Plasma + ZK-SNARKs: A New Approach to Ethereum Scaling

TechFlow Selected TechFlow Selected

Plasma + ZK-SNARKs: A New Approach to Ethereum Scaling

Interpreting Vitalik's Latest Work: Unveiling Ethereum's New Direction — How the Integration of Plasma and ZK-SNARKs Will Change the Game

Author: dt, DODO Research; 0xNing0x, Senior Researcher at EMC Fund

Last week, Ethereum co-founder Vitalik (referred to as "V God" in this article) published a new post on Twitter titled "Exit games for EVM validiums: the return of Plasma." The article focuses on introducing the Plasma scaling technology and suggests combining the increasingly marginalized Plasma scaling approach with ZK (zero-knowledge) proofs. Following its release, many projects related to Plasma technology saw significant price increases, bringing this once-overlooked technology—long overshadowed by Rollups—back into the competition within Ethereum's scaling landscape.

This week’s CryptoSnap, brought to you by DODO Research X NingNing (@0xNing0x), breaks down Plasma in the simplest way possible and explains what V God’s latest article is really saying!

What is Plasma?

Scalability has always been a key research focus for blockchain developers. To achieve the vision of a decentralized world computer, building a cheap and fast blockchain is essential. As a result, various scaling solutions have emerged around the Ethereum mainnet, with Plasma once being a dominant approach among them.

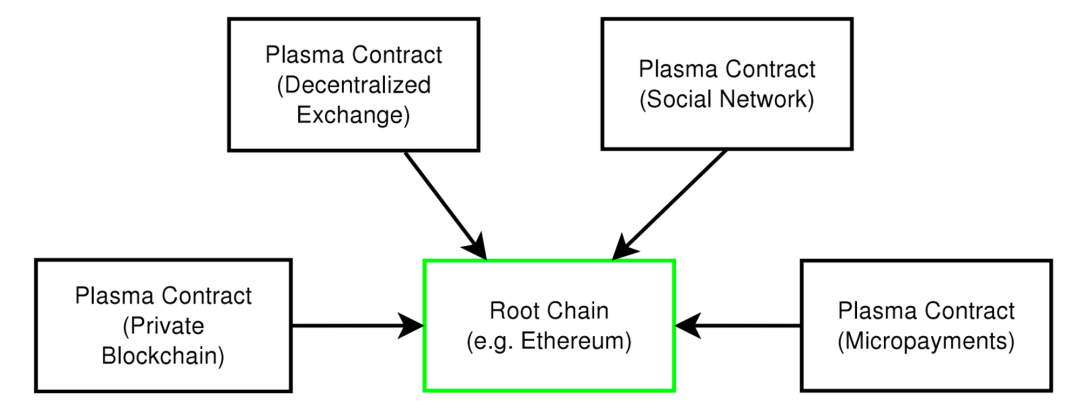

Plasma can be simply understood as a chain built atop the Ethereum mainnet, where smart contracts manage fund deposits and withdrawals between the mainnet and the Plasma chain. Unlike sidechains (e.g., BNB Chain, Gnosis Chain), the Plasma chain periodically submits its final state back to the Ethereum mainnet. And unlike Rollup technologies, the Plasma chain does not submit full transaction data—only the Merkle root representing the state of the Plasma chain.

Exit Game: The Security “Withdrawal Game” Mechanism

Since computation doesn’t occur on the mainnet, Plasma chains significantly enhance network scalability while maintaining a relatively secure validation mechanism to deter malicious actors. When discussing security, we must mention the “Exit game” highlighted in V God’s title—the security mechanism behind Plasma chains.

In the Plasma framework, security is protected by its exit mechanism. When users wish to withdraw funds back to the mainnet or suspect an attack on the Plasma chain, they can submit an “exit” request to the Plasma contract on the mainnet, providing proof that their withdrawal is valid. If no challenger successfully disputes this during a seven-day challenge period, the user can successfully retrieve their assets on the mainnet. Conversely, if the exit is successfully challenged, it fails—and the malicious actor must pay a penalty.

Common attack types include:

-

Exiting immediately after sending a transaction (“Not latest owner”): This occurs when a user sends a transfer and immediately attempts to exit funds during the challenge period. This is invalid because the rightful owner should now be the recipient. The network can challenge such exits by proving the asset was already transferred.

-

Double-spending attacks: A double-spend happens when the same asset is spent more than once. For example, Alice sends 1 token to Bob and then tries to send the same token to Charlie. The network can detect this duplication and challenge the fraudulent transaction.

-

Invalid transaction history: This refers to detecting an invalid state transition in the asset’s history—such as unspent outputs without corresponding consumption records. Users can respond to such challenges by providing valid spending proofs.

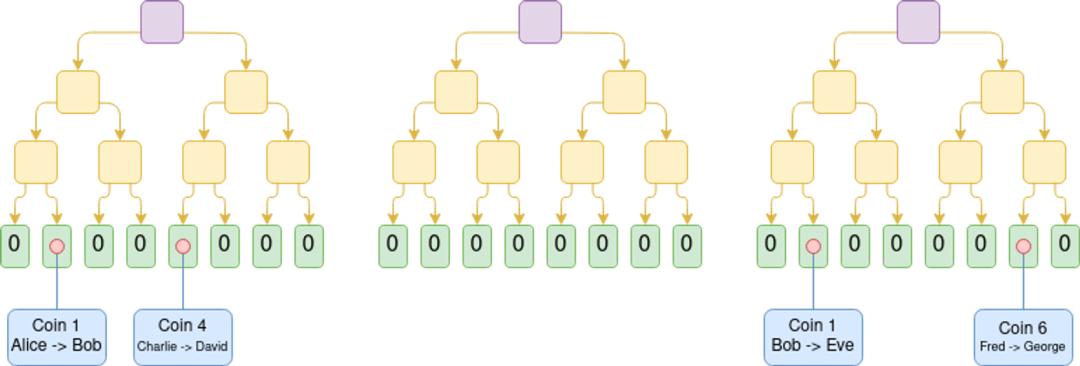

Plasma Cash

Next, V God introduces Plasma Cash—a project using the Plasma framework. In Plasma Cash, each deposited token is treated as an NFT, with every NFT having its own transaction history recorded in a Merkle tree structure. However, due to the indivisibility and uniqueness of NFTs, Plasma Cash has limited use cases, primarily serving specific payment purposes. This led to an improved version based on the UTXO model, which solves the fragmentation issue inherent in Plasma Cash’s original NFT-based design, enabling better usability in payments. However, this also makes integration with smart contracts difficult.

Technical Bottlenecks of Plasma

The current technical bottleneck of Plasma lies in its difficulty implementing EVM compatibility. Many state objects within EVM contracts lack a clear “owner,” which contradicts Plasma’s security model. The Plasma exit mechanism requires every state object to have a clearly defined owner responsible for monitoring its data and initiating an exit when necessary to protect assets. However, in EVM contracts, many state objects do not have a single owner—for instance, liquidity pools in Uniswap or CDP positions in MakerDAO. In such cases, if problems arise on the Plasma chain, the following scenarios may occur:

-

No owner initiates an exit, leaving the state permanently locked on the Plasma chain.

-

Even if third parties attempt to initiate exits, they are vulnerable to Exit Game attacks, posing high risks.

-

Complex contract states are difficult to verify.

Plasma + ZK-SNARKs

To address these existing technical bottlenecks, V God proposes that integrating mature validity-proof technology (zk-SNARKs) could effectively resolve some issues. Specifically, this combination offers five key benefits:

-

zk-SNARKs can prove the validity of Plasma blocks directly on the main chain, reducing reliance on the exit mechanism.

-

It enables instant withdrawals from the Plasma chain, eliminating the seven-day fraud-proof challenge window and mitigating chain reorganization issues.

-

A parallel UTXO structure representing EVM state can be constructed and proven equivalent via zk-SNARKs, bypassing certain EVM limitations.

-

zk-SNARKs drastically reduce the amount of state data users need to verify and store, improving user experience.

-

For smart contracts with unclear ownership, partial security guarantees can still be achieved if critical components can be broken down into verifiable units.

While these methods still cannot fully cover all complex EVM contracts, ongoing advancements in ZK technology and continued exploration of Plasma designs may eventually yield new solutions that better balance security, scalability, and user experience.

Authors’ Perspectives

DT @19971122:

Before reading V God’s article, I wasn’t familiar with Plasma’s technical architecture—after all, today’s Ethereum scaling landscape is almost entirely dominated by Rollup technologies. Teams are racing to launch L2 networks based on Rollups, giving rise to modular architectures that offload data availability (DA layer) to other networks (Celestia, EigenLayer, Avail). This has even led to statements like one from Ethereum researcher Dankrad Feist on Twitter: “Modular blockchains that don’t use ETH for their DA layer aren’t Rollups, nor are they Ethereum L2s.” Debates over what constitutes the “true” path for Ethereum development remain common. Just as discussions around Rollup evolution intensify, V God’s article feels like a shot of adrenaline for Plasma—reminding the Ethereum community that Rollup isn’t the only scaling option. A ZK+Plasma hybrid might just be another viable alternative.

I believe diversity is natural in a decentralized ecosystem. Yet, when capital efficiency comes into play, homogenized, modular development appears more economical—leading to standardized frameworks like OP Stack or Polygon zkEVM CDK, allowing various entities to build their own L2s. But this trend sacrifices some diversity. Perhaps V God’s move is a corrective nudge toward rebalancing Ethereum’s scaling trajectory. Whether any teams will step forward to implement this vision is something worth watching closely. As a long-time Ethereum user and supporter, I welcome balanced technological progress across Ethereum’s scaling stack.

NingNing @0xNing0x:

Plasma is a solution designed to improve blockchain scalability by moving most data and computation off-chain. First introduced in 2017, it has gone through multiple iterations including Plasma Cash and Plasma Cashflow. However, due to fundamental limitations when expanding beyond simple payments—such as the problem of ownerless states and incentive misalignment—Plasma-based L2 solutions gradually became marginalized.

Meanwhile, Rollups have become the mainstream L2 solution, primarily due to their clean design and developer-friendliness. However, with the realization and maturation of zkEVM technology, Plasma is opening up new design possibilities, offering fresh avenues for simplifying developer experiences and safeguarding user assets.

Vitalik’s recent advocacy for Plasma L2s may not be about positioning it as a direct competitor to Rollup dominance, but rather emphasizing the importance of paradigm diversity and innovation in the L2 space. Currently, Rollup L2s hold an absolute lead in terms of TVL and user numbers, and due to the Matthew effect, this lead is likely to strengthen further in the foreseeable future.

In recent days, Blast—a new-paradigm L2 developed collaboratively by Paradigm and Blur—has demonstrated an alternative path. Although its architecture doesn’t strictly meet Vitalik’s definition of an L2, it has gained significant traction in the market and community, quickly attracting attention and substantial funding. This shows that both markets and communities crave diversity in L2 paradigms, no longer content with just one or two standardized designs.

Overall, Plasma L2 solutions possess certain potential and innovation, but the evolution of L2s should not depend on a single top-down blueprint designed by a supremely rational architect. Instead, it should emerge organically from complex, nonlinear market competition.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News