IOSG: Is economic security a meme?

TechFlow Selected TechFlow Selected

IOSG: Is economic security a meme?

Is economic security being somewhat of a meme a bad thing?

Author: Danny Huang

On June 3, Solana co-founder Anatoly and Ethereum Foundation researcher Justin discussed economic security during a debate hosted by Bankless. Toly argued that economic security is a meme, sparking extensive follow-up discussions among KOLs across both communities.

The overall discourse has been fragmented. Here, we take Toly’s perspective as a starting point to organize and analyze the key points.

1. Toly's Logic

-

Due to centralized staking services, the cost of acquiring 33% of nodes for an attack is far lower than the actual staked value

-

POS chains with minimal staked economies have never been attacked, suggesting network security stems from decentralized network operations rather than economic stakes

-

Even if an attack occurs, social layer recovery can quickly restore the network, ensuring attackers cannot extract more value than their costs

-

Social layer recovery may temporarily render the network inactive, but this impact is negligible

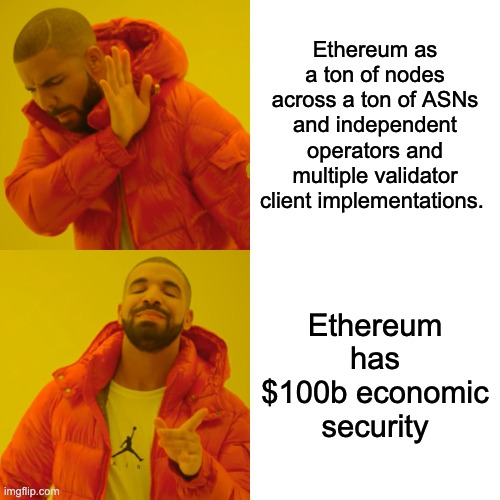

Therefore, his conclusion is that economic security is a meme for POS networks; Ethereum’s security comes from superior engineering design, node distribution, and client diversity.

Following this, KOLs from both communities engaged in heated debates around economic security, yet no definitive conclusions were reached. Let us attempt to clarify the core propositions, analyze arguments, and examine evidence.

2. Is Economic Security a Meme?

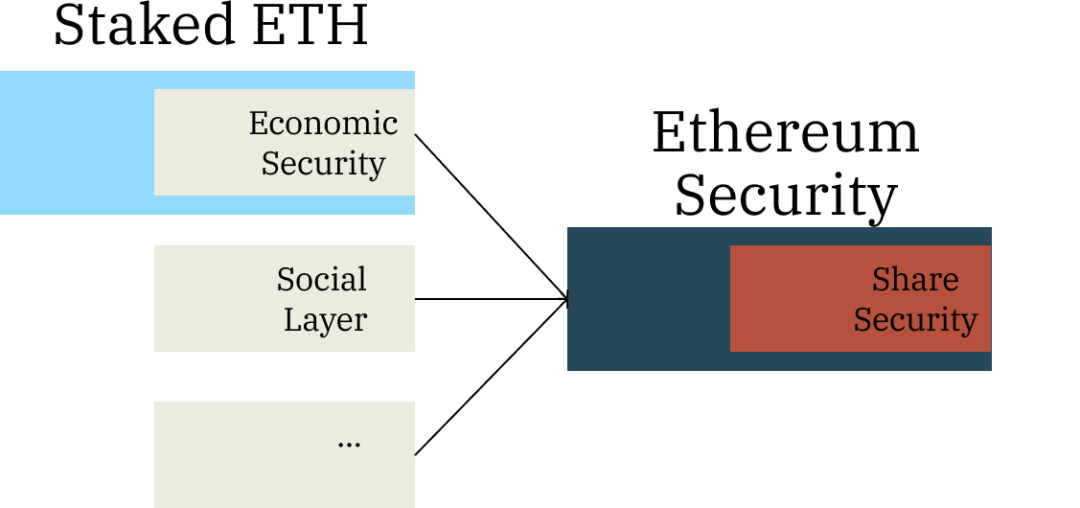

Before exploring this question, we must first clarify the definitions and interrelationships between staking, economic security, Ethereum security, and shared security—terms often conflated in discussions.

The diagram below illustrates their relationships: staked ETH partially constitutes economic security. Economic security, together with other security factors, forms Ethereum security, which in turn serves as shared security for AVSs.

Source: IOSG

Toly’s first argument is that the security contribution of staking in preventing attacks on POS chains is much smaller than the staked value. To verify this, we need to assess how much of the staked ETH translates into actual Ethereum security.

Staking → Economic Security → Ethereum Security

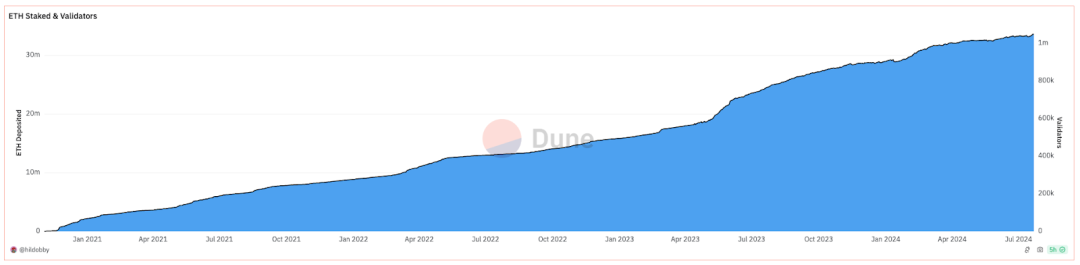

Currently, about 33 million ETH are staked, with a market cap approaching $120 billion. Does such a large staked amount equally and effectively contribute to economic security?

First, let’s revisit "attacks"—the counterpart to security. Two main types of attacks are relevant:

-

>=33% of nodes could theoretically launch double-signing attacks or halt the network

-

>50% of nodes could censor transactions or execute short-range reorganizations

Theoretically, acquiring 33%/51% of nodes can be achieved through:

-

Running new validators

-

Controlling existing nodes

Regarding the first method, given that new validators face queue delays, adding over 33% new validators would take hundreds of days—nearly impossible.

As for the second, Toly argues that due to LST protocols and centralized staking services, the cost of gaining control of 33% of nodes is far less than the staked value. Essentially, this cost refers to attacking or bribing liquid staking protocols or centralized staking providers—not direct capital expenditure.

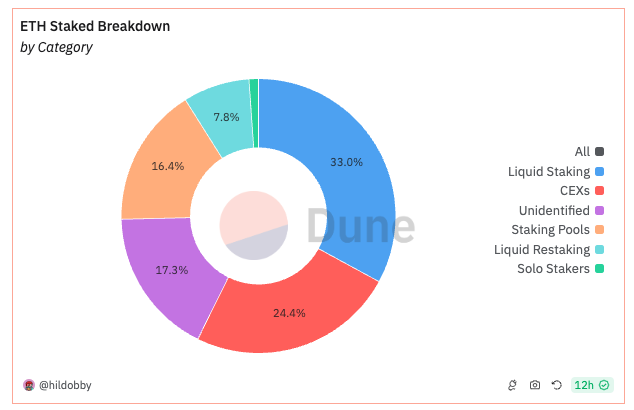

Let’s examine the current staking landscape. Liquid staking accounts for nearly 33% of total staking, while CEXs and other centralized providers account for 24.4%, close to the critical 33% threshold.

Source: hildobby - Dune Analytic

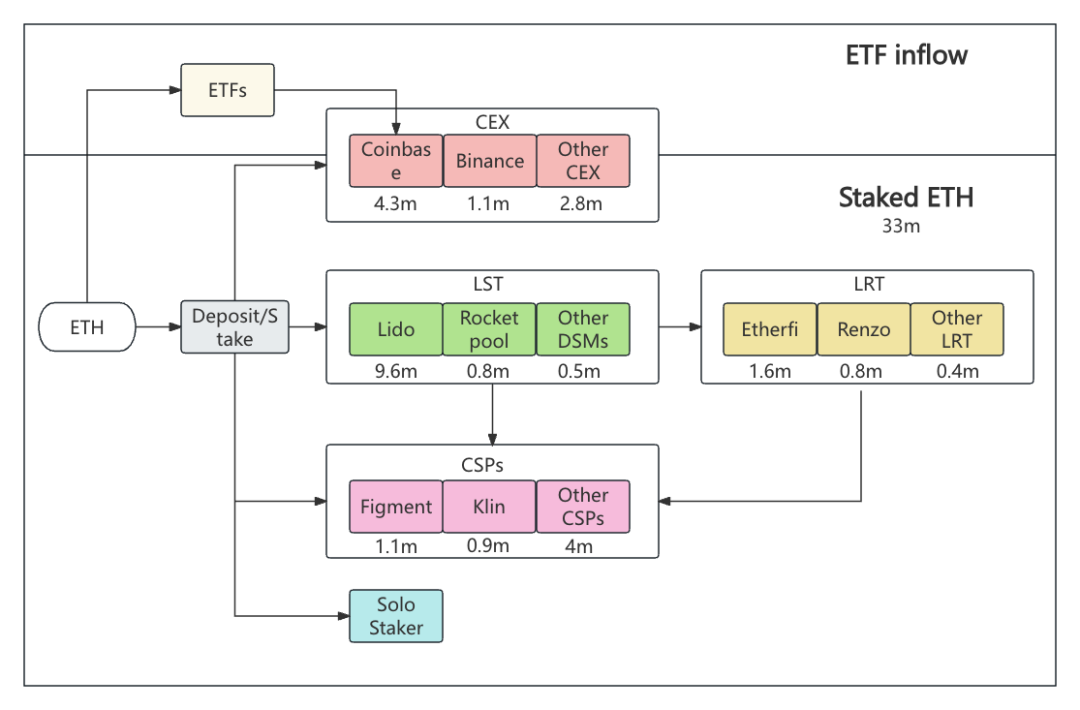

For CEXs, this proportion may increase further following approval of Ethereum ETFs—similar to Bitcoin ETFs, where Coinbase is frequently used as custodian.

Source: Maximum Viable Security: A New Framing for Ethereum Issuance

CEX staking is highly centralized. For example, Coinbase once produced eight consecutive blocks using its own validators. This centralization will likely worsen post-ETF approval. Such concentration not only fails to enhance economic security but may actually undermine it.

Source: IOSG Ventures

Liquid Staking

Overall, Lido, as the leading protocol, controls nearly one-third of staked ETH, meaning the Nakamoto coefficient drops to 1 (only one entity needed to compromise the network).

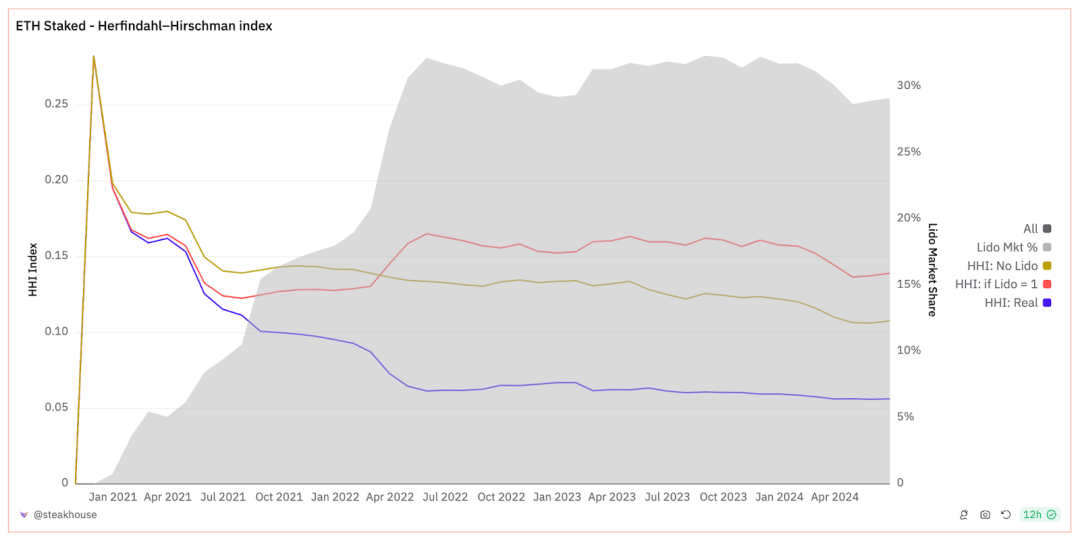

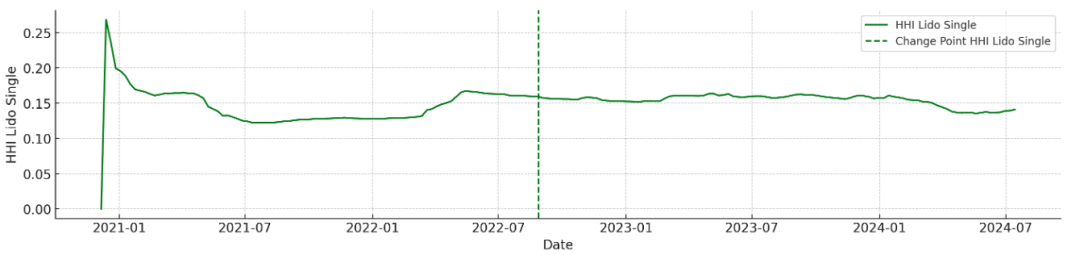

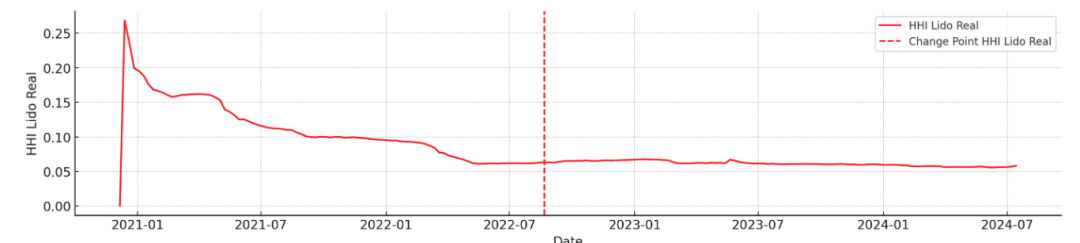

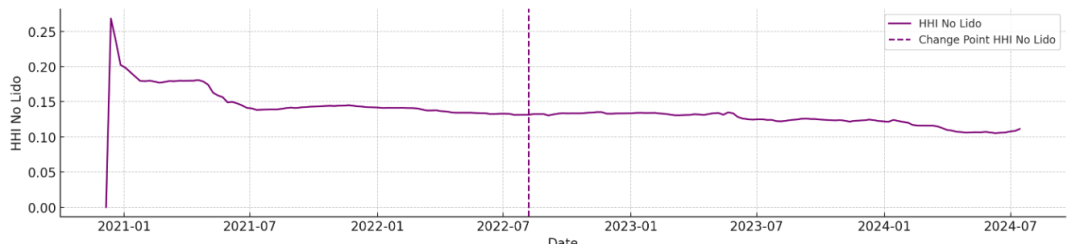

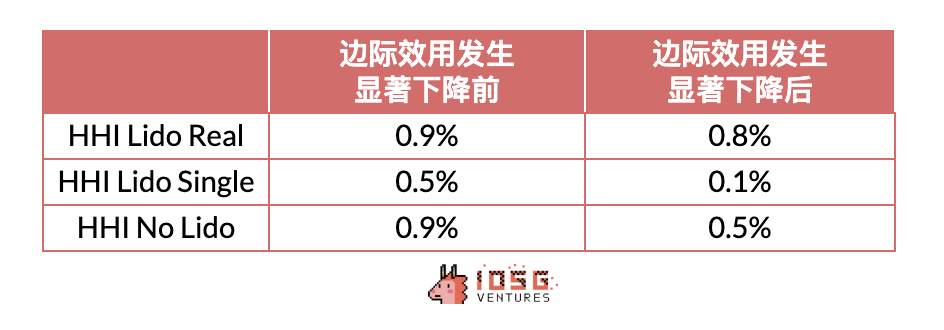

Compared to CEXs, liquid staking mitigates centralization through various means: DAO governance over operator selection, dual-token governance, Lido’s DVT, and Rocket Pool’s mini-pools. The HHI index plotted by Steakhouse measures staking centralization on Ethereum (in a sense, reflecting the efficiency of staked value converting into economic security). HHI Lido Real assumes Lido employs decentralized governance, HHI Lido Single assumes no decentralization, and HHI No Lido assumes Lido doesn’t exist. We see that active governance by Lido (blue line) positively impacts decentralization.

Source: steakhouse - Dune Analytic

Further analysis of HHI trends shows that around August 2022, when staked ETH reached ~11% of total supply (~120M ETH), the marginal utility of additional staking in improving decentralization began to noticeably decline. We refer to this as “staking saturation”—where incremental staking yields diminishing returns in decentralization.

Source: IOSG

We find that increased staking always improves decentralization, but liquid staking protocols with active governance deliver higher marginal gains (0.9%) and continue providing meaningful benefits even after saturation (0.8%).

Source: IOSG Ventures

Given that total staked ETH continues to grow, economic security may still be increasing—albeit slowly and incrementally.

Source: hildobby - Dune Analytic

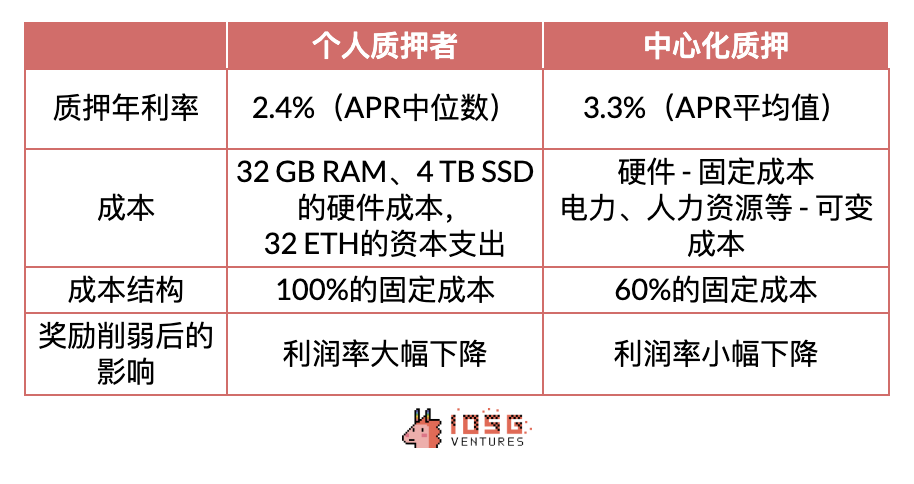

Now consider solo stakers. This group contributes most to decentralization, as each adds a geographically and socially independent validator. However, individual stakers currently face disadvantages compared to centralized providers, primarily due to cost structure.

Source: IOSG Ventures

Due to high fixed costs, solo stakers (and small operators) are more sensitive to changes in staking rewards than large-scale operators. With the Ethereum Foundation aiming to reduce future issuance rates, solo validators will face increasingly tough competition.

Source: IOSG Ventures

Thus, we observe that equal amounts of staked ETH contribute differently to economic security depending on the staker type—centralized providers, liquid staking protocols, or individual stakers. While exact quantification remains difficult, we draw the following conclusions:

1. As staking volume increases:

-

Centralized staking providers negatively impact economic security;

-

Actively governed liquid staking protocols provide positive but diminishing marginal returns;

-

Solo validators offer the highest positive impact;

2. With ETF approval, staking centralization will increase

3. With issuance adjustments, solo validators’ disadvantages will intensify

Source: IOSG

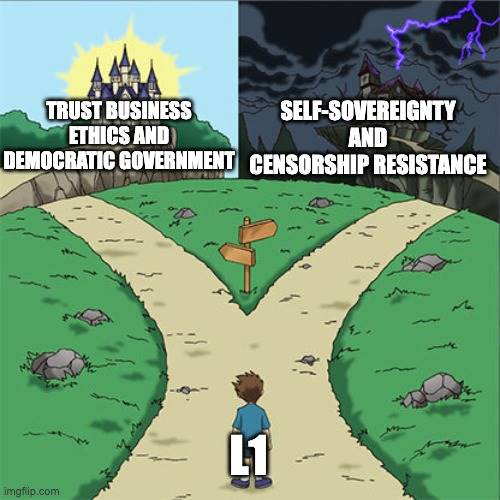

Beyond economic security, social layer defense and user-driven forks are two primary protective mechanisms for POS chains.

Ethereum is constantly monitored by thousands of developers and community members. If any attack occurs, observing nodes issue warnings, enabling rapid social response to restore the network. In cases of external attacks (e.g., government censorship or system vulnerabilities), user-led forks serve as the ultimate defense, albeit at the cost of temporary network downtime.

How then should we interpret the actual contribution of economic security? One approach uses Kunal’s model of expected security demand to value ETH. If ETH’s price reflects demand for economic security, comparing total staked market cap against Ethereum’s economic activity gives a rough estimate of how much the market values economic security relative to total security. Current calculations place this ratio around 50%.

3. Is It Bad That Economic Security Is Partially a Meme?

In Toly’s context, “meme” refers more to “exaggerated marketing slogans.” He believes the actual effect of economic security exceeds current needs.

Based on our earlier analysis, this statement holds merit:

-

Economic security contributes less than implied by staked value

-

Centralized staking providers don’t necessarily improve security; liquid staking contributions now yield very low marginal gains

-

Social layer defenses and deterrence mechanisms remain effective

Why then does Ethereum continue promoting economic security?

-

Network Activity

First, the key difference lies in network activity. Ethereum aims to become a global asset settlement layer, requiring institutional-grade trust. Any brief downtime harms its reputation in this regard. In contrast, Solana effectively rebuilds post-social-layer disruption—users accept restarts and reorgs as normal because Solana never claimed to be infallible.

-

User Perception

Second, marketing motivations exist. Toly criticizes economic security as marketing, citing Luna as an example where staking created false security perceptions. However, users seeking true security wouldn’t rely on Luna. Where Toly is correct is that economic security remains a better marketing metric than other attributes.

For users, especially institutions, concrete numbers are easier to grasp. When network security isn't directly perceptible, a collateral figure serves as a strong psychological anchor. For ETH, it’s 33 million ETH; for Solana, 337 million SOL.

Source: IOSG

4. What Does the Future of Economic Security Look Like?

To date, economic security—as part of Ethereum’s long-term strategy—has clearly entered a phase of staking saturation, generating surplus security.

Moreover, centralized staking providers, liquid staking protocols, and solo validators play vastly different roles. Recap: centralized providers offer no net security benefit, and their share will inevitably rise with ETF approval. Liquid staking protocols can enhance security through better governance, though returns are diminishing. Solo validators contribute most to network health but face structural cost disadvantages that will worsen under issuance and staking curve adjustments.

Given this, several clear development directions emerge:

4.1 More Refined Staking Design

Led by proposals like Sreeram’s Stakesure, this involves shifting from coarse-grained protocol-level metrics to per-user quantification of expected loss during attacks, potentially backed by insurance. This ensures slashed funds fully cover user losses post-attack.

Quantifying staking from the user’s perspective rather than the attacker’s enables more accurate assessment of economic security needs and more efficient use of capital. Naturally, this demands stronger infrastructure—a direction we’re actively exploring.

4.2 Incentivizing Solo Validators

The importance of solo validators is self-evident—their number and distribution directly reflect censorship resistance. Currently, networks like Solana function without them. But long-term realization of “autonomy” makes growing the solo validator ecosystem a crucial yet non-urgent priority for Ethereum.

The cost disadvantage of solo stakers is hard to overcome. Initiatives like 0xMaki’s aim to tag solo validators and offer additional incentives akin to merge mining. We believe—and closely watch—for continuous innovation in this space.

Source: IOSG

4.3 Evolution of POS

Initial skepticism toward Ethereum’s shift to POS included concerns about creating a class-based system favoring wealthy stakeholders. Viewing solo validators as individuals and centralized providers as whales, we see ETH flowing into liquid staking protocols gradually transcending the binary POS framework.

Liquid staking itself arises from the tension between security and liquidity demands. This prompts cautious exploration within these protocols on enhancing governance decentralization. As a result, novel consensus models built atop POS are emerging—such as dual governance, proof of authority (PoA), and proof of governance (PoG). These aim to maintain decentralized security while enabling more efficient validator network management and selection.

Source: IOSG

This thinking encourages backward reasoning from endgame scenarios. What will Ethereum’s POS ultimately look like? Perhaps all ETH ends up in Lido due to cost advantages—making dual-token governance essential. Or perhaps reliable node operation is ensured via governance oversight. In many thinkers’ visions, models like PoA and PoG—relying on community governance and entity reputation—represent POS’s ultimate form.

We believe liquid staking protocols actively exploring these paths will go further, possibly becoming integral to Ethereum’s consensus. We also observe ongoing POS innovations in the Cosmos ecosystem—an area we’ll continue monitoring.

4.4 Exploring Beyond POS

At its core, economic security ensures validators don’t act maliciously—not staking itself. All current solutions revolve around POS staking and slashing mechanisms. Yet, some protocols are already exploring new consensus models that secure networks with minimal or even zero economic security overhead.

The shift from POW to POS sparked vast paradigm innovation. The next industry breakthrough may lie in another fundamental shift in consensus mechanisms.

5. Final Thoughts

In a sense, Toly is right to call economic security a meme—Ethereum’s current conversion rate from staked value to real economic security is indeed declining, while other security layers remain robust. Yet this doesn’t diminish Ethereum’s need for economic security. As one component of overall security, it protects network activity, represents the most tangible form of security for users, and safeguards Ethereum’s core value proposition.

Regardless, this moment of reflection has prompted broader thinking about the path forward—including adjustments to issuance curves, incentives for solo stakers, new governance models, novel consensus designs, and shared security evolution.

Clearly, we remain in the foundational building phase. Nick Szabo posited that blockchain’s value lies in social scalability. Kyle Samani elaborated: just as people enter buildings without worrying about structural safety, they should eventually use Ethereum without questioning its security. Until that day arrives—when trust in Ethereum or other infrastructures becomes default—we know we’re not quite there yet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News