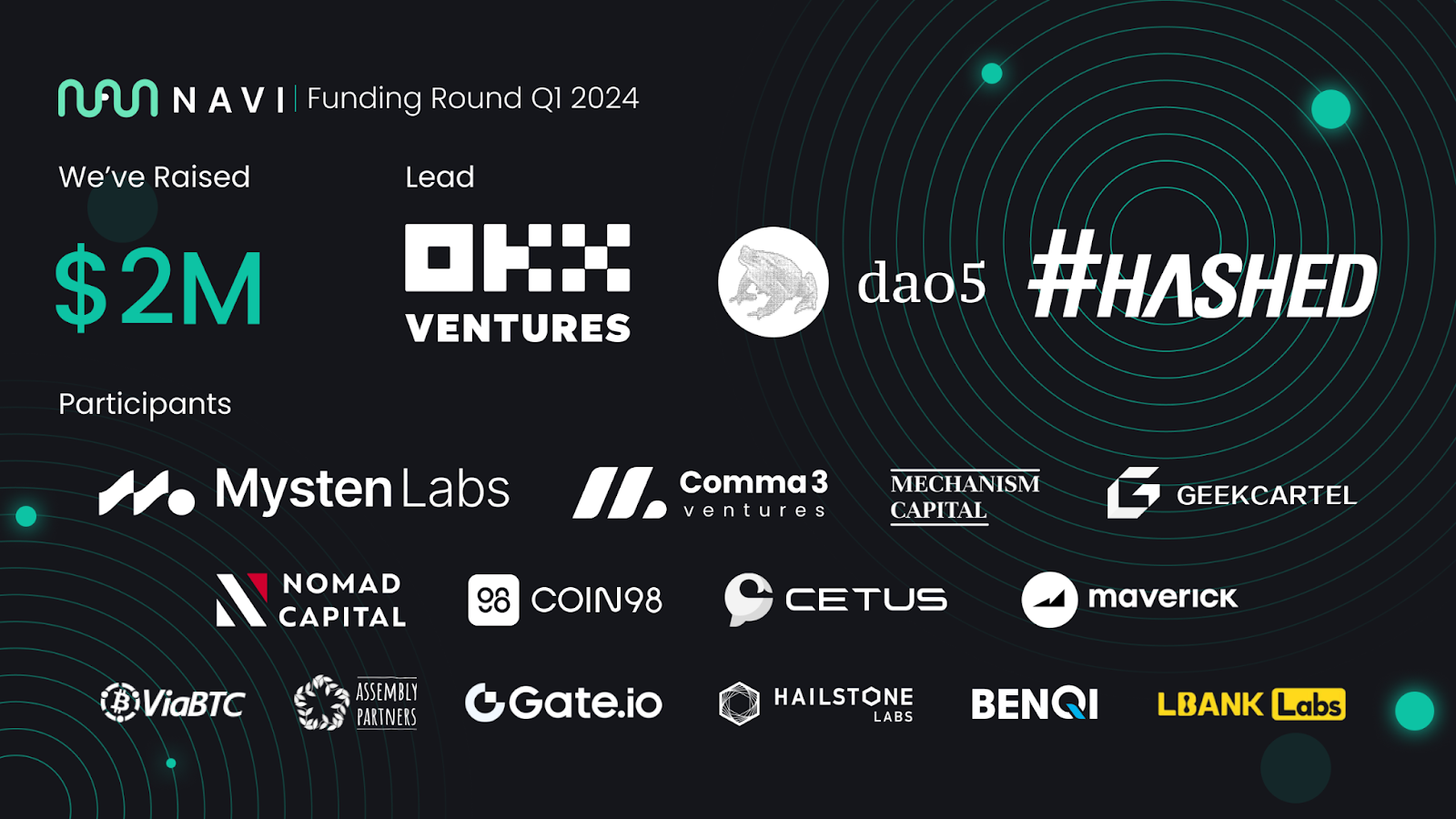

NAVI Protocol, the first native all-in-one liquidity protocol on Sui, has raised $2 million to expand its innovative integrated lending, borrowing, and LSDeFi platform.

TechFlow Selected TechFlow Selected

NAVI Protocol, the first native all-in-one liquidity protocol on Sui, has raised $2 million to expand its innovative integrated lending, borrowing, and LSDeFi platform.

Since its launch on the Sui mainnet in July 2023, NAVI Protocol's TVL has exceeded $150 million, ranking first on Sui for several consecutive months.

On January 31, 2024, NAVI Protocol, the first native all-in-one liquidity protocol on Sui, raised $2 million to expand its innovative integrated lending, borrowing, and LSDeFi platform. The round was co-led by OKX Ventures, dao5, and Hashed, with participation from Mysten Labs, Comma3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate.io, Hailstone Labs, Benqi, and LBank Labs.

NAVI Protocol enables users to participate in Sui's DeFi ecosystem as either liquidity providers or borrowers, serving as critical infrastructure for the rapid development of DeFi. Leveraging Move’s innovative capabilities, NAVI allows users to utilize existing assets and access new trading opportunities with minimized risk.

Since launching on the Sui mainnet in July 2023, NAVI Protocol has achieved a total value locked (TVL) exceeding $150 million, served over 800,000 users, and captured 66% of lending volume and activity on the Sui mainnet. The platform has cumulatively issued approximately $55 million in loans and has ranked first in TVL on Sui for several consecutive months.

With this funding, NAVI Protocol plans to scale its product offerings and operations. In addition to completing its recent acquisition of Volo, Sui’s leading liquid staking protocol, the team will further refine its multi-asset collateral strategy to balance loan exposure and liquidity demands for volatile assets.

Ryan Kim, Founding Partner at Hashed, said: “NAVI Protocol is emerging as a beacon of innovation, offering a one-stop liquidity shop that starts with Sui and aims to seamlessly integrate liquid staking and money market solutions across multiple ecosystems. NAVI Protocol is a battle-tested team that has demonstrated resilience and dedication within the competitive Sui ecosystem.” He added: “Hashed is excited to support NAVI Protocol in expanding its commitment to the Move ecosystem. We believe in their ability to lead transformative change and create value in the rapidly growing Move space.”

Dora, Founder of OKX Ventures, said: “We are honored to co-lead the investment in NAVI Protocol. NAVI has demonstrated its ability to unlock the immense potential of DeFi within the SUI ecosystem and serves as a key infrastructure framework in the rapidly rising decentralized finance landscape. Since its successful deployment on the Sui mainnet eight months ago, NAVI Protocol has proven its stability and efficiency, consistently maintaining a leading position in TVL rankings and making significant contributions to the growth and expansion of the Sui ecosystem. With Sui’s parallel processing capability and Move’s asset-oriented programming features, we remain bullish on the potential for sophisticated applications such as derivatives, NFTs, gaming, and AI. NAVI Protocol will continue to serve as foundational DeFi infrastructure, driving composability and prosperity within the Sui ecosystem.”

In the coming months, NAVI Protocol plans to launch new features such as flash loans and isolated pools.

To learn more about NAVI Protocol and its products, visit naviprotocol.io.

About NAVI Protocol

NAVI Protocol is the first all-in-one liquidity protocol on Sui, combining lending/borrowing with LSDeFi. It enables users to participate in Sui’s DeFi ecosystem as either liquidity providers or borrowers.

NAVI Protocol provides lending/borrowing and LSDeFi infrastructure, ranking first in TVL in both categories. Liquidity providers can supply assets to markets and earn passive income through yields, while borrowers can flexibly obtain loans in various assets. The protocol enables users to leverage existing assets and access new trading opportunities with minimized risk. NAVI Protocol’s design supports digital assets across different risk levels based on user-selected strategies, with advanced security features ensuring user fund protection and systemic risk mitigation.

NAVI Protocol leverages the simplicity and security of the Move programming language.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News