Exploring the Sui Ecosystem: DEX Trading Volume Up 4x MoM, Gaming Apps on the Rise

TechFlow Selected TechFlow Selected

Exploring the Sui Ecosystem: DEX Trading Volume Up 4x MoM, Gaming Apps on the Rise

The Sui ecosystem is moving toward DeFi and also holds significant potential in gaming and social sectors.

Author: ABOUDI RAI

Compiled by: TechFlow

We are excited to announce the launch of Sui Application Activity on the Artemis platform. We believe it will be crucial for investors to explore the Sui platform and its on-chain activity. In this research article, we will introduce the unique features of the Sui blockchain, the economic outlook for the SUI token, and explain how investors can use Sui Application Activity to understand which dApps are driving on-chain usage.

Summary

-

Sui is a proof-of-stake (PoS) Layer-1 blockchain featuring innovative capabilities such as an object data model, zkLogin, and more secure smart contracts written in the Move programming language.

-

The Sui token has a total supply of 10 billion, released over time as staking rewards and vesting unlocks to investors, the Mysten Labs team, and community projects. Sui can be staked on-chain with instant unstaking, and staking rewards are distributed at the end of each epoch.

-

Sui scales efficiently because its object data model enables massive transaction parallelization, keeping gas prices stable even as usage surges.

-

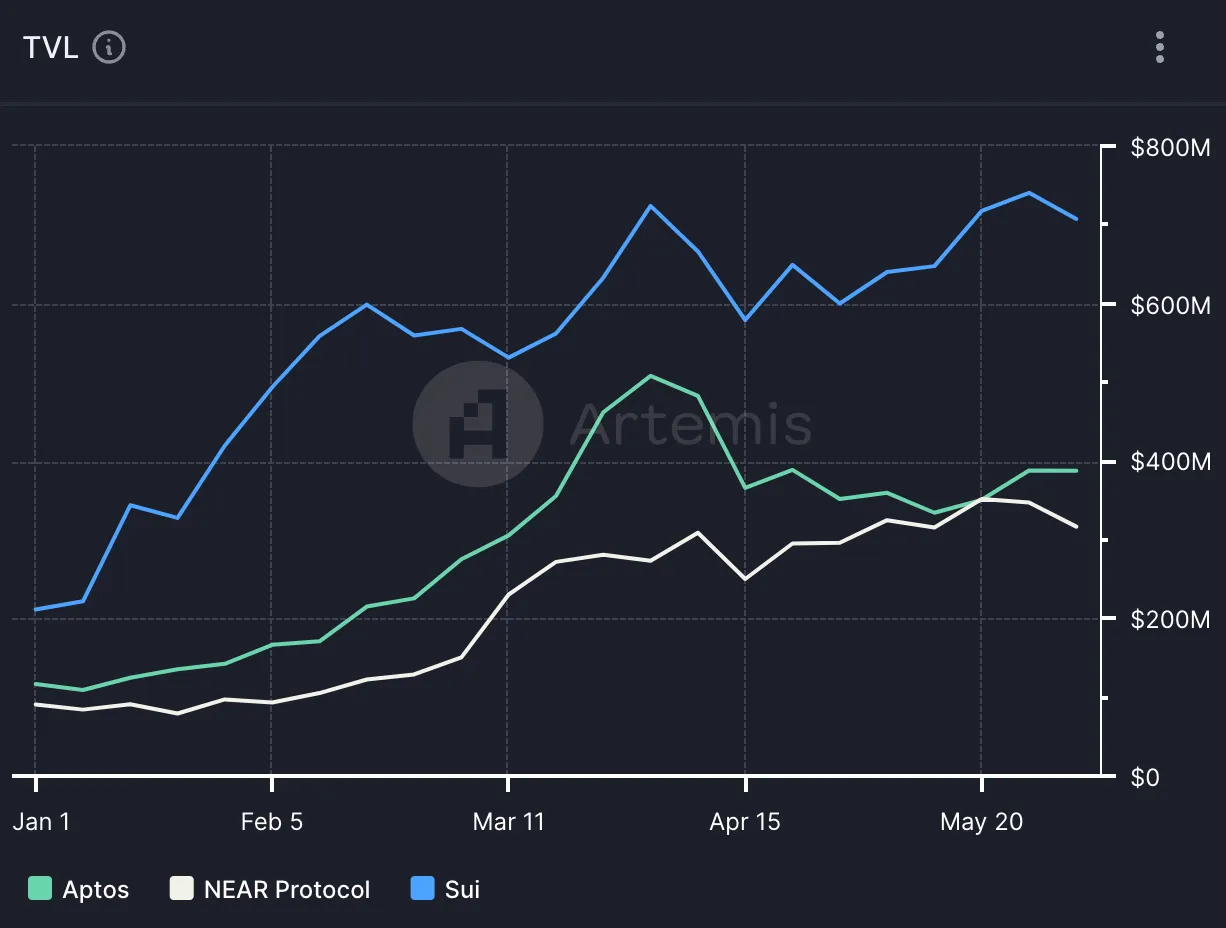

In the last quarter, Sui's ecosystem saw significant adoption, with Total Value Locked (TVL) increasing 240% quarter-over-quarter and DEX trading volume rising 407% quarter-over-quarter.

-

The Sui Foundation is heavily investing in community-building initiatives, such as Sui Overflow—a global hackathon with over $1 million in prizes—and Sui Basecamp, a conference featuring panelists from top industry players like Binance, Messari, and a16z.

-

Sui Application Activity has just launched on Artemis and can be used to analyze real-time metrics, on-chain activity, and performance.

Sui Ecosystem

Exploring Sui and user behavior patterns typically requires extensive research and often involves aimless exploration. The good news is that Sui Application Activity makes exploring on-chain activity more efficient and structured, allowing investors to analyze real-time trends and explore user activity. Let’s examine user activity on Sui.

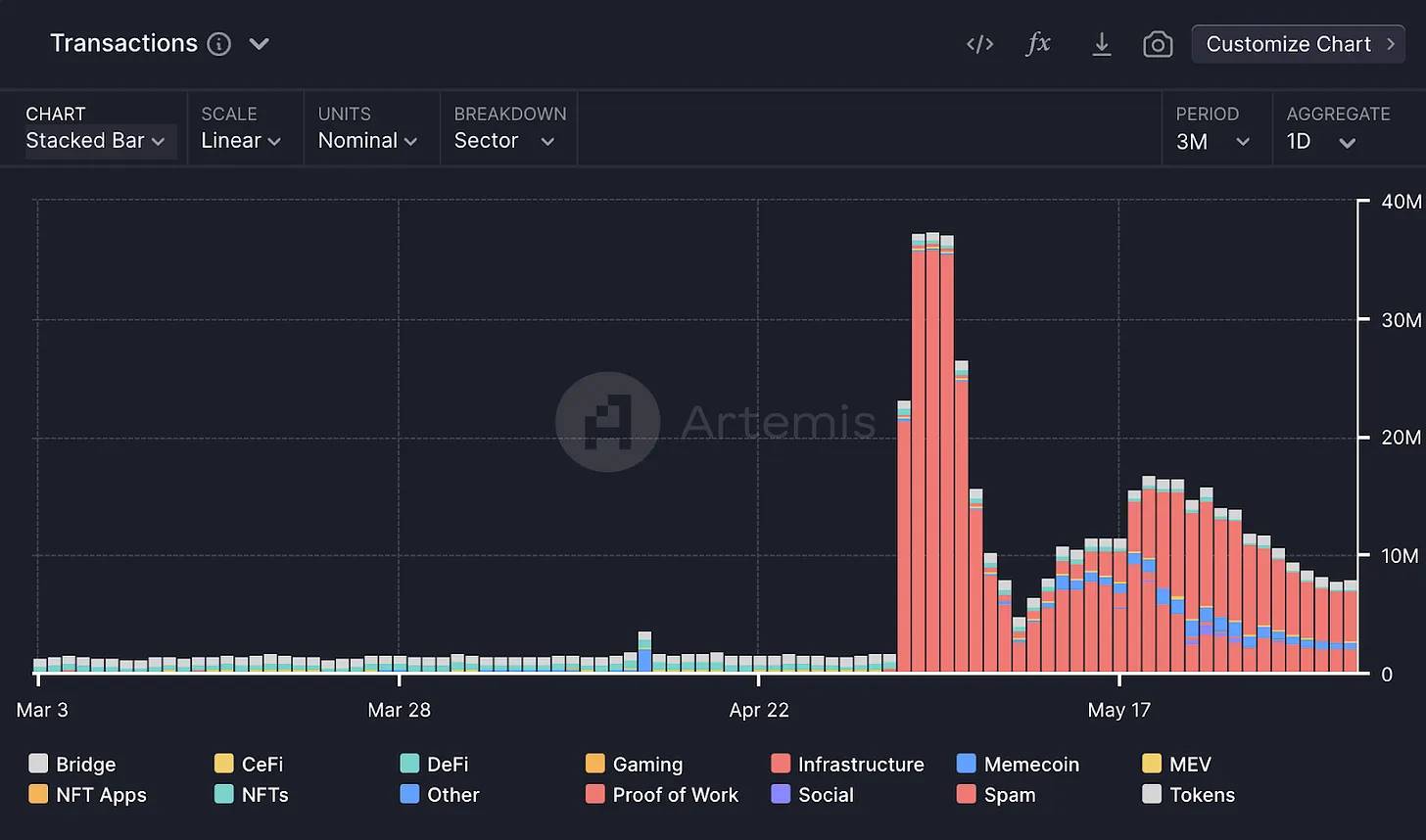

By analyzing transaction distribution over the past three months, we noticed a surge in user transactions in early May 2024, dominated by Spam, peaking at 37.5 million transactions on May 4, 2024—accounting for 96.04% of all daily transactions. To identify which dApp within Spam was responsible for the high activity on Sui, we examined the breakdown table.

Spam is dominated by a single dApp: Spam Sui.

Spam Sui is a community-driven stress test developed by Polymedia, where users earn SPAM tokens by sending transactions on the Sui network. Spam Sui successfully achieved its goal, with total transaction volume growing 1,134% during the week before and after its launch.

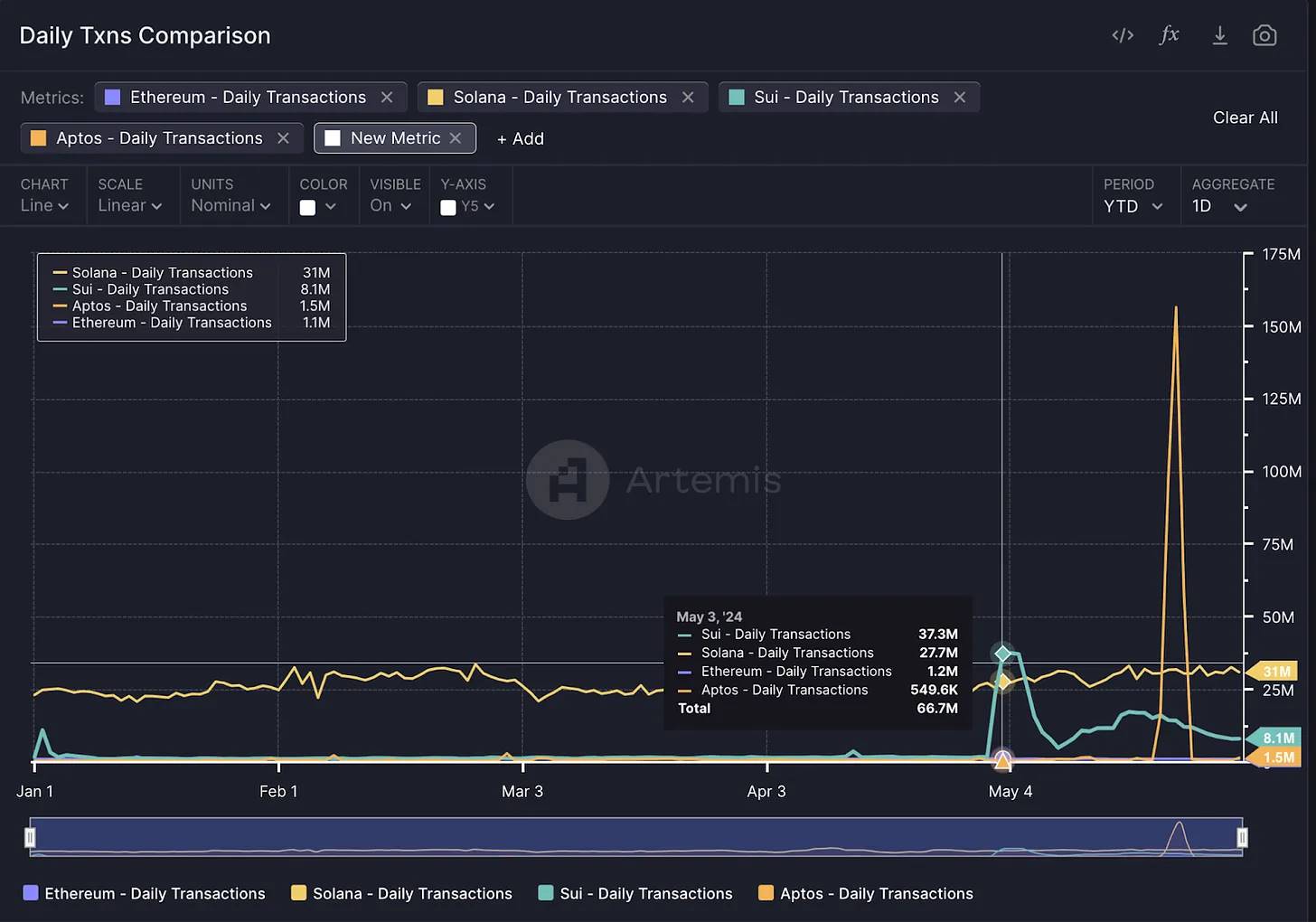

Due to Spam Sui, Sui’s daily transaction volume temporarily surpassed Solana’s for three days, demonstrating its ability to handle traffic far beyond what its L1 competitors experience. In early June, Sui processed ~8 million transactions per day.

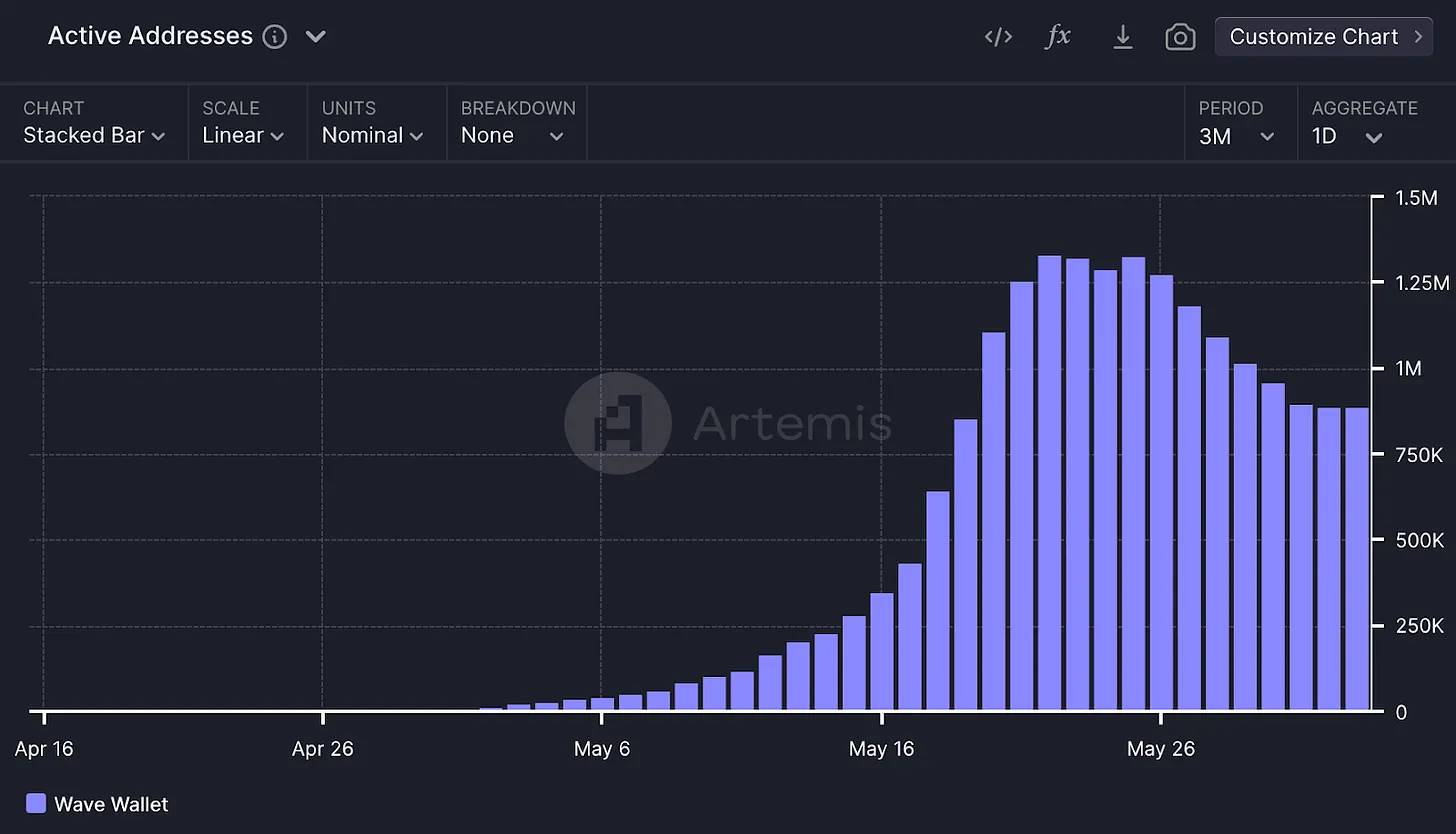

Another dApp recently gaining user interest on Sui is Wave Wallet, a Telegram-based Sui wallet with its own native Sui token, $OCEAN. Both active addresses and submitted transactions for Wave Wallet have shown rapid growth. Active addresses surged, reaching 163,600 on May 12—an increase of 265% compared to one week prior and 3,618% compared to two weeks earlier. Transactions submitted via Wave Wallet also showed similar growth, rising 258% week-over-week to 3.5 million transactions. These transactions primarily involve users mining $OCEAN by playing the OCEAN game within the Telegram wallet.

From recent trends, whether Spam Sui or Wave Wallet, most Sui transactions over the past three months originated from users bridging to Sui via Wormhole. Wormhole is an interoperability protocol compatible across more than 17 blockchains. In Q1 2024, net inflows of assets bridged to Sui via 1,100 active addresses reached $423.7 million across 59.9 million transactions—an increase of 432% compared to asset transfers in Q4 2023.

By reviewing ecosystem flows on the Artemis platform, we observe another impressive metric: Over the past three months, Ethereum-originated assets bridged to Sui via Wormhole exceeded those from any other blockchain.

DeFi

Users are moving substantial liquidity to Sui, leading to increased DeFi usage.

In Q1 2024, Sui’s DEX trading volume reached $7.1 billion, up 407% quarter-over-quarter. TVL reached $724 million, up 240% quarter-over-quarter.

If we examine the breakdown of the DeFi sector in Sui Application Activity, sorting by Gas (USD) helps us better understand specific DeFi user transactions. Data shows gas fees have risen 122% year-to-date, reaching $81,975.80, with most spent on DeepBook.

DeepBook is one of Sui’s native primitives, providing foundational functionality and frameworks on the Sui blockchain that dApps can leverage or extend. It serves as Sui’s native liquidity layer in the form of a central limit order book (CLOB). Although it lacks a built-in user interface, Cetus recently launched an interface on its decentralized exchange platform. Gas fees on DeepBook have increased 78% year-to-date as more independent DeFi protocols and MEV bots utilize its CLOB for liquidity.

As shown in the table, the two DeFi protocols Scallop and NAVI have gas expenditures an order of magnitude higher than other protocols on Sui. Let’s take a closer look.

Scallop is a lending protocol built on Sui. It was the first project to receive a grant from the Sui Foundation and is known for its robust security. It recently launched its native governance token, $SCA. As increasing liquidity flows into the Sui ecosystem—much of it going to Scallop—its Total Value Locked (TVL) has reached $121 million, up 256% year-to-date. Scallop is currently running a biweekly incentive program, rewarding lenders and borrowers with Sui to attract users and liquidity. Starting May 13, the biweekly incentive program offered 251,000 Sui each to suppliers and borrowers for enhanced yields. Incentives vary per biweekly cycle.

NAVI is another DeFi platform on Sui offering lending and liquid staking services. It recently launched its governance token, $NAVX. Unlike Scallop, NAVI has a 2024 roadmap to expand operations onto additional chains. NAVI Protocol’s TVL has reached $149 million, up 366% year-to-date. They also run a biweekly incentive program. For example, the program starting May 13 offered up to 23.99% annualized yield for deposits.

Where there’s DeFi, there’s MEV. Sui is no exception—MEV bot gas spending has grown 1,905% year-to-date, surpassing 22% of the DeFi sector’s spending during that period. While there is some double-counting since MEV smart contracts call DeFi protocol contracts, this also indicates that a significant portion of DeFi activity actually originates from MEV bots.

Given the popularity of DeFi on Sui, it’s important to note that smart contracts on Sui are written in Move. Move is a Rust-based programming language developed by Meta and extended by Mysten Labs, offering greater security and reliability than Solidity. Recent hacking incidents, such as Euler Finance losing $197 million or KyberSwap losing $54.7 million, may prompt DeFi founders and users to seek safer and more reliable smart contracts, such as those written in Move on Sui.

Gaming

Sui’s low gas fees and high transaction efficiency create a favorable environment for gaming. Sponsored transactions—where one Sui address pays gas fees for another—enable users to interact with games on-chain without needing to pre-fund their wallets. However, the gaming sector remains in its early stages, accounting for only 3% of the Sui ecosystem in Q4 2023 and declining to below 0.1% each subsequent quarter.

Despite relatively low activity, two platforms have dominated this space so far this year.

The first is Arcade Champion, a mobile arcade-style game developed by Blue Jay Games, using a “play-to-own” model where players earn “heroes”—NFTs that can be traded or sold within the game or directly on Sui. The game holds a 4.8-star rating on the App Store with over 170 reviews. Although it spent around $10,300 in gas fees in Q4 2023, its activity appears to have slowed amid the rapid rise of DeFi, declining 96% quarter-over-quarter.

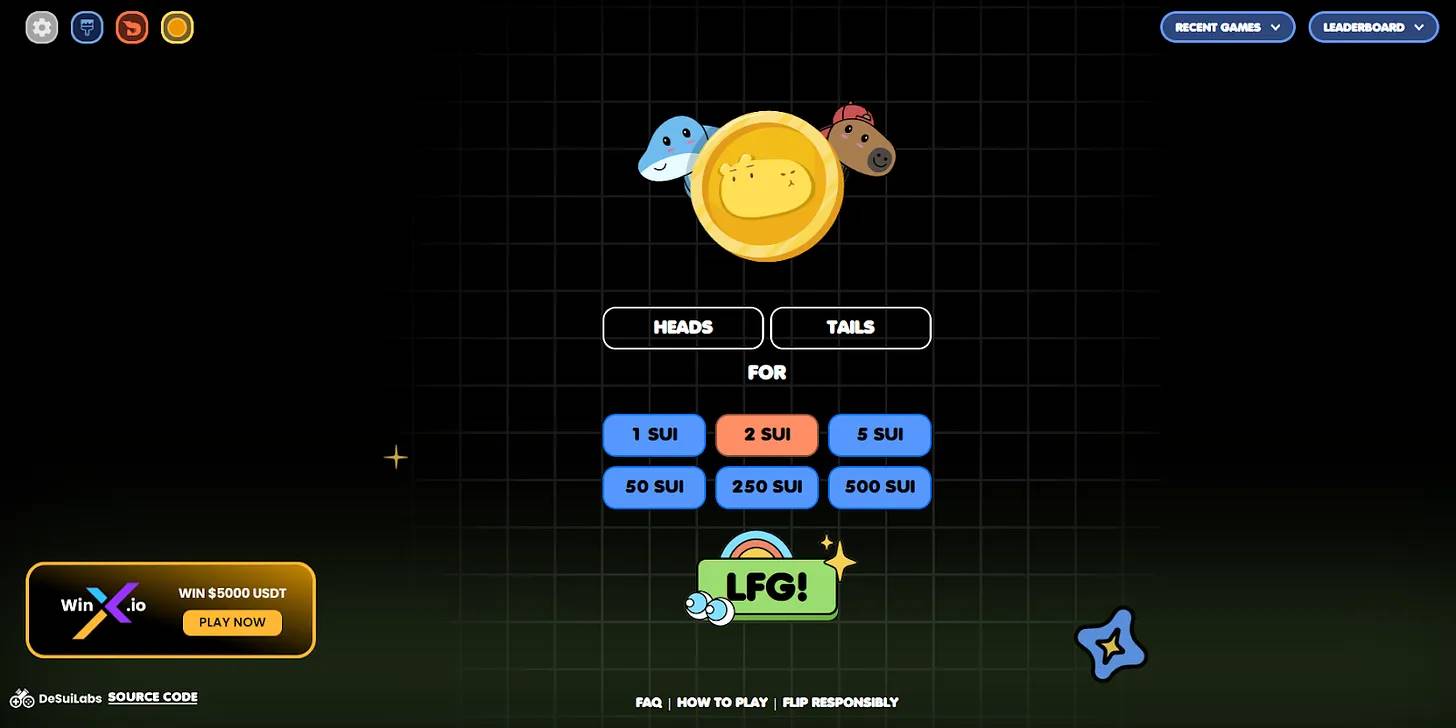

The second platform is DeSuiLabs’s on-chain betting games such as Sui Coin Flip, which have seen transaction volumes exceed $20 million. In Q4 2023, users spent $1,200 in gas fees on DeSuiLabs games, down 93% quarter-over-quarter. DeSuiLabs does not offer sponsored transactions.

More gaming releases on Sui are expected in the second half of 2024. Notable announcements at Sui Basecamp include Ambrus Studio’s E4C: Final Salvation and NDUS Interactive’s Xociety. The Sui-based mobile gaming device SuiPlay0X1 has also announced a projected release date of 2025.

Community

Sui has also announced Sui Overflow, Sui’s first global hackathon with over $1 million in prizes. This will undoubtedly attract students, developers, and founders worldwide to build on Sui—including those who previously had no experience or even interest in building on Sui.

Finally, the recent Sui Basecamp conference demonstrated Sui’s highly coordinated efforts to attract new participants to its ecosystem and foster existing community growth. According to the event website, over 1,200 people attended, including speakers from Messari, Binance, a16z, Aftermath Finance, and Mysten Labs.

Sui is making heavy investments in community development and gaining recognition from top industry participants.

Conclusion

To reiterate, Sui is a PoS L1 blockchain with a novel architecture designed to bring the next billion users into Web3. Its object-centric model enables transaction parallelization through horizontal scaling of validators. The Sui ecosystem is trending toward DeFi, but given its low gas fees, sponsored transactions, high transaction capacity, and zkLogin, it also holds great potential in gaming and social applications. The Sui token has a fixed supply of 10 billion, released as staking rewards and vesting unlocks for private investors, the Mysten Labs team, and community projects. The Sui Foundation is strengthening community-building initiatives, including DeFi incentives, the Sui Overflow hackathon, and the Sui Basecamp conference. Of course, using Artemis’s Sui Application Activity is an excellent way to monitor and analyze real-time on-chain Sui activity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News