Analyzing the investment potential of platform tokens: which one is more worth holding?

TechFlow Selected TechFlow Selected

Analyzing the investment potential of platform tokens: which one is more worth holding?

In summary, holding platform tokens during a bull market can bring higher returns and additional profit opportunities.

As Bitcoin breaks through the $38,000 mark, the crypto market is rapidly emerging from a two-year bear market. With Bitcoin’s halving approaching and spot Bitcoin ETFs potentially gaining approval, these factors suggest the crypto industry may be on the verge of an unprecedented bull run. So, how can one best seize this wealth opportunity in the crypto space?

Currently, one of the most profitable sectors in the crypto industry is trading platforms, and platform tokens represent one of the most important tracks within crypto assets. During the previous bull market, Bitcoin surged from $5,021 to a historic high of $67,000—an increase of approximately 1,200%. However, the platform tokens of major exchanges significantly outperformed Bitcoin. For example, Binance, a leading exchange, saw its platform token appreciate around 60-fold, while other exchange tokens such as OKB, GT, and KCS each gained over 20 times in value. Therefore, investing early in platform tokens at the beginning of a bull market is a highly strategic move—offering strong certainty, relatively lower risk, and substantial upside potential.

So, how should one choose a platform token? Which platform token has greater appreciation potential? Below, we will conduct a comprehensive comparative analysis based on fundamental metrics of exchanges, price trends of their platform tokens, and additional value provided by these tokens. By deeply understanding operational performance, market share, historical price movements, and utility features of various platforms, we can better assess the growth potential of each platform token. Additionally, we can identify innovative and promising new platforms and their tokens. Ultimately, through thorough analysis and holistic evaluation, investors can select platform tokens with the greatest upside potential.

Top-Tier Exchanges Weaken While Mid-Tier Platforms Show Strong Growth

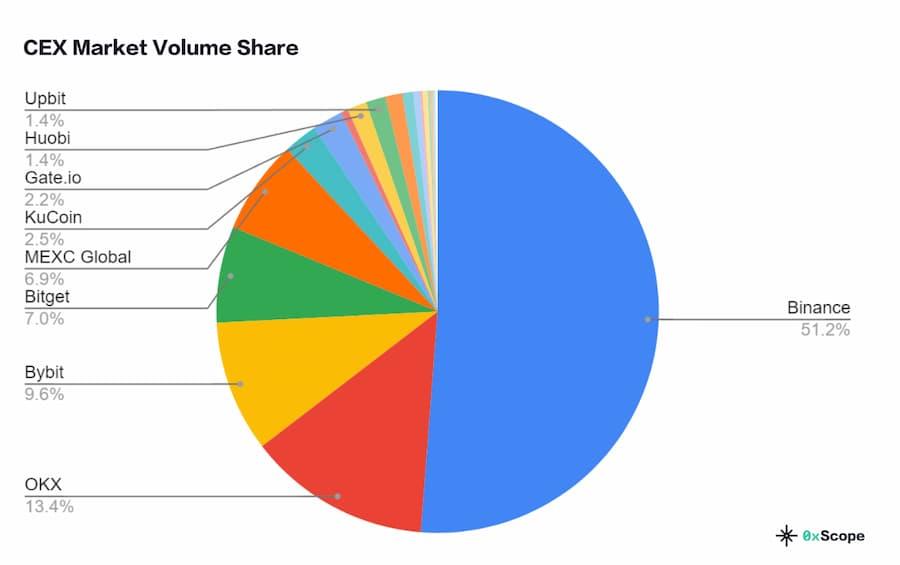

As the saying goes, “It’s easy to thrive under a big tree.” This holds true in the cryptocurrency world as well. The value of a platform token is largely determined by the fundamentals of its underlying exchange. Over the past nearly two years of bear market conditions, the landscape among crypto platforms has shifted considerably. Take Binance, for instance: at the beginning of 2023, it commanded up to 60% of trading volume and market share, demonstrating clear dominance. However, according to recent CEX reports published by 0xScope, Binance's market share has dropped to 51% and could decline further.

Meanwhile, some mid-tier exchanges like Bitget and Bybit have emerged strongly and experienced rapid growth. For example, Bitget had only a 2% market share at the start of 2023, but that figure has now risen to 7.0%, making it one of the fastest-growing exchanges of the year and securing its position among the top four global trading platforms.

From this comparison, we observe that while top-tier exchanges remain powerful, they are gradually weakening. In contrast, fast-growing platforms like Bitget and Bybit have leveraged more aggressive listing strategies and superior product offerings to rise against the tide during the bear market, capturing greater value for their platform tokens. Thus, for investors, choosing platform tokens from high-potential platforms like Bitget and Bybit offers stronger investment appeal.

Performance of Major Platform Tokens in 2023

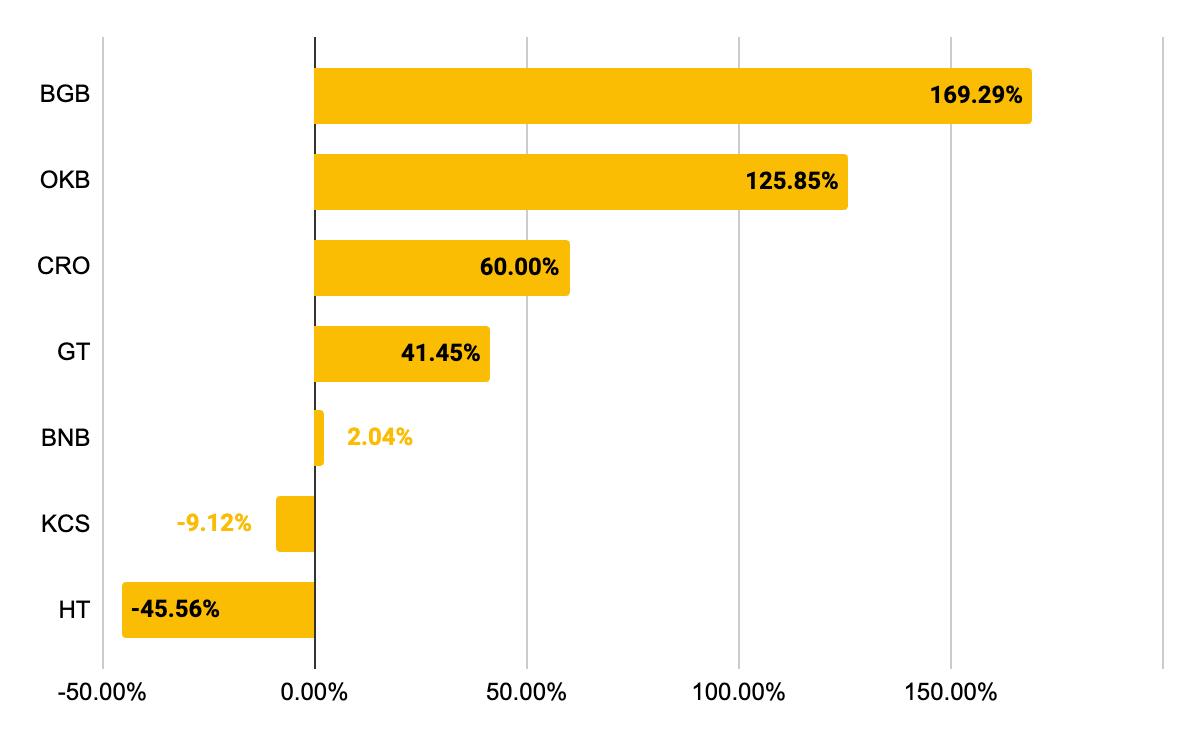

The price trend of a platform token is the most direct indicator of its investment potential. As clearly shown in the chart below, BNB—the token of the industry leader—has seen only a 2% gain this year, while Kucoin and Huobi tokens have experienced significant declines. This aligns with a fundamental principle: the operational health of an exchange directly impacts its token’s price. The same logic holds true for standout performers. Take Bitget, which rose to prominence in 2023: its native token BGB has surged 168% since the beginning of the year—a return that even surpasses Bitcoin (BTC is up 107% year-to-date). BGB has become one of the best-performing platform tokens this year and is among the few to outperform Bitcoin.

Notably, bear markets serve as a crucial test of asset quality. Tokens capable of rising逆势 during downturns often demonstrate even greater appreciation potential when the bull market returns. Currently, BGB is in an upward trajectory with strong momentum. Once the bull market arrives, this uptrend could accelerate dramatically, fueled by growing market confidence and capital inflows.

The Power of Compounding: Additional Value from Platform Tokens

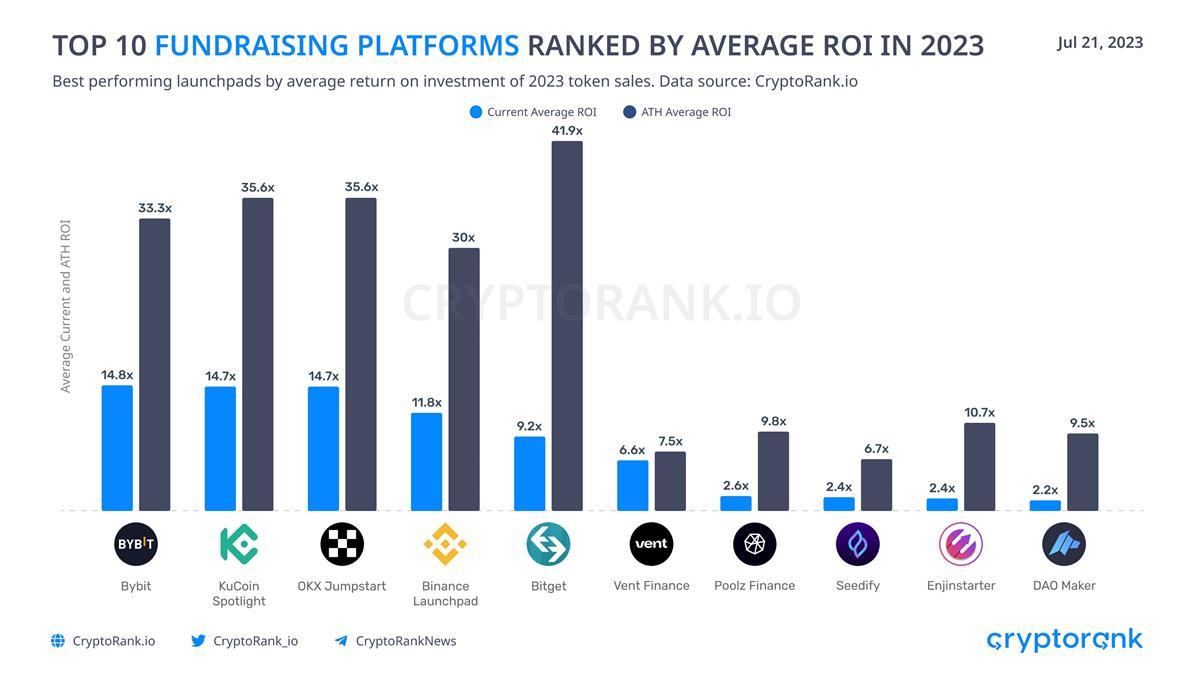

High-quality assets not only need appreciation potential but also the ability to generate additional returns.Compared to other cryptocurrencies, platform tokens offer a unique advantage—they create extra value for holders. One primary way this value manifests is through participation in exchange LaunchPad programs. So, which platform token delivers greater additional value? We can examine this from two perspectives.

First, the returns from LaunchPad projects. According to data from CryptoRank, top-tier exchanges’ LaunchPad projects performed impressively in 2023, with average peak returns exceeding 10x. For example, Bitget’s LaunchPad achieved an average historical peak return of 41.9x across all projects—ranking first globally. OKX and Bybit followed closely behind with average peak returns of 35.6x and 33.3x, respectively.

Second, the number of new LaunchPad projects launched. Since the start of 2023, Bitget has rolled out six LaunchPad projects—an average of one every 1.5 months. Binance follows with three projects launched, averaging one per quarter. Other exchanges have taken a more conservative approach, launching fewer new projects and thus offering limited additional earning opportunities via their platform tokens.

Overall, Bitget’s LaunchPad offers both higher returns and more frequent project launches, meaning holding BGB generates significantly more additional value. Furthermore, BGB holders can participate in Bitget’s Launchpool, staking programs, and receive airdrops from new projects—all contributing to incremental earnings. While these benefits may seem modest today, once the bull market resumes and compounding effects kick in, they could unlock massive profit potential for token holders. From the perspective of added utility and passive income generation, Bitget’s BGB stands out as a platform token with considerable investment potential and long-term upside.

Conclusion

In summary, holding platform tokens during a bull market can deliver higher returns and access to additional earning opportunities. Recently, platform tokens from fast-growing mid-tier exchanges such as Bitget and Bybit have drawn increasing attention. Compared to those issued by top-tier platforms, these mid-tier tokens offer far greater room for growth.Take Bitget as an example: its market share stands at 7%, roughly 1/7th of Binance’s (51%), while BGB’s market cap is just $600 million—about 1/70th of BNB’s ($38 billion). Based on this gap alone, BGB still has at least 10x growth potential, indicating it is currently undervalued.

Therefore, when selecting a platform token, investors should comprehensively evaluate the underlying exchange’s fundamentals, historical price performance, and the additional value provided by the token—to achieve maximum returns at minimal cost.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News