From "Ethereum Killer" to Partner: Solana's Transformation Journey

TechFlow Selected TechFlow Selected

From "Ethereum Killer" to Partner: Solana's Transformation Journey

If you can't beat them, join them.

Author: Pavel Paramonov

Translation: TechFlow

Solana is the reason behind the chaos of Ethereum L2 rollups.

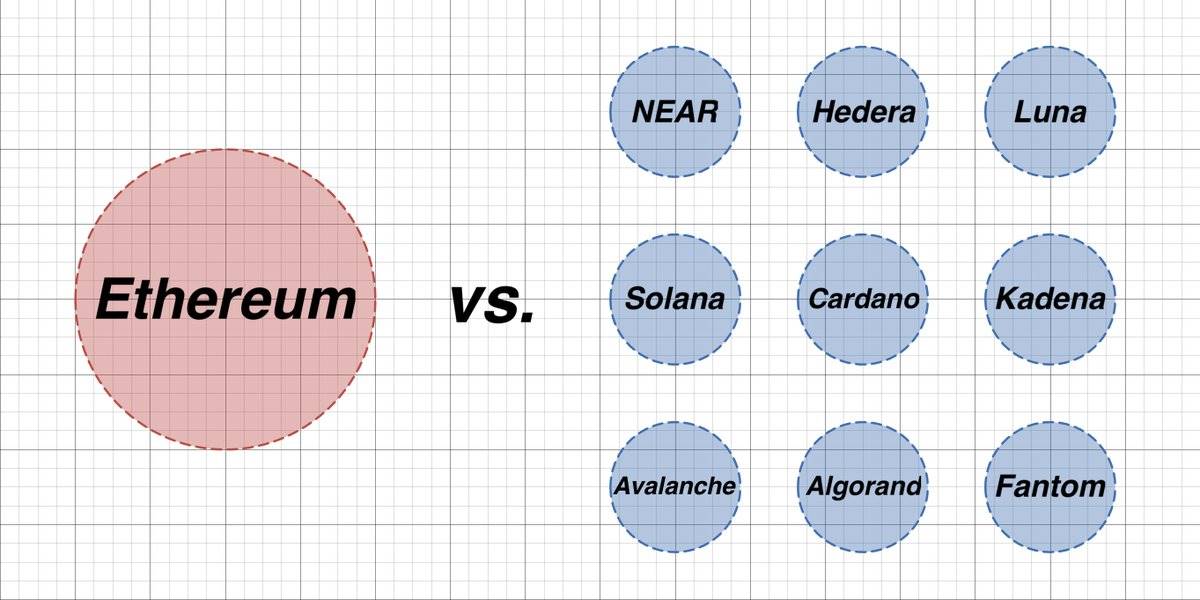

During the 2021 bull market, we witnessed a battle among L1 blockchains competing for the title of "Ethereum killer."

Yet, no one won this race. Founders realized that "if you can't beat them, join them."

The catalyst for this shift was Solana.

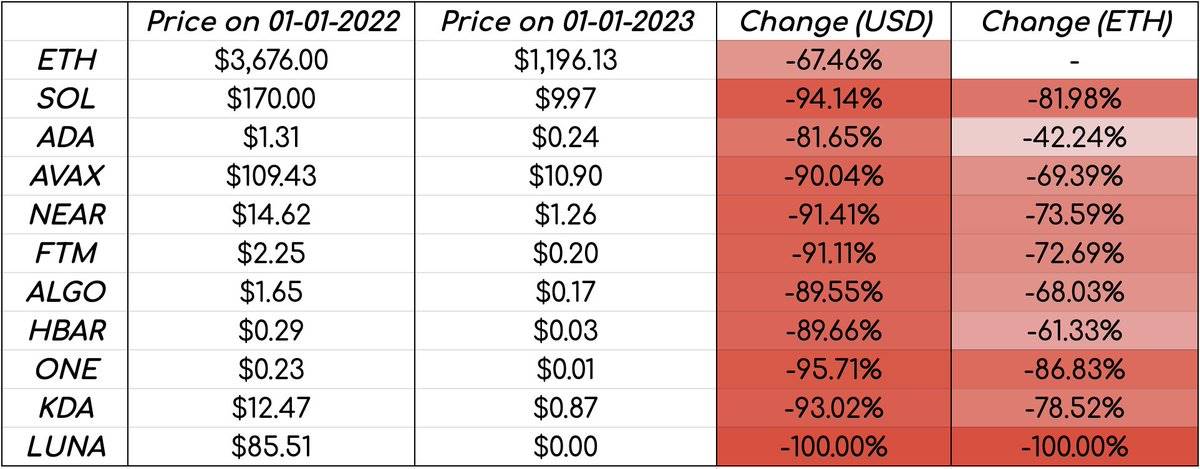

From early to late 2022, most L1 blockchains saw their native tokens lose over 90% of their value.

All blockchains were trying to solve the blockchain trilemma, claiming they were faster and more secure than Ethereum.

However, no one truly won because competing with giants is hard.

Imagine you're building a wallet from scratch trying to compete with @MetaMask. You might have better UX/UI, better features, and smoother flows.

But most people will still choose MetaMask simply because they're used to it.

-

Solana became the only non-EVM blockchain that users actually care about.

You cannot say the same about other non-EVM blockchains like @NEARProtocol, @Cardano, @Algorand, or @kadena_io.

The landscape in 2021 looked like this:

Current TPS on these chains does not exceed 10 when it comes to real users.

Solana also has its well-known issues:

-

Multiple outages

-

Association with SBF and FTX

-

@okx delisted USDC and USDT on Solana

-

@DeGodsNFT bridged to Ethereum

-

And many more

Yet, it's the only team that genuinely cares about users, technology, and the future.

@aeyakovenko and the team received all this feedback and managed to address every issue, essentially pushing forward despite the challenges.

Solana did not win the L1 war but instead explored a previously uncharted path, thanks to @0xMert_, @SuperteamDAO, and other core contributors.

-

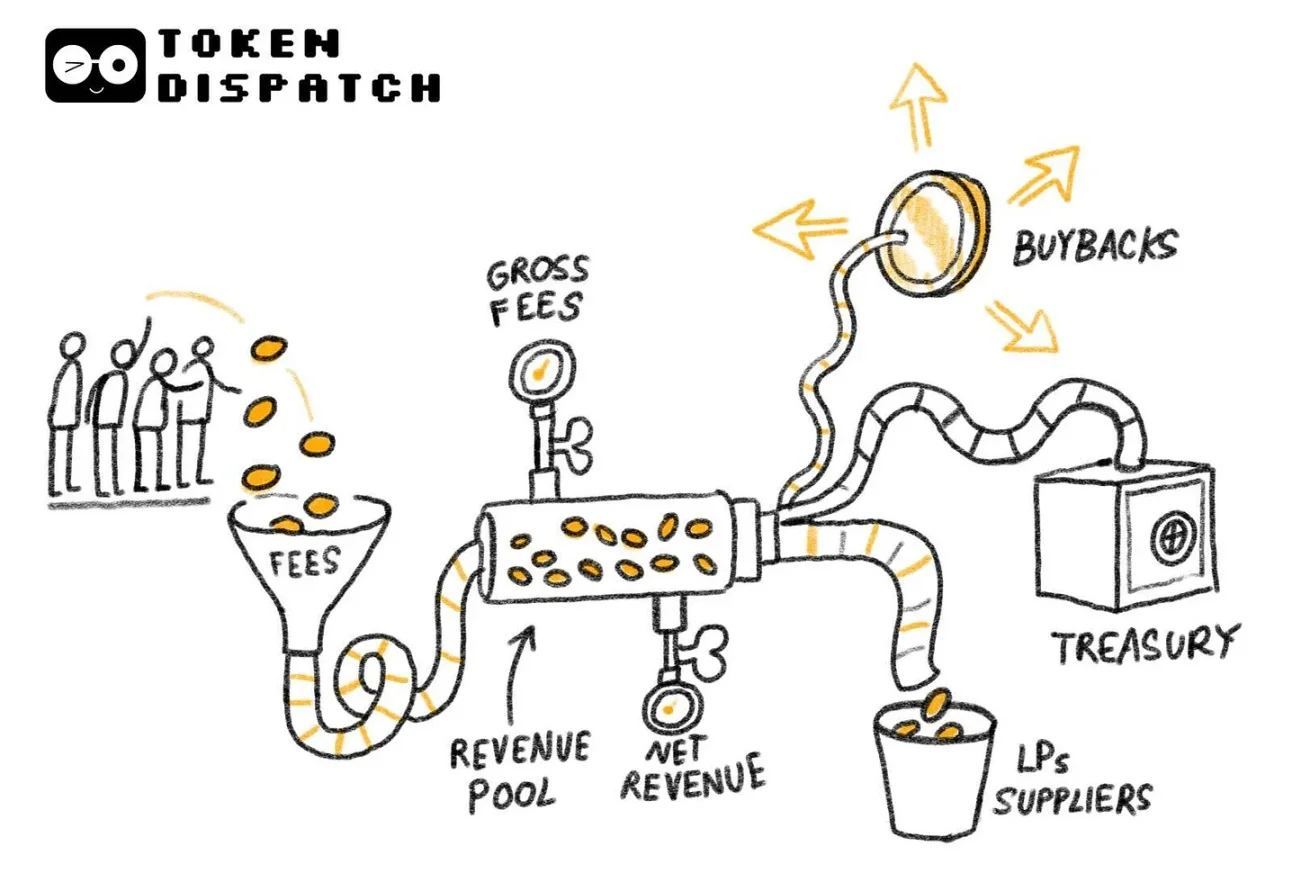

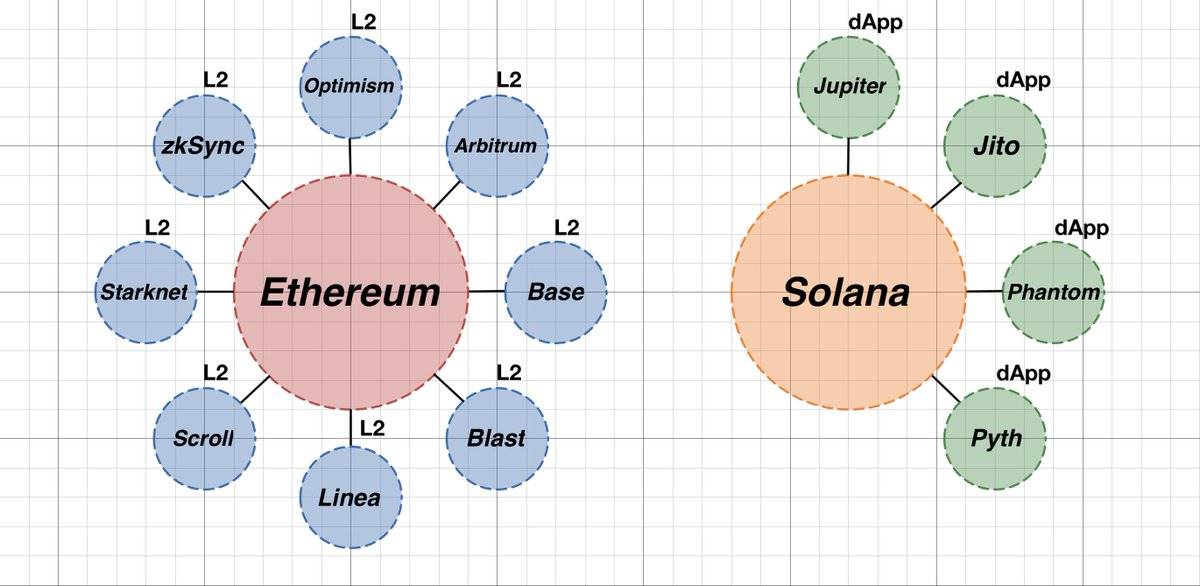

Blockchains cannot compete for liquidity at the L1 level, so they decided to benefit from it rather than fight against it.

Why compete when you can directly benefit from Ethereum?

Deploying an L2 usually means benefiting from Ethereum's economy while maintaining your own economic ecosystem.

If you're a rollup, attracting liquidity becomes easier since you're built atop a native chain with hundreds of millions in TVL.

At the same time, creators have the ability to launch their own native tokens, creating a micro-economy within the larger ecosystem.

Moreover, creating rollups is now easier than ever: you have multiple solutions like @conduitxyz, @alt_layer, and of course, @Optimism's OP Stack.

-

Liquidity fragmentation across L2s is actually social fragmentation.

Each L2 has its own focus:

- @Optimism focuses on scalability. - @arbitrum focuses on DeFi. - @base focuses on SocialFi. - @MetisL2 focuses on DAOs.

Is that bad? Of course not!

Each rollup is unique and has the chance to develop its own identity, but sometimes the loudest voices complaining about liquidity fragmentation are from the very same groups.

As @eawosikaa pointed out at ethCC, people primarily attend side events because it's easier to find like-minded individuals there.

Still, I believe it's important not just to identify as a zksync enthusiast, but to remain open to other cultures, ideas, and perspectives.

We're all playing in the same sandbox (Ethereum).

-

On Ethereum, people build rollups. On Solana, people build apps.

If I had to compare the current state of these two ecosystems, I'd paint this picture.

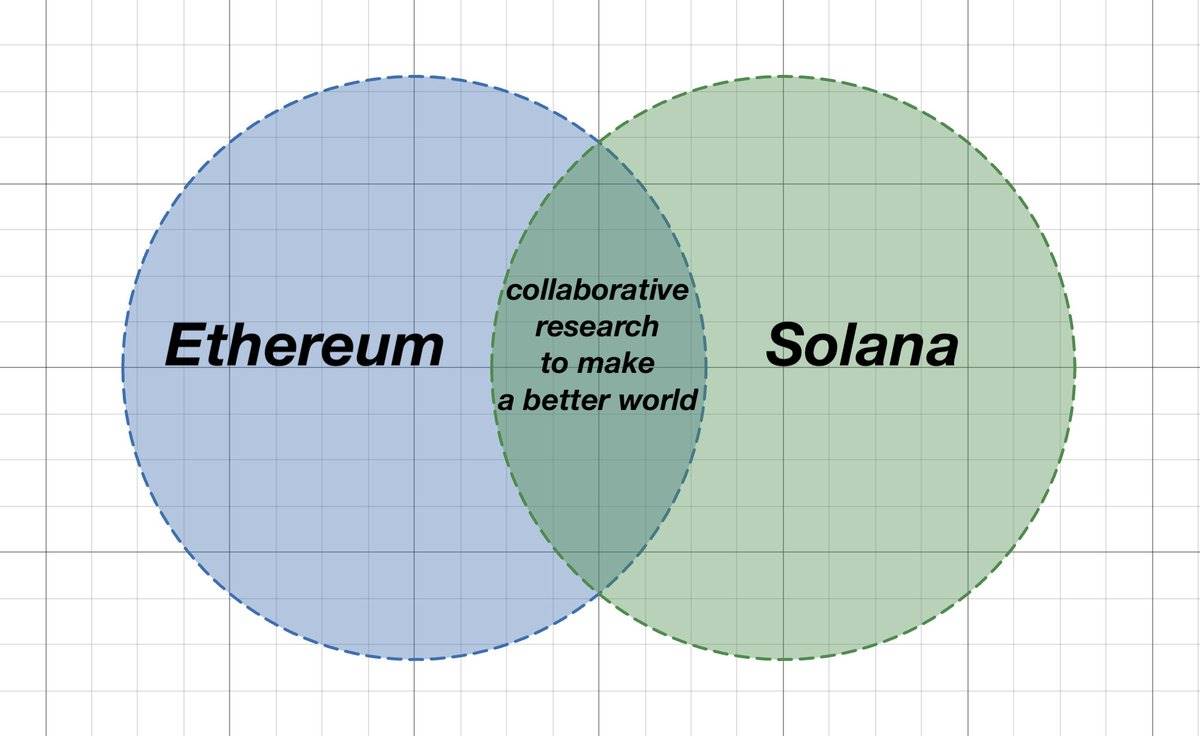

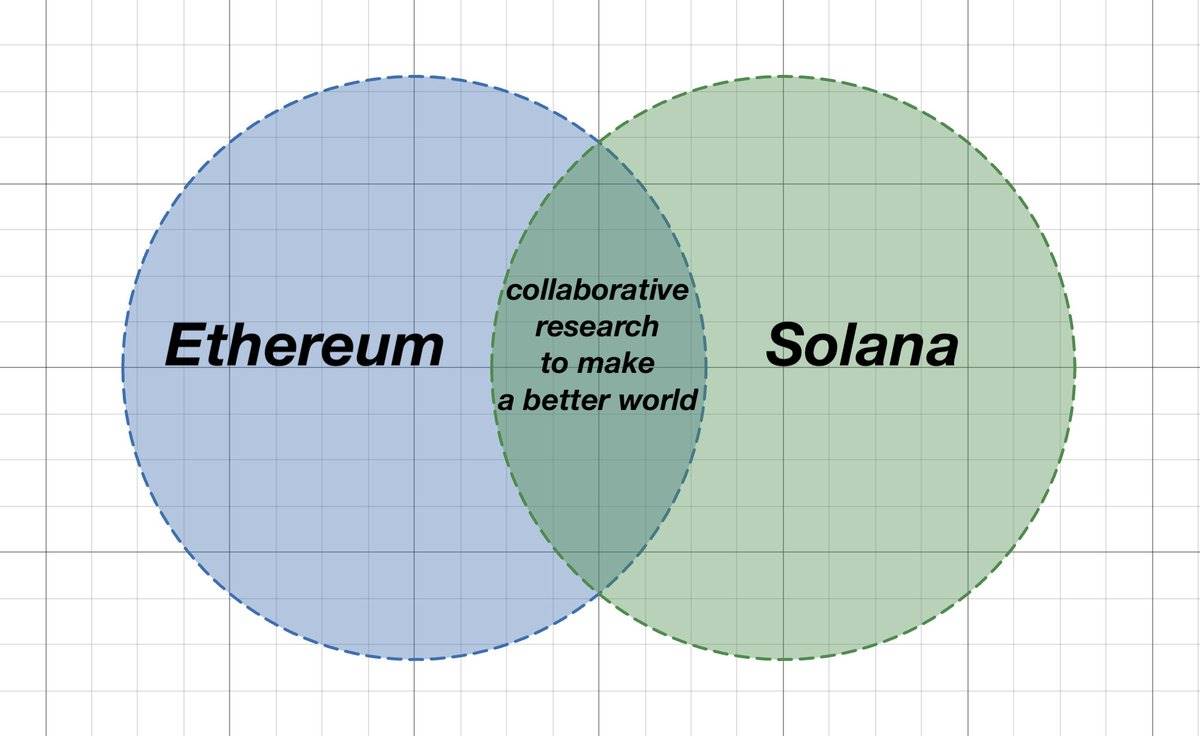

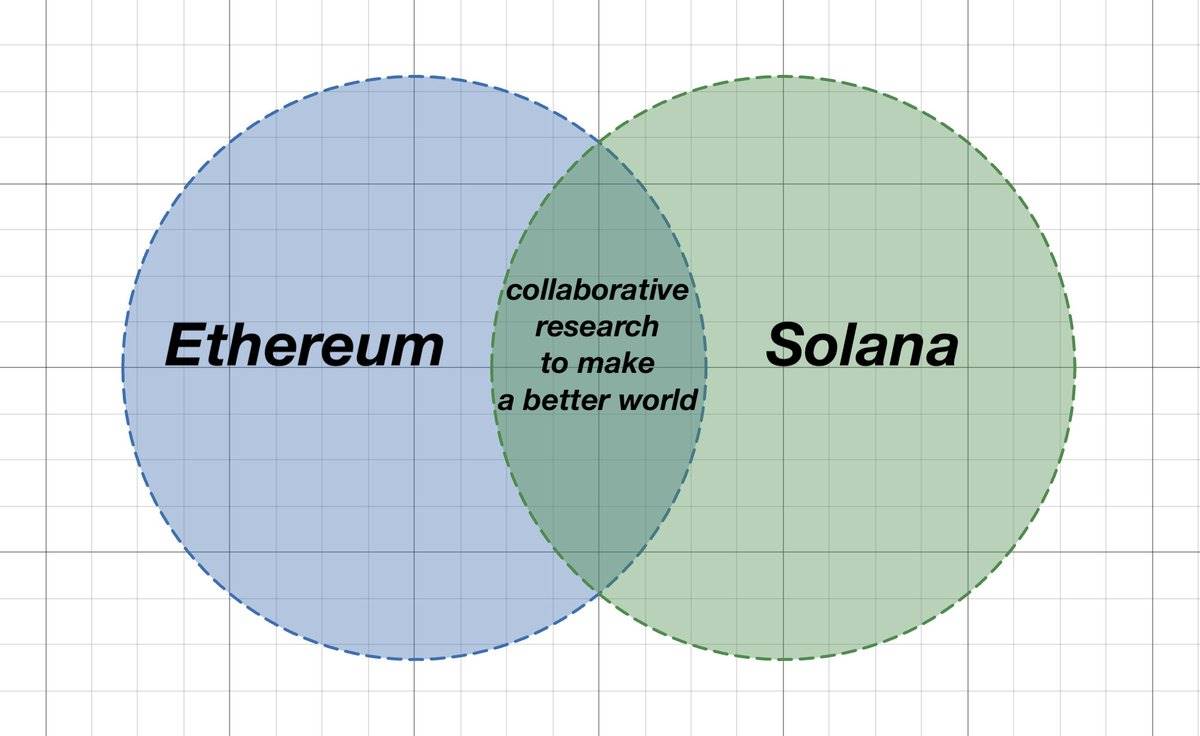

Currently, there's no real competition between Ethereum and Solana because these blockchains serve different purposes.

Ethereum has become a big sandbox where kids (developers) build sandcastles (rollups).

More and more developers are focusing on deploying the same dapp across multiple rollups.

I think this could become a problem, as some developers prioritize bringing liquidity to their app over building a truly great product.

Solana is the same sandbox, but here the sandcastles are applications, and currently, they are more beautiful.

-

There's no better swap experience than using @JupiterExchange.

-

There's no better wallet experience than @phantom.

-

Even native liquidity provision exists for non-native assets via solutions like @CloneProtocol.

@jito_sol created the best liquid staking experience on Solana, including MEV rewards—something previously impossible.

But things aren't that simple.

-

Solana's current stage resembles Ethereum's previous phase.

People started migrating to L2s and creating new ones due to limitations of the native chain.

Some may remember 2021, when you had to pay $200–$300 in fees for a single swap.

Ethereum itself couldn't handle such high throughput, so a solution was needed to increase capacity and reduce fees to make the network usable.

Solana can currently handle its activity, but there are architectural limitations:

-

Block producers are spammed by bots, causing transactions to fail.

-

Failed transactions waste compute units and network bandwidth.

-

The fee mechanism doesn't incentivize efficiency and lacks incentive compatibility.

To solve these problems, you don't necessarily need to create an L2 on Solana.

In my view, creating an L2 on Solana makes sense in two cases:

-

When the network cannot handle large transaction volumes even after all optimizations, or when it can handle them but fees are prohibitively high.

-

When creating an app-specific chain to leverage Solana's liquidity while still maintaining your own economic ecosystem.

Perhaps in the future, we'll see a similar L2 competition on Solana as we currently do on Ethereum.

Here, there is no absolute winner. In the end, collaboration often triumphs over competition.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News