ArkStream Capital: 9 Sectors Where Web3 Will Explode in 2024

TechFlow Selected TechFlow Selected

ArkStream Capital: 9 Sectors Where Web3 Will Explode in 2024

ETH L2, Restaking, BTCfi, GameFi...

Written by: ArkStream Capital

1. ETH L2 Summer Arrives as Expected

ETH + L2 has effectively become the largest homogeneous cross-chain ecosystem cluster. With the launches of Starknet, zkSync, Scroll, and Blast, competition between technical and market-driven approaches will intensify the L2 landscape.

Watchlist: Starknet / zkSync / Scroll / Blast / Manta

2. Modularization: An Inevitable Evolution in Public Chain Technology

With Celestia's launch, the data availability (DA) layer is showing signs of breaking Ethereum’s de facto monopoly. Today, solutions like OP Stack and Polygon CDK offer mature smart contract frameworks, enabling industry-wide exploration into Bitcoin-based DA using cutting-edge research such as BitVM. Innovations including shared/decentralized sequencers and RaaS (Rollup-as-a-Service) are flourishing, signaling rapid modular evolution across blockchain infrastructure.

Watchlist: Celestia / Altlayer / Dymension / Avail / Fuel / Espresso

3. BTCfi Explosion: Unlocking 10% of Bitcoin’s Liquidity

The fusion of purism and market momentum generates energy beyond what technical purists might imagine. The value of unlocking Bitcoin's liquidity remains an underexploited gold mine. Following the inscription narrative, we’re now entering a wave of Bitcoin L2s and applications. As over 10% of Bitcoin’s liquidity becomes accessible, BTCfi is poised to support a market cap exceeding $100 billion.

Watchlist: Stacks / Merlin / B² Network / Chainway

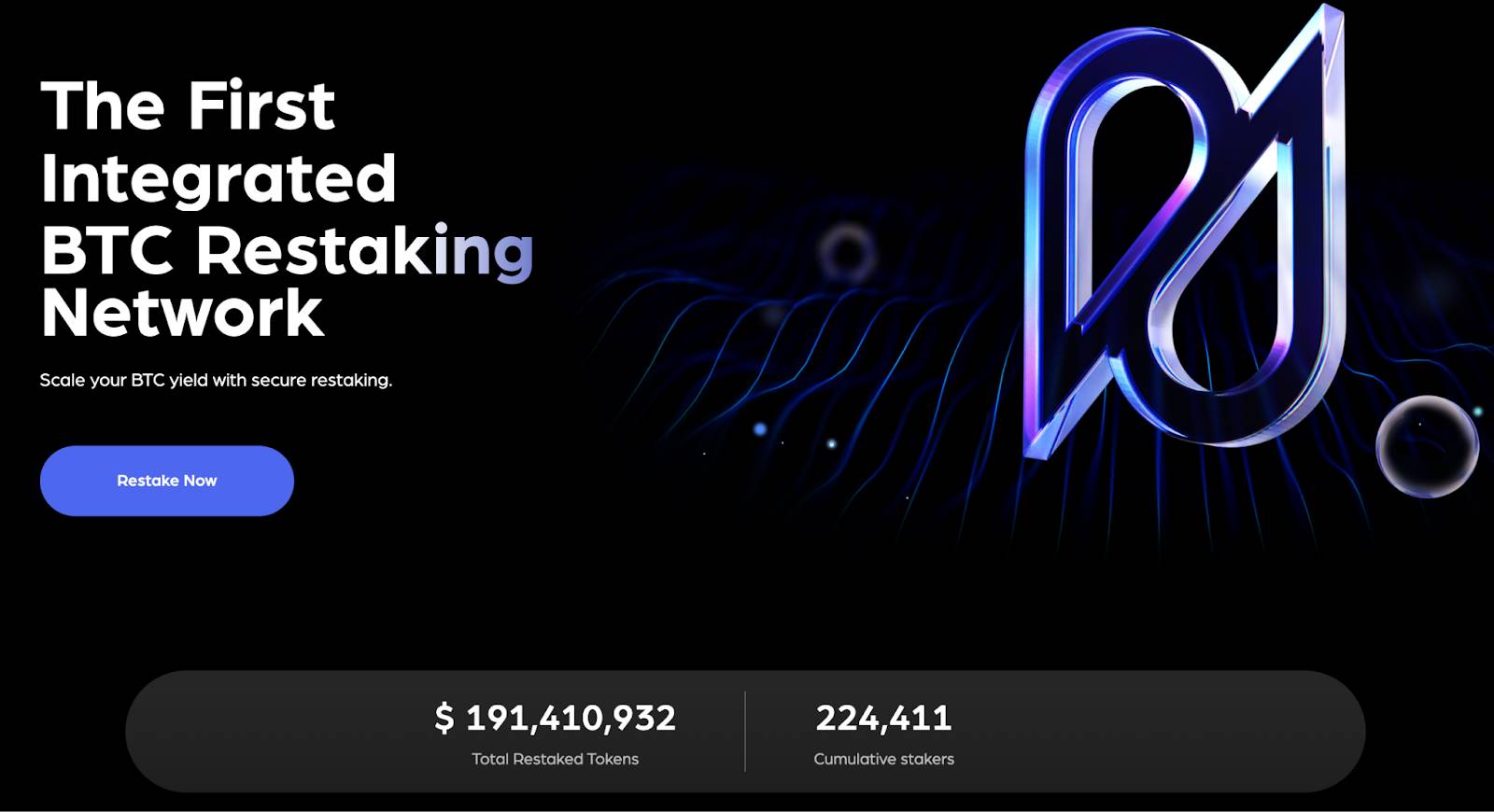

4. Restaking: The Matryoshka Doll of Consensus Lego

Within the modular blockchain narrative, projects exploring the consensus layer remain limited. Bitcoin and Ethereum provide the two globally recognized sources of consensus security. Restaking enables emerging blockchains to bootstrap with robust security, avoiding unhealthy tokenomics driven by excessive inflation. In the Bitcoin ecosystem, Babylon leads this movement, with increasing adoption across BTC-related projects. On Ethereum, EigenLayer dominates, extending the LSD (Liquid Staking Derivatives) narrative into LRD (Liquidity Re-Staking Derivatives). Building atop these narratives, Pendle—known for yield and principal stripping—stands out as a unique ecosystem player, consistently delivering strong performance in TVL, user metrics, and token price.

Watchlist: EigenLayer / Babylon / Renzo / Puffer / Pendle

5. GameFi’s Second Cycle

The widespread adoption of MPC wallets has expanded user accessibility. After three years of iteration, new games offer deeper gameplay and stronger user acquisition than their predecessors. Richer content increases economic complexity, gradually moving beyond the Ponzi-like structures of the previous cycle.

Watchlist: Illuvium / Space Nation / Lumiterra / Matr1x

6. AI + Web3: A Long-Term Narrative Around Algorithms, Compute Power, and Verifiability

AI remains the dominant technological narrative, continuously injecting vitality into crypto. Onchain AI leverages smart contracts to automate and dynamize machine learning and artificial intelligence. Meanwhile, blockchain provides transparency and verifiability for AI components (e.g., zkML/opML). Critical elements such as AI models, GPU compute power, data feeding, and labeling can all be integrated into blockchain systems.

Watchlist: TAO / OLAS / JANCION

7. DePIN – Physical Flywheel DeFi, Exponential Growth

A new phenomenon combining online and offline token distribution and service delivery. As infrastructure matures, crypto applications will drive exponential growth in DePIN networks.

Watchlist: Mobile / Io.net / Meson / POKT

8. Social Monetization Experiments Underway

Despite Friend.tech’s failure, it demonstrated the explosive potential of social monetization. Censorship resistance and security remain core demands driving social platforms toward Web3. Protocols like Lens and Farcaster continue to carry that promise forward.

Watchlist: Farcaster / Lens / Nostr

9. DeFi Derivatives: Poised for Takeoff

Financial use cases remain blockchain’s highest-value and most sustainable applications with real yield. GMX’s global shared liquidity pool and Gains’ capital-efficient synthetic model continue to lead the market. This bull run has also seen futures protocols like Aevo and Whales spark explosive growth in pre-market trading. We believe derivatives represent one of the strongest long-term fundamental narratives.

Watchlist: GMX / Gains / Drift / Apex / Aevo / Whales

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News