The Bitget Launchpad "New Token Offering" Ledger: A Win-Win Feast for BGB and Tokens

TechFlow Selected TechFlow Selected

The Bitget Launchpad "New Token Offering" Ledger: A Win-Win Feast for BGB and Tokens

Investors, whether participating in the Biget Launchpad project or holding BGB tokens, enjoy not only high but also stable returns.

It's said that Bitget Launchpad has been the most reliable "freebie" this year, with every project launched delivering impressive gains. However, for ordinary users, it's clearly unrealistic to expect both winning an allocation and successfully selling these tokens at peak prices. So today, let’s take a closer look at Bitget Launchpad—just how much can users realistically earn?

Profits from BGB

The mechanics of Launchpad programs across the industry are largely similar, primarily involving staking the platform’s native token—the more you stake, the higher your chances of receiving allocations. For example, in Bitget’s latest Launchpad offering, TonUP, the minimum requirement is 50 BGB, with larger stakes increasing potential allocations (capped at 7,500 UP per user).

Therefore, participants stand to gain from two sources: appreciation of BGB holdings + gains from price increases of allocated tokens after listing.

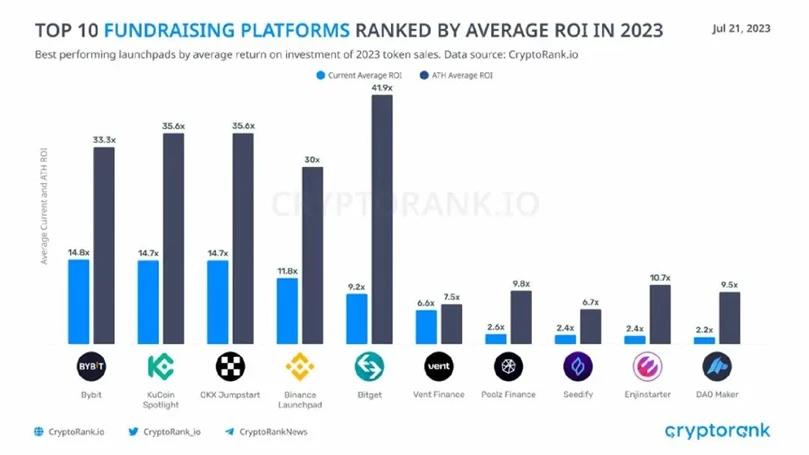

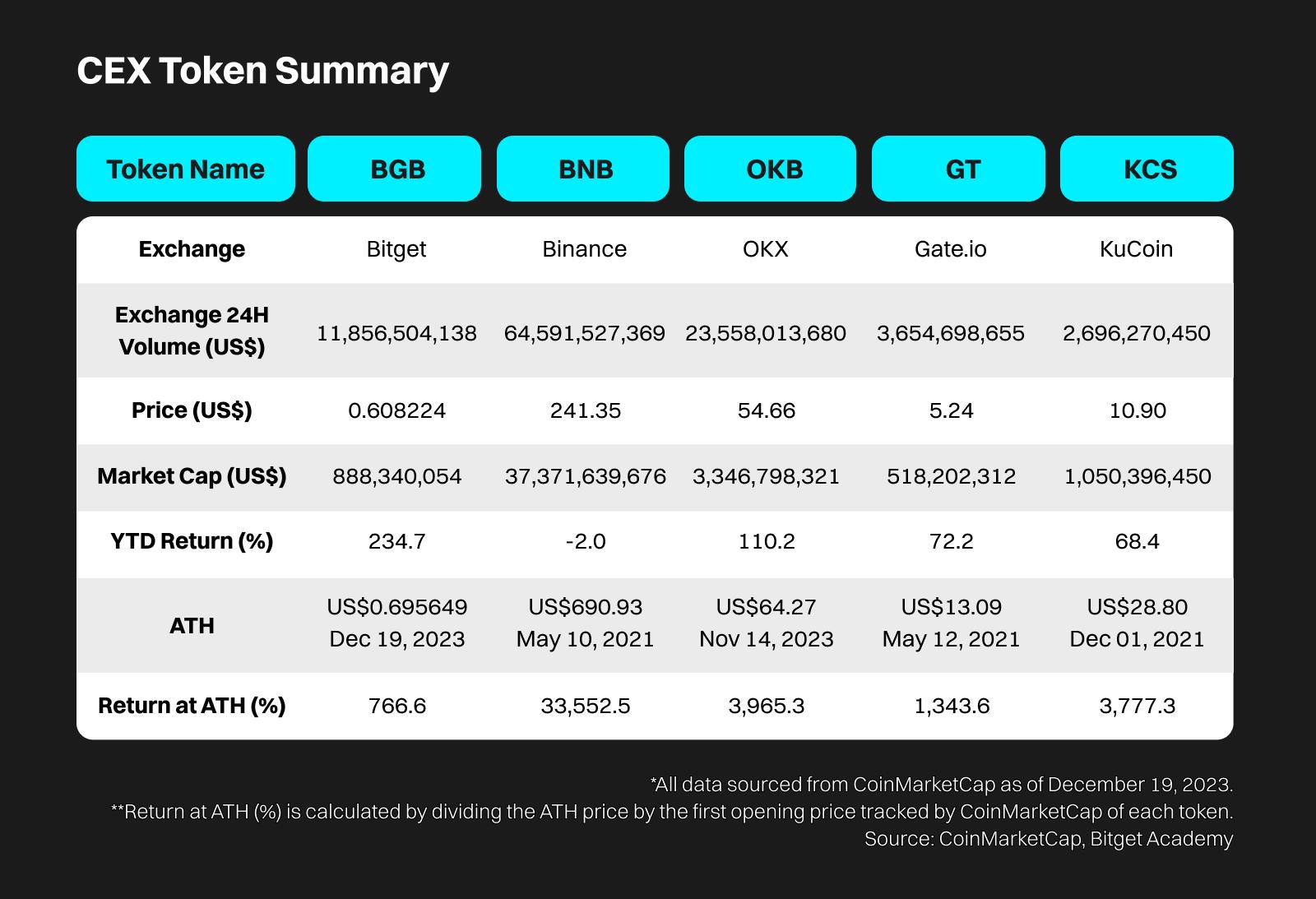

The announcement for this round of TonUP was made on December 15, when BGB was trading around $0.50. Following the announcement, demand surged as users rushed to acquire BGB for participation, pushing its price steadily upward. As of now, BGB has reached approximately $0.65, peaking at $0.70 on December 19—the seventh all-time high (ATH) this year.

To be fair, even excluding the peak price of $0.70, a rise from $0.50 to $0.65 represents a 30% gain. This means users could still earn a solid 30% return just by holding BGB—even if they didn’t receive any UP tokens.

Returns from Launchpad Projects

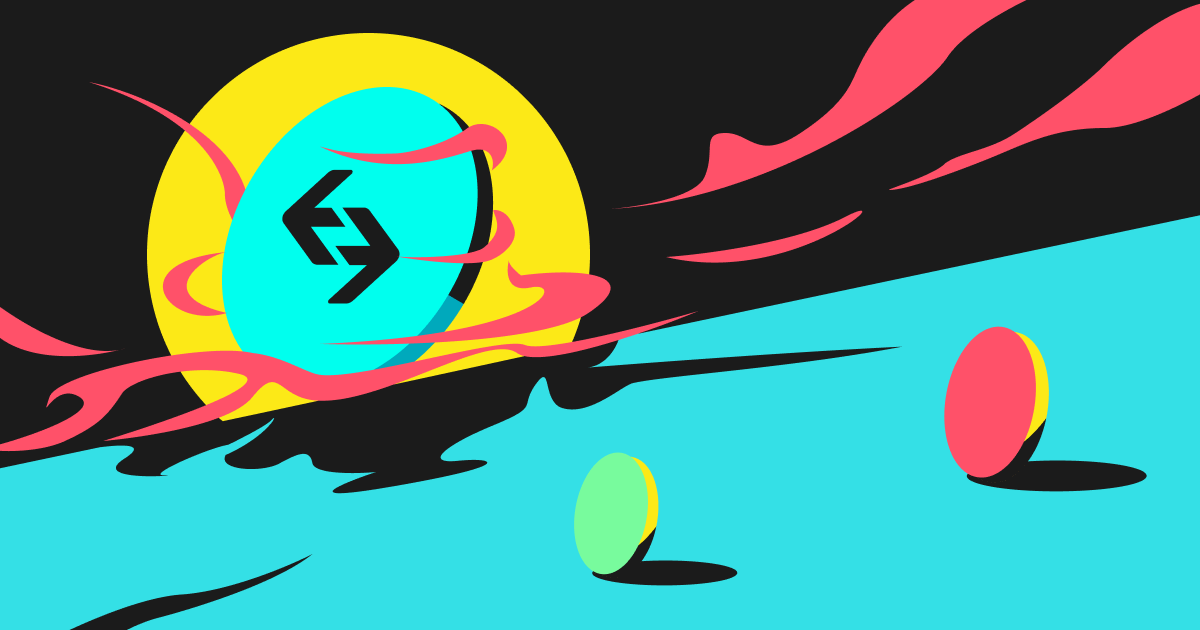

Since TonUP hasn't yet launched, we don't yet know the actual returns for this specific round. However, we can draw insights from previous Bitget Launchpad projects. According to ChainCatcher data, since its inception, every Bitget Launchpad project—from PandaFarm (BBO) to the most recent T2T2—has delivered maximum returns exceeding 25x, creating significant wealth effects for retail investors. As of the end of November, CryptoRank ranked the top 10 exchange Launchpads by average ATH ROI in 2023, with Bitget ranking first at 41.9x.

It should be noted that this ROI refers only to gains from the project tokens themselves, not including any appreciation in BGB value. In other words, simply being allocated a token would, on average, yield higher returns than holding BGB alone. The more BGB you commit, the greater your chance of allocation—and the higher your overall return potential.

Of course, there are risks involved. Launchpad programs aren't exclusive to Bitget—many exchanges periodically launch such initiatives, but results vary widely. Given that much of this year was spent in a bear market, even traditionally low-risk IEOs have underperformed. For instance, Gate.io launched 57 projects on its Launchpad this year, yet overall returns were mediocre, with several projects ending up below their issue prices. This dampened user enthusiasm and damaged the platform’s reputation.

In contrast, most projects launched via Bitget Launchpad this year have performed exceptionally well, including some achieving 100x returns. This success stems not only from Bitget’s rigorous project selection but also its unique listing strategy. While identifying high-quality projects, Bitget has skillfully aligned itself with market trends—for example, entering the inscription sector early amid its recent boom.

Moreover, BGB has hit seven new highs this year. At the beginning of 2023 (January 1), BGB traded at just $0.18. In less than a year, its price surged by 282.8%. Put simply, even without participating in any Launchpad events, merely holding BGB would have outperformed most alternative investments.

Summary

Overall, whether participating in Bitget Launchpad projects or simply holding BGB, investors have enjoyed strong and consistent returns. Currently, the market appears to be transitioning from bearish to bullish. Crypto investors may consider allocating capital toward platform tokens that demonstrated resilience during the bear market, belong to platforms on an upward trajectory, and offer multiple layers of potential return. Such tokens often exhibit greater upside potential and room for growth when bull markets arrive. By strategically diversifying assets and investing in promising platform tokens, investors can reduce risk while enhancing overall returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News