Bitcoin's Ecosystem Layer: Unveiling the Curtain on a Trustless Financial Era (IV)

TechFlow Selected TechFlow Selected

Bitcoin's Ecosystem Layer: Unveiling the Curtain on a Trustless Financial Era (IV)

Bitcoin is increasingly becoming the cornerstone for building a new, trustless financial system.

Authors: Kyle Ellicott, Yan Ma, Darius Tan, Melody He, The Spartan Group

Translation: 0xNirvana

"The Bitcoin Ecosystem Layer: Unveiling the Dawn of Trustless Finance" is a research report on various aspects of the development within the Bitcoin ecosystem. This report was co-authored by the Spartan Group team, Kyle Ellicott, and numerous experts who provided feedback, insights, and generously reviewed the final version. Drafted in December 2023, all data presented reflects information available at that time. This article is the fourth and final installment in a four-part series.

Part One: The Bitcoin Ecosystem Layer: Unveiling the Dawn of Trustless Finance (I)

Part Two: The Bitcoin Ecosystem Layer: Unveiling the Dawn of Trustless Finance (II)

Part Three: The Bitcoin Ecosystem Layer: Unveiling the Dawn of Trustless Finance (III)

The atmosphere surrounding the Bitcoin ecosystem in 2023 mirrors the excitement and anticipation seen in the Ethereum community back in 2017. Enthusiastic developers, investors, and community members are actively exploring possibilities across multiple layers of the Bitcoin ecosystem. Drawing inspiration from Ethereum's remarkable success story, Bitcoin—still dominant with its unparalleled market capitalization—is approaching a tipping point where it could surpass previous highs. Just as Bitcoin’s emergence in 2009 revolutionized trust mechanisms, its ecosystem now stands poised to fulfill its original promise—laying the foundation for a truly trustless financial system built upon its core L1 technology.

The market opportunity for Bitcoin L2s is undoubtedly one of the most promising segments within the Bitcoin economy. To estimate the total addressable market for Bitcoin L2s, we draw lessons from the existing Ethereum L2 landscape. Currently, the total value locked (TVL) in Ethereum L2s accounts for approximately 5.62% of Ethereum’s total market cap. Applying this same ratio to Bitcoin’s market cap provides our benchmark for estimating Bitcoin L2 potential.

● Pessimistic Scenario: Predicts a Bitcoin L2 market cap of $4.8 billion, roughly 10% (0.56%) of current Ethereum L2 TVL.

● Base Case Scenario: Projects a Bitcoin L2 market cap reaching $24 billion, about 50% (2.81%) of current Ethereum L2 TVL.

● Optimistic Scenario: Forecasts a Bitcoin L2 market cap of $48 billion, equivalent to 100% (5.62%) of current Ethereum L2 TVL.

Given that the majority of market participants today are already caught up in the "building on Bitcoin" sentiment, these projections assume a timeframe of around two years without factoring in additional compounded annual growth rates. Moreover, they rest on the assumption that Bitcoin L2 adoption will continue expanding. The rapid evolution of Bitcoin L2 technologies and their alignment with existing infrastructure provide key support for our forecast: the Bitcoin L2 network market cap will reach $24 billion by 2025. Future developments and industry milestones outlined below may influence how each of these three scenarios unfolds.

Short-Term Outlook: The Enduring Cultural Impact of Ordinals

In the short term, the cultural impact of Ordinals cannot be underestimated and will continue driving progress in the Bitcoin ecosystem. By embedding art and collectibles directly onto the Bitcoin blockchain, Ordinals have successfully cultivated a community focused on authenticity, creativity, and permanence. This cultural resonance solidifies their position within the Bitcoin ecosystem and continues attracting diverse user groups. Aligning perfectly with digital-age trends, Ordinals have significantly expanded Bitcoin’s influence far beyond its original use cases.

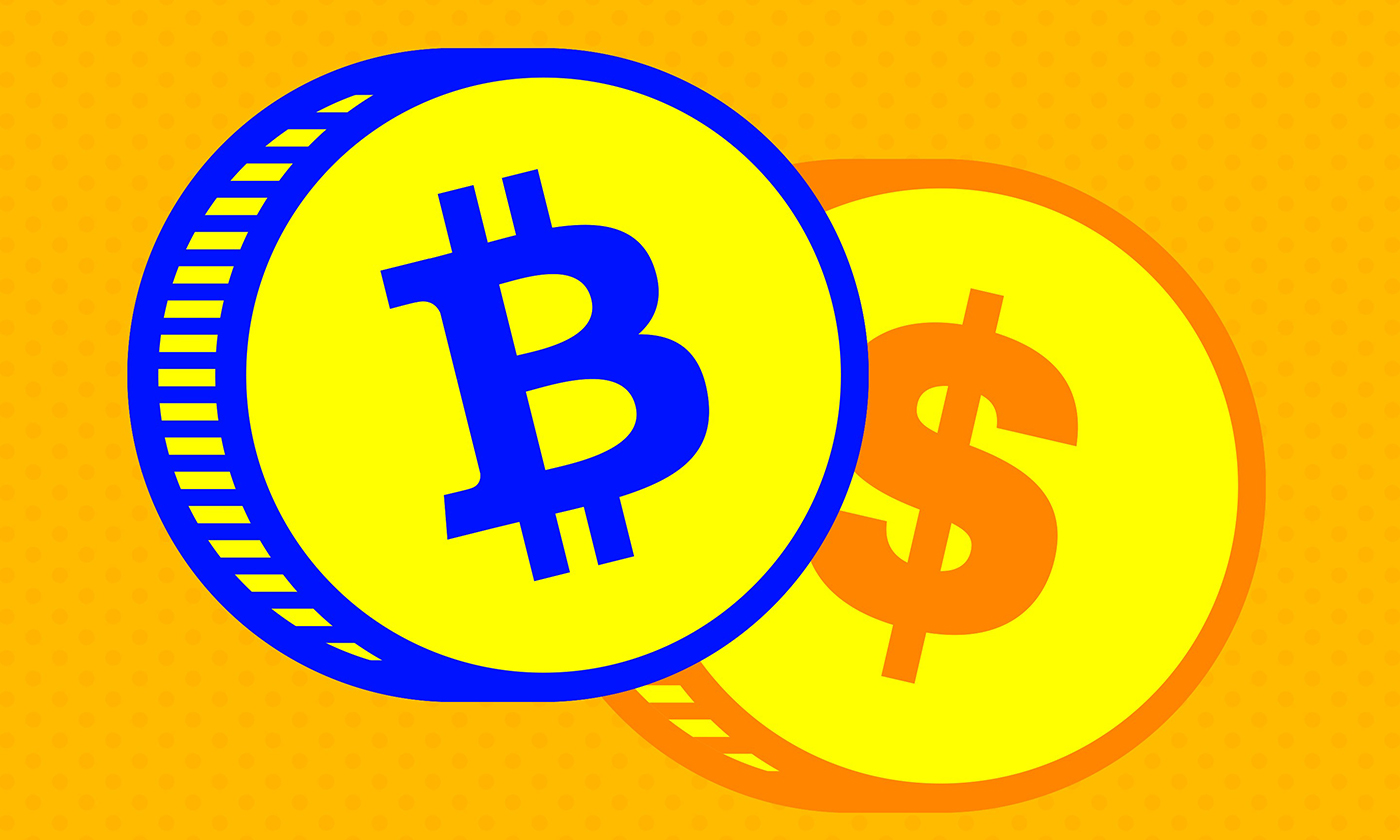

By 2023, the explosive growth of Ordinals made non-smart-contract Bitcoin one of the leading NFT platforms, even outpacing smart-contract-enabled chains like Solana. In November alone, Bitcoin NFT (Ordinals) sales surged by an astonishing 500%, exceeding both Ethereum and Solana during the same period. Despite being less than a year old, assets deployed on Bitcoin benefit from the network’s immutability and durability, resulting in substantial value appreciation.

NFT Trading Volume Across Chains (2023)

Source: The Block, CryptoSlam

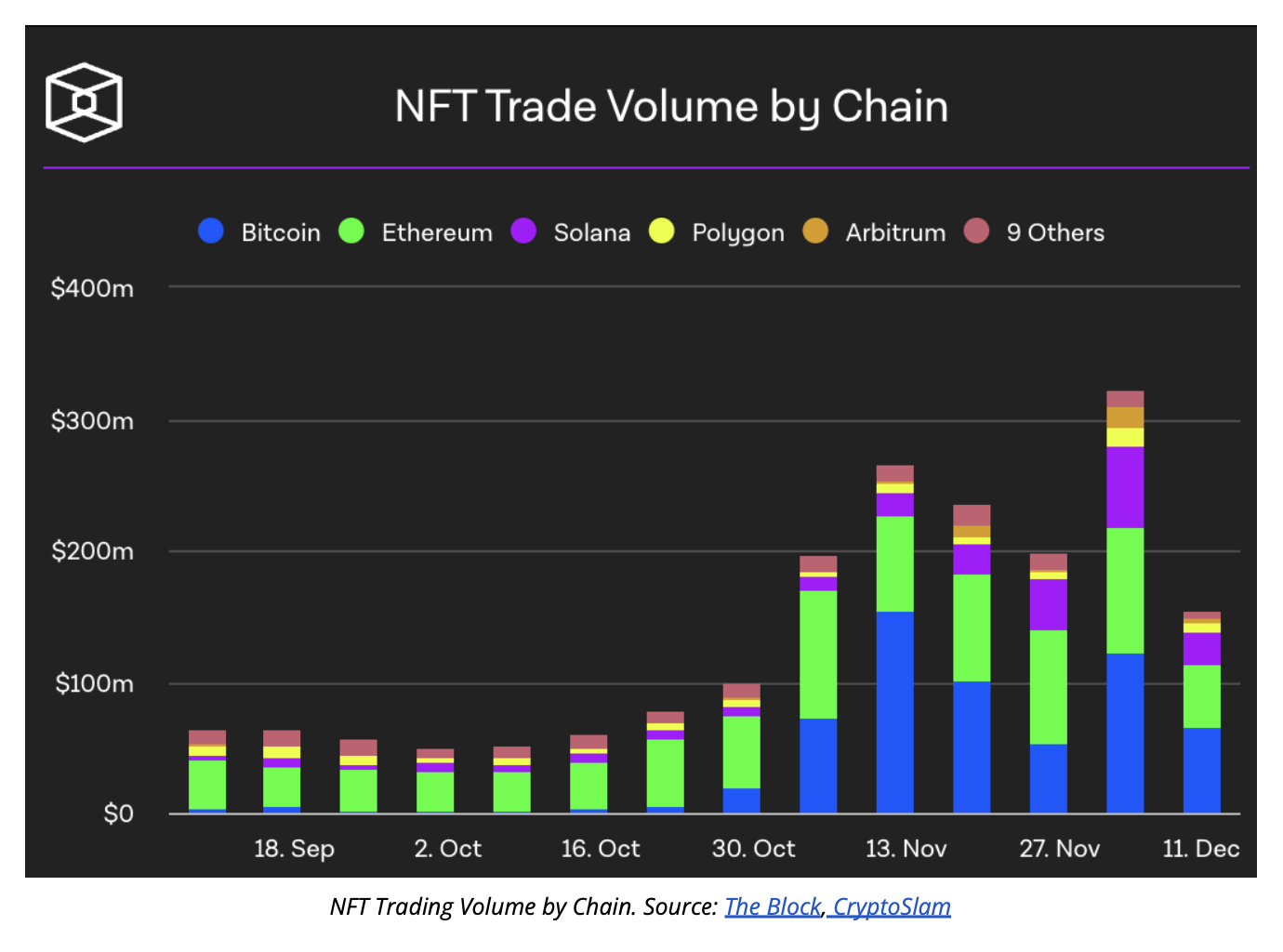

OnChain Monkey NFT creators doubled prices after launching on Bitcoin

Source: Metagood

As Bitcoin NFTs gain popularity and wider acceptance, phenomena such as OnChain Monkey—originally an Ethereum-based NFT—doubling in price after reissuing on Bitcoin highlight growing curiosity among users toward the Bitcoin ecosystem. Interest in exploring Bitcoin use cases in DeFi, gaming, and other domains is intensifying, potentially ushering in transformative shifts for Bitcoin’s future trajectory. Although Bitcoin faces limitations in transaction speed, smart contract compatibility, and scalability, innovation persists—especially at the protocol level.

● Many early projects in the ecosystem cannot issue tokens with the same utility and governance capabilities as those on Ethereum (e.g., BRC-20 vs. ERC-20).

● These projects must rely on equity funding and lack effective means to bootstrap communities using native tokens.

● Solutions include issuing fungible tokens via smart contracts on Stacks (SIP-10), or adopting other emerging token standards.

● Bidirectional bridges like MultiBit are beginning to emerge, enabling cross-chain transfers between BRC-20 and ERC-20 tokens. However, these remain interim solutions.

Sustained innovation is critical to overcoming these challenges. As L2s advance further, efforts aim to reduce transaction costs while fully preserving Bitcoin’s finality. Meanwhile, innovation is gradually permeating Bitcoin’s L1 layer. Despite obstacles, developers and enthusiasts continue actively exploring various use cases.

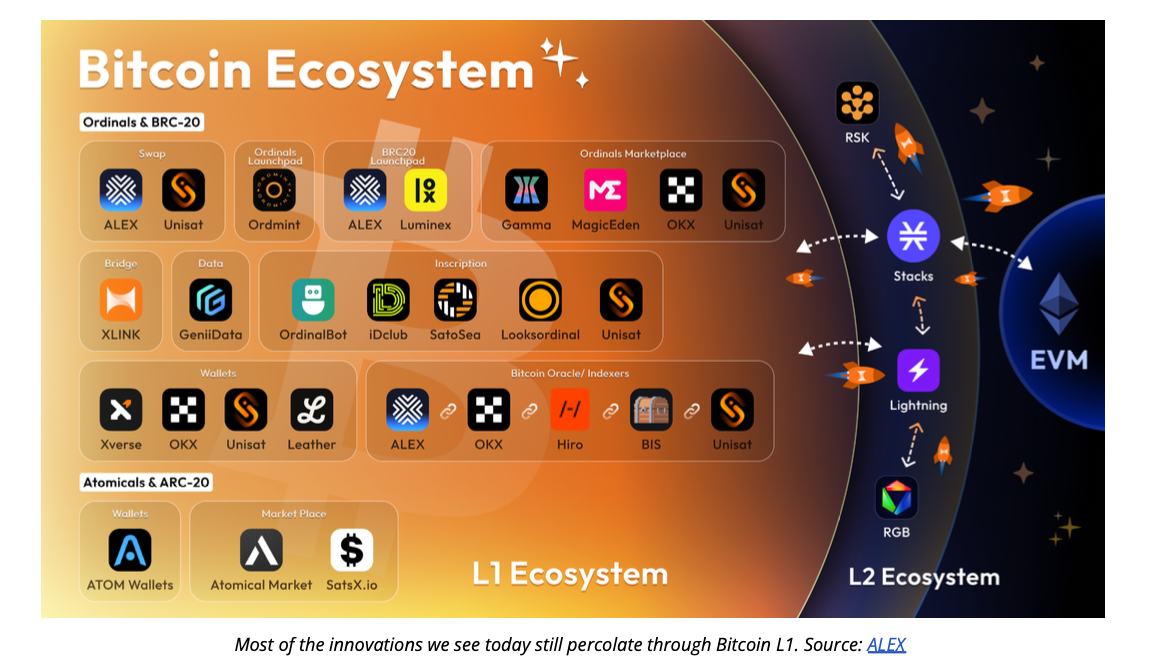

Most of the innovation we see today still occurs via Bitcoin L1

Source: ALEX

Medium-Term: Breakthroughs in Bitcoin L2 and Emerging Use Cases

The Bitcoin ecosystem is expected to witness significant breakthroughs in the medium term, driven primarily by advancements in L2 technologies—such as Stacks’ Nakamoto Upgrade (SIP-021)—and the introduction of sBTC. These developments are not merely incremental but transformative, particularly in Bitcoin DeFi and broader application landscapes.

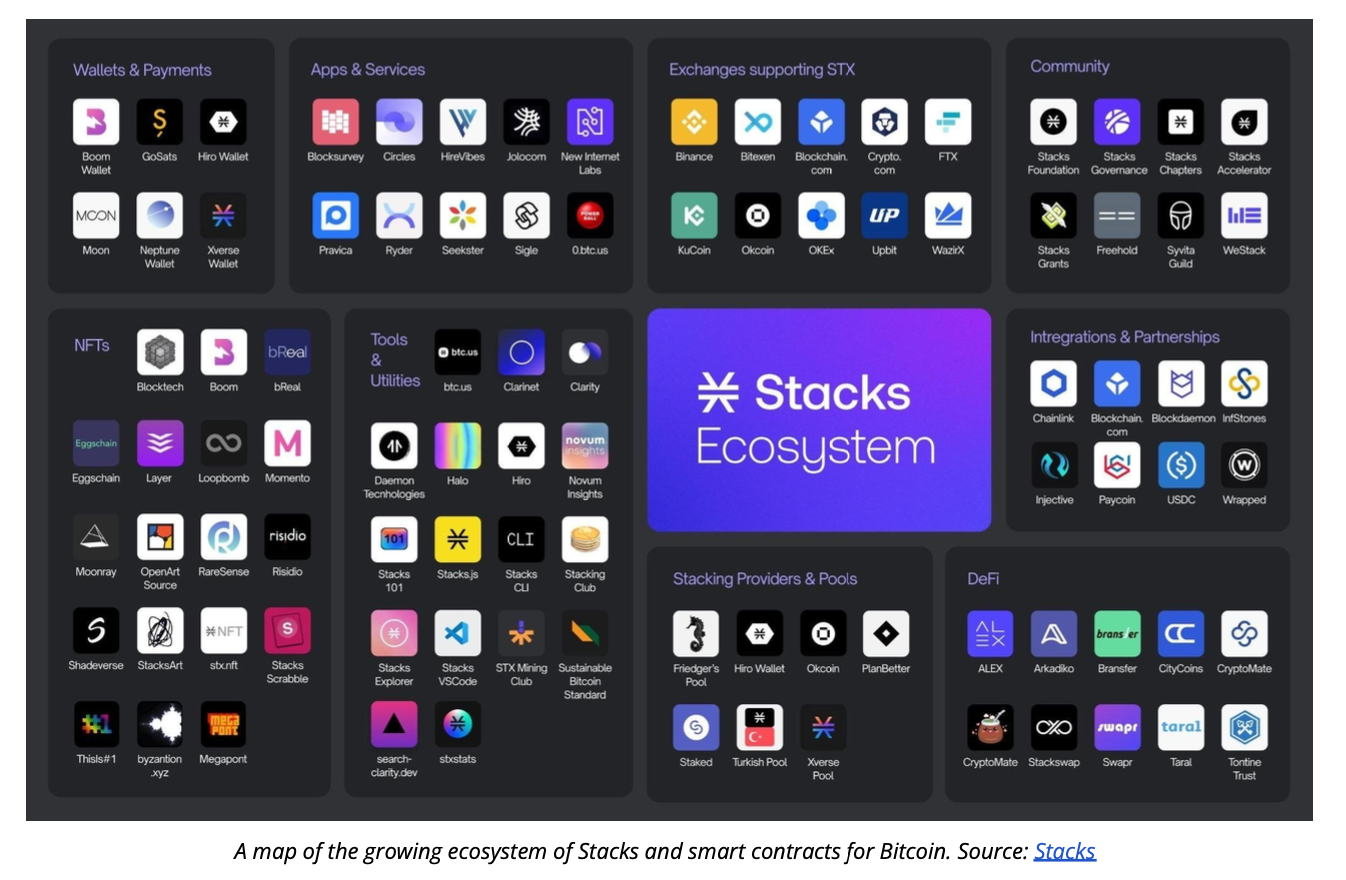

Stacks and Other Bitcoin Smart Contract Platforms Continue Evolving

Source: Stacks

The Nakamoto Upgrade reduces block times from over 10 minutes down to just 5 seconds—dramatically improving speed while enhancing security. Achieving this “Ethereum-like” user experience is crucial for attracting new developers and catalyzing a self-reinforcing cycle of adoption and innovation.

● Faster blocks combined with sBTC implementation will enable Stacks to deliver high-performance BTC-denominated applications—such as NFT marketplaces—that facilitate efficient trading of Ordinals and unique L2 NFT collections.

● The Bitcoin DeFi space is expected to expand massively, including lending functionality enabled through sBTC. Teams like Zest Protocol are already building these features on Stacks.

● ALEX is preparing comprehensive DeFi functionality; recently surpassing $500 million in trading volume and establishing the foundation for exchange markets priced in sBTC for various sub-tokens. These diverse applications can generate yield autonomously on Stacks while being explored.

The key to unlocking Bitcoin’s market cap lies in creating a flywheel effect similar to Ethereum’s user adoption model. As infrastructure matures, numerous new use cases will emerge across multiple dimensions of Bitcoin, ultimately drawing in end users. The Bitcoin ecosystem boasts not only the largest potential TVL in the industry but also targets a broader audience—aiming to serve mainstream users. Several pivotal developments lay the groundwork for ecosystem success:

● Trust Machines is building Bitcoin-native applications designed to maximize network value by introducing novel use cases and expanding the Bitcoin economy.

● Anticipating an influx of developers, Hiro is strengthening developer tools within the Bitcoin ecosystem.

● Wallets such as Xverse, Leather, and Ryder are focused on delivering seamless user experiences to drive mass adoption across various asset types on different Bitcoin layers.

● Following the Ordinals boom, major centralized exchanges quickly launched Ordinal marketplaces—including Binance, Magic Eden, and OKX. At the same time, new platforms like Ordzaar, Gamma emerged rapidly. On-chain Monkey recently launched its own marketplace called Osura.

● Other notable developments include Ordz Games launching the first-ever game built on Bitcoin, complete with its BRC-20 token, $OG.

● Friend.tech-inspired projects like New Bitcoin City, built on the Bitcoin L2 network NOS and launched by Trustless Computer, reached a total TVL exceeding $1.38 million by October 2023.

● StackingDAO introduced liquidity staking for Stacks in December 2023, launching liquid STX (stSTX).

● Additionally, Darewise, under Animoca Brands, is developing a metaverse based on Ordinals, showcasing the expanding frontier of possibilities within the Bitcoin ecosystem.

Snapshot of Bitcoin Application Ecosystem – March 2024

Ultimately, the expansion of the Bitcoin ecosystem powered by L2 technologies goes beyond simply adding new functions or attracting more users—it signifies deeper integration of Bitcoin into the global blockchain economy. Pioneering projects like ALEX are leading the charge, launching permissionless yield-generating stablecoins backed by Bitcoin, while bridges like XLink connect Bitcoin with Ethereum and other ecosystems. Such measures are essential for building a more interconnected and efficient Bitcoin ecosystem, laying a robust foundation for sustained financial innovation and service offerings.

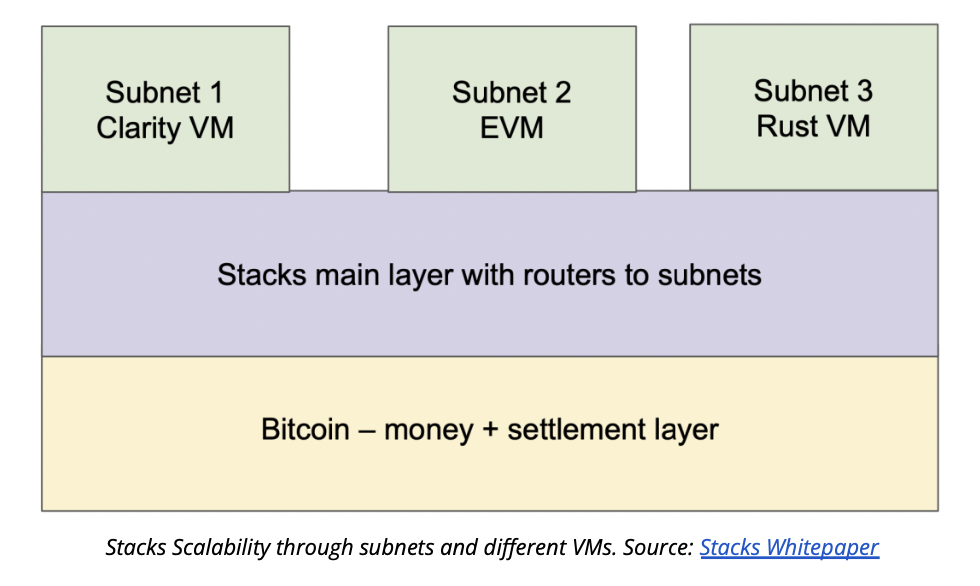

Furthermore, Stacks' evolving scaling solutions are expected to greatly enhance interoperability between the Bitcoin ecosystem and other blockchain networks at the L2 level. With the upcoming Nakamoto Upgrade, Stacks plans to introduce new subnets supporting multiple programming languages and execution environments, including EVM subnets and Rust VM. Integration of WASM support directly into Stacks L2 is also underway, expected to launch alongside the Nakamoto Upgrade. In December 2023, a working group within the Stacks ecosystem released details of a new ClarityWASM virtual machine integration proposal. This integration will allow more languages—such as Rust and Solidity—to run natively on Stacks L2.

Stacks achieves scalability through subnets and multiple virtual machines

Source: Stacks Whitepaper

Long-Term Vision: Paving the Way for Institutional Adoption

Bitcoin’s long-term outlook further cements its leadership position as a institutional-grade digital asset and cornerstone of DeFi adoption. Industry-wide anticipation surrounds the potential approval of the first spot Bitcoin exchange-traded fund (ETF), widely viewed as a pivotal moment that could fundamentally reshape how institutional investors engage with Bitcoin markets. This approval is expected to trigger a major paradigm shift, with institutions increasingly focusing on Bitcoin-centric financial products and services. As a deeply scrutinized and proven resilient asset class, Bitcoin stands at the threshold of broad institutional adoption.

Once a spot Bitcoin ETF is approved, demand for native Bitcoin (Bitcoin-native) trading and yield-generating products is projected to surge significantly due to their superior security and tax efficiency. With rising interest in these instruments, we may see a wide array of regulated Bitcoin financial products developed. As traditional banks recognize this shift, they may begin integrating Bitcoin and these emerging products into their private blockchains, enabling large-scale servicing of institutional clients.

Institutional integration into Bitcoin’s DeFi ecosystem brings far more than just capital inflows. It represents a unique synergy combining the strengths of traditional finance with the revolutionary innovations of decentralized finance. Built upon Bitcoin’s security and transparency, this convergence is expected to reshape institutional finance and blur the boundaries between traditional and modern financial systems.

From cultural transformation and technological innovation to institutional adoption, this cascade of dynamic developments is expected to significantly boost Bitcoin’s market value and TVL within its ecosystem. As we navigate this emerging decentralized financial landscape, it becomes clear that Bitcoin is not merely a digital asset—but the foundational bedrock of a new, trustless financial paradigm.

Conclusion and Reflections

From a dormant asset to foundational technology for decentralized finance, Bitcoin’s evolution has been propelled by its market capitalization exceeding $850 billion, underpinned by the stability and security of its network. Yet, a critical challenge remains: Bitcoin’s network capabilities are still underutilized—a consequence often stemming from the failure to distinguish Bitcoin as a network versus Bitcoin as a digital asset (BTC). To awaken this dormant capital and fully realize Bitcoin’s potential, we must leverage its network functionality, transforming Bitcoin from a mere store of value into core infrastructure powering a Bitcoin-based economic system.

This transformation manifests in the emergence of an “ecosystem layer” architecture built atop Bitcoin’s core network (L1), developed specifically to address Bitcoin’s scalability limitations. Inspired by Ethereum’s achievements in scalability and flexibility, this architecture gained momentum following the introduction of Ordinals, sparking both cultural and developmental shifts. While key L1 upgrades like SegWit and Taproot have alleviated some constraints, rising transaction fees underscore the growing urgency for more efficient L2 solutions—such as Stacks.

As we approach the 2024 Bitcoin halving event and heightened market expectations around spot Bitcoin ETF approvals, the Bitcoin ecosystem is becoming increasingly scalable and secure. This evolution is expected to drive significant institutional adoption, positioning Bitcoin at the forefront of a new financial paradigm—one that seamlessly integrates traditional and decentralized financial systems. Driven by the cultural impact of Ordinals and expanding use cases in DeFi and gaming, the potential of Bitcoin smart contracts is anticipated to attract greater attention and capital inflows.

In the medium term, breakthroughs in Bitcoin L2 technologies—particularly Stacks’ Nakamoto Upgrade and the introduction of sBTC—are poised to revolutionize the decentralized finance (DeFi) landscape. These advancements are expected to deliver smoother, more efficient user experiences and unlock new possibilities for Bitcoin-based NFT markets and DeFi applications.

In the long run, Bitcoin is expected to play a central role in institutional adoption of digital assets and decentralized finance (DeFi), especially if the first spot Bitcoin exchange-traded fund (ETF) gains regulatory approval. This milestone could catalyze massive institutional investment into Bitcoin-based financial products and services, deepening the integration between traditional finance and decentralized systems. This convergence will go beyond mere capital injection, combining the strengths of both worlds to open a new era of finance for institutional investors.

Overall, these developments will dramatically enhance Bitcoin’s market value and ecosystem TVL, unveiling a new chapter in decentralized finance. Cutting-edge innovations such as Ordinals, Stacks’ Nakamoto Upgrade, sBTC, and the potential institutional participation driven by spot Bitcoin ETF approvals are not only reinforcing Bitcoin’s market dominance—they are actively shaping the future of finance. Bitcoin is evolving into the cornerstone of a new, trustless financial system, leading the next wave of financial transformation.

Appendix

Additional Resources

- Hal Press of North Rock Digital, Stacks Thesis and the December 2023 updated Stacks Thesis

- Catrina Wang of Portal Venture, Bitcoin Thesis

- Paul Veradittakit of Pantera Capital, Stacks Thesis

- River’s October 2023 Lightning Report

- Sora Venture’s, Bitcoin Utility Q3 2023

- Messari’s State of Stacks Q2 2023 Report

Bitcoin Builders Community

- Bitcoin Builders HK Telegram Group

- Bitcoin Builders BKK Telegram Group

- Bitcoin Builders Association (BBA)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News