Following VCs to Trade: A Guide to Using Free On-Chain Tracking Tools

TechFlow Selected TechFlow Selected

Following VCs to Trade: A Guide to Using Free On-Chain Tracking Tools

You can use this tool to view: tokens that VCs are buying and selling, tokens they are holding, and how these holdings are changing.

Written by: Deebs DeFi

Compiled by: TechFlow

How to track smart money is a perennial question in crypto. Chain analyst Deebs has built a tool for tracking smart money—this is also how he discovers early-stage tokens.

Tool link: Click here (requires access to global internet).

First, why should we track smart money or venture capital firms (VCs)? VCs typically have:

• Insider information;

• A proven track record;

• Experts with deep understanding of cryptocurrency.

For these reasons, I’ve created a dashboard to help you track and mimic their investments.

With this tool, you can view:

1) Tokens that VCs are buying and selling.

2) Tokens currently held by VCs.

3) How these holdings are changing over time.

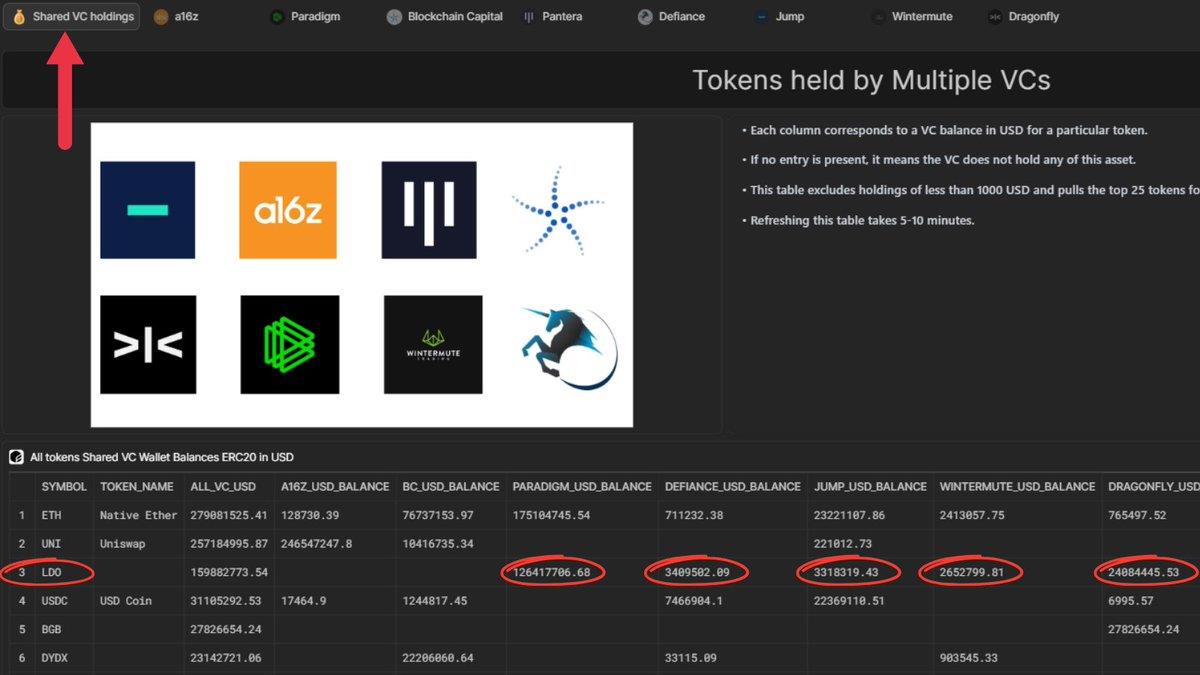

There’s also an exclusive feature not found elsewhere—comparing tokens jointly held by multiple VCs.

This is by far my favorite feature for discovering promising investment opportunities:

1) Click on "Shared VC holdings";

2) Scan the table to identify tokens held by multiple VCs;

3) Create a list of tokens ranked by highest holding amounts.

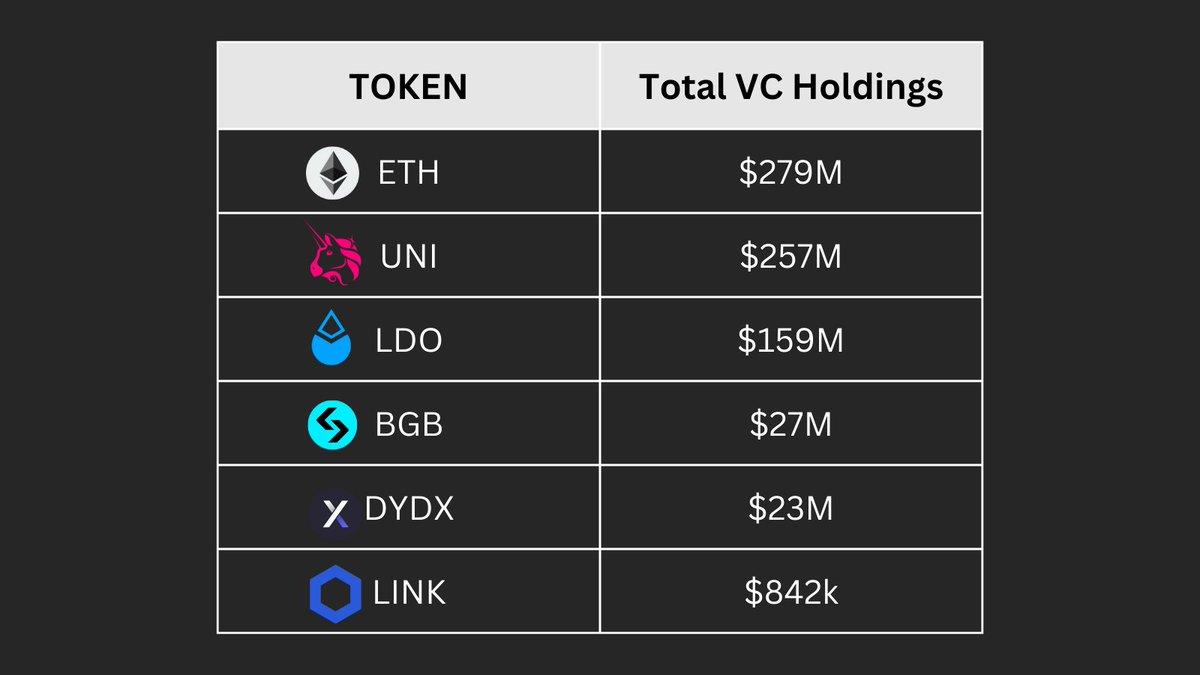

In the image below, you’ll see a list of tokens held by multiple VCs. These could be potential candidates for your portfolio.

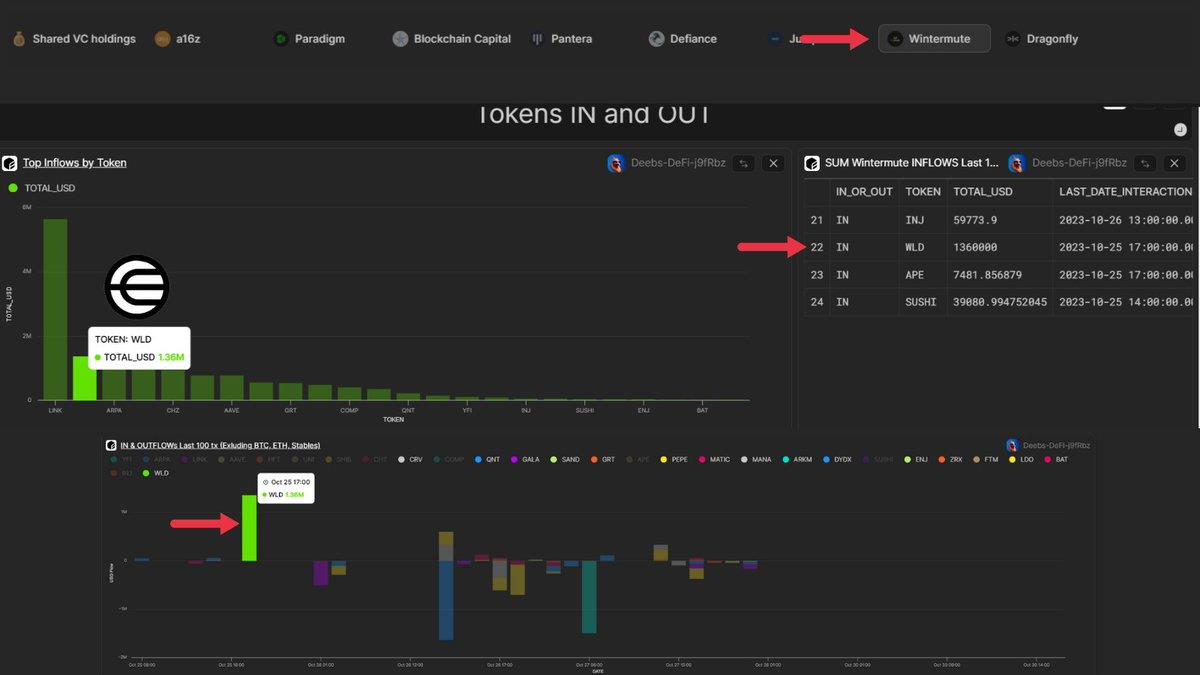

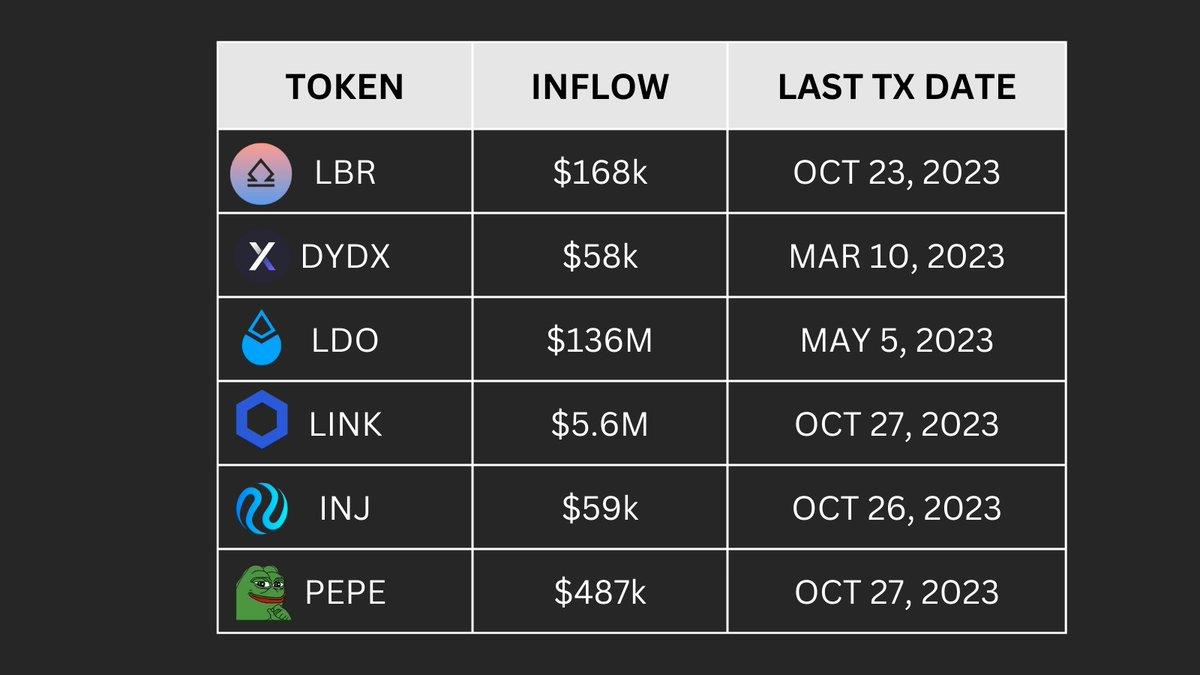

If you’re not only interested in what VCs hold, but also want to know what they’re actively buying, you can click another tab:

1) Click on the VC tab;

2) Go to "Tokens IN and OUT";

3) List the tokens that this VC is accumulating.

Example: Wintermute added $1.36 million worth of WLD in October.

Once you master these two functions, it’s time for the final step.

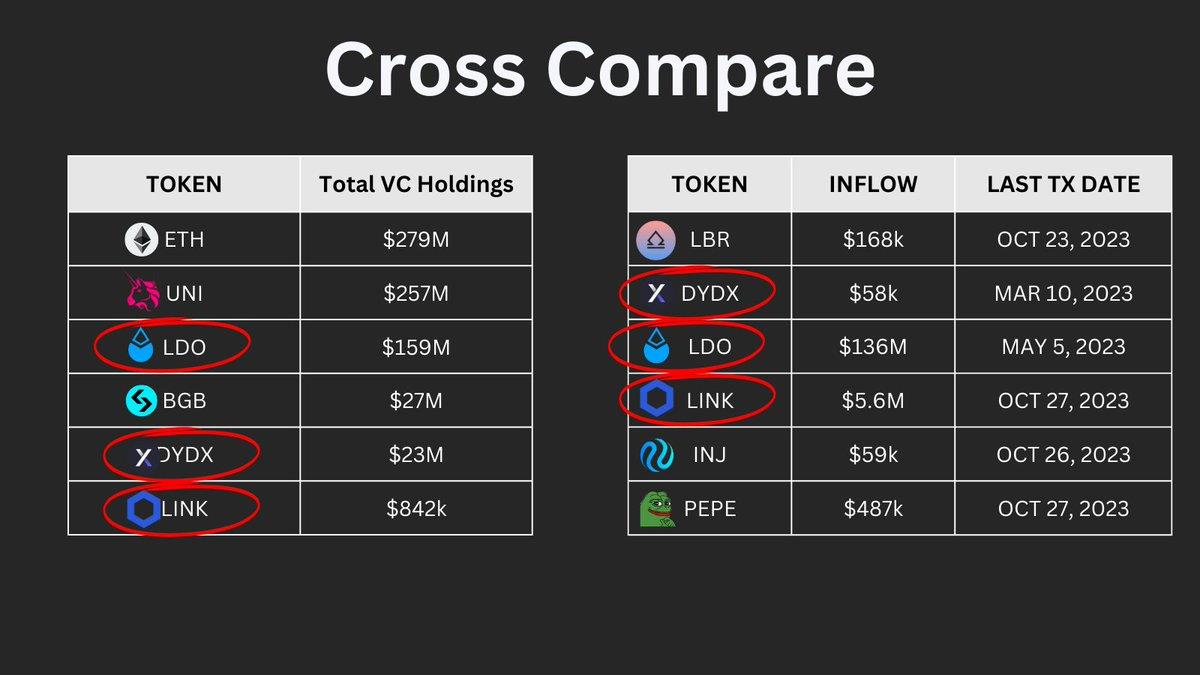

You can cross-compare them:

1) Identify which tokens appear in both List 1 (jointly held) and List 2 (currently being accumulated);

2) Add those tokens to your final research and potential investment list.

Tips:

• Increase the number of past transactions to gain a more comprehensive view of your VC’s buying and selling behavior;

• Click refresh at the top of the page to get the latest updates;

• Remember: This is not financial advice. VCs generally have a much higher risk tolerance than most retail investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News