No time to watch the market? How to dollar-cost average (DCA) Bitcoin elegantly and effectively

TechFlow Selected TechFlow Selected

No time to watch the market? How to dollar-cost average (DCA) Bitcoin elegantly and effectively

DCA is a superior strategy because you never take on excessive risk, you achieve the best average Bitcoin price, and over the long term you still outperform most traders.

By: A Fox

Translation: TechFlow

Summary

-

Passive observers are those who want to invest in cryptocurrency but do not wish to become active participants in the market, making dollar-cost averaging (DCA) the most suitable strategy.

-

Using DCA to buy Bitcoin means purchasing BTC with a fixed dollar amount at regular intervals, such as buying $100 worth of Bitcoin every month.

-

DCA is a superior strategy because you never take on excessive risk, you achieve the best average price for Bitcoin, and over the long term, you still outperform most traders.

-

Investing in BTC via DCA helps avoid the trap of "round-tripping" profits from other tokens, as Bitcoin is the most resilient—it survives every bear market and emerges stronger.

People who don’t work full-time in crypto often ask me what they should buy.

The truth is, if you’re not planning to spend time researching cryptocurrency, the best long-proven strategy is investing in Bitcoin using dollar-cost averaging (DCA).

Why I Wrote This Article

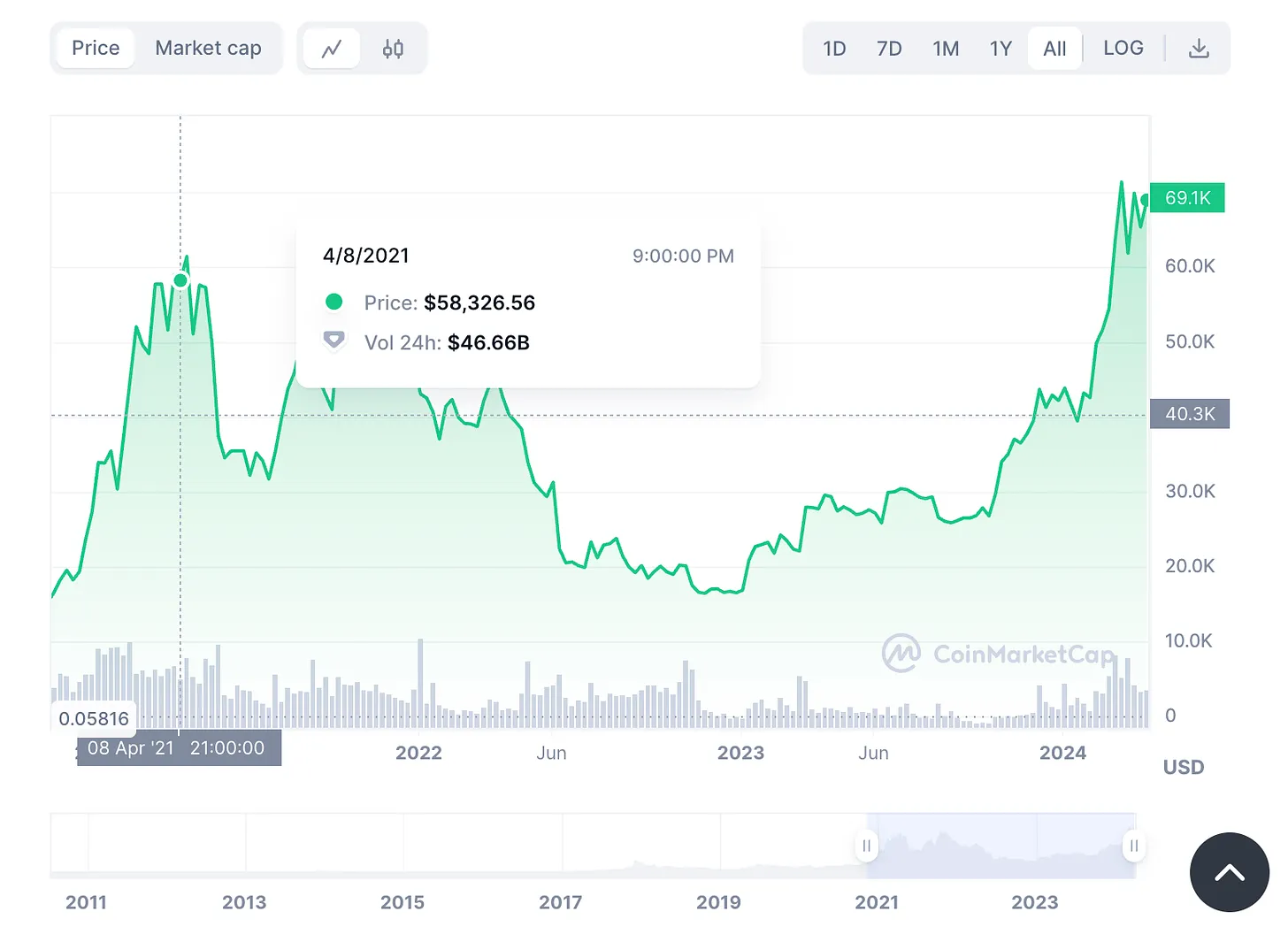

Interest in cryptocurrency is growing as Bitcoin’s price hovers around $70,000—near its all-time high—and with the Bitcoin halving approaching in about eight days.

Rising crypto prices act as a growth mechanism, drawing more people into the space. Some become deeply interested and stay, but most end up as passive observers.

This article is written for that majority of passive observers!

These individuals typically want to dip their toes into crypto investment without becoming full-time Web3 participants or spending all their time learning about different coins, projects, and diving down endless rabbit holes.

At first, passive observers often get overly excited and buy a bunch of low-quality coins recommended by friends, only to find themselves losing significant money and much of their initial investment.

This is an extremely common path for newcomers to crypto.

If you want to avoid this experience, and your sole goal is passive investment with profit, then you should probably adopt “dollar-cost averaging.”

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is one of the simplest investment strategies—essentially investing a fixed amount in Bitcoin (or any other asset) at regular intervals.

Most people receive their salary once per month, so many choose a fixed, comfortable amount—say $100 per month—and set it aside. DCA into Bitcoin means taking that $100 each month and using it to buy Bitcoin. You can also do this daily, weekly, or biweekly, depending on your preference.

DCA is a strategy of buying at fixed intervals. It eliminates the risk of investing more than you can afford and allows you to acquire Bitcoin at an averaged price over time.

In fact, DCA into Bitcoin is so simple that most people don’t believe it works, so they skip it and instead try more complex strategies—which are likely to lose them money.

Why DCA Is a Superior Strategy

Now, you could simply put that $100 per month into a savings account—the approach most people take. However, all government fiat currencies are inherently inflationary, as central banks globally target a small level of inflation. This means your $100 will buy less over time.

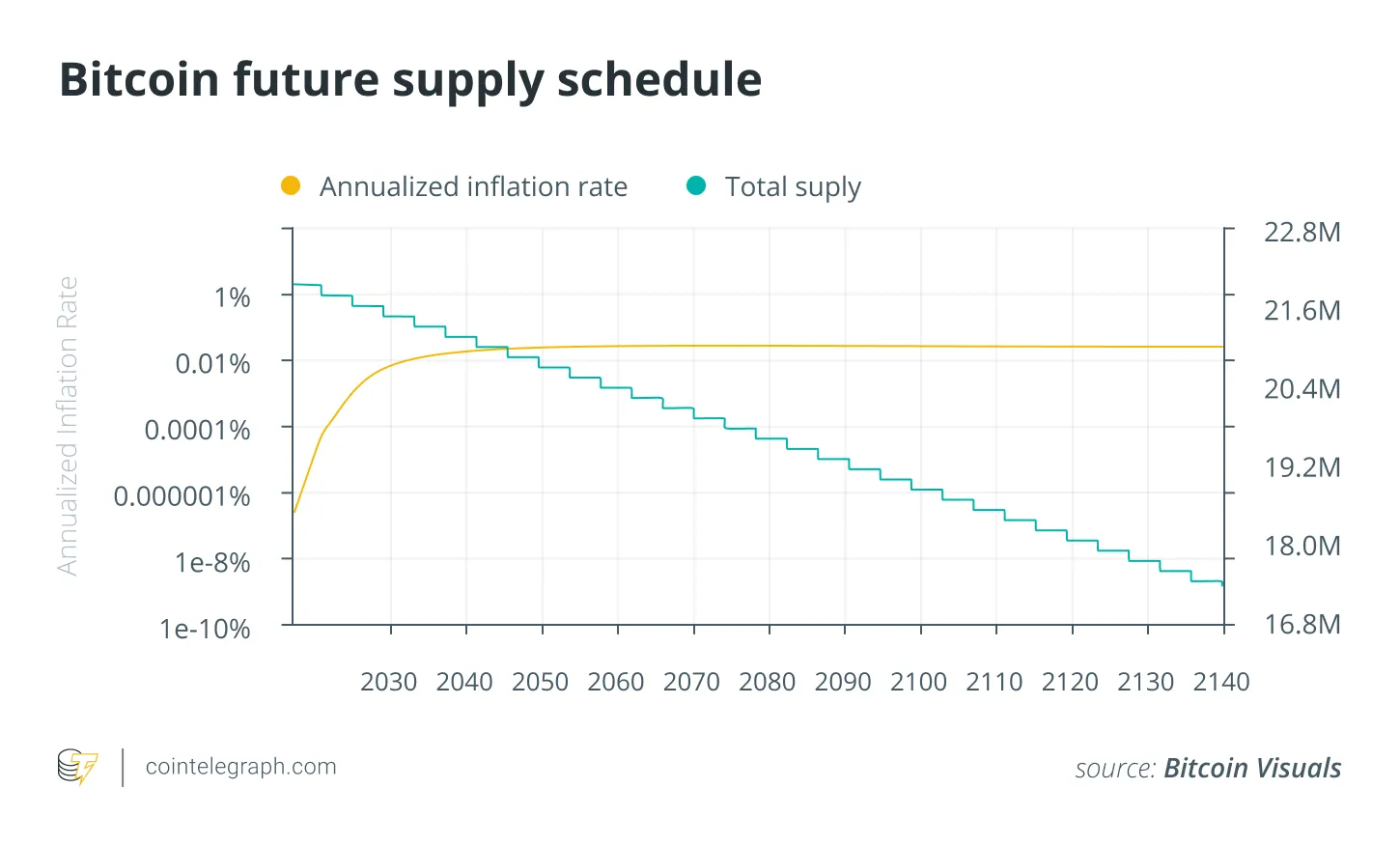

Meanwhile, Bitcoin has a fixed total supply—only 21 million coins ever—making it deflationary over the long term. Therefore, the same $100 invested in Bitcoin today will tend to be worth more over a sufficiently long period, as Bitcoin's price generally trends upward.

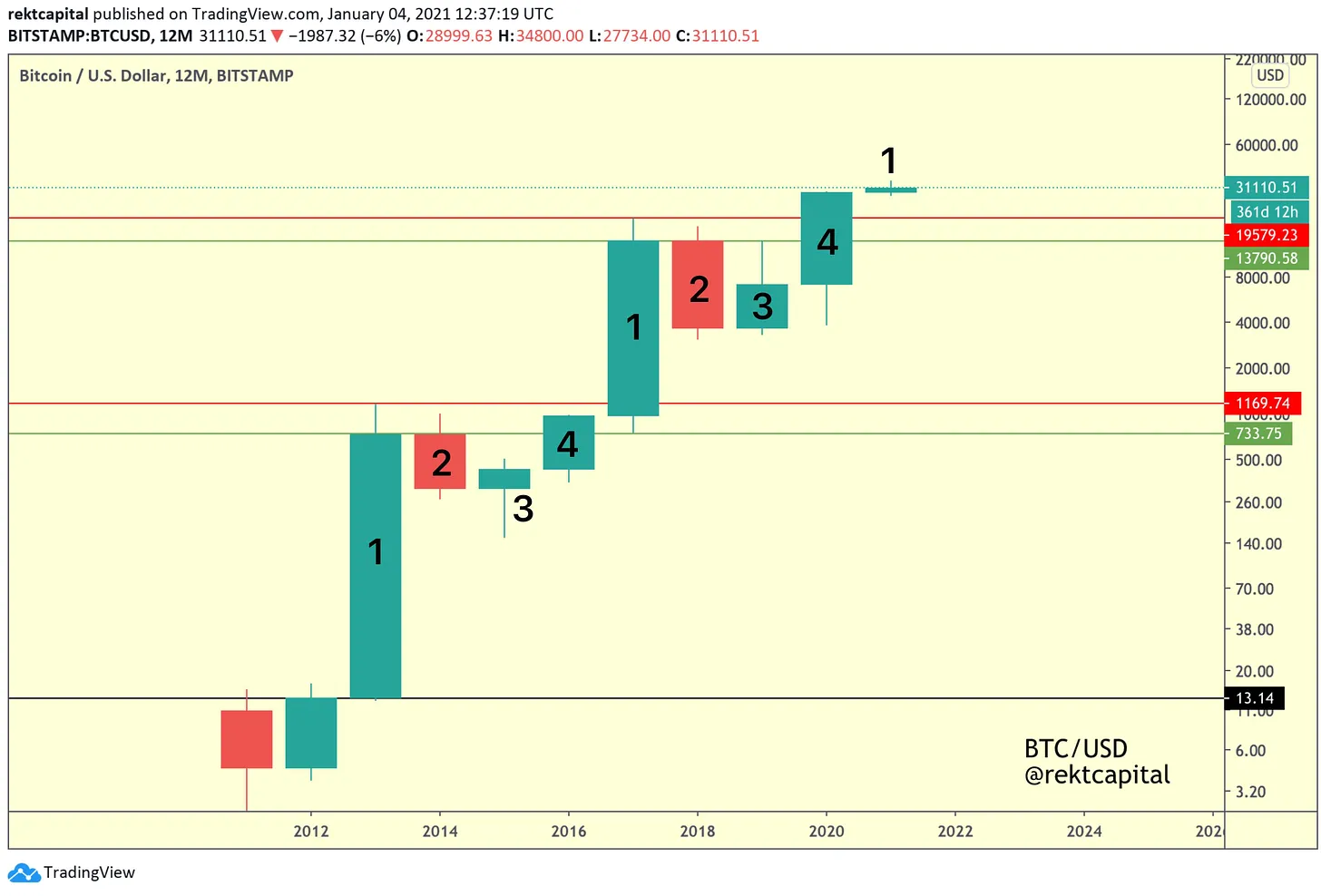

Simply put, Bitcoin is a hedge against inflation. Despite high volatility, its fixed supply means that as more people adopt it, the price trend is upward.

The next question is: why not buy as much Bitcoin as possible right now?

Well, due to Bitcoin’s extreme price volatility, if you buy all at once, you might enter near a local peak and end up paying more than necessary. By purchasing a fixed dollar amount each month, you pay an averaged price over months or even years, tending to get a better overall price. We can illustrate this below.

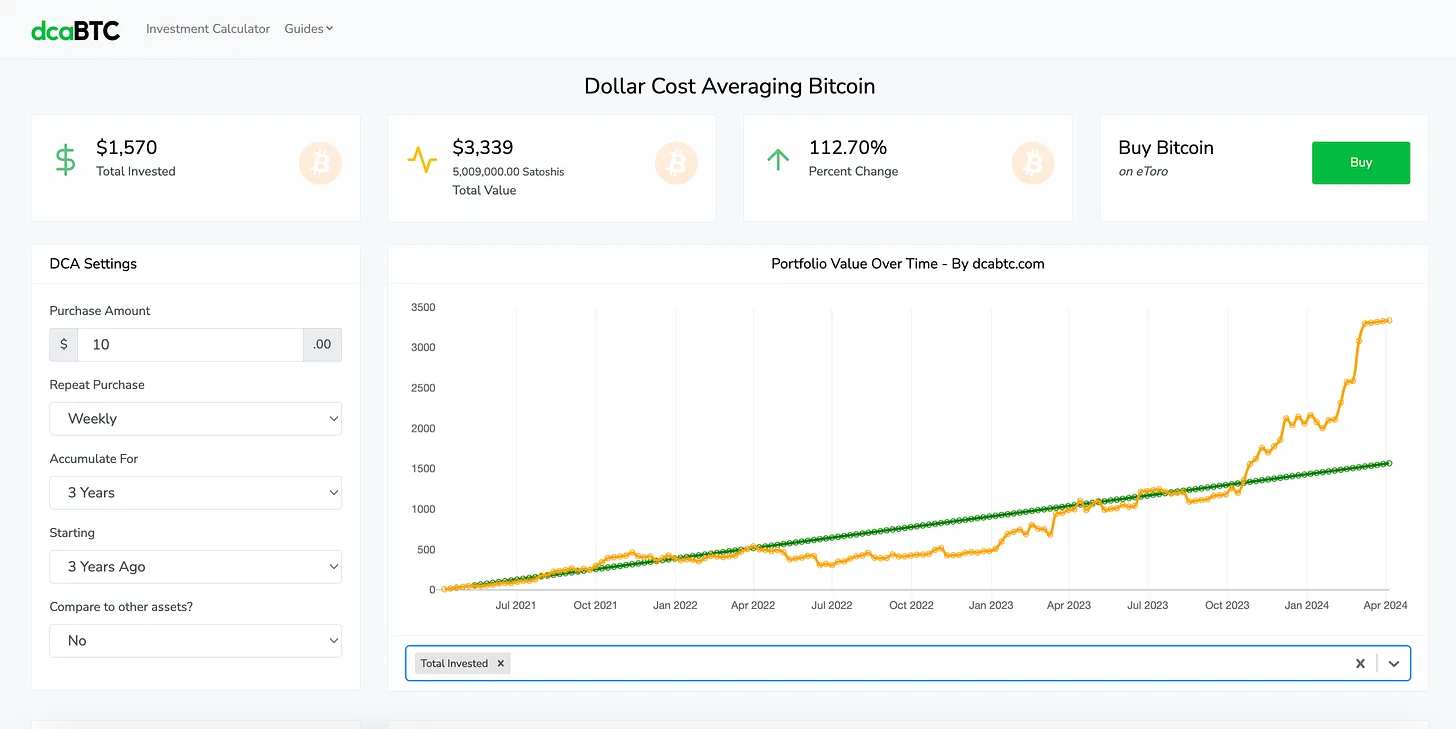

On the website dcabtc.com, you can estimate returns from different DCA strategies. By default, we see that investing $10 weekly for three years turns a total investment of $1,570 into $3,339—a 112.7% return.

Meanwhile, if you had simply bought $1,570 worth of Bitcoin three years ago instead of DCA’ing $10 weekly, you’d have earned only about 20%—not the 112.7% shown above—and today you'd have roughly $1,890, far less than $3,339.

Importantly, as discussed earlier, if the amount you DCA does not significantly impact your finances, you can sustain this process over a longer period. Thus, you not only get the best average price, but you also never take on excessive risk—and even during major price swings, you won’t lose sleep worrying about losses.

Bitcoin enthusiasts encourage DCA so strongly that they’ve even given it a name: “stacking sats.” Since the smallest divisible unit of Bitcoin is called a satoshi, or “sat,” regular DCA means you’re consistently stacking these sats!

Bitcoin Is Built Differently

When I tell most people to DCA into Bitcoin, they either feel they’ve missed the boat or think it’s too simple—and insist they should buy a bunch of other tokens instead.

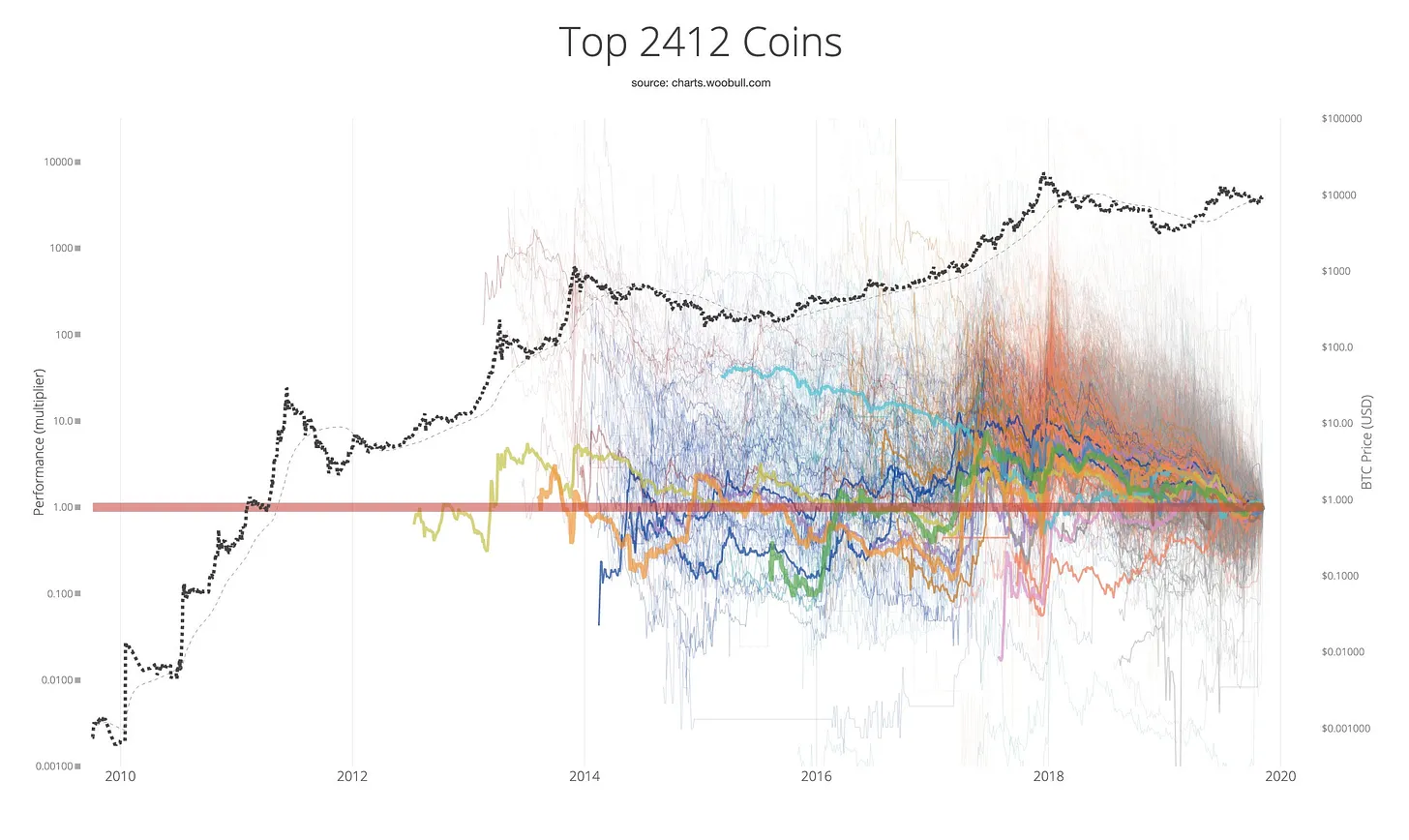

For a passive observer, this is usually a mistake. While many altcoins may outperform Bitcoin during bull markets, they also lose far more in bear markets and often never recover to previous highs.

It’s common for people to “round-trip” their profits: they buy a token, see its price surge, and then—even as its price drops more than Bitcoin’s during a bear market—they continue holding it. They hold on hoping it will rebound, but it never does, and they end up losing more than they would have by simply holding Bitcoin.

Bitcoin is built differently.

There are many reasons Bitcoin carries greater fundamental value—I can discuss these in future posts. Bitcoin’s price often drives the broader market up and down. Despite lower yields compared to other tokens, it continues to rise even after other tokens exit the market.

Therefore, for passive observers who want to invest in crypto without regularly monitoring the market, Bitcoin is the safest haven.

While I primarily recommend Bitcoin, today you could say Ethereum has also become a fairly solid safe haven, and Solana may reach that point too. Still, I suggest passive investors prioritize DCA’ing into Bitcoin first, and if they truly wish, place Ethereum DCA second.

Importantly, both BTC and ETH have fixed or decreasing supplies, while SOL does not. Bitcoin will always have only 21 million in circulation, and Ethereum is actively burning ETH through its protocol, reducing supply over time. This is a key factor for long-term value appreciation, though of course other factors also drive price increases.

For Active Market Participants in the Cycle

This article mainly targets passive observers, but even if you aim to do more—to participate more actively in crypto market opportunities—DCA’ing into Bitcoin is still a solid strategy. That said, you might improve returns by taking on additional risk.

As mentioned, most altcoins and NFTs tend to underperform Bitcoin over the long term. However, during bull market peaks, many altcoins and NFTs can outperform Bitcoin. Picking the right ones remains challenging, but allocating a portion of capital to current cycle narratives may be a wise move.

For example, it’s now clear that there’s significant money to be made in areas related to artificial intelligence, meme coins, and Bitcoin Ordinals and Runes. Taking measured risks in these narratives could yield higher returns than simply holding Bitcoin.

However, a major issue here is that most people don’t understand crypto’s four-year cycle and may, as previously noted, lose those gains.

Therefore, if you want to be an active market participant, make sure to sell your positions before the cycle ends. While you can’t precisely predict when that will happen, when it does, these tokens likely won’t return to their previous highs.

It’s important to conclude this article by stating that this advice reflects only my personal viewpoint as someone who has participated in and observed the market for over eight years.

As often said in crypto, none of this is financial advice—please do your own research. In other words, treat my opinion as just another perspective among online content, not as gospel truth. I trust you won’t take it as such. Before investing your own funds, ensure you read widely and conduct thorough due diligence!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News