After BlackRock steps into the RWA arena, who will benefit?

TechFlow Selected TechFlow Selected

After BlackRock steps into the RWA arena, who will benefit?

Layer 1 and Layer 2 dedicated chains, oracles, and RWA protocols for RWAs are the most promising directions to watch.

Author: Miles Deutscher

Translation: Frank, Foresight News

RWA is one of the biggest opportunities in this crypto cycle. BlackRock has just launched a tokenized fund, and by 2030, the market cap of tokenized assets is expected to reach $10 trillion.

New RWA Signals in 2024

RWA refers to real-world assets such as gold, real estate, and other commodities being tokenized into cryptocurrencies on blockchains, offering the following advantages:

-

Increased efficiency (no brokers required, lower costs);

-

Improved accessibility (can be divided into smaller shares, higher liquidity);

Real-World Asset Tokenization (RWA) will become a major driver of on-chain value for the following reasons:

-

Access to massive traditional markets such as the global bond market ($133 trillion) and the gold market ($13.5 trillion);

-

Ability to capture DeFi yields from real-yield-generating real-world assets;

-

Lowered entry barriers;

-

Reduced broker and intermediary costs;

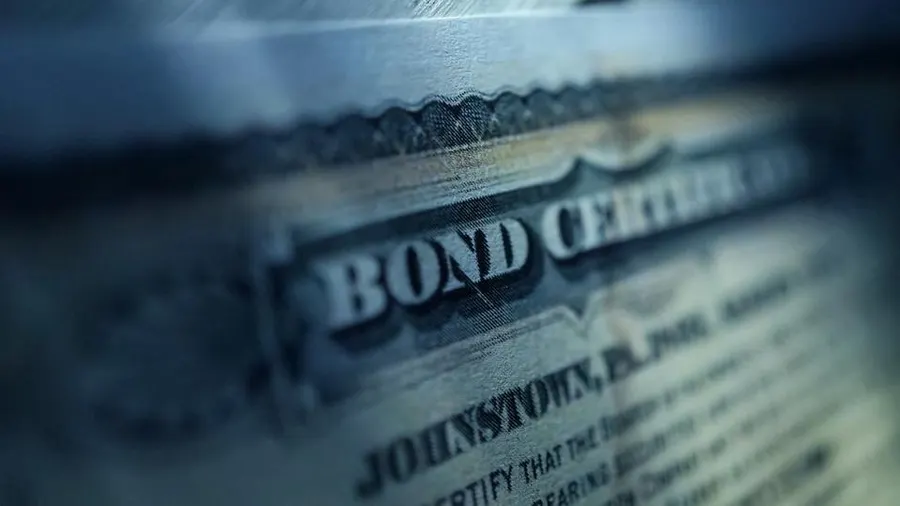

How do they work?

RWAs represent ownership of assets as tokens on-chain. Issuers use smart contracts to mint RWAs and determine their valuation and trading mechanisms on their underlying blockchain. Each token represents a portion or the full value of the asset.

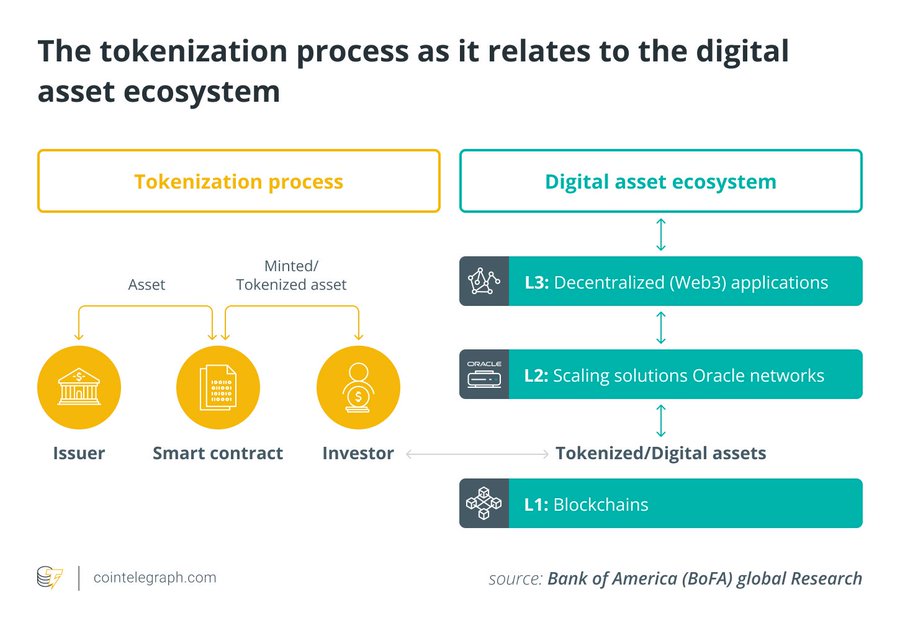

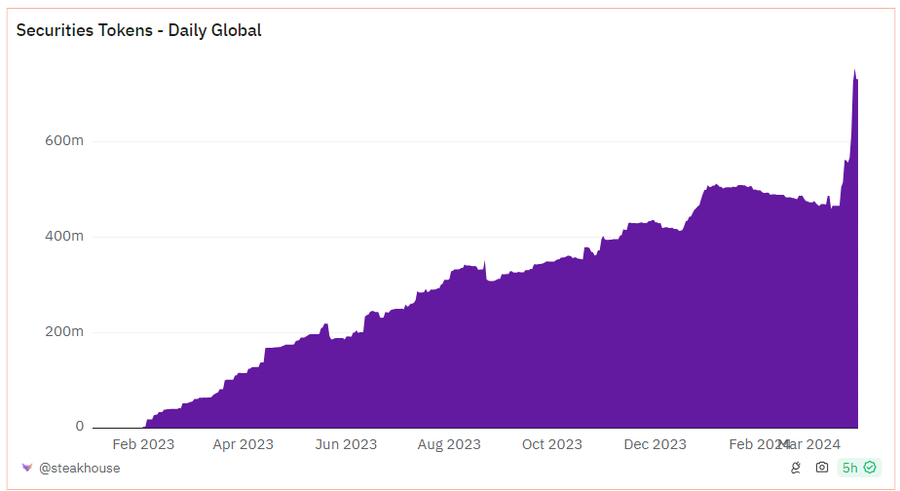

The following data supports growing demand for RWA:

-

The market capitalization of tokenized public securities has now exceeded $700 million;

-

According to a Bank of America report, the tokenized gold market is also approaching $1 billion;

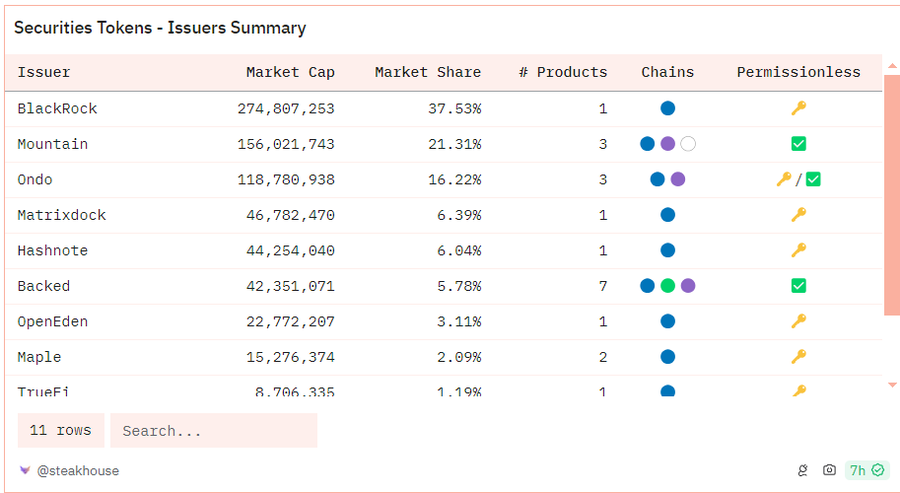

BlackRock's recent move into the RWA space is one of the key factors driving this surge in demand. It recently launched a digital asset fund for tokenized bonds, which within just two weeks grew its market cap to $274 million, capturing a 37.53% market share.

BlackRock CEO Larry Fink has long believed tokenization is the future of securities. Given Larry’s optimism and the fund’s strong performance, BlackRock’s involvement in this sector is only likely to increase over time.

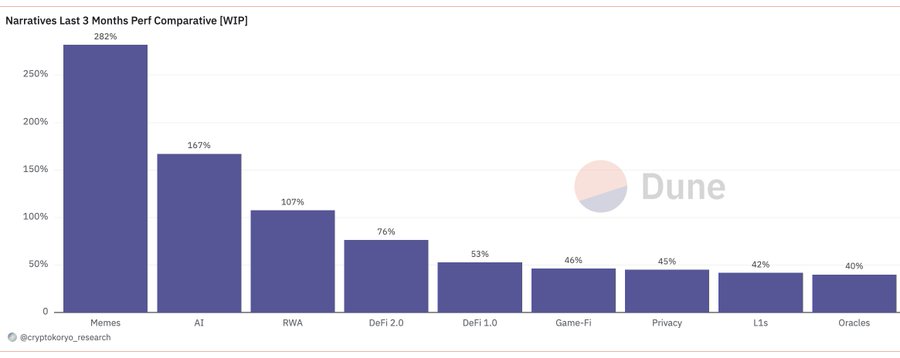

But it's not just BlackRock paying attention to RWA. Other major TradFi institutions like Citibank, Franklin Templeton, and JPMorgan are also beginning to enter the RWA space, all of which adds legitimacy to the RWA sector for 2024 and beyond. This wave of interest has fueled a surge in attention across the entire RWA token segment, making RWA the third-best performing narrative theme so far this year (behind only meme and AI narratives).

Who Will Benefit?

Now that we understand the RWA landscape, let’s examine some key projects that may benefit from growing interest in RWA. We’ll analyze them by sector:

1. L1 and L2 Blockchains

Popular narratives typically draw significant liquidity and users to the base-layer chains supporting underlying DApps. Therefore, L1 chains hosting RWA protocols can indirectly benefit from their growth. While this investment approach offers strong downside risk hedging, it lacks direct upside exposure.

In short, if you’re seeking greater potential upside linked to RWA, then blockchains specifically focused on RWA—such as Redbelly Network and MANTRA Chain—can offer more direct exposure.

2. Oracles

RWA protocols actively use oracles to ensure accurate price data feeds and enable cross-chain data transmission—keeping RWA prices aligned with real-world markets is a critical component of the tokenization process.

For example, if your house increases in value by 50%, the tokenized version should accurately reflect that change. Oracles are responsible for bridging this information onto the blockchain, which is why I’m bullish on oracle networks like Chainlink.

Chainlink unlocks the full potential of RWA by providing real-time, secure, and cross-chain data bridging. As one of the pioneering oracle providers, Chainlink’s services are widely used across the industry for proof of reserves, identity verification, data streaming, and more.

For those seeking lower risk, other oracles like Pyth may be more attractive. While Chainlink serves a broader range of use cases, Pyth stands out as a compelling choice for Ethereum-centric DeFi investments due to its extensive L1 compatibility.

3. RWA-Focused Protocols

These are decentralized applications (DApps) that either provide infrastructure enabling RWA integration into DeFi on-chain, or leverage underlying real-world assets to power their platforms—the most direct way to gain exposure to RWA.

Ondo Finance, with its cross-chain U.S. Treasury and stock products, boasts over $250 million in total value locked (TVL), making it the third-largest cross-chain RWA protocol. Ondo directly addresses a core scalability challenge for RWA—liquidity—through its new product, Global Markets.

Additionally, Pendle is a yield-tokenization platform allowing users to earn returns across various liquidity pools, including RWA pools such as sDAI. The flexibility of their platform enables them to easily launch new RWA pools and leverage their existing user base.

Frax Finance is a robust DeFi protocol featuring a native stablecoin, liquid staking, lending, L2 solutions, cross-chain bridges, and more, offering access to traditional investment products such as government bonds and cash deposits on their platform.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News