The market has moved from prosperity to a depressed phase, and survival is now the most important thing.

TechFlow Selected TechFlow Selected

The market has moved from prosperity to a depressed phase, and survival is now the most important thing.

People hesitated, thinking "Bitcoin is too expensive." Ironically, this was precisely when the major upward trend began.

Author: ardizor

Compiled by: TechFlow

Unsure whether $BTC is just correcting or if the bull run has ended? You're not alone.

The market is currently influenced by Mt. Gox, Germany, the U.S. election, ETFs, and FTX repayments.

But after 100 hours of data analysis, one thing is clear: we are being manipulated.

Here are the truths that large holders don't want you to know.

First, let's discuss the current market phase.

We are now in a phase known as "depression."

Many people are exiting the crypto market.

Those who have lost faith in crypto's bright future are selling their holdings.

What they fail to realize is that surviving this stage is paramount.

Because such pullbacks happen in every cycle.

They always have, and they always will.

This is how market psychology works.

We've seen much larger price drops before without catastrophic outcomes.

Considering all factors and the bigger picture, things aren't that bad.

There are more bullish indicators than bearish ones—you should leverage the current sentiment.

While altcoins are significantly lagging behind Bitcoin—which doubled after ETF approval—many remain hesitant, thinking "Bitcoin is too expensive now."

Ironically, this is exactly when the main upward trend begins.

Due to minimal inflows into ETH ETFs and summer stagnation fueling FUD, the local market may not see significant growth next month.

However, the big picture remains unchanged: growth is inevitable. During this minor correction, implementing a DCA strategy (Dollar-Cost Averaging) will yield the best results and help you outperform 90% of traders.

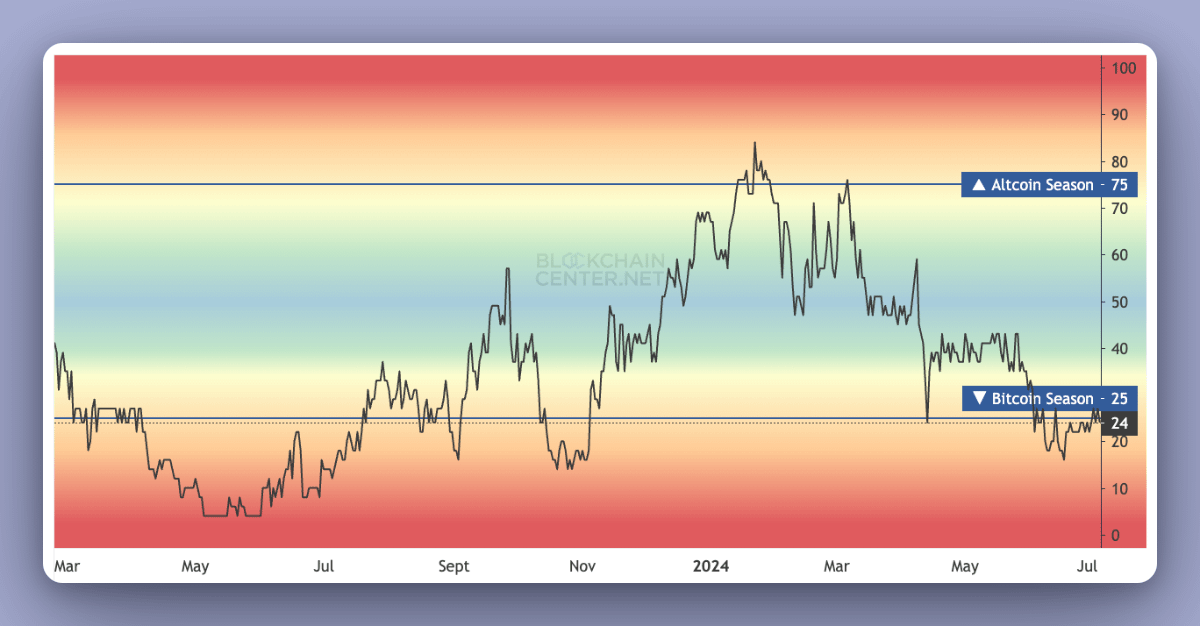

When uncertain about what to do, focus on the bigger picture. Look at the altcoin index—it's currently at the same level as November 2023. Do you remember what happened after that? The market grew fivefold.

All you need to do now is focus on the positive catalysts driving growth, such as:

➬ Approval of Ethereum ETF S-1 forms

➬ Trump's support for cryptocurrency

➬ Upcoming interest rate cuts in the U.S.

Here are some potential reversal indicators:

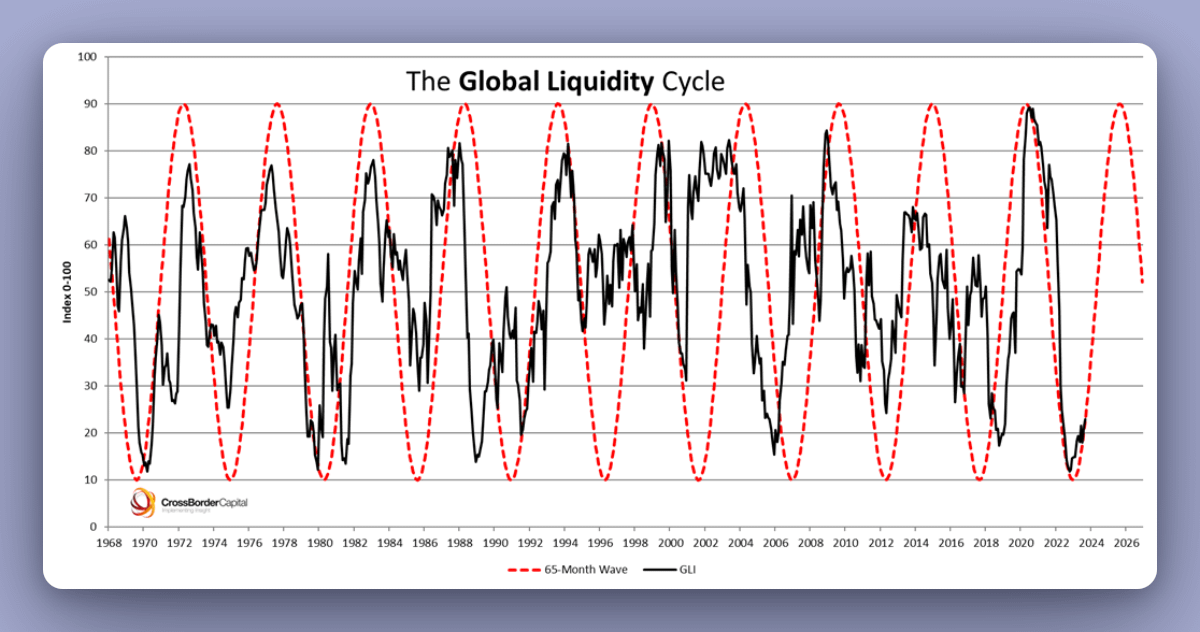

(1) Global Liquidity Index:

The Global Liquidity Index helps assess the current market phase. It includes assets from major central banks and Fed reserves. Currently, global liquidity also appears to be in a consolidation phase.

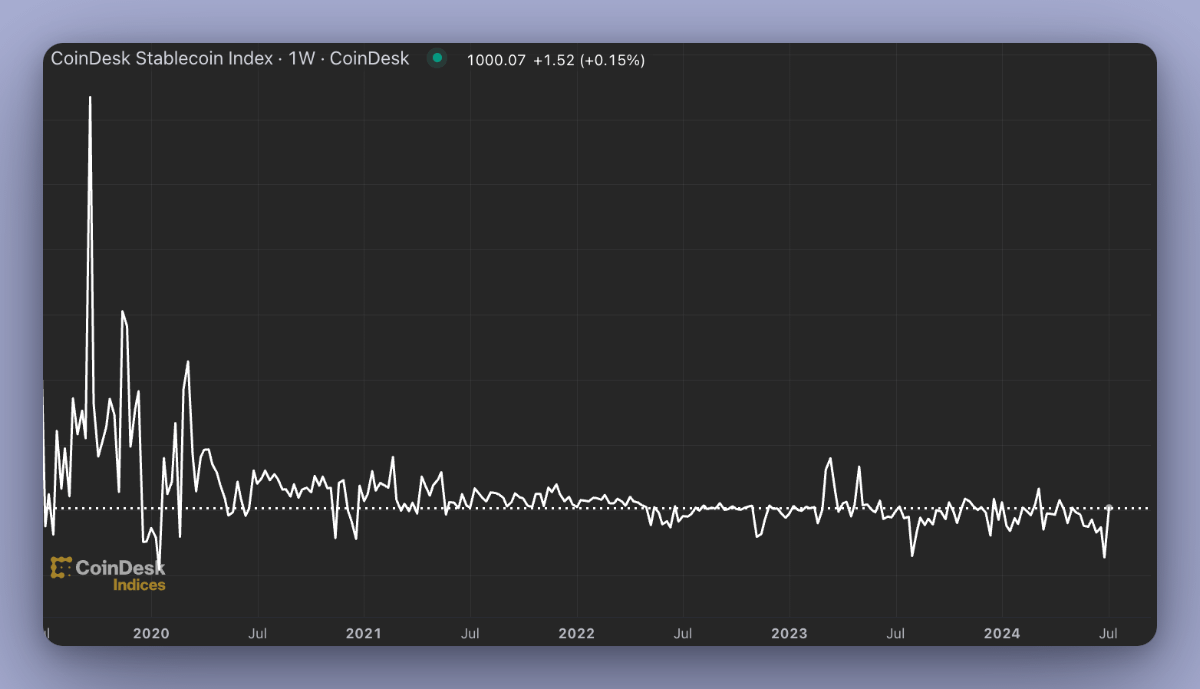

(2) Stablecoin Index:

This indicator reflects new capital entering the crypto market. As we can see, we are far from previous cycle levels. The golden rule is: once liquidity starts increasing, the market will rise accordingly.

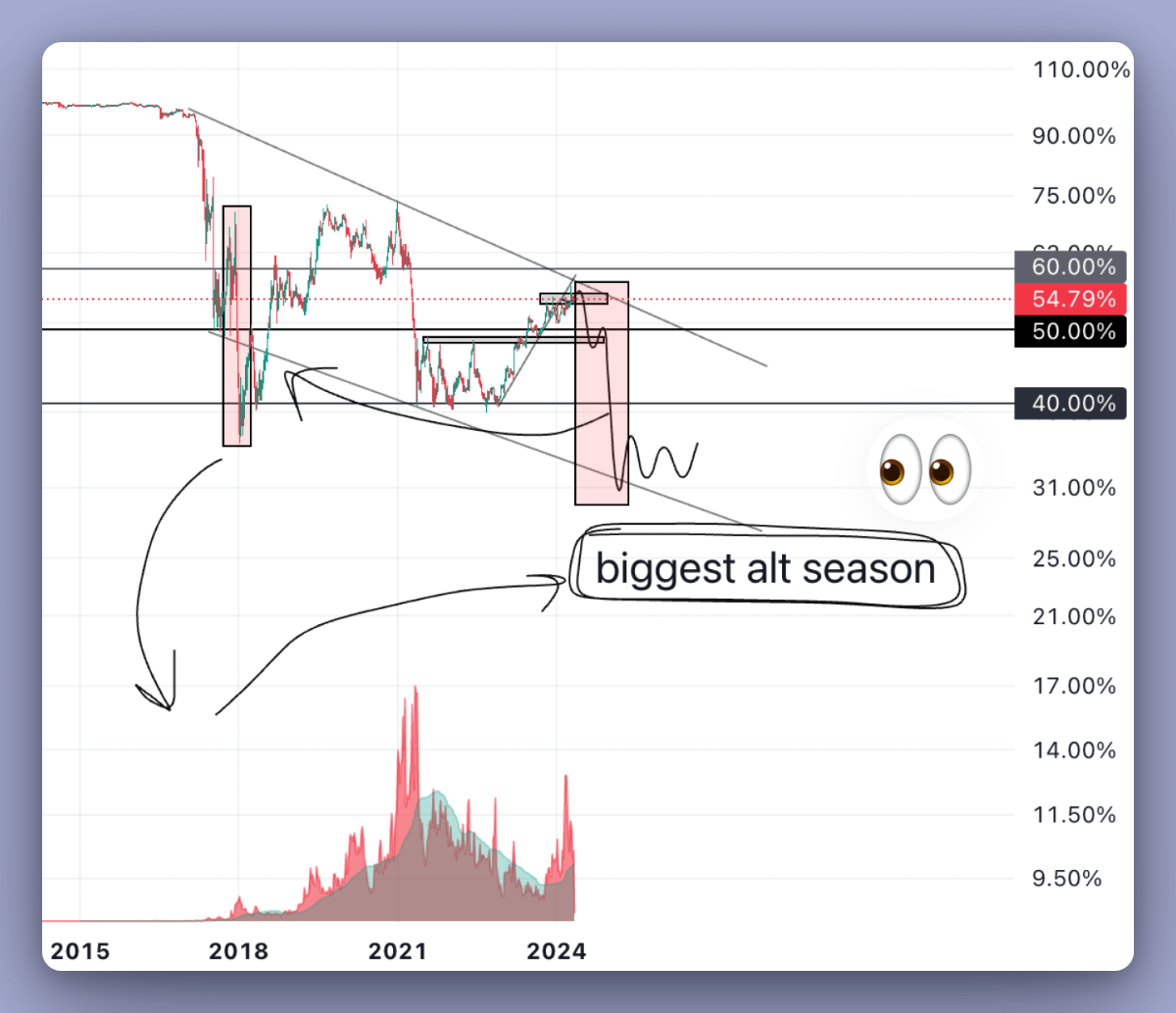

(3) BTC.D Index:

The chart shows Bitcoin’s market cap as a percentage of total crypto market cap. Notice how BTC.D has been consolidating between 54% and 57% since April. Once it breaks below this range, we can expect a massive altseason to begin.

(4) Trading Volume Across All Platforms:

Current trading volume is significantly lower than peak levels. Despite Bitcoin trading higher than in 2021, volume remains subdued. The lack of retail activity is evident—but once it returns, the market will be primed for growth.

Summary:

Here’s what I recommend doing right now:

-

Consider taking on a side job to increase income

-

Research emerging narratives and ideas

-

Accumulate undervalued altcoins

-

Learn new skills

Because building the right positions now can lead to 100x gains in the future. You’ll thank yourself for taking action. By the end of the cycle, you’ll be among the winners.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News