2023 Annual Report Highlights: The Rise and Competition of DEXs

TechFlow Selected TechFlow Selected

2023 Annual Report Highlights: The Rise and Competition of DEXs

Transitioning from Uniswap's "single dominant player" to a "one superpower with multiple strong competitors" landscape.

Author: xiaoyu, DODO Research

Spring always steps through muddy paths—2023 was a year of both challenges and opportunities. We witnessed the launch of Uniswap V4 and UniswapX, Curve's core code being attacked, and the emergence of new DEX contenders like Maverick.

In this volatile market environment, DEXs have not only faced technological hurdles but also mounting competitive pressures. Nevertheless, many DEXs continued pushing innovation boundaries by introducing safer and more efficient trading mechanisms, attracting a large influx of new users.

Over the past year, the DEX Weekly Brief closely monitored and reported on the latest developments and key data in the decentralized exchange (DEX) market. The DEX Annual Report consolidates DODO Research’s detailed observations and analysis of the entire year’s market dynamics, offering an in-depth exploration of prominent trends and critical insights from the 2023 DEX landscape for your reference.

I. Trading Volume & Market Share

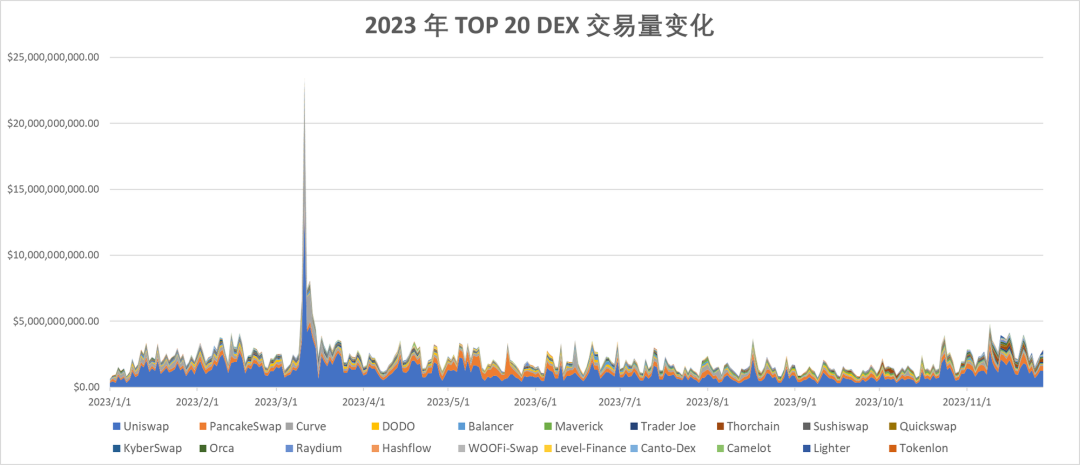

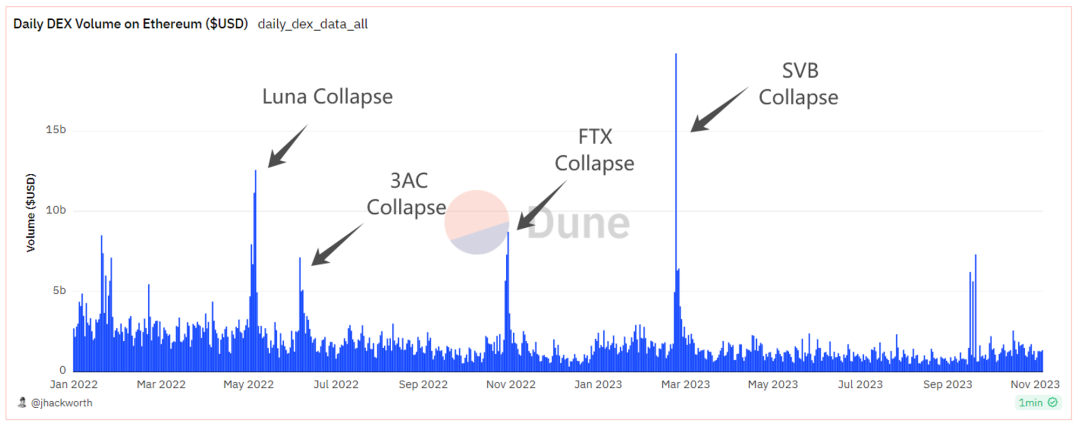

"Total DEX trading volume peaked at the beginning and end of 2023, fluctuating at lower levels in between, showing a positive correlation with overall market trends."

Starting in October, fueled by expectations around ETF approvals, total DEX trading volume showed clear signs of growth. The recovery in market activity is evident, and further growth is expected in 2024.

Individually, Uniswap maintained stable performance throughout the year, dominating market share. Other DEXs stood out during event-driven periods—for example, PancakeSwap launched V3 on BNB Chain and Ethereum in April, improving capital efficiency and restructuring fee models, which led to significant short-term increases in monthly trading volume and market share.

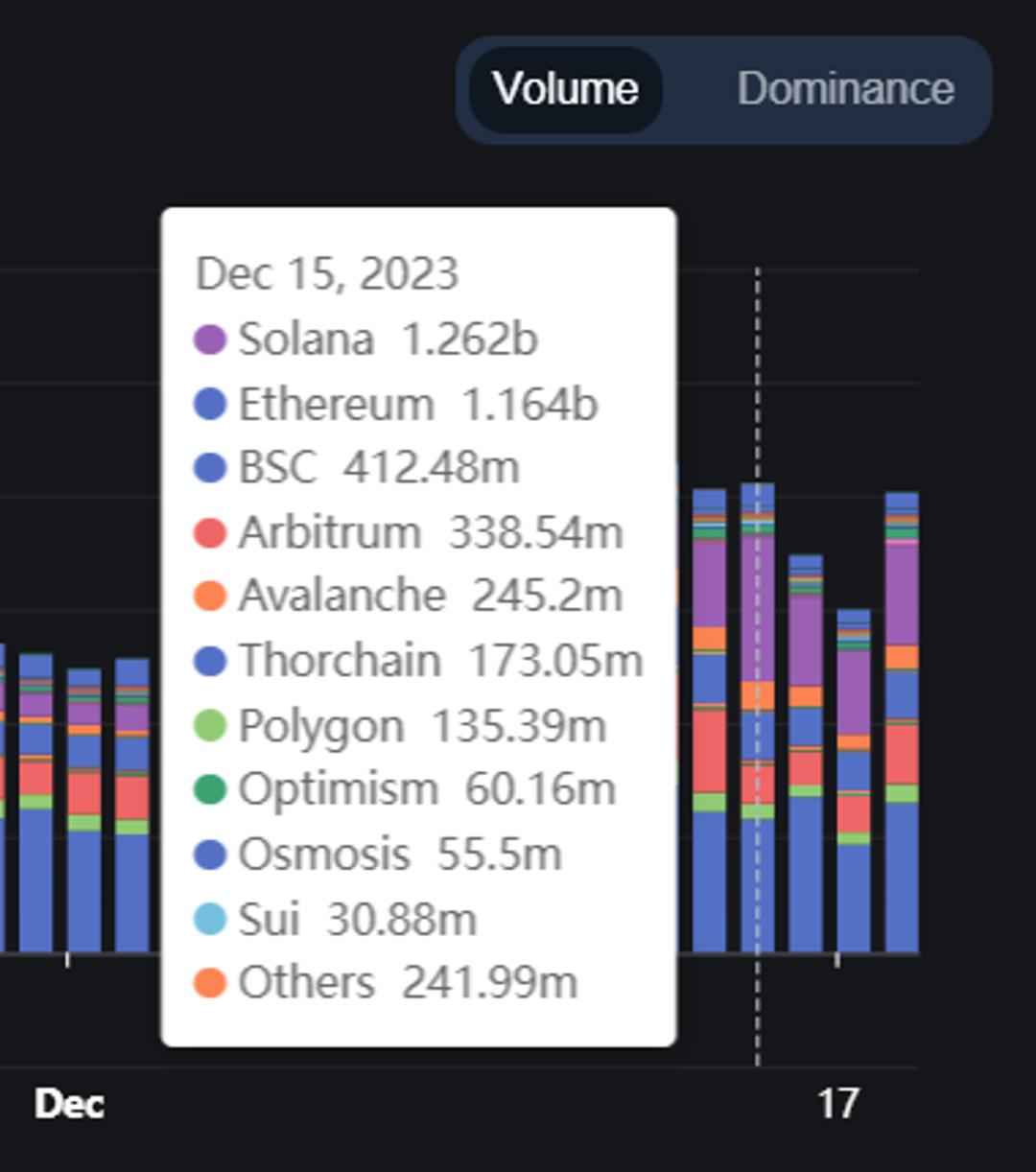

From late October onward, market dynamics began shifting: transitioning from Uniswap’s “single dominant leader” model toward a “one superpower, multiple strong players” landscape. Driven by active ecosystems on chains like SOL and AVAX, leading DEXs on these networks contributed substantial trading volumes—sometimes surpassing traditional Ethereum-based DEXs (as detailed in Weekly Brief). According to Defillama data, on December 15, Solana’s DEX trading volume exceeded $1.2 billion, surpassing Ethereum for the first time as the top chain.

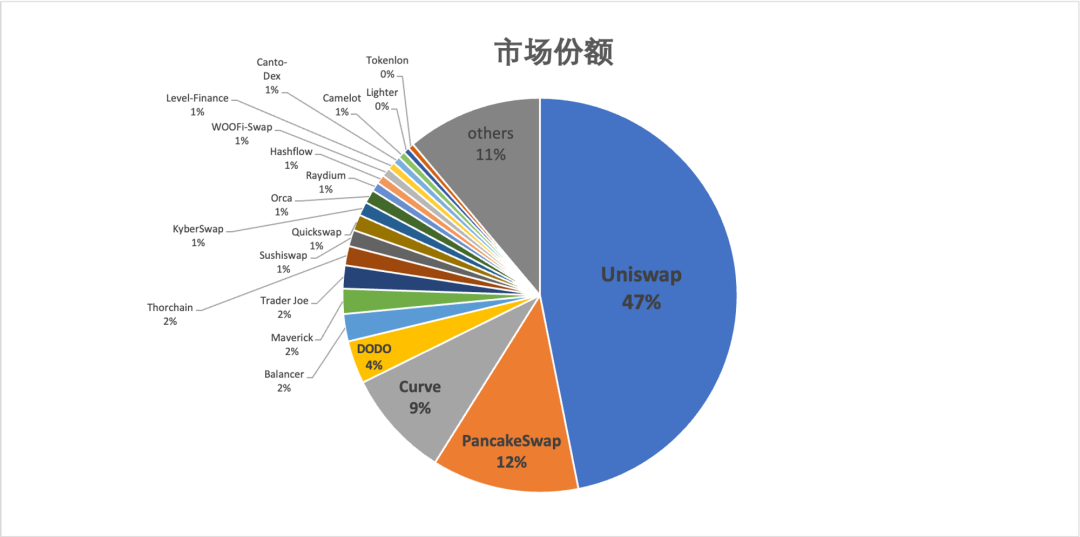

The pie chart above shows the market share distribution among the top 20 DEXs, which collectively account for approximately 89% of the total DEX market. Uniswap retained its leading position with a 47% share, maintaining the overall DEX market’s “tiered structure.”

Uniswap stands in the first tier, boasting rich product offerings and broad reputation, commanding over half the market. The second tier includes PancakeSwap, Curve, and DODO, together holding about 25% market share. The third tier consists of Balancer, Maverick, Trader Joe, Thorchain, and others, while the rest fall into the fourth tier.

Second-tier platforms are all established players with long operating histories and mature, stable products. The third tier features rising stars: Maverick, leveraging its auto-balancing liquidity mechanism, frequently broke into the top 5 in market share since its launch; Thorchain’s unique native asset minting mechanism also saw renewed momentum amid market recovery.

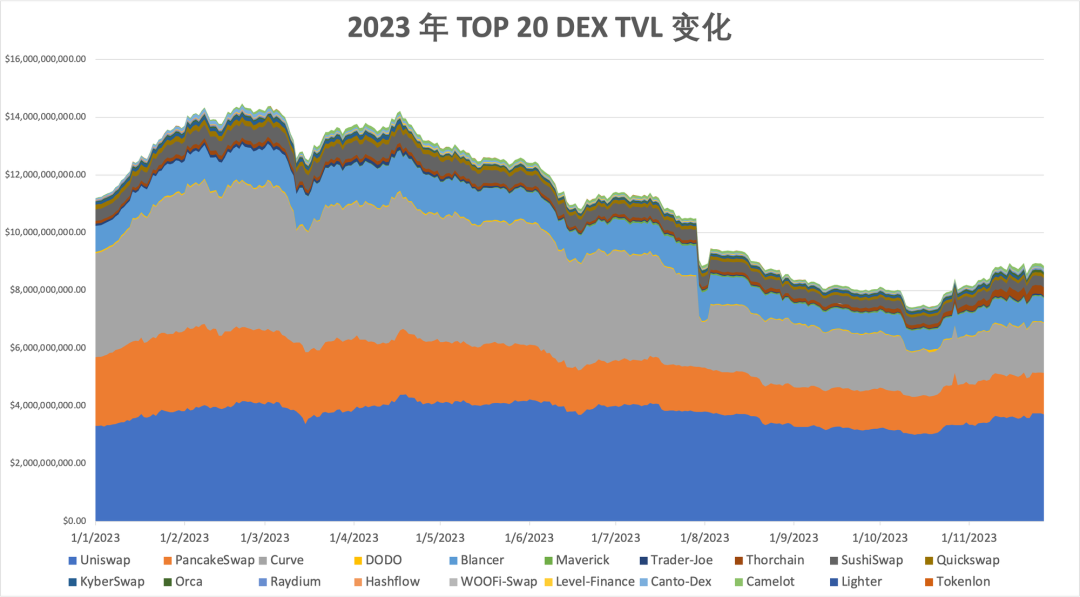

Using the top 20 DEXs’ TVL as a benchmark, the overall DEX sector no longer experienced the cliff-like drops seen in 2022. After some early-year recovery, the pace of TVL decline gradually slowed, reaching a potential turning point in October. Total DEX TVL now hovers around $9 billion.

The vast majority of TVL remains concentrated in top-tier exchanges: Curve, PancakeSwap, and Uniswap. Uniswap’s TVL remained stable, while Curve’s dropped significantly after the hack, narrowing the gap with PancakeSwap. Thorchain demonstrated relatively strong TVL performance.

II. DEX Capital Efficiency

"Overall, the DEX sector has shown signs of capital efficiency recovery, transitioning from localized activity to broader market-wide activation, indicating improved capital utilization and market回暖."

Looking at individual DEX capital efficiency, the yellow line (DODO) led the market throughout the year, with only Curve (gray line) matching its activity early on. Starting in August, Maverick (green line) emerged strongly, performing exceptionally well even during market volatility.

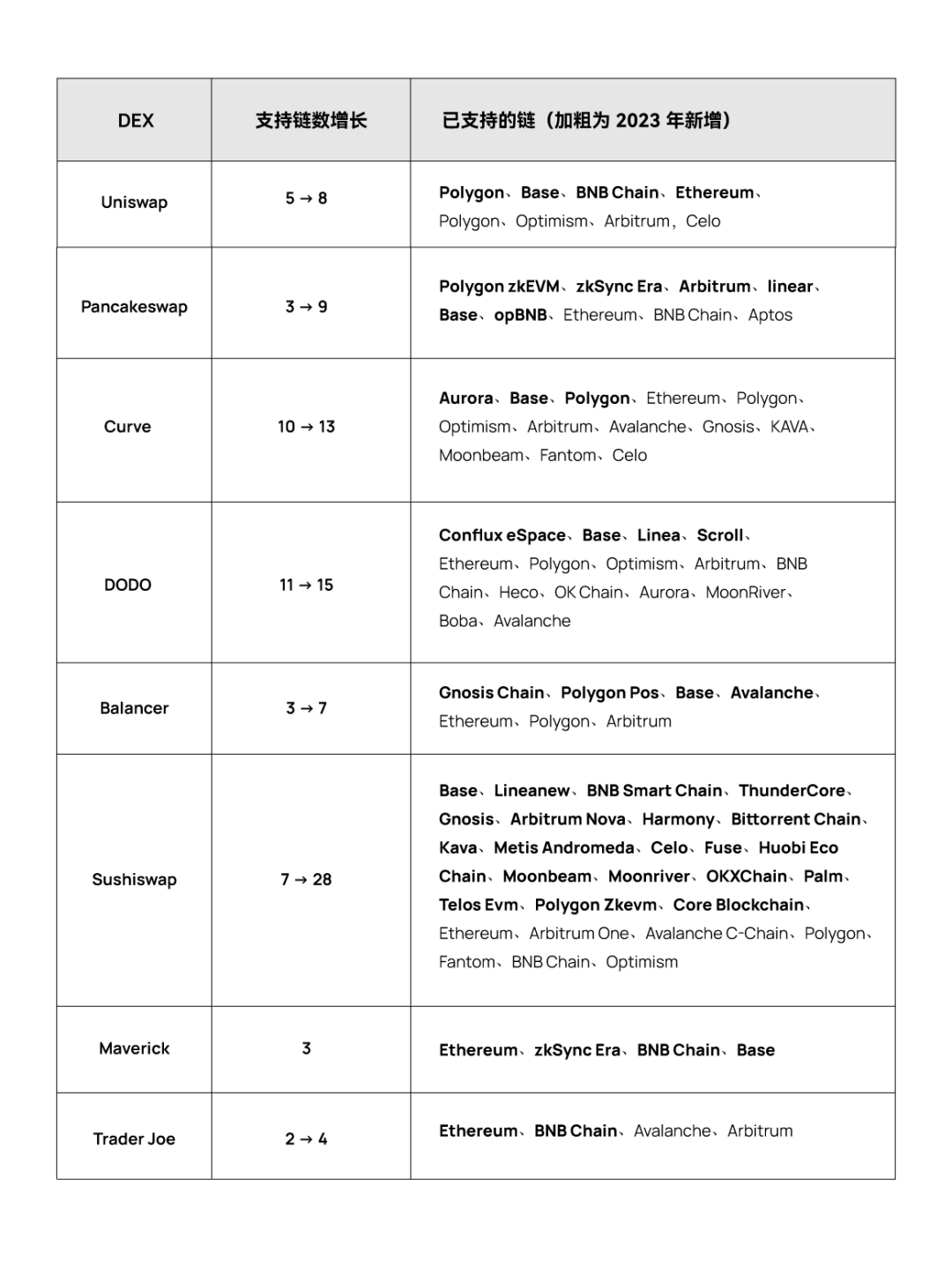

III. Multi-Chain Deployment of DEXs

"Overall, major DEXs are actively expanding onto EVM-compatible public chains and Layer 2 solutions."

This expansion not only diversifies user bases but also reflects DEXs’ adoption of L2 solutions to reduce fees and congestion on Ethereum (handling 4.5x more transactions per second at one-tenth the cost). Due to its distinct architecture, Solana has higher deployment costs and fewer supported DEXs; Raydium and Orca remain the primary DEX platforms on SOL.

However, Solana’s high throughput and low transaction costs have spurred the rise of cross-chain solutions enabling seamless asset transfers across blockchains. Cross-chain platform ThorChain, offering native asset swaps, performed notably well in Q4. Cosmos’ IBC framework enables interoperability between blockchains and presents another promising avenue for DEX multi-chain deployment.

Below we outline the multi-chain development status of top Ethereum-based DEXs within the top 20 market share:

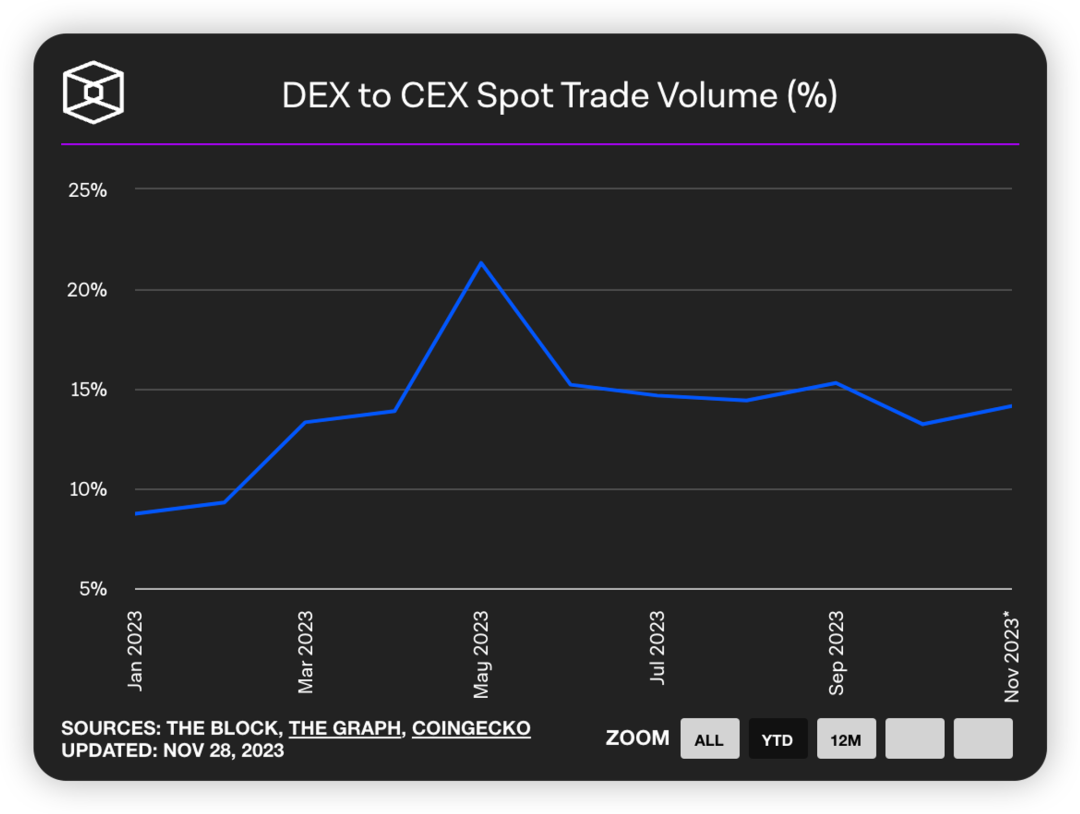

IV. DEX vs. CEX Market Share Comparison

"DEX spot trading market share rose in the first two quarters, peaking at 21.31%, a new historical high."

It later retreated and stabilized around 15%, continuing the trend from the previous year. The FTX collapse triggered a trust crisis, prompting users to move assets to DEXs. Meanwhile, DEX user experience continues to improve, with platforms like Uniswap and Paraswap launching their own wallet apps.

Most importantly, DEXs—especially AMMs—allow permissionless liquidity provisioning for long-tail tokens (e.g., meme coins), bypassing regulatory or listing barriers imposed by centralized exchanges. Projects can bootstrap liquidity instantly via DEXs, enabling broader market participation. According to CoinGecko, Uniswap lists nearly 20 times as many tokens as Coinbase and 3.4 times as many as Binance.

The fundamental difference from CEXs is that DEXs consistently execute programmatically defined tasks: enabling permissionless trading. During collapses of centralized entities (such as FTX, BlockFi, Celsius, and Voyager), DEX trading volumes surged dramatically, setting record single-day highs. The SVB collapse (and USDC depeg) led to the largest single-day DEX trading volume of ~$19.7 billion.

V. Mechanism Innovations in DEXs

"MEV and mass adoption remain key challenges for DEXs, yet numerous mechanism innovations were introduced this year."

Notable examples include Uniswap X, which allows users to sign orders off-chain, with solvers executing via Dutch auctions; Maverick offering four modes allowing automatic price-following or unidirectional/bidirectional liquidity adjustments; and DODO V3 enabling LPs to entrust funds to professional market makers for active management to boost returns.

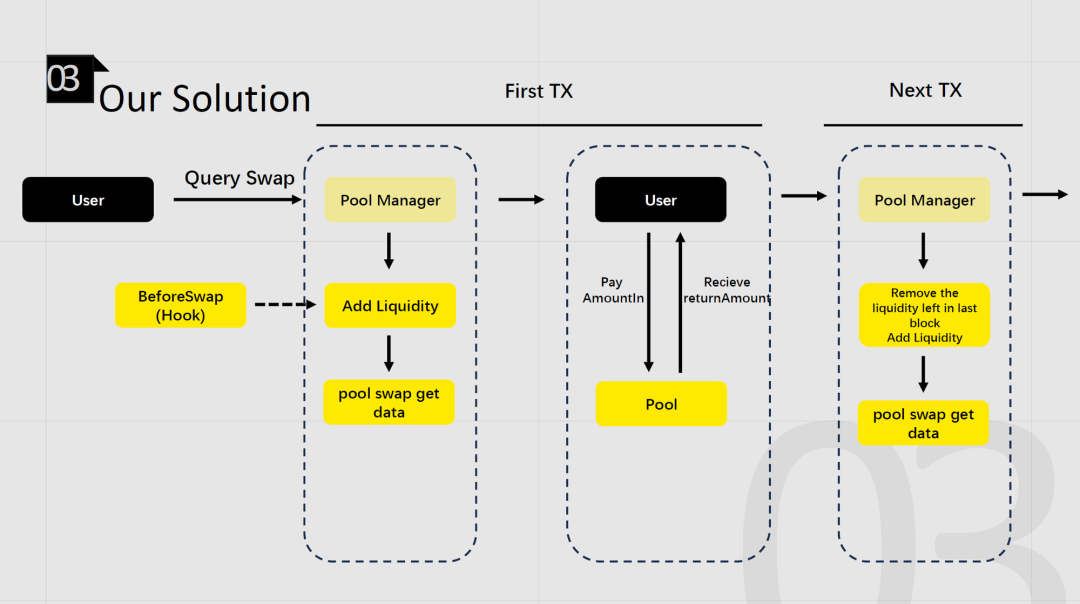

Hooks in Uniswap V4 allow customizable pool functionalities, opening up new innovation possibilities for DEXs. Based on this, the DODO team developed Aggregator_Hook, a system that accurately maps liquidity positions across various DEX platforms onto Uniswap V4 quotes, simplifying LP operations and enhancing user experience and market liquidity.

VI. Major DEX Events

Product Updates

-

Uniswap launched V4 and Uniswap X; Trader Joe introduced AutoPool; Balancer is set to launch V3, etc.

-

Uniswap introduced front-end fees, charging 0.15% on certain token trades starting October 17, sparking major community controversy

-

Curve launched its crvUSD stablecoin, currently with a circulating supply of ~$150M

-

Uniswap and Paraswap launched wallet apps

-

DODO’s Hook aggregator Aggregator_Hook won Best Hook Usage Award at the Istanbul Hackathon

Governance Tokens

-

DODO paused DODO emissions in the vDODO staking pool and reduced the vDODO exit fee to 0%

-

PancakeSwap introduced the veCake governance model, strengthening $CAKE’s governance power

-

SushiSwap proposed a new SUSHI economic model addressing trading fees, routing fees, staking incentives, and partnerships

User Experience

-

DODO will launch intelligent slippage prediction

-

Matcha added a feature to view historical trade queries

-

SushiSwap automatically detects "taxed tokens"

-

Trader Joe’s Quick-Picks intelligently recommends popular tokens

-

PancakeSwap’s Dumb mode enables automatic position closing upon expiry

Hack Incidents

-

On July 30, Curve suffered a hack due to a vulnerability in its core code, resulting in a 51% drop in TVL and a loss of $62 million. Approximately 79% of the funds have since been recovered.

-

On September 20 and November 18, Balancer and Trader Joe’s frontends were compromised, losing ~$238K and ~$87K respectively

-

On November 23, KyberSwap was hacked, losing ~$4.8M worth of crypto assets

Summary and Outlook

DEXs are the most critical infrastructure in DeFi, serving as bridges for token circulation, while LP assets form the bedrock supporting numerous DeFi protocols. TVL and trading volume reflect market activity, while capital efficiency reveals how effectively different DEX mechanisms utilize funds. This year may mark a market inflection point.

DEXs have proven resilient through market tests, operating without permission or oversight. Each DEX continues colorful and relentless efforts to address crises and pain points, constantly innovating. Despite ongoing challenges—hacks, MEV, mass adoption—new contenders continue to emerge, bringing fresh excitement.

DEXs never stop evolving, relentlessly advancing toward a future of trustless, barrier-free decentralized trading experiences.

Your next exchange—why not a DEX?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News