TON Ecosystem Landscape: Uncovering Chain Stars and Future Opportunities (Part 1)

TechFlow Selected TechFlow Selected

TON Ecosystem Landscape: Uncovering Chain Stars and Future Opportunities (Part 1)

This article will analyze the development and risks of the TON ecosystem as a whole.

Author: WolfDAO

Following the first article, "In-Depth Analysis of TON Chain: Unveiling the Core Power of a Future Blockchain Giant," this is the second installment in the TON Ecosystem Special Series. Due to its length, the report has been released in two parts—Part [Upper] analyzes the overall development and risks within the TON ecosystem; Part [Lower] focuses on the most influential star projects on-chain, examining their innovative features and future opportunities. Through detailed data analysis and case studies, we will showcase TON’s outstanding performance and immense potential in decentralized finance (DeFi), NFTs, gaming, and other fields.

Preface

As a research institute community dedicated to understanding market trends and deeply engaging with blockchain technology, WolfDAO has been closely monitoring the rapid growth and expansion of the TON ecosystem. After reviewing existing reports, we believe there remain many untapped potentials within the TON ecosystem that have yet to be fully explored—this insight is precisely what motivated us to write this series.

TON not only possesses a massive user base serving as a foundation for diverse innovations and emerging applications but also brings significant disruption and boundless possibilities to the entire market.

In the first part, "In-Depth Analysis of TON Chain: Unveiling the Core Power of a Future Blockchain Giant", we thoroughly examined TON blockchain's technical advantages, market performance, and development potential, revealing why it could become a dominant force in the future of blockchain.

You are now reading the second part of the TON Special Report series; this report, titled "The Big Picture of the TON Ecosystem: Uncovering On-Chain Star Projects and Future Opportunities", uses comprehensive data analysis and case studies to demonstrate TON’s remarkable achievements and vast potential in DeFi, NFTs, gaming, and more.

Additionally, in the third part, "Regulatory Compliance and Risk Assessment of TON Chain: Coexistence of Prospects and Challenges", we will delve into the regulatory compliance challenges facing TON amid its rapid growth and analyze their impact on future development. Will the rolling wheels of gold come to a halt due to insurmountable obstacles? Stay tuned for our in-depth exploration of this critical question, offering you a comprehensive evaluation of TON’s prospects and risks.

Overview of the TON Ecosystem

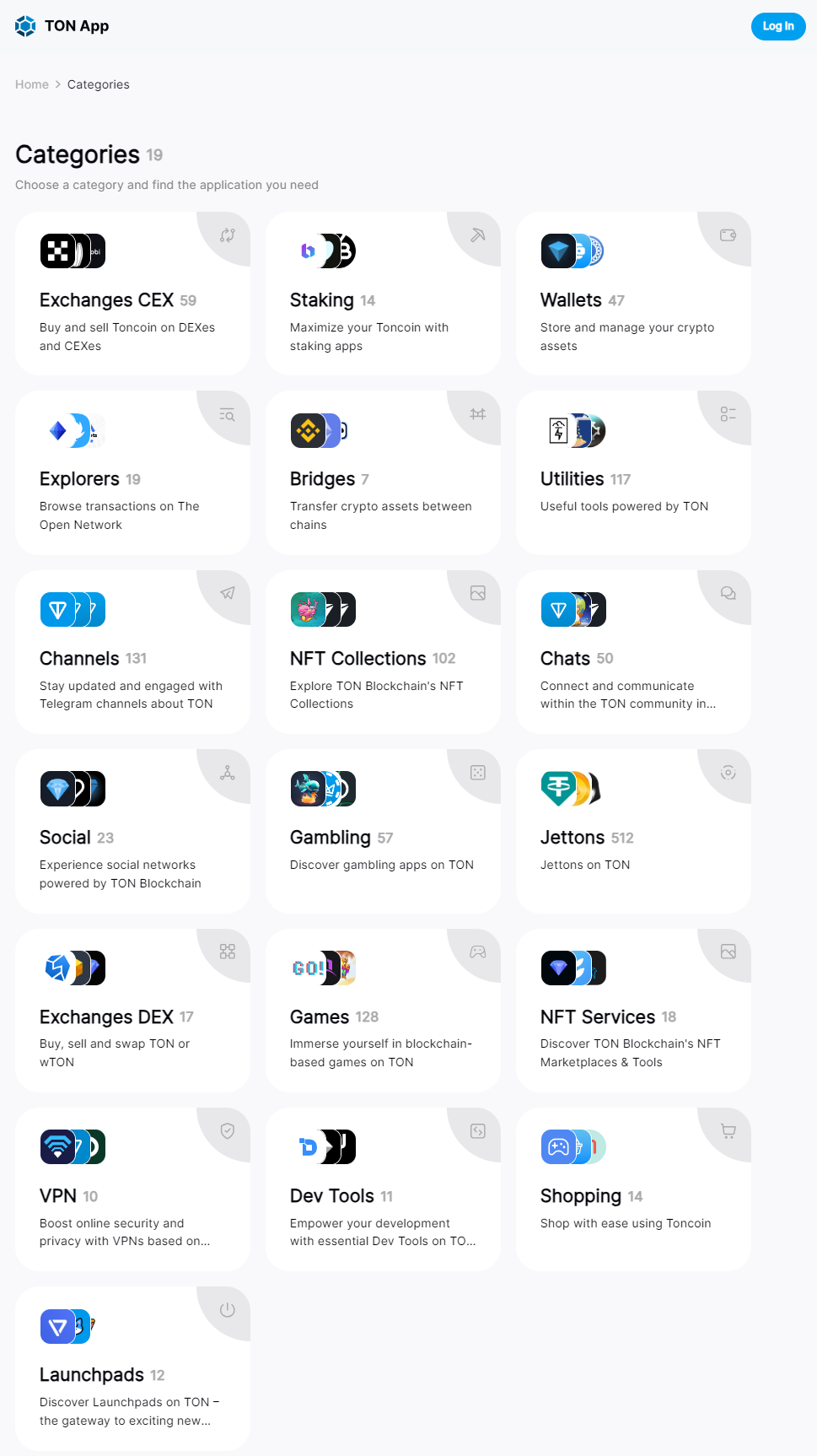

Within the TON ecosystem, there are 19 distinct sectors, each encompassing various types of applications and services. These include CEX exchanges, DEX exchanges, staking platforms, wallets, explorers, bridges, utility tools, channels, NFT collections, chat apps, social platforms, gambling, Jettons, games, VPNs, developer tools, shopping platforms, and launchpads. Excluding the highly duplicated Jetton category, the most popular sector is gaming, which hosts 128 projects and stands out as one of the most important areas of development within the TON ecosystem.

Classification of TON Ecosystem Apps Source: TonApp

One key event driving TON’s popularity was the launch and viral success of the "Tap-to-Earn" game Notcoin. This low-barrier, high-reward gaming model effectively attracted a large number of users and became a flagship project for TON’s market promotion. However, relying on a single sector makes it difficult to create a sustainable feedback loop to nourish the broader ecosystem. Therefore, a healthy ecosystem requires balanced development across multiple core sectors. Current ecosystem growth depends on an active developer community, strong technical support, and a vibrant user market to achieve prosperity. The following sections will provide detailed analysis of these factors.

TON Ecosystem Developer Community

1. Size and Activity Level of the Developer Community

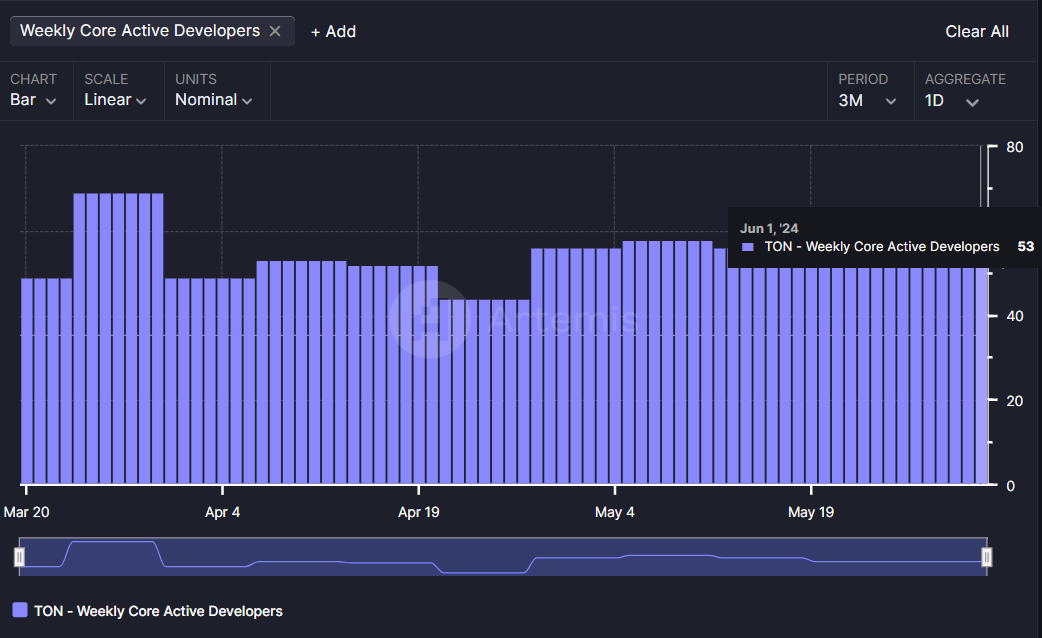

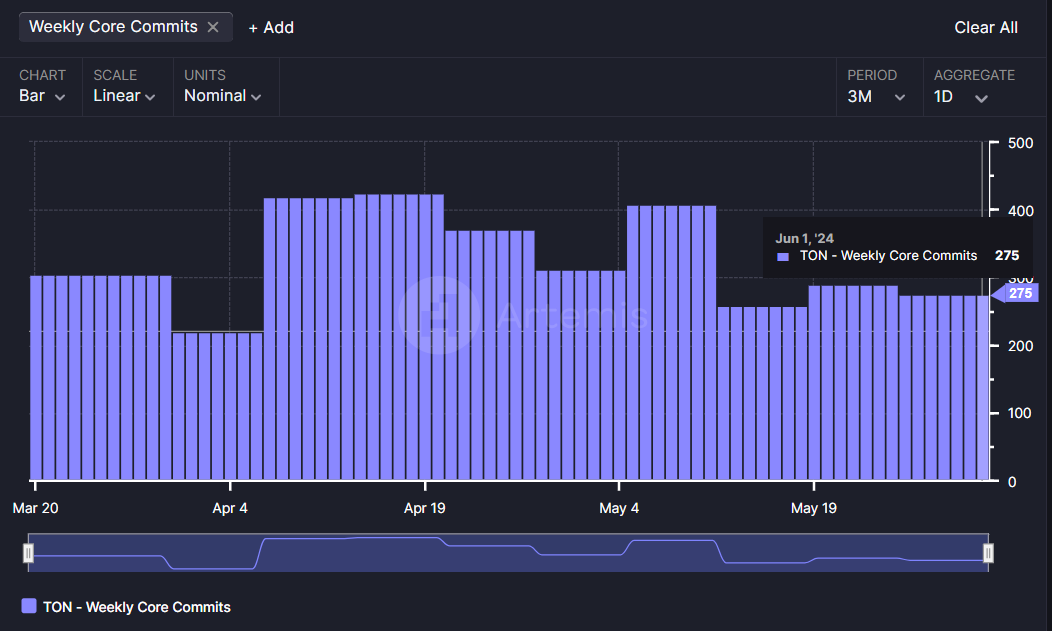

According to statistics from Artemis, TON maintains around 50 weekly active core developers, with approximately 300 core commits per week. Compared to other public chains like Solana and Aptos, the size of TON’s developer community still has considerable room for growth.

Weekly Active Core Developers on TON source: artemis

Weekly Core Commit Count on TON source: artemis

Current State and Future Outlook of the TON Developer Community

TON developers primarily communicate through Telegram, where engagement and activity levels are very high. Currently, the English-speaking developer channel on Telegram has 10,548 members, averaging about 600 messages daily discussing coding and deployment issues. Meanwhile, the Chinese-speaking developer channel has 6,716 members, with around 400 messages exchanged daily on various technical topics.

Although TON has only recently launched, its ecosystem is already relatively mature and active, giving rise to numerous high-profile projects. As such, we hold a very positive outlook for TON’s future development. With solid technical foundations and a vibrant developer community, TON is well-positioned for further expansion and innovation.

2. Support Programs and Incentive Mechanisms (Detailed Introduction to TON’s Support and Incentives for Developers)

Analysis and Outlook of TON’s Developer Incentive Program

TON’s developer incentive program is managed by the TON Foundation. Established in Switzerland in 2023, the TON Foundation is a nonprofit organization entirely funded by community donations. Its mission is to serve the interests of the community by supporting initiatives that advance the vision of an open network.

It is worth noting that while the TON Foundation does not directly control TON technology, it authorizes the operation of TON projects and functions as one of many decentralized contributors within the TON community. TON operates on open-source code, allowing anyone to contribute without centralized control.

Currently, TON’s incentive programs fall into two main categories:

-

Token incentives for specific projects and communities

The TON Foundation offers token incentives for specific projects or communities. For example, a recent announcement revealed a $30 million liquidity pool incentive program for TON/USDT pairs. Additionally, John, Head of the Asia-Pacific Region at the TON Foundation, announced during “TON's Achievement in Asia Pacific Region and TON Society HK” that one million TON tokens would be allocated to incentivize MiniApp developers in the Chinese-speaking region.

-

OpenLeague

Launched on April 1, 2024, OpenLeague Season One ran for one month and distributed 30 million TON tokens (worth approximately $200 million at current prices) as ecosystem incentives. TON ecosystem projects compete monthly for substantial prizes, while users on the TON chain can earn generous rewards by participating. This competition includes four components:

-

The League

-

Token Mining

-

Tasks and Airdrops

-

Liquidity Pool Boosts

Each component attracts participants from different backgrounds—including both developers and users—thereby enhancing overall ecosystem activity and diversity.

TON Ecosystem Node Operators

Global Distribution of TON Validators source: TON Official Website

1. Node Distribution

TON validators are distributed globally, mainly concentrated in Europe and the United States. As of June 3, there were over 300 nodes, with nearly 500 million TON staked—accounting for nearly 20% of the circulating supply.

2. Role of Nodes

TON uses a Proof-of-Stake (PoS) consensus model, meaning network security and stability are maintained by a set of validator nodes. Anyone can become a validator and earn Toncoin rewards for contributing to network security.

Validators are responsible for verifying all user transactions. If all validators reach consensus, the transaction is deemed valid and included in the blockchain. Invalid transactions are rejected.

Users pay a small amount of Ton as a fee for validator work, which is proportionally distributed among elected validators during each validation cycle. Additionally, new tokens are minted during validation and also distributed to validators. The overall annual inflation rate is approximately 0.5%. A validator node with average stake earns roughly 120 Ton per day.

To receive block rewards, validators must:

-

Successfully participate in the validator election—requiring a minimum stake of 300,000 Ton and winning the election with at least 400,000 Ton, while not being excluded due to reaching the maximum validator limit.

-

Successfully validate blocks throughout the entire validation cycle.

Punishment Mechanism

Two behaviors may lead to penalties for validators:

-

Idling: prolonged non-participation in block creation and transaction signing during the validation cycle;

-

Malicious misconduct;

If a validator remains idle for long periods or engages in malicious behavior during a validation round, they may face fines. Any network participant who suspects improper conduct can file a complaint. During the complaint process, the complainant must provide cryptographic evidence of misconduct for all validators to vote on. All running validators check the validity of the complaint and collectively decide whether to uphold it. Once 66% of validators agree, the offending validator faces severe penalties, with corresponding amounts deducted from their total stake.

3. Degree of Decentralization

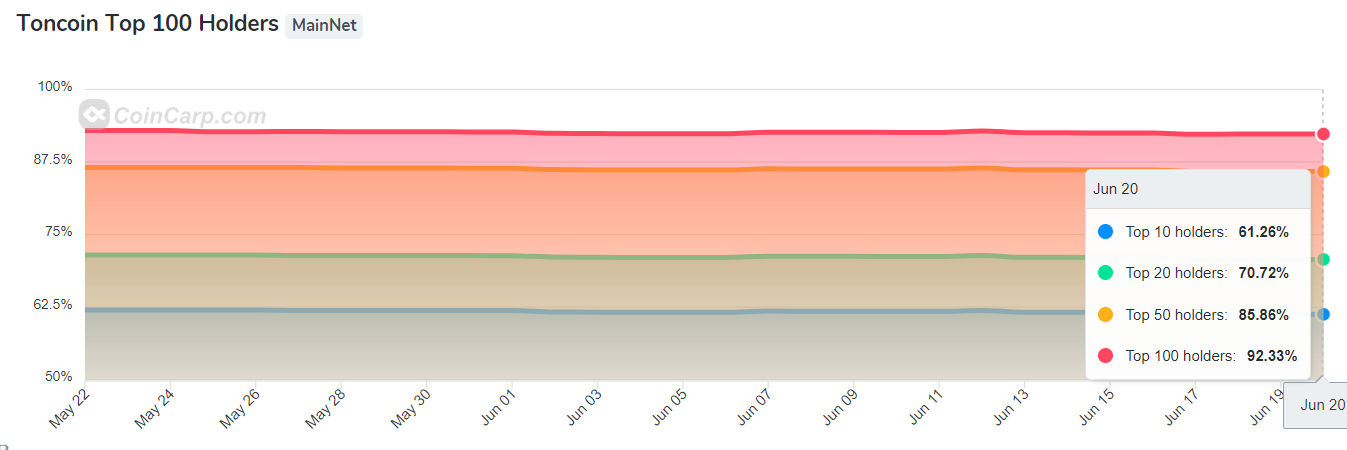

Top 100 Toncoin Holders source: coincarp

A large portion of early TON tokens were concentrated among miners, and this concentration has persisted to some extent. According to data from June 20, 2024, the number of TON holding addresses reached 3,600,868. Among them:

-

The top 10 holders account for 61.26% of all tokens;

-

The top 20 holders account for 70.72%;

-

The top 50 holders account for 85.88%;

-

The top 100 holders account for as much as 92.33%

These figures indicate that although TON continues efforts toward token decentralization, large holders still exert significant influence over the entire network.

Compared to other major public chains, TON’s token distribution appears slightly more concentrated. Many mature blockchain projects exhibit more dispersed token holdings, with the top 100 addresses typically holding far less than TON’s 92.33%. This level of concentration poses higher centralization risks, especially in governance-related decisions, where a few large holders can significantly sway voting outcomes.

Considerations include:

-

Network Security: While fewer major holders may enhance early network stability, it also means malicious actions by a few individuals could severely impact the network.

-

Decentralized Governance: High concentration may compromise fairness and democracy in on-chain governance. A small number of large holders wield substantial voting power, influencing major decisions.

-

Long-Term Healthy Development: To ensure sustainable growth, TON needs to continue improving token distribution. Encouraging participation from new users and small holders enhances decentralization and censorship resistance.

-

Dynamic Monitoring and Adjustment: Continuously monitor changes in ownership concentration and use economic incentives and technical mechanisms (e.g., delegated proof-of-stake, token distribution) to dynamically adjust and balance decentralization with security.

User and Application Data Analysis

1. User Analysis

According to data from Artemis, TON (The Open Network) has recently shown significant growth, largely driven by the popularity of ecosystem projects like NotCoin and Catizen. New wallet registrations, active addresses, and daily transaction counts on TON have all surged.

From March 20, 2024, to June 18, 2024, TON maintained a high level of daily active addresses, averaging around 500,000. Notably, during this period, TON’s daily transaction count frequently exceeded 5 million, peaking close to or even surpassing 8 million at certain points. As of June 18, the daily transaction count stabilized around 5 million.

Daily Transaction Volume and Daily Active Addresses on TON source: artemis

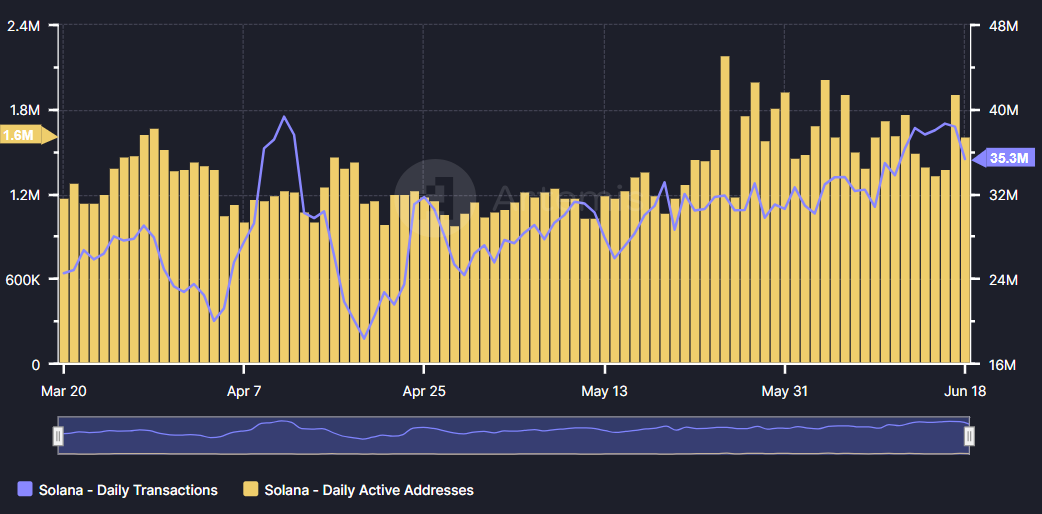

Compared to its main competitor Solana, TON demonstrates relatively higher growth potential in user activity and transaction volume. Solana averages about 1.6 million daily active addresses, with daily transactions mostly stable around 350,000—significantly lower than TON. This data indicates that TON has surpassed Solana in both user activity and transaction volume over recent months.

In terms of decentralization, TON shows signs of healthy ecosystem development through a large number of active addresses and high-frequency transactions. This reflects strong appeal and broad user adoption in decentralized applications and services. While Solana also boasts robust technology and application prospects, its relatively lower active users and transaction volumes suggest it faces certain challenges in the current competitive landscape.

Solana Transaction Volume and Daily Active Addresses source: artemis

TON performs exceptionally well in new user acquisition, active addresses, and transaction volume, highlighting its tremendous potential in blockchain application and user ecosystem development. With continued progress from projects like NotCoin and Catizen, TON’s future outlook is promising.

2. TVL Data Analysis

In contrast to the booming popularity of mini-games on TON, DeFi applications on TON appear relatively quiet. To date, TON’s Total Value Locked (TVL) stands at $600 million. Although this represents explosive growth since the beginning of the year, compared to TON’s current market cap ($17.042 billion), its TVL is less than one-tenth of other leading Layer 1 blockchains. This suggests that most of TON’s user traffic currently comes from Telegram-based mini-games like Notcoin and Citizen, whereas foundational infrastructure and DeFi applications have yet to attract significant user interest.

TON Chain TVL (Source: Defillama)

The data shows a clear upward trend in TON’s locked value from late 2023 to early 2024, particularly pronounced in recent months. Stablecoin market cap ($44.928 billion) and 24-hour trading volume ($2.459 billion) also reflect potential activity within certain applications in the TON ecosystem. However, compared to other top-tier Layer 1 blockchains like Ethereum and Binance Smart Chain (BSC), TON remains in the early stages of DeFi development.

Nevertheless, as a relatively young Layer 1 blockchain, TON holds great promise for future ecosystem growth. Given its backing by Telegram’s massive user base, TON has the potential to gradually attract more DeFi projects and infrastructure, thereby increasing ecosystem diversity and user participation.

Overall, TON’s current ecosystem performance is largely driven by mini-game users, while DeFi applications require further development.

The TON ecosystem demonstrates strong development potential but also faces technical challenges and concerns regarding ecosystem health. As TON continues advancing in cross-chain interoperability, DeFi, enterprise applications, and privacy technologies, its ecosystem will continue to expand and deepen.

Market Development Outlook

1. Market Trends via Wallet Addresses

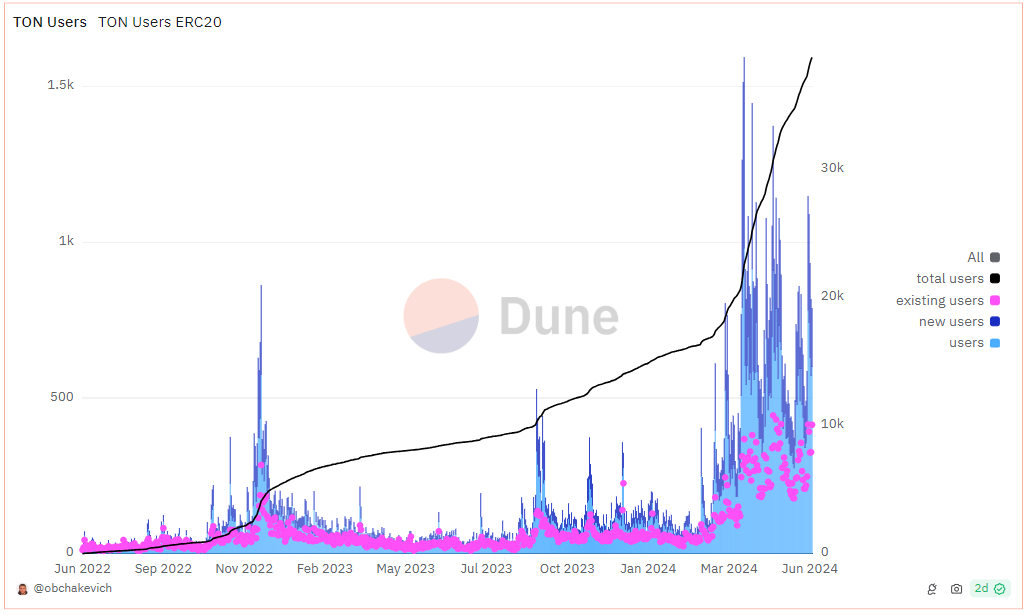

Cumulative Wallet Count Source: [@obchakevich] TONERC20

TON has made significant progress in market expansion. Steady new user acquisition and continuously growing cumulative wallet numbers reflect its market appeal and user loyalty. Latest data show a positive development trend in TON’s market outreach.

Regarding new users, observations from May 20 to June 16 show daily new wallet creations remained relatively stable, peaking around June 4 and June 13. Daily additions often reached about 200, indicating strong performance in marketing and user acquisition, consistently attracting new users.

Secondly, cumulative wallet numbers continue to rise. Data indicated by the pink line show a consistent upward trend. By June 16, cumulative wallet count had surpassed 4,000. This reflects steady inflow of new users and good retention of existing ones, demonstrating continuous expansion of TON’s user base and strong growth momentum.

TON User Count Source: [@obchakevich] / TONERC20

TON enjoys steadily growing user base. Continuous increase in total users indicates the TON ecosystem keeps attracting newcomers while maintaining high retention rates. Despite fluctuations in daily new user counts, the overall trend remains stably upward, reflecting TON’s strong performance in user acquisition and retention.

Moreover, user activity remains high. Although activity levels fluctuate between existing and new users, they remain generally elevated, indicating strong user stickiness within the TON ecosystem. Sustained user engagement is crucial for healthy ecosystem development, and TON excels in this aspect.

2. Ecosystem Expansion

-

Diversified application scenarios: Innovations in DeFi, NFTs, supply chain management, digital identity, and other areas have greatly expanded the scope of TON’s ecosystem. These applications not only attract more users but also boost engagement and participation among existing users.

-

Strong developer support: By providing rich development tools, resources, incentive programs, and technical assistance, TON has attracted a large number of developers to join its ecosystem. Active developer participation drives technological innovation and real-world application, further strengthening TON’s vitality and competitiveness.

3. Future Development Expectations

-

Continuous user growth: Based on current trends, TON is expected to continue attracting new users and maintain high retention rates among existing users. As the user base expands, TON’s market influence will grow accordingly.

-

Technological and application innovation: TON will continue pushing forward technological advancement and application innovation, leveraging cutting-edge technologies such as cross-chain interoperability, privacy protection, and decentralized autonomous organizations (DAOs) to improve user experience and meet evolving demands.

-

Steady ecosystem development: TON’s diversified application scenarios and strong developer support will ensure robust ecosystem growth. In the future, TON is poised to play a pivotal role across more industries and use cases, accelerating the adoption and development of blockchain technology.

Key Challenges Facing the TON Ecosystem

Despite demonstrating strong potential and sustained growth in technology and applications, the TON blockchain still faces several key challenges moving forward. As part of the TON special report series, this article primarily examines two aspects: historical ecosystem challenges and ecosystem health. For fundamental challenges, readers may refer to WolfDAO’s first TON专题 article, "In-Depth Analysis of TON Chain: Unveiling the Core Power of a Future Blockchain Giant"; for regulatory compliance risks and trend-based risk analysis, stay tuned for WolfDAO’s third TON专题 article, "Regulatory Compliance and Risk Assessment of TON Chain: Coexistence of Prospects and Challenges".

1. Historical Ecosystem Challenges

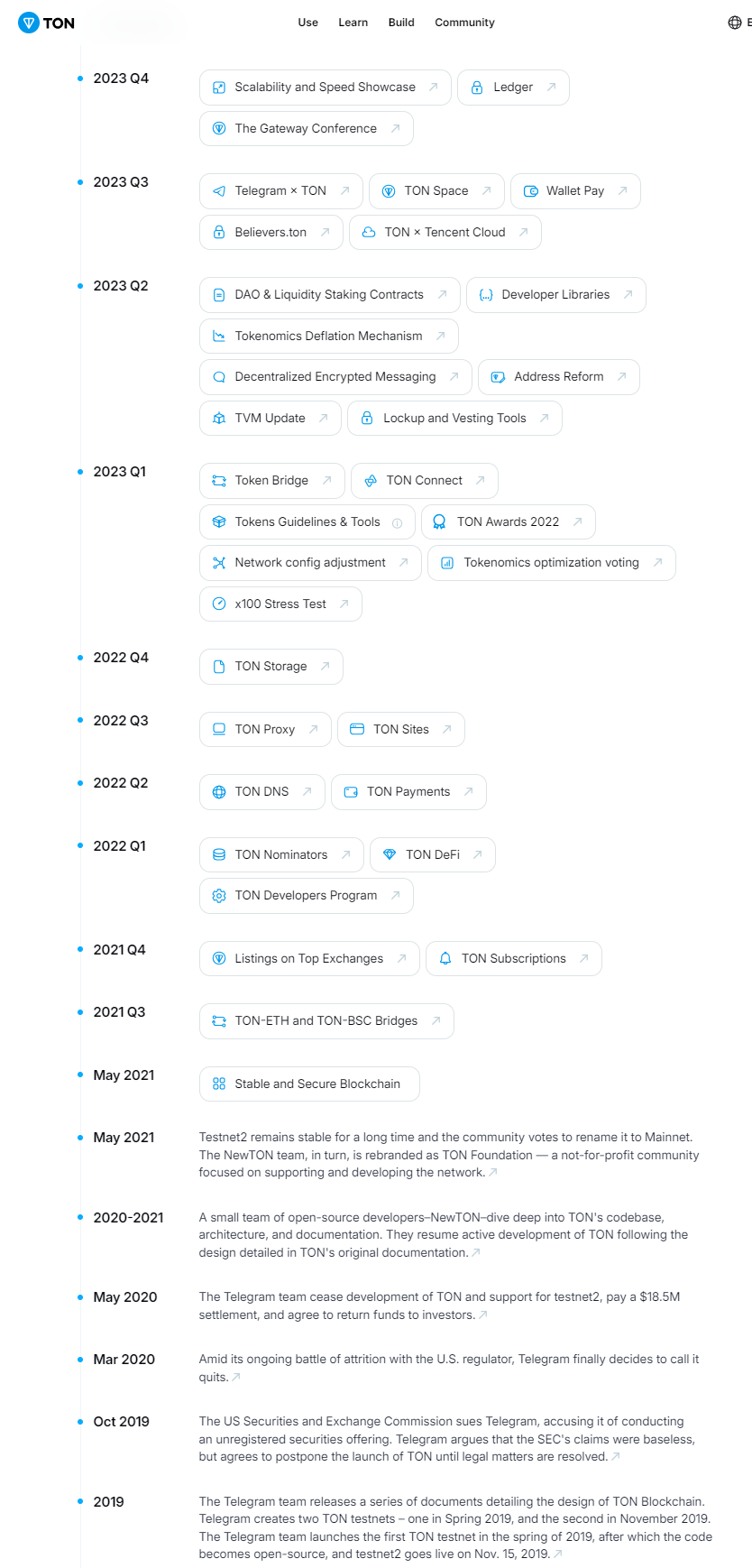

Historical Roadmap of TON Source: TON Official Website

From TON’s historical roadmap, several notable issues and shortcomings emerge during its development:

Deficiencies and Issues

1. Early Regulatory Issues and Legal Obstacles (2019–2020):

-

In October 2019, the U.S. Securities and Exchange Commission (SEC) sued Telegram, alleging unregistered securities sales. This regulatory issue severely impacted TON’s progress and forced Telegram to delay TON’s launch pending resolution of legal matters.

-

In May 2020, the Telegram team announced it would cease TON development and support testnet2, paid an $18.5 million settlement, and agreed to return funds to investors. This caused project suspension and uncertainty, undermining community confidence.

2. Developer Team Transition and Project Restructuring (2020–2021)

-

After Telegram’s exit, a small open-source team called NewTON took over, conducting in-depth research on code, architecture, and documentation to restart development. While this ensured continuity, the transition likely led to delays and resource reallocation challenges.

3. Gradual Improvement of Infrastructure and Technology (2021–2023)

-

In 2021 and 2022, TON introduced bridges to Ethereum (TON→Ethereum) and Binance Smart Chain (TON→BSC), along with new features like TONDNS, TONProxy, and TONPayments. While these enhanced the ecosystem, gradual integration of new technologies may have introduced compatibility and stability issues.

-

In the first half of 2023, new functionalities such as DAO & liquid staking contracts, decentralized encrypted messaging, and TVM updates enriched the ecosystem, though these complex upgrades placed higher demands on development and maintenance.

4. Ecosystem Growth and Integration (2023 and Beyond)

-

In 2023, collaborations including Telegram×TON integration, TONSpace, WalletPay, and Tencent Cloud helped expand usage and user base. However, integration challenges between different platforms and systems persist, potentially affecting user experience and system stability.

The TON ecosystem has encountered challenges related to regulation, team transitions, technological upgrades, and ecosystem integration during its development. Despite these shortcomings, TON has strived to refine its ecosystem through continuous technological improvements and strategic partnerships, aiming for broader applications and greater stability. Overcoming these challenges requires further strengthening of R&D, optimization of user experience, and proactive responses to regulatory and legal issues—a commitment evident in subsequent roadmap developments.

2. Ecosystem Health

1. User Growth and Retention

-

User Growth and Retention: TON maintains around 500,000 daily active addresses, with daily transaction counts frequently exceeding 5 million, showing strong user growth momentum. Compared to peers like Solana, TON performs exceptionally well—its user activity and transaction volume highlight superior performance in user acquisition. Additionally, stable new wallet additions and continuously rising cumulative wallet numbers reflect solid user retention. Overall, high user activity indicates strong user stickiness, laying a solid foundation for long-term development.

-

User Stickiness: While TON excels in user growth, maintaining high activity and engagement remains a challenge. Continuous improvement in user experience and introduction of new features are needed to enhance user involvement and satisfaction.

-

Market Competition: The blockchain space is fiercely competitive. TON must continue investing in marketing and user acquisition to maintain its competitive edge and market share.

2. Ecosystem Diversity

-

Lopsided Ecosystem: TON spans 19 sectors, including DeFi, NFTs, and gaming, showcasing a wide range of applications and a healthy trend toward diversity. The successful launch of games like Notcoin has drawn massive user attention, proving the sector’s potential. However, DeFi’s relatively low TVL (Total Value Locked) indicates the need for further development of infrastructure and applications to attract more users and capital, thus enhancing ecosystem diversity and health.

-

Expansion of Use Cases: While TON has made significant strides in DeFi and NFTs, it needs to explore additional applications such as supply chain management, digital identity, and IoT to enrich ecosystem diversity.

-

Project Quality: Attract and support high-quality projects to avoid negative impacts from low-quality or fraudulent ones, ensuring healthy ecosystem development.

3. Community Governance

-

Centralization Risks: TON uses PoS (Proof-of-Stake) with over 300 globally distributed validator nodes, ensuring network security and decentralization. However, early token concentration is high—the top 100 addresses hold over 92%, posing centralization risks. Further governance optimization is required to mitigate this. Meanwhile, the TON Foundation offers various developer incentive programs, such as token rewards and ecosystem competitions, helping attract more developers to drive innovation and application development. The developer community’s high activity provides strong technical support and momentum for ecosystem growth.

-

Decentralized Governance: Advancing DAO development to achieve decentralized community governance requires transparent, fair, and efficient mechanisms. Balancing stakeholder interests and boosting member participation and decision quality are key challenges.

-

Incentive Mechanisms: Design rational incentive structures to stimulate community initiative and creativity, promoting autonomous ecosystem development and innovation.

4. Legal and Regulatory Challenges

-

Legal Litigation and Settlement: In 2019, the U.S. SEC sued Telegram, claiming its TON project involved unregistered securities sales. This lawsuit significantly affected project progress and ultimately led Telegram to abandon TON in 2020, paying an $18.5 million settlement. This brought legal and financial pressure and damaged community confidence.

-

Regulatory Uncertainty: Early legal issues with the SEC and Telegram’s withdrawal posed major challenges and uncertainties for the TON ecosystem. The subsequent takeover by the new open-source team NewTON may have caused project delays and resource re-allocation issues.

-

Compliance: The global legal and regulatory environment for blockchain is complex and ever-changing. TON must ensure its technologies and applications comply with laws and regulations across jurisdictions to avoid potential legal risks.

-

Policy Changes: Monitor and respond promptly to shifts in global blockchain policies and regulatory landscapes, adjusting strategies to align with compliance requirements.

Conclusion

TON’s innovations and advancements in technology, market positioning, and ecosystem development have set new benchmarks for the blockchain industry. Despite facing technical hurdles and market competition, TON demonstrates its potential to become a leading global blockchain platform through continuous technological progress, application innovation, and ecosystem building. In the future, TON is expected to play a pivotal role across more industries and use cases, advancing the adoption and development of blockchain technology. For detailed analyses of specific ecosystem projects, please read the next part of this report: "The Big Picture of the TON Ecosystem: Uncovering On-Chain Star Projects and Future Opportunities" [Lower].

Despite these legal and regulatory challenges, the TON ecosystem continues to evolve and strengthen. However, these early legal issues and regulatory barriers still affect ecosystem trust and stability, requiring ongoing legal and compliance management to ensure healthy operations.

However, TON previously exited the market due to regulatory issues. Amid its current rapid development, regulatory compliance remains a key concern for investors. Whether the rolling wheels of gold will stop due to towering obstacles is a perspective we will explore further in our next report.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News