Interpreting the Current State and Six Major Trends of National Debt RWA Projects

TechFlow Selected TechFlow Selected

Interpreting the Current State and Six Major Trends of National Debt RWA Projects

This Bing Ventures research article will discuss treasury bond RWAs and the current state and key development trends of the entire RWA sector.

Author: Bing Ventures

On-chain asset tokenization is becoming a significant long-term trend with immense potential. Among its segments, tokenized government bond RWAs (Real World Assets) are emerging as a key branch. This sector achieved nearly 7x growth in 2023 and, after a brief pullback at the end of that year, quickly resumed its upward trajectory.

This research article by Bing Ventures explores the current state and key development trends of government bond RWAs and the broader RWA ecosystem.

Status of the RWA Ecosystem

In the current market environment, relatively low DeFi yields combined with rising real interest rates have jointly driven the growth of RWA assets such as tokenized government bonds. This reflects increasing investor preference for stable, more predictable-return asset classes. Investors seeking balance between traditional finance and cryptocurrency markets are increasingly turning to products like tokenized government bonds that combine features of both worlds.

According to a BCG report, the global market for tokenized illiquid assets is expected to reach $16 trillion by 2030—accounting for 10% of global GDP. This includes both on-chain asset tokenization and traditional fractional ownership models such as ETFs and REITs. For the crypto industry, even capturing a small fraction of this massive market represents a significant growth opportunity.

Ecosystem Participants

RWA Infrastructure

RWA infrastructure, often referred to metaphorically as "RWA Rails," provides the necessary regulatory, technical, and operational foundations for RWA ecosystems. These infrastructures are critical to the sustainable development of the entire RWA space.

Asset Providers

In addition, there are asset providers who focus on creating demand for various types of RWAs—including real estate, fixed income, and equities—contributing to the diversity and breadth of the RWA market.

RWA Market Size

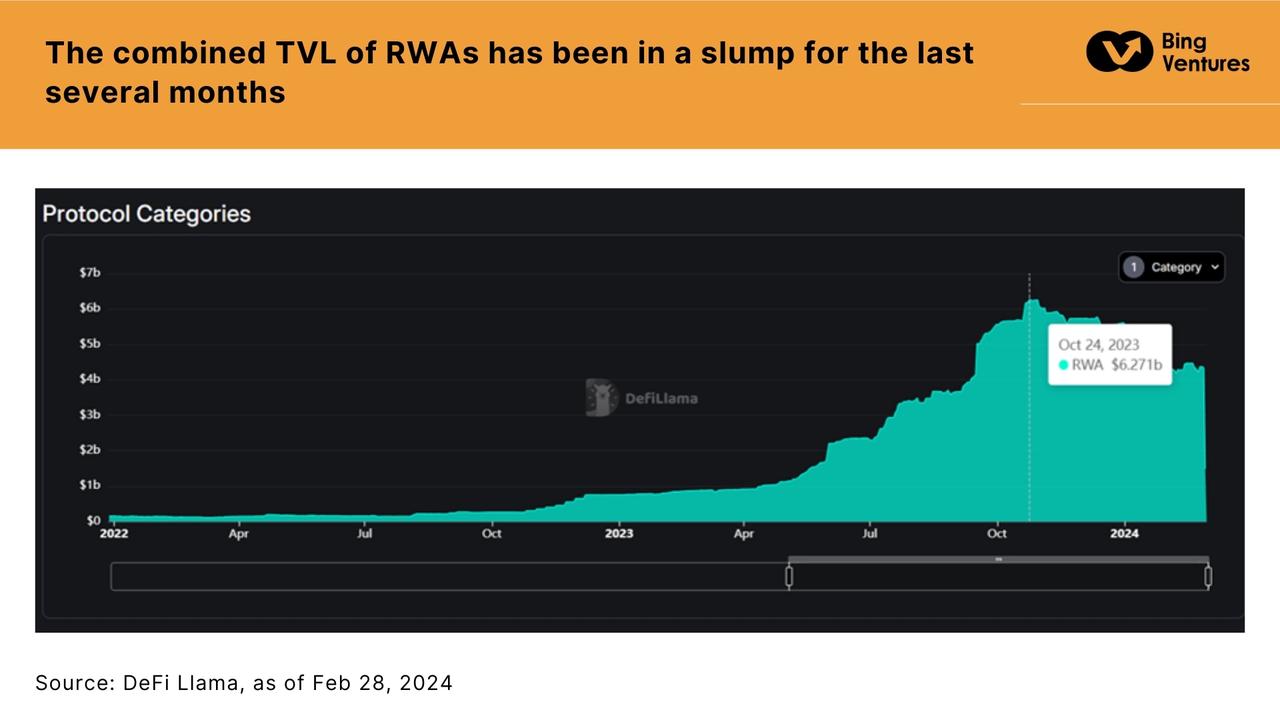

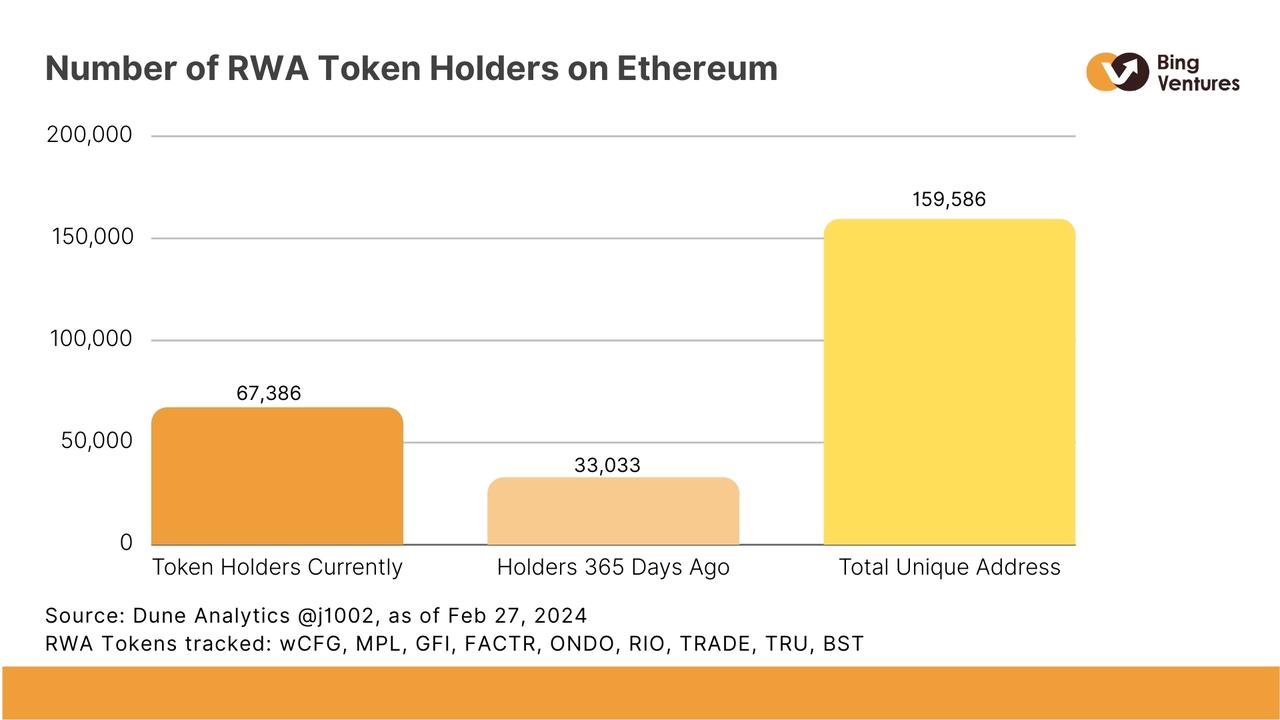

Currently, according to protocols tracked by DeFi Llama, the RWA market ranks as the 11th largest category in DeFi, with a total value locked (TVL) exceeding $4 billion. According to a dashboard created by @j1002 on the Dune Analytics platform, holders of RWA-related protocol tokens on Ethereum exceed 67,000—an increase of over 100% in the past year. In the government bond segment specifically, data from RWA monitoring platform RWA.xyz shows that as of March 21, 2024, the tokenized U.S. Treasury market has grown from approximately $379 million a year ago to $719 million, with an average annualized yield-to-maturity of around 5%.

However, following a peak of $6.272 billion in October last year, the overall TVL of the RWA market has seen a sustained decline over recent months. Similarly, the value of the tokenized treasury market pulled back from $771 million at the end of November last year. Nonetheless, since February this year, the tokenized government bond sector has re-entered an upward trend. This shift may be attributed to the broader recovery in the crypto market, prompting some investors to redirect capital toward higher-yielding opportunities in DeFi lending and liquid restaking.

User Profile and Behavior

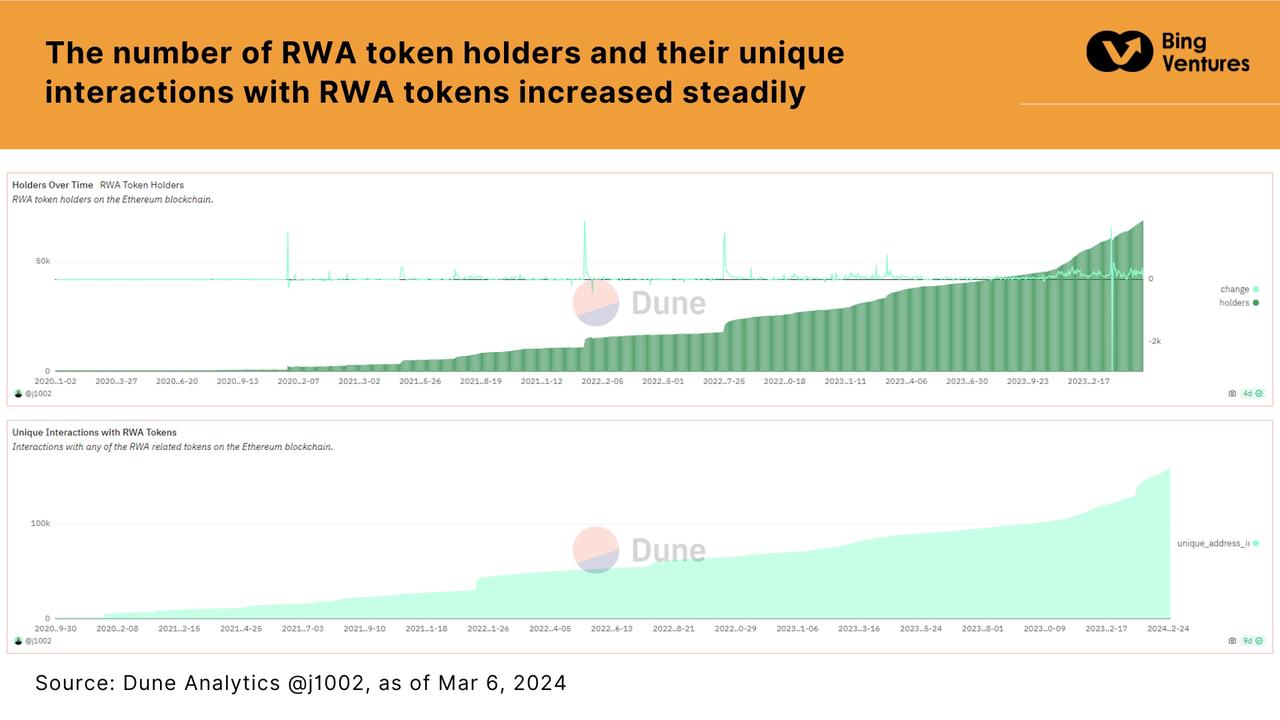

We attempt to analyze RWA user profiles and behaviors to better understand shifts in underlying investor demand. In fact, most RWA users within DeFi are native participants of the crypto ecosystem, indicating that early adopters of RWAs did not transition from traditional investment channels. This is supported by one notable trend: the average creation date of wallet addresses interacting with RWA tokens predates the blockchain launch of those RWA assets. These signs suggest that RWA adoption is evolving organically within the crypto community rather than being driven by a sudden influx of traditional investors. RWA users typically possess strong familiarity with blockchain technology, with many having engaged in DeFi well before RWA gained popularity.

Using the number of RWA token holders as a proxy metric, we can indirectly gauge RWA adoption. Despite a recent drop in overall RWA TVL, both the number of token holders and unique wallet interactions have steadily increased. We believe this reflects growing awareness and positive sentiment toward RWA among investors.

Time-series analysis of RWA holder wallet addresses reveals that most have extensive blockchain activity histories. This confirms that participants in the RWA space are largely composed of healthy, long-term crypto users.

At the same time, we also observe growth in new addresses. This could indicate that as traditional financial institutions such as Franklin Templeton and WisdomTree enter the space, the RWA sector is gradually reaching more conventional investors.

RWAs bridge the gap between the crypto world and traditional finance, but they also inherit real-world risks and limitations. Most RWA interactions require checks from the traditional financial system—such as KYC/AML, credit assessments, and minimum balance requirements—which inherently limit their potential to expand financial inclusivity.

Competitive Landscape Analysis

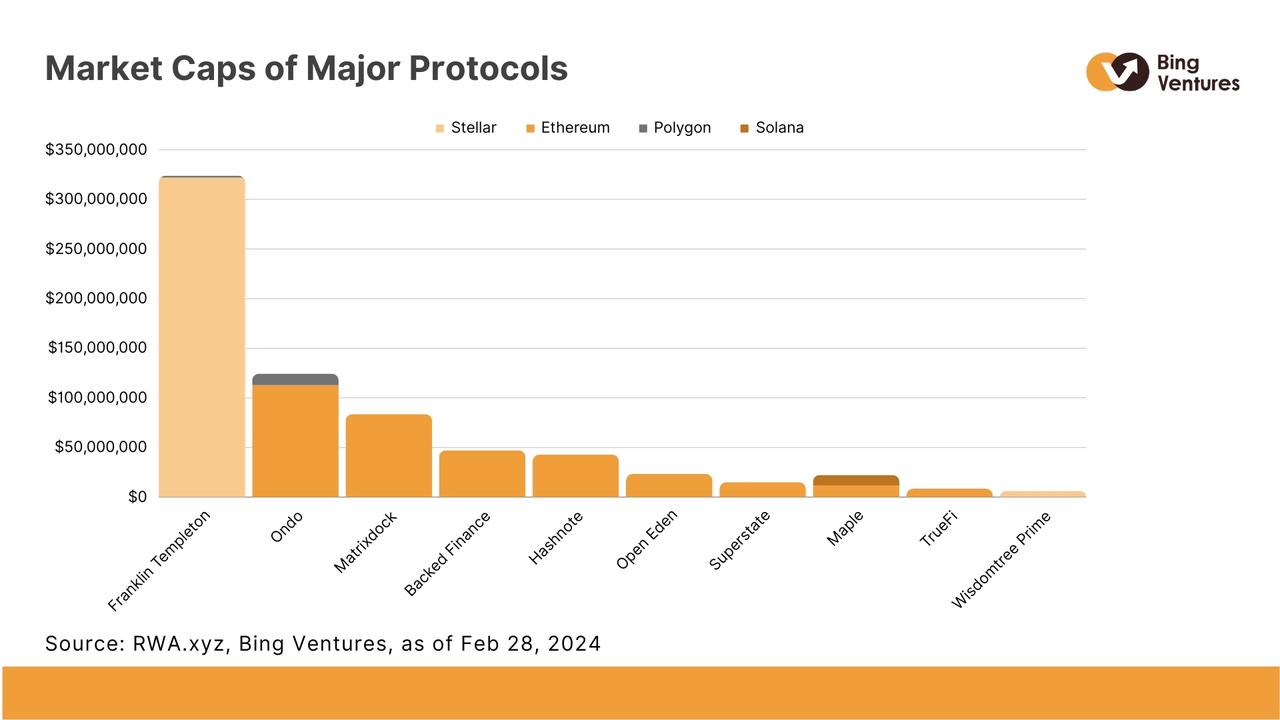

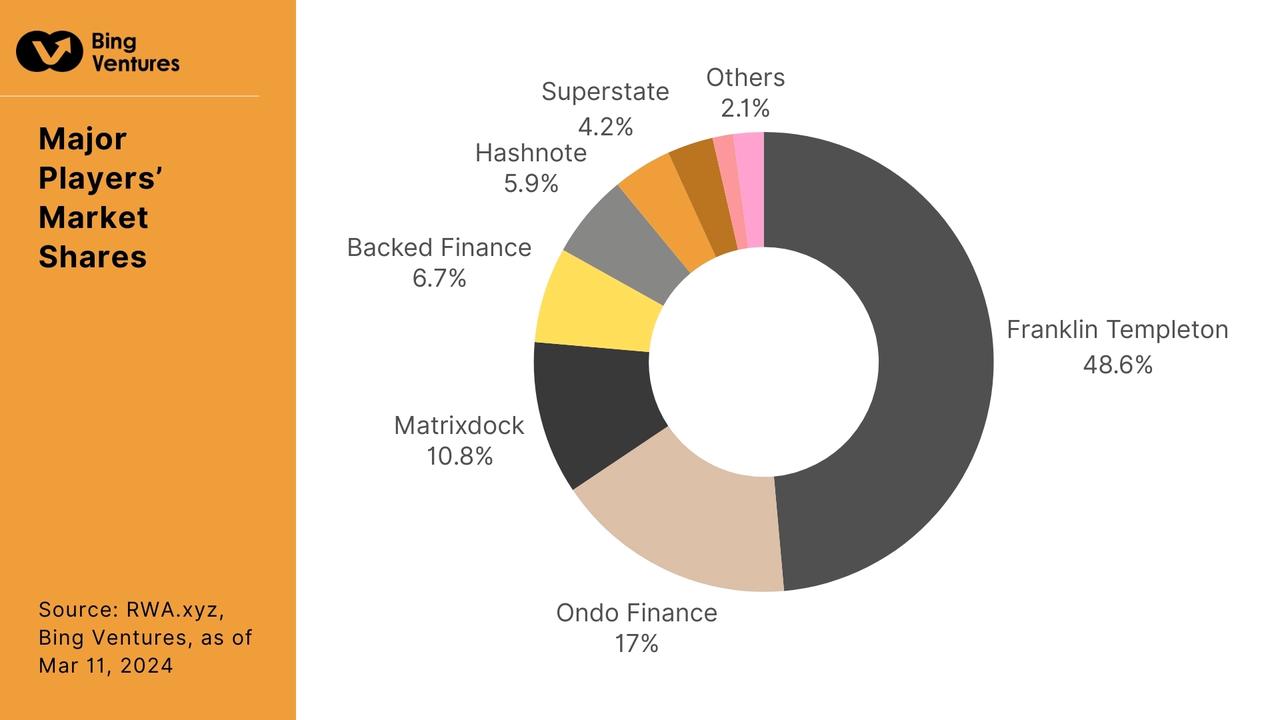

We conduct an in-depth comparison of different projects across market share, growth rate, pricing structure, and user experience to assess the competitive landscape. In the government bond RWA market, Franklin Templeton holds the largest market share, leveraging its deep roots and brand strength in traditional finance. Ondo Finance and Matrixdock, by contrast, demonstrate distinct market strategies and target different user bases. Emerging players like Hashnote and Superstate, while currently holding smaller shares, are growing rapidly, reflecting the dynamism and diversity of the market.

In terms of pricing, management fee variations reflect differing approaches to market positioning and cost control. For example, Franklin Templeton and Ondo Finance offer lower fees, helping attract large institutional investors. Matrixdock and Maple Finance charge higher fees, possibly to offset revenue pressures stemming from smaller market shares.

Regarding user experience, due to the nature and complexity of government bond RWA products, offering clear, intuitive, and user-friendly interfaces is crucial for attracting and retaining users. Moreover, as competition intensifies, service quality and customer support will become key differentiators among platforms.

In summary, government bond RWA projects are in a phase of rapid development, with significant differences across market share, growth speed, pricing strategy, and user experience. Their future trajectories will be heavily influenced by macroeconomic conditions, regulatory policies, and technological innovation. To remain competitive, these projects must continuously refine product offerings, enhance user experience, and adapt to evolving market and regulatory landscapes.

Leading Government Bond RWA Projects

Franklin Templeton

Franklin Templeton is a U.S.-based global asset management firm managing over $1.3 trillion in assets. As a traditional investment firm actively involved in blockchain, Franklin Templeton has previously launched blockchain-focused venture and equity funds.

-

Market Share: 48.6%

-

Treasury Product Market Cap: $350,077,608

-

Management Fee: 0.15%

-

Quarterly Market Share Change: -5.51 percentage points

Ondo Finance

Ondo Finance partners with major asset managers like BlackRock and PIMCO to launch three tokenized U.S. Treasury and bond products: the U.S. Government Bond Fund (OUSG), Short-Term Investment Grade Bond Fund (OSTB), and High Yield Corporate Bond Fund (OHYG).

-

Market Share: 17.01%

-

Treasury Product Market Cap: $122,511,877

-

Management Fee: 0.15%

-

Quarterly Market Share Change: -6.69 percentage points

Matrixdock

Matrixdock is a Singapore-based on-chain treasury platform launched by Matrixport. STBT, Matrixdock’s first product, introduces a risk-free rate backed by U.S. Treasuries.

-

Market Share: 10.78%

-

Treasury Product Market Cap: $77,674,902

-

Management Fee: 0.3%

-

Quarterly Market Share Change: -2.11 percentage points

Backed Finance

Backed Finance, headquartered in Switzerland, focuses on bringing real-world assets on-chain. The company has issued blB01—a tokenized short-term U.S. Treasury ETF—on Coinbase’s Layer 2 network Base.

-

Market Share: 6.73%

-

Treasury Product Market Cap: $48,485,006

-

Management Fee: 0%

-

Quarterly Market Share Change: -0.4 percentage points

Hashnote

Hashnote is a CFTC- and CIMA-regulated firm operating as a fully compliant, institution-grade DeFi asset management platform, offering consumers full-service support, zero counterparty risk, and customizable risk/return strategies.

-

Market Share: 5.92%

-

Treasury Product Market Cap: $42,613,396

-

Management Fee: 0%

-

Quarterly Market Share Change: +0.2 percentage points

Superstate

Superstate is a blockchain-based asset management company. It raised $14 million in venture funding last November to develop regulated on-chain fund products for U.S. investors. In February this year, it launched its first tokenized U.S. Treasury fund on Ethereum.

-

Market Share: 4.16%

-

Treasury Product Market Cap: $29,985,969

-

Management Fee: 0.15%

-

Quarterly Market Share Change: +4.16 percentage points

Open Eden

Open Eden is a crypto startup founded in early 2022 by Jeremy Ng and Eugene Ng, former APAC head and business development lead at Gemini, respectively.

-

Market Share: 3.24%

-

Treasury Product Market Cap: $23,328,886

-

Management Fee: 0%

-

Quarterly Market Share Change: -1.12 percentage points

Maple Finance

Maple Finance is an institutional capital network providing infrastructure for credit specialists to operate on-chain lending businesses. A leader in private credit, Maple launched a new fund pool in April 2023 enabling non-U.S. accredited investors and entities to directly invest in U.S. Treasuries using USDC.

-

Market Share: 1.45%

-

Treasury Product Market Cap: $10,428,616

-

Management Fee: 0.5%

-

Quarterly Market Share Change: -3.23 percentage points

Future Trend Predictions

We identify six key trends that will drive the development of the government bond tokenization segment within the RWA market. These trends will bring profound changes to the government bond RWA space and create new opportunities for investors.

1. Deep Integration of On-Chain and Off-Chain Systems for Enhanced User Experience

The future of the government bond RWA market will see deeper integration between on-chain technologies and traditional financial assets. This trend will streamline asset tokenization processes, improve synchronization between on-chain and off-chain data, and significantly boost transaction efficiency and transparency. For investors, this means faster, more trustworthy transactions—potentially attracting greater capital inflows into the government bond RWA market.

2. Regulatory Technology Innovations for Higher Compliance

As regulators increase scrutiny over digital assets, government bond RWA projects will need to strengthen compliance. We expect to see more blockchain-based compliance innovations—such as smart contracts for automated compliance checks—to meet increasingly stringent regulatory standards. This will build greater investor confidence and encourage wider institutional participation.

3. Enhanced Cross-Chain Interoperability for Greater Accessibility

Advances in cross-chain technology will enable seamless interoperability between government bond RWA products across different blockchains, enhancing liquidity and accessibility. This will give investors more choice and flexibility while reducing market fragmentation. Additionally, improved cross-chain functionality will promote global market integration and unlock more international investment opportunities.

4. Launch of Customized and Personalized Financial Products

Government bond RWA projects are likely to introduce more customized and personalized financial products tailored to specific investor needs. By precisely targeting varying risk appetites and investment goals, these offerings will empower investors to better achieve their financial objectives and expand diversification options.

5. Dual Enhancement of Transparency and Security

Future government bond RWA projects will place greater emphasis on transparency and security, leveraging blockchain's immutability and traceability to strengthen investor trust. This will attract more risk-averse investors and help mitigate risks of market manipulation.

6. Integration of Cutting-Edge Fintech

Applications of artificial intelligence for market analysis, forecasting, and generating automated investment strategies will become a key innovation vector in the government bond RWA market. Such advancements will empower investors with deeper market insights and smarter decision-making tools, elevating the intelligence level of investment processes.

Promising Project Types for the Future

Based on the above analysis, we highlight five types of projects worth watching:

1. Strongly Compliant Projects

In an era of tightening regulations, projects that fully comply with regulatory requirements and deliver high transparency will gain investor and market trust. These projects will build credible reputations and attract broader participation.

2. Technologically Driven Innovative Projects

Projects that leverage cutting-edge technologies such as blockchain, AI, and big data—especially those delivering efficient trading and intelligent investment strategies—are poised to capture meaningful market share and offer faster, smarter investing experiences.

3. Cross-Chain Compatible Projects

Government bond RWA projects capable of seamless interoperability across multiple blockchains—particularly those offering broader asset selection and optimized liquidity—will enjoy clear competitive advantages.

4. User-Friendly Platforms

Platforms that are easy to use, offer comprehensive customer support, and provide educational resources will be more attractive—especially to non-professional investors.

5. Low-Cost, High-Efficiency Solutions

Projects that excel in cost control and operational efficiency—such as those offering low management fees and highly automated services—will stand out in a competitive landscape.

In conclusion, against the backdrop of rising interest rates set by the Federal Reserve, investors are increasingly seeking higher-yield opportunities. The growth of the RWA market indicates that despite macroeconomic pressures, the potential for high returns continues to draw substantial capital. With maturing regulations and advancing technology, we expect the government bond RWA market to continue expanding—especially as stablecoins and CBDCs gain wider adoption.

Nonetheless, government bond RWA projects may face stricter regulatory scrutiny in the future, particularly regarding anti-money laundering (AML) and know-your-customer (KYC) requirements. As the regulatory landscape stabilizes, these projects are expected to integrate more smoothly into the traditional financial system while offering investors new channels and risk management tools.

To mitigate inherent risks in RWA products, we believe government bond RWA issuers should adopt decentralized governance mechanisms—for example, DAO structures similar to those used in private credit markets. Such frameworks enhance transparency, improve risk assessment and mitigation, and may also help reduce compliance burdens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News