Data Scan Polymarket: Total trading volume exceeds $1 billion, weekly active users grow 14-fold

TechFlow Selected TechFlow Selected

Data Scan Polymarket: Total trading volume exceeds $1 billion, weekly active users grow 14-fold

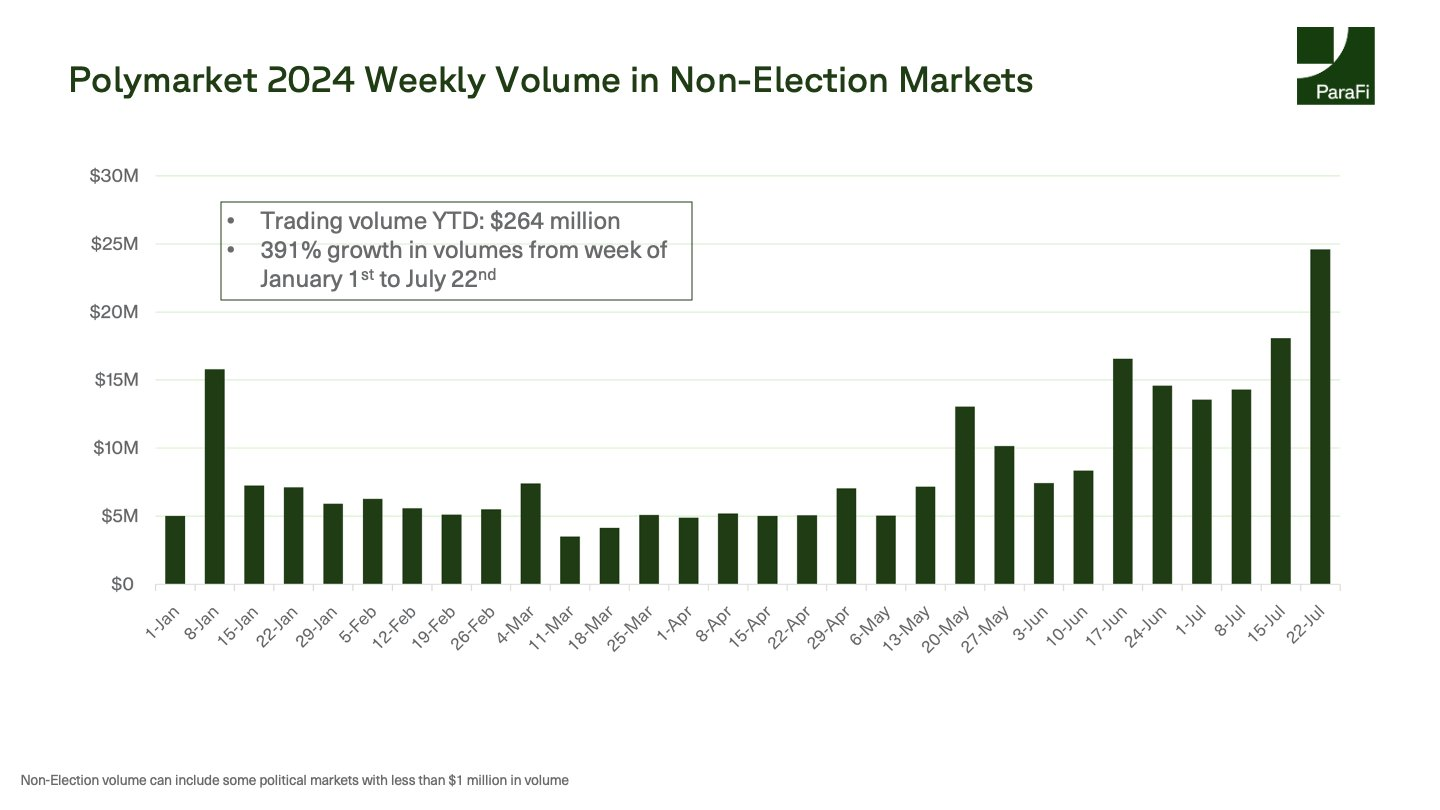

Polymarket's non-election-related market trading volume has increased by 391% year-to-date.

Author: ParaFi Capital

Translation: 1912212.eth, Foresight News

With recent explosive growth in Polymarket's trading volume, ParaFi—among the largest individual investors in Polymarket—analyzes on-chain data to clarify two key questions:

-

What factors are driving Polymarket’s recent surge in popularity and attention?

-

How closely tied is Polymarket’s explosive growth to the U.S. election?

Since 2018, ParaFi has been researching and investing in prediction markets. We participated in Polymarket’s seed round back in 2020 and have continued increasing our investment over subsequent years.

As the 2024 U.S. presidential election approaches, Polymarket has recorded $688 million in trading volume year-to-date (note: The Block’s latest data shows total volume has surpassed $1 billion), with weekly active users growing from around 1,400 to over 20,000—an increase of approximately 14x.

Polymarket is widely regarded as a “source of truth” for real-time insights into major global events and has been cited by presidential candidates, Bloomberg, The Wall Street Journal, and other media outlets.

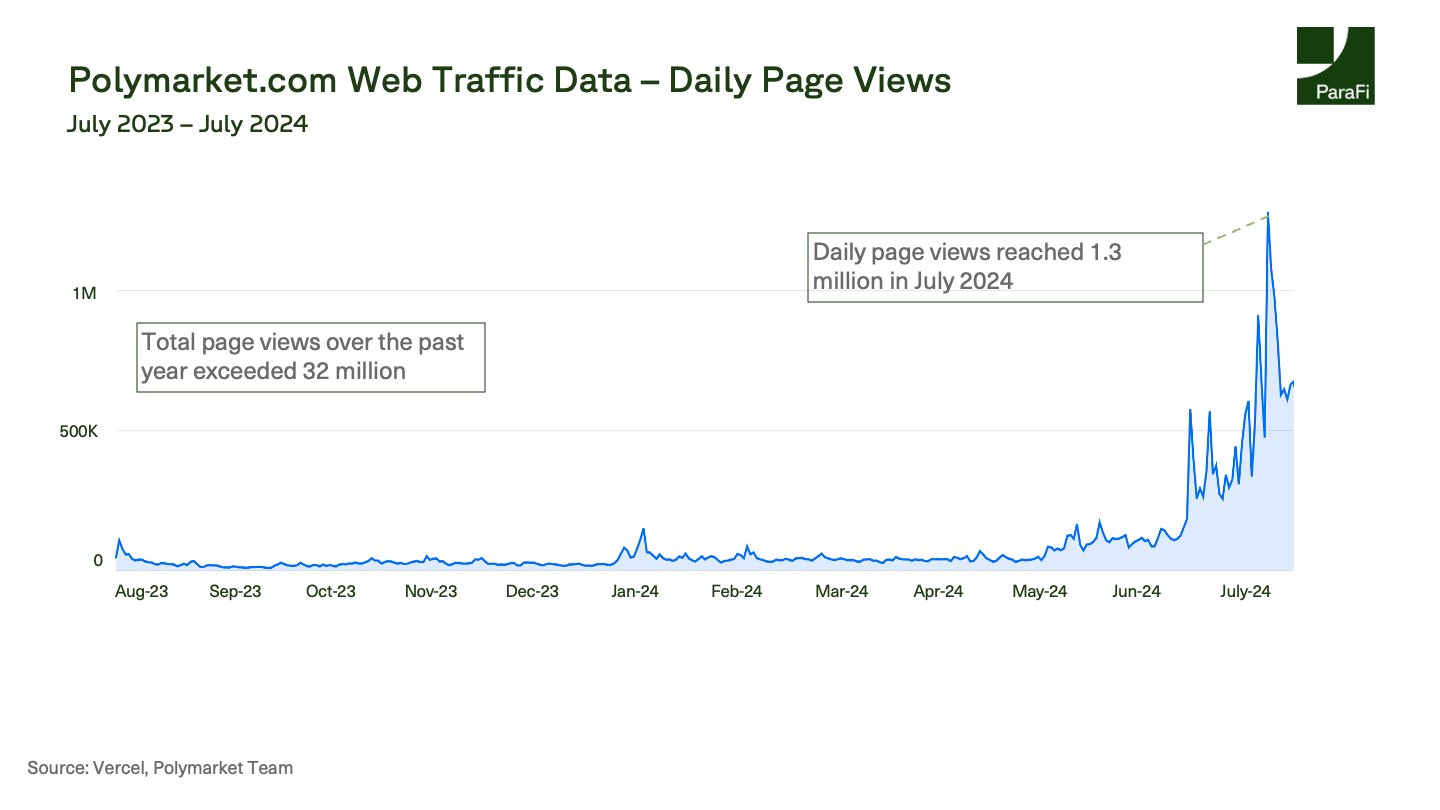

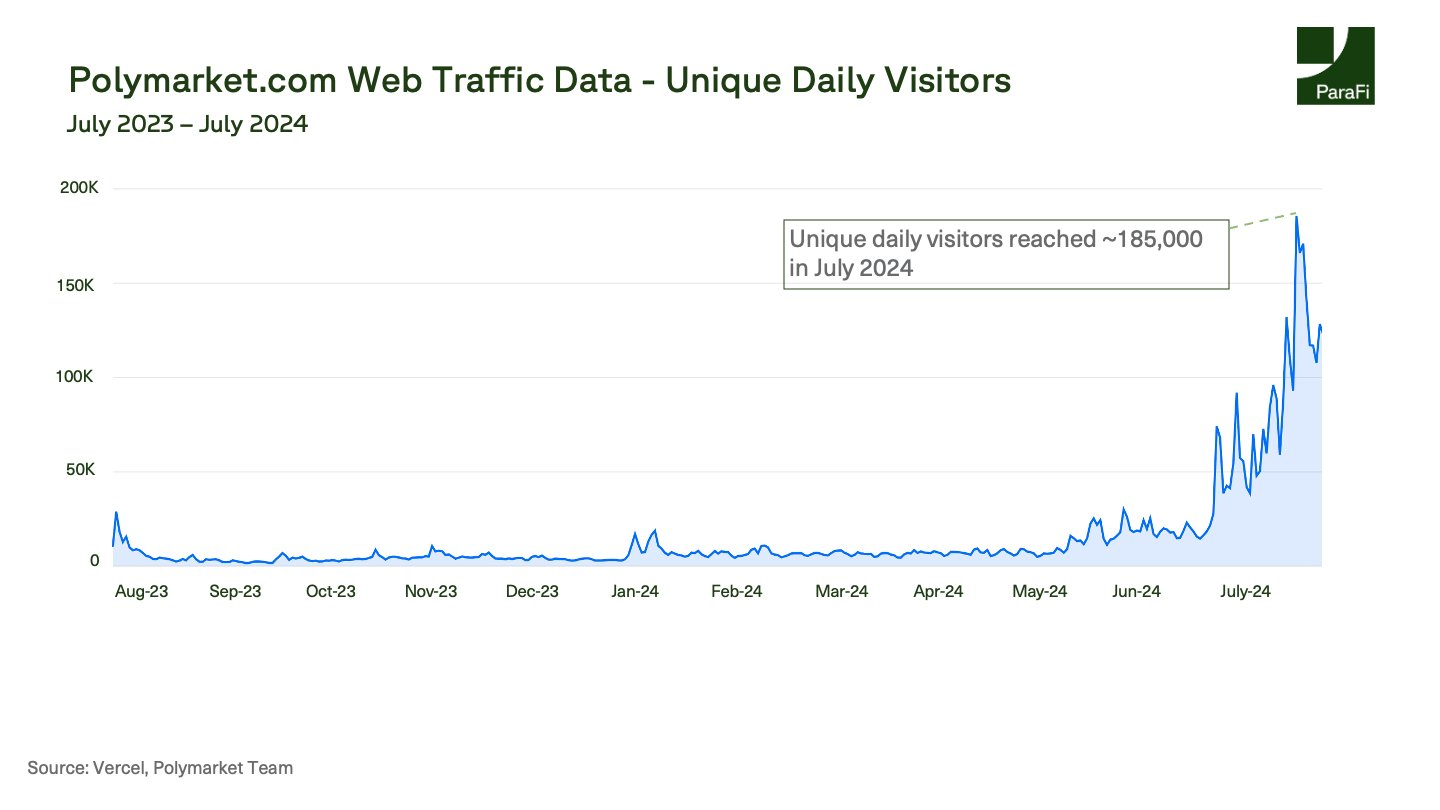

Over the past 12 months, website traffic to Polymarket has grown exponentially. Daily page views have increased tenfold, accumulating over 32 million page views. In late July, Polymarket reached a peak of 1.3 million page views per day and 185,000 daily visitors.

These figures reveal that the number of people visiting the site exceeds actual traders by several orders of magnitude. Polymarket’s rising popularity signals that platforms like this are emerging as a credible alternative to traditional media.

Is the U.S. election the sole driver behind Polymarket’s growth? Not entirely.

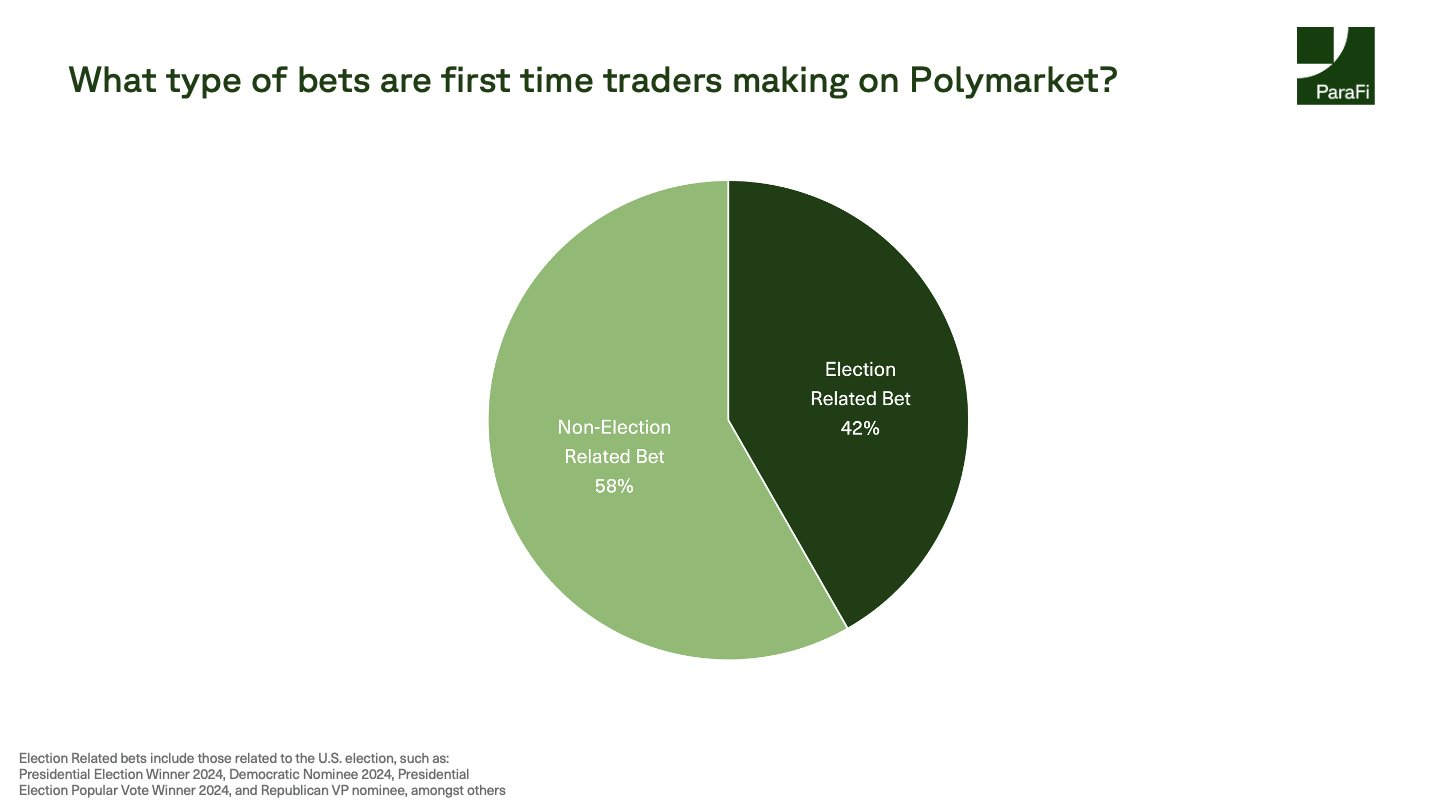

Among nearly 70,000 addresses making their first trade on Polymarket, only 42% placed their initial bet in election-related markets. The remaining 58%, or about 40,000 users, initially traded in non-election markets covering culture, business, science, and macroeconomics.

Some of our favorite prediction markets include Olympic medal counts, Taylor Swift’s engagement date, and the release date of GPT-5.

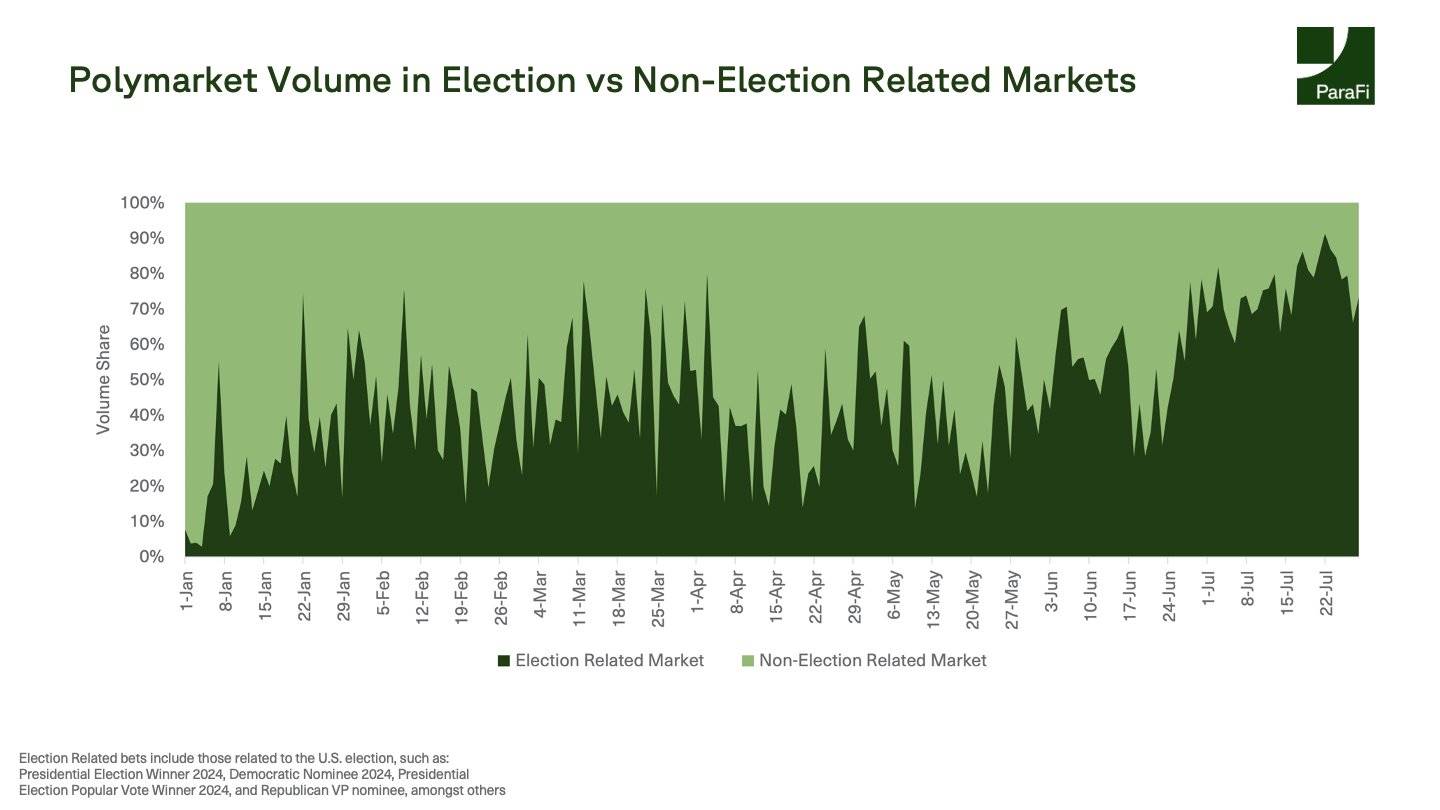

While initial user activity appears more evenly distributed, over 70% of daily trading volume in recent weeks has been linked to election-related prediction markets. Given the proximity of the U.S. election and its inherent volatility, this is not surprising.

However, other markets on Polymarket have also successfully captured public attention. For example, in May 2024, non-election trading volume surged due to speculation around the approval of Ethereum ETFs, generating over $13 million in cumulative trading volume.

This year, non-election market trading volume on Polymarket has also grown explosively, increasing 391% since the beginning of the year.

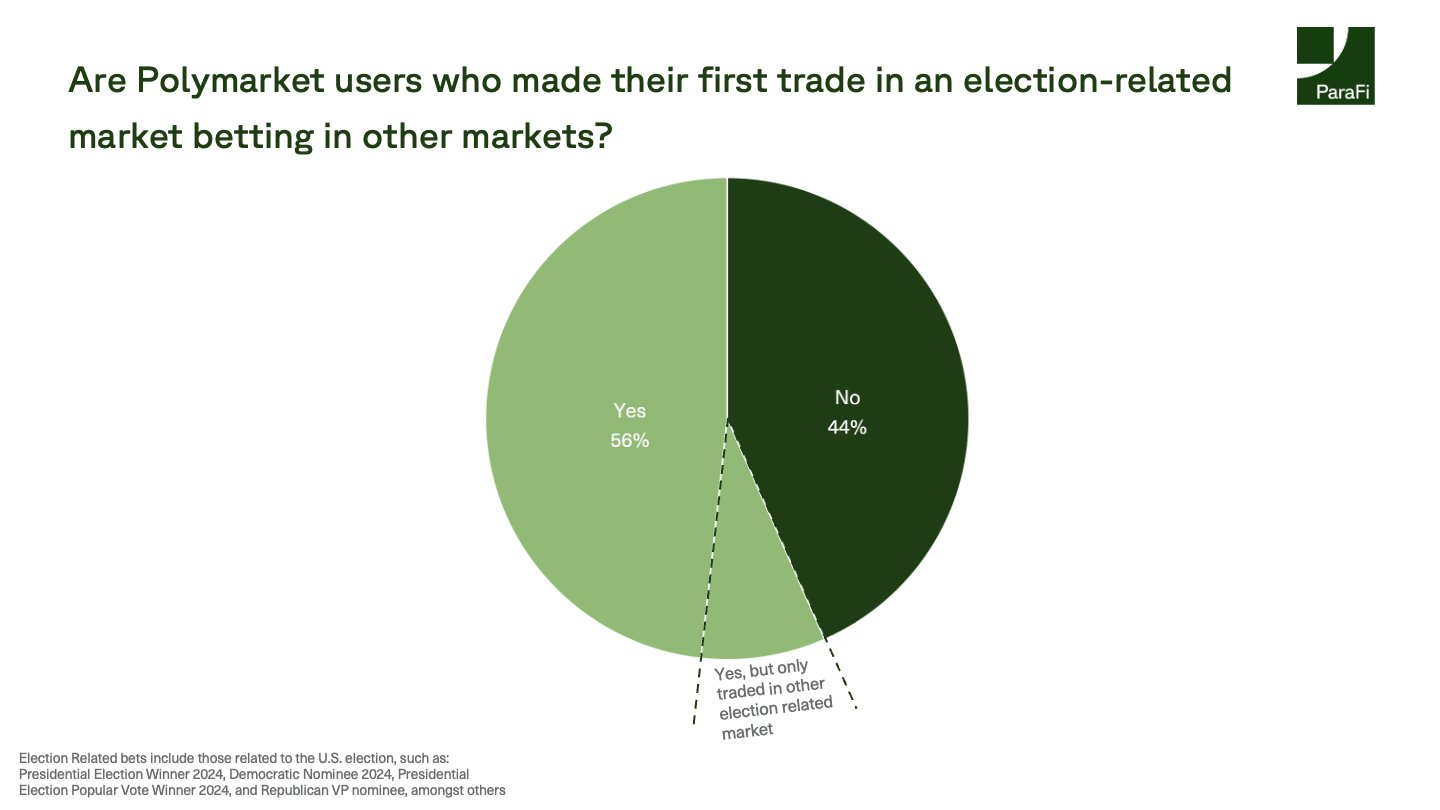

Of the 28,000 users who made their first bet in election-related markets, 56% subsequently traded in other markets.

Essentially, nearly half of these users have expanded into prediction markets covering topics such as economics, sports, and cryptocurrencies.

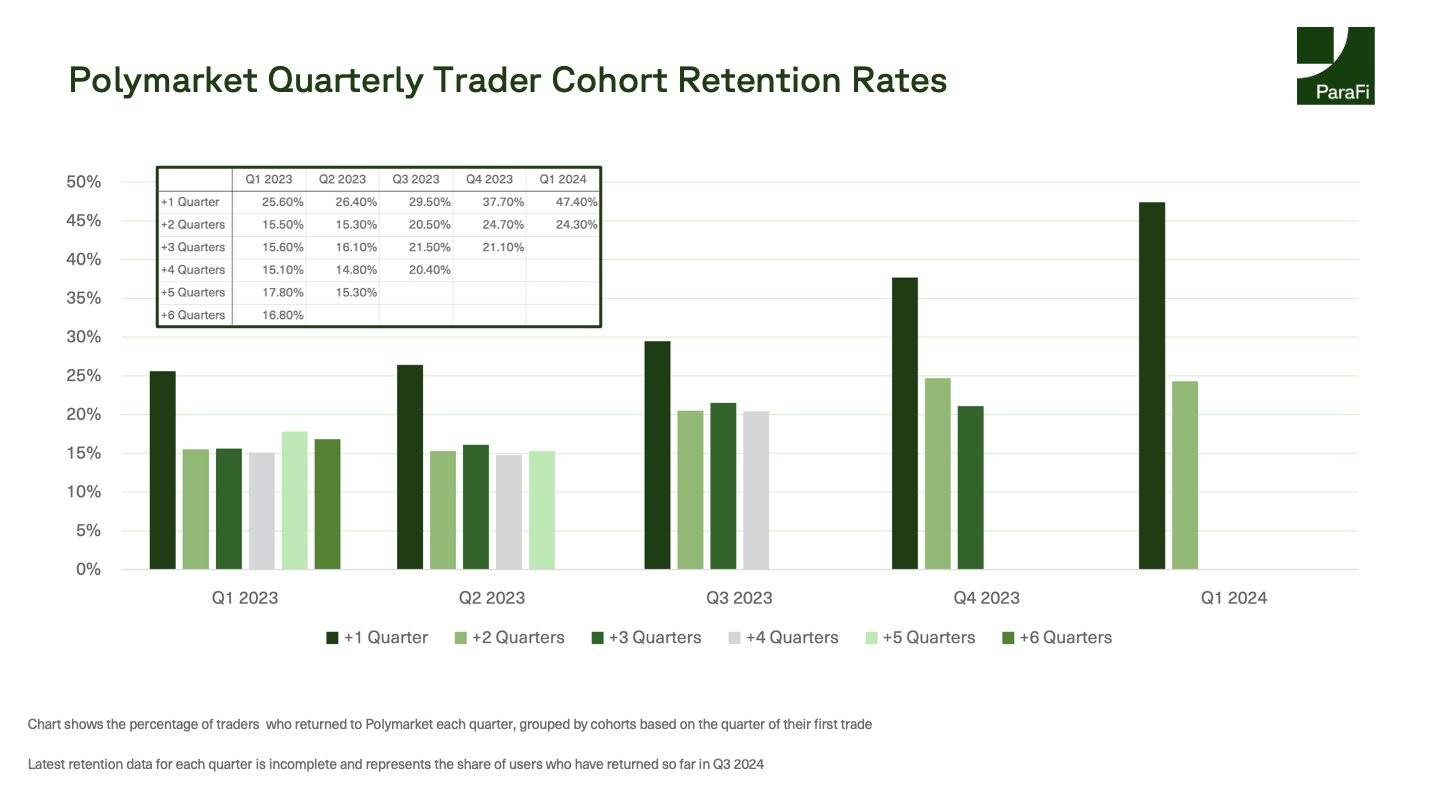

Another indicator of sustained user engagement is cohort-based quarterly retention rates. Among users who registered in Q1 2023, at least 15% used Polymarket in each subsequent quarter.

Notably, Polymarket’s retention rate has not declined significantly over time. The return rate for the Q1 2023 cohort in Q3 2023 is roughly comparable to the current Q3 2024 return rate.

In fact, recent quarterly retention rates have improved following the rise in election-related trading activity, as early cohorts of traders are incentivized to return to the platform.

Recent user retention data is also strong. Over 45% of users who traded on Polymarket for the first time in Q1 2024 continued trading in the following quarter, compared to just 25% for the Q1 2023 cohort.

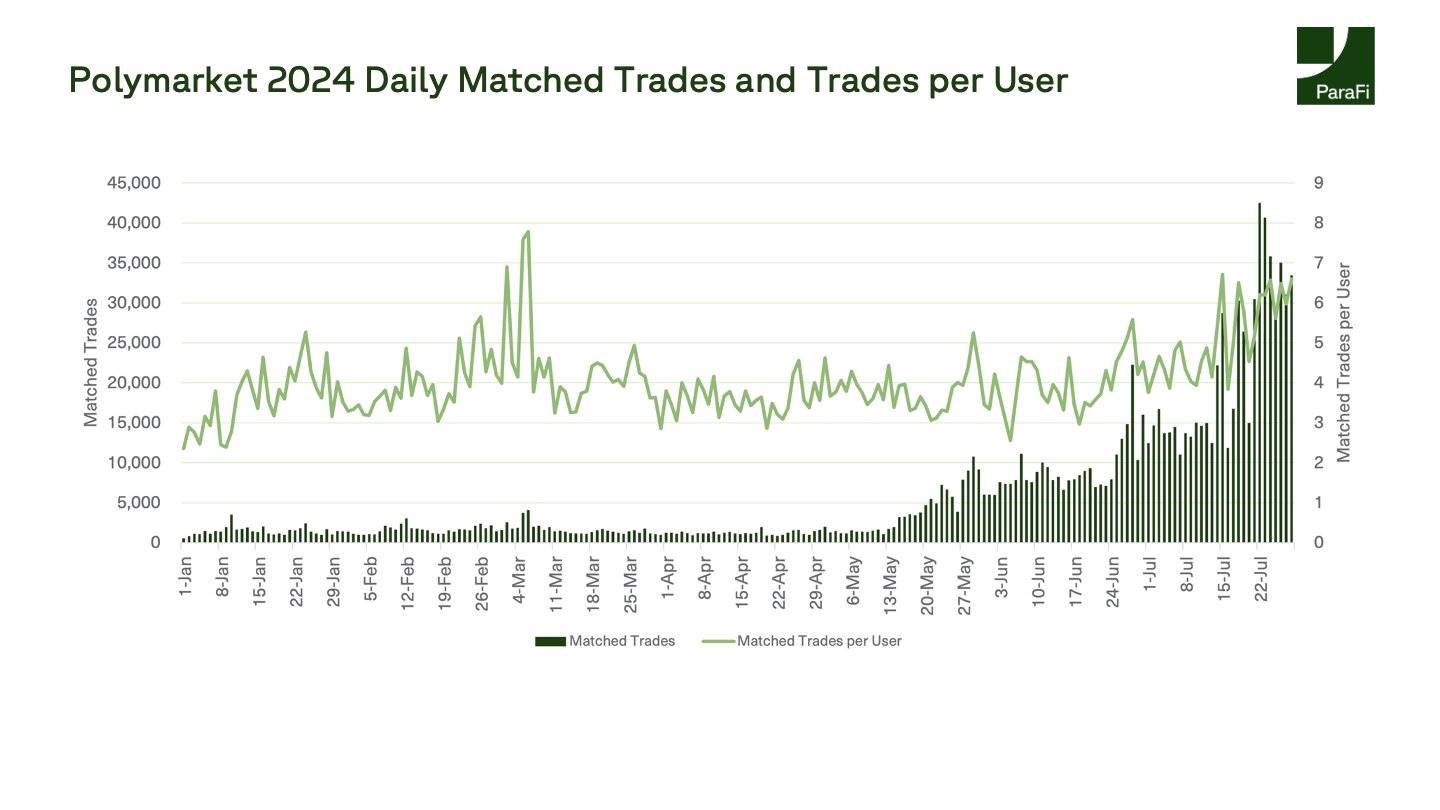

Trading volume represents only part of overall trading activity. We observe consistent trends across transaction value and user count, with matched trades on Polymarket surging in recent months. Since the beginning of the year, the number of matched trades on Polymarket has increased by over 3,000%, exceeding 40,000 in late July.

Given the rise in other metrics, the increase in matched trades on Polymarket is unsurprising—but it indicates that volume growth is not solely due to larger individual bets. In fact, the number of transactions facilitated by Polymarket is also rising steadily.

Notably, the ratio of daily matched trades to daily active users has recently shown an upward trend. Although this ratio has fluctuated throughout the year, it suggests that users are engaging more frequently on the platform each day.

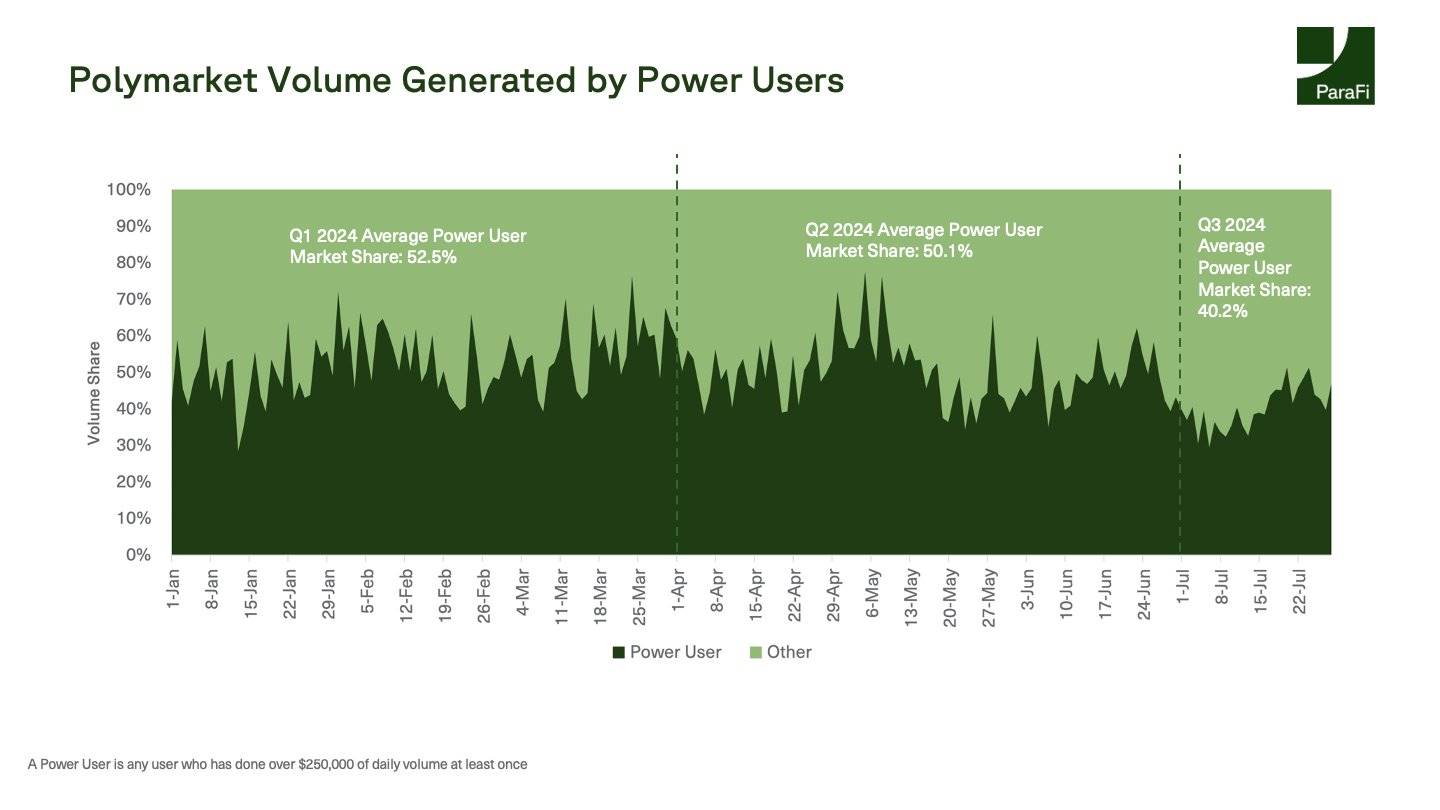

From a volume perspective, heavy users do not necessarily dominate platform metrics. We define heavy users as those with over $250,000 in daily trading volume. In Q1 and Q2 2024, heavy users accounted for 51% of daily trading volume. However, their market share has recently declined as Polymarket’s user base shifts toward smaller traders.

ParaFi believes prediction markets are valuable tools that harness collective intelligence and serve as “truth machines.” We believe this is only the beginning for Polymarket.

Disclaimer:

-

All data spans from November 21, 2022, to July 29, 2024.

-

“Election-related prediction markets” refer to markets identified by the ParaFi team that are associated with the outcome of the 2024 U.S. presidential election and have traded over $1 million in volume. Non-election markets may still include minor political themes.

-

A “user” is defined as an address acting as either a maker or taker on Polymarket.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News