Stargate Finance: Crossing Chain Boundaries to Achieve Infinite Liquidity

TechFlow Selected TechFlow Selected

Stargate Finance: Crossing Chain Boundaries to Achieve Infinite Liquidity

Stargate Finance aims to serve as a bridge between blockchains and decentralized applications (DApps).

Author: Tea House Assistant

1. Project Overview

Stargate Finance (STG) is a decentralized finance (DeFi) platform designed to serve as a bridge between blockchains and decentralized applications (DApps).

Built on the LayerZero protocol, Stargate Finance enables interoperability among different blockchains. With Stargate, you can exchange USDT on Ethereum for USDC on Arbitrum in a single transaction, supporting many other chains as well.

The STG token is the native utility token of the Stargate Finance ecosystem, used across various platform functions and reward mechanisms. Users can earn STG tokens by providing liquidity and participating in platform governance. Additionally, users can stake STG tokens to participate in governance, voting on key decisions such as fee structures and target asset allocations.

2. Core Mechanisms

2.1 LayerZero Technology

LayerZero technology forms the foundation of Stargate Finance, offering a secure and efficient solution for cross-chain communication and asset transfers. Below is a detailed overview:

1. Concept

LayerZero is an interoperability protocol designed to enable direct communication between different blockchains through a decentralized architecture. It provides the infrastructure for cross-chain asset transfers, addressing many limitations found in traditional bridge solutions.

2. Working Principle

LayerZero achieves cross-chain communication via the following mechanisms:

-

Cross-Chain Message Passing: LayerZero allows direct message transmission between blockchains without intermediaries, enabled by lightweight relayers and oracles.

-

Lightweight Relayers and Oracles: Relayers transmit transaction data, while oracles verify its validity. This separation ensures high security and decentralization.

-

User Application (UA): Smart contracts deployed on source and destination chains that manage the logic of cross-chain transactions. UAs ensure accurate execution and handle user asset transfers.

3. Security and Decentralization

LayerZero employs multi-layered security and a decentralized architecture to safeguard cross-chain communication:

-

Minimal Trust: LayerZero follows a trust-minimized design, reducing reliance on third parties. Relayers and oracles are operated independently, ensuring data integrity.

-

Distributed Validation: Oracles validate data transmitted by relayers, minimizing single points of failure through a distributed network.

-

Fraud Prevention: LayerZero includes anti-fraud measures to detect and respond to malicious activity, protecting user assets.

4. Cross-Chain Asset Transfers

LayerZero supports native asset transfers across chains with efficiency and cost-effectiveness:

-

Single Transaction Transfer: Users complete cross-chain transfers in one transaction without needing wrapped tokens.

-

Instant Confirmation: Once confirmed on the source chain, assets arrive instantly on the destination chain, ensuring reliability.

5. Integration with Stargate Finance

LayerZero is deeply integrated into Stargate Finance, powering its cross-chain liquidity pools and transfer infrastructure:

-

Unified Liquidity Pools: LayerZero enables shared liquidity across chains within Stargate’s unified pools.

-

Delta Algorithm Support: Provides cross-chain communication for the Delta algorithm, enabling efficient liquidity management and rebalancing.

6. Advantages

LayerZero offers several advantages over traditional bridge solutions:

-

Efficient Communication: Lightweight relayers and oracles reduce latency and fees.

-

Decentralization: Eliminates central points of failure, enhancing system resilience.

-

Flexibility: Supports multiple blockchains and asset types, ensuring broad compatibility.

2.2 Delta Algorithm

The Delta algorithm is a core innovation behind Stargate Finance’s efficient and secure cross-chain transfers. Here's how it works:

1. Foundation of the Delta Algorithm

The Delta algorithm manages and optimizes Stargate’s cross-chain liquidity pools, ensuring instant guaranteed finality and pool stability during asset transfers.

2. Instant Guaranteed Finality

The Delta algorithm guarantees that once a transaction is confirmed on the source chain, assets will be delivered on the destination chain—eliminating failures due to insufficient liquidity or token incompatibility. Key steps include:

-

Source Chain Confirmation: Upon confirmation, the algorithm locks equivalent assets on the destination chain.

-

Destination Asset Transfer: Assets are immediately credited to the user’s account, ensuring finality.

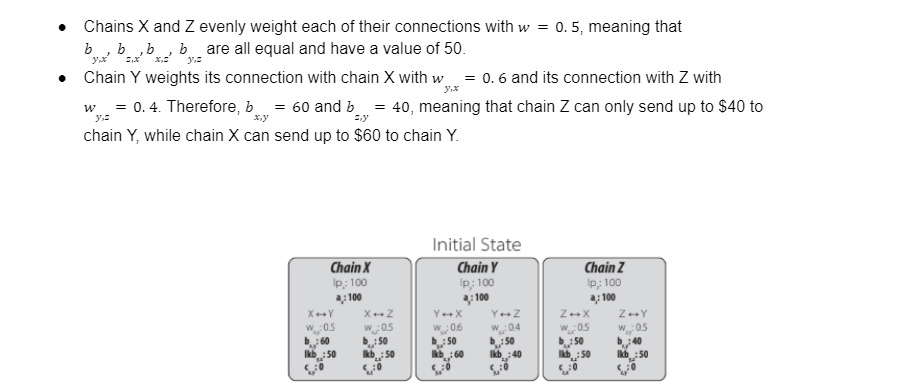

3. Unified Liquidity Pools and Soft Partitioning

Stargate uses unified liquidity pools managed intelligently by the Delta algorithm:

-

Unified Liquidity Pool: All liquidity from supported chains is pooled together, allowing seamless cross-chain movement with reduced slippage and improved efficiency.

-

Soft Partitioning: The pool is dynamically divided (e.g., allocating funds to BNB Chain or Fantom). These partitions can borrow from each other during liquidity shortages and repay afterward.

4. Liquidity Management and Rebalancing

To prevent pool depletion under high demand, the Delta algorithm implements a rebalancing mechanism:

-

Rebalancing Fees: A portion of transaction fees incentivizes users to add or remove assets to maintain balance. Fees are calculated based on trade size and current pool state.

-

Reward Mechanism: Collected rebalancing fees are redistributed to users who help restore equilibrium, with rewards proportional to their contribution.

5. Dynamic Liquidity Management

The Delta algorithm dynamically allocates and borrows liquidity to sustain operations during large-scale concurrent transfers:

-

Liquidity Allocation: Funds are dynamically assigned across chains to meet transaction demands.

-

Liquidity Borrowing: Chains can temporarily borrow from each other’s pools during congestion, ensuring uninterrupted service.

2.3 Decentralized Application (DApp)

Stargate Finance’s DApp enables secure and efficient cross-chain asset management and trading. Key features include:

1. Core Features of the DApp

-

Cross-Chain Transfers: Seamless native asset transfers across chains without complex bridging.

-

Liquidity Provision and Mining: Users supply liquidity to pools and earn rewards through liquidity mining.

-

Cross-Chain Swaps: Instant exchanges between tokens on different blockchains.

2. Cross-Chain Asset Transfers

-

One-Transaction Completion: Transfers completed in a single step, simplifying the process.

-

Instant Confirmation: Assets arrive immediately after source chain confirmation via LayerZero.

-

Native Assets: Uses native tokens instead of wrapped versions, avoiding extra fees and complexity.

3. Liquidity Provision and Mining

-

Unified Pool Access: Deposit assets into a single pool to support multiple chains.

-

Reward Distribution: LPs receive stablecoin rewards equal to 0.045% of each transaction fee, distributed proportionally.

-

Flexible Management: LP tokens can be redeemed anytime, giving users full control over their positions.

4. Cross-Chain Trading

-

One-Click Swap: Exchange tokens across chains (e.g., USDT on Ethereum → BUSD on BNB Chain).

-

Reduced Slippage: Deep liquidity from unified pools ensures fair pricing and minimal slippage.

5. User Interface and Experience

-

Intuitive Design: Clean and user-friendly interface for easy navigation.

-

Simplified Workflow: No technical expertise required—users perform complex operations with simple clicks.

3. STG Token

The STG token is the native utility token of the Stargate Finance ecosystem, playing a vital role across the platform. Below is a comprehensive overview:

1. STG Token Overview

STG is the native token of Stargate Finance, used for liquidity provision, governance, and incentive programs. Its design supports long-term growth and active user participation.

2. Use Cases of STG Token

Governance and Voting

-

Staking and Governance: Users stake STG to receive vestG (vote-escrowed STG), granting voting rights on proposals such as fee adjustments and pool configurations.

-

Time-Weighted Rewards: Longer staking periods yield more vestG, increasing governance influence and aligning long-term incentives.

Liquidity Provision and Mining

-

Liquidity Provision: Users contribute STG to liquidity pools and earn a share of transaction fees.

-

Liquidity Mining: Additional STG rewards are available for participants in mining programs, boosting liquidity and user returns.

Trading and Cross-Chain Transfers

-

Fee Discounts: Transactions using STG enjoy fee reductions. For example, STG-based cross-chain transfers may waive protocol fees, while non-STG transfers incur a 0.06% fee.

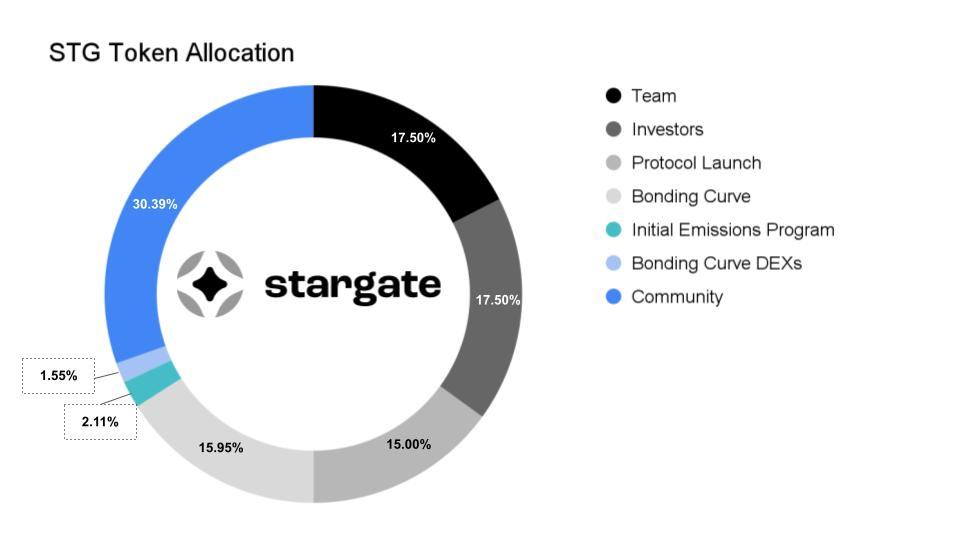

Token Supply and Distribution

-

Total Supply: 1 billion STG, with 205 million currently in circulation (20.43%).

-

Initial Allocation:

-

17.5% to team

-

17.5% to investors

-

15.0% for protocol launch

-

15.95% via bonding curve

-

2.11% for initial release

-

1.55% for bonding curve DEXs

-

30.39% to community

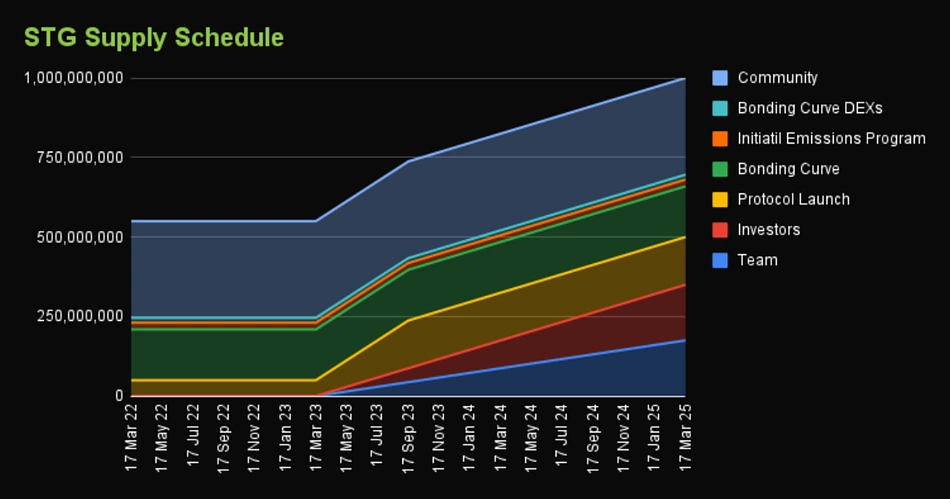

Vesting Schedule

-

Team and Investors: Allocated tokens unlock gradually over 1–2 years to ensure stability and controlled supply.

-

Community: Released at launch to fund ecosystem development and community initiatives.

Economic Model

The STG token economy is designed to support sustainable growth and engagement:

-

Incentive Mechanisms: Staking and liquidity mining encourage active participation and strengthen platform vitality.

-

Deflationary Mechanism: A portion of transaction and rebalancing fees is used to buy back and burn STG, reducing circulating supply and increasing scarcity.

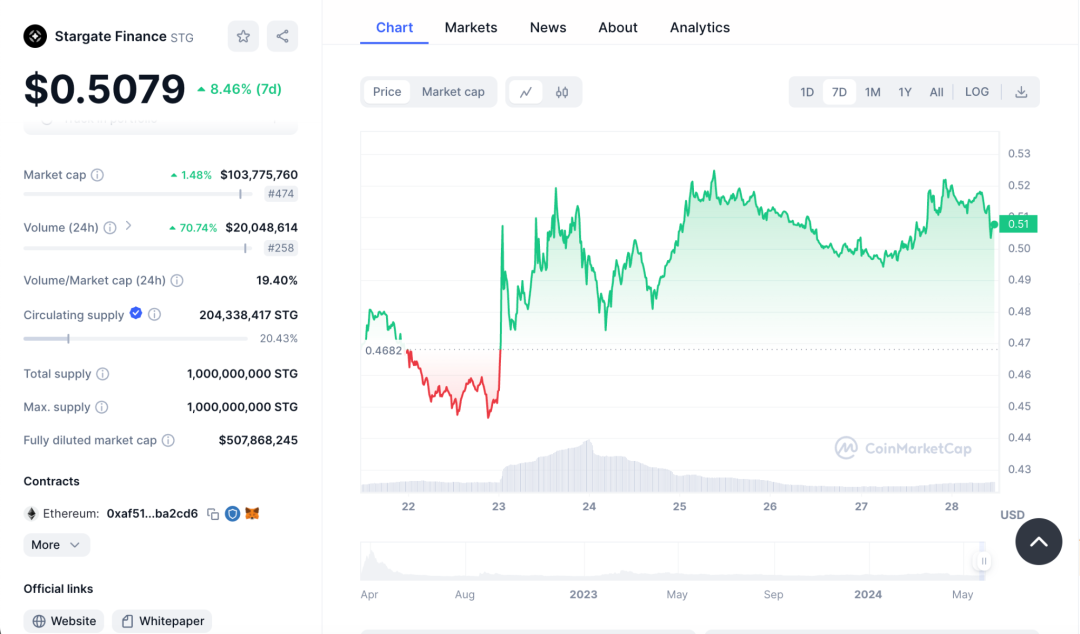

Token Performance

-

Current Price: $0.5079 (up 8.46% over past 7 days)

-

Market Cap: $103,775,760 (up 1.48%)

-

24h Volume: $20,048,614 (up 70.74%)

-

Market Cap / Volume Ratio: 19.40%

-

FDV: $507,868,245

-

Price Trend: Significant volatility from April 2023 to May 2024. Started around $0.4682 in early 2023, dipped, then rebounded sharply by late May.

-

Increased Market Interest: 70.74% rise in 24h volume indicates growing trading activity and confidence in the project.

-

Market Cap Growth: Modest 1.48% increase compared to volume surge suggests significant short-term trading interest.

4. Project Evaluation

4.1 Sector Analysis

Stargate Finance operates in the decentralized finance (DeFi) sector, focusing on cross-chain interoperability and liquidity management. By leveraging LayerZero and the Delta algorithm, it enables seamless cross-chain transfers and efficient liquidity sharing, establishing itself as essential DeFi infrastructure.

Other notable projects in this space include:

1. Polkadot (DOT)

-

Overview: A multi-chain protocol enabling interoperability via relay and parachain architecture.

-

Similarity: Like Stargate, Polkadot addresses interoperability but focuses on ecosystem-level connectivity rather than liquidity pooling.

2. Cosmos (ATOM)

-

Overview: A decentralized network using IBC and Tendermint for secure cross-chain communication.

-

Similarity: Both prioritize interoperability; Cosmos provides a framework, while Stargate enables direct asset transfers via unified pools.

3. Thorchain (RUNE)

-

Overview: A decentralized liquidity protocol for cross-chain swaps using native assets and RUNE.

-

Similarity: Shares Stargate’s focus on cross-chain liquidity and asset exchange, though implemented via decentralized nodes.

4.2 Project Strengths

1. Cross-Chain Interoperability

Leveraging LayerZero, Stargate enables secure and efficient cross-chain communication, solving key issues in legacy bridges. Shared liquidity pools enhance capital efficiency, reduce slippage, and improve UX.

2. Instant Transaction Finality: Confirmed source chain transactions guarantee delivery on destination chains, eliminating delays and uncertainty.

3. User-Friendly Experience

-

Simplified Transfers: One-click cross-chain transfers eliminate complex processes.

-

Intuitive UI: Designed for accessibility, catering to both novice and advanced users.

4. Diverse Incentives

-

Liquidity Mining and Rewards: Encourages participation and strengthens liquidity.

-

Governance Participation: Staking STG grants voting power, promoting long-term commitment.

5. Security and Decentralization

-

Distributed Validation and Fraud Protection: Ensures transaction integrity through decentralized oracles and fraud detection.

-

Decentralized Architecture: Minimizes central failure risks, enhancing system resilience.

6. Market Performance

-

Strong Price and Volume Momentum: An 8.46% price increase and 70.74% volume surge reflect rising market confidence.

4.3 Project Weaknesses

1. Rebalancing Fee Complexity

-

Complex Fee Structure: The rebalancing mechanism, while effective, may be difficult for some users to understand, potentially deterring frequent traders.

2. Intense Competition

-

Competitive Landscape: Faces strong competition from Polkadot, Cosmos, and Thorchain, requiring continuous innovation to maintain edge.

3. Ecosystem Development

-

Ecosystem Expansion: As a newer project, ongoing integration with additional chains and DApps is crucial but resource-intensive.

4. Market and Regulatory Risks

-

Crypto Market Volatility: High price swings can impact STG valuation and investor sentiment.

-

Regulatory Uncertainty: Evolving global regulations may affect operations and user access.

5. Conclusion

Stargate Finance is an innovative DeFi project leveraging LayerZero and the Delta algorithm to deliver secure, efficient cross-chain asset transfers and liquidity management. Its unified pools and instant finality significantly enhance user experience and blockchain interoperability.

Despite challenges related to technical complexity, security, and competition, Stargate Finance demonstrates strong potential through its technological edge and innovative design. As its ecosystem expands and user adoption grows, it is well-positioned to become a leading platform in cross-chain interoperability and liquidity management, driving the next phase of DeFi evolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News