The large-scale adoption of RWA will begin with NFTs being accepted by the market

TechFlow Selected TechFlow Selected

The large-scale adoption of RWA will begin with NFTs being accepted by the market

RWAs pave the way for doing things on-chain that you can't do elsewhere—that's where the magic lies.

Written by: WILLIAM M. PEASTER

Compiled by: TechFlow

In short, there are two types of real-world assets (RWAs): those representing financial instruments (bonds, real estate, stocks, etc.) and those representing cultural items (baseball cards, Pokémon cards, etc.).

In either case, more individuals and organizations are increasingly undergoing the process of bringing "offline" items "on-chain" to leverage the unique capabilities offered by networks like Ethereum. Think non-custodial lending in decentralized finance (DeFi), or globally accessible, open auction infrastructure provided via non-fungible tokens (NFTs). At its core, it's about making illiquid assets more liquid.

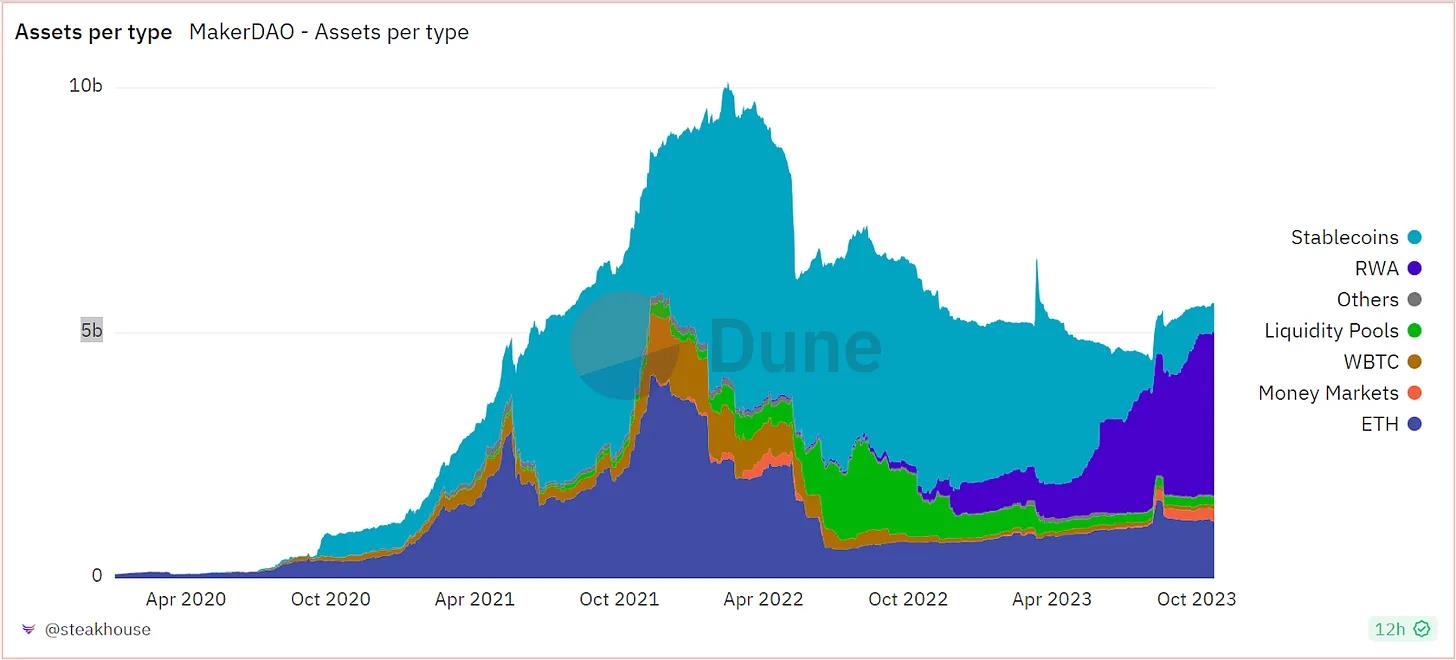

However, RWAs are not new to crypto. For example, Maker—the first DeFi protocol to gain significant adoption—has been increasingly using RWAs such as U.S. Treasuries to back its Dai stablecoin since April 2021. Other DeFi projects, including Canto, Frax, Maple, and Polygon, have also recently made deeper strides into the RWA space.

Yet, if you look closely, the dominant approach so far in DeFi has been one exemplified by Maker: tokenizing RWAs through fungible ERC-20 token pools. Given that RWAs now constitute the majority of Dai’s backing, this method has proven effective thus far.

By contrast, in the cultural domain, NFTs have become the preferred tokenization tool because they naturally support one-to-one mapping with unique collectibles—for instance, a first-edition “mint condition” Charizard card, which cannot be exchanged for other collectibles.

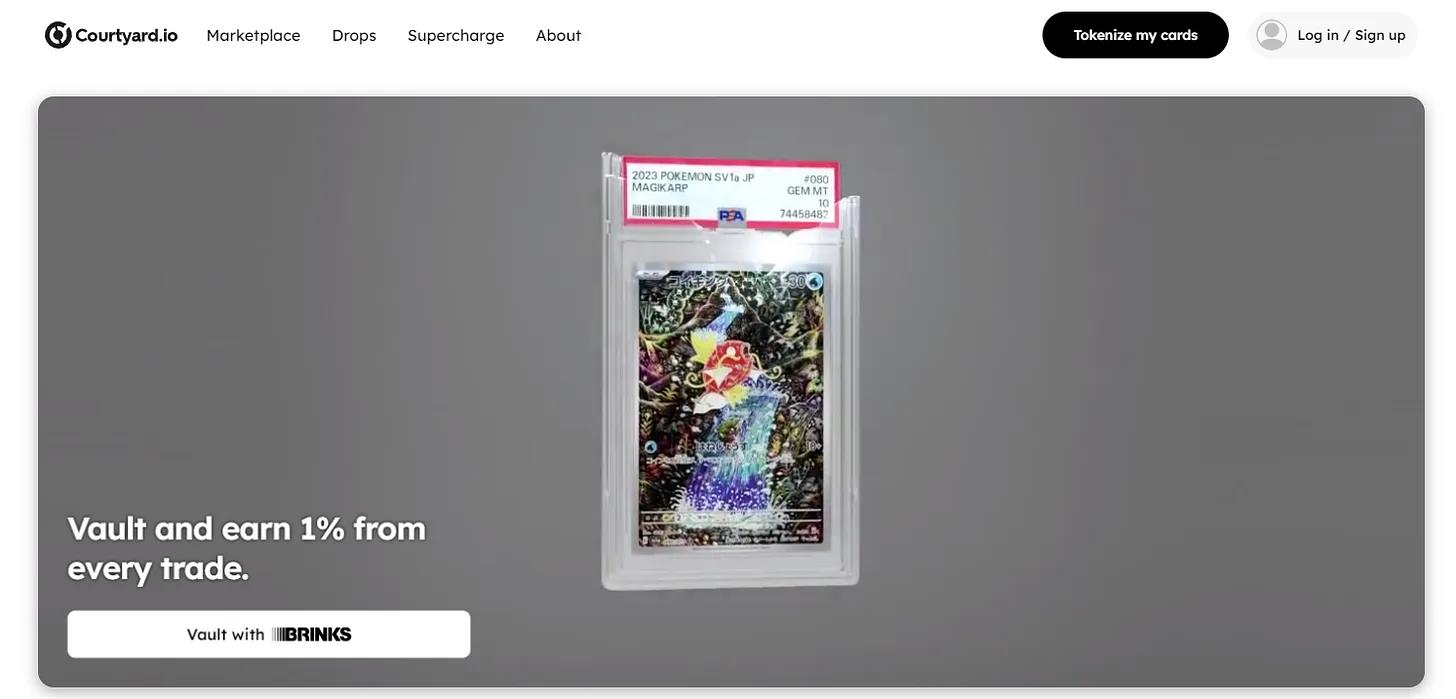

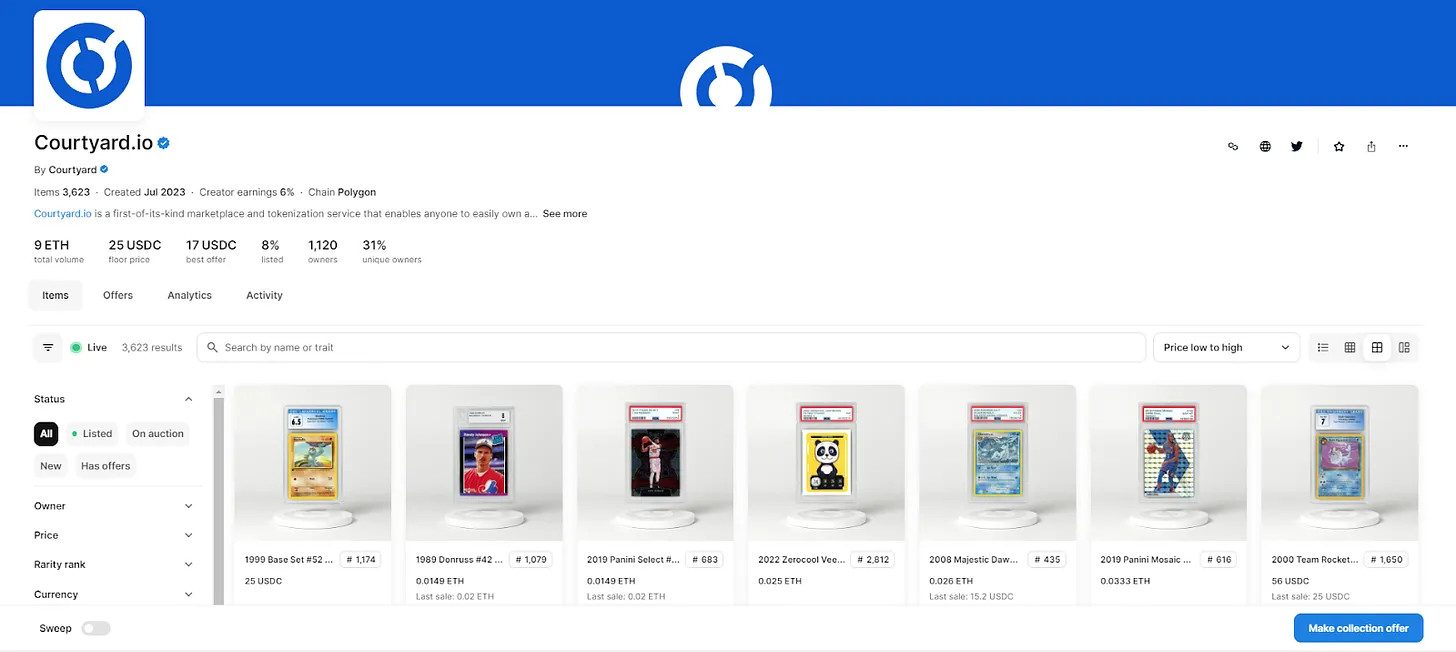

One of today’s most notable large-scale projects is Courtyard.io, which recently gained attention due to its Pokémon card releases on Polygon.

Courtyard is not just a tokenization service—it’s also a marketplace where collectors can vault and tokenize their own graded trading cards, or buy and sell cards already tokenized by others. Its card packs, some priced as low as $5 each, sell out within seconds, and one recent pack opener won a pristine “Mario Pikachu” card worth around $6,000!

All cards on the platform are authenticated and then stored in Brink’s secure vaults, ensuring the associated NFTs maintain integrity and redeemability at all times.

But at the intersection of NFTs and RWAs, it’s not all fun and games—we’re also beginning to see financially oriented use cases gaining early traction.

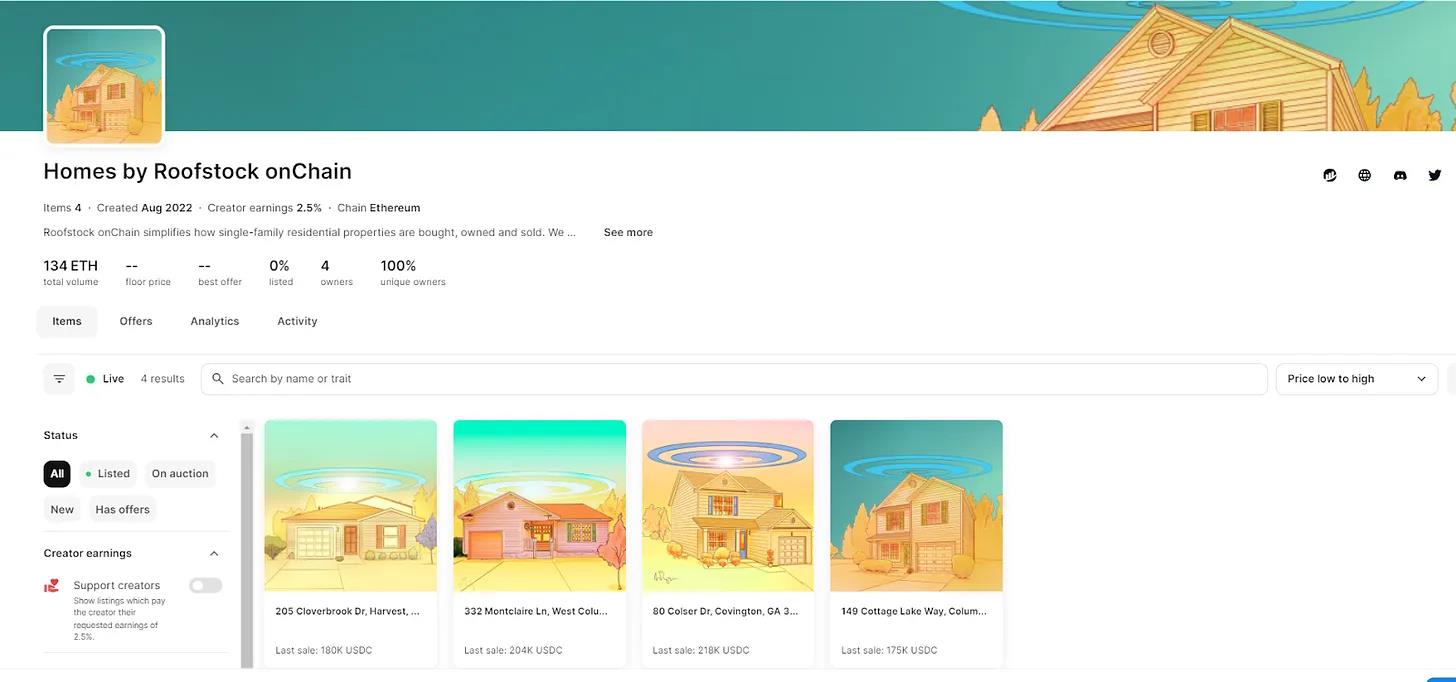

For instance, Roofstock onChain has already resold several homes in the real world via NFTs on OpenSea, with the highest sale reaching 218k USDC.

Over time, I predict we’ll see more DeFi projects adopt NFT-style tokenization as more unique financial assets go on-chain and innovations around NFTs continue to emerge.

Indeed, across both cultural and financial domains, we’ve already unlocked new possibilities such as embeddability and composability—for example, you can now place other tokens inside your RWA NFTs via ERC-6551, or insert your RWA NFTs into other on-chain constructs like on-chain game engines.

This might sound far-fetched today, but this is precisely the power—and allure—of RWAs: they pave the way for doing things on-chain that simply aren’t possible elsewhere. That’s where the magic lies.

Still, at least for now, the RWA space remains relatively experimental and pioneering, as the frontier is still being built. Numerous challenges persist, such as the current lack of regulatory clarity around crypto, which keeps many companies and major financial institutions on the sidelines.

As we gain greater clarity over time, there may eventually come a day when all financial instruments and many cultural items are issued on-chain. So what’s my overall take? If that future does arrive, NFTs will undoubtedly play a crucial role in making it happen!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News