Bull market does not equal profits—15 rules to help you achieve returns

TechFlow Selected TechFlow Selected

Bull market does not equal profits—15 rules to help you achieve returns

If your active portfolio hasn't outperformed BTC, reassess your strategy.

Author: Crypto, Distilled

Translation: TechFlow

A bull market isn't as simple as you might think.

Even if $BTC reaches $100,000, many people may still see their profits dwindle.

Don't be one of those investors.

Here are 15 rules to help you maximize gains in this cycle.

1. Unrealized Gains Aren't Real Gains

This is the most important rule of all.

Set it as your lock screen, stick it on your fridge—whatever it takes, never forget it.

Paper gains are just imaginary numbers until you actually sell.

(h/t TradeSanta)

2. Avoid Leverage

Altcoins already have enough momentum.

You don't need extra volatility to achieve strong returns.

Don’t let greed kill your profits.

I've seen a lot of people ruined by alcohol and leverage—leverage meaning borrowing money. In this world, you don't actually need to borrow. If you're smart, you can make a lot without borrowing. — Warren Buffett

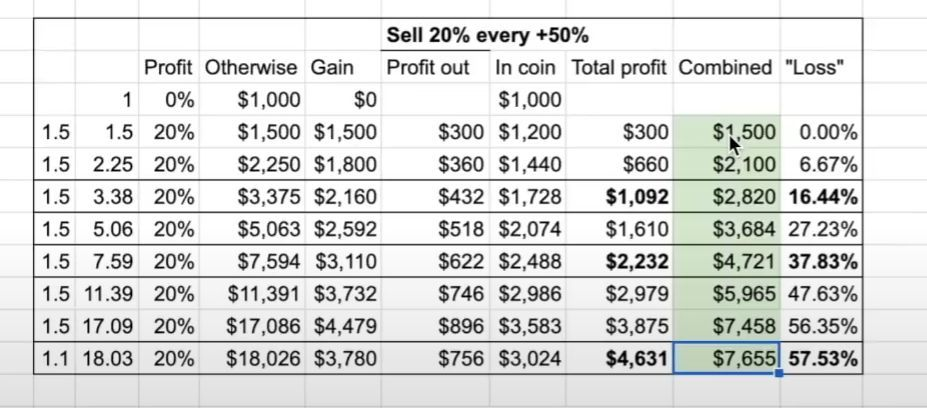

3. Trim Gradually

No one can perfectly time the market top.

Plan to exit during the top third of the cycle.

Accept leaving some gains behind to secure your future.

(Example strategy from @denomeme)

4. Prepare for Downturns

Considering downside risk is just as important as considering upside potential.

Optimize your strategy to ensure you can withstand worst-case scenarios.

Generational wealth opportunities are rare. Stay alive long enough to capture them.

5. Seek Asymmetric Bets

Not all opportunities are equal.

Don’t let rising prices lure you into poor risk/reward positions.

Upside potential should always exceed downside risk.

(via @ssaurel)

6. When in Doubt, Think Long-Term

Don’t get lost in the hype. Step back and consider the long-term picture.

Are multi-year trends more likely to continue or reverse?

Over the next 6+ months, will liquidity flow into or out of the market? Why?

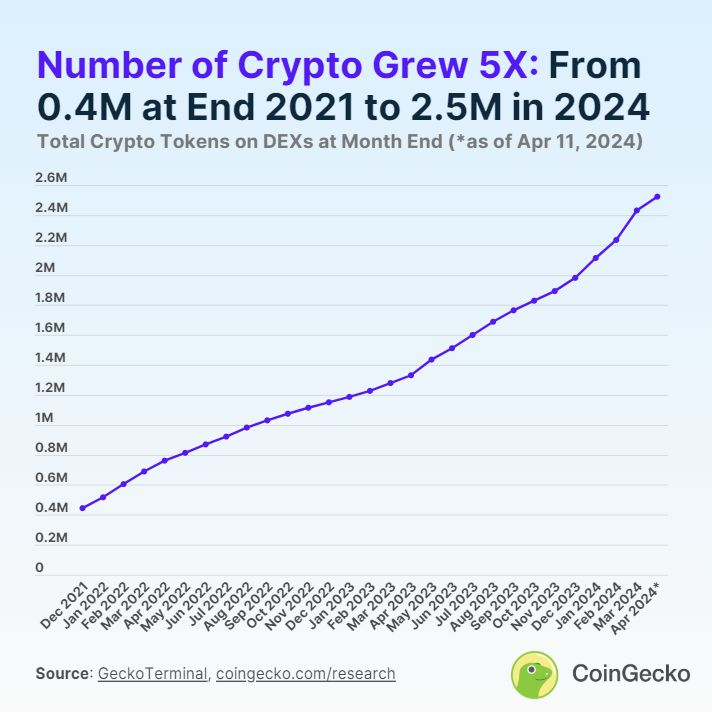

7. Be Extremely Selective

Altcoin dilution has reached unprecedented levels.

You don’t need to chase every shiny coin.

Most altcoins go to zero after the cycle ends—be very picky.

8. Keep Your Strategy Simple

Complexity doesn’t equal success.

Complicated plans often collapse when markets heat up.

Narrow your focus and keep it simple.

9. Be a Big Fish in a Small Pond

There are dozens of niches within crypto.

It's impossible to be an expert in all of them.

Focus on your niche and master a few sub-sectors.

10. Not Your Keys, Not Your Crypto

Sadly, many learn this simple truth the hard way.

Even the "best" traders can lose savings due to security lapses.

Develop good wallet hygiene. Spread assets across multiple wallets or centralized exchanges (CEX).

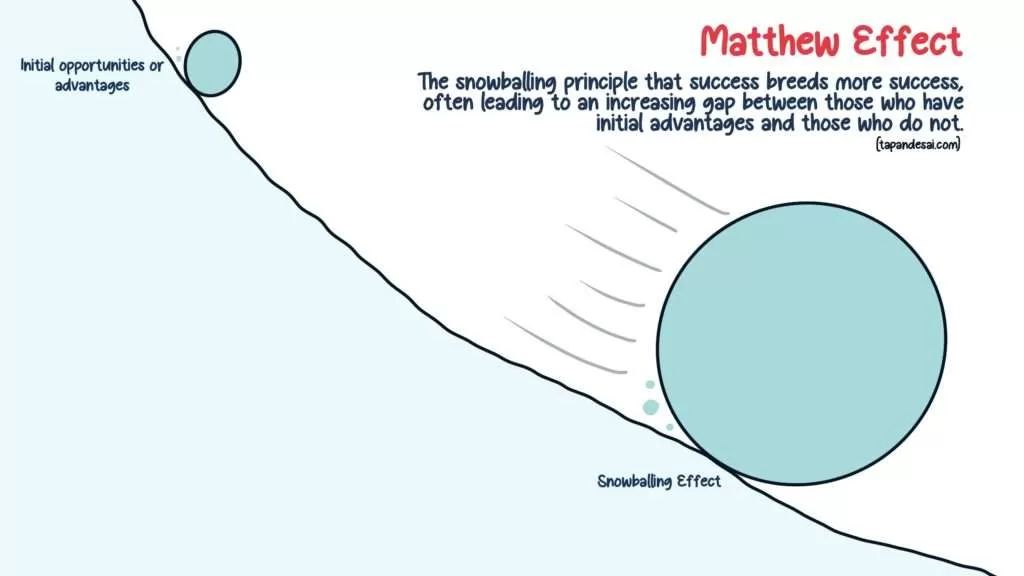

11. Bet on Leaders

Retail investors love chasing “catch-up plays.”

Long-term, this is almost always a losing battle. Winners keep winning.

(h/t Tapan Desai)

12. Collaborate with Others

Remember, your network is your net worth.

Don’t be a lone wolf—you’ll earn less.

Connect with other sharp investors and crypto enthusiasts.

13. Compare Alts Against BTC

Focusing only on altcoin dollar valuations is a mistake.

Instead, analyze ALT/BTC pairs.

If your active portfolio isn't outperforming BTC, reconsider your strategy.

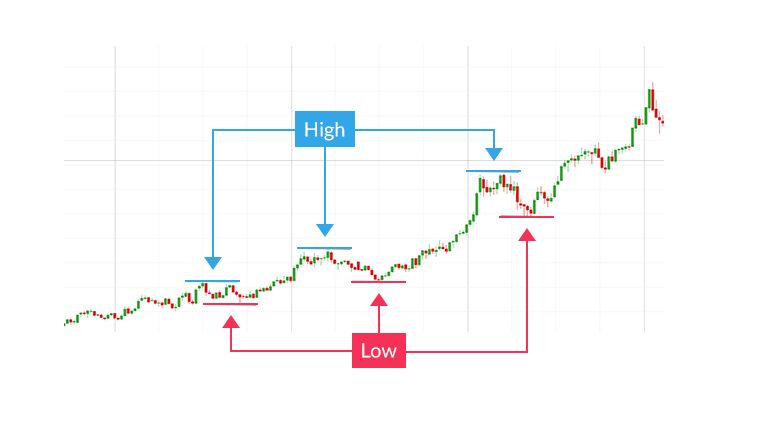

14. Trends Are Your Friends

During strong trends, it’s best to go with the flow.

Only go against the trend at macro turning points.

Otherwise, you'll get trampled by the crowd (don’t bail out mid-ride).

15. Don’t Obsess Over Peak Net Worth

Markets don’t care about your P&L.

Obsession only clouds your judgment.

Seize opportunities and accept losses calmly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News