OKX Web3 Wallet Launches DeFi High-Yield Season with Lido, Offering Higher APR

TechFlow Selected TechFlow Selected

OKX Web3 Wallet Launches DeFi High-Yield Season with Lido, Offering Higher APR

Simplify users' on-chain ETH and liquid staking derivatives staking experience, and expand yield opportunities

As Ethereum transitions from PoW to PoS, ETH staking continues to grow. According to OKLink browser data, as of December 1, the amount of ETH staked on the Ethereum Beacon Chain has exceeded 28.79 million, accounting for 23% of circulating supply—up nearly 72% compared to 16.75 million staked a year ago—demonstrating strong market demand for yield-bearing ETH assets.

In this context, DeFi protocols built on liquid staking derivatives such as stETH, rETH, and swETH—collectively known as LSDFi—are gradually emerging as the new growth engine for DeFi. LSDFi not only helps users improve capital efficiency and generate more low-risk passive income, but also enhances the security of the Ethereum network, with its market size continuously expanding. Among them, Lido has become the largest liquid staking protocol in the Ethereum ecosystem.

To further simplify users' on-chain ETH and liquid staking derivative staking experience and expand yield opportunities, OKX Web3 Wallet, in collaboration with leading protocols including Lido, Stader, and Swell, officially launched the "DeFi Interest Rate Season" campaign from November 14, 2023, 18:00 to February 12, 2024, 18:00 (UTC+8), offering users a rewarding interest-boosting event.

Due to the high flexibility of this campaign, users can choose their own investment portfolios based on personal preferences.

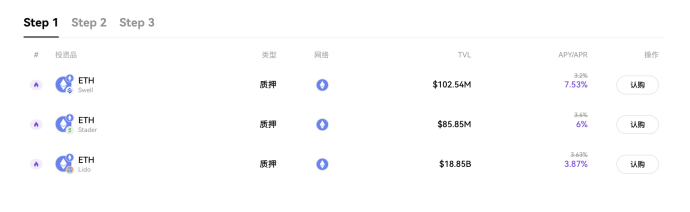

1. Single ETH Staking for Higher APR

If a user’s needs are simple—limited to single-token ETH staking—they can participate in the interest-boosting activities co-hosted by OKX Web3 DeFi with top-tier protocols like Lido, Stader, Swell, and Tranchess—to earn higher APRs.

1. Lido Official Bonus Up to 3% APR Subsidy

From now until June 2024, users who stake ETH via the DeFi section of OKX Web3 on the Lido protocol will receive an additional bonus subsidy of up to 3% APR in $stETH.

Join now: Participation link

2. Stader Official Bonus Up to 2.4% APR Subsidy

From now until December 11, 2023, users who stake ETH via the DeFi section of OKX Web3 on the Stader protocol will receive an additional bonus subsidy of up to 2.4% APR in $SD.

Join now: Participation link

3. Swell Official Bonus Up to 8% APR Subsidy

From now until April 12, 2024, users who stake ETH via the DeFi section of OKX Web3 on the Swell protocol will have their ETH swapped into swETH and receive an additional bonus of up to 8% APR in swETH.

Notably, since Swell currently does not support direct unstaking, ETH staked through OKX Web3 DeFi will be converted into swETH via swap, rather than direct staking, giving users a discount of under 2%. This means when Swell enables withdrawals, users will effectively exchange 0.98 ETH for 1 ETH.

Join now: Participation link

4. Tranchess Official Bonus Up to 8% APR Subsidy

From now until January 26, 2024, users who stake ETH via the DeFi section of OKX Web3 on the Tranchess protocol will receive an additional bonus subsidy of up to 8% APR.

Join now: Participation link

2. Simplified On-Chain Process, Multi-Layer Yield Boosting

Beyond the single-token ETH staking options mentioned above, users who engage in multi-layer staking across six partner protocols (Lido, Stader, Swell, Pendle, Equilibria, and Penpie) via OKX Web3 DeFi can enjoy not only greater convenience—avoiding constant switching between multiple platforms—but also stacked yield boosts and multiple income streams.

Simply put, this involves staking ETH and liquid staking tokens across different liquidity protocols.

For example, users can first stake ETH into Lido, Stader, or Swell to obtain staking derivatives, then deposit those tokens into Pendle to receive liquidity tokens and yield, and finally stake the Pendle LP tokens into Equilibria or Penpie to earn additional yield boosts along with the base rewards from the protocols, thereby generating multiplied returns.

1. Equilibria and Penpie Official Bonus Up to 9.5% Additional APR Subsidy

From now until February 12, 2024, users who provide Pendle LP liquidity via the DeFi section of OKX Web3 on Equilibria and Penpie can receive up to 9.5% additional APR.

1) Deposit stETH/ETHx/swETH obtained from the first category of activities into the Pendle protocol to receive stETH/ETHx/swETH LP tokens. Note that due to the unique nature of Pendle’s liquidity pools, using single-token deposits via OKX Web3 DeFi may incur slippage. To minimize losses, users are advised to use dual-token deposits directly on the Pendle platform.

Join now: Participation link

2) Deposit stETH/ETHx/swETH LP tokens into Equilibria or Penpie via OKX Web3 DeFi for liquidity mining to receive up to 9.5% additional APR subsidy.

Join now: Participation link

Notably, when participating in the second type of activity, users will simultaneously benefit from subsidies offered in the first category. For users seeking ETH staking opportunities, the OKX Web3 Wallet "DeFi Interest Rate Season" offers a convenient way to achieve higher staking yields.

3. How to Participate

Participation is very simple. Users can access the event directly via the links above, or navigate through the OKX web or mobile app by switching to the Web3 wallet, entering the DeFi section, and clicking on the featured area to join the interest-boosting campaign.

4. Considerations & Risk Disclaimer

Ethereum’s more eco-friendly and incentive-driven PoS mechanism has created strong demand for ETH and liquid staking derivatives, making LSDFi an increasingly important force within DeFi and providing users with relatively stable yields. However, for many new users, the complex and cumbersome on-chain investment experience remains unfriendly. To better streamline the process, OKX Web3 Wallet has launched a one-stop DeFi investment platform that supports features such as cross-chain asset investing and automatic yield calculation, helping users improve capital efficiency, save on gas fees, and make DeFi investing simpler.

It should be noted that while staking ETH and liquid derivatives through decentralized, highly liquid DeFi protocols like Lido is generally safer than centralized alternatives, unpredictable risks still exist. Users should always remain cautious when investing in the crypto space. This article does not constitute financial advice and is provided solely for event information purposes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News