DeFi Back in the Spotlight: Overview of 8 High-Potential Protocols to Watch (With Airdrop & Yield Strategies)

TechFlow Selected TechFlow Selected

DeFi Back in the Spotlight: Overview of 8 High-Potential Protocols to Watch (With Airdrop & Yield Strategies)

Whether EVM, non-EVM, or Cosmos, it involves the broad field of DeFi.

Author: ROUTE 2 FI

Translation: TechFlow

Hello everyone!

If you're hunting for airdrops, yields, or points programs, here are some potentially promising DeFi protocols worth exploring.

Below is a list of DeFi protocols with untapped potential—including yield and airdrop opportunities—that you can explore today. These span various networks (EVM, non-EVM, and Cosmos) and cover diverse areas within DeFi such as derivatives, yield, and decentralized exchanges (Dex). They’ve been highlighted due to notable backing and strong incentive opportunities. However, this article does not constitute financial advice—please do your own research before engaging.

Let’s dive in:

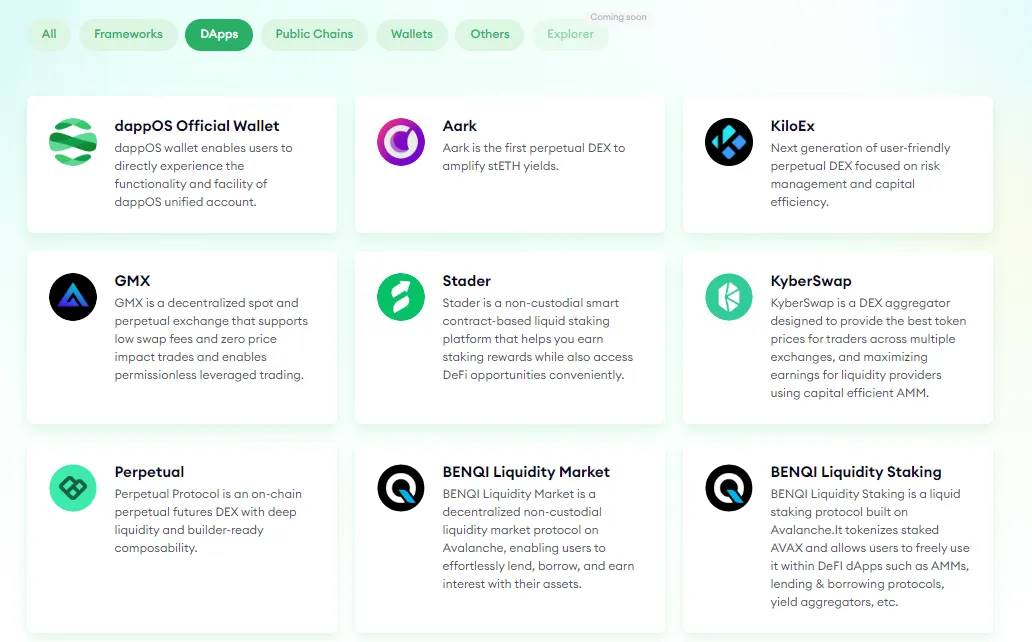

1. dAppOS

dAppOS is an intent-centric execution platform that creates a two-sided market connecting blockchains and dApps. What sets dAppOS apart is its seamless, user-friendly, and time-saving interaction model. Imagine you want to trade 100 USDC on GMX on Arbitrum, but your funds are scattered across chains: 50 USDC on Arbitrum, 30 USDC on BNB Chain, and 20 USDC on Ethereum. You’d normally need to bridge them, spending both time and gas fees. With dAppOS, you simply click once—and all your funds become available on Arbitrum within minutes. No manual fund allocation, no worrying about specific tokens for gas—all handled through its interface, potentially shielding users from smart contract risks. dAppOS boasts prominent backers like Polychain, Binance Lab, and Hashkey Capital, raising $15.3 million at a $300 million valuation. dAppOS V2 is already integrated into perpetual DEXs like GMX and KiloEX—you can explore more dApps in their ecosystem.

Rumors suggest dAppOS V3 will launch alongside a token generation event (TGE), though discussion around dAppOS remains limited—the last post I found dates back over a year with under 100k views.

I've interacted with several dApps in the ecosystem, but a pro tip is to watch for newly launched ones, as they often run prize campaigns for each new integration. A great example is the recent 50K Arbitrum trading competition following the Aark integration.

2. Symbiotic

Following Eigenlayer’s success as a leader in restaking with over $18 billion in total value locked (TVL), competitors like Karak have quickly risen, hitting over $1 billion TVL in short order. The newcomer Symbiotic takes a different technical approach to stand out. Symbiotic is permissionless and modular, allowing any protocol to launch native staking for their tokens to enhance network security. Its core contracts are immutable (similar to Uniswap), reducing governance risk and ensuring continuity even if the team departs. More importantly, it supports multi-asset deposits from any chain, making it more diversified than Eigenlayer, which only supports ETH and its derivatives. Symbiotic raised $5.8 million in a round co-led by Paradigm and Cyberfund (founded by Lido’s Konstantin Lomashuk)—confirming rumors that Paradigm and Lido are backing an Eigenlayer competitor!

According to Blockworks’ interview with Symbiotic CEO Misha Putiatin, “mainnet will go live on some networks around late summer.” This suggests a simultaneous token generation event (TGE), meaning Symbiotic tokens could launch before $Eigen becomes tradable—potentially capturing the restaking narrative early. Even more interestingly, Symbiotic runs a points program, though deposit caps have been reached. Their solution? Introducing Mellow—a liquidity restaking token (LRT) built atop Symbiotic, similar to Renzo and Etherfi for Eigenlayer. You can earn points for both Mellow and Symbiotic simultaneously. Pendleintern has a great guide on maximizing yields via Pendle deposits:

Another strategy is depositing $mETH into Symbiotic when caps lift, which currently offers 5x rewards in the Methamorphosis campaign toward Mantle’s upcoming liquid restaking token ($cMETH) and governance token $Cook, while also earning Symbiotic points.

3. Elixir

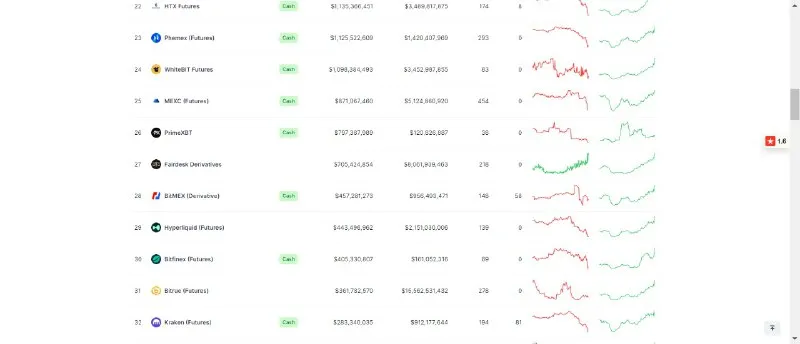

One reason decentralized orderbook exchanges lag behind centralized exchanges (CEX) is liquidity. Even the largest derivative DEX by volume, Hyperliquid, ranks only #29 with $440 million open interest (OI), compared to Binance’s $15 billion OI at the time of writing.

Common unhealthy methods projects use to attract liquidity include airdrop farming, which attracts only short-term capital that flees after claiming rewards, or relying heavily on KOL promotions. Enter Elixir—an essentially modular DPos network designed to provide liquidity infrastructure for orderbook exchanges. It enables protocols to easily bootstrap liquidity for their orderbooks. Elixir benefits both LPs and traders: LPs earn rewards through exchange incentive programs, while traders enjoy tighter bid-ask spreads. This isn’t just another Uniswap fork—by their latest report in May, Elixir provided 40% of total liquidity for DeFi orderbook exchanges, partnering with leaders like Hyperliquid and Dydx.

They’ve also raised $17.6 million from Hack VC and Arthur Hayes—who also backed Ethena, another well-executed airdrop project with strong PMF—at an $800 million valuation.

Mainnet is expected to launch in August, and to prepare, they’re running an initiative called Apothecary. Users earn "potions" by providing liquidity across multiple pools. There are three ways to maximize rewards: first, lock ETH until mainnet launches in August for a 50% bonus; second, deposit via the Orderly Quantum program to earn "covenants" backed by Elixir; third, stay active on Discord.

4. Mitosis

With the explosion of chains and protocols, ordinary liquidity providers (LPs) face major bottlenecks: constantly tracking news for optimal yields, losing value during cross-chain transfers, and being stuck in opaque points systems where reward calculations are unclear. Mitosis solves this with a novel liquidity model—Ecosystem-Owned Liquidity (EOL). EOL allows LPs and protocols to adapt to a multi-chain environment, earning cross-chain yields without manually allocating capital, while offering a transparent reward system so LPs can choose the best options. Mitosis raised $7 million in a round led by Amber Group and Foresight Venture.

Their ongoing Expedition campaign supports Etherfi’s liquidity restaking token (LRT) weETH. Depositors earn staking APR + restaking APR + Eigenlayer points + Etherfi points + Mitosis points. Additionally, depositing on tokenless Layer 2s like Scroll, Linea, and Blast (Season 2) positions you well for future airdrops.

The campaign has attracted over 45,000 stakers, mostly small-scale participants with 0–1 weETH deposits. Depositing over 1 weETH places you in the top 3,000.

5. Infinex

Poor user experience (UX) and steep learning curves hinder mainstream crypto adoption. New users must learn wallets, bridges, security, etc. Infinex accelerates mainstream adoption by unifying the decentralized ecosystem under a CEX-like UX, built specifically for Web2 audiences while remaining fully decentralized. Imagine a beginner trading on-chain just like on a CEX—without knowing terms like transactions or gas fees—but with 100% decentralization. That’s what Infinex is building. Developed by the team behind Synthetix, a top-10 ranked derivatives protocol, Infinex hasn’t announced formal funding. But according to Blockworks’ interview with Synthetix founder Kain, he has personally invested $25 million into Infinex—demonstrating deep commitment and confidence.

They’re running a current initiative called Craterun, where users earn “crates”—but it’s not a typical deposit-and-farm activity. As Kain explained, there's a twist:

Craterun is a 5-week final event (ending July 30), which raised over $100 million in its first 10-day phase. Five million crates are up for grabs, each with a 50/50 chance to win 1,000 Patron NFTs, 5,000 Patron passes, access to a $5 million prize pool, and other rewards. So you're not just farming crates—you're competing for real prizes. Deposit assets like USDe, stETH, wstETH, and ezETH to earn dual rewards.

6. Hyperlane

Hyperlane is the first universal interoperability layer built for modular blockchain stacks. Unlike Wormhole and LayerZero—which support only EVM and select non-EVM chains like Solana—Hyperlane supports EVM, non-EVM, and Cosmos chains (e.g., Tia, Inj). More importantly, Hyperlane allows anyone to deploy permissionlessly across any blockchain environment, enabling seamless communication between chains. Backed by notable investors including Circle and Kraken Ventures, Hyperlane has raised over $18 million, though valuation remains undisclosed.

Interoperability and bridge protocols perform exceptionally well in DeFi due to strong product-market fit and profitability. A recent example is Wormhole: despite LayerZero facing backlash, Wormhole remained a favorite among farmers. Inspired by these successes, I believe Hyperlane will follow a similar trajectory. To maximize gains, adopt a contrarian strategy: most focus on EVM-to-EVM transfers, neglecting Cosmos chains like Tia. As seen in Wormhole, users who engaged with non-EVM chains received boosts in final distributions—a pattern likely to repeat with Hyperlane. Use their official bridge Nexus to transfer non-EVM assets (like Tia), or leverage partner integrations such as Renzo, Nautilus, and Forma, and complete ongoing Layer3 quests.

7. Shogun

Berachain is one of 2024’s most anticipated projects, often compared to Solana for its meme-centric culture. Currently in testnet, I expect a surge in token deployments upon mainnet launch due to this hype. A crucial tool in decentralized trading is Telegram bots—they enable fast swaps and trades, unlike slower, clunkier standard Dex UX. Shogun is building an intent-centric platform that broadcasts orders to any blockchain for execution, starting with Berachain. It acts as an interchain aggregation layer, eliminating the need for multiple exchange interfaces via its intuitive Telegram bot. Shogun secured undisclosed funding from Binance and a $6.9 million round led by top-tier investor Polychain.

They’re waiting for Berachain mainnet to go live. Until then, join their Telegram beta and participate in Discord for future roles.

8. Infinity Pool

According to Binance Lab’s report last year, traders lost up to $892 million on oracle-related exploits due to manipulable vulnerabilities. Attackers inflate prices of low-liquidity tokens on target dApps, then swap them for other assets.

Imagine a decentralized exchange offering infinite leverage on any asset—with no liquidations, no counterparty risk, and no reliance on oracles. That’s the breakthrough Infinity Pools is building. Built atop Uniswap V3 with concentrated liquidity, it uses LP positions as credit sources, allowing repayment in any LP asset. Backed by top investors like Dragonfly, Coinbase Ventures, and Wintermute, Infinity Pools also won the Blast Bang Bang competition. While mainnet hasn’t launched yet, turn on notifications on Twitter and Discord for future updates.

That’s all for today—hope you enjoyed the read.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News