Crypto Craze: The Birth of Meme Wealth

TechFlow Selected TechFlow Selected

Crypto Craze: The Birth of Meme Wealth

In the world of memes, whoever creates trends can directly monetize them through tokens.

Author: Armonio, AC Capital

Humans chase trends, and trends create value. This is a history that humanity keeps repeating.

Tulip mania = trend + limited supply.

This was humanity's most famous and earliest super meme. Entering the 21st century, the information age has moved from infinitely replicable Web2.0 into Web3.0—an era of limited digital information.

Information spreads at light speed across the internet, while the physical carriers of trend-driven value have shifted from offline luxury bags, watches, and supercars to online strings of non-replicable data. Payment scenarios now span every corner of the globe via mobile devices. Bong! A meme explosion occurs, giving birth to a surreal meme world.

In the world of meme coins, whoever creates trends—especially internet trends—can directly monetize them through tokens.

So, how do you create a trend? This article first proposes a theory of meme virality, then uses this framework to deconstruct the rise of BTC and BOME.

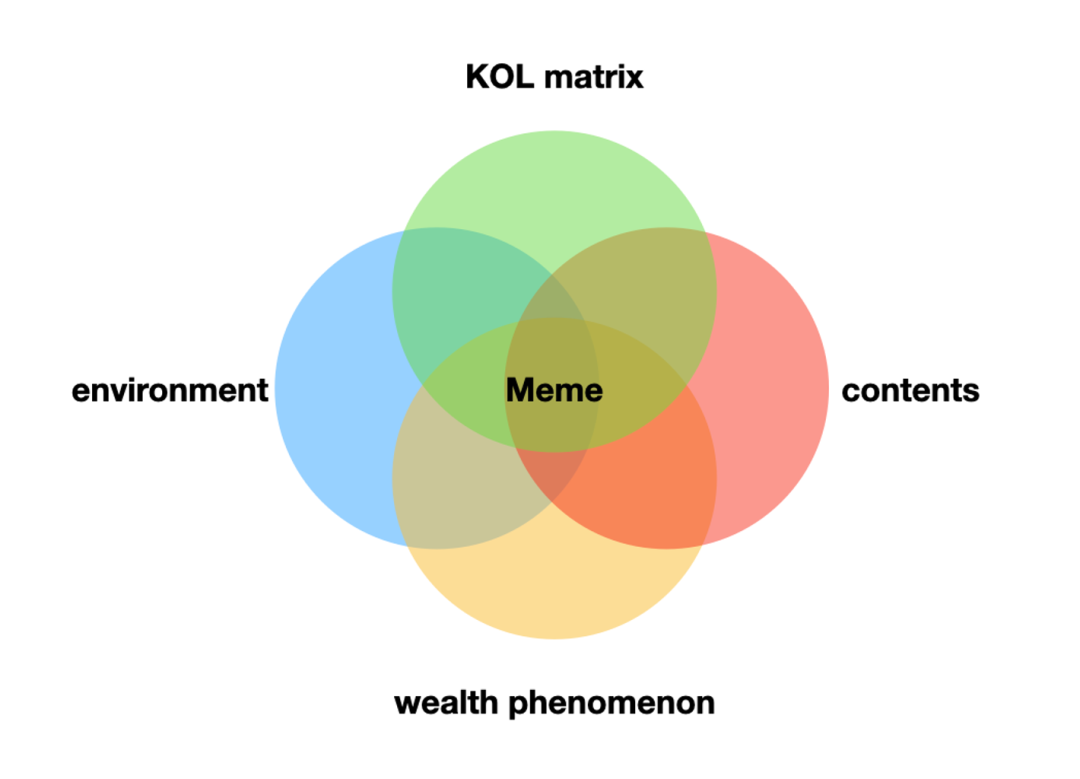

0 The Secret of Crypto Virality

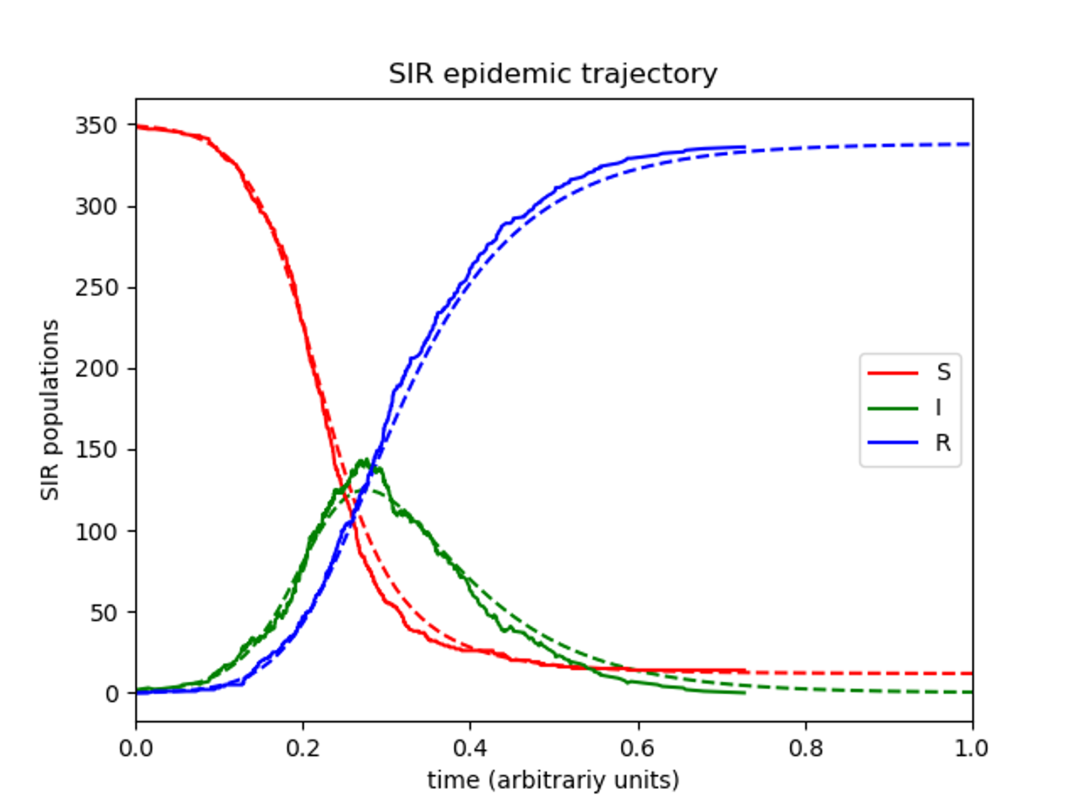

The spread of information is essentially no different from the spread of disease. In communication studies, both information diffusion and virus transmission use the SIR model; interested readers may refer here. We won’t go into details:

The process of information dissemination consists of two parts: infection and immunity.

Information infection: transforming ordinary people into believers of a viral trend.

Information immunity: believers disengaging from the influence of the trend and becoming outsiders.

The core of making an idea go viral is ensuring the infection rate exceeds the immunity rate. As long as more people are infected than become immune within a given time frame, the number of believers grows, and the trend expands. Otherwise, it begins to decline. So how can we increase the infection rate and reduce the immunity rate?

Undoubtedly, the greater the exposure to new audiences (those previously unaware), the higher the infection rate. The higher the quality and stickiness of the information, the easier it spreads—and the harder it becomes to shake off. Drawing from communication theory and social psychology, I summarize four key external factors for meme success:

The Four Key Elements

Content:

Content is the message—the main body of transmission, which determines its attributes. The target audience and preferred transmission nodes are all defined by the content itself. For example, $PEOPLE naturally carries left-wing connotations, evoking emotional resonance among left-leaning individuals. Using such concepts to appeal to progressive groups offers inherent advantages. Similarly, $DOGE has natural affinity with dog lovers, creating lasting appeal.

Content stickiness matters. Some memes are time-sensitive—such as those based on recent political figures or sports events. Once elections end or games conclude, real-world popularity fades, depriving the on-chain meme of fuel. The state where infections > immunity may gradually shift to infections < immunity.

Affinity also includes secondary sharing potential. A successful viral event must lower barriers to transmission—simple, direct, easy for anyone to share—leading to wider propagation.

Environment:

Environment comprises two aspects: time and space.

1) Time: Crypto Market Cycles

Time refers to the unique economic cycles of the crypto industry. Memes explode when the sector gains attention and users are willing to gamble—traditionally during mid-to-late bull markets, after other project narratives have run dry, allowing pure cultural memes to shine. However, the current wave driven by inscriptions marks a significant shift. Industry attention is now captured by memes themselves. Cultural propagation is no longer a fallback option when project stories fail—it has become a primary method for attracting traffic. Crucially, the broader context for Bitcoin’s inscription-based meme boom includes: 1) the imminent approval of a BTC ETF, positioning BTC as a mainstream asset under global spotlight; 2) the upcoming BTC halving, which historically precedes bull runs, thus drawing increased attention.

2) Space: Communities

Space refers to communities—defined as groups of people with shared goals. Shared purpose implies shared traits. If the content aligns with these traits, transmission efficiency increases. Just as diseases spread differently across populations—malaria thrives in poor sanitation areas like Africa—memes depend heavily on community fit. Early-stage memes are fragile and easily suppressed. Initial spread requires a nurturing micro-environment—akin to a petri dish.

KOL Matrix

Research shows individuals vary greatly in their ability to spread trends. Some excel at conveying ideas and persuading others—these are super-spreaders, or KOLs (Key Opinion Leaders). The more KOLs involved, the stronger the KOL matrix, amplifying reach across multiple groups. KOLs are deeply tied to communities. Only those influential within specific communities—true KOCs (Key Opinion Consumers)—are valuable nodes. Without access to target demographics, a KOL’s value diminishes significantly.

Wealth Effect

A defining feature of crypto is that wealth effects drive attention. "Price wins hearts"—financial gains reinforce narrative spread. Thus, memes experience self-reinforcing feedback between price and culture: rising prices amplify cultural reach and strengthen belief; falling prices hinder cultural momentum and erode faith. Hence, meme coins often exhibit extreme volatility.

02 Meme Project Case Studies

In this section, we analyze two projects using the above framework.

BTC

Many refuse to acknowledge BTC as a meme coin. But that’s irrelevant. The concept of meme originates from Darwinian evolution, referring to how information replicates, mutates, and undergoes selection—just like biological genes. At a macro level, BTC’s consensus expansion follows the same path as other meme coins—only differing slightly in narrative content.

BTC’s core message is fear of centralized financial collapse. Its genesis block embeds the headline: “The Chancellor is bailing out banks again.” This news snippet acts as an anchor—a memorable anecdote reinforcing fears of centralization each time it’s retold. Every financial crisis strengthens BTC’s narrative. The stickiness of BTC’s consensus is exceptionally strong. True believers rarely abandon their faith—a fact widely observed in the industry.

Fair mining in the consensus mechanism embodies reciprocity: early participants who invested computing power received BTC rewards. Satoshi even conducted small airdrops—another form of reciprocity. The act of mining itself signals endorsement, psychologically binding recipients to the project. Supply-wise, BTC hardcoded scarcity—21 million caps written into code. Satoshi’s whitepaper even envisioned BTC reaching $1,000 if globally adopted—an ambitious promise at the time, however conservative by today’s standards. Yet back when BTC had no market price, such a vision was incredibly enticing.

Like any nascent virus, early-stage memes are extremely fragile. With few initial transmission nodes, success depends on maximizing propagation odds. BTC’s whitepaper launched in 2008—not a bull market, but amid global financial turmoil. Public trust in centralized finance was crumbling. The timing perfectly matched the narrative—a critical advantage in early virality.

BTC’s initial community was carefully selected: the cryptography community. Their ideals aligned closely with BTC’s design—shared urgency and mission around decentralization. Recruiting them as seed users minimized resistance.

BTC’s initial KOL matrix included crypto pioneers: Dai Wei, Hal Finney, Jon Matonis, Laszlo Hanecz, etc. Consider one example: in emails to Dai Wei, Satoshi emphasized that BTC not only fulfilled Dai’s theoretical framework but had already gained Hal Finney’s support—providing crucial credibility. These figures might be unknown outside crypto circles, but they held immense sway within. Their endorsement helped BTC take root rapidly in the crypto ecosystem.

BOME

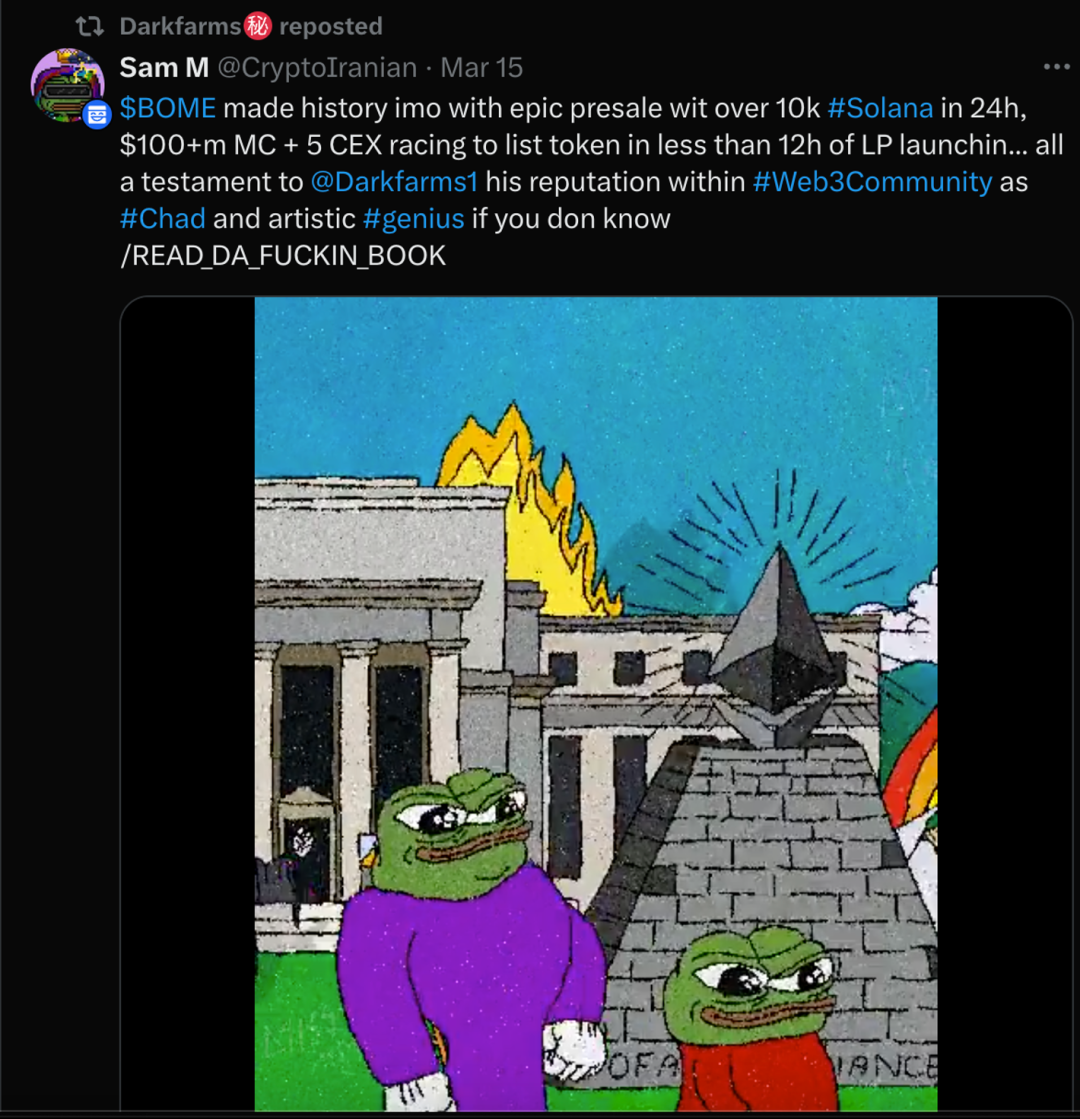

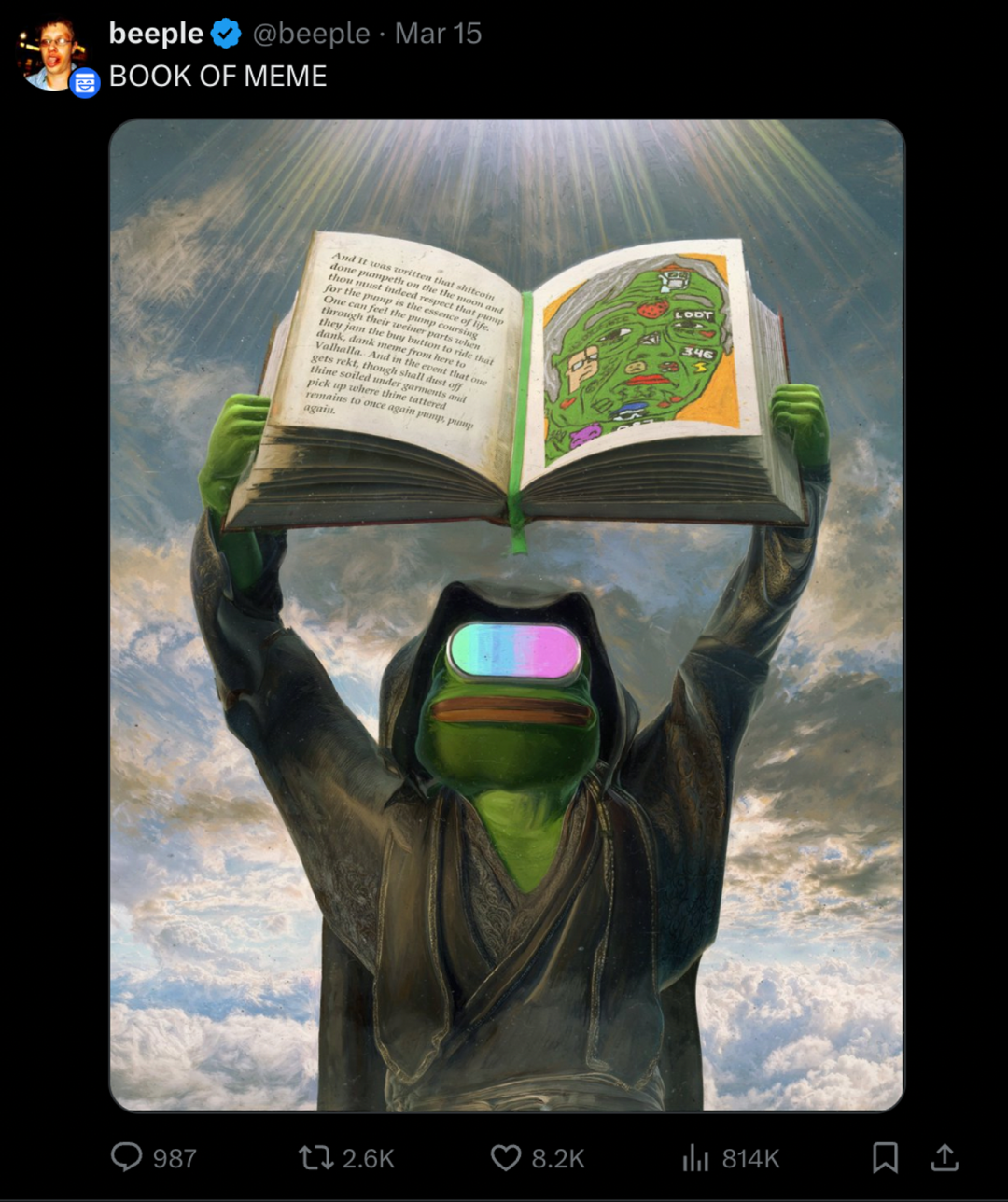

Before launching BOME, whether intentionally or not, artist Dark Farm was thoroughly prepared for a meme to go viral. Content-wise, BOME aims to be a “Book of Memes,” documenting meme history. In today’s context, this holds historical significance. As mentioned earlier, launching tokens via culture has evolved: it’s no longer a last-resort tactic when no viable projects remain—it now leads industry innovation. Whether on Solana, Avalanche, or Ethereum, memes are increasingly used as key user acquisition tools. Investors are beginning to recognize meme tokens as legitimate assets. Positioning BOME as a compendium of meme culture naturally attracts attention. This concept resonates strongly with meme enthusiasts.

Timing-wise, BOME launched during a bull market with abundant capital. Community-wise, Dark Farm had long cultivated meme culture within the ETH ecosystem. Creating the Book of Meme wasn’t a spontaneous idea—he already had influence in crypto meme circles. Prior to Book of Meme’s breakout, his works maintained floor prices above issuance levels, proving recognition and reputation within the community. This audience overlaps significantly with speculative “pump-and-dump” traders.

Looking at BOME’s post-sharing patterns, many early boosts came from fellow artist-KOLs. Though not massive individually, these influencers brought authentic, cohesive followings. As the meme gained traction, it attracted broader engagement—such as promotion by Beeple. As a Twitter-based meme artist, DarkFarm has strong instinct for virality, skillfully leveraging super-nodes to amplify his project’s reach.

Early adopters’ profile pictures reveal origins in the SMOWL community. Having an established base allowed BOME to bypass the most vulnerable stage of meme development—likely part of DarkFarm’s plan. His BOME manifesto image features SMOWL alongside initial KOLs, mutually validating one another. After BOME succeeded, SMOWL NFTs surged to a 0.7 ETH floor price, rewarding early community members handsomely. The entire operation formed a perfect closed loop.

I’ve said before that internet-era projects rest on three pillars: traffic, technology, and capital. In the meme world, technology and product don’t exist. Meme success lies entirely in aligning traffic with capital. Capital can inflate token prices, but price alone cannot sustainably attract retail participation.

This suggests that in any given era, there can only be one true BOME. From a traffic economy perspective, all other memes are competitors. If BOME’s attention分流 (diverts), BOME collapses—and imitators (“second-tier,” “third-tier”) copying half-heartedly stand little chance. Without diversion, challengers remain insignificant players.

03 Conclusion

Meme tokens represent the most distinctive phenomenon of attention economics in the Web3 era. Attention is directly assigned financial value. Meme tokens emerge from the alignment of capital and attention.

Creating attention means engaging people. Beyond the wealth effect, success hinges on KOL networks, environmental conditions, and content-community fit. Aligning all these factors isn't easy—which is why creating breakout memes remains rare. When evaluating a meme’s emergence and breakout potential, beyond volume, liquidity, or founder background, consider these four elements.

Memes play with attention. In investing, consider the phenomenon of attention spillover—e.g., how the BOME community boosted SMOWL’s value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News