MT Capital Research Report: Breaking the Liquidity Dilemma in Public Blockchains, Berachain Could Become the Next-Generation Super L1

TechFlow Selected TechFlow Selected

MT Capital Research Report: Breaking the Liquidity Dilemma in Public Blockchains, Berachain Could Become the Next-Generation Super L1

As a public blockchain with built-in technology, community, meme culture, and liquidity, Berachain is poised to become the standout star chain in this bull market cycle.

Authors: Severin & Ian, MT Capital

TL;DR

-

Berachain originated in 2021 when its founders, inspired by fragmented liquidity across chains and the "ghost town" phenomenon on public blockchains, conceived the idea of building a liquidity-centric blockchain. The Berachain community exhibits strong Ponzi culture, Meme culture, and NFT culture.

-

Berachain is a high-performance EVM-compatible blockchain built on Proof-of-Liquidity (PoL) consensus. EVM compatibility allows Berachain to seamlessly integrate with the mature EVM ecosystem. The PoL consensus incentivizes on-chain liquidity through BGT emissions and vote bribing, helping avoid the liquidity ghost towns seen on other blockchains, promoting DeFi growth and trading activity, granting protocol-level flexibility for more effective liquidity incentives, fostering balanced ecosystem development, and spinning up the blockchain's upward flywheel.

-

The ecosystem on Berachain is still in its very early stages. Beyond official components, projects on Berachain are developing along three distinct trajectories: (1) serving long-tail markets underserved by core protocols; (2) innovating around the PoL mechanism, BGT, and vote bribing; (3) attracting high-quality external projects drawn by the PoL mechanism.

-

From an investment perspective, we focus on high-quality DeFi projects on Berachain and infrastructure that innovates around Berachain’s PoL, BGT, and vote bribing mechanisms. We also closely monitor NFTFi protocols combining NFTs and DeFi, as well as Layer 2 solutions and related infrastructure built on Berachain. (Project teams are welcome to DM @0X_IanWu or @Severin0624 on Twitter.)

Introduction

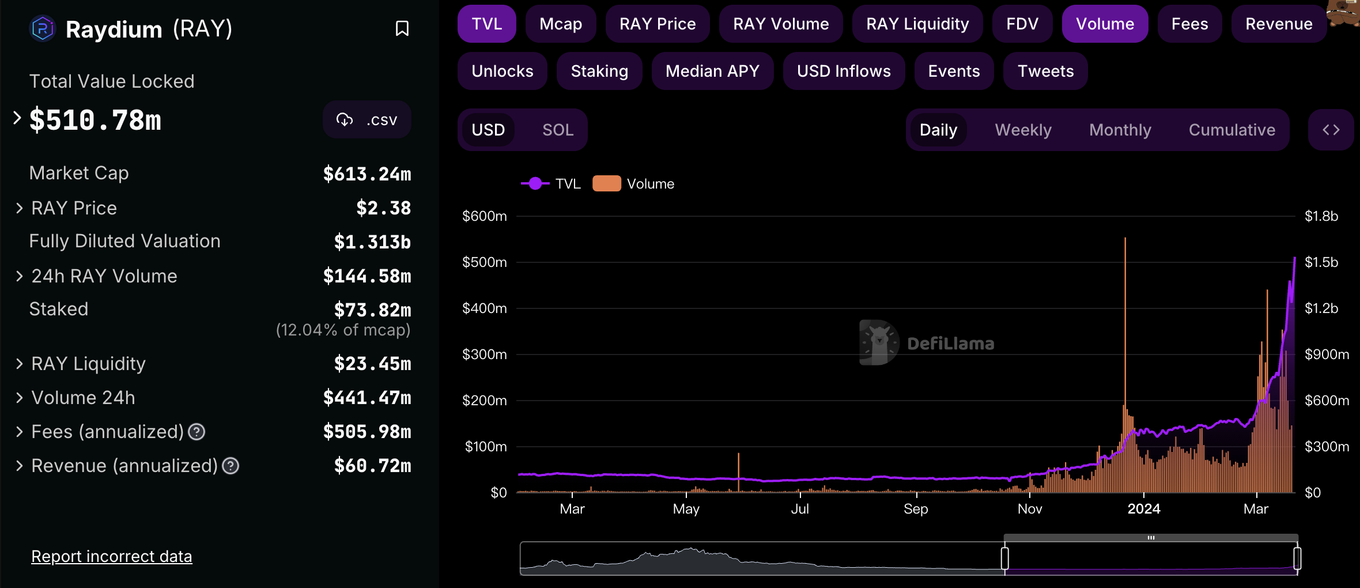

Recently, there's been an interesting trend where alt-L1 blockchains—once proud of their technical advantages—are now leveraging memes to capture attention in the crypto market. Solana, for example, saw its high-TPS, low-latency technology finally resonate with users amid a wave of meme speculation, achieving gains in publicity, capital, users, and traffic. This meme-driven surge brought significant attention, new users, active trading, and liquidity to Solana. The influx of liquidity further energized Solana’s meme economy and boosted its broader ecosystem. Notably, Raydium, the preferred DEX for Solana meme trades, saw a 246% monthly increase in TVL. While technology remains foundational in blockchain evolution, it is clearly not the sole determinant of a chain's future success. Market attention and liquidity, exemplified by memes, may become the main battleground in the next round of L1 competition.

source:https://defillama.com/protocol/raydium?events=false&volume=true

Yet there is a blockchain, Berachain, which from inception embraced meme culture so deeply that despite anonymous founders and lack of technical documentation, it managed to attract a loyal user base even during a crypto bear market. The name "Bera" itself is one of the most distinctive crypto memes—one derived from the classic crypto phrase "HODL," reimagining "Bear" as "Bera." It also introduced the innovative PoL mechanism, aiming to attract liquidity by rewarding on-chain liquidity providers, thus avoiding the ghost-town fate of many existing blockchains. Additionally, being EVM-compatible enables seamless migration for developers and users from the EVM ecosystem. These three combined strengths caused its testnet to rapidly attract over a million users, achieving one million active wallets within just 7.5 days.

source:https://twitter.com/berachain/status/1749522523895570700?ref=research.despread.io

As a blockchain with inherent technology, community, meme culture, and liquidity, Berachain has the potential to reshape the competitive landscape of L1s, break the cycle of blockchain liquidity deserts, and emerge as a superstar chain in this bull market cycle.

Development History

Berachain Development Timeline

The founders of Berachain are early anonymous DeFi participants who began investing in crypto projects and trading in 2015, fully participating in DeFi Summer. Between 2021 and 2022, they engaged with various DeFi ecosystems across different chains, frequently switching between alt-L1s, and became acutely aware of cross-chain liquidity fragmentation and the "ghost town" effect. They observed that blockchains often rely heavily on token incentives to attract TVL and liquidity, which quickly evaporate once emissions dry up. They also noted issues with PoS chains, where large amounts of value tokens are staked for network security, sacrificing much-needed liquidity—the lifeblood of DeFi and protocol activity. Their extensive experience in DeFi shaped their vision of an ideal blockchain model and laid the foundation for the later introduction of the PoL mechanism.

About a year and a half ago, Smokey and another co-founder jokingly mentioned creating a smoking bear NFT series called Bong Bears. After launching the Bong Bears NFT, it unexpectedly gained massive community support. Since the founders were OGs from top DeFi communities, most attracted members were also DeFi enthusiasts. Through ongoing interactions with the community, the founders gradually developed the idea of building a liquidity-focused blockchain and held a community vote. Remarkably, despite no prior blockchain development experience, they received overwhelming community support, giving birth to Berachain.

Although the founding team had rich DeFi experience and sharp market insights, building a blockchain required substantial technical work. During discussions, the Berachain team connected with Polaris, a team specializing in EVM-compatible development. The two teams aligned perfectly, forming the current core of Berachain. Thus, Berachain was essentially established. Technically, Berachain adopted Polaris’s tech stack to build a high-performance EVM-compatible L1 on Cosmos. Mechanistically, Berachain implemented the PoL mechanism to incentivize on-chain liquidity and promote DeFi ecosystem prosperity.

Key Milestones

2021.8 – Bong Bears NFT minted, laying the groundwork for Berachain.

2021.10 – First rebase event for Bong Bears NFT.

2021.11 – Berachain first mentioned.

source:Bonga Bera 101 — The Honey Jar (mirror.xyz)

2022.3 – Olympus DAO OIP-87 proposal for Berachain seed funding approved; Berachain raised $0.5M at a $50M valuation.

2023.4 – Berachain disclosed a $42M raise led by Polychain.

source:https://twitter.com/berachain/status/1649050293080915968?ref=research.despread.io

2024.1 – Berachain testnet launched.

2024.3 – Berachain reported to be raising over $69M led by Framework Ventures.

Community Culture

Ponzi Culture

Berachain was initiated by several veteran OGs from major DeFi communities. The founding team doesn’t shy away from Ponzi culture—they embrace and even enjoy it. In the Berachain community, discussing Ponzi schemes is common and unapologetic. Berachain is currently perceived by the market as the next Luna-like project with a Ponzi model—an imperfect analogy but one that reflects both the cultural essence of the Berachain community and external perceptions of it.

Meme Culture

Beyond Ponzi, Berachain naturally embodies meme culture, as its origin lies in the highly memeable Bong Bears NFT—smoking bears. Bong Bears started as a joke among the founders, unexpectedly gaining widespread community attention and support. Beyond Bong Bears, the name "Bera" itself is a meme—a nod to the classic crypto term HODL, reworking "Bear" into "Bera." Founder Smokey even wears a Bera mask at formal events, embodying meme spirit. The Berachain community thrives on meme culture. The official Twitter account deliberately misspells words—e.g., "Henlo" instead of "Hello." While other communities use GM/GN, Berachain floods chat with "Ooga Booga." From top to bottom, official and grassroots alike, Berachain is immersed in a unique meme culture.

NFT Culture

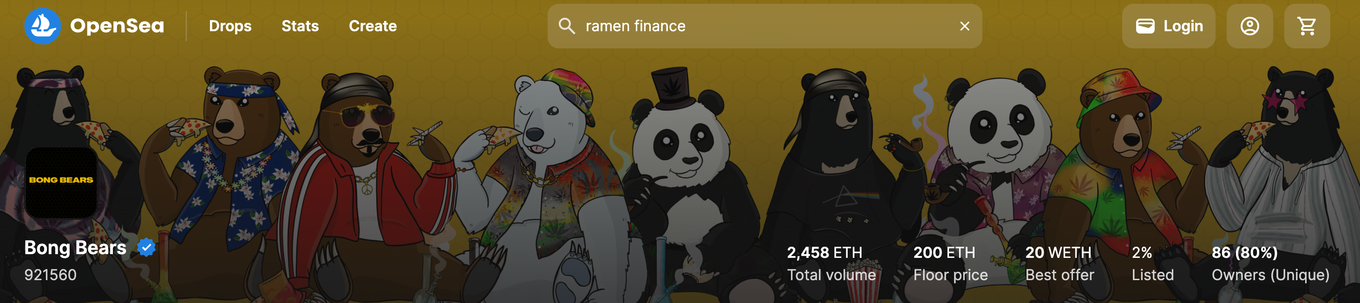

Since Berachain originated from an NFT collection, NFTs naturally became one of its defining cultural elements. When discussing other blockchains, few come to mind beyond Ethereum in terms of symbolic NFTs. But with Berachain, the conversation inevitably turns to the rebase-powered Bong Bear NFT. Beyond founder-led NFTs, ecosystem projects on Berachain issue their own NFT collections, all themed around bears. In many ways, NFTs on Berachain hold equal importance to tokens. Compared to plain tokens, NFTs carry additional cultural significance and community identity, strengthening overall consensus and cohesion. Take Bong Bears and Honey Comb as examples—despite strong secondary market appreciation, few owners sell; listing rates are under 2%, reflecting the powerful community consensus within Berachain’s NFT culture.

source:https://opensea.io/collection/bongbears

Summary

Berachain’s unique cultural attributes distinguish it from other blockchains. We expect these cultural traits to impact Berachain in the following ways:

-

Stronger purchasing power and wealth effect compared to other chains: The appeal of Ponzi culture is undeniable. Berachain’s roots in major DeFi and even Ponzi communities, combined with its openness to such models, give it stronger buying power and make it fertile ground for Ponzi-style projects.

-

Greater attention and traffic compared to other chains: In this cycle, chains have realized native memes are the best marketing. From this angle, Berachain—born with meme DNA, embracing self-deprecating humor, and constantly generating new memes—is more likely to go viral and capture broader market attention.

-

Stronger community cohesion compared to other chains: Most existing chains lack a unified symbol or spiritual consensus. Just as nations have national treasures, Bera serves as Berachain’s spiritual icon. Nearly every NFT collection on Berachain uses Bera as its core motif, reinforcing community identity and stickiness. Moreover, different projects collaborate and share benefits via NFTs, strengthening ecosystem synergy and unity.

Berachain Technical Architecture

Berachain is a high-performance L1 blockchain built on Cosmos SDK, using CometBFT consensus and EVM-compatible. Being built on Cosmos SDK enables seamless integration with the Cosmos ecosystem and horizontal scalability via IBC. Simultaneously, Berachain developed its own Polaris Ethereum module to provide EVM compatibility, allowing better aggregation of existing EVM developers and users, integrating the EVM ecosystem, and delivering a familiar developer and user experience. Berachain aims to become the key node unifying liquidity across EVM and Cosmos ecosystems, creating the fastest, most powerful, and most liquid blockchain network in the multi-chain landscape.

Polaris Ethereum

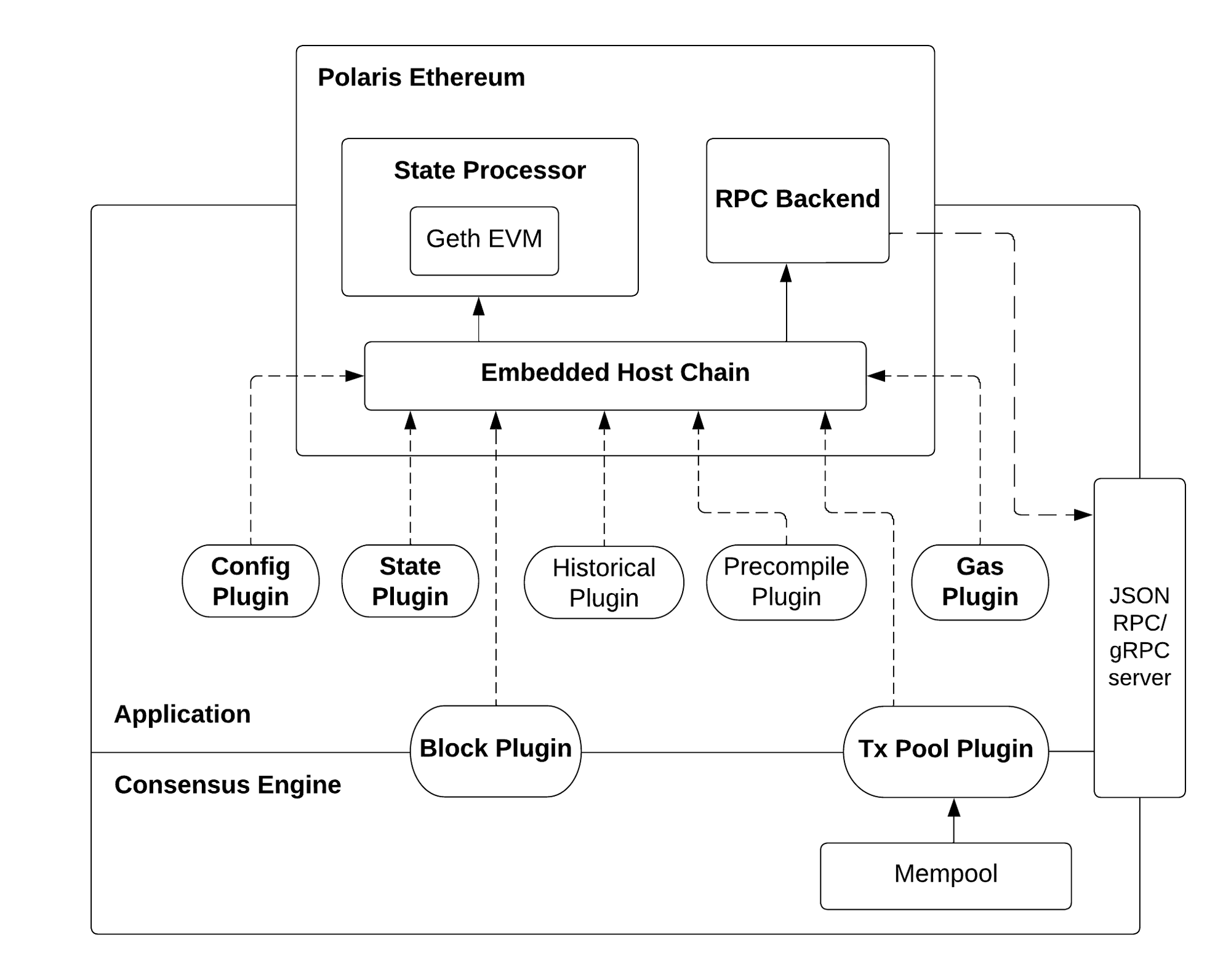

Polaris Ethereum offers developers an enhanced EVM development experience. Beyond basic EVM compatibility, Polaris provides advanced features such as stateful precompiled contract modules and custom opcode support, enabling developers to build more flexible and adaptable smart contracts.

EVM Compatibility

Polaris works similarly to running an Ethereum-equivalent virtual machine atop the L1 chain. By plugging in configuration, state, gas, and other plugins, Polaris can effectively process state transitions, supporting any L1 to execute Ethereum transactions via smart contracts.

source:Polaris Architecture – Polaris Ethereum Docs (berachain.dev)

Precompiles

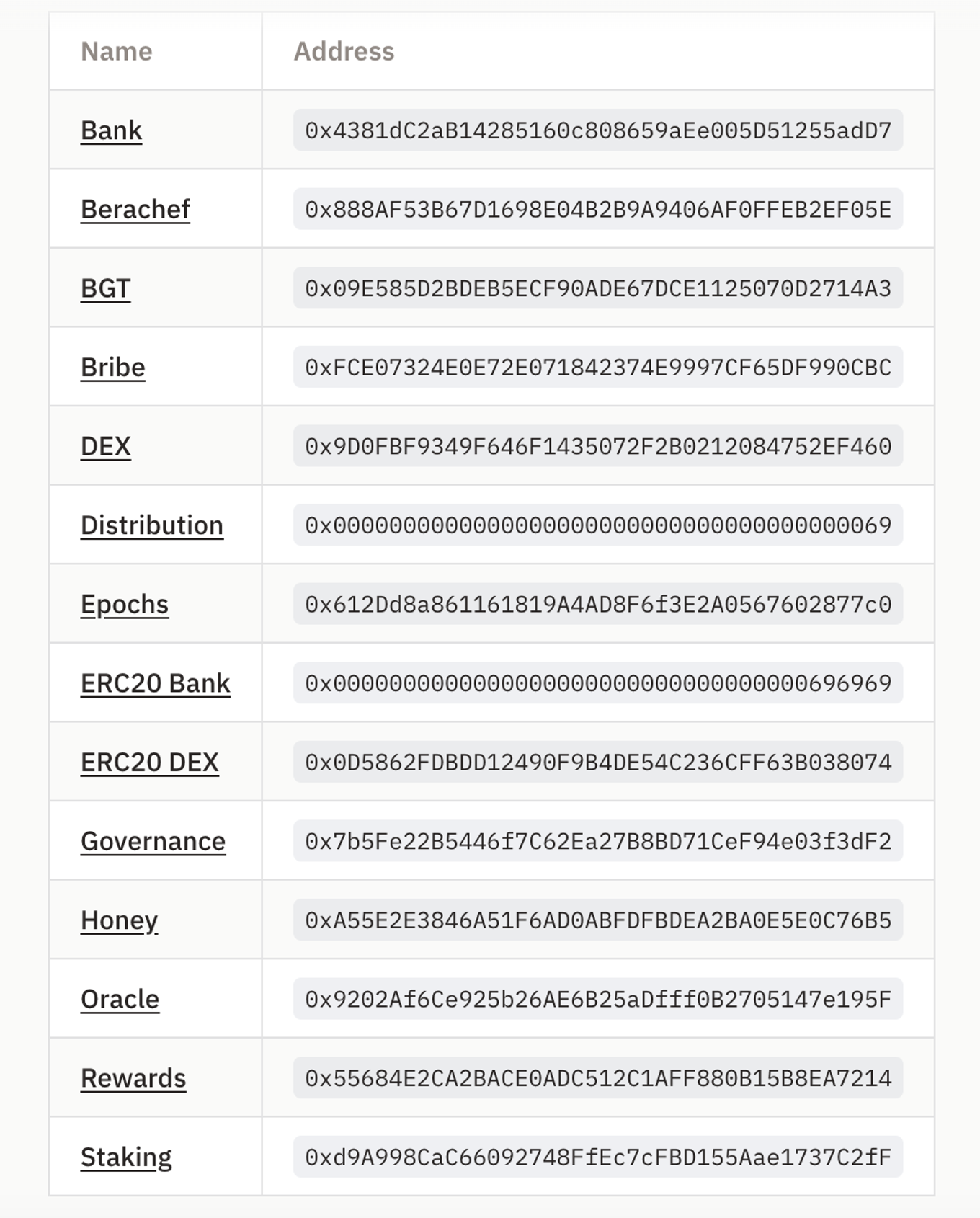

Precompiles, or precompiled contracts, are special-purpose smart contracts directly embedded in blockchain nodes rather than executed as bytecode in the EVM. Precompiles enable efficient state operations at lower gas costs and add functional logic. Polaris’ support for precompiles enables direct interaction with Cosmos modules. Current precompile types include BGT redemption and bribe creation functions.

Polaris also supports custom opcodes to enable more complex smart contracts.

source:Precompiles & Deployment Addresses | Berachain Docs

Modularity and Interoperability

Polaris is a modular implementation of EVM, easily integrable into any consensus engine. Each component is developed as a standalone package with comprehensive testing and documentation. Developers can use individual components or combine them as needed, significantly reducing time and effort for EVM integration.

Additionally, Polaris Ethereum’s integration with Cosmos SDK enables true interoperability between EVM and Cosmos ecosystems. By incorporating multiple state precompiles, Polaris allows EVM users to perform native Cosmos operations—such as governance voting and validator delegation—and interact with other chains via IBC. This design preserves native EVM usability while achieving deep interoperability, bringing Berachain closer to its vision of becoming the liquidity hub for EVM and Cosmos.

(Note: Since Polaris hasn't been battle-tested, Berachain’s actual performance, load capacity, and EVM compatibility post-mainnet launch remain to be seen.)

Proof-of-Liquidity (PoL)

Why PoL?

PoS is currently the most common consensus mechanism. Though proven effective over years, balancing security, decentralization, and efficiency, PoS has drawbacks. For instance, PoS network security depends on the amount of staked assets—the higher the value, the lower the attack risk. However, high staking reduces available liquidity for on-chain activity, hindering trading and DeFi growth, especially before liquid staking became widespread in 2021–2022. Additionally, PoS rewards only flow to stakers, incentivizing staking but not trading or liquidity provision—activities crucial for ecosystem vitality. These limitations led Berachain to abandon PoS in favor of PoL—Proof-of-Liquidity.

At its core, PoL aims to foster DeFi ecosystem growth—where liquidity is paramount—by incentivizing sustainable, deep on-chain liquidity.

PoL Mechanism

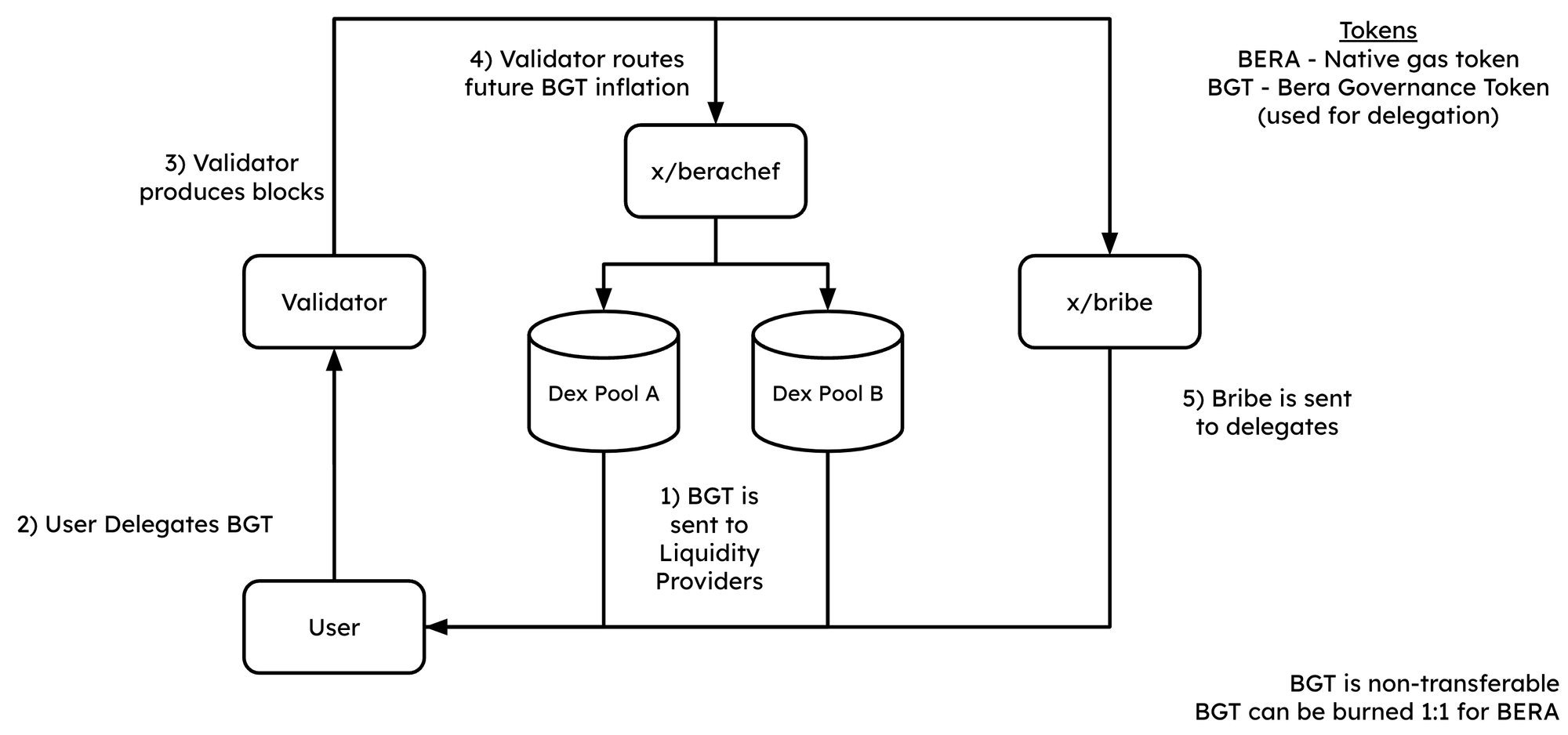

The specific mechanics of PoL are as follows:

-

Users seeking token rewards akin to PoS must provide liquidity to designated pools on Berachain, receiving BGT governance tokens as rewards. Unlike PoS, where rewards come from staking, PoL rewards stem from liquidity provision.

-

Similar to PoS staking, users can delegate their BGT to validators, who then represent them in network validation.

-

Like PoS, validators generate blocks proportionally to their delegated BGT weight and earn block rewards and fees.

-

Unlike PoS, validators can vote on future BGT reward allocations across different liquidity pools. While PoS rewards are relatively fixed, PoL rewards are dynamic and influenced by governance decisions.

-

New BGT emissions are then dynamically distributed across pools based on voting outcomes, flowing back to liquidity providers—closing the loop.

source:What is Proof-of-Liquidity? | Berachain Docs

PoL vs PoS

PoL’s improvements over PoS are evident:

-

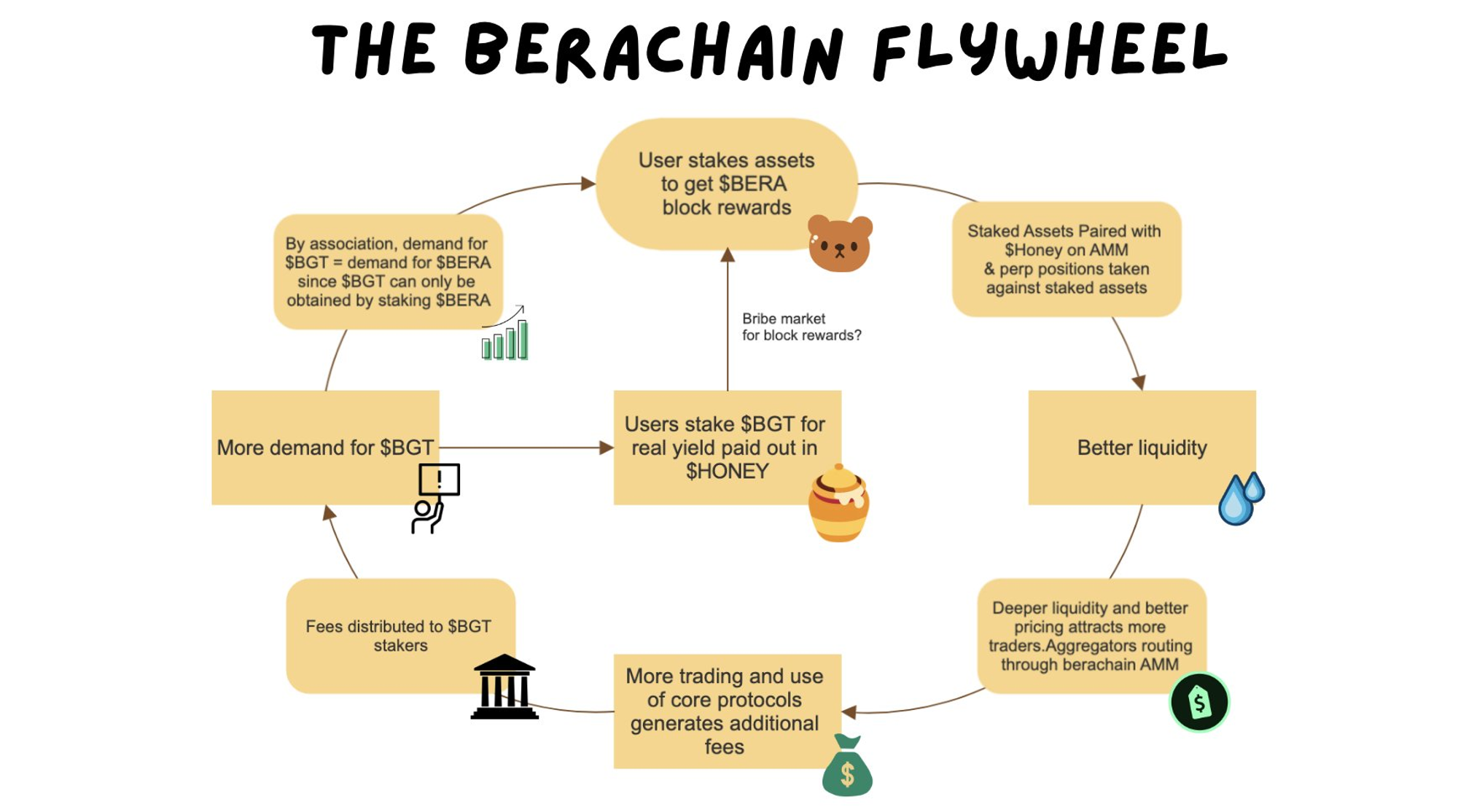

First, PoL directly incentivizes on-chain liquidity, boosting DeFi and trading activity. The only way to earn token emissions on PoL is by providing liquidity. Thus, emissions attract liquidity providers. The higher the native token value, the greater the incentive, driving more users to become LPs and deepen network liquidity. Persistent liquidity incentives also make PoL networks more sustainable, avoiding the liquidity drain seen on PoS chains after incentive programs end.

-

Second, PoL grants chains protocol-level flexibility to effectively incentivize and guide liquidity, promoting balanced ecosystem development. Similar to a protocol-level veToken model, governance allows targeted incentives for specific assets or pools, guiding otherwise chaotic liquidity. This mirrors how chains subsidize certain ecosystems or protocols—but in a more elegant way.

-

Third, PoL may offer higher security than PoS. PoL has a built-in positive flywheel: as users provide liquidity and earn emissions, they deepen network liquidity, improving UX and ecosystem health. Stronger fundamentals reflect in token price, driving price appreciation, which further incentivizes liquidity provision and emission capture—creating a virtuous cycle. Increased liquidity also means improved network security, potentially surpassing PoS chains in security.

In summary, PoL effectively promotes sustainable liquidity and DeFi growth through token emissions, escaping the reliance on airdrops for user acquisition. It also enables more flexible ecosystem incentives, potentially spinning up a flywheel of liquidity, price, and ecosystem growth.

However, PoL has downsides: it only incentivizes liquidity—the base layer of DeFi. While liquidity is vital, it's not everything. PoL cannot effectively reward protocols with low liquidity needs. For example, aggregators contribute high volume but low TVL. Under PoL, Berachain struggles to incentivize such protocols. Similarly, non-DeFi sectors like NFTs and GameFi face uneven incentives. Thus, the current PoL model may evolve as Berachain matures, enabling more balanced support across diverse protocols and ecosystems.

Token Model

Berachain’s tokenomics differ from other chains, featuring three distinct tokens: governance token BGT, gas token BERA, and stablecoin HONEY.

Three-Token Model Overview

BGT functions similarly to a PoS governance token, except it is non-transferable. Ways to earn BGT are limited: users can receive BGT emissions by providing liquidity on BEX, lending HONEY, or depositing HONEY into the bHONEY vault on Berps. BGT is used for governance—users delegate BGT to validators and earn governance rewards and bribe income. Once validators produce blocks, users also receive transaction fee and gas rewards from Berachain’s native apps: BEX, Bend, and Berps. BGT can be converted 1:1 into BERA, Berachain’s gas token, though this conversion is one-way and irreversible—BERA cannot be converted back to BGT.

BERA serves similar roles as native tokens on other chains—paying gas and earning block rewards. However, holding BERA does not grant voting rights; governance is reserved for BGT holders.

HONEY is Berachain’s native stablecoin, providing a stable medium for app transactions. Users can mint HONEY 1:1 by collateralizing USDC.

Understanding the Three-Token Model

To understand the three-token model, return to Berachain’s PoL mechanism. PoL incentivizes liquidity by rewarding users with BGT. To effectively drive liquidity, BGT must hold real value.

How is BGT’s value secured? If BGT were merely a governance token like on other L1s, its value would be hard to sustain—weakly tied to chain fundamentals, an unsustainable path. Two approaches secure BGT’s value: (1) ensure real value flows into BGT or visible future returns; (2) encourage holding over selling. With these principles, revisiting Berachain’s PoL and token design becomes clearer.

First, to discourage selling, BGT is designed as non-transferable, with a separate gas token BERA. To sell BGT, users must convert it 1:1 to BERA—adding friction to slow down dumping.

Still, this only delays the inevitable. To make users perceive BGT as valuable, they need to see tangible returns. Here, Berachain adds two layers of utility. First, BGT holds governance power—not over project direction, but over BGT emissions (i.e., user rewards). This governance right means users must hold and delegate BGT to validators who vote for pools they’re mining, maximizing their BGT rewards. In this player-vs-player dynamic, if one side dumps early, their future BGT emissions drop, undermining profit maximization. Thus, BGT’s earnings-linked governance helps delay sell pressure and encourages holding for higher future gains.

Second, validators themselves enhance BGT’s value. Validators earn income from block rewards and ecosystem fees. To maximize profits, they need more externally delegated BGT to boost block production chances. To attract BGT, validators engage in vote bribing—sharing fee income or launching high-APY products to acquire BGT. This competitive race to bribe transforms into a mechanism enriching BGT with protocol revenue and bribe income, strengthening holder confidence.

Now, the relationship between PoL and the three-token model becomes clear. You can also see why Berachain keeps DEX, Lending, and Perps in-house. Simply put, these three are the most profitable components, benefiting greatly from PoL and generating high protocol revenue. Officially capturing this revenue allows redistribution to validators, who in turn channel it into BGT, anchoring its real value. Without revenue from DEX, Lending, and Perps, wouldn’t BGT’s value feel like a house of cards?

Further, BGT and the broader Berachain ecosystem are mutually reinforcing. Protocol revenues are BGT’s primary value source. If the ecosystem is inactive, BGT’s value weakens, prompting users to sell. Falling BGT value reduces Berachain’s appeal to LPs, leading to liquidity withdrawal, worsening DeFi UX, and accelerating ecosystem decline—a negative spiral. Conversely, a vibrant ecosystem with high official protocol revenue sharing more with users strengthens BGT’s value, encouraging holding. Stronger BGT demand attracts more liquidity, fueling DeFi growth and initiating a positive spiral. Rationally, the spiral starts or stops based on the balance between BGT’s staking yield and its market price. When aligned, stability prevails. When misaligned, Berachain risks rapid ascent or collapse.

source:https://twitter.com/burstingbagel/status/1565705660888596481

Berachain Ecosystem

Though founded in 2021, Berachain’s core mechanisms have undergone continuous refinement, and documentation remained private until recently. As a result, Berachain lacks a mature project ecosystem. Due to late public disclosure, most community projects emerged only after January 2024—placing the ecosystem in its earliest stage.

Official Ecosystem

Berachain’s official ecosystem forms the foundational layer. To prevent redundant DEX, Lending, and Perps protocols from cannibalizing each other via vampire attacks, the team decided to build these core products themselves. As analyzed earlier, these three generate the bulk of ecosystem revenue. Keeping them centralized enables better profit-sharing with BGT holders, strengthening BGT’s value foundation and powering Berachain’s positive flywheel.

Beyond BEX, BEND, and BERPS, official offerings include BGT Station (governance delegation platform), HONEY minting/redeeming portal, Beratrail (block explorer), and testnet faucet.

source:https://www.berachain.com/

DeFi Ecosystem

Infrared

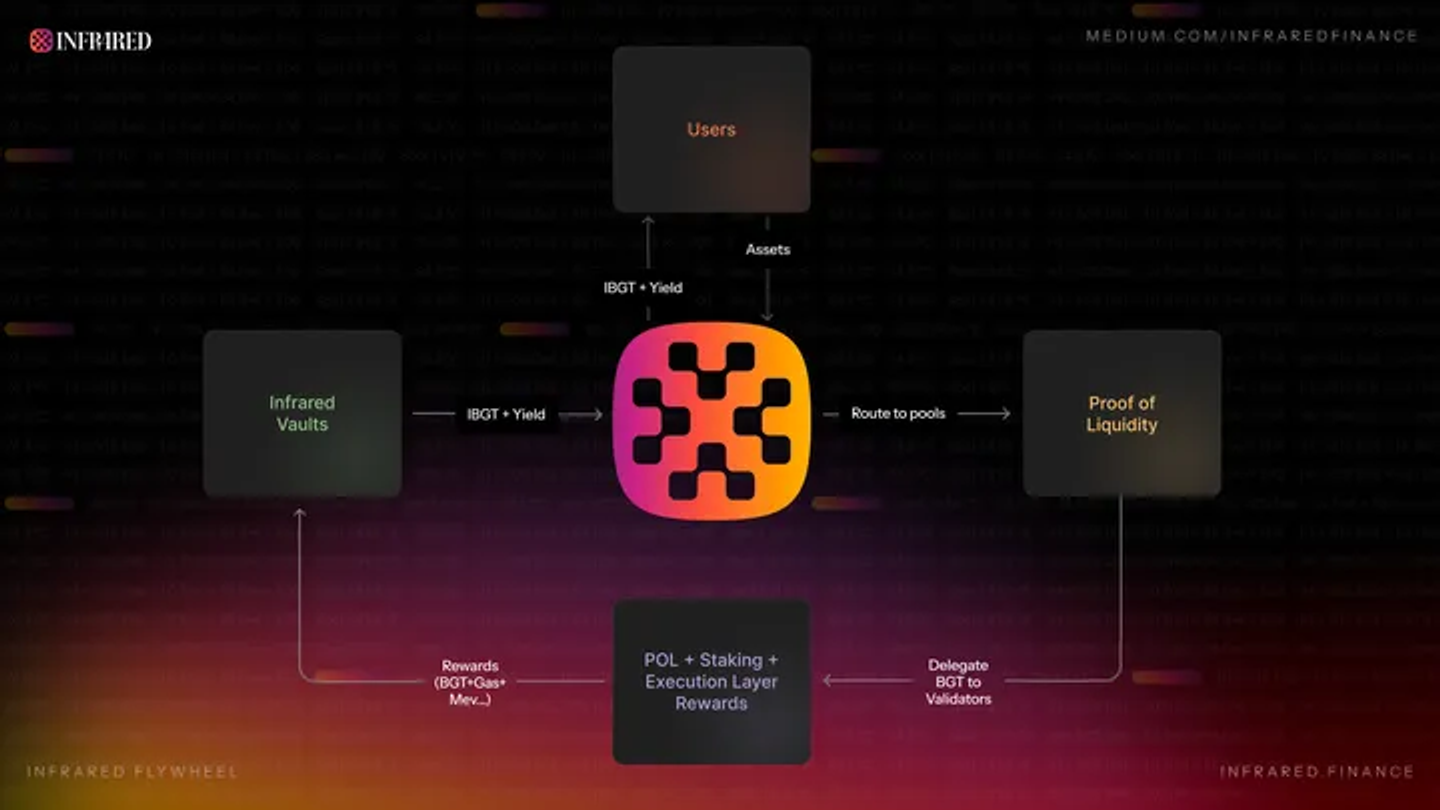

Infrared is a PoS and LSD protocol on Berachain. It announced a $2.5M seed round in January 2024 led by Synergis, with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, and others. Infrared cleverly adapts Berachain’s PoL into the more familiar PoS model, issuing liquid staking derivatives to improve capital efficiency. By accepting user liquidity assets and providing liquidity, Infrared captures BGT emissions, then issues iBGT and siBGT tokens as BGT representations. Users earn BGT rewards while using iBGT/siBGT across other Berachain DeFi apps. Infrared aims to become Berachain’s Lido, expanding its iBGT ecosystem.

Kodiak

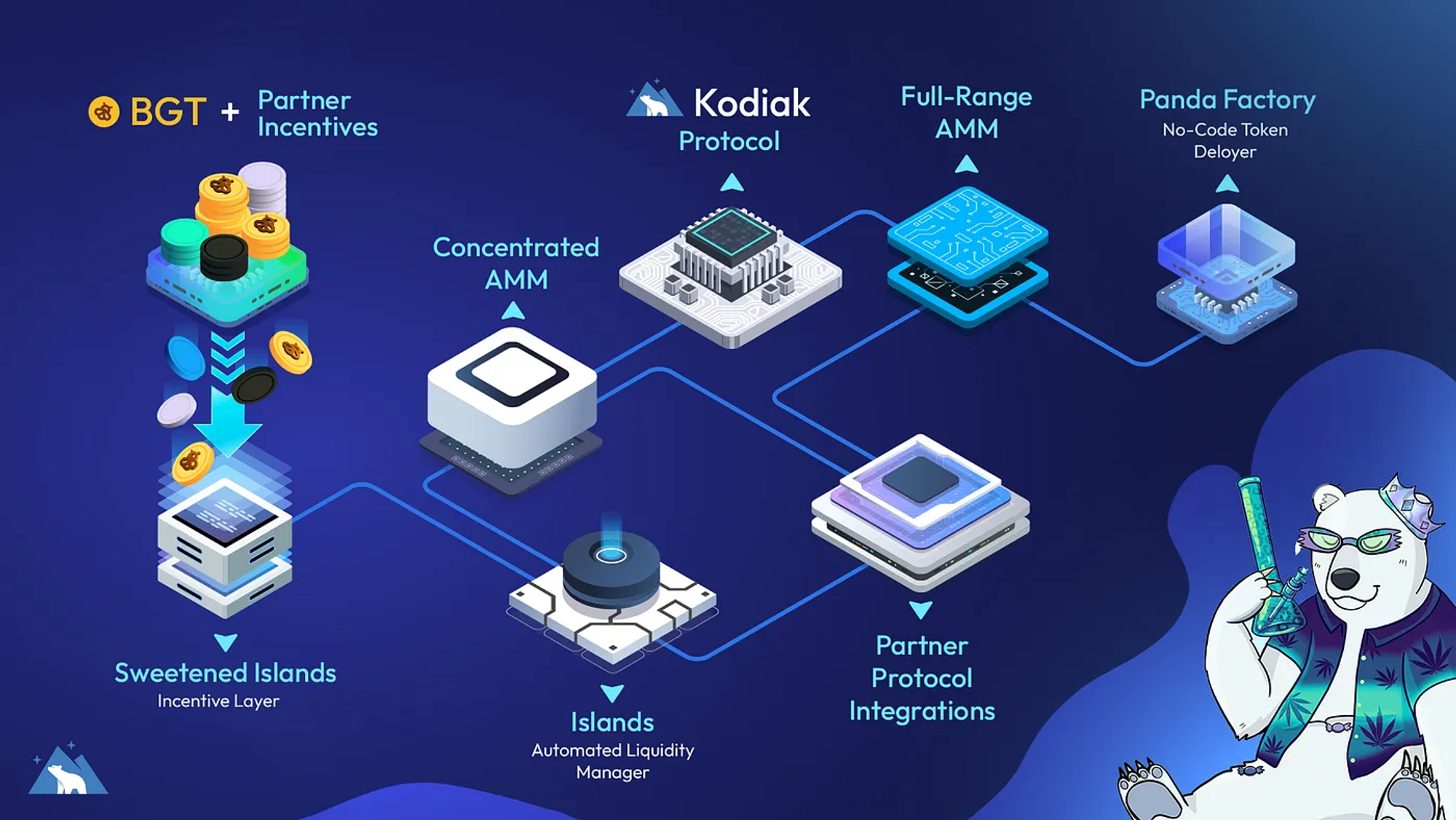

Kodiak is the only DEX project incubated by Berachain’s Build-a-Bera accelerator. It announced a $2M seed round in February 2024 backed by Build A Bera, Amber Group, Shima Capital, DAO5, and others.

Kodiak aims to be Berachain’s comprehensive liquidity hub, offering DEX, automated liquidity management, and no-code token deployment. While also a DEX, Kodiak complements rather than competes with the official DEX—focusing on long-tail assets, providing auto-LP tools to relieve manual management, and enabling fast, no-code token launches. Kodiak delivers a full lifecycle solution from token creation to trading and liquidity management.

source:https://medium.com/@KodiakFi/introducing-kodiak-berachains-native-liquidity-hub-63c3e7749b30

Beradrome

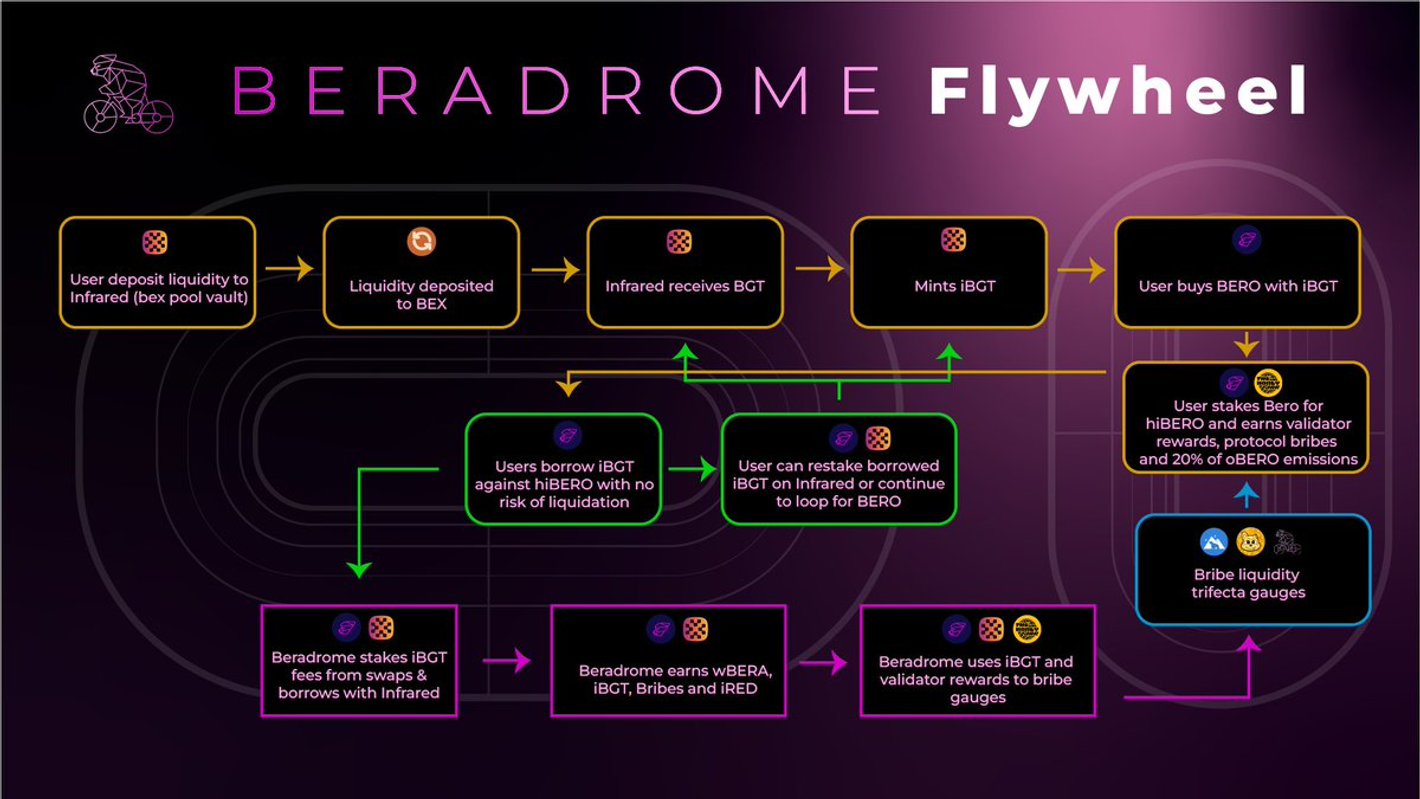

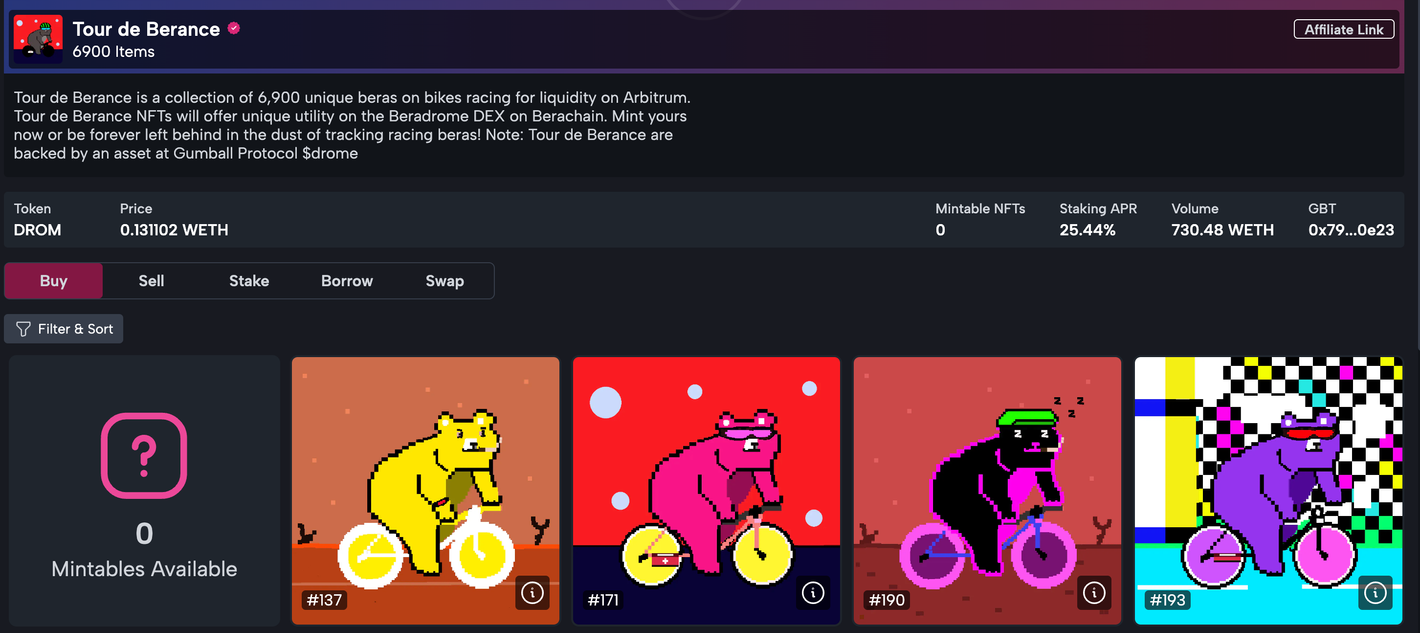

Beradrome aims to be Berachain’s DEX and restaking liquidity market, bringing Solidly’s ve(3,3) economics to the ecosystem. iBGT holders can buy and stake BERO on Beradrome to receive hiBERO, capturing validator rewards, bribe income, and oBERO emissions. Users can also leverage hiBERO in a risk-free loop to borrow and stake more iBGT, amplifying capital efficiency and returns.

source:https://twitter.com/beradrome

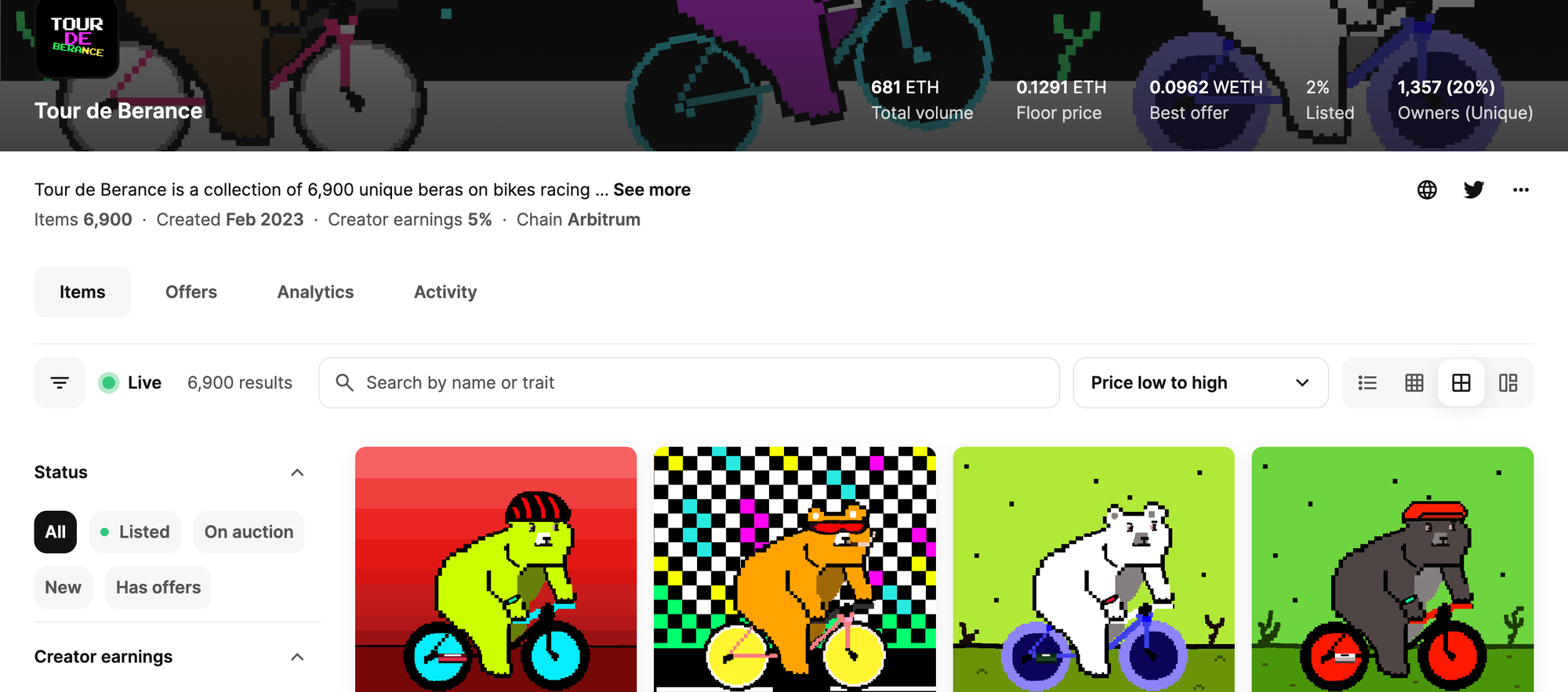

Notably, Beradrome partnered with The Honey Jar to jointly operate a Berachain validator. It also launched its NFT collection Tour de Berance, granting holders increased hiBERO allocation and voting rights.

source:https://opensea.io/collection/tour-de-berance

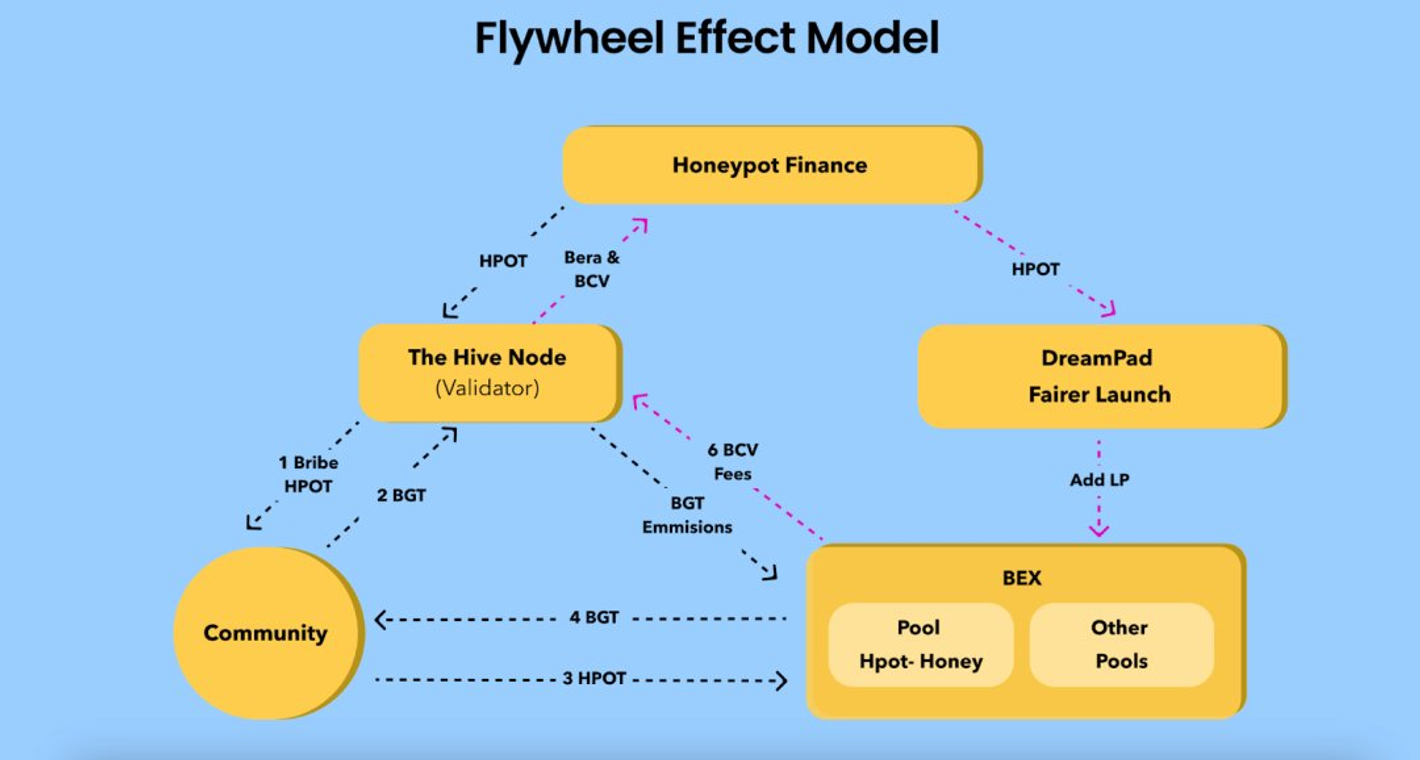

HoneyPot Finance

Similar to Infrared, HoneyPot Finance offers a PoS-like staking solution for BGT. Instead of absorbing liquidity assets and issuing iBGT, HoneyPot accepts BGT delegations via platform token bribes, using yield governance to incentivize users to mine pools offering bribe rewards—effectively creating a PoS layer. Additionally, HoneyPot launched a fair-launch Launchpad and Batch AMM model optimized for long-tail assets, aiming to become Berachain’s liquidity infrastructure for emerging asset issuance and trading.

source:https://docs.honeypotfinance.xyz/v/zh-cn/overview/map

Beyond these DeFi protocols, several promising projects under development—though not yet detailed—deserve attention:

-

Gummi, a money market protocol supporting arbitrary currencies

-

Wakalah, a commodities and RWA protocol on Berachain

-

Exponents, an oracle-free derivatives platform on Berachain

-

IVX, a 0DTE options AMM platform

-

OOGA BOOGA, a DEX aggregator

-

Smilee Finance, an options protocol offering up to 1000x leverage, no liquidation, and impermanent gains

-

Shogun, an intent-centric order flow aggregator and modular smart liquidity routing platform

-

D^2 Finance, a 100% on-chain, non-custodial multi-strategy hedge fund protocol

-

…

NFT Ecosystem

NFT Collections

Bong Bears

Berachain originated from the Bong Bears NFT collection. On August 27, 2021, three anonymous founders launched Bong Bears—a set of 100 uniquely styled bears. Minting differed from typical NFTs: each cost 0.069 ETH, and buyers could preview and select specific bears on OpenSea beforehand.

Bong Bears introduced the concept of Rebase NFTs, spawning four derivative collections: Boo Bears, Baby Bears, Band Bears, and Bit Bears.

Early Bong Bears community stickiness drove prices from 0.069 ETH to over 50 ETH despite zero public updates. Following Berachain funding announcements, holding Bong Bears became seen as the optimal strategy for qualifying for a potential airdrop, causing listing rates to plummet. Today, Bong Bears are effectively off-market, with floor prices reaching 200 ETH.

source:"Proof of Liquidity" Project Berachain Launches Public Testnet, Artio (investingcube.com)

The Honey Jar

Beyond the official Bong Bears, The Honey Jar is the most popular NFT collection and community on Berachain. Serving as Berachain’s gateway, The Honey Jar ran offline/online events and grew its own community even before Berachain went public. It acts as both a traffic funnel and educator for Berachain users. As a community, it also incubates and partners with other Berachain ecosystem projects.

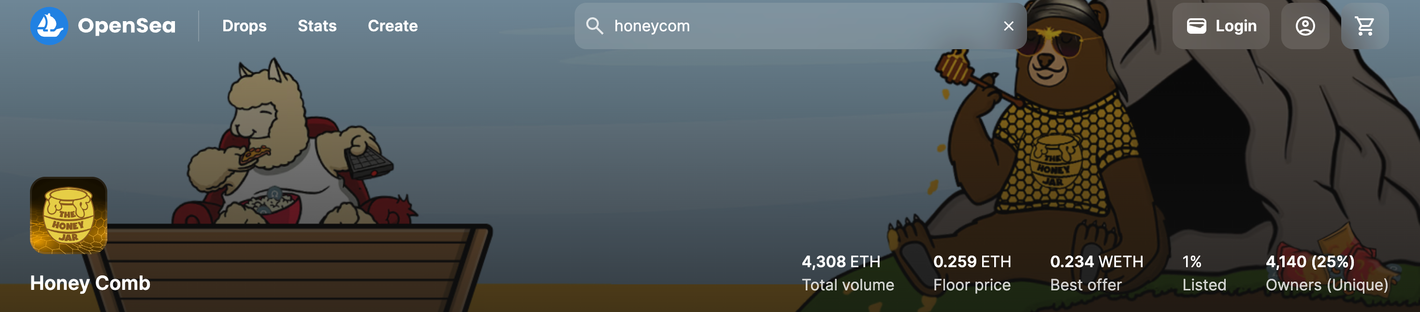

The Honey Jar launched its Honey Comb NFT series. As a core community NFT, holders gain exclusive perks—whitelist mints, boosted yields—from partner projects. Honey Comb has achieved 4.3k ETH in OpenSea volume, with a ~0.25 ETH floor and only 1% listed—highlighting exceptional community stickiness.

source:https://opensea.io/collection/honey-comb-2

NFT Protocols

Goldilocks

Goldilocks is a comprehensive DeFi + NFTFi platform on Berachain, offering NFT-backed lending. Its key features: (1) NFT floor prices are voted on by LOCKS token holders, eliminating oracle dependency; (2) loans are denominated in iBGT—users supply BGT to lending pools, receive GiBGT liquidity tokens, earn interest, and reuse GiBGT in other Berachain DeFi apps.

Kingdomly

Kingdomly aims to be Berachain’s native OpenSea. For retail users, it offers NFT minting, sales, trading, and leasing. For enterprises, it enables quick NFT collection deployment and seamless issuance. Kingdomly partnered with Honeypot Finance to launch its genesis NFT.

Protecc

Protecc is a comprehensive NFTFi platform, aiming to be a one-stop NFT marketplace. It offers NFT AMMs for instant trading, OTC and bulk desks for whales, auto-yield vaults, and cross-chain NFT trading bots.

Gumball Protocol

Gumball Protocol is an innovative NFT Launchpad and AMM. Each NFT collection comes with a corresponding token and underlying asset, enabling immediate trading. By pairing fractionalized NFTs with assets, Gumball supports instant NFT trading.

source:https://www.gumball.fi/collections/arbi/0x794075aef95d9bd7e5cfd0ea8a1e68493b7e0e23/buy

GameFi Ecosystem

BeraTone

BeraTone is a multiplayer open-world RPG inspired by Animal Crossing, centered on farming. Each player owns a customizable plot of land. Activities include crop planting, resource gathering, animal husbandry, and trading with other players. Built with 3D aesthetics, BeraTone is an evolving virtual world where players explore, interact with characters, complete quests, level up, solve puzzles, and uncover its mysteries.

BeraTone launched its Genesis NFT, BeraTone Founder’s Sailcloth, in January 2024 at 0.1 ETH. It now has a near 1 ETH floor and 355 ETH in volume, with only 3% listed—reflecting strong market anticipation for this Build-A-Bear incubated project.

source:https://opensea.io/collection/beratone-founders-sailcloth

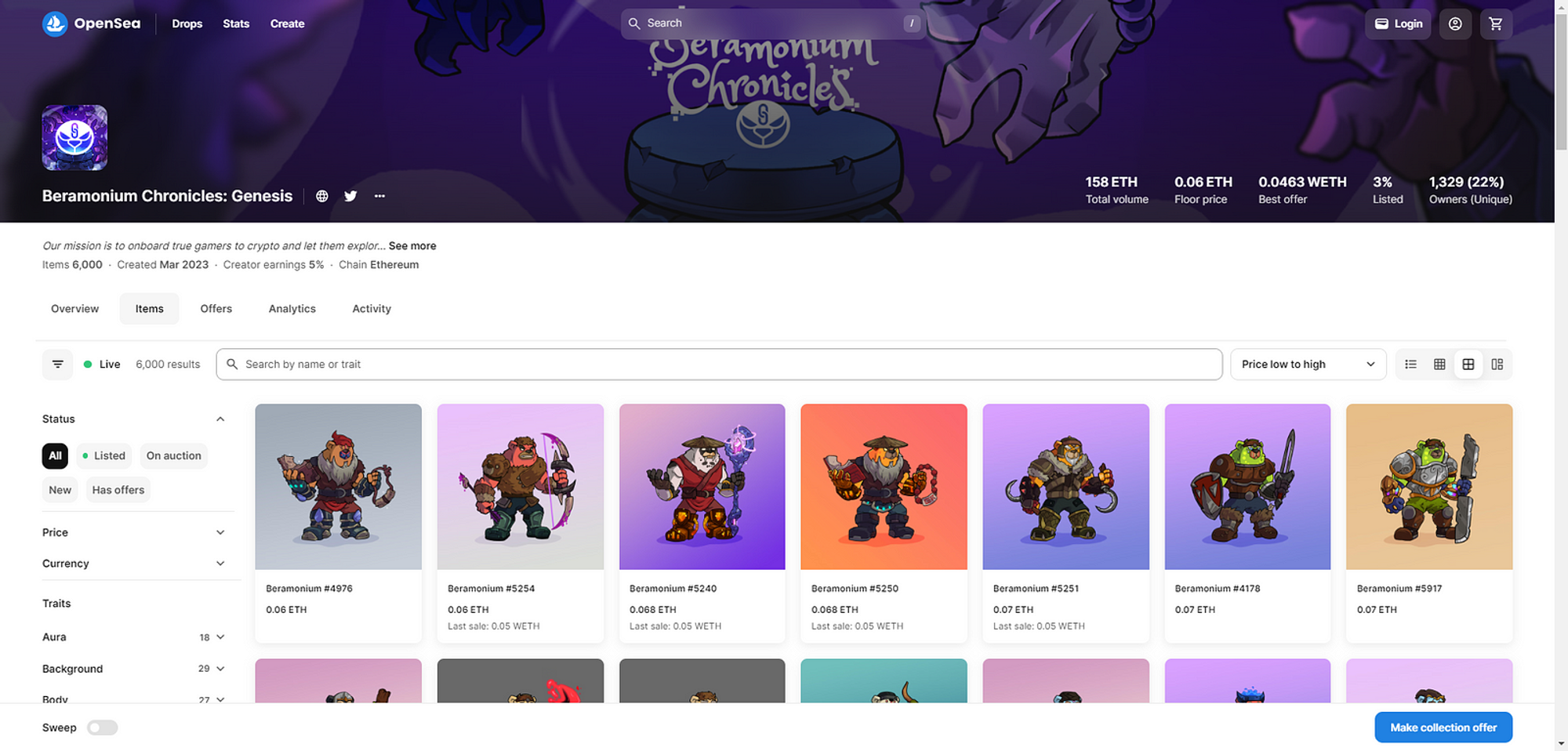

Beramonium

Beramonium is an ARPG game on Berachain, launching Gemhunters—a hack-and-slash RPG where players send their Beramium Genesis Bera into dungeons, battle bosses, and complete missions to earn gems. These gems can be exchanged for NFTs from other top Berachain projects like Honey Combs and Beradoges. The Genesis character NFT has a ~0.06 ETH floor, 158 ETH in volume, and only 3% listed, with a highly active community.

source:https://opensea.io/collection/beramonium-chronicles-genesis

Memes

BabyBera

BabyBera aims to create a triple-threat ecosystem combining NFTs, yield farming, and meme coins. It will roll out in three phases: NFT minting, yield farming, and $BBBERA meme coin launch. All $BBBERA will be distributed as liquidity mining rewards during the farming phase, ensuring users are highly committed degens—positioning $BBBERA as Berachain’s premier meme coin.

BeraDoge

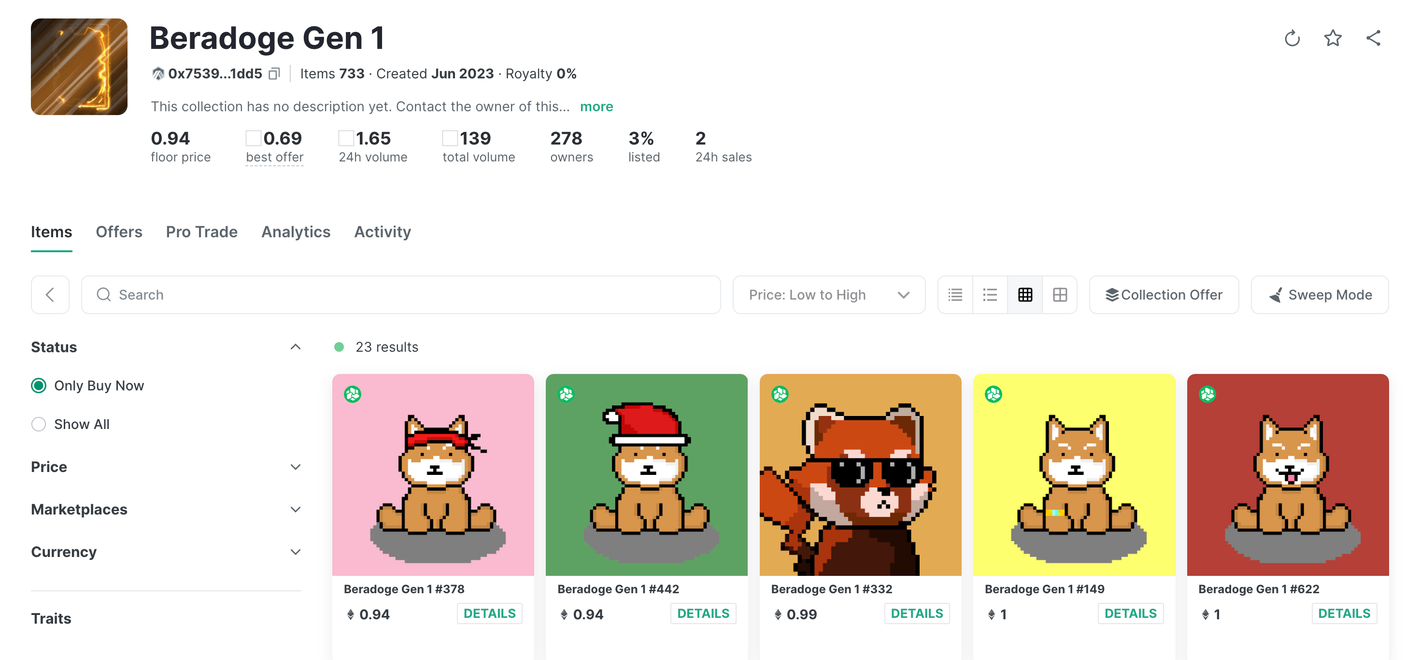

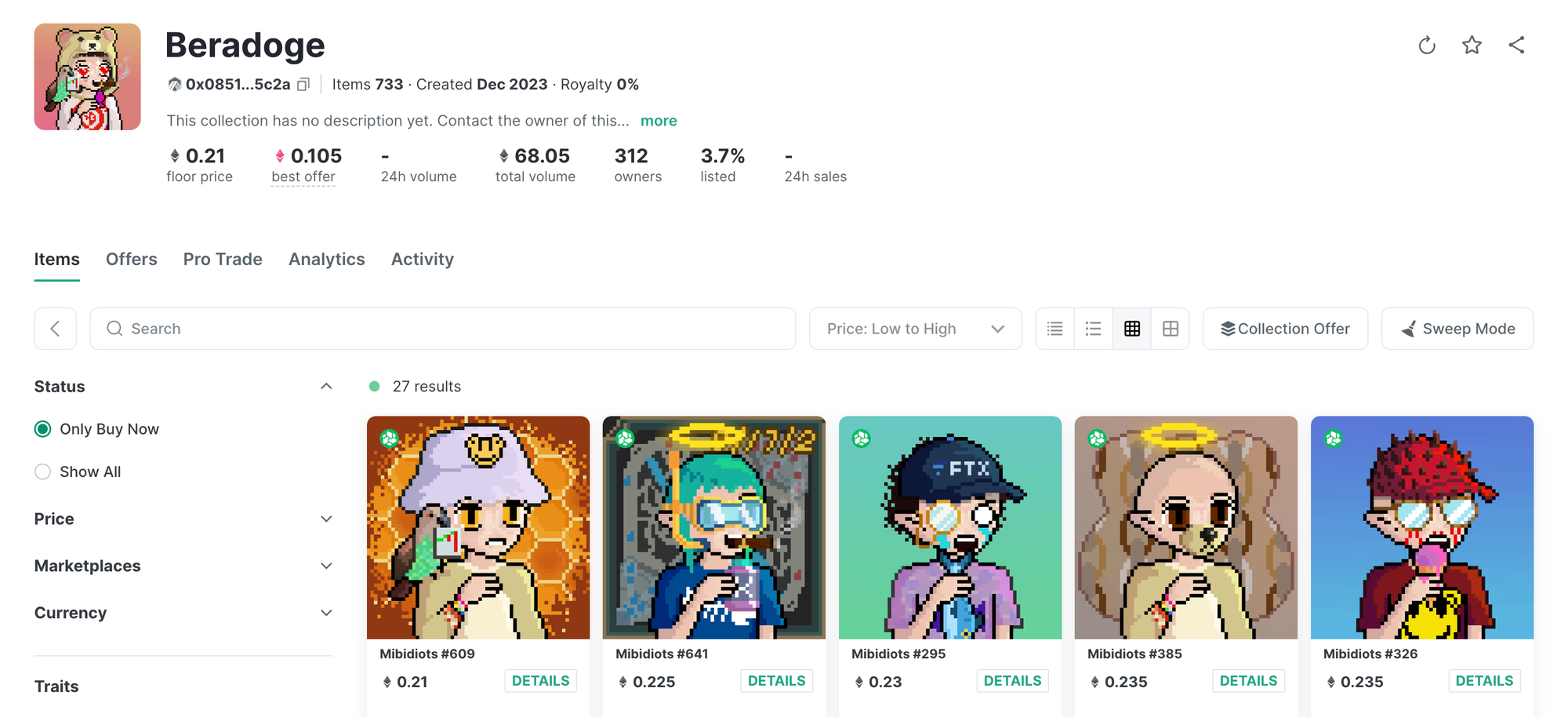

BeraDoge is another major meme project on Berachain, featuring two NFT collections: Beradoge Gen 1 and Mibidiots. Holders are promised “a bunch of useless stuff” or “a bunch of useless BDOGE.” Rumors also suggest BeraDoge may launch its own DeFi platform.

source:https://element.market/collections/beradoge-d51393

Ecosystem Summary

Currently, official components remain critical infrastructure. Beyond these, Berachain’s DeFi ecosystem shows three distinct trends:

(1) Filling gaps in long-tail markets underserved by core protocols;

(2) Innovating around PoL, BGT, and vote bribing;

(3) Attracting high-quality external DeFi projects drawn by the PoL mechanism.

Indeed, as intended, by launching foundational yet critical components like DEX, Lending, and Perps, Berachain avoids redundant projects and vampire attacks. Instead, official components push DeFi projects to innovate meaningfully, building sophisticated services atop existing primitives.

Currently, projects from the Build A Bear accelerator show higher quality, followed by imported top-tier external projects. Native community projects vary more in quality.

As previously noted, since Berachain inherently embraces NFT culture, platforms for NFT issuance, management, and liquidity protocols will be essential parts of its ecosystem.

Currently, gaming and meme ecosystems on Berachain are still in their infancy.

Investment Opportunities

Focus on High-Quality DeFi Protocols on Berachain

Berachain’s PoL mechanism strongly attracts high-quality DeFi protocols. With fewer vampire attacks, leading DeFi projects in niche categories can gain greater visibility, potentially achieving higher TVL, traffic, and user adoption. More concentrated liquidity improves user experience. We expect a stronger winner-takes-more effect on Berachain, with category leaders commanding higher valuations. Early participation in top-tier niche leaders is likely the best way to capture market premium.

Focus on Infrastructure Innovating Around PoL, BGT, and Vote Bribery

Berachain’s biggest differentiator is its novel PoL mechanism and three-token model. Beyond replicating existing chain mechanics, some projects will innovate at the infrastructure layer to adapt to PoL and the token model. Innovation can follow Infrared’s path—transforming unfamiliar PoL into familiar PoS, giving issued liquid tokens wider market adoption. Or, projects can innovate around BGT’s delegation rights, yield rights, and bribe rights, creating composable mechanics. Such foundational innovations can build strong moats and establish defensible protocol ecosystems.

Opportunities in NFTFi—Combining NFTs and DeFi

Unlike other chains, NFTs are a core liquidity component on Berachain. Unlocking NFT liquidity and integrating NFT mechanics with Berachain’s DeFi primitives presents a compelling opportunity. While NFTFi protocols elsewhere haven’t gained traction, those on Berachain may capture sufficient liquidity and achieve sustainable growth. Yield strategies and vaults from NFTFi protocols can integrate with vote bribing, enhancing flexibility and composability.

Opportunities in Berachain-based L2s and Infrastructure

The current testnet hype reflects strong market expectations. With mainnet launch and PoL activation, Berachain could replicate Ethereum’s DeFi Summer. Despite positioning as a high-performance L1, massive traffic and frequent interactions will require scalability. Once Berachain’s flywheel spins up, rising BGT prices may increase gas fees, necessitating cost reduction. Therefore, we anticipate major DeFi, GameFi, and SocialFi apps will build L2s on Berachain for scaling. We remain bullish on and closely monitoring Berachain-based L2s and their infrastructure ecosystems.

Conclusion

Liquidity has always been the most critical topic in crypto. Tokens, grants, points—all ultimately compete for users and liquidity. Without liquidity, even the most robust ecosystem and infrastructure are castles in the air.

Berachain has the potential to break the liquidity deadlock plaguing public blockchains. Through its innovative PoL consensus and three-token model, it could draw liquidity from other chains and become the liquidity hub

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News