Revisiting Liquid Staking: Do the Numbers Show Lido Is Still Attractive?

TechFlow Selected TechFlow Selected

Revisiting Liquid Staking: Do the Numbers Show Lido Is Still Attractive?

This article will explore Lido's prominent position in the liquid staking sector.

Written by: Tanay Ved

Compiled by: TechFlow

Introduction

Ethereum's evolution into a Proof-of-Stake (PoS) blockchain has brought significant changes for key participants and its underlying economy, positioning PoS as the cornerstone of Ethereum’s consensus. Following the successful completion of “The Merge,” the subsequent “Shapella” upgrade further solidified industry momentum around PoS. With approximately $40 billion in assets staked and a growing ecosystem of stakeholders, it is essential to understand the current state of this space and examine the major players exerting substantial influence.

Lido, the largest player in the PoS economy, has garnered attention for its liquid staking token (stETH), governance token (LDO), and its foundational node operators. This article aims to explore Lido’s prominent position within the liquid staking landscape—a topic that has become increasingly contentious within the Ethereum community.

Current State of Ethereum PoS

Before delving deeper into Lido and stETH (staked ETH), it is helpful to first understand the current state of Ethereum’s PoS, particularly amid tightening monetary policy and rising interest rates.

As of October, approximately 27.9 million ETH—about 23% of the current supply, or roughly $40 billion in value—has been staked on the Beacon Chain, highlighting the rapid growth in staking since the Shapella hard fork. However, this accelerated adoption appears to have slowed recently. This deceleration can be attributed to the decline in Ethereum staking APR from over 5.5% pre-Shapella to 3.5% in October, driven by an influx of validators and lower transaction fees. In contrast, the current yield on U.S. 10-year Treasury bonds stands at 4.67%, creating a significant opportunity cost for capital seeking safer and higher returns. Nonetheless, shifts in these conditions could change the outlook, potentially making on-chain yields attractive once again.

Understanding Lido's Dominance

Lido plays a pivotal role in the PoS economy by democratizing staking. At its core, the protocol connects capital providers (i.e., ETH stakers/delegators) with infrastructure providers (i.e., node operators), enabling users to deposit any amount of ETH rather than being restricted to the 32 ETH required to run a validator independently. When users deposit ETH into Lido’s smart contract, funds are pooled and delegated to a vetted set of node operators who run the necessary software and hardware. In return, depositors receive “stETH”—a fungible claim representing their deposited ETH, minted at a 1:1 ratio.

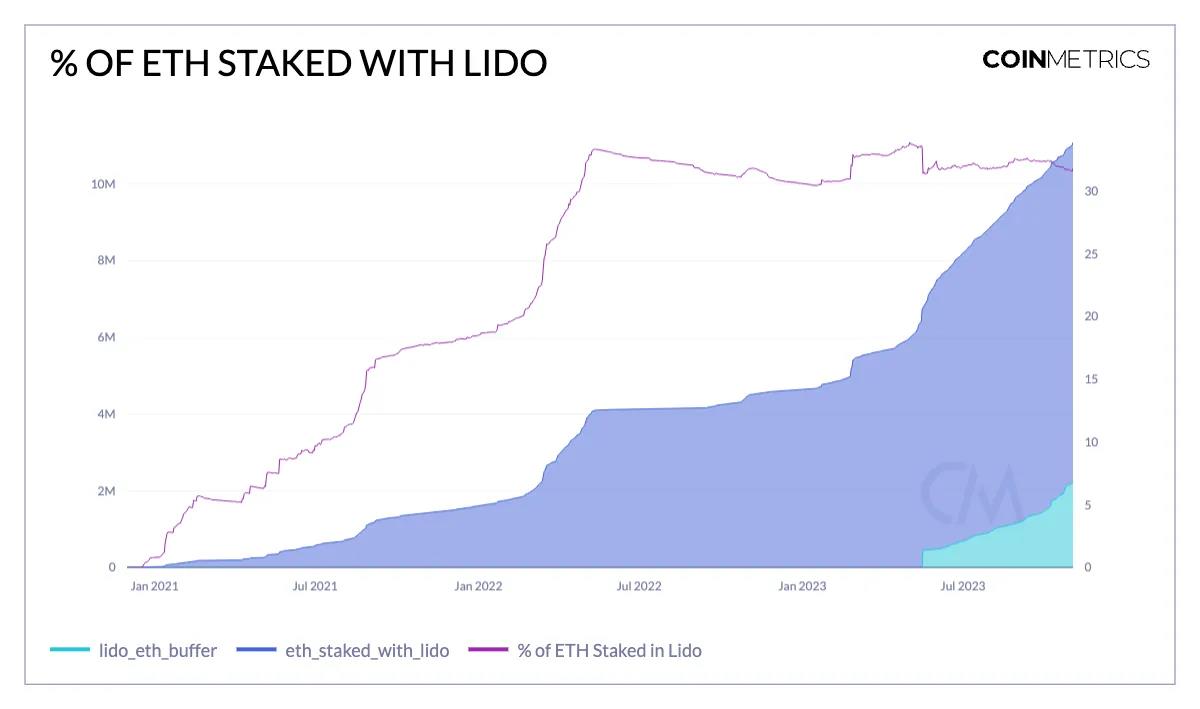

Out of the total 27.6 million ETH staked, 8.9 million ETH—valued at $16.8 billion—is staked via Lido, making it the largest liquid staking and decentralized finance (DeFi) protocol. In percentage terms, this represents about 32% of all ETH staked. This metric has drawn scrutiny, as Lido controls roughly one-third of all staked ETH, raising concerns about centralization risks.

These concerns stem from the idea that if a single liquid staking provider—or its underlying node operators—exceeds a critical threshold of total staked ETH, it could increase the likelihood of adverse outcomes for the Ethereum network. These include increased centralization, coordinated extraction of Maximum Extractable Value (MEV), unfair slashing penalties, and other forms of manipulation such as time-bandit attacks for personal gain. However, it is important to note that Lido does not operate as a single entity but relies on a distributed set of 38 node operators, subject to staking caps and geographically dispersed server locations to maintain jurisdictional decentralization of the validator set.

Arguably, the governance process overseen by the Lido DAO (Decentralized Autonomous Organization) poses a greater (potential) risk to the protocol than its share of staked ETH.

The debate surrounding Lido’s dominance has intensified recently. Supporters argue that Lido enhances staking accessibility and attribute its success to free-market dynamics around stETH and strong network effects. Critics, however, express concern over the potential for centralization due to its growing influence, urging Lido to limit its growth and exploring alternatives such as integrating staking more directly into the Ethereum protocol itself. While the reality is more nuanced, it is clear that striking a balance between accessibility and decentralization is crucial for preserving Ethereum’s core principles and long-term health.

Network Effects of stETH

Lido’s first-mover advantage and the introduction of native yield through stETH have enabled the protocol to accumulate significant network effects. These characteristics have fostered a winner-takes-most dynamic, resulting in an oligopolistic market structure around liquid staking. stETH is one of the most critical components of the Lido ecosystem, allowing users/stakers to “delegate” their ETH to secure the network (participate in consensus) in exchange for a tokenized representation—an on-chain derivative of their underlying stake. This token not only provides native yield but also offers additional utility, as it can be traded, swapped, borrowed against, or used to provide liquidity—all while accruing staking rewards. This dual benefit is a key value proposition of liquid staking.

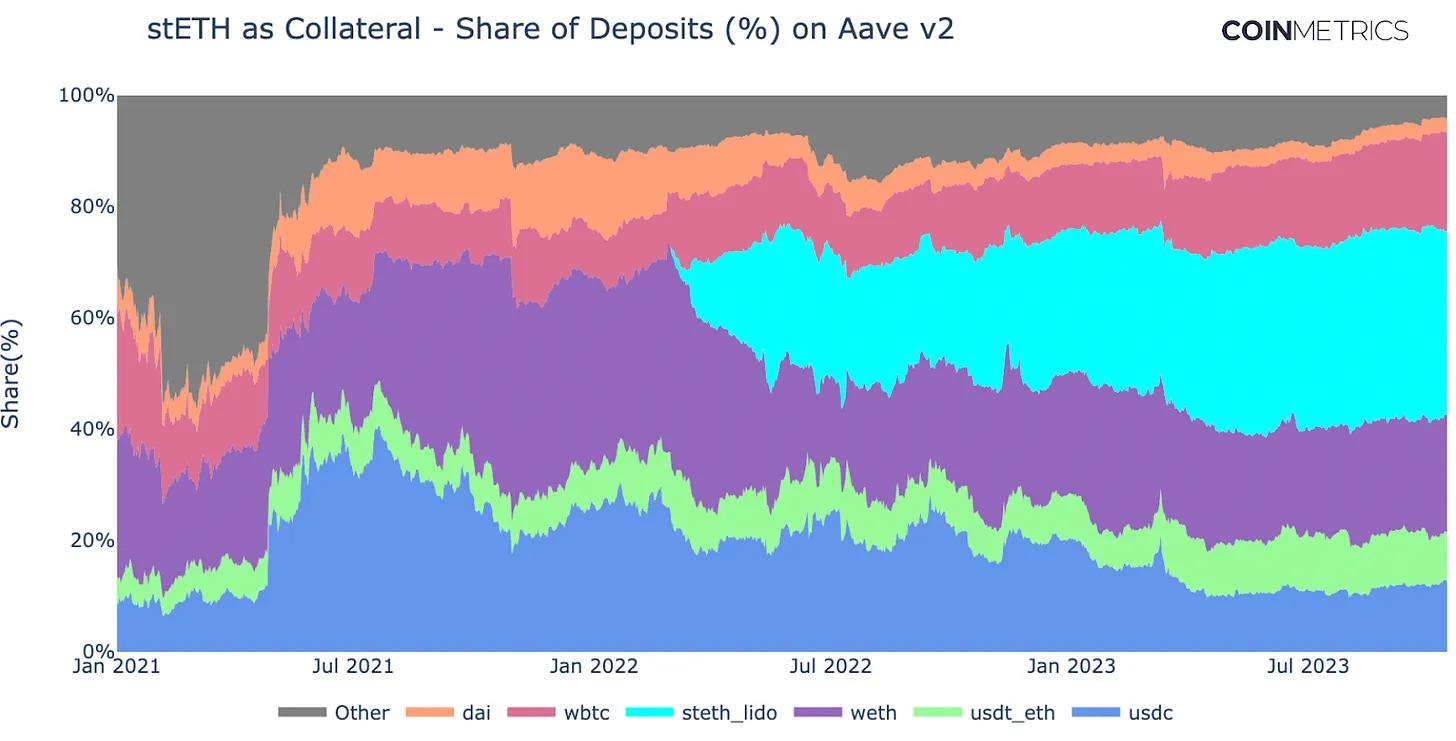

stETH as Collateral

stETH and its wrapped version (wstETH) have become among the top collateral assets supported on several DeFi platforms—including Aave, Maker, and Compound—for lending purposes. As shown above, stETH accounts for 33% of total deposits on Aave v2, experiencing rapid growth since its integration. Meanwhile, the share of wrapped ETH (WETH) has declined from a peak of 39% to its current level of 21%. The rise of stETH is driven by its yield-bearing nature and capital efficiency, offering a compelling opportunity cost compared to holding or using plain ETH.

These attributes have also led to the emergence of new products leveraging stETH as either over-collateralized backing or primary collateral for synthetic stablecoins. Such products complement others like sDai, sFrax, and USDM, which bring yields from traditional securities (e.g., U.S. Treasuries) on-chain.

stETH on Exchanges

stETH maintains a presence across both decentralized and centralized exchanges, enabling users to gain exposure to the token and its staking rewards. Additionally, it enjoys substantial liquidity on automated market makers (AMMs) such as Curve Finance and Uniswap, facilitating efficient trading. As illustrated above, stETH historically benefited from strong liquidity on Curve, reaching monthly trading volumes of approximately $35 billion in May 2022. Recently, however, this trend appears to be waning as Uniswap gains increasing liquidity and trading volume. In comparison, liquidity on centralized exchanges tends to be lower, although platforms like OKX and Huobi show signs of recovery.

stETH Token – Rebase Mechanism

The stETH token employs a “rebase” mechanism, which has significant implications for Lido users and applications interacting with stETH. Fundamentally, rebase tokens like stETH are designed so that the token supply increases proportionally with the underlying asset—reflecting changes in users’ staked ETH balances. In this case, when users deposit ETH (the base asset) into Lido, the stETH supply (the derivative asset) increases along with accrued staking rewards. As a result, users see their staked balances grow automatically without needing to perform additional transactions.

Rebase Function:

balanceOf(account) = shares[account] * totalPooledEther / totalShares

As shown above, the rebase function of stETH can be visualized at a high level. For example, consider three hypothetical accounts with initial deposits of 50, 30, and 20 ETH respectively. An oracle reports daily statistics from the Beacon Chain regarding the total amount of pooled ether across validators. Any increase or decrease in this pooled amount (in cases of validator penalties) along with accumulated rewards is reflected in users’ account balances at the end of each daily rebase, much like interest accrual in a traditional savings account.

While this offers a user-friendly experience, it means that applications unable to support rebasing tokens must introduce non-rebasing versions for compatibility. This led to the creation of wrapped staked ETH (wstETH), which is compatible with various protocols including Maker, Aave v3, Compound v3, and Uniswap V3.

Lido DAO Governance and the LDO Token

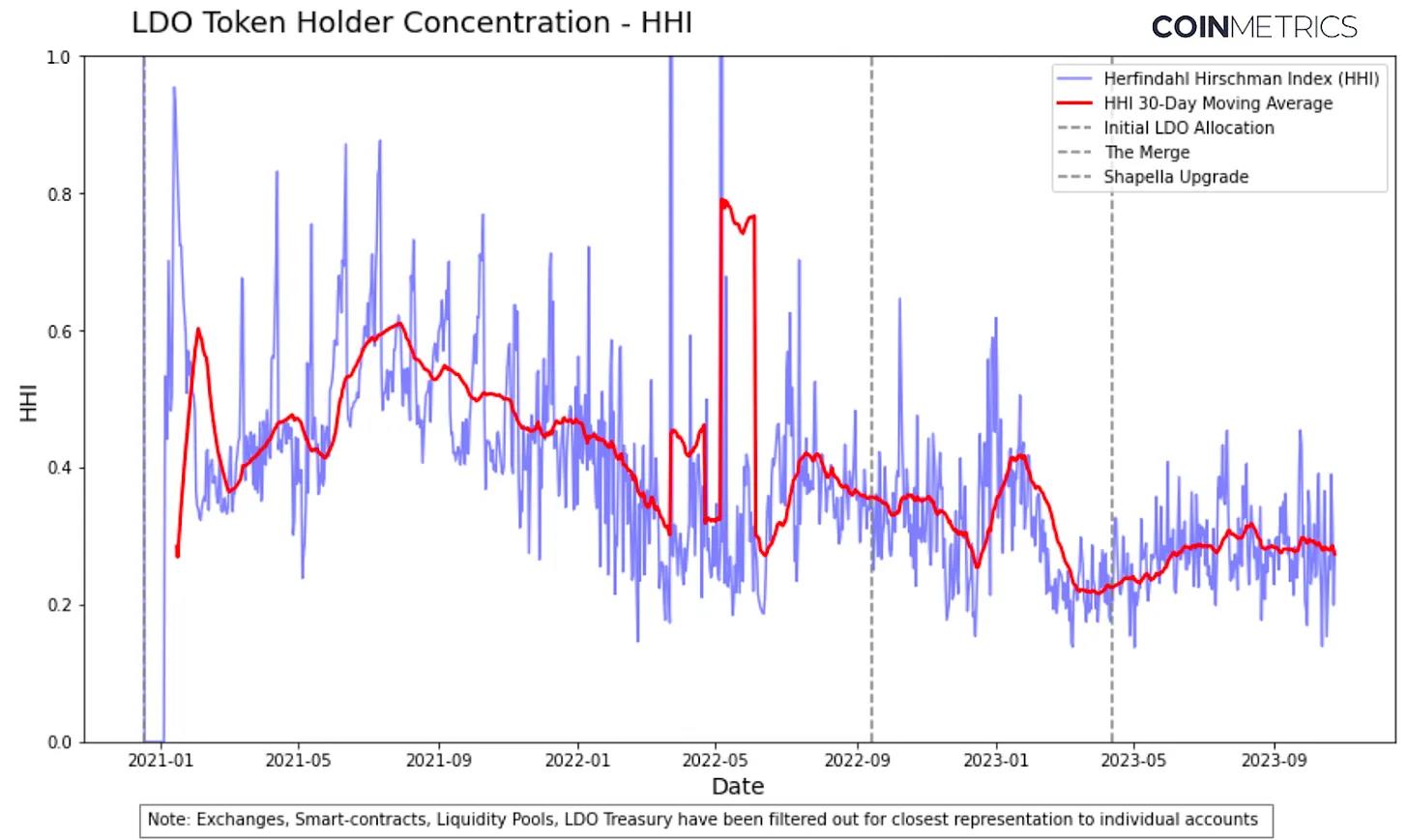

As previously mentioned, governance is a crucial component of the Lido protocol. The Lido DAO, managed by LDO token holders, holds “root” access to certain critical aspects of the protocol. This includes the ability to upgrade smart contracts, manage registries of node and oracle operators, control associated withdrawal keys, and oversee the Lido treasury. These privileges, combined with the high concentration of LDO token holdings, have raised concerns about the governance layer serving as a potential attack vector. In response, proposals for dual governance have emerged, allowing stETH holders to veto decisions made by LDO holders—aiming to create a more balanced power dynamic.

The chart above shows the Herfindahl-Hirschman Index (HHI) for LDO token holders. HHI measures the concentration of participants within a market—in this case, the distribution of LDO token holdings across accounts. An HHI near 0 indicates uniform distribution, while values approaching 1 reflect extreme concentration, where a small number of holders control a disproportionate share of supply. Clearly, concentration fluctuates significantly with daily changes in holder base. Peaks above 1 may stem from the initial token distribution in December 2020 and temporary increases in concentration during sharp price declines. Nevertheless, in the long term, there appears to be a declining trend in LDO holder concentration—from 0.6 in early 2021 to 0.3 in October 2023, as depicted in the chart.

Conclusion

Lido is a critical component of Ethereum, and thus its health is closely tied to the overall well-being of the Ethereum network. Consequently, there is a strong incentive to safeguard Lido. The ongoing discussion about Lido and its prominent status reflects a welcomed developmental trajectory for Ethereum as a PoS blockchain. While the path forward may be subtle and not entirely clear, it demonstrates that stakeholders on both sides of the debate are ultimately acting in Ethereum’s best interests—upholding its principles of accessibility and decentralization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News