosystem Participants

In the M^0 protocol, three main participants play distinct roles:

Minters: Participants authorized to mint M tokens. Their role resembles financial service providers, such as stablecoin issuers. Minters must provide independent collateral and submit proof of reserves. They are also responsible for updating the on-chain value of collateral to ensure sufficient balance to repay debt. Additionally, minters pay fees to the protocol. To incentivize participation in the M ecosystem, minter fees must be lower than the yield earned on collateral (net income is also influenced by the mint-to-collateral ratio parameter, since fees are charged based on the outstanding M balance rather than deposited collateral value).

Verifiers: Responsible for confirming the validity of minter collateral by providing signatures and executing on-chain proof-of-reserves. Verifiers act as supervisors over minters and can take action to restrict a minter’s activities if systemic threats arise. The M^0 protocol does not provide incentives for verifiers, so it is expected they will enter binding off-chain agreements with minters that include specific terms and compensation. The verifier role is analogous to auditors in traditional finance and commerce.

Yielders: Entities approved through governance processes who benefit from yield mechanisms. Their yield depends on a governance-set yielder rate, adjusted further by fund utilization (the ratio of circulating M within the yield mechanism to total M), with the final rate being the lower of the two. This mechanism aligns yield with fees paid by minters, ensuring system stability. Yielders represent demand for M tokens. Yielders in the M^0 protocol include institutional holders and distributors of M tokens.

Additionally, custodians—though less interactive with the protocol—play a critical role. They are professional agents approved by the protocol's governing body responsible for holding collateral backing M tokens. They must possess technical and operational capabilities and hold operating licenses. All collateral custodians must operate independently from minters.

Any qualified participant may be removed from the protocol ecosystem via governance voting proposals. Once removed, they cannot engage in protocol activities except to repay outstanding debts.

Asset Characteristics of M

M is a permissionless ERC20 token that anyone can buy or sell on secondary markets. However, its creation, maintenance, and destruction are managed by governance-approved minters and verifiers. While backed by certain assets, M is not a tokenized version of those assets; instead, these assets support its value and credibility. This makes M as secure as its underlying collateral, though DeFi protocols introduce additional risks.

The circulating value of M must not exceed the value of collateral held by custodians, as this could lead to M depreciation and undermine protocol stability. M’s peg to $1 is maintained through arbitrage mechanisms. If M trades above $1 on secondary markets, minters may deposit collateral to mint more M. Conversely, if M trades below $1, minters may purchase M to redeem their collateral. For minters creating M tokens, they must hold sufficient off-chain collateral approved by the protocol, with verified value. Minters display information about collateral value along with verifier signatures proving correctness, ensuring protocol security and integrity. Based on this, minters specify the number of M tokens they wish to mint. The system verifies whether the collateral value multiplied by the minting ratio (collateral-to-token ratio) exceeds the total value of M to be minted. Additionally, M^0 introduces a minting delay, giving verifiers time to block transactions if violations occur. If no intervention is needed, minters complete the token generation process and send tokens to their designated addresses. Minters can destroy their M tokens at any time to redeem collateral.

Is M Just Another Stablecoin?

In many ways, M resembles typical stablecoins currently available in the market. Like fiat-backed stablecoins, M is backed by cash equivalents such as Treasury bills. However, unlike competitors, M implements on-chain verification of collateral, ensuring greater transparency. Independent entities storing collateral minimize contagion risk. Another key difference lies in the process of minting new tokens. Stablecoins like USDT or USDC typically rely on a single entity to coordinate new token issuance, resulting in excessive centralization. In contrast, the M^0 protocol allows an unlimited number of minters to participate, subject to governance approval.

The M^0 protocol does not include a blacklist function and therefore will not freeze individual tokens. This contrasts sharply with other stablecoins, whose blacklist functions are intended to combat fund theft. Delegating decision-making on critical issues within M^0 to governance reflects a more flexible approach to management and project development. Some yield-bearing stablecoins in the crypto market allow users to automatically earn interest simply by holding tokens. M itself does not offer this functionality, but the underlying collateral generates passive income. Unfortunately, solutions used in yield-bearing stablecoins face regulatory restrictions because they are treated as securities, which are prohibited in major markets like the United States. However, M^0’s design mechanism is likely to avoid such limitations. M requires over-collateralization, similar to crypto-backed stablecoins, yet its collateral types are more price-stable, reducing de-peg risk and simplifying the mechanism for maintaining stablecoin value.

In summary, the M^0 protocol aims to deliver a fully autonomous, secure, and transparent stablecoin, enabling minters to earn yield from their collateral. Important decisions within the M^0 protocol are governed by its governance body, making the project more decentralized.

Governance

The M^0 protocol employs a governance mechanism known as Two-Token Governance (TTG). TTG aims to ensure neutrality in protocol governance, prevent fraud and control by malicious actors, and determine key protocol parameters related to rates and participant approvals. The TTG mechanism in M^0 operates in 30-day cycles called epochs, divided into two 15-day phases: Transfer Epoch and Voting Epoch. The Transfer Epoch collects proposals and allows voting power to be delegated to other addresses, while the Voting Epoch focuses on voting on proposals. TTG involves two types of tokens responsible for core decision-making: POWER and ZERO. POWER tokens are used to vote on active proposals, allowing holders to directly govern the protocol. As a reward for participating in voting, token holders receive ZERO tokens, which are more passive in voting as they are reserved only for the most important updates. Both tokens have inflationary mechanisms: the supply of POWER increases by 10% each epoch, while the supply of ZERO increases by up to 5,000,000 tokens, distributed proportionally. Any unclaimed POWER tokens are auctioned via Dutch auction, while corresponding ZERO tokens are not minted.

In TTG, proposals are categorized into three types. The most common are standard proposals, decided by simple majority. POWER holders must participate in voting; otherwise, they face reduced voting power and loss of ZERO rewards. The second type is POWER threshold proposals, requiring a specified POWER threshold, used in emergencies. The third category consists of ZERO threshold proposals, voted on by ZERO token holders, used for reset functions and critical changes within the protocol.

Fees

Fees are the primary revenue source for protocol participants. The M^0 protocol has two main fee types: minting fees and penalties.

Minter Fee: Collected from minter rate fees, primarily distributed to yielders, with a portion reallocated to ZERO token holders. This encourages entities (e.g., CEXs) to hold M tokens and earn yield—but only if whitelisted and approved by governance. Minter fees should be lower than the yield earned by minters to incentivize token generation. Therefore, minter rates are expected to remain below the U.S. federal funds rate.

Penalties: Imposed when minters fail to maintain an appropriate collateral-to-M balance ratio or do not update balances within the required timeframe. Unlike minter fees, penalty rates are charged one-time upon collateral checks.

Fees in the M^0 protocol incentivize ecosystem participants, but note that verifiers are excluded, as the protocol does not coordinate this aspect—their work is compensated under off-chain agreements with minters. For governance proposal submission fees, users can choose between M and WETH tokens, which serve as internal protocol funds and also support POWER token auctions.

Risks and Mitigation Strategies

M^0 faces common blockchain protocol risks, including smart contract vulnerabilities, hacking, and infrastructure failures. Due to its structure, the protocol also faces financial risks stemming from market factors. M^0 is sensitive to interest rate changes, particularly U.S. Treasury yields. Monetary policy shifts can affect the protocol’s profitability and attractiveness to minters and yielders. Another risk is volatility in collateral value, although using U.S. Treasuries helps mitigate this. Additionally, changes in supply and demand for M tokens may cause liquidity challenges and temporary price instability until arbitrageurs restore M’s value to its peg.

The project also faces risks directly tied to ecosystem participants. The reliability and credibility of partners (e.g., custodial solution operators) are crucial for collateral security. Although M itself is self-custodied, its collateral is not, meaning custodial operators introduce a degree of risk. Hence, they should be reputable, regulated entities operating within legal frameworks.

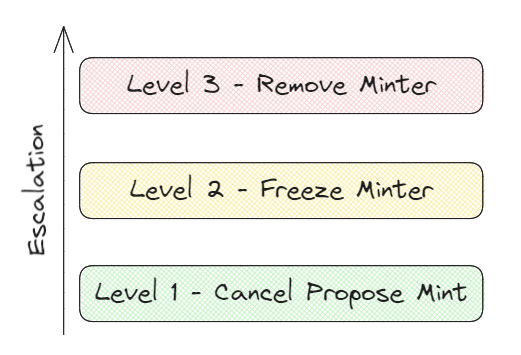

M^0 implements solutions designed to prevent improper minter behavior. Beyond penalties, the protocol includes additional measures to address actions threatening system stability. In such cases, verifiers can intervene to cancel M minting proposals and temporarily freeze a specific minter’s ability to generate M. If a minter’s behavior is particularly severe or repeated, further actions may be taken—including removal via a proposal in TTG. A key risk mitigation tool is the reset function, executable by ZERO token holders to completely reset system governance and proportionally redistribute POWER tokens. After a reset, all active and pending proposals are canceled, immediately invalidating any proposals that might have introduced malicious actors. The reset function enables rapid response to threats and serves as a protective mechanism in crises.

Funding

In June 2024, M^0 raised $35 million in a Series A round led by Bain Capital Crypto. Other notable investors in this round include Galaxy Ventures, Wintermute Ventures, GSR, Caladan, and SCB 10X. The financing included both equity and tokens, with M^0 offering investors both governance tokens—POWER and ZERO—subject to lock-up periods. An earlier funding round was a $22.5 million seed round led by Pantera Capital in April 2023. M^0’s total funding has now reached $57.5 million. Project valuation has not been disclosed.

Final Thoughts

M^0 proposes a novel solution in the stablecoin space—one that is more flexible, less centralized, and grants greater decision-making autonomy to governance members. Key protocol parameters and participants are determined by others within the ecosystem, opening new possibilities for project development and integration with existing products. Given its strong resemblance to widely used fiat-backed stablecoins, the most critical factor determining M^0’s success may be its ability to enable on-chain verification of collateral backing the M supply, thereby increasing trust in the protocol.

However, this system is significantly more complex than current popular stablecoin systems, making protocol management more complicated and introducing higher risks. Due to the protocol’s decentralized nature, long-term sustainability depends on its ability to incentivize ecosystem participants to act. A major challenge lies in balancing voting incentives against preventing excessive inflation of governance tokens. Another issue is appropriately incentivizing verifiers, as the protocol does not directly coordinate this. While yield is highly important within the ecosystem, it should not become the primary determinant of success.

The M^0 protocol has the potential to significantly impact the stablecoin industry by offering a more transparent and decentralized product, with collateral at least as secure as that used by the most popular stablecoins. M^0’s success will depend on decisions made by its governance body, which offers opportunities to rapidly adjust protocol parameters in response to market demands.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News