Meme Coin Economics: The Shift from Value Investing to Meme Investing

TechFlow Selected TechFlow Selected

Meme Coin Economics: The Shift from Value Investing to Meme Investing

Three key factors of meme survival: longevity, fecundity, and copying fidelity.

Author: Lingyun, Miss Cat

Review: Ashley

Cover image source: Midjourney

Value investing fades into oblivion; memes rise to palace glory overnight. Today, AU Research decodes the economic principles behind meme mania and how to screen reliable investment targets.

01 What Is a Meme?

The term "meme" was first introduced by British scholar Richard Dawkins in his book The Selfish Gene. He argued that just as biology has genes, culture also has a fundamental unit—the meme—that carries cultural information.

Meme, also translated as "mimeme" or "mem," originally derives from the Greek word mimema, meaning "that which is imitated." Biologist Richard Dawkins first coined the term in his 1976 book The Selfish Gene, simplifying it into a word phonetically similar to "gene"—"meme." He applied evolutionary theory to cultural change, formally defining a meme as a small cultural unit that replicates and spreads through imitation between individuals. Chinese scholars He Ziran and He Xuelin translated "memes" as "moyin" (模因) in 2003.

Richard Dawkins drew an analogy between cultural transmission and biological evolution. Memes encompass a broad range of cultural elements, including religion, rumors, news, knowledge, ideas, habits, customs, slogans, proverbs, language usage, jokes, and more.

Unlike genetic replication in nature, meme replication isn't perfectly accurate. It's not merely mimicry but often involves creative reinterpretation, following the principle of natural selection.

Just as genes jump from one person to another, memes leap from one mind to another through imitation, reproducing themselves. When a meme occupies someone’s mind, it turns that mind into a vehicle for its own propagation—akin to a virus infecting a cell. Just as not all genes survive, some memes spread widely while others vanish quickly.

02 How Do Memes Spread?

Dawkins identified three key factors affecting a meme's survival: longevity, fecundity, and copying fidelity.

Among these, longevity is relatively less important because a meme's survival largely depends on its host's lifespan. When the brain carrying the meme dies or the storage medium (like a CD) is destroyed, the meme disappears.

Fecundity is more critical. For example, if a meme represents a scientific discovery, its survival chances depend heavily on how many people learn about it—roughly measurable by citation counts in academic journals or publication sales. The higher a meme's reproductive capacity, the wider it spreads and the greater its chance of survival.

Copying fidelity refers to how accurately a meme retains its original form when copied and transmitted. Differences may arise due to variations in education, interests, age, gender between copiers and receivers. Sometimes, the replicator intentionally alters the meme. A typical case is in academic writing, where authors selectively present aspects of a meme, analyze it from new angles, or combine it with other memes to create something novel. High-fidelity memes are better preserved in their original form.

03 What Drives a Meme to Go Viral?

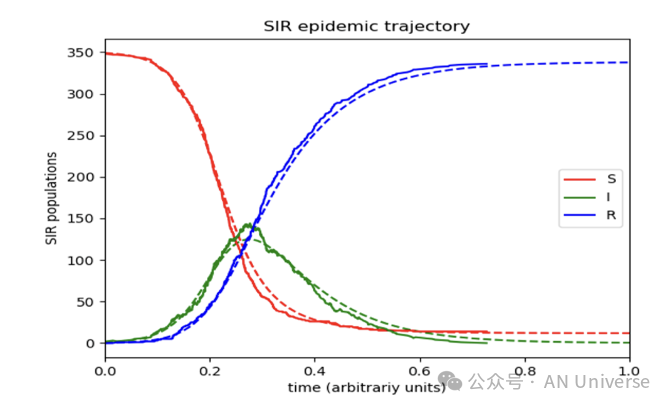

Simply put, virality follows the laws of communication science. To understand memes, we must study communication patterns and market sentiment—specifically, how to trigger human emotions. This brings us to the SIR model of information diffusion.

Originally a model for disease spread, the SIR framework applies equally well to information. The red line represents susceptible individuals, green indicates infected ones, blue shows recovered, and the x-axis marks time.

The core of information spread lies in making infection rate exceed recovery rate, thus continuously expanding the number of infected. In communication and psychology terms, this means exposing more new people to the information, increasing the chance of further contagion.

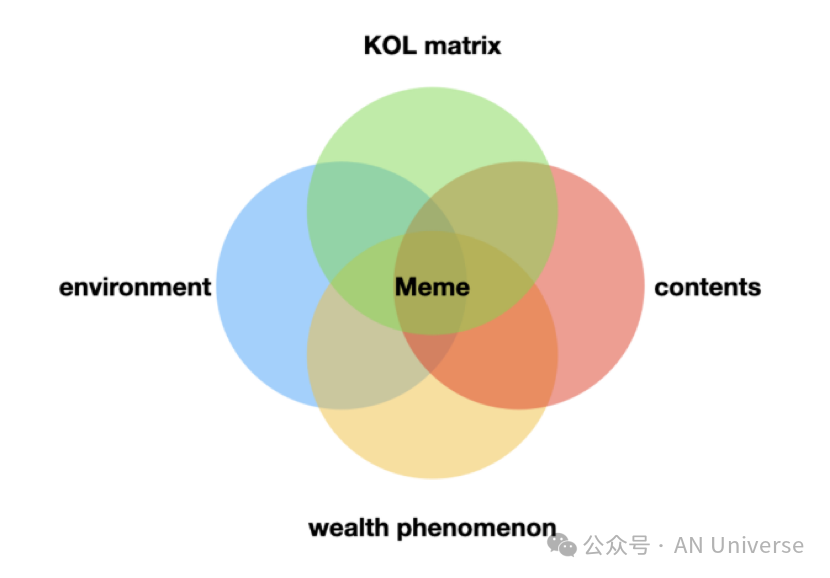

Combining psychology and communication theory, we can identify four key drivers of meme success: meme content, environmental context, KOL promotion, and wealth-generation effect.

Content: At its core, a meme tells stories and conveys emotion through images. Take $Doge: for dog lovers, it's instantly relatable and enjoys strong long-tail appeal—many find cute, funny dogs increasingly endearing over time. $PEPE, the sad frog, was already a beloved emoji before becoming a meme. Similarly, sloths gained popularity through Zootopia.

In emotional delivery, simpler and more straightforward is better. As one saying goes about the sci-fi novel The Three-Body Problem: “Every added equation loses ten thousand readers.” The same applies here—down-to-earth content spreads easily, while overly technical material only appeals to insiders.

To summarize: cute, universally likable, simple, and direct content tends to go viral.

Environment: This includes macro conditions and economic cycles. This bull market has attracted many outsiders who don’t understand complex tech concepts like oracles, restaking security mechanisms, or smart contracts. But memes are easy to grasp—and cheaply priced. With just $10, you can buy thousands of tokens. If it drops a zero, it becomes a 10x gem. Many “shitcoins” gain zeros within an hour—easy entry points.

This meme boom also reflects broader economic downturns. Put simply, crypto consumers are downgrading. Aside from the U.S., most countries have seen economic weakness in recent years, reducing public appetite for cutting-edge technology exploration. Like animals hibernating, people adopt low-energy, easily digestible behaviors. Under such conditions, meme markets thrive even more.

KOL Promotion: Creating a meme involves issuance, liquidity pool setup, KOL promotion, and community outreach—all essential steps. Regardless of actual expertise, KOLs craft highly persuasive narratives that people readily believe. Much of crypto pricing stems from bubbles, and bubbles arise from consensus. Thus, meme marketing inevitably relies on KOL endorsements and community-driven dissemination.

Here comes a risk warning: You might see multiple group admins simultaneously hyping the same coin, reinforced by a flood of WeChat articles convincing you a certain meme holds real value. After jumping in, you may discover you’ve either been scammed by trading bot sellers, bought at the peak, or watched your investment drop to zero in ten minutes.

Following English-speaking and international KOLs helps assess a meme’s true cultural value. Cross-cultural consensus is genuine consensus.

Wealth-Generation Effect: The reason memes have become a mainstream sector lies in their effortless creation of overnight millionaires and the resulting FOMO (fear of missing out). Pumping prices upward, spreading tales of instant riches (“Someone made $30 million in two hours!”), and amplifying community-wide FOMO fears—these are common meme marketing tactics that align perfectly with communication science.

04 What Is a Meme Coin?

The extension of meme culture into the crypto world manifests as various memecoins and meme NFTs. Memecoins, a subset of cryptocurrencies, focus on popular internet memes, pop culture references, and viral online trends. Famous examples include different versions of the Japanese Shiba Inu dog Kabosu and the Pepe the Frog cartoon—even extending to celebrities like Elon Musk.

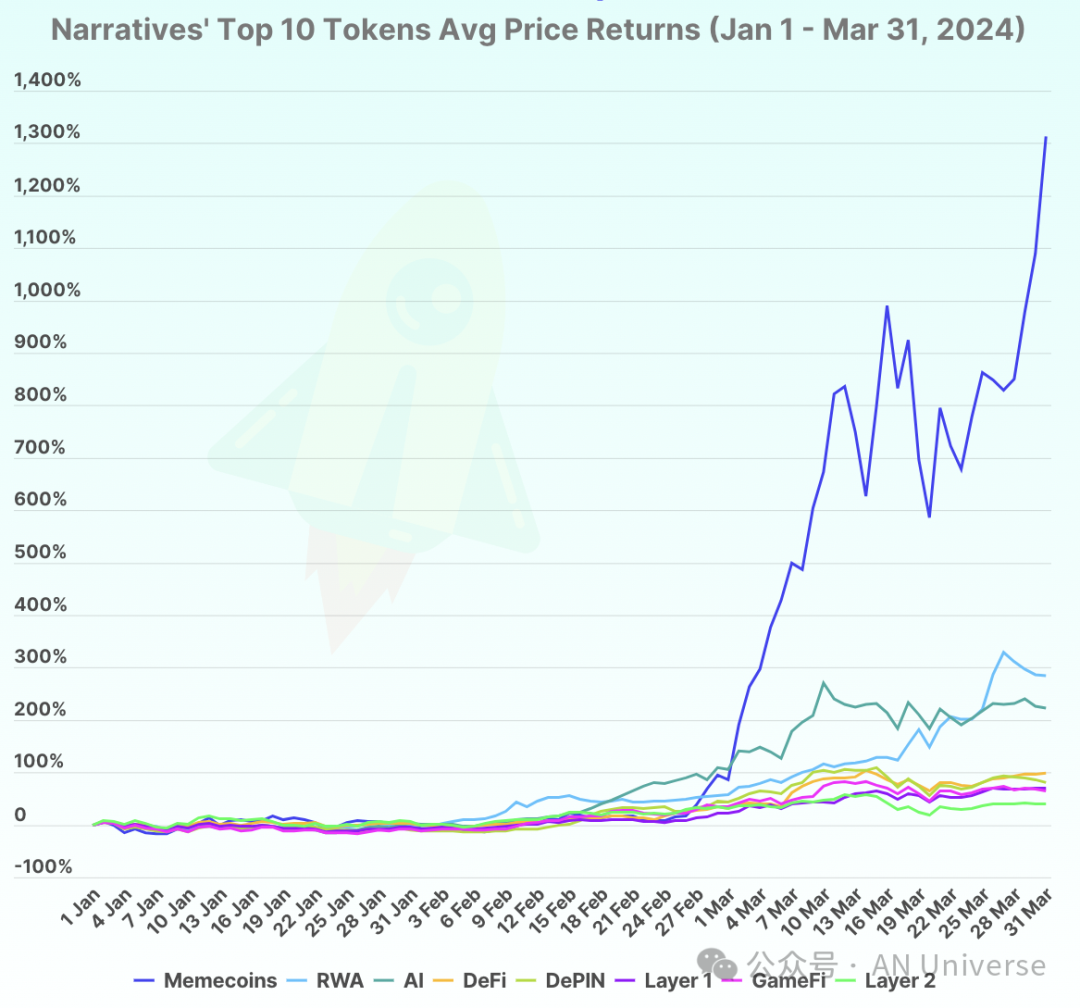

According to a recent report by CoinGecko, the memecoin sector has become the most profitable space so far this year.

The report shows that among the highest-market-cap tokens, memecoins delivered the highest average return: 1,312.6%. By quarter-end, several memecoins launched in March had entered the top 10 by market cap, including Book of Meme (BOME), Brett, and Cat in a Dog's World (MEW)—outperforming both RWA and AI sectors.

Memecoin creators leverage various themes to capture speculators’ attention and drive trading volume. Often, prominent KOLs and forums like Reddit join the memecoin frenzy. Unlike major cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), which primarily function as digital money, memecoins are typically created as lighthearted social experiments with limited technological value.

Many view memecoins as refreshingly different from the seriousness of traditional crypto—inviting a new generation of users to blockchain in an accessible, unconventional way. Yet others argue they pose high risks and undermine the legitimacy of ambitious blockchain projects. Whether or not you dare to dive into memes, understanding how memecoins work, their common uses, and associated risks remains crucial. Let’s now explore the relationship between memes and cryptocurrency.

05 History of Memecoins

The concept of memecoins dates back to the early days of cryptocurrency, though it didn’t gain popularity until Dogecoin (DOGE), the original representative memecoin, emerged in 2013. Dogecoin was created as a joke by software engineers Billy Markus and Jackson Palmer. Featuring the then-popular Shiba Inu dog “Doge” as its logo, despite its humorous origin, DOGE quickly gained traction in the crypto space due to its low price and fast block generation speed.

Bitcoin itself could be considered the ultimate memecoin—its value stems entirely from collective belief rooted in decentralized ideology and secured by cryptography. Today, we generally refer to cryptocurrencies based purely on consensus, humor, or rapid virality—lacking technological innovation—as memecoins.

From tipping on Western platforms like Reddit to donations for international nonprofits, Dogecoin evolved beyond a joke into a commonly used medium of exchange. Inspired by DOGE’s success, numerous memecoins emerged based on internet trends and jokes—tokens like Pepe (PEPE), inspired by the sad frog, and Shiba Inu (SHIB) gained significant attention and ignited the crypto community.

Later developments, especially the rise of DeFi (decentralized finance) and NFT (non-fungible token) mania, provided fertile ground for further memecoin experimentation.

06 Memecoins and NFTs

Memecoins have also leveraged the NFT boom, transforming viral internet characters into unique digital assets users can own and trade. For instance, a memecoin project might release limited-edition NFTs featuring elements tied to their token. Users can buy, sell, or trade these NFTs across various NFT marketplaces. This allows meme enthusiasts to preserve a fragment of internet history while supporting their favorite meme projects. Rare Pepes and later Fake Rares were among the earliest NFT projects developed from viral internet memes.

Shiba Inu Coin (SHIB), one of today’s most popular memecoin projects, launched its own “Shiboshis” NFT series—10,000 cartoon dogs inspired by Shiba Inus. Holders can use them in Shiba Eternity, a popular play-to-earn game within the SHIB ecosystem.

Like many popular NFTs, memecoin NFT holders have formed private communities. Some grant access to exclusive offline events or related merchandise.

07 Memecoins and DeFi

DeFi refers to a suite of blockchain-based financial applications that rebuild traditional financial services in a decentralized manner.

Memecoins leverage DeFi protocols to create innovative ways for users to engage with their tokens—not just speculative trading, but also staking, yield farming, and liquidity provision.

Staking: Memecoin holders can stake their tokens on DeFi platforms to earn rewards. These rewards may come in the form of additional memecoins or other tokens, incentivizing long-term holding and active participation in the ecosystem.

The Shiba Inu project exemplifies how integrating DeFi elements fuels growth. SHIB holders can use the ShibaSwap platform to exchange ERC-20 tokens and complete tasks to earn SHIB and two other native tokens: BONE and LEASH. DoggyDAO, a decentralized autonomous organization (DAO), offers additional yields by granting voting rights on key protocol decisions to token holders.

Farming: Yield farming mainly involves lending your memecoins via smart contracts to earn interest. Memecoin DeFi platforms use these loans to facilitate activities like trading or liquidity provision. Users are compensated for contributing to the ecosystem through farming rewards.

Liquidity Provision: Memecoins can establish liquidity pools where users contribute their tokens to enable trading on decentralized exchanges. This process earns users a share of transaction fees and enhances market liquidity and efficiency, with corresponding compensation provided.

08 Investment Risks of Memecoins

Due to their viral nature, many memecoin projects have experienced massive rallies—but also sudden collapses.

1. Extreme Volatility: A memecoin’s value can skyrocket in minutes and crash just as fast, exposing investors to severe financial losses. Highly speculative, they’re extremely sensitive to sudden shifts driven by influential figures (e.g., Elon Musk), news, or online trends.

2. Overreliance on Sentiment: Many new memecoins lack underlying technology or practical use cases, causing their value to depend almost entirely on market sentiment. While some integrate NFTs, DeFi, or community programs creatively, many projects emphasize humor and irony—emotional value over fundamentals. Without solid technical backing, memecoins remain castles in the air.

3. Market Manipulation: The concept-driven nature of memecoins attracts bad actors seeking to profit from hype. They may spread false information, orchestrate coordinated buying ("pump"), and dump their holdings at peak prices—often leaving unsuspecting investors with heavy losses. These schemes exploit the speculative and emotional nature of memecoin trading, so thorough research is essential before heavy investment.

4. Prevalence of Scams: Many memecoin projects are launched by anonymous or pseudonymous developers, making it hard to assess credibility or intent. There are now frequent scam presales where teams collect funds and disappear. Others involve hacked official accounts changing payment addresses—posing significant risks.

09 Conclusion

Overall, memecoins represent a fascinating fusion of digital currency, internet culture, and humor. As memecoins continue capturing attention and evolving, how will they shape the broader crypto landscape? Can they move beyond their joke origins to deliver meaningful applications? How can early value be identified? When should one enter to balance risk and reward? The AU Research team will continue delivering deeper tools and technical analyses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News