Crypto Adoption from a Global Perspective: Hype in Developed Regions vs. Financial Lifeline in Emerging Markets

TechFlow Selected TechFlow Selected

Crypto Adoption from a Global Perspective: Hype in Developed Regions vs. Financial Lifeline in Emerging Markets

Exploring Crypto's role from a payment and financial perspective, and how Crypto adoption impacts daily life.

Written by: @ivyfanshao

Crypto presents two distinct faces across different regions—it is a speculative trend in developed economies and a financial liberator in emerging markets. When a country's economy teeters on collapse, Bitcoin and stablecoins gain grassroots popularity, as seen in Ukraine, Turkey, and Argentina. Over the past decade, the Turkish lira, Argentine peso, and South African rand may have been among the world’s three weakest currencies.

In countries where fiat currencies are weak, foreign exchange controls exist, and liquidity for major currencies like USD or EUR is limited, crypto finds fertile ground—serving local populations as tools for value storage and financial freedom.

I once spoke with an Argentinian friend who uses crypto to pay clinic bills, renew Spotify subscriptions, and shop at supermarkets—an unimaginable scenario from my perspective. To better understand these diverse realities, during ZuConnect I interviewed residents from seven countries and regions, exploring crypto’s role in everyday payments and finance, and how its adoption reshapes daily life.

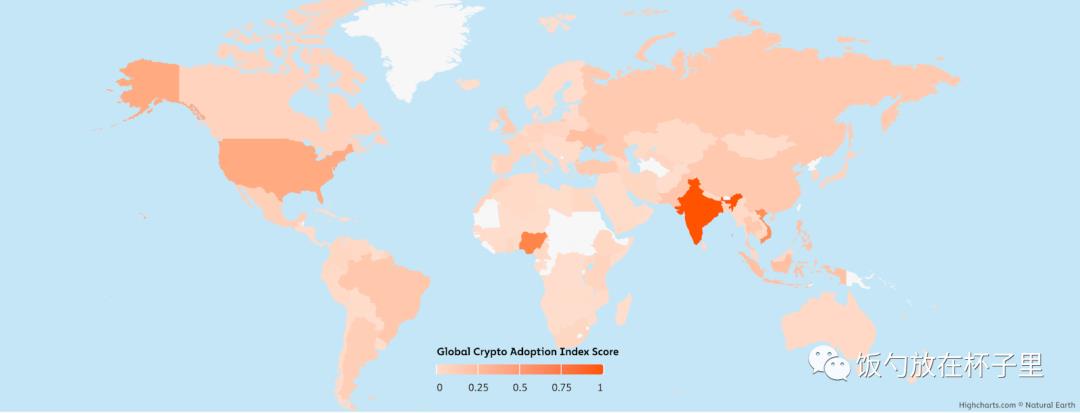

Figure: Crypto adoption rates in 2023—Nigeria, Vietnam, Turkey, and Argentina ranked 2nd, 3rd, 12th, and 15th respectively

Source: Chainalysis

1. Turkey – 52% of Adults Invest in Crypto, Financial Freedom Amid Light Regulation

Overview

With inflation reaching 80%, no foreign exchange controls, free trading between lira and USD/EUR, a highly developed banking system, easy account opening, and minimal KYC requirements—these define Turkey’s financial landscape.

Low barrier to crypto investment: Locally licensed exchanges (Binance TR & CoinTR) allow direct deposits and withdrawals to bank accounts, even via physical cash (USD/lira/EUR) at brick-and-mortar stores. Urban centers host numerous legal shops offering real-time fiat-to-crypto trading, with prices scrolling like live subtitles. These shops operate legally and pay taxes. However, using crypto for payments remains illegal since merchants must report annual revenues, and income tax is a key fiscal source.

Free capital flow: Individuals face no currency conversion limits; corporations are capped at $800,000 USD. Currency exchange shops are widespread and require no KYC, making it easy for Turks to hold USD or EUR for savings.

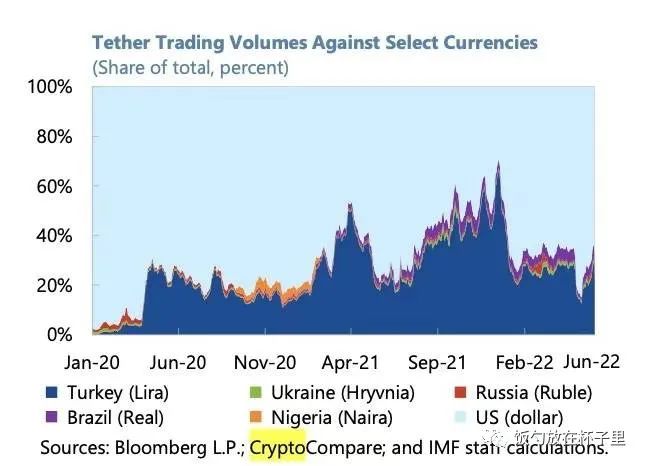

Figure: USDT/TL trading volume far exceeds that of other emerging market currencies.

During the 2021 lira crash against the dollar, USDT/TL volume briefly surpassed USDT/USD.

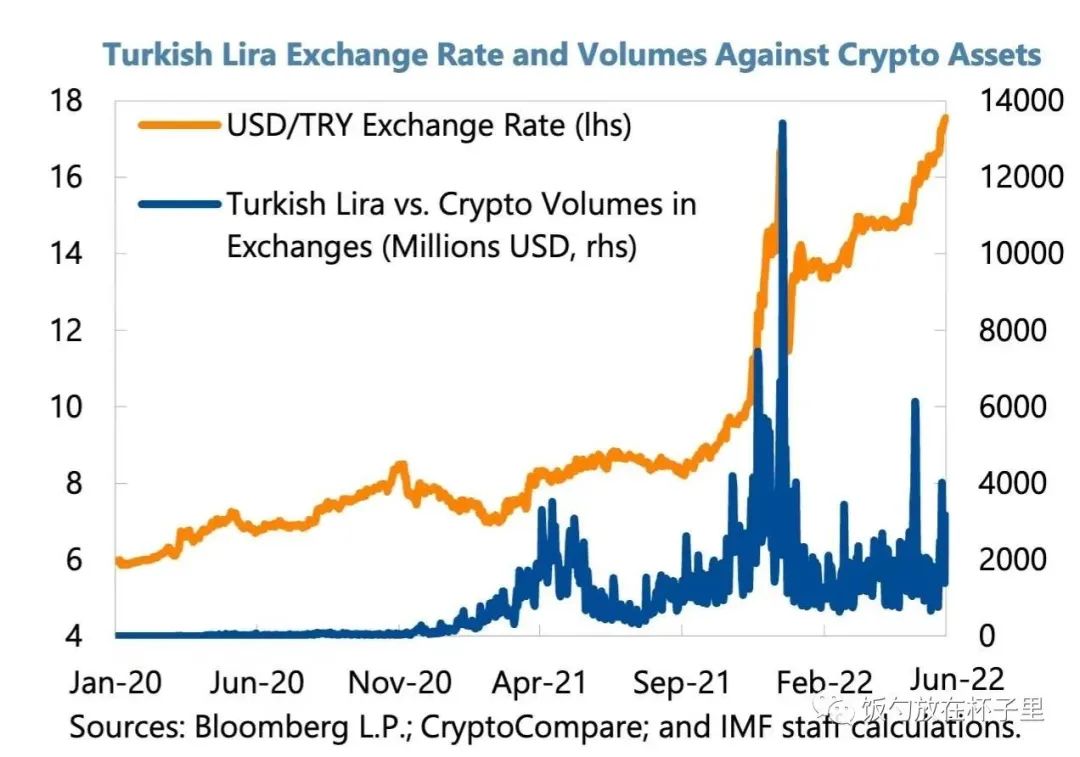

Figure: In November 2021, amid the lira’s collapse, daily crypto trading volume approached half of Turkey’s total daily forex volume.

Cross-border remittances: Local PayPal has been unavailable since 2016 due to regulatory non-compliance. Most people use Wise or Western Union instead.

Card-based payments dominate: Debit and credit cards are widely used. According to BKM (Interbank Card Center of Turkey), there were 291 million cards in circulation in 2021—150 million debit and 83.8 million credit. Turkey leads Europe in card penetration. In 2021, transactions via credit and debit cards totaled 1.71 trillion lira.

Turkey’s banking sector is more advanced than most of Europe, with over 50 commercial banks offering experiences comparable to Alipay.

Light fintech regulation:

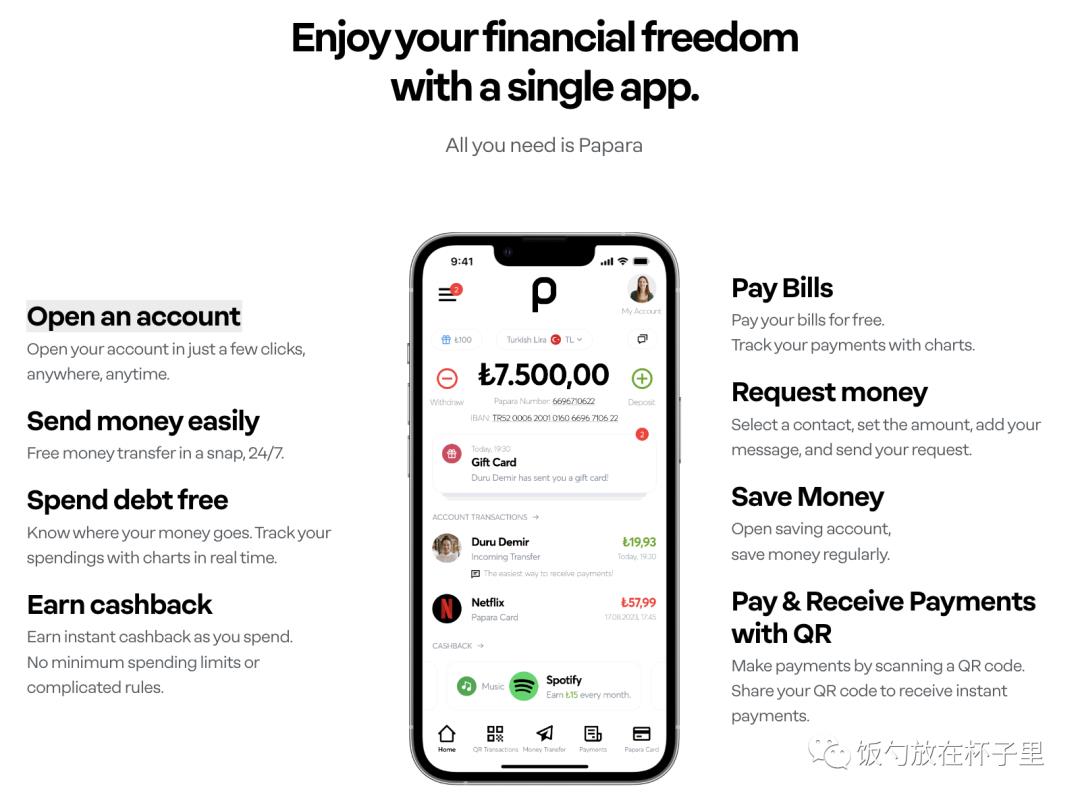

Despite this robust banking system, 26% of Turkey’s population remains unbanked. Outside traditional banks, Papara—a payment app—has 17 million users. It requires only a local phone number and email, no ID-based KYC, charges zero transfer fees, and partners with Mastercard to issue physical cards. Regulated by the central bank, it blends some degree of decentralized financial freedom with the convenience of card payments.

Case Study: Papara—A Payment Solution Beyond Banking

Figure:

Papara operates outside the banking system, yet its card delivers full banking functionality

Figure: Papara offers comprehensive features—sending/receiving money, bill payments, subscription management

Source: https://www.papara.com/en

High level of digital government services: Citizens can handle all administrative tasks at home—pay fines, file taxes, apply for passports, obtain student enrollment certificates.

Figure: Turkey’s public e-government platform

Source: https://www.turkiye.gov.tr/

Smooth on/off ramps: Licensed exchanges Binance TR and CoinTR enable direct bank withdrawals with only a 3 TL fee.

Crypto Adoption Rate

As of October 2022, approximately 8 million people actively invest in crypto. Including immediate family members, this number rises to around 14 million.

Source: https://www.kucoin.com/blog/more-than-half-of-Turkish-adults-invest-in-Crypto

Turkish Crypto Exchanges:

- Licensed Turkish exchanges supporting card deposits/withdrawals

- Binance TR

- CoinTR

- Popular local exchanges: Paribu and Btctürk each have over 6 million local registered users

- https://www.btcturk.com/

- https://www.paribu.com/https://ventures.paribu.com/

- https://www.bilira.co/

Figure: BtcTurk branding visible throughout Istanbul Airport. Source: Author's photo

Notably, CoinTR—a state-linked exchange—has partnered with two national banks, Ziraat Bank and Vakif Bank, to launch fiat on/off ramps. It functions more like a joint venture between regulators, traditional banks, and international tech teams, aiming from inception to address Turkey’s exchange rate and dollar reserve challenges.

2. Argentina – 25% of Adults Frequently Trade Crypto and Use It for Daily Payments

Overview

Latin Americans face persistent challenges with inflation, remittances, wealth preservation, and savings. They benefit from crypto and have become its most passionate advocates. In Argentina, crypto has gone mainstream—used by about 5 million people (out of a population of 45.8 million).

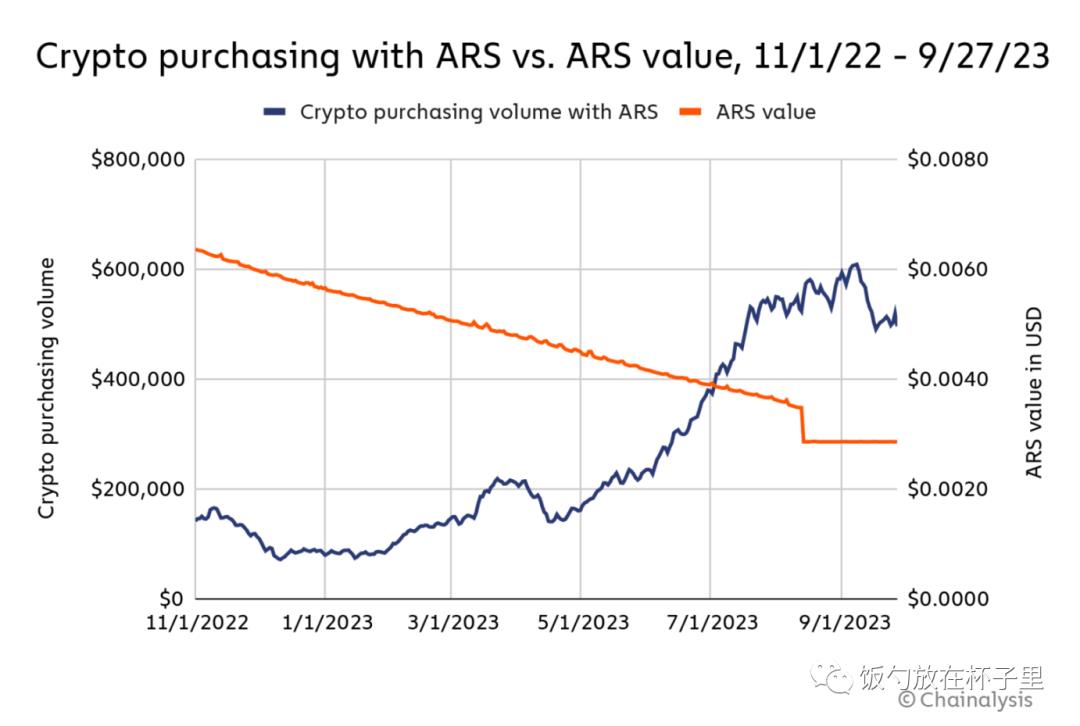

Figure: Crypto trading volume spikes when Argentine peso faces inflation. Source: Chainalysis

Hyperinflation: Argentina’s inflation rate surged to 121% in October 2023, continuing a multi-year trend.

Foreign exchange controls: The Central Bank faces FX shortages and enforces strict capital controls to prevent outflows. Exporters must repatriate overseas earnings within five days. Institutions and banks need authorization to buy USD, and individuals are limited to $10,000 per month.

This demand for USD and tight restrictions fuel a thriving black market. In 2023, Argentina’s black-market dollar rate soared nearly 600x. When USD becomes inaccessible, people turn to alternatives—crypto. This environment drives strong local demand for investment, inflation hedging, and financial freedom—about 25% of Argentine adults now hold crypto.

Crypto adoption: According to Americas Market Intelligence data, Argentina’s crypto adoption is growing rapidly. Only 12% of smartphone users had bought crypto by end-2021, but that rose to 51% by April 2022. Moreover, 27% of consumers reported regularly purchasing crypto.

Local exchanges in Argentina:

- Binance

- Bybit

- eToro

- OKX

- Gate.io

Figure: Binance ad—"Argentine entrepreneurs contribute to Latin America’s financial freedom via Binance P2P"

Economic and Geographic Factors

Approximately 50% of Argentina’s economy is gig-based, creating high demand for cross-border payments. Sharing the same time zone as North America and boasting one of Latin America’s highest education levels, Argentines are well-positioned to provide R&D labor to North American firms.

Crypto in Everyday Argentine Life

According to AMI, 71% of Argentines hold crypto for investment, 67% to hedge inflation, and 46% for financial freedom.

- Daily use: 25% of Argentines frequently use crypto for daily spending and value storage. Even ordinary housewives skillfully use crypto for grocery shopping and medical payments.

- AMI data shows Argentina is a key market for crypto debit and credit cards. For example, Mastercard and Binance launched prepaid crypto debit cards nationwide. Mastercard reports at least 51% of Latin Americans already use crypto for purchases. Between 2021–2022, Latin America saw over $562 billion in total crypto inflows, a 40% increase from 2020.

Figure: Over the past 18 months, local exchanges like Lemon, Buenbit, and Belo have seen explosive growth in issued debit cards.

- Savings & investment: AMI surveys show over 50% of Argentines buy crypto assets as inflation hedges, similar to gold.

- Remittances: World Bank data indicates Argentina receives about $650 million annually in remittances. Chainalysis found increasing numbers of Latin American migrants sending Bitcoin home. With apps like Strike enabling access to Bitcoin’s Lightning Network, more Argentine immigrants are benefiting from crypto’s fast, low-cost cross-border transactions.

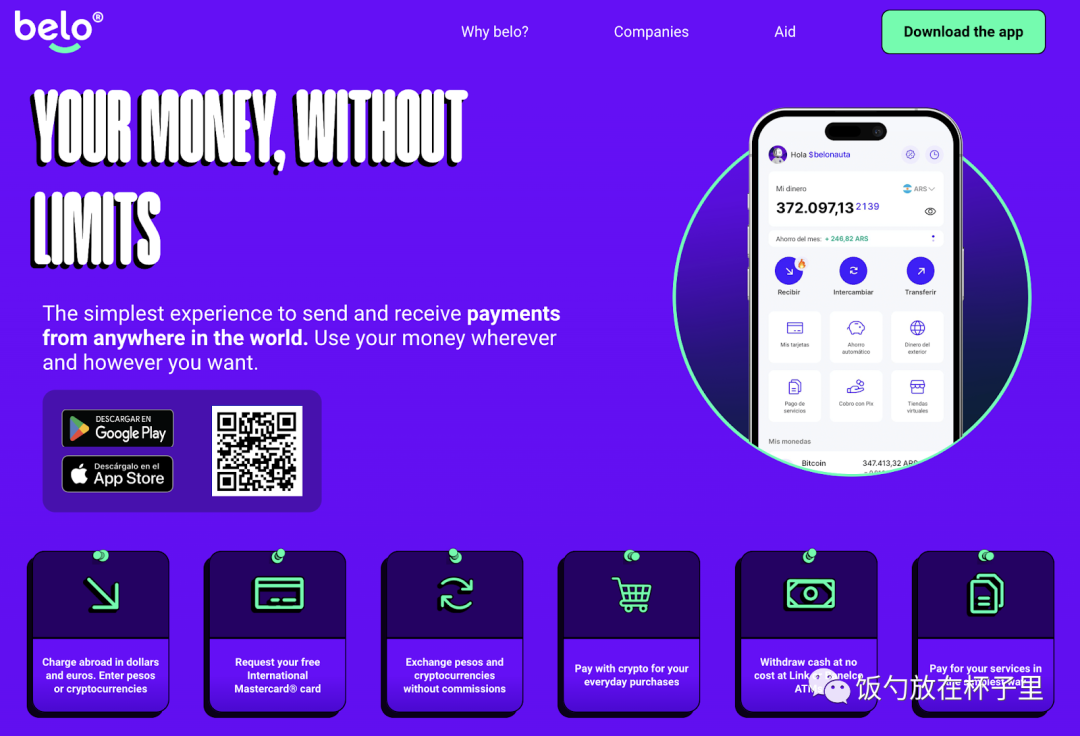

Case Study: Belo—A Crypto Payment App Empowering Financial Freedom

Belo is a local Argentine app combining Web2 and Web3 advantages, integrating banking, fintech, and crypto payments. On the receiving end, it enables instant, uncensored cross-border receipts. On the spending side, it allows users to spend crypto while merchants receive fiat—delivering a seamless debit card experience. However, signing up requires an Argentine ID or passport.

Figure: Belo—Enabling savings and financial freedom for Argentinians. Source: belo.app

Spending Features:

- Card payments: Users spend USDT, recipients receive fiat. Consumers can spend any crypto (BTC, ETH, USDT) and pay in Argentine pesos via debit card, enjoying a Mastercard-like experience with 2% cashback on every purchase.

- Extensive and hyper-localized daily payment options: mobile top-ups, utility bills, insurance, basic services, shopping, dining, telecom (supports four operators). Users can create unlimited virtual cards (similar to Wise), each with customizable daily spending limits for managing subscriptions.

Funding/Recharge Options:

1. Transfer from Payoneer Balance

Instantly transfer balance from Payoneer (a leading Latin American online payment platform) to Belo. Funds are automatically converted to USDC at current rates for storage, swapping into other cryptos, or use with the Belo Mastercard. A 4% fee applies, minimum deposit $5, up to 5 withdrawals per day totaling $5,000.

2. Receive Euros Cross-Border

Belo supports SEPA transfers for receiving euros. Future support will include SWIFT and ACH for USD.

International receipts incur a 1.5% fee and take 1–4 business days. Balances are auto-converted to USDC, which can be swapped or used with the Belo Mastercard. Account creation requires an Argentine DNI.

3. Direct Crypto Deposit via Wallet Address

Figure: Belo supports euro receipts via SEPA, Payoneer transfers, and direct crypto deposits. Source: help.belo.app

Key success factors: Belo was founded by Argentinians, giving the team deep local insight and operational advantages:

- Deep understanding of user needs, executed with precision. As PG said, “Even smooth surfaces have cracks under magnification”—and those cracks are product opportunities. Example: automatic conversion of peso balances to stablecoins, with flexible timing (daily, weekly, monthly).

- Seamless integration of Web2 and Web3 systems: enabling transfers between crypto, banks, and fintech platforms (like Payoneer) across seven+ account types, requiring strong local partnerships and resource coordination.

3. Africa – Regional Disparities, Fragmented Markets, Unclear Crypto Regulation, But Innovation Thrives

Overview

Africa’s situation is complex—highly fragmented across 54 sovereign nations and over 900 million people. Geographically, it's divided into North, East, West, Central, and Southern Africa. Africans and Latin Americans are eager to share their stories—they want the world to hear and see their economic and financial realities.

African payment and account systems:

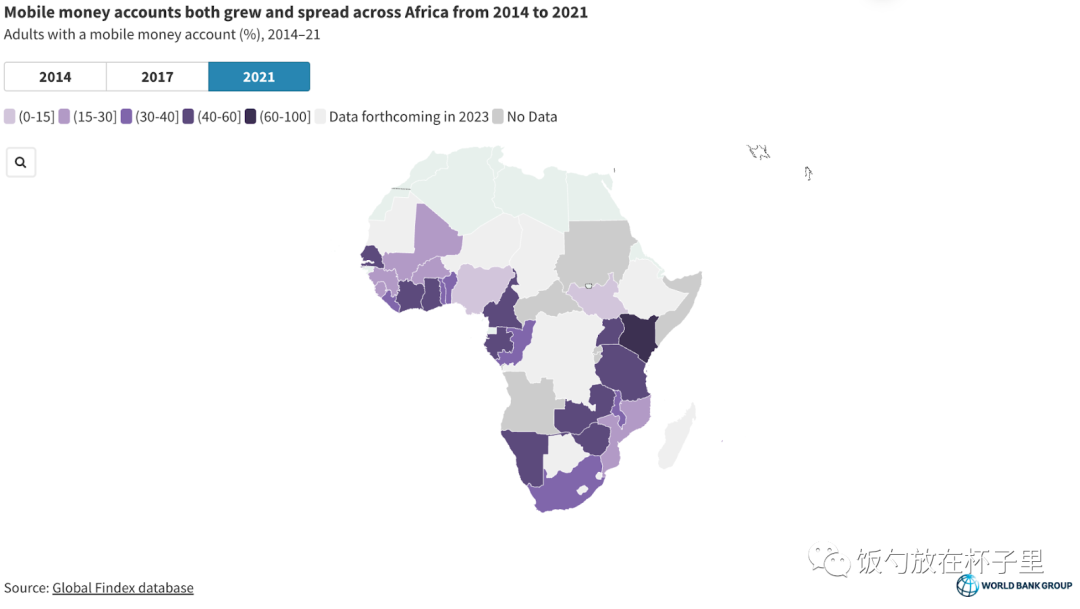

Mobile money has been a key driver of financial inclusion in Sub-Saharan Africa, promoting account adoption through mobile payments, savings, and lending.

Mobile money account penetration: Users no longer rely solely on P2P transfers as originally intended. In 2021, about three-quarters of mobile money account holders in Sub-Saharan Africa used their accounts for at least one non-P2P transaction.

Mobile money has also become a vital savings tool—15% of adults (39% of account holders) in Sub-Saharan Africa use it for savings, matching the usage rate of formal bank accounts.

Mobile money as financial infrastructure: 7% of adults in Sub-Saharan Africa use mobile money accounts to borrow.

Figure: World Bank’s 2021 Global Findex shows 55% of adults in Sub-Saharan Africa have accounts, 33% hold mobile money accounts

Source: The Global Findex Database 2021

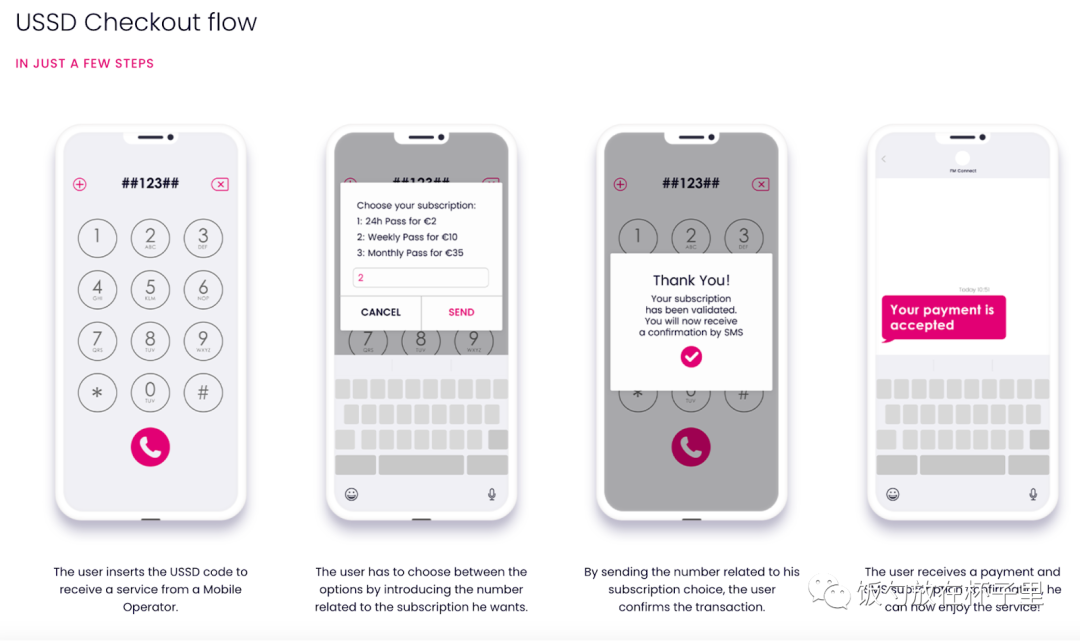

USSD technology enables mobile money:

USSD demands minimal infrastructure, making mobile money a powerful payment method across Africa. USSD allows users to create mobile wallets via phone number, store funds electronically, and conduct transfers, bill payments, airtime top-ups, and merchant payments directly on phones—accessible globally without internet, meeting diverse consumer needs.

Figure: USSD enables users to create mobile wallets and store funds electronically,

and perform transfers, bill payments, top-ups, and merchant payments directly on phones.

Source: Photo by author

Figure: USSD user flow

Source: https://www.digitalvirgo.com/mobile-payment/ussd/#down

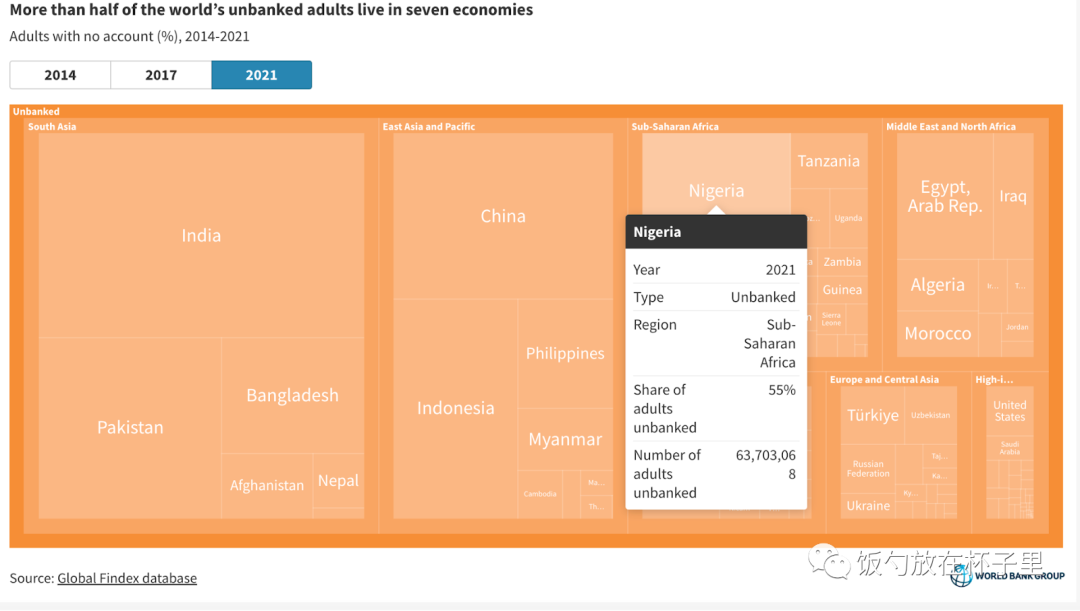

Nigeria – 25% Hold Crypto, An Alternative Path to Financial Inclusion

The Nigerian naira is weak, with massive gaps between official and black-market exchange rates. Foreign reserves are low. According to 2021 World Bank data, 55% of Nigerians lack bank accounts—fueling strong local demand for crypto.

Figure: In 2021, 55% of Nigerian adults lacked bank accounts

Source: The Global Findex Database 2021

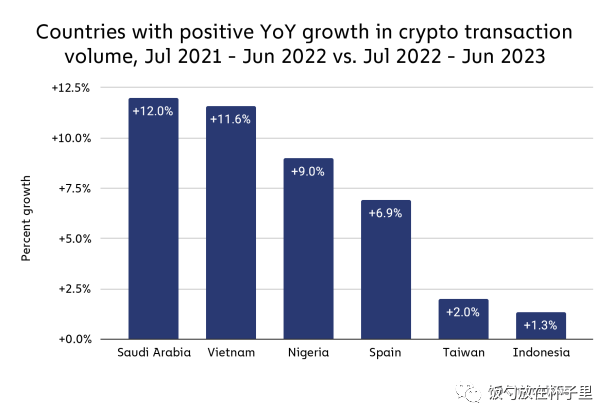

Figure: Nigeria’s crypto adoption grew 9% year-on-year

Source: Chainalysis

Regulation Remains Strict, Most Regions Ban Crypto Payments, Binance P2P Is the Primary On/Off Ramp

4. Vietnam – 16 Million Crypto Holders, Strong Growth Momentum, Young Demographics

Overview

Vietnam’s crypto landscape resembles China’s: most holdings are speculative, centralized exchanges dominate trading, and influencer-driven investing is common. Yet, Vietnam has extremely high crypto adoption, making it attractive for global projects.

Foreign exchange controls: Vietnam enforces strict FX regulations

Inflation: Vietnamese dong (VND) inflation runs at 4–7%, largely offset by bank deposit rates of 6–7%

Economic and Geographic Profile

Vietnam has experienced significant economic growth over the past decade, averaging 6% annual GDP growth—one of Southeast Asia’s fastest-growing economies.

Robust growth and strategic geopolitics attract tech giants like Apple, Samsung, and Intel to set up manufacturing bases. Beyond manufacturing, Vietnam exports software development talent to developed economies.

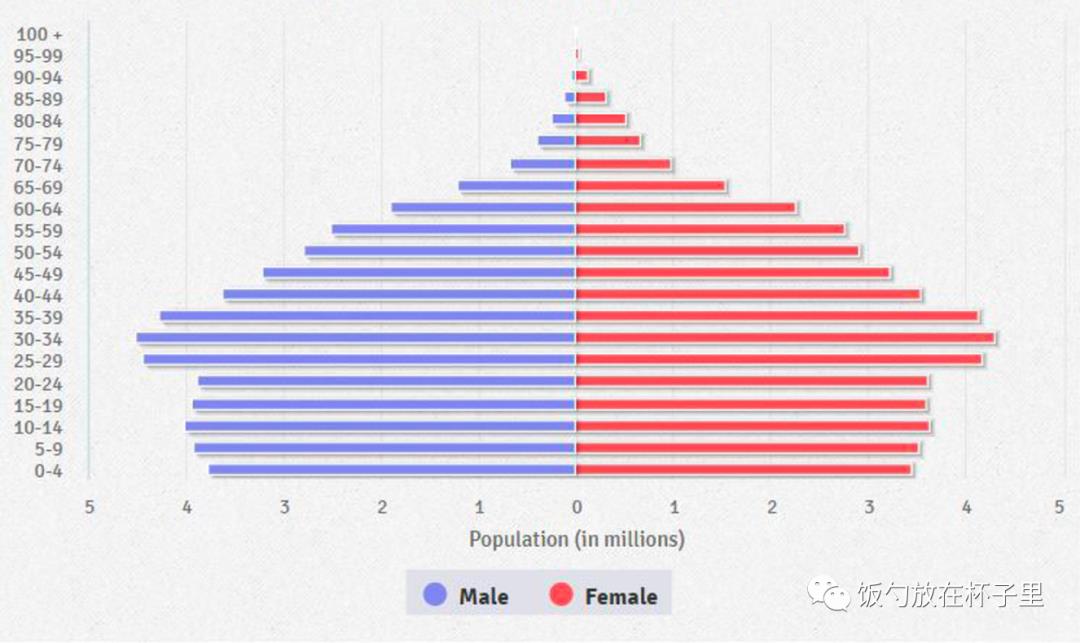

Demographically, Vietnam is one of the youngest nations—30% under age 25. Youth (10–24 years) make up 21% of the population—20.4 million people. This demographic window is expected to last until 2039.

Figure: Vietnam is one of the world’s youngest countries—30% under 25

Source: vietnamplus.vn

Vietnam has over 16.6 million crypto holders—the second-largest investor base in Southeast Asia. About 31% hold Bitcoin, representing roughly 17% of the total population. Motivated primarily by speculation, Vietnam has many local crypto trader influencers.

Vietnam hosts around 200 active blockchain projects, mainly in DeFi, NFTs, infrastructure, and GameFi. Notable ones include Axie Infinity, Kyber Network, and Coin98.

Regulatory environment: In 2020, the State Bank of Vietnam declared crypto not legal tender or a valid payment method. Crypto payments remain in a gray area.

Local Payment Methods

- MoMo (digital wallet): Vietnam’s most popular e-wallet with 20 million users, leading in mobile payments, followed by Moca and Zalo Pay.

- Credit cards remain the dominant online payment method, capturing 31% of the market share.

5. Switzerland – Zug, the Testbed of Crypto Valley

Switzerland is known as "Crypto Valley," largely due to historical reasons—the Ethereum Foundation is registered there. Zug serves as a pilot city for crypto payments. However, such low-tax, affluent areas don’t need crypto as financial infrastructure; these zones are more experimental than practical.

Additionally, in The Economist’s 2021 Democracy Index, Switzerland ranked 9th—making it ideal for DAO experimentation.

Conclusion: Crypto’s Dual Identity—Speculative Asset in Developed Nations vs. Financial Liberation Tool in Emerging Markets

In economies with weak currencies and restricted access to major currencies (due to capital controls or low liquidity), crypto thrives as a tool for value preservation and financial freedom.

Among the four regions discussed, Argentina offers the best soil for crypto payments;

- Turkey has a sophisticated banking system and high financial freedom, but a ban on crypto payments makes it unsuitable for payment innovation; Vietnam has a vibrant ecosystem, but crypto is mostly held for speculation;

- Africa lacks financial infrastructure—difficult bank access, weak currencies, high demand for stable assets and remittances—but poor infrastructure and unclear regulations have doomed many crypto wallet projects;

- Wealthy, low-tax regions like Zug, Switzerland don’t need crypto as infrastructure—such zones serve experimental purposes.

Moreover, technologies like crypto, Papara, and mobile money can help people access financial services without barriers.

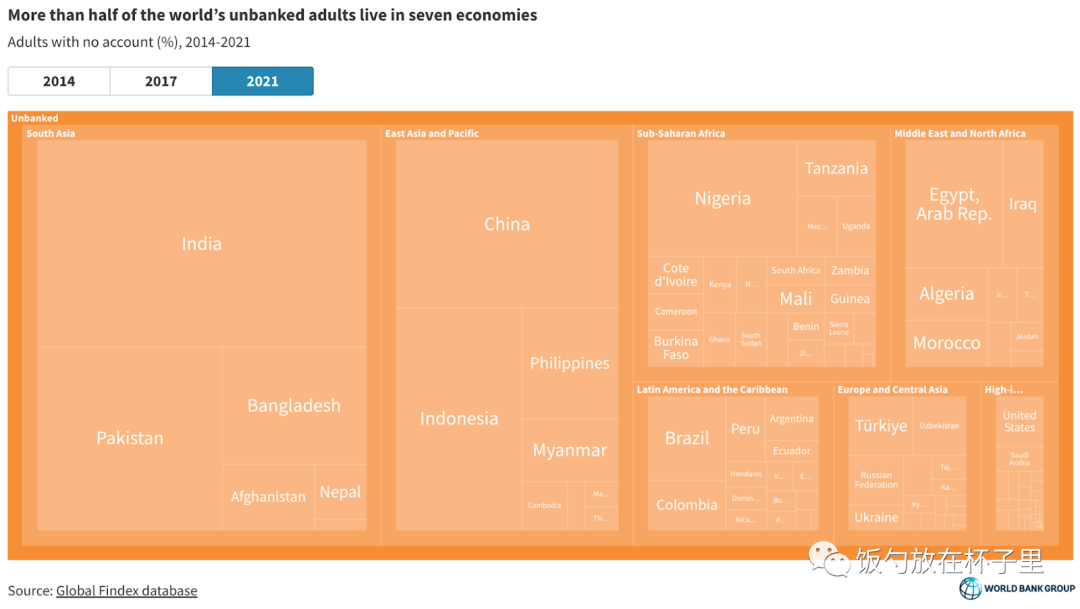

According to the World Bank’s 2021 data, 1.4 billion unbanked adults cite lack of funds, distance to financial institutions, or insufficient documentation as primary reasons. These can be addressed through technical solutions and policy reforms—drawing lessons from Africa’s mobile money success—or by adopting permissionless crypto wallets to boost financial inclusion.

Figure: Percentage of unbanked adults by country in 2021

Source: The Global Findex Database 2021

As two friends from Africa and Argentina put it,

“Living in China, the US, Japan, and Korea, you don’t really need Crypto. They hold Crypto to speculate.

People in Africa and Argentina need Crypto to live.”

“People don’t care about self-custodial, they don’t give you a shxx

People care about how to transfer money across borders easily.”

Crypto wears two faces across regions—it is a speculative asset in developed economies and a financial liberator in emerging markets. For people in China, the U.S., Japan, and Korea, crypto is not essential—it's used for speculation and storytelling. But in Africa and Argentina, people genuinely need crypto to improve daily life—and that has nothing to do with narratives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News