Deep Dive into Pyth: Asset Type Coverage

TechFlow Selected TechFlow Selected

Deep Dive into Pyth: Asset Type Coverage

Each asset type has different characteristics.

In the broad scope of financial market activities, market participants have access to a wide variety of asset types, each with distinct characteristics.

Traditional financial institutions primarily offer trading opportunities across asset types such as foreign exchange (forex), equities, exchange-traded funds (ETFs), futures, options, and derivatives.

Decentralized finance (DeFi) markets share similarities with these financial products but feature their own unique variations in asset types: cryptocurrencies, stablecoins, non-fungible tokens (NFTs), perpetual contracts, synthetic assets, and more.

However, there remains a significant gap between the financial products offered in decentralized markets versus traditional markets—this holds true for both individual investors and institutional participants in Web3 capital markets.

Smart contracts require infrastructure such as oracles to obtain financial data and volatility metrics from both crypto and traditional markets. Yet many oracle solutions primarily serve—or exclusively serve—cryptocurrency and digital asset data.

This lack of asset type coverage limits smart contract developers’ ability to bring more meaningful trading opportunities to DeFi users. Accessing and integrating data required to support non-crypto asset types is highly challenging.

Let’s dive into Pyth Network, a financial oracle dedicated to seamlessly delivering data for both traditional and decentralized financial assets.

This functionality opens up new on-chain development opportunities for DeFi builders, unlocking a whole new world of trading possibilities for DeFi participants.

Supportingthe Assets Developers Need

To date, Pyth delivers over 400 real-time price feeds for these assets across 50+ blockchains, including EVM, Cosmos, Move, and Rust-based chains like Solana.

Pyth price feeds are updated every 400 milliseconds—over 200,000 times per day—meaning DeFi applications receive the latest, most timely pricing data from Pyth.

And integrating these price feeds is permissionless; developers do not need to contact a sales team or sign contracts to begin building smart contracts using Pyth Data.

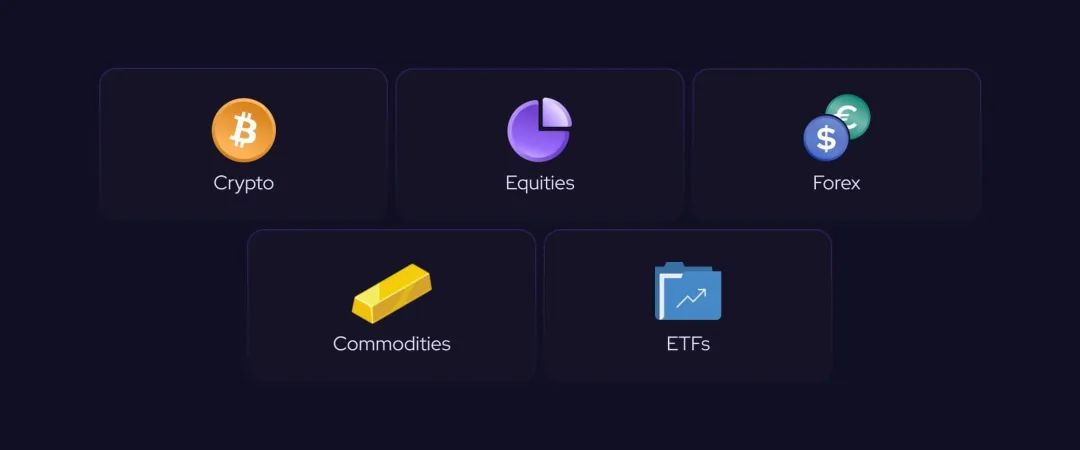

Pyth Network currently supports five primary asset types, enabling smart contract developers to integrate them when building Web3 applications.

Cryptocurrencies

Cryptocurrencies, or “crypto,” are virtual or digital currencies that rely on cryptographic techniques for security and operate on blockchain networks.

Cryptocurrencies serve multiple purposes, including digital payments, value storage, and enabling unique functionalities within decentralized applications.

There are two main forms of cryptocurrency: coins and tokens. Coins are native digital units operating on their own independent blockchain, such as Bitcoin (BTC) and Litecoin (LTC).

Tokens, on the other hand, are digital assets created via smart contracts on existing blockchains. These include cryptocurrencies built according to standards such as Ethereum’s ERC-20, BNB Chain’s BEP-20, or Solana’s SPL.

Despite being a relatively recent innovation, cryptocurrencies provide a significant opportunity for global market participants due to their accessibility without restrictions imposed by centralized institutions.

The Pyth oracle provides low-latency price feeds for tokens such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), and Solana (SOL).

Pyth price feeds also cover tokens like Uniswap (UNI), Aave (AAVE), Tether (USDT), and USD Coin (USDC).

Foreign Exchange (Forex)

Forex is short for “foreign exchange” and refers to the global market for exchanging national currencies. This asset class includes spot forex and forex derivatives such as futures, options, forwards, and currency swaps.

Investing in the forex market allows investors to hedge against international currency and interest rate risks, as well as profit from fluctuations in exchange rates.

The forex market is renowned for its enormous scale and liquidity: with daily trading volumes exceeding $6 trillion, it dwarfs other major financial markets.

Pyth price feeds include G7 (“Group of Seven”) currencies (Canadian dollar (CAD), euro (EUR), Japanese yen (JPY), British pound (GBP), U.S. dollar (USD)), emerging market currencies (such as Brazilian real (BRL), South African rand (ZAR), Mexican peso (MXN)), commodity currencies (such as Australian dollar (AUD), New Zealand dollar (NZD)), and safe-haven currencies (JPY, Swiss franc (CHF)), among others.

Equities

Equities represent ownership in a company or organization, including investments in companies made through stock markets, either via private placements or secondary market trading.

Stocks are key assets for investors because they typically offer capital appreciation and potential dividends. Capital gains occur when a stock's market value increases over time, creating an opportunity to profit upon sale.

Dividends, on the other hand, are periodic payments made by companies to shareholders, usually drawn from corporate profits.

Both individual and institutional investors strategically allocate capital into stocks within investment portfolios to benefit from companies’ growth potential and financial success.

Pyth is the only oracle product providing real-time market data for U.S. equities such as Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN).

ETFs

Exchange-Traded Funds

Exchange-traded funds (ETFs) represent diversified portfolios of securities traded globally on stock exchanges through brokerage firms. The global ETF market caters to various investment themes, industries, regions, and asset classes.

Although frequently compared to mutual funds, a key distinction exists: mutual funds typically trade at net asset value (NAV) at the end of the trading day, while ETFs can be bought and sold at market prices throughout the trading session.

ETFs have gained widespread recognition as one of the most versatile asset types, uniquely offering greater exposure and flexibility within investment strategies.

Pyth is also the only oracle providing real-time data for well-known ETFs such as SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust Series 1 (QQQ).

Commodities

In finance, commodities refer to standardized, interchangeable assets designated for trading and settlement. These include physical goods such as agricultural products, energy resources, and precious metals, which are bought and sold through standardized contracts on various exchanges.

Commodities are broadly categorized into two groups: hard commodities such as energy and metals, and soft commodities including various agricultural products.

Hard commodities, such as crude oil and precious metals like gold, play a pivotal role in shaping the global economic landscape. Energy fuels production sectors, while precious metals contribute to industrial manufacturing and investment portfolios.

Soft commodities encompass a range of agricultural products, including staple crops such as wheat, corn, and cotton. These goods form part of the global food supply and are also subject to market dynamics as tradable commodities.

Commodities can act as a hedge against inflation and serve as safe-haven assets during financial turmoil, independent of stock market volatility—gold being a prime example.

Pyth supports commodities such as gold (XAU) and silver (XAG). The community can collectively decide through governance voting which new commodity price feeds should be added to the Pyth oracle network.

Get Startedwith Integration

Bringing new real-world and digital assets to smart contract developers is crucial for the growth of the decentralized finance industry.

Stay tuned to the official Pyth Network social channels for announcements about new price feed launches.

You can also visit the official website to explore the full catalog of Pyth price feeds and see which asset feeds are upcoming. Integrating price feeds is simple and seamless—refer to the developer documentation for more information.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News