Understanding Aethir: A Decentralized Cloud Computing Powerhouse Spanning Three Key Sectors

TechFlow Selected TechFlow Selected

Understanding Aethir: A Decentralized Cloud Computing Powerhouse Spanning Three Key Sectors

Aethir provides enterprise-grade computing power services to industries such as gaming and artificial intelligence by aggregating high-performance GPUs like the H100.

Author: @dadayu34

TL;DR

-

The advancement of LLMs and AI represents one of the most significant technological leaps in human history, marking our entry into the AI era—where "computing power" has become the scarcest resource.

-

Edge computing is the future trend for computing power development. It effectively reduces physical latency and serves as a foundation for low-latency industries such as the metaverse. Decentralized, distributed cloud computing offers advantages in flexibility, cost-efficiency, and censorship resistance, with vast growth potential.

-

Aethir is a decentralized real-time rendering platform built on Arbitrum, aggregating high-performance GPUs like H100 to deliver enterprise-grade computing services for gaming and artificial intelligence companies.

-

Aethir has partnered with top-tier industry projects such as io.net and Theta, as well as leading game studios and telecom providers. It expects annual recurring revenue (ARR) exceeding $20 million in Q1 2024.

-

Aethir Edge significantly lowers the barrier for ordinary users to monetize excess computing power, greatly expanding the geographic coverage of the Aethir network.

-

Aethir has already raised $80 million through the sale of Checker Node NFTs, demonstrating strong market confidence in its project vision and economic model.

-

The hourly usage cost of A100 GPUs on the Aethir network is significantly lower than that of competitors, giving it a clear competitive edge.

Introduction: The Convergence of AI and Blockchain

Transformations in human society are often driven by a few monumental scientific inventions. Each technological breakthrough directly ushers in a new era of greater efficiency and prosperity.

The Industrial Revolution, the Electrical Revolution, and the Information Revolution were pivotal advancements that completely reshaped human civilization, bringing unprecedented increases in productivity and lifestyle changes. We can no longer return to an age lit by kerosene lamps or where messages were delivered by horseback. With the emergence of GPT, humanity has entered another transformative new era.

Large Language Models (LLMs) are progressively liberating human intelligence, allowing people to dedicate their limited cognitive resources to more creative thinking and practices. We have thus entered a far more efficient world.

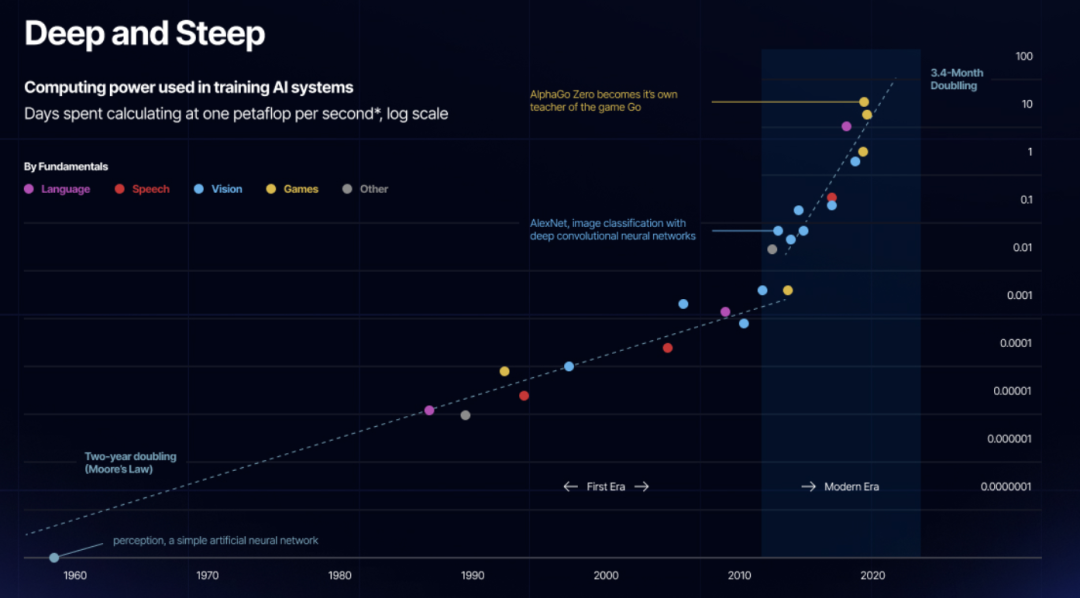

We regard GPT not only as a breakthrough due to its capabilities in natural language understanding and generation but also because it has revealed a fundamental pattern in AI advancement: by continuously increasing model parameters and training data, LLM performance improves exponentially. Given sufficient computing power, this trajectory currently shows no signs of slowing down.

source: https://arxiv.org/pdf/2202.05924.pdf, https://developers.io.net/docs/how-we-started

The applications of large language models extend far beyond language comprehension and dialogue—they represent just the beginning. Once machines can understand language, it opens a Pandora’s box of infinite possibilities. This capability enables the development of disruptive functionalities across various domains.

Today, LLMs are already making impacts across interdisciplinary fields—from video production and artistic creation to drug discovery and biotechnology—heralding revolutionary changes.

In this era, computing power has become a scarce commodity. While tech giants control vast resources, emerging developers face high barriers to accessing computational capacity. In the AI era, computing power equals influence—those who control it possess the ability to reshape the world. GPUs, as the cornerstone of deep learning and scientific computing, play a crucial role.

In the rapidly advancing field of artificial intelligence (AI), we must recognize two key aspects: model training and inference. Inference involves the functional output of AI models, while training encompasses the complex processes required to build intelligent systems—including machine learning algorithms, datasets, and computing power.

Take GPT-4 as an example: to achieve high-quality inference, developers require extensive foundational datasets and massive computing power to train effective AI models. These resources are primarily concentrated in the hands of industry giants such as NVIDIA, Google, Microsoft, and AWS.

High computational costs and entry barriers prevent broader developer participation, reinforcing the dominance of incumbent players. These leaders benefit from access to large-scale datasets and abundant computing resources, enabling them to scale further and reduce per-unit costs—thus solidifying industry moats.

But can blockchain technology offer a solution to lower computing costs and reduce entry barriers? The answer is yes. Decentralized, distributed cloud computing provides exactly such a solution in this context.

Feasibility and Necessity of Decentralized Cloud Computing

Supply Issue: Low GPU Utilization

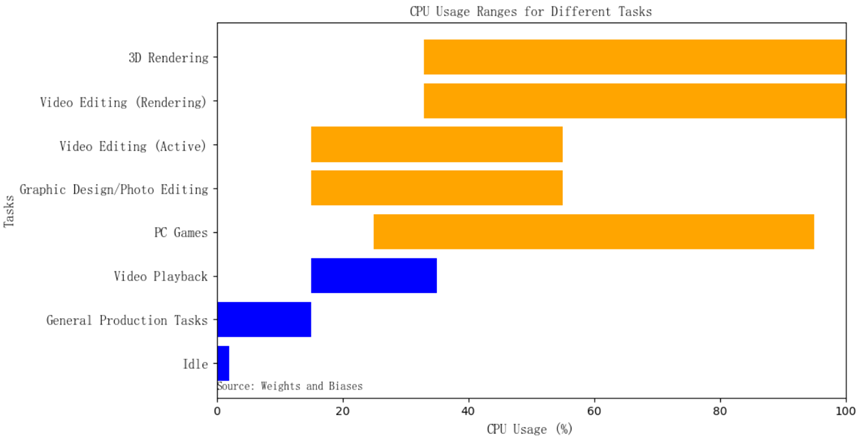

Despite the current scarcity and high cost of computing power, GPUs remain underutilized. This is largely due to the absence of a ready-made mechanism to aggregate these fragmented computing resources and commercialize them efficiently. Below are typical GPU utilization rates across different workloads:

Most consumer devices with GPUs fall into the first three categories, i.e., idle (after booting into Windows):

-

GPU utilization: 0–2%;

-

General productivity tasks (writing, light browsing): 0–15%;

-

Video playback: 15–35%.

These figures highlight extremely low utilization of computing resources. In the Web2 world, there are no effective mechanisms to collect and integrate such idle capacity. However, crypto and blockchain economies may provide the perfect remedy. Cryptoeconomics creates a highly efficient global market where token incentives and decentralized structures enable optimal pricing, transfer, and matching of supply and demand.

Edge Computing

AI will shape humanity's future, and computing power drives AI progress. Since the invention of the first computer in the 1940s, computing paradigms have evolved multiple times—from bulky mainframes to portable laptops, from purchasing centralized servers to leasing computing power. The threshold for accessing computing resources has steadily decreased. Before cloud computing, enterprises had to buy and continually upgrade their own servers. Cloud computing revolutionized this model.

Cloud computing allows users to rent remote servers and pay based on actual usage. Traditional enterprises are now being disrupted by cloud solutions. At its core lies virtualization technology, which partitions powerful servers into smaller virtual instances that can be dynamically allocated.

This model has transformed the computing industry. Instead of owning infrastructure, users simply pay a fee to access high-quality computing services via the web. The future direction of cloud computing is edge computing. Centralized systems suffer from inherent latency due to distance. Although optimization helps, the speed of light imposes a hard limit.

However, emerging sectors like the metaverse, autonomous driving, and telemedicine demand ultra-low latency. To address this, cloud servers must be moved closer to end-users, leading to the deployment of numerous small data centers near consumers—this is edge computing.

Advantages of Decentralized Edge Computing

Compared to centralized cloud providers, decentralized cloud computing offers several key advantages:

-

Accessibility and Flexibility: Accessing compute chips from platforms like AWS, GCP, or Azure typically takes weeks. High-performance GPUs such as A100 and H100 are frequently out of stock. Moreover, users often need to sign long-term, inflexible contracts, causing operational rigidity. In contrast, distributed platforms offer instant access and flexible hardware options.

-

Lower Costs: By leveraging idle chips and combining them with token subsidies from the protocol, decentralized networks can offer cheaper computing power.

-

Censorship Resistance: Web3 systems like io.net and Aethir handle compliance issues such as GDPR and HIPAA during GPU onboarding, data loading, sharing, and result transmission, without positioning themselves as permissionless systems.

As AI advances and GPU supply-demand imbalances persist, more developers will shift toward decentralized cloud platforms. During bull markets, rising token prices incentivize GPU providers to join, creating a positive flywheel effect.

Challenges of Decentralized Edge Computing

Technical Challenges

1. Parallelization Challenges

Distributed computing platforms typically aggregate long-tail chip supplies, meaning individual contributors cannot independently complete complex AI training or inference tasks quickly. To remain competitive, platforms must employ parallelization to decompose and distribute tasks, reducing total processing time and enhancing overall throughput.

However, parallelization introduces challenges including task decomposition (especially for deep learning), data dependencies, and additional inter-device communication overhead.

2. Risk of Technological Disruption

With heavy investment in ASICs (Application-Specific Integrated Circuits) and new inventions like Tensor Processing Units (TPUs), GPU clusters used by decentralized platforms could face disruption.

If these ASICs offer competitive performance and cost efficiency, the GPU monopoly held by major AI organizations might dissolve, increasing GPU supply and disrupting the ecosystem of decentralized cloud platforms.

3. Regulatory Risks

Decentralized cloud systems operate across multiple jurisdictions, each with distinct legal and regulatory frameworks, posing unique compliance challenges. Data protection and privacy laws can be particularly complex.

Currently, cloud computing users are mostly professional developers and institutions who value platform stability over price. For decentralized platforms, achieving reliable integration and consistent computing capacity is key to winning long-term partnerships and stable cash flow.

Next, I will introduce Aethir—a new distributed computing project focused on game rendering and AI—and analyze its potential valuation post-launch compared to peers.

Distributed Cloud Computing Platform: Aethir

Project Overview

Aethir Cloud is a decentralized real-time rendering platform built on Arbitrum. It aggregates and intelligently reallocates unused or newly available GPUs from enterprises, data centers, crypto miners, and consumers to help game and AI companies deliver products directly to end-users.

One of Aethir’s key innovations is its resource pool, which unifies disparate computing contributors under a single interface to serve global clients. A major feature of the pool is that GPU providers can freely connect or disconnect from the network, allowing enterprises or data centers with idle equipment to participate during downtime, improving supplier flexibility and device utilization.

Aethir’s ecosystem operates on three core infrastructures:

-

Container: Containers provide real-time remote rendering with “zero-latency” experience. They act as virtual endpoints where applications are executed and rendered, shifting workloads from local devices to the cloud.

-

Checker: Checker nodes ensure network integrity and service quality by validating containers and their processes. After completing checks, they sign results with private keys and send them to arbiters. Arbiters receive 2N+1 results per container; nodes matching the majority are rewarded with tokens.

-

Indexer: As the core of the Aethir network, Indexers match consumers with suitable containers to enable rapid service startup. The goal is “second-level” delivery—from user request to actual service (e.g., player input to game screen)—requiring minimal delay. To maintain decentralization and improve UX, Indexers are randomly selected to minimize fraud risks and signal latency.

Partnerships and Business Metrics

Aethir boasts a strong team and robust resource backing, reflected in its achievements:

-

Aethir has partnered with io.net, integrating ecosystems to deliver seamless GPU computing experiences including cluster and serverless inference. Both communities will conduct a $50 million airdrop swap—$50 million worth of tokens each—to accelerate ecosystem growth.

-

Aethir is collaborating with Theta EdgeCloud, the first decentralized AI cloud edge computing platform, to launch the world’s largest hybrid GPU marketplace.

-

Aethir has signed contracts with WellLink, the largest cloud gaming company with over 64 million monthly active users, focusing on mixed-reality metaverse and game development. It has also contracted with the world’s largest game studio with 150 million MAUs.

-

Signed a contract with the world’s largest telecom provider, generating $5 million in annual recurring revenue (expected to rise to $13.9 million soon).

-

Partnered with Meta48 as its exclusive GPU cloud service provider for mixed-reality products. Meta48 is a Web3.0 metaverse developer whose core product integrates XR elements (AR, VR, MR).

-

An additional 10 contracts in the gaming sector are in negotiation.

Aethir achieved $80 million in node sales in Q1 2024, setting a record for DePIN and AI projects. It has validated enterprise-level demand for GPUaaS in AI model training, virtual computing, and gaming. Three existing contracts are projected to generate over $20 million in ARR in Q1 2024. Since launch, service fee revenue has reached $1.8 million.

By comparison, the entire DePIN sector generated only $24 million in ARR last year. Aethir’s revenues far surpass those of leading protocols, highlighting its exceptional position and substantial valuation potential. Its strong resources and capabilities support continued scaling, technological advancement, and sustainable, self-reinforcing growth.

Aethir Edge

Aethir Edge is a hardware device launched by the Aethir network to power next-generation GPU cloud computing. Equipped with cutting-edge components like the Qualcomm® Snapdragon 865 chip and 12GB LPDDR5 memory, it handles data-intensive workloads at the edge.

Aethir Edge features 256GB UFS 3.1 storage for high-speed data access, a 1000M GE LAN port, and Wi-Fi 6 2T2R + BT5.2 connectivity, delivering enterprise-grade computing performance.

It connects via the internet to aggregate idle GPU resources from diverse sources and deliver them directly to end-users. This “sand-to-tower” model pools vast amounts of underused computing power, significantly boosting supply and accessibility—making a profound impact on AI and gaming industries.

Aethir Edge allows any user—even without a dedicated graphics card—to become a computing provider on the Aethir network and earn token rewards. Users can connect wirelessly or via cable and manage the device through a dedicated mobile app, optimizing performance for specific tasks like GPU computing.

With this device, users can monetize their bandwidth, IP addresses, or unused GPU resources. Unlike high-barrier mining rigs, Aethir Edge drastically lowers entry requirements—anyone can buy one and profit from underutilized computing power.

Moreover, Aethir Edge’s portability and flexibility allow deployment across broad geographic areas, enabling Aethir’s GPU cloud to achieve wider coverage than traditional clouds, significantly reducing latency and bringing cloud convenience even to remote regions.

Team Background and Funding

Team Background

Aethir’s core team is diverse and experienced. The founder is a seasoned executive with a proven track record in AI, cloud computing, Web3, and gaming. Team members include former professionals from Web3 institutions, traditional financial firms, and major tech companies. This suggests strong networking and resource integration capabilities across both Web2 and Web3 domains.

-

Mark Rydon: Co-founder and CEO, previously held key roles at NOTA Platform, Flux Capital, Gaas LTD, Kulture Athletics, Inc., and Bechtel Corporation.

-

Daniel Wang: Co-founder and Chief Business Officer, formerly IVC (Venture Partner), YGG SEA (CIO), Riot Games (Director of International Publishing Management), and Riot Games China (Operations Director).

-

Kyle Okamoto: CTO, former CEO and GM of Ericsson’s IoT, Automotive, and Security business, CEO of Edge Gravity, and Chief Network Officer at Verizon Media.

Funding

-

Seed Round (token round, early 2022): $60 million valuation, amount undisclosed.

-

Pre-A Round (token round, early 2023): Raised $9 million at a $150 million valuation.

Both rounds were led by Hashkey Capital, with participation from Mirana Ventures, Animoca Brands, Maelstrom Capital, Sanctor Capital, Merit Circle, Big Brain Holdings, Builder Capital, Momentum 6, Tess Ventures, CitizenX Crypto Ventures, and Lapin Digital.

Aethir Economic Model

Core Participants in the Aethir Network

There are five key participant groups in the Aethir network:

Miners, developers, users, token holders, and Aethir DAO.

Miners are categorized into three types:

-

Container: Provides remote rendering services;

-

Checker: Evaluates container performance and service quality;

-

Indexer: Matches users with appropriate containers.

User: Contributes idle GPU computing power via Aethir Edge.

Token Flow and Distribution

The ecosystem token is $ATH, with a total supply of 42 billion.

50% of tokens are allocated to miners—i.e., computing providers and checker nodes.

Of this, 35% goes to computing providers:

Edge/Enterprise/IDC: Providers of idle GPU power and high-performance GPUs from professional institutions. 23% of tokens go to Edge users, while 12% are allocated to Enterprise and IDC contributors.

15% of tokens are allocated to checker nodes—10% distributed over four years, and 5% reserved for performance-based bonuses. Private sale and team tokens are subject to lock-up periods of one year or more.

Three uses of $ATH:

1. Transactional Use: Payment for computing power and compensation for miner services. As the Aethir ecosystem expands—with merged mining and integrated markets—$ATH will continue serving as a medium of exchange across applications.

2. Governance: $ATH holders have the right to propose, discuss, and vote on governance matters within the DAO.

3. Staking: Node operators must stake $ATH to guarantee security and reliability. Malicious nodes risk partial or full slashing. Containers also earn higher rewards through staking—the more staked, the better the performance and rewards.

Rewards are distributed in stages based on workload and performance. Invalid computations are penalized—their rewards deducted and redistributed: 10% burned, 25% reallocated to eligible nodes, and 75% sent to the DAO for future distribution.

Analyzing Aethir’s Economic Ecosystem from Revenue, Expenditure, and Profit Perspectives

Purchase of Aethir Checker Licenses

Miners must purchase Aethir Checker licenses to become checker nodes. Sales follow a pyramid-style tiered pricing model, starting at 0.1259 wETH, with a total of 100,000 nodes. Sales occur via whitelist and public sale—higher-tier nodes are fewer and cheaper. As lower-priced nodes sell out, buyers must purchase at higher prices. Total node sales have exceeded $80 million.

To incentivize promotion, Aethir implements a referral commission system. Buyers using referral codes receive 10% or 5% rebates, while referrers earn 10% or 5% commissions. This design motivates buyers to promote the project widely, achieving breakout growth and increased sales.

source: https://www.aethir.com/checkersaleinfo

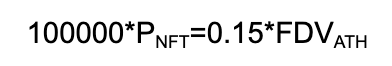

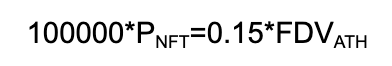

Upon successful purchase, buyers receive an NFT representing a permanent Checker Node license. NFT owners earn mining rewards by operating nodes directly or via托管. These NFTs can be valued similarly to perpetual bonds. The theoretical total value of NFTs in the market equals 15% of ATH’s total market cap, simplifying discounted cash flow analysis:

If the token price is too high relative to NFT value (left side < right side), NFT demand increases. If the token price is too low (left > right), NFT supply rises until equilibrium is restored. NFTs are non-transferable during the first year, ensuring stable checker node operations. However, NFT prices will influence $ATH’s market price.

Due to the pyramid pricing model, early adopters with low-cost NFTs gain cheaper entry, shorter payback periods, and weaker holding incentives—resulting in heavier selling pressure compared to later entrants.

To mitigate this, Aethir introduced the $vATH mechanism. Checker nodes earn rewards through mining—10% of total token supply is distributed over four years to checkers, plus 5% in performance bonuses. These rewards are issued as $vATH. When checkers claim rewards, tokens are locked for 30 or 120 days depending on conditions. After lock-up, $vATH converts to $ATH and can be sold.

If $vATH holders wish to withdraw early, 75% of converted tokens are forfeited as penalty, and bonus eligibility is lost. After 120 days, default lock-up extends to 180 days—delaying reward withdrawals and effectively easing sell-side pressure.

Purchase of Aethir Edge

Aethir Edge is the hardware component of Aethir’s DePIN stack. Through Aethir Edge, ordinary users contribute underutilized computing power and bandwidth to the network and earn rewards from 23% of the total $ATH supply. Official pricing has not yet been disclosed.

We can speculate that Edge mining rewards may also include vesting periods similar to checker nodes. Given the difficulty of transferring Edge devices and higher exit costs, vesting periods might be shorter to encourage broader participation.

In summary, selling checker nodes and Edge miners is a key revenue stream. With checker node sales complete, selling more Edge devices becomes a critical operational goal. Enhancing mining yield expectations is a vital strategy. At $ATH launch, only ~5% of tokens will be circulating. The team has strong incentives to boost token price, increase visibility and annualized returns, attracting more users to build the Aethir ecosystem.

Sector Analysis

Next, we review valuations and funding of peer projects.

-

io.net: A decentralized computing network aiming to unite 1 million GPUs into the world’s largest GPU cluster and DePIN infrastructure. Combines cloud, AI, and DePIN narratives. Token即将 launches. Raised $30 million in Series A at a $1 billion valuation, backed by Hack VC, OKX Ventures, and others.

-

Grass: Flagship product of Wynd Network, enabling users to monetize unused internet bandwidth. Part of cloud and AI sector. Raised $4.5 million across two rounds.

-

Render Network: A decentralized GPU rendering solution connecting render job submitters with GPU owners. Cloud and AI sector. Raised $30 million. Current market cap: $3.5 billion.

-

Akash: A distributed peer-to-peer marketplace for cloud computing, primarily leasing idle CPU power. Cloud sector. Market cap: $1.25 billion.

-

Gensyn: A distributed computing network for AI model training. Cloud and AI sector. Raised $49.5 million, led by a16z.

-

GAIMIN: Built a decentralized data processing network monetizing excess computing power from gaming PCs. Cloud and gaming sector. FDV: $900 million.

-

Hive: A distributed data storage and computing platform allowing users to lease computing resources and perform local storage. Cloud and infrastructure sector. Raised $20 million.

-

Meson Network: A data transport backbone for decentralized storage, computing, and emerging Web3 DApp ecosystems. Monetizes idle bandwidth from long-tail users at low cost. Infrastructure and cloud sector. Backed by OKX Ventures and other top VCs. Valuation: $1 billion. Funding undisclosed.

-

Flux: A decentralized Web3 cloud infrastructure composed of user-operated, scalable, globally distributed computing nodes. Infrastructure and cloud sector. Current market cap: $340 million.

-

Aleph.im: A decentralized cloud platform providing on-demand serverless computing, databases, and storage for dApps and protocols. Cloud and infrastructure sector. Raised $10 million. FDV: $180 million.

-

FormAI: Building a decentralized, distributed computing network primarily for AI model training and inference. Cloud, DePIN, and AI sector. Funding and valuation unknown.

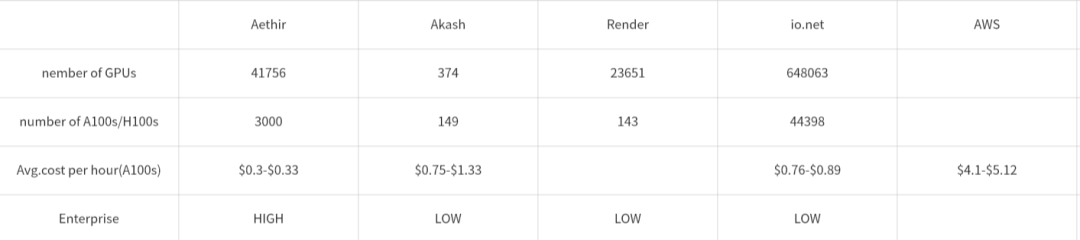

Here, we focus on four comparable projects—io.net, Render, Akash, and Gensyn—that align with Aethir in terms of investor caliber and valuation for detailed comparison.

io.net

Built on Solana, io.net focuses on consumer and enterprise AI/ML. As of writing, io.net has 648,043 GPUs and 94,750 CPUs. It hosts 44,398 combined H100 and A100 units, including 21,777 A100-SXM4-80GB, 18,409 A100 80GB PCIe, 320 A100 PCIe 80 GB K8S (the most utilized, reaching 94% usage on 2024/4/24), and 30 H100 80G PCIe K8S units.

Render

Render Network specializes in rendering services, currently operating 23,651 GPUs and 1,006 CPUs, including 141 H100 PCIe and 2 H100 80GB HBM3 units.

Akash

Akash has 21,500 CPUs and 374 GPUs, with 149 combined H100 and A100 cards of various models.

Gensyn

Gensyn aims to aggregate global idle computing resources for low-cost, large-scale machine learning training. Currently in Devnet mode, with no public network size data.

While io.net leads in connected GPU count, Aethir has 41,756 GPUs, including 3,000 H100s, with 440 online H100s, giving it an edge in enterprise-grade high-performance GPUs over RNDR, Akash, and Gensyn.

Additionally, Aethir offers the most competitive A100 rental rate at $0.33 per hour. This price holds a clear advantage over both Web2 giants and Web3 competitors.

Source: Messari, io.net, Akash Network, Aethir Network

Conclusion

Whoever controls computing power controls the world. In the AI era, we do not want computing power to be monopolized like rare diamonds. Thus, we embrace decentralized cloud computing—reshaping the means and relations of production through blockchain.

Aethir stands out as a powerhouse combining AI, DePIN, and GameFi narratives, achieving remarkable success even before token launch. Its strong team and resource base suggest this journey has only just begun, destined for extraordinary outcomes.

The launch of Aethir Edge breaks the high-latency bottleneck of edge computing, enabling everyone to contribute and access computing power. Thanks to Edge’s convenience, Aethir Cloud can be deployed everywhere.

Today, the computing revolution has only just started. Aethir will stand out by bridging the gap between high-performance computing demands and Web3 AI technologies. When its token launches, it is sure to shine brightly in the market!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News