JOJO Exchange: An OG Exchange Bets on the Perp Track, Building the Future of DEX on the BASE Network

TechFlow Selected TechFlow Selected

JOJO Exchange: An OG Exchange Bets on the Perp Track, Building the Future of DEX on the BASE Network

This article will delve into JOJO Exchange's deployment on BASE, exploring JOJO's technological innovations and its unique vision for the development of the sector.

Written by: TechFlow

Introduction

Diverse ecosystem development and a booming MEME token market have enabled the BASE network to stand out in this high-stakes bull run—where projects no longer passively wait for each other’s support—becoming a popular goldmine actively pursued by users.

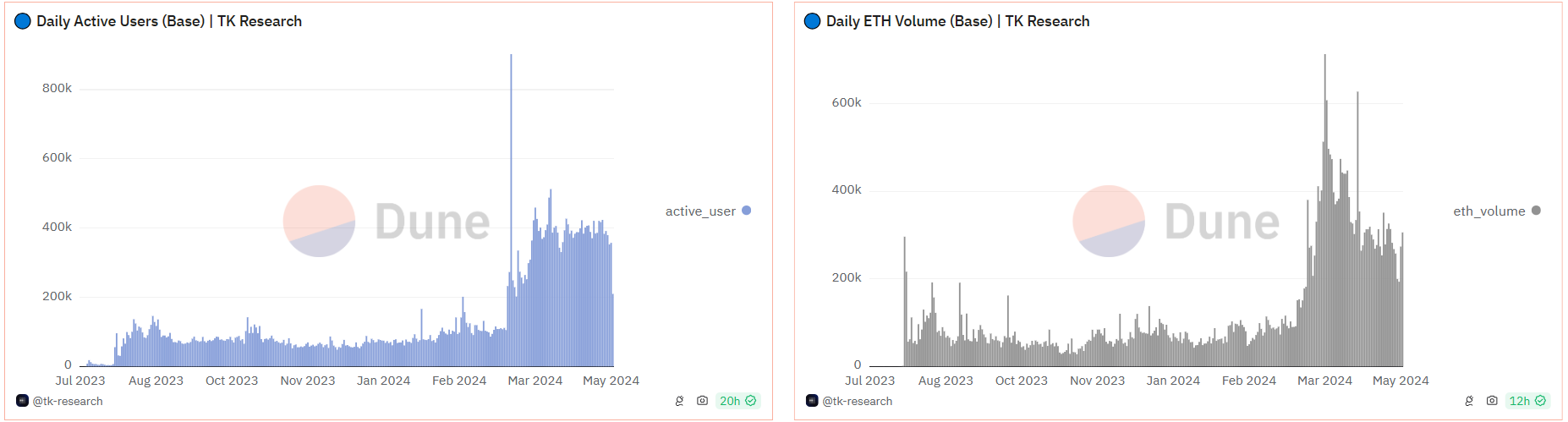

In stark contrast to the weary market sentiment, the BASE ecosystem has maintained consistently high transaction volumes and daily active users despite overall market uncertainty. Unlike the short-lived hype driven by early adopters and FriendTech last year, the BASE ecosystem is now experiencing more diverse project development and sustained, positive capital inflows following the Cancun upgrade.

Daily active users and ETH transaction volume since BASE mainnet launch

Unlike existing mainstream L2 protocols, BASE made a clear decision from the outset: no native network token. This foundational choice has led to high daily activity and TVL growth fueled by a large influx of high-quality, real users.

Aligned with current market trends, BASE’s explosive growth also benefited from inheriting the memecoin craze originating from the SOLANA ecosystem. From $DEGEN rooted in its own ecosystem to the sudden arrival of $mfer, BASE has proven itself a fertile ground for engaging and playful memecoin experimentation.

Using memecoins as an entry point for ecosystem liquidity and attention is effective—but behind the frenzy lies a long-term challenge: when memecoin enthusiasm fades, the ecosystem will urgently need new, diverse narratives capable of absorbing capital and retaining users over time.

Clearly, some projects and users are turning to on-chain derivatives as the next destination for capital. Over the past three months, derivative trading volume on the BASE network has steadily climbed.

TVL and derivatives trading volume since BASE mainnet launch

After exploring multiple high-performance blockchains, JOJO Exchange ultimately chose the rapidly expanding BASE ecosystem, aiming to fill a critical gap by becoming the go-to Perpetual DEX on BASE.

Deeply focused on the on-chain derivatives space, JOJO Exchange combines innovative technical vision with strong team capabilities. With features like its novel Turing-complete Hybrid Liquidity Model, multi-asset staking for mining, and up to 1000x leverage, JOJO brings new avenues for capital growth and a unique on-chain trading experience to BASE users.

JOJO Exchange successfully launched its mainnet in April and is now actively preparing for its pre-mining campaign ahead of token distribution. Currently, JOJO has established partnerships with leading BASE ecosystem protocols such as Aerodrome and Moonwell, collectively driving forward ecosystem growth.

In this article, we’ll dive deep into JOJO Exchange’s strategic positioning on BASE, exploring its technological innovations and unique vision for the future of the derivatives sector.

The Unique Positioning of JOJO Exchange

Significant Growth Potential in the Perpetual DEX Sector

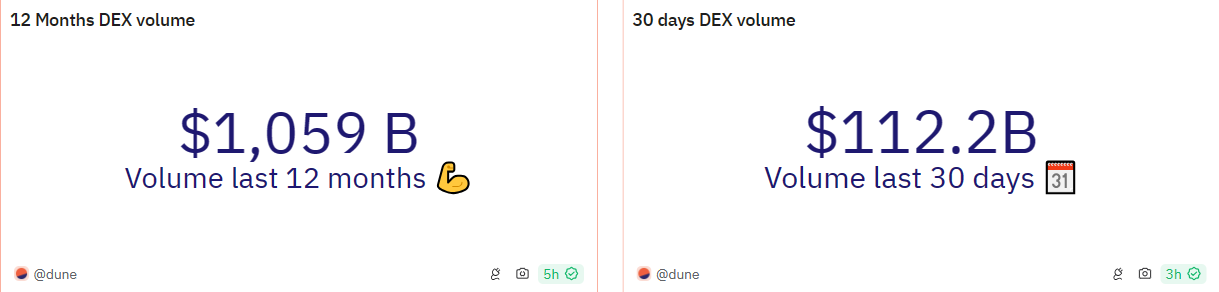

As hubs for on-chain token trading, DEXs facilitate value exchange for massive amounts of capital, with leading protocols generating an average daily trading volume of $2.9 billion.

Trading volume of major cross-chain DEXs over the past 12 months and last month

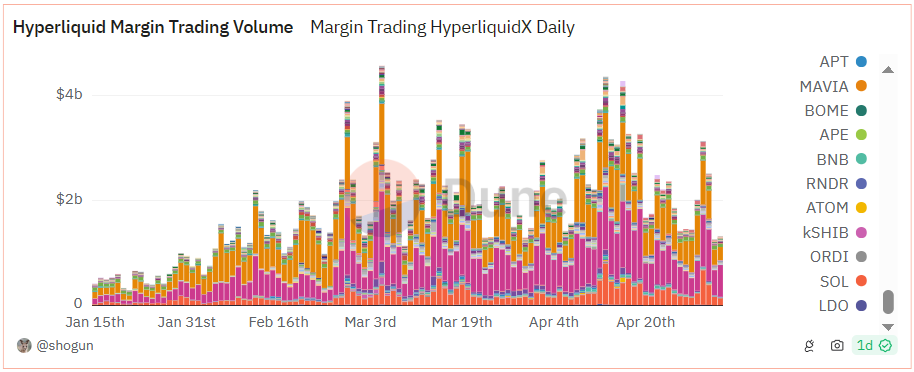

As an extension of DEXs, Perpetual DEXs provide futures contract trading services, meeting the substantial on-chain demand for perpetual contracts. Leading platforms like Hyperliquid have even seen single-day trading volumes surpassing the combined totals of major DEXs.

Hyperliquid platform daily margin trading volume

Clearly, there is genuine and robust market demand for Perpetual DEXs.

Given the current热度 and capital flows within the BASE ecosystem, JOJO Exchange—poised for significant expansion—may possess enormous growth potential.

While DEXs have become essential tools for on-chain users, they still face real challenges: poor liquidity, transaction efficiency hindered by network congestion, and subpar front-end user experiences. The market clearly needs a more refined and user-friendly decentralized exchange.

JOJO Exchange offers its own answers to these pressing market needs.

JOJO Exchange: An Innovative and Efficient Decentralized Perpetual Contract Platform

As a rising player in the Perpetual DEX space, JOJO Exchange is committed to building the most open and liquid platform possible. To enhance user trading experience, JOJO has introduced unique innovations in liquidity architecture and asset utilization.

Turing-Complete Smart Contracts: The "Golden Experience" at the Liquidity Layer

Leading DEX protocols like dYdX and Hyperliquid use closed, non-expandable liquidity structures, severely limiting protocol scalability and user creativity.

The core innovation of JOJO Exchange lies in its liquidity layer, which introduces Turing-complete smart contracts, enabling developers to embed arbitrary scripts into orders.

As a Maker, users can develop custom on-chain strategies—such as funding rate arbitrage similar to Ethena or JIT (Just-In-Time) liquidity—making trading more flexible and efficient. As a Taker, users benefit from enhanced liquidity, as order execution leverages these complex logics and tailored strategies to ensure optimal trading conditions. JOJO also offers industry-leading low fees: Taker 0.03%, Maker -0.01%, further improving the user experience.

Through its open PrepDEX architecture, JOJO hands the future of the liquidity layer to imaginative and proactive developers, unlocking infinite possibilities not only for JOJO but for the entire DeFi sector.

Multi-Asset Staking Pre-Mining: The "Gate to Paradise" Unlocking Asset Potential

Multi-Asset Staking

JOJO allows users to post various types of assets as trading margin. This includes traditional cryptocurrencies (like BTC, ETH) and various DeFi assets such as LP tokens and yield-bearing assets.

When users use non-standard assets like LP tokens as collateral, JOJO uses integrated price oracles to assess the value of each collateral type.

Yield-Bearing Margin

When yield-generating assets are deposited as margin on JOJO, users can earn both JOJO platform points through trading activities and participate in pre-mining by staking these yield-bearing assets (e.g., $cbETH, $mUSDC), qualifying them for JOJO token airdrops.

Users don’t need to worry about idle funds during pre-mining—they can over-collateralize to borrow JOJO’s native stablecoin $JUSD. $JUSD can serve as margin for perpetual contracts and be freely traded, enabling users to achieve a “one fish, many meals” scenario: [Original protocol yield + JOJO token rewards + Borrowed $JUSD used for trading].

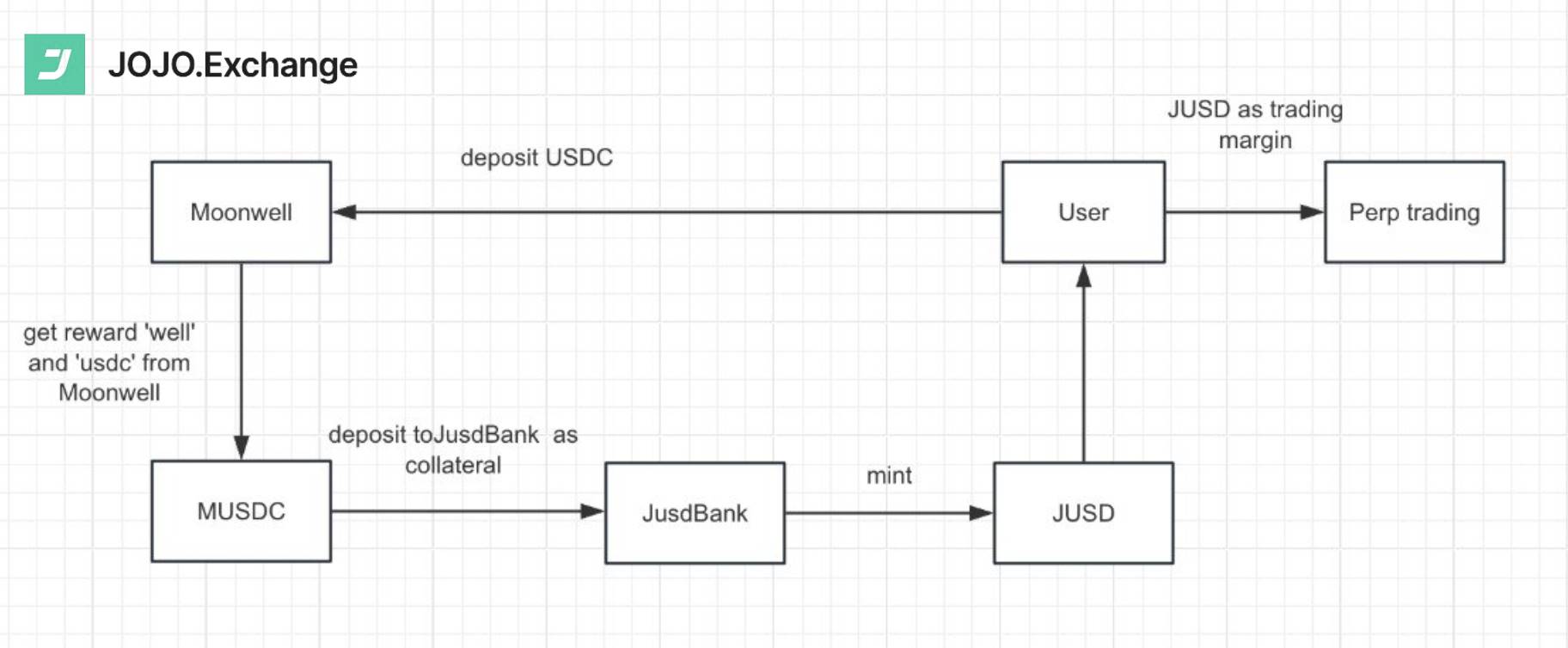

Example using $mUSDC from Moonwell:

User deposits USDC into Moonwell → receives mUSDC receipt → stakes mUSDC into JOJO for rewards. Through this process, one deposit yields:

1. Yield from Moonwell lending + WELL token rewards + Circle USDC incentives;

2. JOJO airdrop from staking mUSDC + ability to over-collateralize and borrow $JUSD for trading;

This unique pre-mining mechanism uses targeted incentives to encourage users to first deposit margin and then freely allocate their capital based on personal preferences.

By incentivizing margin deposits, JOJO simplifies initial steps, increases user engagement, unlocks new asset potentials, and creates additional earning opportunities.

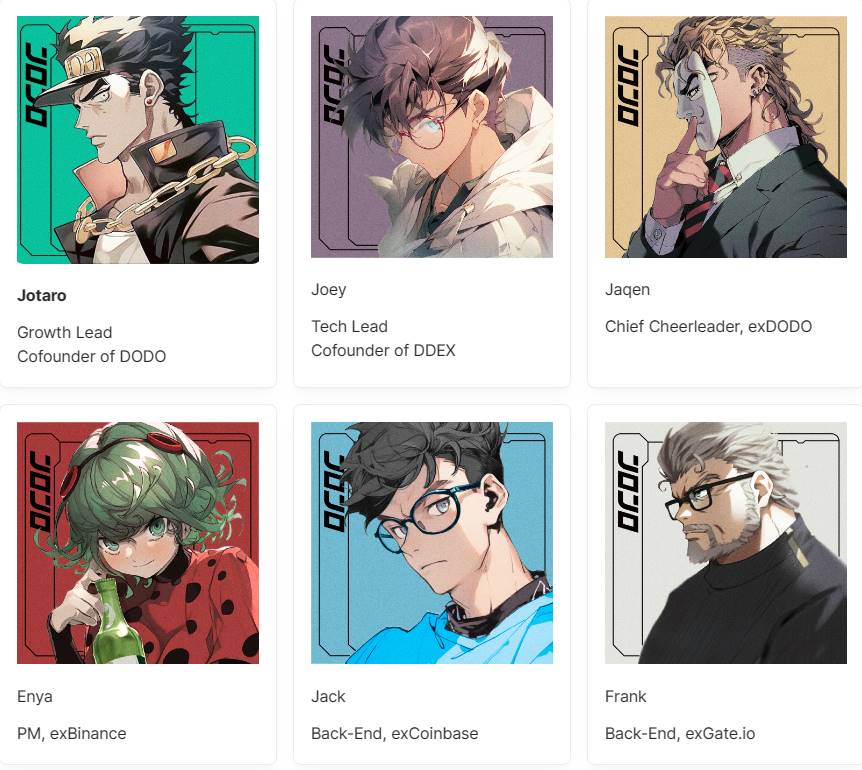

The Force Behind JOJO

JOJO’s distinctive edge is backed by an exceptional founding team. Most members come from renowned Web3 projects and have strong trading expertise, including the Cofounder of DODO, Cofounder of DDEX, and former employees of Binance and Coinbase. With years of industry experience, they bring deep expertise and sharp market intuition.

The JOJO team firmly believes that DeFi must harness the power of open-source communities, forge its own path, and accomplish what CEXs cannot—ultimately reshaping the perpetual trading landscape. This bold pioneering spirit embodies the team’s “Golden Spirit.”

To learn more about the team, click here.

JOJO’s Momentum: Diverse Experiences Within the Platform

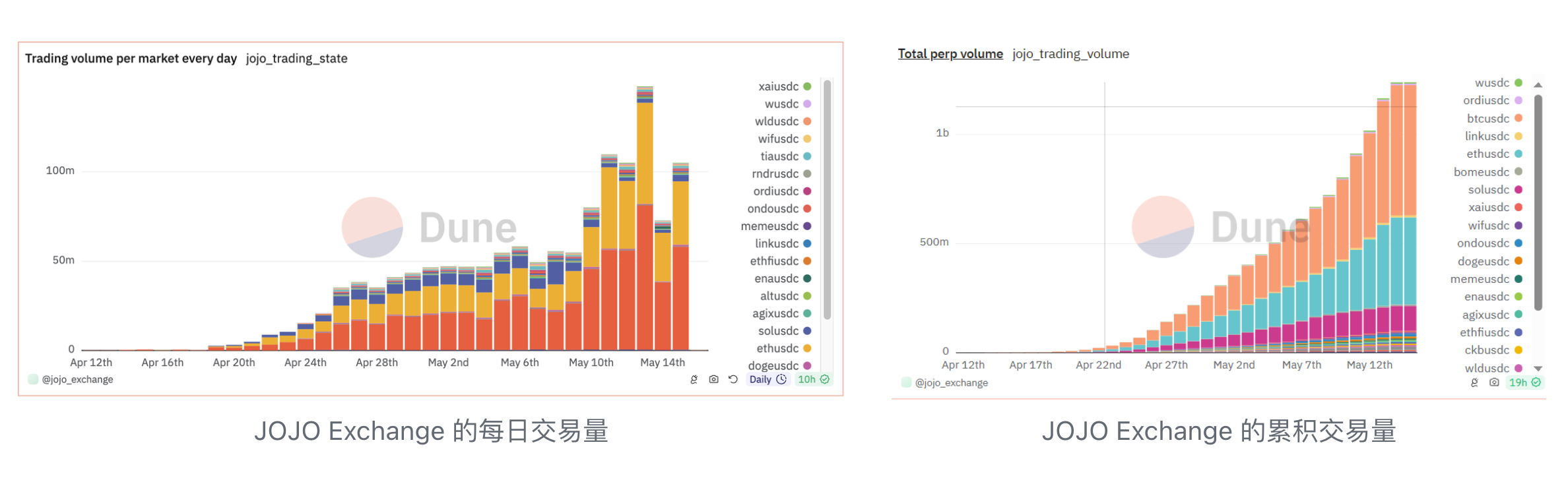

Since its mainnet launch, JOJO Exchange has delivered impressive performance metrics.

Within one month of launch, ecosystem TVL surpassed $2 million. Daily perpetual contract trading volume shows healthy growth, cumulative trading volume has exceeded $1 billion, and daily active users continue to rise.

So, what exciting features await users on the JOJO platform?

Leverage Up: JOJO’s 1000x Leverage

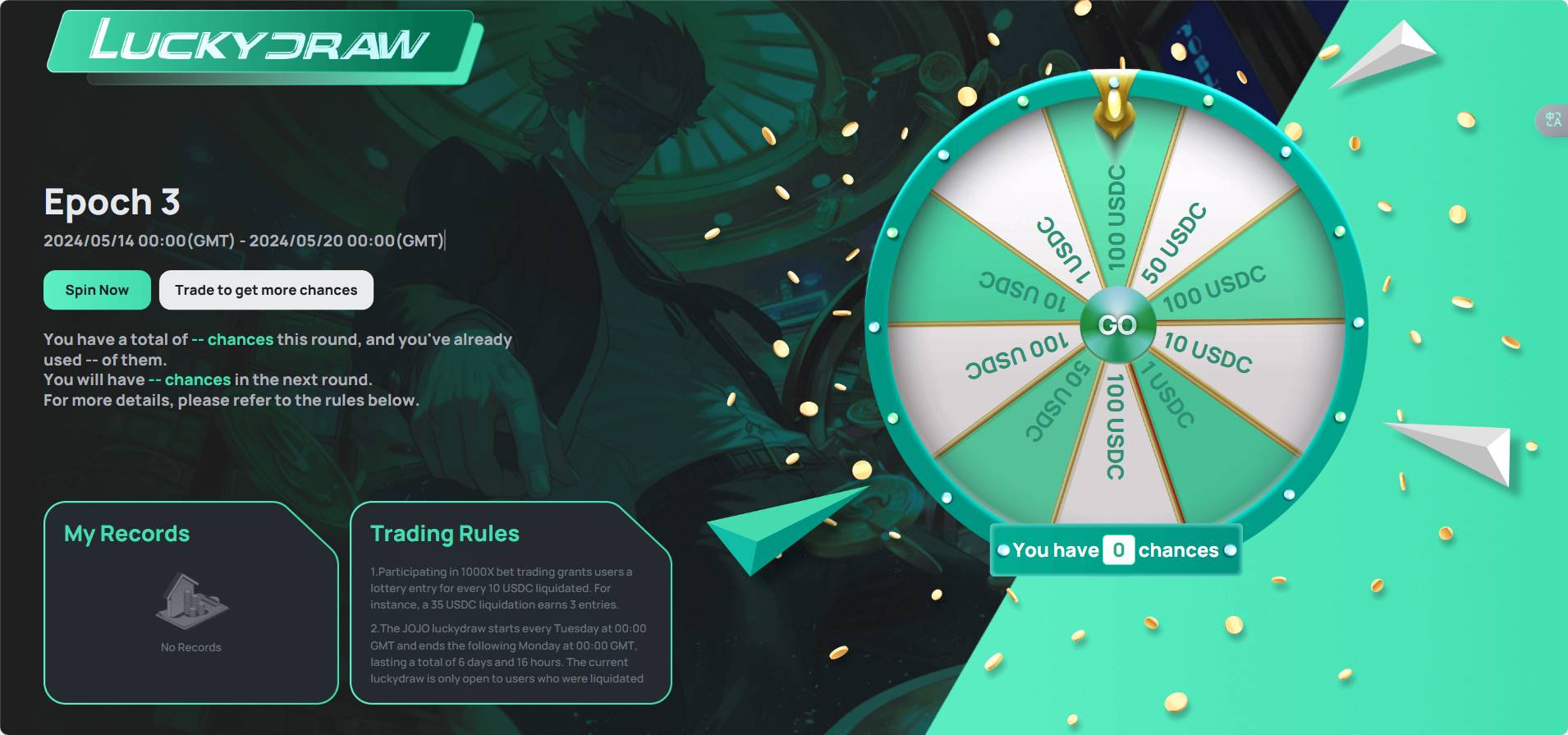

JOJO Exchange offers up to 1000x leverage, allowing users to control large positions with minimal capital, delivering a unique trading experience for high-risk-tolerant traders.

JOJO also runs special incentive campaigns—LUCKYDRAW: when users are liquidated during 1000x leverage trades, they receive one lottery draw for every $10 liquidated, with rewards ranging from $1 to $100.

LUCKYDRAW lottery page

Personal Strategy Manager: Grid Bot

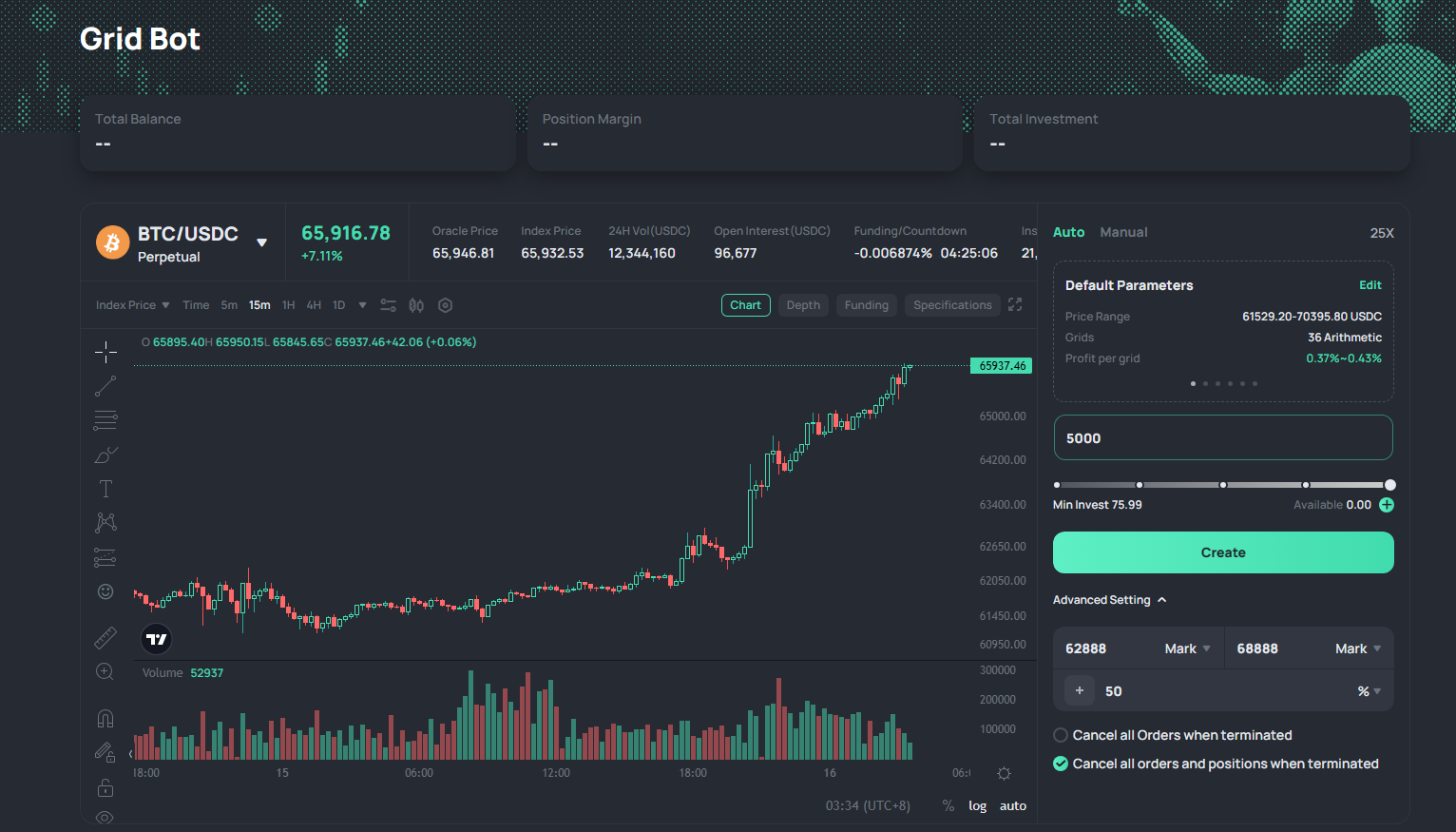

On JOJO Exchange, users can automate futures trading using the platform’s quant robot, Grid Bot.

Grid Bot automatically places buy and sell orders within user-defined price ranges. When prices oscillate within the set range, the bot creates evenly spaced trading grids (arithmetic or geometric), profiting from neutral strategies during volatile markets.

JOJO’s AI strategy can also intelligently recommend optimal grid parameters based on current market conditions—ideal for beginners unfamiliar with grid bots. Additionally, users can employ grid bots for hedging and range arbitrage to achieve steady profits while earning JOJO points.

JOJO Exchange Grid Bot interface

As the project evolves, more users will discover and adopt JOJO Exchange. Future plans include launching more trading pairs, supporting a wider range of collateral assets, and developing user-centric products—the journey of ecosystem building continues.

JOJO Exchange is expected to launch its ecosystem token in Q3, offering generous rewards to users participating in pre-mining.

Conclusion

As the on-chain world continues to evolve, standards for ecosystem infrastructure will keep rising.

Market demand for Perpetual DEXs may gradually shift from sheer volume (“more”) to superior user experience (“better”). JOJO’s relentless focus on optimizing interaction flows and enhancing user experience could define a new direction for the sector.

JOJO, though still early in its journey, has already demonstrated solid performance. Its cutting-edge technical innovations and unique perspective on the Perpetual DEX space are likely to attract growing market attention. As JOJO gains momentum, we’ll be watching closely to see if it can stay true to its vision and steadily achieve its ambitious goals.

Links: JOJO Exchange Official Website | JOJO Airdrop Guiding

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News