How Far Can the Low-Market-Cap RWA Project NEOPIN Go in a Bull Market?

TechFlow Selected TechFlow Selected

How Far Can the Low-Market-Cap RWA Project NEOPIN Go in a Bull Market?

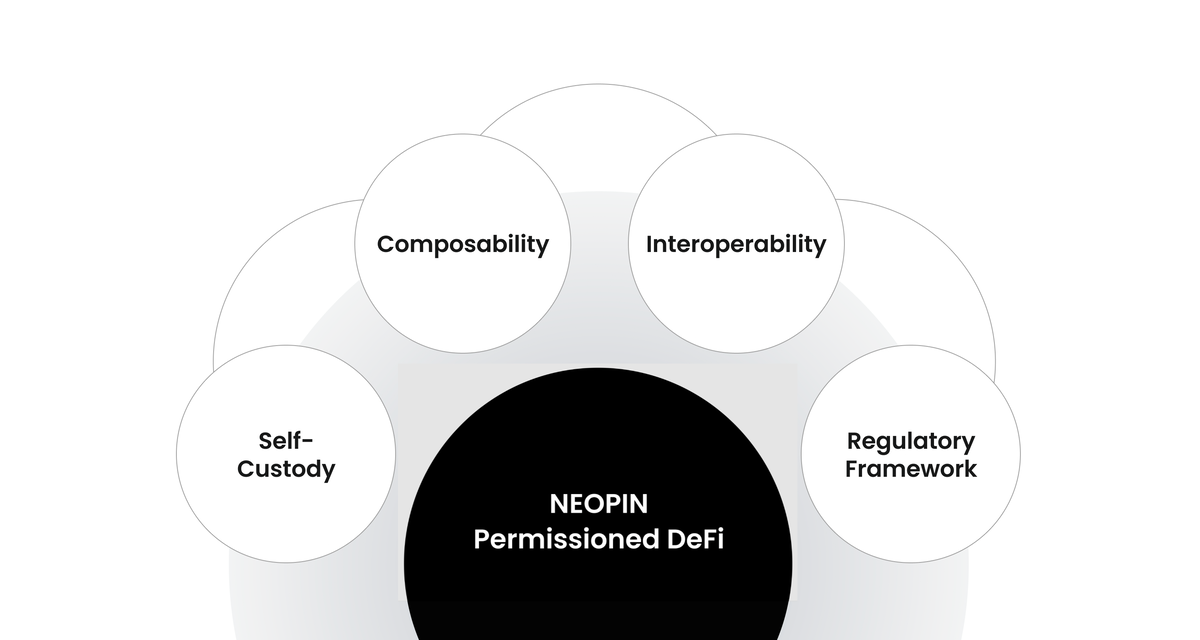

NEOPIN aims to provide users with one-stop DeFi services by combining the security and compliance of CeFi with the flexibility and openness of DeFi.

Crypto Market Poised for Takeoff

With the SEC's official approval of Bitcoin ETFs at the beginning of 2024, the cryptocurrency market has reached a historic turning point, marking deeper acceptance of crypto assets by mainstream financial markets. In the coming months, crypto investments will become more accessible and widespread than ever before.

Moreover, the market is approaching the next Bitcoin halving cycle. Against the backdrop of the imminent halving event and broad market expectations of Federal Reserve rate cuts, the crypto market is exhibiting an unprecedentedly positive outlook. Undoubtedly, these favorable factors will collectively drive the crypto market into a major bull run in 2024.

How to Outperform Others in the Bull Market

Bull markets typically lift the entire market, creating an environment where almost any investment can generate returns. To outperform other investors in such a scenario, selecting low-market-cap projects with high growth potential is key to achieving超额收益 (excess returns). These projects often start with lower valuations, offering greater upside potential. Furthermore, if a project has strong fundamentals and promising long-term prospects, its growth momentum can be even stronger.

Therefore, to capture gains beyond general market appreciation, we should actively seek out these low-cap, high-potential projects.

A Hidden Gem in the Crypto Market — NEOPIN

As a project combining the strengths of CeFi and DeFi, NEOPIN not only possesses significant innovative potential but also leads the industry in regulatory compliance. These attributes give NEOPIN notable investment value heading into the upcoming bull market.

The reason NEOPIN has been undervalued until now is threefold. First, the market is flooded with numerous projects, and investor attention tends to focus on those promising short-term, ultra-high returns, causing fundamentally strong, long-growth-potential projects like NEOPIN to remain under the radar. Second, the concept of compliant DeFi clashes with the "purity" mindset held by some investors who believe permissioned systems contradict the original spirit of crypto; thus, it takes time for users to accept this new model. Lastly, as a South Korean project, NEOPIN has struggled to gain visibility in the U.S.- and China-dominated crypto landscape, limiting its exposure to global investors.

Hence, entering before the market fully recognizes its true value means positioning oneself for substantial future returns. Next, we’ll dive into NEOPIN’s project details, product features, and its explosive potential during the bull run.

Project Overview

NEOPIN positions itself as a decentralized “crypto bank,” aiming to provide one-stop DeFi services by integrating the security and compliance of CeFi with the flexibility and openness of DeFi. Its product suite includes a decentralized wallet, DEX trading, liquidity mining, liquid staking, lending, and more.

Developed by a team with deep technical expertise and extensive experience in South Korea, NEOPIN’s core members come from industry giants including Samsung, Neowiz (South Korea’s largest gaming company), Binance, and Gnosis—both traditional finance and Web3 sectors—committed to building a secure and user-friendly DeFi ecosystem.

Key Features

Compliance-Focused Services

NEOPIN emphasizes regulatory compliance and user safety. It is currently a member of the Abu Dhabi Investment Office (ADIO) Innovation Program—the first South Korean Web3 project to receive funding from ADIO—and collaborates with the Abu Dhabi Global Market (ADGM) to become the world’s first DeFi protocol integrated within a formal regulatory framework. By implementing KYC, AML policies, and two-factor authentication, NEOPIN ensures its operations meet international financial regulatory standards.

CeFi and DeFi Integration

As technology and markets mature, demand for decentralized, secure, and privacy-preserving financial tools grows. Coupled with DeFi’s ability to offer borderless access to global users, this drives broader market participation. It is foreseeable that trading activity will gradually shift from traditional centralized exchanges to DEXs. In this transition, NEOPIN naturally emerges as an ideal middleware thanks to its unique blend of CeFi and DeFi advantages.

By merging CeFi’s security with DeFi’s innovation, NEOPIN offers a distinctive platform enabling users to securely access decentralized financial services such as crypto trading, staking, lending, and yield farming.

Multi-Yield Protocol Based on RWA

NEOPIN’s RWA product leverages the BDLP (Bond Derivatives Linked Protocol) mechanism, using sDAI backed by U.S. Treasuries and sUSDe derived from internet bonds to deliver returns exceeding those of U.S. Treasury yields. The protocol supports deposits in DAI, USDT, and USDC, offering users up to 30.2% annualized yield.

Additionally, NEOPIN has developed proprietary AI algorithms that analyze individual user data and on-chain behavior to recommend optimal asset allocation strategies, empowering users to efficiently leverage complex DeFi derivatives based on personal preferences.

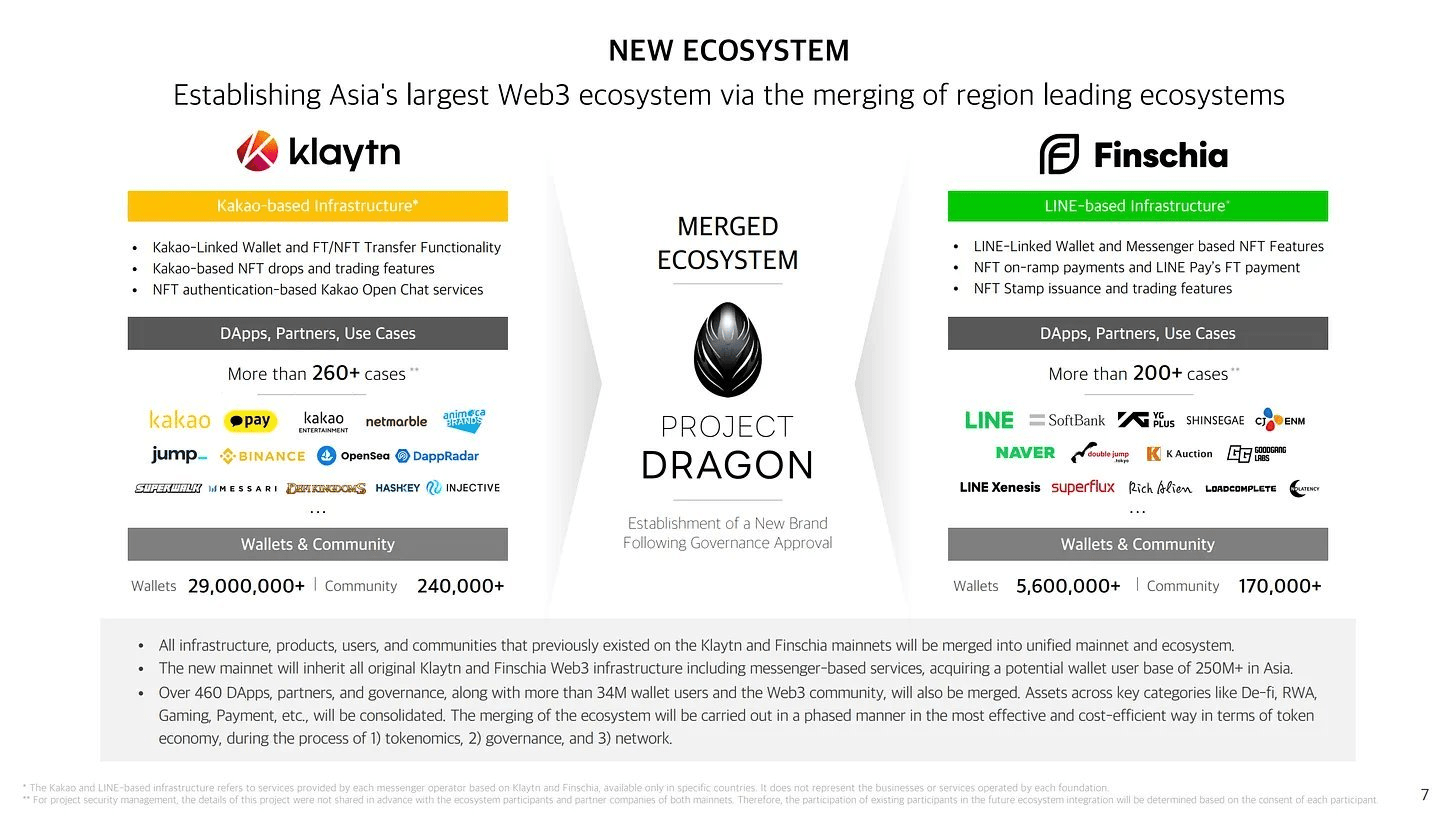

Flagship Project of Project Dragon Ecosystem

NEOPIN is currently the flagship project on Project Dragon, a blockchain formed by the merger of Klaytn and Finschia. This integration brings together over 250 million users and enables compatibility with major blockchains including Ethereum, Cosmos, Polygon, and Tron. With individual valuations of approximately $820 million and $240 million respectively, the merged entity is valued at around $1 billion. This massive user base and consolidated ecosystem provide NEOPIN with immense growth potential and market influence.

Backed by Japanese and Korean Tech Giants

While Klaytn and Finschia may not be familiar names to everyone, their parent companies—Kakao and Line—are household names across Asia. As the leading project on this Japan-Korea powerhouse blockchain alliance, NEOPIN benefits from robust technological and resource support, along with direct access to over 250 million potential users across Japan and South Korea.

NEOPIN’s Bull Market Outlook

Currently, NEOPIN’s TVL stands at $183 million, a level reflecting severe undervaluation. Within its category—a one-stop DeFi platform—NEOPIN competes with projects like Raydium, which combines trading, liquidity mining, staking, and more. Raydium currently has a market cap of around $600 million, while NEOPIN’s is only about $85 million, indicating a potential 7x upside. If NEOPIN’s ecosystem expands further and reaches the scale of top-tier DeFi platforms such as Uniswap, Curve, or PancakeSwap, the price potential becomes even more extraordinary.

From a blockchain perspective, NEOPIN’s position as the flagship project on Project Dragon further highlights its undervaluation. Compared to similarly positioned projects on blockchains with comparable valuations—such as Benqi, Trader Joe, or GMX on Avalanche or Polygon—these counterparts typically have market caps 3–5 times higher than NEOPIN’s. This discrepancy underscores NEOPIN’s current market neglect and suggests significant room for valuation growth.

Looking ahead, NEOPIN’s solid foundation—powered by strong technical capabilities, regulatory compliance, government partnerships, leadership within the Project Dragon ecosystem, and backing from Asian tech titans Kakao and Line—positions it strongly for rapid development and market capitalization growth.

Furthermore, NEOPIN has yet to list on Binance, the world’s largest crypto exchange, or Upbit, South Korea’s top exchange. A listing on either platform is expected to attract significant new users and capital inflows, substantially boosting its market cap. Given the vast potential of Japan and South Korea’s crypto markets, and NEOPIN’s strategic advantage through its ties to major regional tech leaders, its future growth trajectory is highly promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News