Chainlink: Can RWA Become a Key Catalyst for the Project's Future Growth?

TechFlow Selected TechFlow Selected

Chainlink: Can RWA Become a Key Catalyst for the Project's Future Growth?

Chainlink's value in the RWA narrative lies in its efforts to become the key infrastructure enabling the trading of these assets on-chain, bridging traditional finance and decentralized finance.

Written by: Jose Oramas

Compiled by: TechFlow

Chainlink has been busy building.

Despite its token only recently surging, the protocol has partnered this year with some of the world’s largest financial institutions, including ANZ Bank, DTCC, Citibank, and BNY Mellon.

What’s driving these partnerships, and why should you care? Tokenization of real-world assets (RWAs) could bring trillions of dollars into capital markets and the DeFi sector. More importantly, it can fulfill crypto’s original promise—by making our outdated financial systems more accessible and efficient for the broader public.

Chainlink is currently in a pivotal position to play a key role in the success and mainstream adoption of RWAs. Let’s dive in.

The Importance of Oracles in Connecting Blockchain with the Real World

Oracles can be seen as middleware through which multiple networks and applications retrieve accurate external data and execute smart contracts based on these inputs.

Their primary function is to deliver off-chain data to smart contracts, since blockchains cannot independently access information outside their respective networks.

The value of oracles like Chainlink in the RWA narrative becomes clear—they bridge the information gap between TradFi and DeFi, which is crucial for the success of RWAs and tokenized markets. Without oracles, blockchains would be unable to interact with the outside world, and vice versa, rendering tokenization impractical and data retrieval impossible.

Below, we’ll examine how Chainlink’s functions, data streams, proof of reserves, and CCIP add value to the tokenization of RWAs.

The Surge in RWAs Could Be a Catalyst for Chainlink

With the potential influx of institutional capital, Chainlink and competing oracle providers may see a surge in demand for their services. Why?

-

RWA protocols require accurate importation of off-chain data.

-

Institutions will want access to crypto-native RWAs across different chains or institution-native RWAs across tokenized markets.

-

By acting as middleware between DeFi and TradFi, oracles can eliminate the complexity of interacting with blockchain-based protocols.

-

Additionally, by connecting multiple public and private blockchains, financial institutions can trade RWAs in a cross-chain and cross-currency manner.

Chainlink addresses these needs using the following services:

CCIP: Cross-Chain Interoperability Protocol

Multiple financial entities have sought out CCIP this year because it allows traditional back-end infrastructures and dApps to interact with any blockchain network via a single middleware solution.

In September, post-trade financial services company DTCC used CCIP to work on Swift’s blockchain interoperability project. Similarly, Australia and New Zealand Banking Group (ANZ) leveraged CCIP to allow customers to transfer ANZ-issued stablecoins across chains and purchase nature-based assets.

Chainlink Functions and Data Streams

Chainlink Functions is a serverless platform that enables Web3 developers to connect smart contracts with Web2 APIs. The Data Streams service does exactly what it sounds like—it’s a decentralized off-chain system that retrieves real-world data into on-chain verification contracts. Both Functions and Data Streams can help transfer RWA data to on-chain protocols in real time, even as data moves into Web3.

Chainlink Proof of Reserves

Verifies off-chain asset backing for on-chain assets within DeFi projects.

How Far Can Chainlink Go With RWAs?

It’s been an interesting year for LINK; the token traded sideways for most of 2022 and 2023 but has recently exploded higher. Rising from $5.90 in early September, LINK reached $11 by October 25—a roughly 90% increase.

Looking at the chart, we note that LINK has broken above the $10 resistance level for the first time since May 2022, though it remains far from the $50 all-time high seen during DeFi Summer.

That said, there’s still significant room for growth. Potential drivers include:

- Key developments and updates within the Chainlink ecosystem, such as the upcoming Staking v0.2 platform;

- Integration of five Chainlink services across seven different chains, including Base and Arbitrum;

- Partnerships with financial entities like SWIFT leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP) for asset tokenization and cross-chain interoperability;

- A surge in TVL within the RWA sector and growing hype around the narrative.

The last two factors on this list could push LINK to new highs over the coming years. If RWAs capture just 1% of the global total asset market (around $90 trillion), approximately $9 trillion in value could flow into the cryptocurrency market.

By the same logic, by 2030, oracles facilitating the transmission of tokenized RWA data and serving as the interface required to interact with blockchain-based applications could generate around $9 billion in revenue—and significantly appreciate in price beyond previous all-time highs.

Oracle Growth and Chainlink's Competition

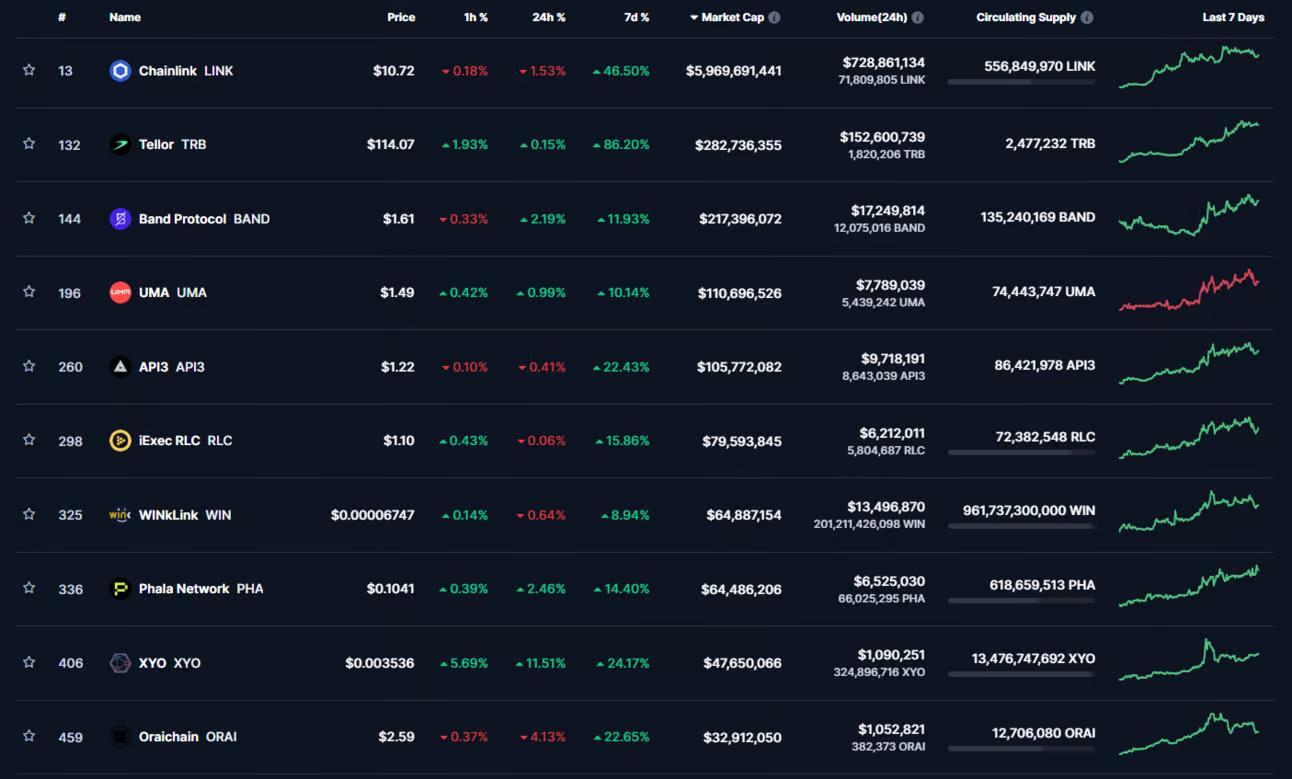

Top oracles by market cap have seen healthy growth over the past 30 days. Most likely, they’ve benefited from the RWA narrative. However, their primary growth drivers stem from recent protocol developments, integrations across multiple chains, and other significant news.

If we look for oracles partnering with institutions to facilitate RWA tokenization, Chainlink stands out as the clear leader. Yet, even acknowledging its dominance in terms of TVS and market cap, that doesn’t mean there’s no competition.

Tellor

The second-largest oracle by market cap. While price increases can be attributed to higher network activity, RWA demand, and its recent deployment on Manta Mainnet, most analysts believe the rally was driven by whale manipulation.

Band Protocol

Built on the Cosmos blockchain but operates as a chain-agnostic oracle. Much of Band Protocol’s growth has come through collaboration with Horizen’s EVM-compatible sidechain, EON.

UMA

Unlike most oracles, UMA allows developers to create synthetic assets. Synthetic assets are encapsulated versions of indices on the blockchain—essentially tokenized stocks. UMA rose following a series of on-chain governance changes and amid the RWA narrative.

API3

API3 is arguably a cheaper and more accessible oracle. It enables projects to access external data via decentralized application programming interfaces (dAPIs). API3 surged after being integrated into five popular networks: Mantle, Base, Linea, Kava, and Rootstock.

On Tokens and Utility

A token’s performance doesn’t necessarily reflect a project’s fundamentals. Perhaps the project has solid fundamentals and a good product. Tokens can be used to pay node validators for their duties and tasks.

But this makes governance and proof-of-stake seem redundant—if a protocol has strong product-market fit, it could theoretically operate well without a token. Sometimes governance justifies the token’s existence, but more often, tokens serve primarily as fundraising vehicles based on future protocol performance and speculation.

Protocols using ERC-20 tokens could simply charge fees in ETH and still perform well. This explains why there can be a significant divergence between price and TVL in certain protocols. A project might have high TVL due to strong product appeal and large deposits into its contracts, yet if it focuses on enhancing value accrual for its token, it can narrow the gap between these two metrics.

So Why Do We Need the LINK Token?

For example, LINK is used to pay node validators who retrieve data, and more recently, due to the launch of its PoS system—and the upcoming PoS v0.2.

Beyond that, however, the token offers no additional utility. One could argue that Chainlink as a business could thrive without the LINK token. Applying this logic to RWA-based tokens presents a problem; most tokens from RWA protocols would automatically qualify as yield-bearing assets—which, I believe, the SEC would love.

Moreover, when dealing with tokenization involving institutions and real-world assets, governance and decentralization become somewhat irrelevant.

In this context, RWA protocols are more likely to succeed if they focus on the following:

- Licensing—this would give them a competitive edge;

- Audits via protocols like PeckShield or CertiK to assess smart contract risks and vulnerabilities;

- Building investor trust—this can be achieved by using Chainlink’s Proof of Reserves to verify that on-chain assets are backed by off-chain assets and a central custodian.

Final Thoughts

The crypto community frequently emphasizes the benefits and use cases of blockchain technology across multiple industries.

If so, we should pay closer attention to the tokenization of real-world assets (RWAs) and how this sector delivers the utility we’ve just discussed. Chainlink has been actively upgrading its platform and integrating some of the market’s most popular chains.

Chainlink’s value in the RWA narrative lies in its efforts to become the critical infrastructure enabling trading of these assets on-chain, bridging traditional finance and decentralized finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News