Exclusive Interview with Safe Co-Founder: Don't Call Me Gnosis Safe, Call Me Safe

TechFlow Selected TechFlow Selected

Exclusive Interview with Safe Co-Founder: Don't Call Me Gnosis Safe, Call Me Safe

"A key aspect of Safe is its inherent modularity, which enables future adaptability."

Interview: Sunny, TechFlow

Guest: Lukas Schor, Co-founder of Safe

“A key aspect of Safe is its inherent modularity, which provides future adaptability.”

——Lukas Schor, Co-founder of Safe

Safe is the largest account abstraction wallet in Web3, safeguarding over $100 billion in assets.

Today marks a pivotal moment for Safe: the Safe token contract has officially been unpaused, allowing SAFE to enter free market circulation.

Shortly after, the Safe token began trading at a global valuation of $2.8 billion.

Both the $100 billion in secured assets and the $2.8 billion global valuation represent landmark milestones for a Web3 smart contract wallet. Last week, Safe successfully acquired a financial management platform previously backed by Sequoia. These consecutive developments have significantly strengthened Safe’s momentum, signaling that more users will likely transition from Ethereum external owned accounts (EOAs) to smart contract wallets.

At the recent ETH Dubai event, Lukas Schor, co-founder of Safe, shared his views on ERC-4337 and the recently revived EIP-3074. As the leading consumer-facing application in the smart contract wallet space, Safe's adoption of any standard carries critical weight, given its vast user base of sophisticated smart wallet users.

TechFlow interviewed Lukas about standards for smart contract wallets and related topics.

Don’t Call Me Gnosis Safe, Call Me Safe

TechFlow: Should we refer to it as "Safe" rather than "Gnosis Safe"? Is this your preferred brand name to communicate to the audience?

Lukas Schor:

Safe’s history is deeply tied to Gnosis; it’s part of our DNA and forms what’s known as the “Gnosis Mafia”—a network including projects like Cow Swap. Despite the SEO challenges associated with the name "Safe," we are committed to building and strengthening the brand around it. Our focus is on reinforcing Safe’s identity within the ecosystem.

TechFlow: Is SAFE built on the Gnosis chain?

Lukas Schor:

Safe is highly flexible; our smart contracts are deployed across 100 different EVM networks, though not all are major players from a usage standpoint. Initially, Safe spun out from Gnosis, establishing a foundational link. However, this relationship is more of a soft connection rather than an exclusive commitment to the Gnosis ecosystem.

Safe Overview

TechFlow: Safe is the largest smart account, best known for its multi-sig system. Can you briefly introduce Safe?

Lukas Schor:

Safe’s core mission is to transform every user account into a smart account.

Security of ownership is crucial; users should be confident they won’t lose access to their accounts even if they lose their private keys. This can be achieved through smart accounts, which eliminate reliance on a single private key and instead use more complex access control systems, such as multi-signature setups.

Safe’s capabilities extend beyond multi-sig: they include session keys for low-risk operations, two-factor authentication configurations, and account recovery options—forming a hybrid custody solution where trusted parties can co-sign or block malicious transactions without initiating them.

Currently, SAFE smart accounts manage approximately $100 billion in assets, primarily driven by collective launches by teams and significant contributions from high-net-worth individuals and institutional participants.

The shift to smart accounts offers various benefits—from improved user experience and enhanced security to protection against future quantum threats, as traditional Elliptic Curve Digital Signature Algorithm (ECDSA) signatures are vulnerable.

Our project isn't just about building technology—it's also about cultivating an ecosystem. We’re developing open-source tools and infrastructure to support diverse user groups transitioning to smart accounts, from retail traders to teams focused on financial management. Safe is a collaborative effort aimed at realizing a quantum-resistant Web3.

Quick read on Safe’s founding history (link)

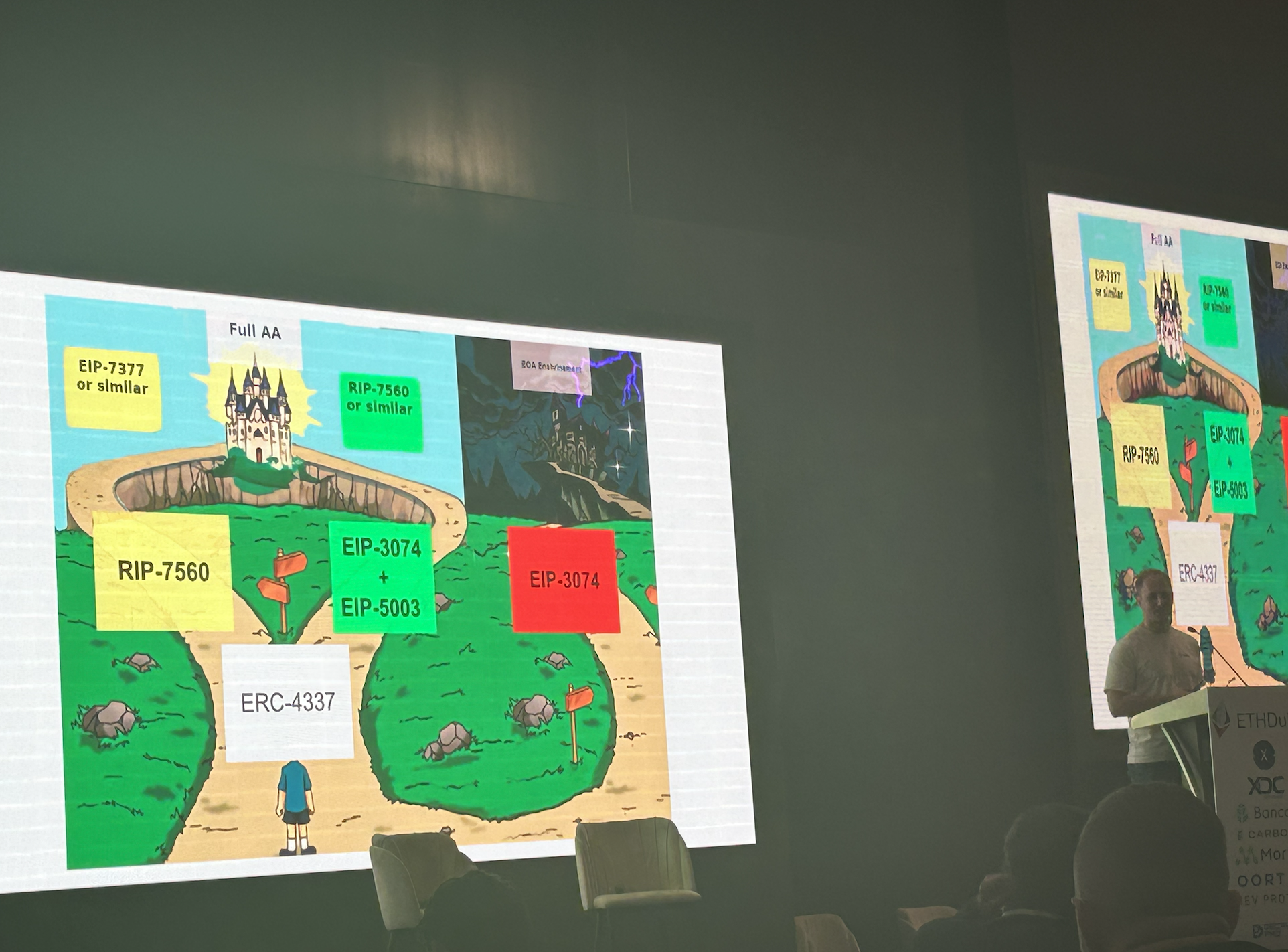

ERC-4337, EIP-3074, EIP-5003: Which Account Abstraction Path Is Best?

TechFlow: Could you explain why you're shifting from ERC-4337 to EIP-3074, and how this aligns with your broader strategy for account abstraction?

Lukas Schor:

We are committed to advancing the roadmap for account abstraction on Ethereum, focusing on transitioning from EOAs (externally owned accounts) to smart accounts.

Initially, we planned to build on ERC-4337, using an application-layer approach with a bundler-paymaster ecosystem, avoiding protocol changes. However, due to complexity, we began rolling out using EIP-7650 as a more efficient and decentralized method.

The decision to move toward EIP-3074 by the end of 2024 reflects a pragmatic step to enable batched transactions and simpler migration from EOAs to smart accounts, leveling the playing field. This sets the stage for EIP-5003, which would allow EOAs to be fully converted into smart accounts at the same address.

Our strategy emphasizes not only enhancing EOA functionality but also pushing for full native account abstraction to avoid hindering progress. Integrating EIP-3074 with EIP-5003 will provide a clear upgrade path, ensuring a coherent and efficient transition.

Detailed analysis of smart contract standards (link)

TechFlow: What is the relationship between Safe and companies like Pimlico that offer Paymaster services?

Lukas Schor:

Pimlico is essentially our partner, providing the Paymaster bundler infrastructure that Safe does not offer. They integrate this infrastructure with Safe smart accounts, focusing on transaction sponsorship to improve application usability. They also provide an SDK that allows developers to specify which transactions should be sponsored. This strategic integration expands the functionality and accessibility of Safe smart accounts.

Brief note: Safe is inherently modular and adaptable. You can choose to use only Safe’s native account abstraction system, or add an ERC-4337 module to make it fully compatible with ERC-4337.

(Special thanks to Kristof Gazso, founder of Pimlico and co-author of ERC-4337, for feedback.)

Smart Accounts Are Quantum-Proof

TechFlow: Earlier, you mentioned the threat quantum computers pose to EOAs. Could you elaborate on that?

Lukas Schor:

Current cryptographic methods like ECDSA signatures are vulnerable to quantum attacks. As quantum computing advances, these vulnerabilities could be exploited, rendering existing Ethereum accounts (EOAs) insecure. The community recognizes that transitioning to smart accounts using advanced cryptography, such as Schnorr signatures, is necessary. Discussions include potential emergency upgrades during a quantum attack scenario (similar to EIP-5003), which would force migration to smart accounts. However, a voluntary transition is preferred over a forced, reactive upgrade to avoid the complexity and risks involved.

Keystore Is Safe’s Next Move

TechFlow: Could you pick a topic related to Safe’s future development and share more insights?

Lukas Schor:

I’m particularly excited about the potential of Keystore.

Keystore will allow us to abstract away network complexity for both users and developers. Ideally, users won’t need to worry about which network their assets are on—similar to how we access websites without thinking about server locations. This abstraction is crucial for simplifying interactions across various networks like Optimism or Arbitrum.

Keystore centralizes access control mechanisms—much like a password manager—where you can manage your keys and seamlessly perform operations like key rotation across all accounts. This is especially beneficial for cross-chain operations, where you might hold assets on different networks but manage them via a single, centralized keystore.

These keystores will typically use cryptographic proofs to synchronize with all associated accounts, ensuring any updates to your keys are automatically propagated. We’re considering implementing these keystores on dedicated rollups optimized for this function, which will interact with state proofs from various networks to reliably deliver current account states.

This development aims to simplify managing multiple accounts across chains by solving the problem through a unified access point. It addresses common issues associated with smart accounts, particularly those related to state synchronization and account deployment across multiple networks.

Safe is actively involved in this area, with Scroll and Base also researching prototypes. Exciting updates are expected in the coming weeks, with Safe playing a key role.

Will MetaMask Be a Competitor?

TechFlow: Do you think MetaMask will become a competitor to Safe in the future?

Lukas Schor:

Given Safe’s mission to turn every account into a smart account, MetaMask currently operates mostly on EOAs (externally owned accounts) and has only partially adopted account abstraction via Snaps—an initiative that hasn’t seen significant adoption. In that sense, they could be viewed as competitors. However, their commitment remains unclear, especially regarding developments like EIP-3074, which they haven’t strongly supported. This EIP leans toward enhancing EOAs, unlike EIP-5003, which enables direct transition to smart accounts. MetaMask’s platform is largely built around EOAs, and shifting to smart accounts could significantly disrupt their current model. Their level of support for smart accounts—which would align more closely with Safe’s goals—remains to be seen.

TechFlow: What do you see as Safe’s competitive advantages? Is it your go-to-market strategy attracting diverse clients, engineering capability, or organizational flexibility?

Lukas Schor:

Safe isn’t the most flexible project, mainly because our priority is security, which often conflicts with flexibility. Our smart contracts have run for seven years, securely managing over $100 billion in assets. This longevity and reliability help build growing trust over time (Lindy effect).

A key feature of Safe is its inherent modularity, enabling future adaptability. For example, when new standards like ERC-4337 emerge, we can simply integrate new adapters into our Safe accounts, maintaining compatibility and flexibility.

Another competitive advantage is our commitment to open-source principles and neutrality in tokenomics. Although Safe has its own governance token, our core contracts remain tokenless. This policy fosters an ecosystem built on trust and utility, promoting network effects by attracting a broader developer community and encouraging shared learning and tool creation. Together, these elements strengthen Safe’s position as a foundational component in the smart contract landscape.

The Secret to Reaching Billions

TechFlow: Over six years, how did Safe attract such massive capital, totaling in the billions? Was there a “snowball moment” that accelerated this growth?

Lukas Schor:

Before Safe, there was no less opinionated, more efficient multi-sig concept like ours. We launched Safe as a more energy-efficient, modular, and superior solution, but convincing people to transition from traditional setups to Safe was challenging—especially since trust in smart accounts was low due to issues with other products like Parity. It took about one to two years to achieve 50% migration.

Key milestones helped accelerate this transition. First, Gnosis moved $50 million in assets to Safe, signaling strong confidence. Shortly after, major centralized exchange Bitfinex transferred all customer assets—around $1 billion—to Safe. Another significant endorsement came from Vitalik Buterin moving his ETH to Safe, possibly following his own rigorous review.

These key actions created a snowball effect, significantly boosting trust in and adoption of Safe contracts.

SAFE Token and Community Governance

TechFlow: Is there anything you’d like to share about the Safe token?

Lukas Schor:

The Safe token is gaining attention, which may soon affect its perception. Interestingly, a key governance vote took place last week. Initially, the Safe token was distributed as a non-transferable asset to ensure the community had a voice in its future development.

The decision on whether to make the token transferable was left to the community via voting. After the FTX collapse caused industry turmoil, the community initially voted against making the token transferable. They set certain milestones, agreeing not to reconsider until those were met.

Over the past year and a half, we’ve worked hard to achieve these milestones. In the latest vote last week, the community approved making the token transferable. This change takes effect next week, on the 23rd (today). This is the first time we’ve gone through such a broad, community-driven process to change the token’s status, and it will be fascinating to see how this new phase impacts Safe.

TechFlow: What guiding principles or “bible” did Safe follow when designing its governance token?

Lukas Schor:

From the start, we chose not to let any backers or investors purchase equity, setting us apart from projects like Uniswap that may face conflicts of interest due to their financial structures. The key entity behind Safe is a foundation, and the Safe token fundamentally represents the value of the ecosystem, driving its operations.

Next week, we’ll introduce additional utility for the Safe token as part of a new program involving several key projects within the ecosystem. This aims to encourage more users to migrate to smart accounts.

While specific details remain confidential, this update will significantly increase the value of the Safe token. Additionally, we’re exploring creative ways to use the Safe token for transaction fee discounts on Safe, though these ideas are still in development. (link)

TechFlow: How does Safe’s investment structure work, particularly regarding token warrants? Don’t investors receive token equity as part of the protocol?

Lukas Schor:

Unlike typical Web3 projects where supporters usually receive equity plus tokens, Safe’s backers two years ago purchased tokens purely, aligning with our ethos. We deliberately avoided equity to prevent misaligned incentives that could compromise our mission as an open-source project. At Safe, we believe the project’s utility and value should be encapsulated entirely within the Safe token itself, ensuring all benefits directly enhance the token ecosystem’s value—without the complications of equity.

TechFlow: How does Safe incentivize investor participation in governance? Do they also contribute to product rollout strategies?

Lukas Schor:

We’ve simplified our governance to avoid overwhelming token holders with frequent proposals. We also established an early participation agreement that clarifies the legal aspects of governance participation, giving institutional backers confidence to engage actively.

In practice, our last proposal saw about 15% of the total token supply voted—higher participation than many other projects, with over a thousand voters emerging from 20,000 holders.

TechFlow: While I understand that smart contracts effectively replace traditional contracts, meaning “code is law,” you still use off-chain agreements for governance. How do you establish these rules for your community? Is this more of a grassroots initiative, or defined by the foundation, especially considering your base in Switzerland?

Lukas Schor:

We implemented a participation agreement that participants must accept on Snapshot. This off-chain solution is approved as the standard for participation, ensuring legal clarity for everyone involved in governance. This framework significantly boosts voter confidence by clearly defining legal boundaries.

How Does Safe Collaborate With Web2&3 Giants to Attract Users?

TechFlow: Given your interactions with major Web2 and Web3 giants, what are their thoughts on using Safe’s smart accounts for executing customer transactions?

Lukas Schor:

Different organizations use Safe for different purposes. For example, Reddit uses Safe to handle NFT avatars, though I don’t know the specifics. Sotheby’s leverages Safe to auction NFTs, benefiting from the enhanced security of not relying solely on private keys, especially given the high value of the NFTs involved.

Additionally, Budweiser used Safe when purchasing the beer.eth domain and used it as an avatar on social platforms—a transaction worth $100,000.

Safe’s structure enables them to enforce corporate policies through multi-sig approvals and hierarchical controls, offering a secure self-custody solution that avoids the risks of a single private key or shared passwords.

Approximately 10% of all USDC is securely held in Safe. This significant use case highlights Safe’s importance in the ecosystem. Circle is particularly interested in how we can optimize this for users holding USDC in Safe, such as exploring ways to generate yield on these holdings.

TechFlow: Can you discuss your strategy for bringing Web2 users into the ecosystem?

Lukas Schor:

Passkeys could be the most impactful development this year for on-chain transaction authentication.

In cryptography, distributing private keys has always been a challenge. Currently, people manage their keys using 12-word seed phrases, which are easily lost or improperly stored.

Passkeys aim to solve this by simplifying private key generation and storage, thanks to standardization efforts by Apple, Google, and other Web2 companies aiming to replace passwords. This would allow storage in systems like iCloud Keychain, enhancing interoperability and security.

Such a setup would allow passkeys to manage account behaviors. Ultimately, we may see every domain, email, or AI agent managing on-chain accounts via methods like zero-knowledge (ZK) proofs, which verify off-chain states.

While some smaller teams are exploring passkeys, widespread adoption isn’t immediate. For instance, Shopify is evaluating the technology, but typically, rollouts signal intent 6 to 12 months in advance—we haven’t yet seen sufficient commitment signals for this year. From Safe’s perspective, we’re monitoring these developments but don’t expect broad adoption to happen overnight.

Previous TechFlow conversation on the Gnosis ecosystem (link)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News