Bitcoin's Ecosystem Layer: Unveiling the Era of Trustless Finance (III)

TechFlow Selected TechFlow Selected

Bitcoin's Ecosystem Layer: Unveiling the Era of Trustless Finance (III)

Emerging Bitcoin ecosystem layers are introducing diverse functionalities, further transforming the network's capabilities.

Authors/Contributors: Kyle Ellicott, Yan Ma, Darius Tan, Melody He

Chinese Translation: 0xNirvana

"Bitcoin Layers: Unveiling the Era of Trustless Finance" is a research report on various developments within the Bitcoin ecosystem. This report was co-authored by the Spartan Group team, Kyle Ellicott, and multiple experts who generously provided feedback, insights, and reviewed the final version. Drafted in December 2023, all data reflects the state at the time of writing. This article is the third in a four-part series.

Part One:Bitcoin Layers: Unveiling the Era of Trustless Finance (I)

Part Two:Bitcoin Layers: Unveiling the Era of Trustless Finance (II)

The concept of Bitcoin Layers emerged in 2018 as a response to scalability challenges, marking a pivotal turning point in Bitcoin's evolution. Historically, efforts to enhance Bitcoin L1 performance have shared a common goal: enabling off-chain transactions to improve network scalability. These attempts revolve around the secure settlement layer provided by L1. Drawing inspiration from Ethereum’s layered architecture, Bitcoin layers have evolved into a range of solutions including Layer 2 (L2), Layer 3 (L3), data layers, and application layers. These innovations reflect Bitcoin’s adaptive response to its inherent limitations, demonstrating an intrinsic drive toward building a stronger, more functional blockchain infrastructure.

Emerging Bitcoin layers are introducing diverse capabilities that further transform the network’s efficiency. These layers provide:

Smart Contract Programmability: Enables execution of complex financial and contractual transactions directly on the Bitcoin network.

Increased Throughput Speed: Significantly reduces transaction processing times, with some layers achieving speeds under 30 seconds.

Trust-Minimized BTC Transfers to L2: Facilitates secure and efficient movement of BTC across layers, offering a solution to the excessive centralization issues present in federated approaches to Bitcoin adoption.

Cost Efficiency: Reduces transaction costs, lowering barriers to entry and improving accessibility for a broader user base.

Asset Issuance and Rollups: Introduces new methods for asset creation and batched transaction processing to boost efficiency.

Interoperability and Privacy Measures: Enhances interaction with other blockchain systems and protects user privacy.

Virtual Machines (VMs) and Specialized Features: Supports applications across gaming, finance, media, and decentralized science (DeSci).

These layers built atop Bitcoin L1 are strategically designed, leveraging L1 as a "cold storage" platform for foundational BTC assets. This layered architecture not only allows seamless transfer of BTC across different layers—unlocking over $850 billion in dormant capital—but also enables applications built on these layers to benefit from Bitcoin’s unparalleled security and stability.

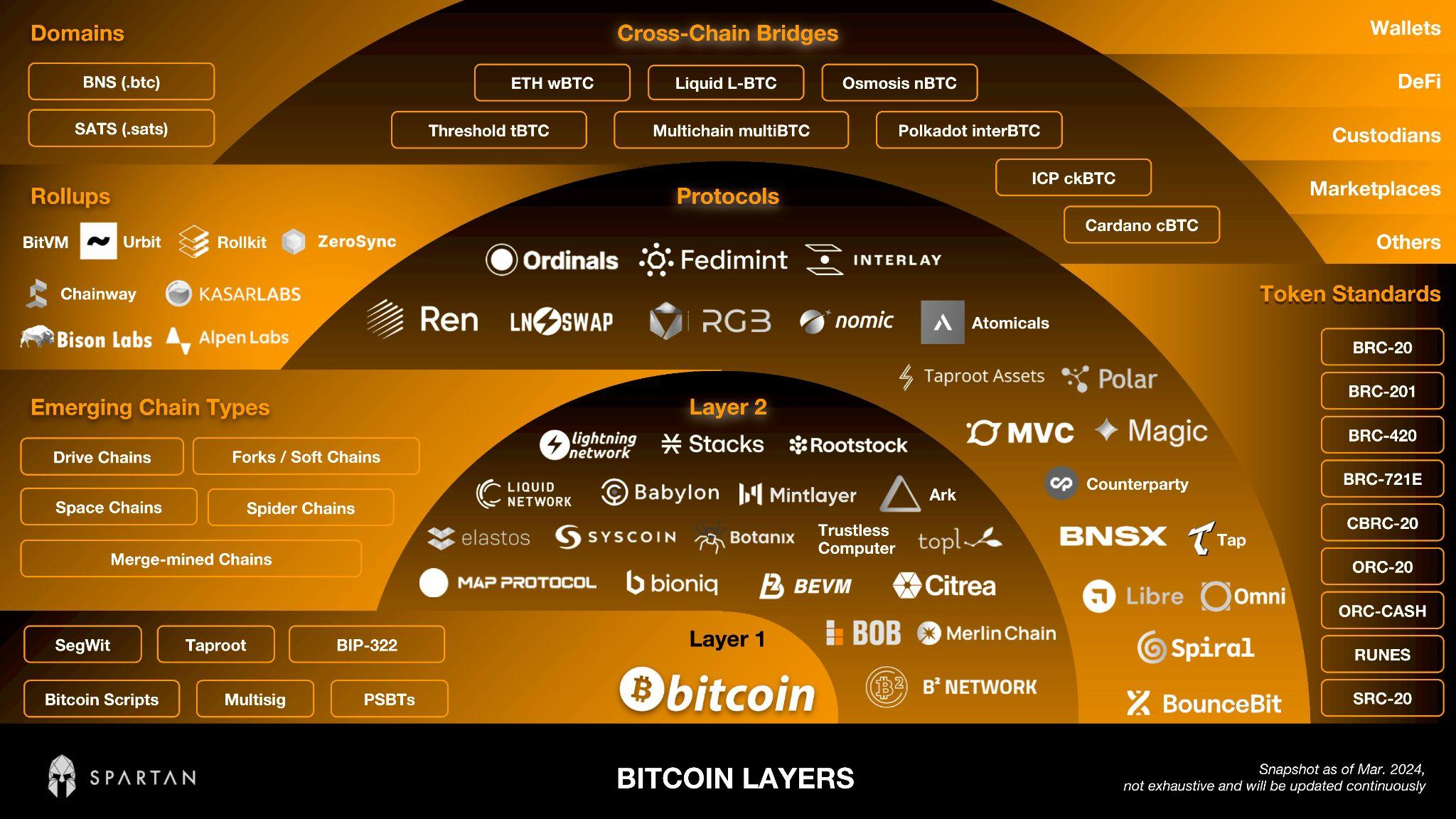

Bitcoin Layers Landscape (March 2024)

By Q4 2023, significant progress had been made in Bitcoin layer development, particularly in L2 solutions. The Bitcoin ecosystem has expanded to include sidechains, drivechains, merge-mined chains, and proof-of-stake chains. Concurrently, numerous protocols, token standards, cross-chain bridges, rollups, and other innovative solutions have emerged.

These developments represent not just technological leaps but also a paradigm shift in Bitcoin’s utility, opening new pathways for user adoption and application deployment. The layered approach highlights Bitcoin’s adaptability and evolutionary capacity, further solidifying its position in an ever-changing digital world. The following sections detail key innovations within these categories, showcasing the dynamism and forward-looking nature of Bitcoin’s layered ecosystem.

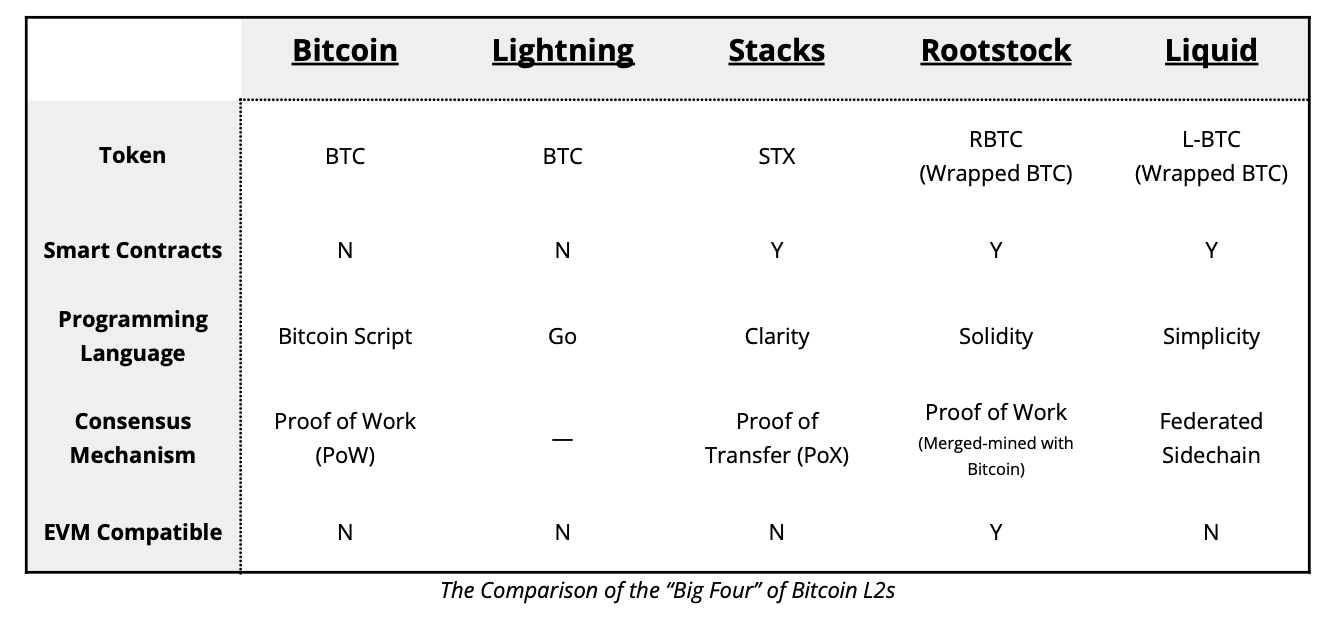

Bitcoin L2: The Four Giants

Bitcoin’s Layer 2 landscape is led by the “Four Giants”: Stacks, Lightning Network, RSK, and Liquid. These four handle the majority of Bitcoin L2 transactions and shape the contours of Bitcoin’s scalability solutions. Each L2 offers unique features and contributes distinctively to the growth and scalability of the Bitcoin ecosystem.

Comparison of Bitcoin L2 "Four Giants"

1. Stacks, launched in 2017 by Princeton computer scientists Ryan Shea and Muneeb Ali, aims to enable smart contracts on Bitcoin. The Stacks network went live in January 2021, allowing smart contracts and decentralized applications to use Bitcoin as a secure L1. Stacks activates Bitcoin’s economy through its Proof-of-Transfer (PoX) consensus mechanism, which runs parallel to Bitcoin’s Proof-of-Work (PoW) and reuses Bitcoin’s computational power.

Network security is further enhanced via “Stacking,” where STX token holders commit their native STX tokens (valued at $252.87 million in the current stacking cycle) to validate transactions, securing the Stacks network and earning rewards in BTC.

Smart contracts on Stacks are written in Clarity, a human-readable native language capable of responding to Bitcoin transactions and natively swapping assets with BTC.

The STX token serves as fuel on the L2 and was the first token recognized by the U.S. Securities and Exchange Commission (SEC) in 2019, later filing a decentralized update with the SEC prior to mainnet launch in 2021 as a non-security asset.

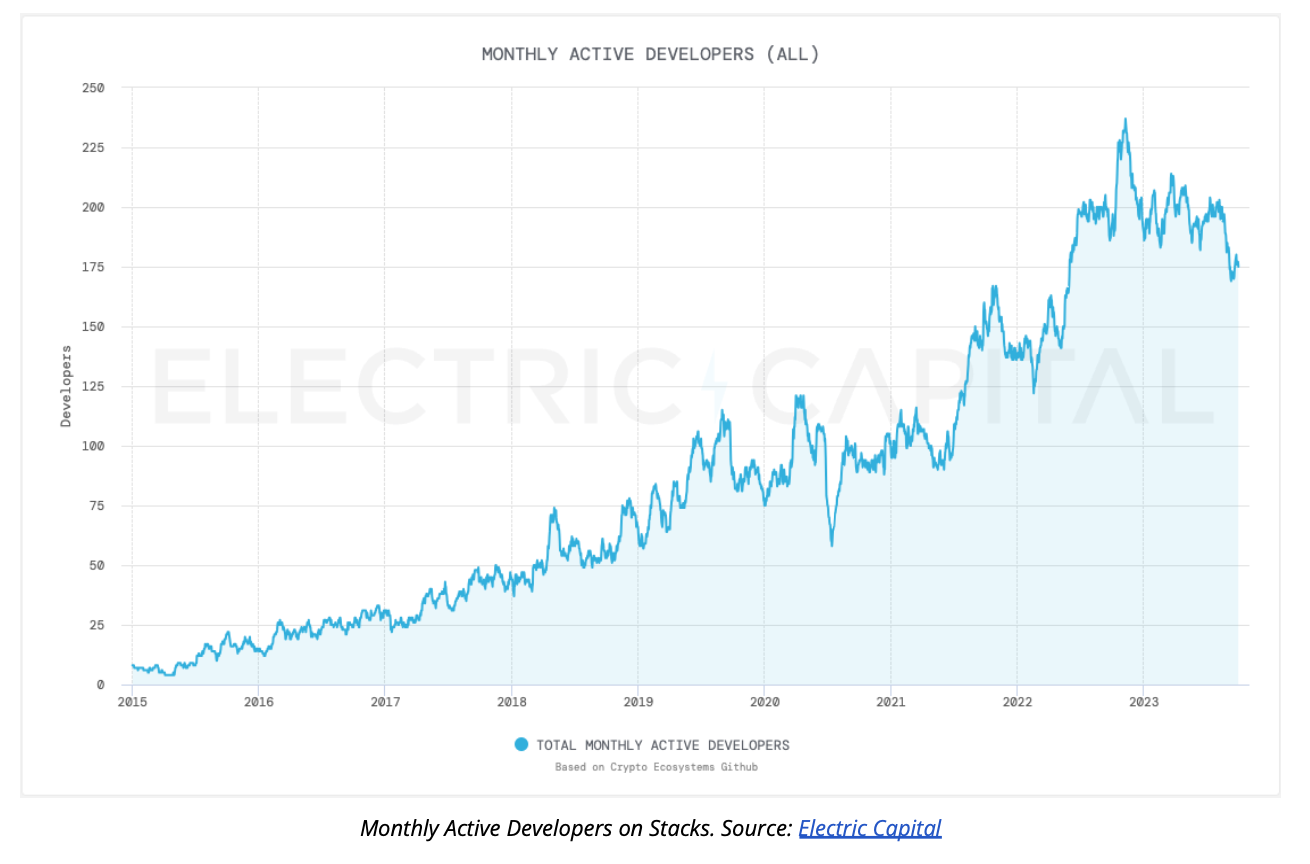

STX ranks among the top 50 projects in the entire crypto industry and is currently the only Bitcoin L2-native token in CoinMarketCap’s top 100. According to the 2022 Electric Capital Developer Report, developer activity on STX ranked 38th industry-wide, with monthly active developers growing consistently since 2015, reaching 175 by October 2023.

Monthly Active Developers on Stacks. Source: Electric Capital

Future Potential Factors

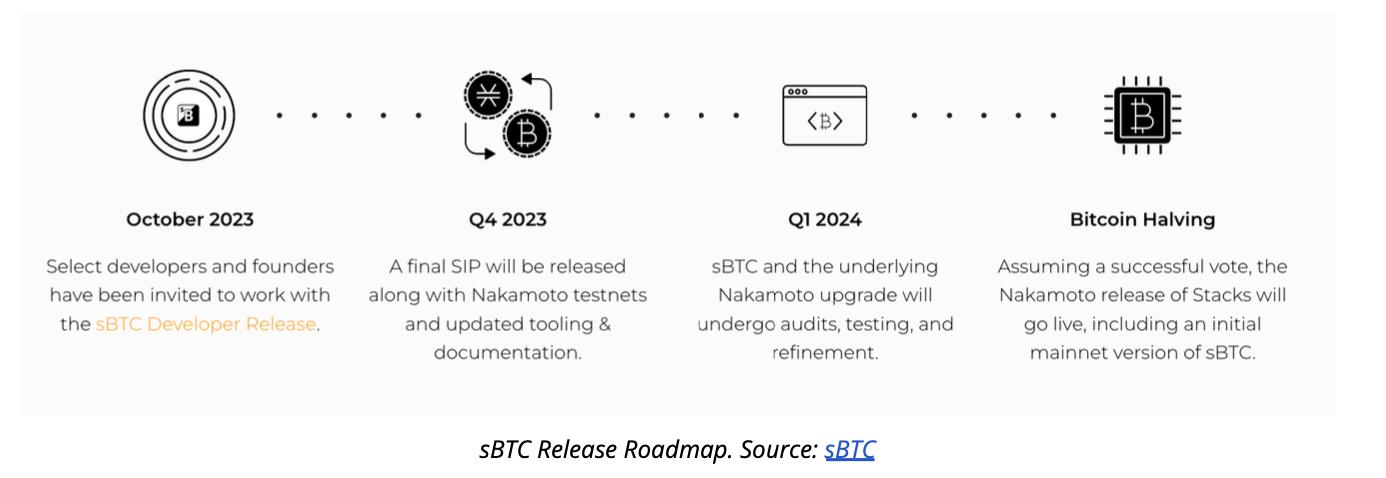

○ The Nakamoto network upgrade (Q2 2024) will enable fast and low-cost BTC transfers via L2 while maintaining 100% security alignment with Bitcoin (resistance to reorganizations). Transaction speed will improve from the current 10–30+ minutes per settlement to approximately one block every 5 seconds—a roughly 1000x speed increase, far surpassing Bitcoin’s average two-block interval. As of December 2023, this upgrade achieved two major milestones: v0.1 “Mockamoto” and v0.2 Neon, a “controlled” testnet featuring a single miner, single stacker, and stacker signature functionality.

○ sBTC is a decentralized, 1:1 BTC-pegged asset that enables BTC deployment and transfer between Bitcoin and Stacks (L2), usable as gas without requiring additional assets. sBTC transfers are secured 100% by Bitcoin’s hash power; reversing a transaction would require attacking Bitcoin itself.

sBTC Launch Timeline. Source: sBTC

Stacks’ successful operation transforms Bitcoin into a fully programmable asset in a decentralized manner, driving increased demand for both Stacks and Bitcoin. This could create fertile ground for a rapidly expanding Bitcoin economy, unlocking hundreds of billions in dormant Bitcoin capital and positioning Bitcoin as a pillar of a more secure Web3 network.

2. The Lightning Network, launched in 2018 (white paper published in 2016), enables instant, low-cost micropayments on Bitcoin regardless of geography. Its notable transaction throughput and growing adoption underscore its role in enhancing Bitcoin’s scalability and transaction efficiency.

The protocol uses smart contracts to create payment channels combining on-chain settlement with off-chain processing.

When a channel closes, transactions are consolidated and sent to the underlying network—Bitcoin. The native asset of the Lightning Network is Lightning Bitcoin.

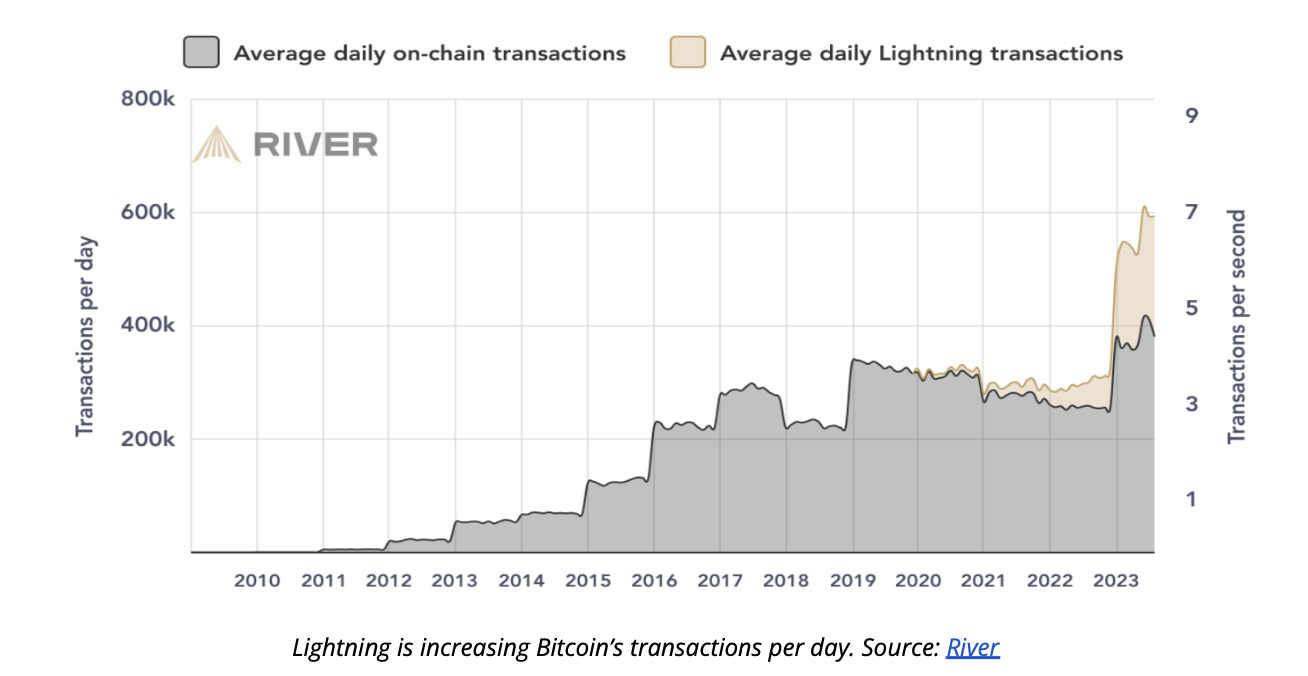

As of August 2023, the network processes approximately 213,000 routed transactions daily, totaling around 6.6 million monthly—about 52% of the network’s public capacity. This represents a 1212% increase from K33’s estimated 503,000 Lightning payments in August 2021.

Additionally, on average, the Lightning Network handles at least 47% of Bitcoin’s daily on-chain transaction volume.

The Lightning Network is increasing Bitcoin’s daily transaction volume. Source: River

3. Rootstock (RSK), founded in 2015 by RSK Labs, brings Ethereum Virtual Machine (EVM)-compatible smart contracts to Bitcoin via its RSK Virtual Machine (RVM). Using RVM, developers can port Ethereum contracts onto Bitcoin. RSK’s native asset is Smart Bitcoin (RBTC), pegged 1:1 with BTC but not trustless. Due to its security relying on “merged mining,” RBTC still depends on centralized custodians, highlighting a trade-off between security and decentralization in L2 solutions.

4. Liquid Network, launched by Blockstream in 2018, operates as a Bitcoin sidechain enabling fast, secure, and confidential transactions. Independent of Bitcoin, Liquid maintains its own ledger and abandons Bitcoin’s PoW consensus, instead relying on the Liquid Federation—a consortium of about 60 members—to produce new blocks. Liquid’s native asset, Liquid Bitcoin (L-BTC), is a “wrapped” version of BTC. Liquid Network’s independent operation exemplifies methodological diversity within the Bitcoin L2 ecosystem.

Today, although no Bitcoin L2 solution holds more than 10,000 BTC or boasts millions of users, their potential for exponential growth remains undeniable, reinforcing their critical role in advancing Bitcoin’s future scalability and functionality. As Bitcoin L2 technology matures, developers are exploring multiple paths for rapid experimentation while preserving core network stability. The success of future L2 solutions will depend on their ability to offer complete execution environments (like EVMs) to overcome current development constraints and support a more inclusive developer ecosystem.

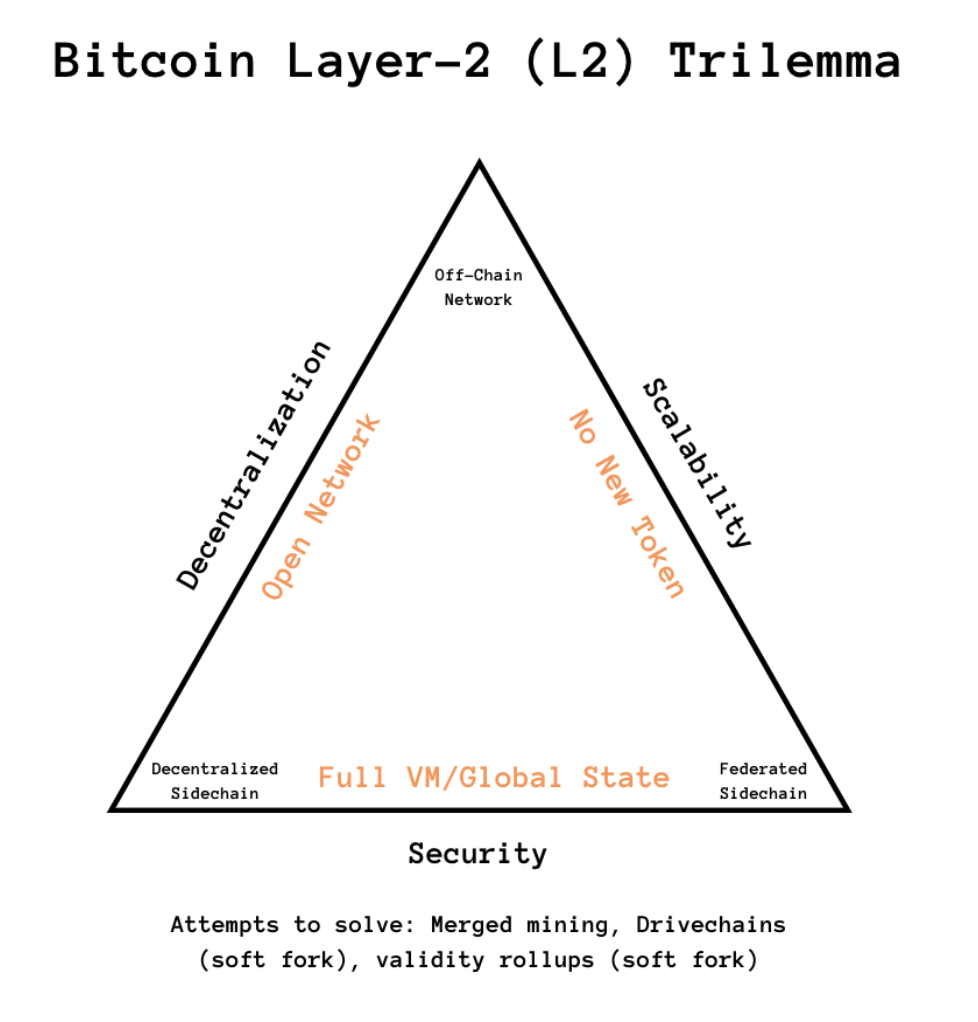

Decoding Bitcoin L2’s Impossible Triangle

In pursuing improved scalability for Bitcoin layers, a new challenge emerges: the L2 impossible triangle. Revisiting blockchain’s trilemma and applying it to Bitcoin L2s reveals similar trade-offs, albeit slightly nuanced. In the L2 impossible triangle, choices are limited to:

A. Open network vs. federated network.

B. Introduction of a new token.

C. Presence of a full/global virtual machine (VM) or only limited off-chain contracts.

The industry has attempted to “square” this “impossible triangle” by repurposing existing Bitcoin miners to mine on L2s. RSK (formerly Rootstock) and Drivechains are early examples. In such models, miner incentives remain unresolved—a challenge reminiscent of early Ethereum, where transaction fees may not sufficiently incentivize miners.

Lightning Network chooses A and B—open network, no token—but lacks a full VM with global state.

Stacks chooses A and C—open network with full VM—and introduces a new token (STX).

Liquid chooses B and C—no token but with full VM—operating via federation.

Early discussions mentioned adding new opcodes to Bitcoin (L1), theoretically helping resolve existing issues. For example, an op-snark-verify opcode could verify L2 computations directly on Bitcoin (L1). However, historically, implementing soft forks or hard forks in Bitcoin is highly challenging, suggesting such solutions may not be feasible in the short term.

Looking ahead, the Bitcoin ecosystem is likely to expand far beyond current L2 solutions, requiring hundreds of new ones to fully explore and realize the network’s potential. Currently, developers are weighing trade-offs in the L2 trilemma, striving for balance. A trend is emerging toward open networks where anyone can freely join and mine, providing full VM environments for smart contracts with global state as a core feature. Mimicking successful architectures seen in ecosystems like Ethereum and Solana, this approach is expected to significantly influence the future trajectory of Bitcoin L2 development.

Proliferation of Innovative Solutions

Beyond the four established giants, rapid experimentation continues across the Bitcoin ecosystem, with numerous projects emerging in infrastructure tools, standards, and protocols. As the tech stack evolves, filling existing technical gaps in application needs, these innovations are actively defining new categories.

Ark is an experimental L2 protocol launched in May 2023. Through its always-on, trustless intermediary—Ark Service Providers (ASPs)—Ark enables low-cost, anonymous off-chain scalable payments in Bitcoin. Users transacting on the protocol allow recipients to receive funds without needing inbound liquidity, reducing costs while preserving recipient privacy compared to the Lightning Network comparison.

Babylon, unveiled at Cosmoverse 2023, is a proof-of-stake (PoS) network featuring two security-sharing protocols connecting Bitcoin and other PoS networks: Bitcoin timestamping and bridgeless staking.

Botanix (Spiderchain L2) is a PoS Ethereum Virtual Machine (EVM) designed for Bitcoin, using a distributed multi-signature network to achieve bidirectional pegging and enhanced interoperability.

Interlay is a modular and programmable network connecting Bitcoin and multi-chain ecosystems, operating as a Polkadot parachain. Interlay creates a decentralized Bitcoin bridge that mints iBTC, or “valuated BTC,” a multi-chain asset backed 1:1 by Bitcoin.

MintLayer is a PoS network designed as a Bitcoin sidechain, optimized for decentralized finance (DeFi) activities like atomic swaps. On MintLayer, users can create tokens without using wrapped BTC or smart contract languages (e.g., Solidity), simply by creating transactions containing extra data due to its UTXO-based model. The network aims to produce a block every 120 seconds using Verifiable Random Functions and achieve finality after 1,000 blocks.

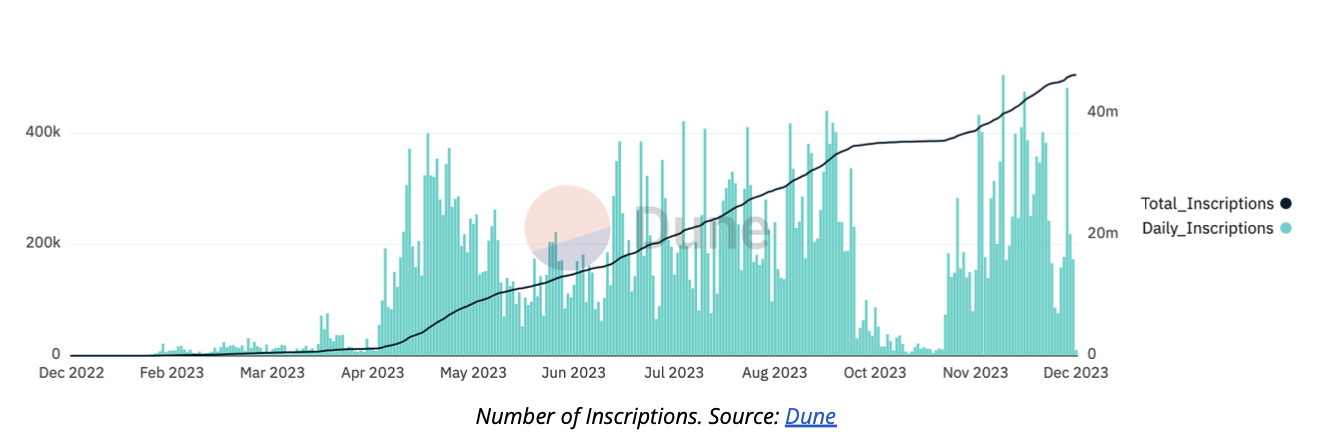

Ordinals. The innovative framework “Ordinal Theory,” released on June 30, 2022, immediately sparked a cultural wave of building on Bitcoin. Just months later, by December 2023, developers increasingly turned to Ordinals (Ord), enabling inscription directly on Bitcoin without requiring separate sidechains, tokens, or updates to Bitcoin’s core network. These inscriptions are immutable, on-chain, non-monetary digital artifacts (e.g., Bitcoin NFTs) containing raw file data (video, audio, images, executable software), permanently recorded on Bitcoin and transferable to addresses or wallets.

Since the first inscription on December 14, 2022, Ordinals has followed an exponential growth path, with new experiments, infrastructure tools, and standards continuously emerging. Within the initial 90 days, over 460,000 inscriptions were completed; to date, annual inscriptions exceed 46.2 million, generating fees of approximately 3,365 BTC (worth ~$148.8 million).

RGB Network (Really Good Bitcoin) is a Bitcoin-based protocol leveraging Lightning Network technology but is not a token protocol.

Threshold Network is a privacy-focused merged network combining Keep and NuCypher functionalities, enabling users to protect private data using Keep Network’s off-chain containers and NuCypher’s secret management and dynamic access control tools. Threshold created tBTC, a decentralized, permissionless bridge connecting Bitcoin and Ethereum networks.

Developers release numerous new protocols and standards weekly—these represent only a fraction of ongoing experiments. The continuous emergence of new protocols and standards reflects the vitality and evolution of Bitcoin’s tech stack. The momentum generated, especially against the backdrop of the upcoming Bitcoin halving in Q2 2024, signals vast potential for further innovation and adoption across the Bitcoin ecosystem.

Rise of Token Standards

Following the emergence of multiple new protocols, the community has begun experimenting with novel token standards, offering an initial glimpse into token designs leveraging Bitcoin’s unique architecture. While still nascent, these standards are gaining recognition among developers, who increasingly see parallels with counterparts in the Ethereum ecosystem.

BRC-20 is an experimental token standard created by DOMO and launched in early March 2023 to issue fungible tokens on Bitcoin. Leveraging Ordinal inscriptions and JSON data, it mimics Ethereum’s ERC-20 model but is tailored for Bitcoin with limited functionality. Multiple platforms quickly followed, developing tools and launchpads supporting this experimental standard (ALEX, Bitget, Leather, OrdinalsBot, UniSat Wallet, Xverse, etc.). Notably, ORDI—the first token deployed under this standard—surpassed a $1 billion market cap by May 2023, ranking #52 on CoinMarketCap, exceeding $1.3 billion at the time of writing.

BRC-721E is an experimental token standard similar to the widely adopted ERC-721, jointly developed by Bitcoin Miladys, Ordinals Market, and Xverse. Initially, this standard allows users to bridge NFTs from Ethereum to Bitcoin, inscribing a lightweight version of the NFT along with a link pointing back to the original Ethereum version, and supports airdrops. Once bridged, the NFT automatically appears on Ordinals Market. This experiment opens possibilities for cross-chain interactions between the two networks.

ORC-20 is an experimental open token standard aiming to maintain backward compatibility with BRC-20 while offering more flexible namespaces and introducing UTXO-based mechanisms in future iterations to prevent double-spending.

ORC-CASH is an experimental token standard based on the Ordinals Protocol, optimized for the UTXO security model and serving as a simplified version of the ORC-20 standard.

RUNES, proposed in September 2023 by Ordinals creator Casey Rodarmor, is an experimental fungible token protocol intended as an alternative to BRC-20. Runes avoids reliance on off-chain data or native tokens, instead using UTXOs to hold balances and identifying transactions via specific script conditions.

SRC-20, created by Mike In Space, is a token standard known as Bitcoin Secure Tradeable Art Maintained Securely—digital artworks stored directly on the Bitcoin blockchain and residing in the UTXO set (unspent transactions), making them immune to pruning.

STX-20 is an experimental inscription protocol standard launched in December 2023, designed to create and share digital artifacts on the Stacks blockchain by embedding protocol information in metadata during STX token transfers, limited to 34 symbols. STX-20’s release triggered one of the largest blocks ever on the Stacks network recorded, containing over 10,000 transactions.

Privacy and Security Solutions

Beyond scalability, developers are working to bring rollup technology to Bitcoin and adding crucial security layers. Though still in early stages, notable experimental projects include Urbit, Rollkit, ZeroSync, Alpen Labs, Bison Labs, Chainway, Kasar Labs, and others.

Other ecosystem experiments include specially designed protocols such as 1btc, BNSx, and Rooch Network, giving rise to new category definitions like Drivechains, Spiderchains, Federated Chains, Spacechains, and Softchains, each reflecting project advancements aimed at expanding the tech stack.

These innovations elevate Bitcoin’s intrinsic value and position it as a more multifunctional, secure platform. They play a critical role in enhancing network scalability and supporting diverse applications. As these technologies evolve, they are expected to significantly strengthen the network’s ability to handle larger transaction volumes and varied applications while upholding core principles of privacy and security. The proliferation of Bitcoin ecosystem innovations shares a singular goal: delivering seamless user experiences without concern for underlying infrastructure limitations.

Bitcoin and the Future of Finance

Bitcoin is shaping a trustless financial ecosystem through innovations in Layer 2 solutions and privacy-enhancing technologies. These advances mark a significant shift in Bitcoin’s functionality and its potential impact on the financial industry. With enhanced privacy, security, and scalability, Bitcoin is poised to support a wide range of financial applications—from traditional transactions to innovative decentralized finance (DeFi) solutions. This transformation underscores Bitcoin’s evolving role—not merely as an asset, but as a foundational component in building safer, more efficient, and inclusive financial systems. As these technologies gain adoption, Bitcoin’s central role in constructing trustless financial infrastructures becomes increasingly evident, reinforcing its status as a key pillar of future finance.

Author Update (March 1, 2024)

Since our initial report, the Bitcoin ecosystem has witnessed remarkable developments. Notably, Bitcoin surpassed $63,000 for the first time since November 2021, signaling a strong market rebound. Meanwhile, the landscape of Bitcoin Layer 2 solutions is rapidly expanding, with DWF’s L2 tracker now listing 28 new Bitcoin L2 projects. So the question arises: how do we accurately assess the potential of these L2s?

Bitcoin Magazine has established an editorial policy defining true Bitcoin L2s by three criteria: using Bitcoin as the native asset, using Bitcoin for transaction settlement execution, and demonstrating functional dependence on Bitcoin—sparking considerable debate. This definition classifies many emerging platforms, especially those developing toward decentralized scaling with their own tokens, as “meta-protocols” or “parasitic chains” rather than genuine L2 solutions.

Despite these classifications, many project teams and users remain unconcerned, as the broader goal remains strengthening the overall ecosystem. Below are some notable innovations capturing our attention:

Merlin Chain – Led by the team behind BRC-420 and Bitmap, this asset-centric L2 aims to bridge substantial L1 assets and their user base to L2, achieving a total value locked (TVL) exceeding $2 billion by end of February.

B-squared Network – Employing a modular approach, it combines zk-rollup as the execution layer with the B² Hub, integrating decentralized storage with the Bitcoin network to form a comprehensive ecosystem covering consensus, data availability, and settlement layers.

BounceBit – A Bitcoin restaking chain allowing users to earn original CeFi yields while utilizing LSD to stake BTC and engage in on-chain farming—essentially “restaking” on Bitcoin. TVL surged past $500 million this month, with successful fundraising completed.

BOB – This project leverages the Ethereum Virtual Machine (EVM) to enable creation and execution of smart contracts.

BEVM – Achieves decentralized interaction between Bitcoin and BEVM through a combination of Bitcoin light nodes and Taproot threshold signatures under a POS consensus.

Citrea – A zkEVM on Bitcoin, where proofs are recorded on Bitcoin and verified via BitVM.

Notably, the rise of many emerging Bitcoin L2 projects is primarily driven by Chinese teams and supported by large Chinese-speaking communities bringing significant TVL, indicating a shift of the Bitcoin ecosystem toward the East.

These projects have successfully enhanced Bitcoin’s cross-chain capabilities, achieving notable growth by leveraging prior development experience. However, this surge has also raised concerns about potential liquidity fragmentation among L2 solutions, as seen in Ethereum. Conversely, it presents opportunities to broaden Bitcoin asset usage and attract more Bitcoin users to these new platforms. While many products exhibit similarities, the future of Bitcoin L2s remains uncertain and dynamic, awaiting further developments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News