Trump Boosts Polymarket: How Lucrative Is the Cryptocurrency Prediction Market?

TechFlow Selected TechFlow Selected

Trump Boosts Polymarket: How Lucrative Is the Cryptocurrency Prediction Market?

The Future Development of Cryptocurrency Prediction Markets from a Polymarket Perspective

Author: Daniel Li

In recent years, crypto prediction platforms have rapidly emerged as a new force in the blockchain industry, attracting widespread attention. This unique market model leverages collective wisdom by allowing users to buy and sell shares tied to the outcomes of future events, thereby predicting their trajectories. It not only provides investors with a novel investment channel but also offers valuable data resources for research institutions. Industry reports indicate that the scale of crypto prediction platforms is experiencing explosive growth and is expected to maintain this high-speed expansion in the coming years.

Among numerous crypto prediction platforms, Polymarket has distinguished itself through its unique operational mechanism and timely engagement with trending political events, emerging as a leader in the field. As a blockchain-based decentralized prediction market platform, Polymarket enables users to bet on future outcomes across various topics using cryptocurrencies. Running on smart contracts on the Polygon blockchain, it significantly reduces transaction fees and accelerates processing speed. Since its launch, Polymarket has attracted a large user base and garnered significant attention due to its high transparency and user-friendly interface, becoming today's largest crypto prediction platform.

This article will delve into Polymarket’s operating mechanisms and principles while analyzing the latest trends in the crypto prediction market, aiming to provide readers with a comprehensive and in-depth understanding of this evolving sector.

01 Polymarket: Understanding the Real World Through Betting

Polymarket, a decentralized prediction market platform built on blockchain technology, has recently begun gaining visibility in public discourse. Founded in 2020 by Shayne Coplan, the platform was born out of Coplan’s profound observations during the pandemic. Amid an overwhelming flood of uncertain opinions and conflicting narratives—where both sides stubbornly defended their views—and exacerbated by rampant misinformation and profit-driven algorithms, people found it increasingly difficult to discern the truth. In response, Coplan created Polymarket to offer a new way for individuals to more accurately understand what is truly happening in the real world.

Polymarket draws theoretical inspiration from Friedrich Hayek’s seminal paper “The Use of Knowledge in Society.” Hayek argued that economic incentives are crucial for motivating people to better understand uncertainty. When such incentives exist, individuals tend to seek higher-quality information sources, engage in deeper analysis, and allocate their capital toward outcomes they believe are most likely to occur. Coplan put this theory into practice—essentially using betting as a method to interpret reality.

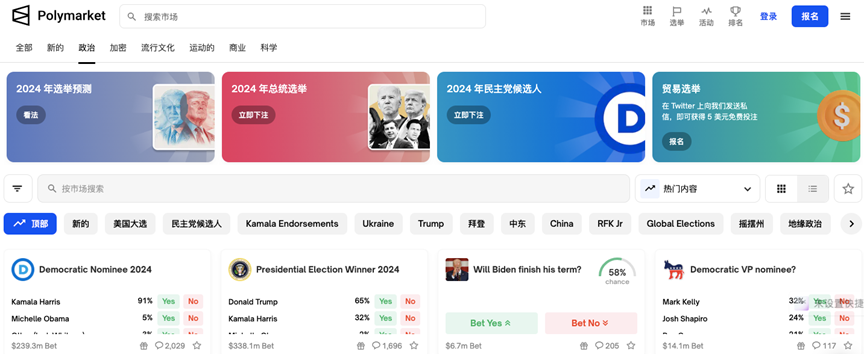

Upon visiting the Polymarket website, users are immediately presented with prominent global news events such as Donald Trump’s odds of winning the upcoming presidential election, whether a conflict might arise between Elon Musk and Mark Zuckerberg, or how many times the Federal Reserve is expected to cut interest rates this year. Users can select specific markets based on personal interest and purchase “outcome shares” representing potential results of these events. The market price of these shares reflects the collective perception of likelihood, offering users an intuitive reference point. Before market resolution, users enjoy the flexibility to sell their shares at any time, typically without incurring high transaction fees. Once an event’s outcome is officially confirmed, users who correctly predicted the result can redeem their shares at $1 per share, while those with incorrect predictions see their shares become worthless. Notably, all transactions and settlements on Polymarket are executed automatically via smart contracts, ensuring fairness, transparency, and security.

By introducing a reward-and-penalty mechanism, Polymarket holds each user accountable for their beliefs, making the platform’s aggregated statistics more reflective of actual market sentiment. Compared to traditional platforms or social media, Polymarket’s predictions tend to be closer to the truth. For example, during the room-temperature superconductor controversy, despite skepticism from authoritative media outlets and influencers confidently affirming its validity—even fabricating evidence—Polymarket offered a more rational forecast, with a 9-to-1 ratio favoring falsehood, demonstrating how incentive structures promote rationality among users.

Today, amid the proliferation of social media and spam content, people’s access to factual information is often constrained. Institutions may lack objectivity due to vested interests, and social platforms reinforce filter bubbles by curating content based on user preferences. As a decentralized prediction market powered by blockchain technology, Polymarket maintains fairness and impartiality, offering a transformative opportunity for public discourse. Its non-politically correct, de-emotionalized, and objectively grounded nature reveals genuine public judgment, providing a fresh lens through which to interpret reality. As founder Coplan puts it, Polymarket is a platform that harnesses market mechanisms to tap into the wisdom of the crowd.

02 Can Polymarket’s Popularity Last?

Crypto prediction platforms are not a new phenomenon. As early as 2018, Augur launched the first blockchain-based crypto prediction platform. However, limited by technological constraints and low blockchain adoption at the time, Augur’s complex operations and poor user interface prevented it from reaching mainstream audiences. It wasn’t until Polymarket emerged that crypto prediction platforms gained widespread traction within the blockchain industry and matured into viable applications.

Data shows that Polymarket, leveraging its unique betting-based prediction model, is attracting unprecedented global attention and participation. Particularly during the current U.S. election cycle, Polymarket has become a popular platform not only for ordinary citizens to express their voting intentions but also for investors seeking profits through accurate candidate forecasts. Over recent months, active participants have poured hundreds of millions of dollars into Polymarket, propelling the platform’s scale and reputation to historic highs.

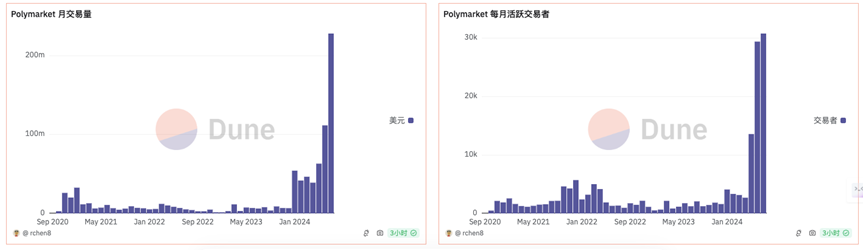

Recent data from Dune further confirms Polymarket’s surge in popularity. Since April, both trading volume and user numbers have exploded. Especially following the July incident involving an assassination attempt on Trump—which drew global attention—Polymarket, as a representative of prediction markets, received extensive media coverage worldwide, boosting its visibility and influence. Fueled by this event, Polymarket’s monthly trading volume doubled from June to July, surpassing $200 million, with daily volumes consistently exceeding $20 million and over 6,000 daily active traders.

Polymarket’s rise has not only drawn enthusiastic user engagement but has also led some idealists in the crypto space to view it as an arbiter of truth. They believe its decentralized and transparent nature positions it to become a primary source of reliable information. Yet beneath this popularity lie significant challenges and risks that must be acknowledged.

First, the lack of sustained capital inflow poses a critical challenge to Polymarket’s long-term viability. Prediction markets, being zero-sum games by nature, cannot attract passive investments like stocks, bonds, or cryptocurrencies in traditional financial markets. This characteristic creates ongoing challenges for maintaining liquidity, affecting the platform’s ability to generate consistent revenue and sustain growth.

Second, market liquidity constraints remain a key issue. Currently, Polymarket’s top-ranking markets are almost exclusively related to the U.S. election, capturing the majority of user attention. However, most other markets—especially those covering niche topics or non-immediate payouts—struggle to attract sufficient interest. This leads to inadequate liquidity, undermining effective price discovery and reducing the accuracy and credibility of predictions.

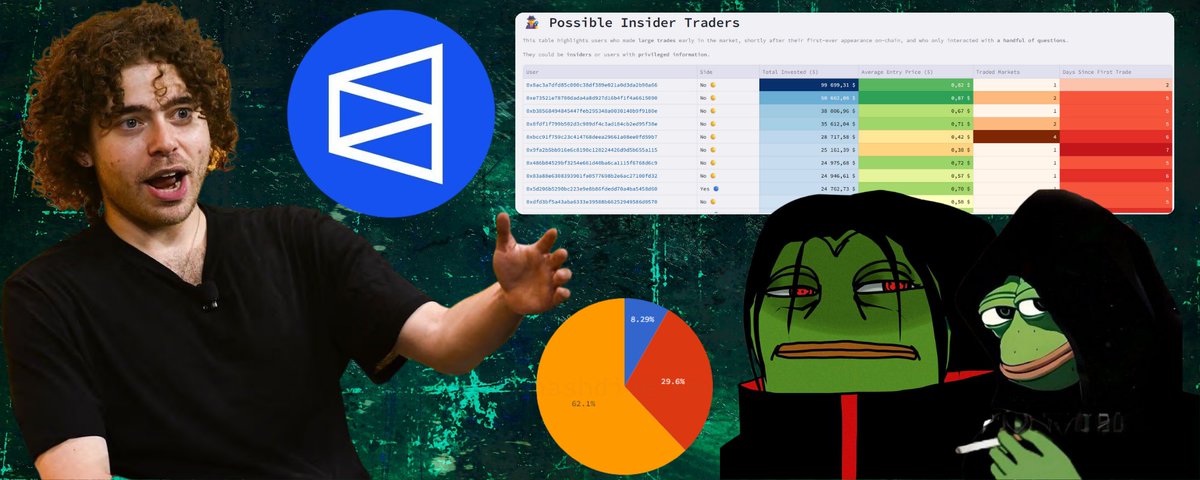

Third, the influence of certain market participants is another concern. A shortage of professional market makers and other sophisticated players may allow a few well-informed individuals to manipulate or unduly influence market prices. This undermines the predictive power of the market and could trigger unfairness and trust crises. For instance, insiders with advance knowledge of developments may place large bets ahead of time, profiting at the expense of ordinary users. Therefore, establishing fairer oversight and auditing mechanisms is vital for Polymarket’s future development.

Lastly, Polymarket relies on trending news to create betting topics, which sometimes involves sensitive social issues. Recently, the platform faced backlash after its official X account posted tweets containing inappropriate language—specifically using the offensive term "Retardio" (meaning "mentally slow")—as part of a marketing campaign. Although Polymarket later issued an apology, fired responsible personnel, and initiated internal reviews, public skepticism remained. Some media outlets accused the platform of profiting from tragic events.

03 The Future of Crypto Prediction Markets Through the Lens of Polymarket

Polymarket’s surge highlights the immense potential of crypto prediction markets. Historically, prediction markets remained largely theoretical, and when implemented, were often closely associated with gambling—or even exploited by criminals for money laundering. However, the integration of blockchain technology has brought transformative change, with its transparent and immutable ledger making crypto markets more accessible and trustworthy for everyday users.

Although Polymarket did not pioneer crypto prediction platforms, it is undoubtedly the most mature and influential one today. Its success lies not just in rapid user growth and soaring trading volumes, but in successfully bringing crypto prediction markets to the general public, injecting new vitality into the field. Polymarket’s rise showcases new use cases within the blockchain industry and underscores the unique appeal and broad prospects of crypto prediction platforms.

For decades, prediction markets have been considered the holy grail of cognitive technologies. As early as 2014, Ethereum co-founder Vitalik Buterin expressed strong interest in using prediction markets as governance tools. However, practical implementation has long faced obstacles such as irrational behavior among participants, insufficient market liquidity, and a lack of incentives for those possessing accurate knowledge to participate. These issues have historically hindered the development of prediction markets.

Polymarket has successfully broken this deadlock. It has captured significant industry attention and demonstrated robust vitality and vast potential in real-world applications. Notably, Vitalik Buterin himself used Polymarket to track Sam Altman’s board ousting incident—an act that undoubtedly enhanced Polymarket’s authority and visibility. Additionally, Packy McCormick, advisor at a16z Crypto, praised Polymarket, calling its homepage “the best place on the internet to start your day.” This endorsement reflects not only Polymarket’s excellence in user experience but also its unique value in information acquisition and decision support.

Richard’s perspective offers another insightful angle: he argues that the crypto industry should reduce zero-sum games and shift toward creating positive-sum experiences. Prediction markets represent one of the best vehicles for achieving this goal. They function both as betting platforms offering entertainment and profit opportunities, and as information sources aiding smarter decision-making. This dual functionality gives prediction markets a distinctive position and value within the crypto ecosystem.

However, we must also recognize the challenges facing the future of crypto prediction markets. Regulatory uncertainty, compliance risks, and ethical considerations are critical areas requiring close attention. Only under conditions of compliance, fairness, and transparency can crypto prediction markets achieve healthy, stable, and sustainable development—a goal demanding collaborative effort and continuous innovation across the industry.

04 Key Crypto Prediction Market Platforms to Watch

Beyond Polymarket, several other platforms in the crypto prediction market space have stood out due to their innovative mechanisms and competitive advantages, drawing increasing attention. These platforms offer novel prediction models and leverage blockchain technology to enhance transparency and trustworthiness, attracting growing interest from crypto enthusiasts and investors alike. Below are several notable platforms currently worth watching:

Augur

As a pioneer in blockchain-based prediction markets, Augur has been advancing the field since 2014. Its operation centers around community-driven participation, enabling users not only to place bets but also to create their own markets—significantly enhancing engagement and customization. Augur uses its native token REP, which plays a crucial role in reward distribution, market creation, and dispute resolution, further strengthening transparency and reliability. To address Ethereum’s scalability limitations, Augur launched a Turbo version utilizing the Polygon network, greatly improving transaction efficiency and scalability, thus enhancing user experience.

In recent years, Augur has continuously improved its platform features and expanded its community, attracting more crypto enthusiasts and investors. However, its community-driven model may leave market outcomes vulnerable to manipulation, a risk users should carefully consider.

Gnosis

Gnosis is a comprehensive blockchain ecosystem encompassing prediction markets, decentralized exchanges, wallet services, and other foundational tools. Centered around the GNO token, its mechanism links users closely to the platform through governance and staking. To overcome Ethereum’s scalability challenges, Gnosis developed its own Layer 2 solution—the Gnosis Chain—providing robust support for Ethereum-based applications like prediction markets.

Gnosis emphasizes a holistic and multifunctional ecosystem, aiming to deliver an integrated and convenient blockchain environment. Currently, it is expanding its ecosystem to meet broader user needs. However, due to its complexity, new users may require time to learn and navigate its various functions and services.

XRADERS

XRADERS is a decentralized market prediction and expert opinion-sharing platform that leverages blockchain for transparent data recording and trust-building. Its model integrates social price prediction, gamification elements, and community-driven cycles to create a secure and reliable environment for user interaction. XRADERS offers curated expert insights to provide actionable intelligence and ensures transparency and integrity through a decentralized voting system.

In recent years, XRADERS has partnered with prominent projects such as UXLINK, SecondLive, and DIN. Its core gameplay—Guess2Earn (predict-to-earn)—and decentralized voting system have attracted substantial user growth. Moreover, XRADERS successfully completed a seed funding round, drawing participation from leading crypto investors and institutions. However, due to its decentralized nature, information on the platform may carry subjective biases and uncertainties, requiring investors to exercise caution when making decisions.

PredictIt

PredictIt is a nonprofit research project operated by Victoria University of Wellington in New Zealand. It holds a special exemption from the U.S. Commodity Futures Trading Commission (CFTC), allowing legal operation in certain U.S. states. PredictIt’s model is straightforward, relying primarily on user predictions and bets on market events. To comply with regulations, PredictIt imposes limits on individual investment amounts. Its markets cover politics, economics, sports, and more, attracting broad participation. However, due to its nonprofit status and regulatory constraints, PredictIt may face challenges in commercialization and market expansion. Investors should also remain mindful of compliance and risk factors to protect their interests.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News