When the market is sluggish, how do crypto VCs view the current situation?

TechFlow Selected TechFlow Selected

When the market is sluggish, how do crypto VCs view the current situation?

Why does venture capital seem to follow overall market trends rather than lead them?

Author: IGNAS | DEFI RESEARCH

Translation: TechFlow

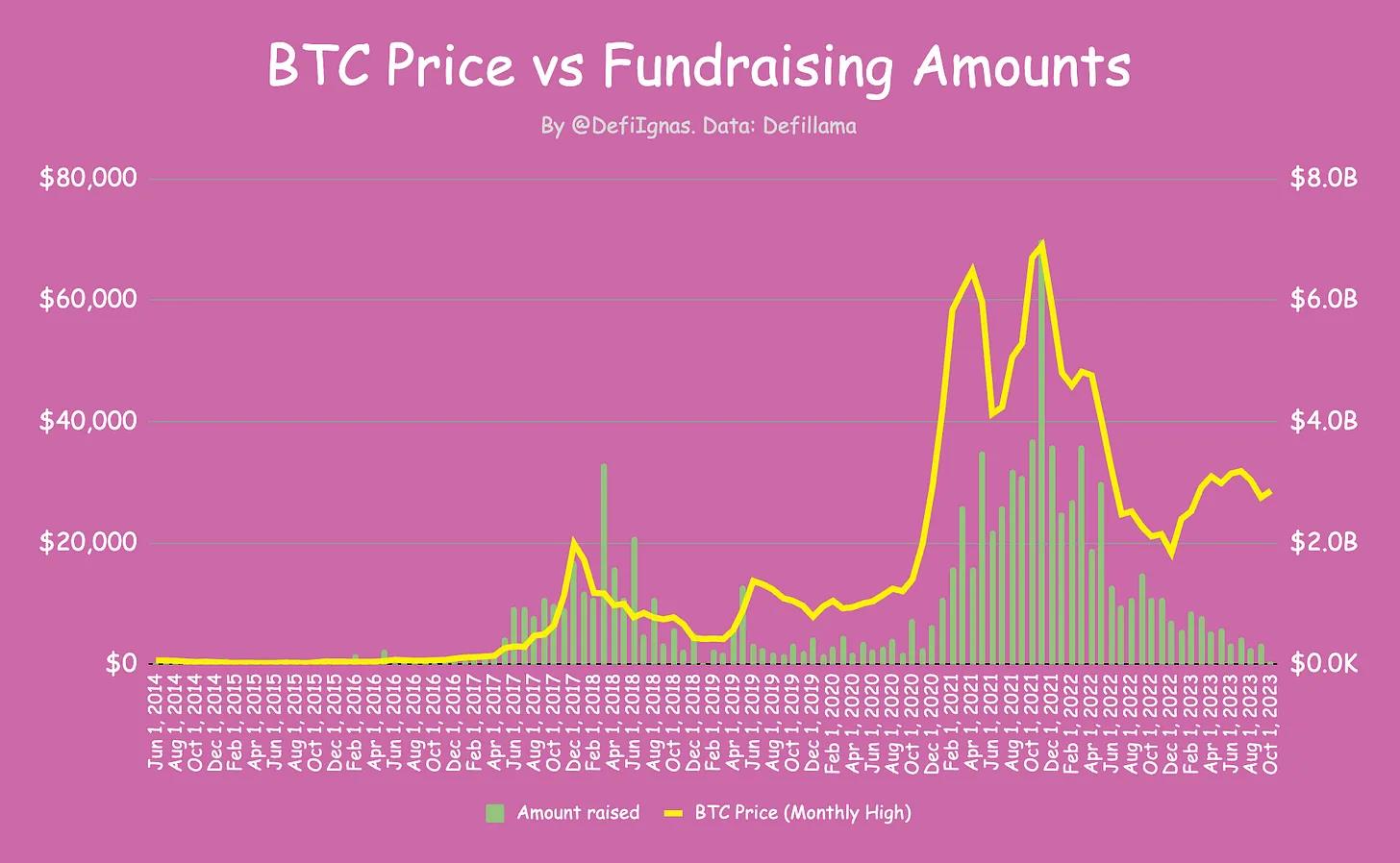

Take a look at the chart below. The correlation between Bitcoin price and fundraising amounts in the crypto market is truly striking. As Bitcoin's price declines, so does fundraising volume.

Interestingly, despite Bitcoin and Ethereum prices being higher than their 2018 bull market peaks, fundraising has dropped back to pre-2020 levels. Bitcoin has actually rebounded from its 2022 lows, yet fundraising continues to decline.

Venture capital is typically seen as a market leader, making intelligent, forward-looking decisions. So why does venture capital appear to be following broader market trends rather than leading them?

And when the market shows slight recovery signs, fundraising has already fallen to 2018–2019 levels. Do they know something retail investors don't? Isn’t this exactly when we should be “buying the dip” amid depressed valuations?

To find answers, I reached out to several crypto venture firms and DeFi project founders who recently raised funding. They include Sachi Kamiya from Polygon Ventures, Etiënne from TRGC, and an anonymous angel investor (hereafter referred to as Mr. Anon), all of whom kindly shared their insights.

Jaimin, founder of Caddi, also provided valuable perspectives from the DeFi builder’s standpoint. Caddi is a browser extension that helps users save money and avoid scams during DeFi swaps. He recently raised $650,000 from VCs including Outlier Ventures, OrangeDAO, and Psalion VC, as well as angel investors such as Bryan Pellegrino from Layer Zero, Alex Svanevik from Nansen, and Pentoshi.

How Bad Is It?

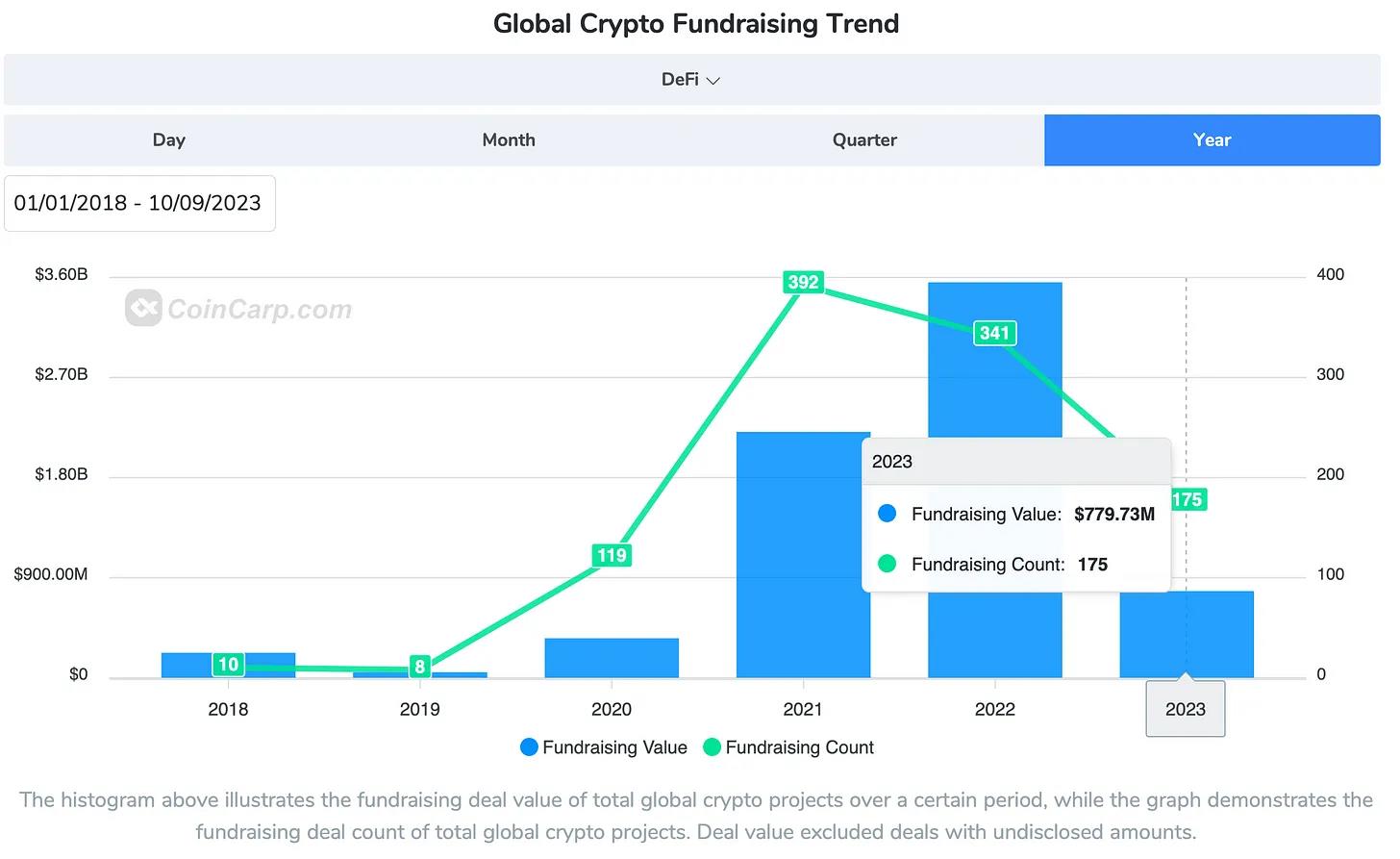

The chart below from CoinCarp offers a different perspective. With a total of $18.6 billion across 1,053 deals, fundraising appears significantly better than in 2020.

However, this chart includes Web2 deals—such as Stripe’s $6.5 billion raise—which are irrelevant to our discussion.

Focusing on my beloved DeFi sector, there were 175 DeFi funding rounds, raising a total of $779 million, averaging $4.4 million per round. This marks a sharp decline compared to last year’s 341 rounds totaling $3.56 billion, with an average of $10 million per round.

So yes, capital is tighter, and the average amount raised per round has dropped by over 55%.

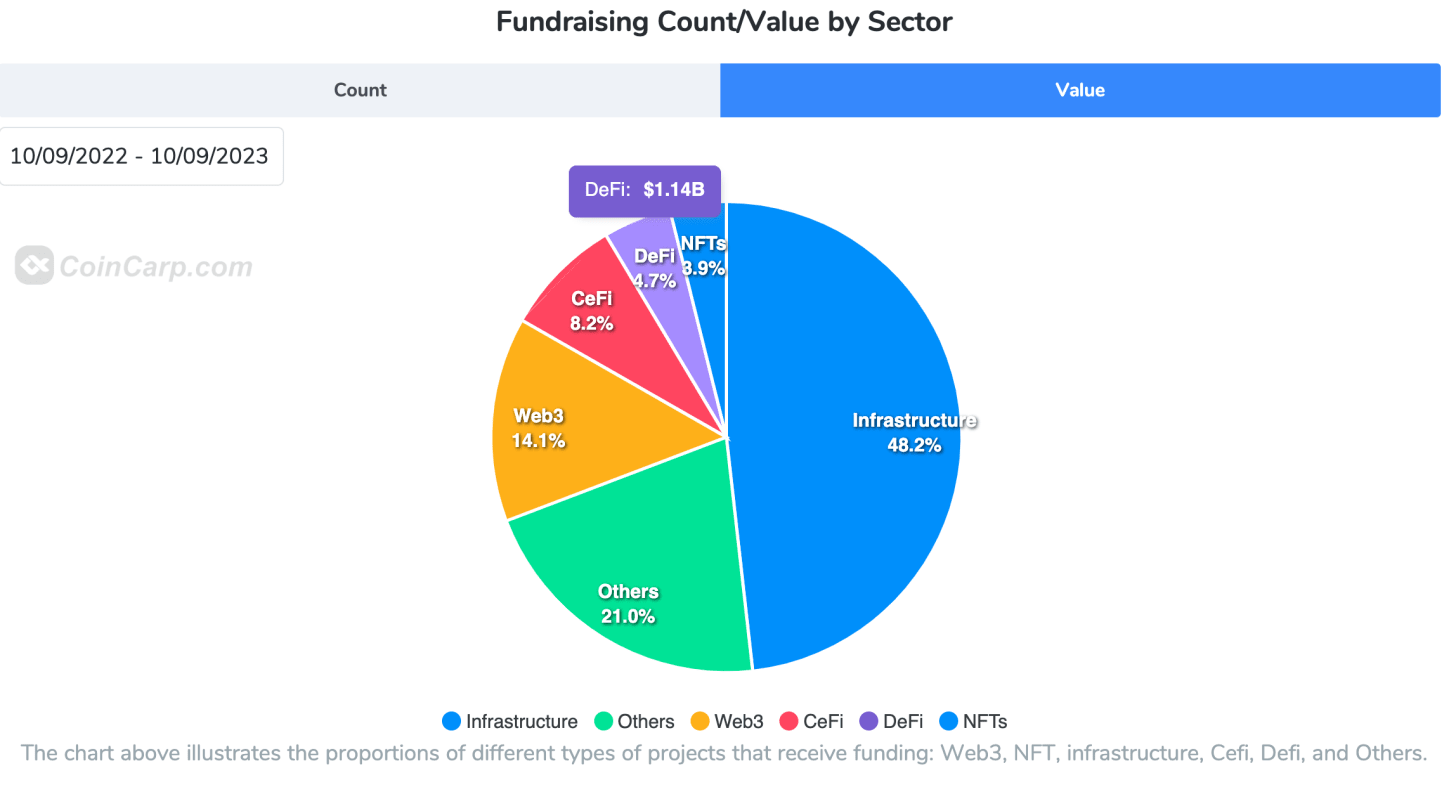

Unfortunately, DeFi has performed second-worst among all sectors, only slightly better than NFTs. Over the past 365 days, DeFi protocols raised just $1.14 billion, while CeFi startups raised $2 billion. Where is our decentralized future?

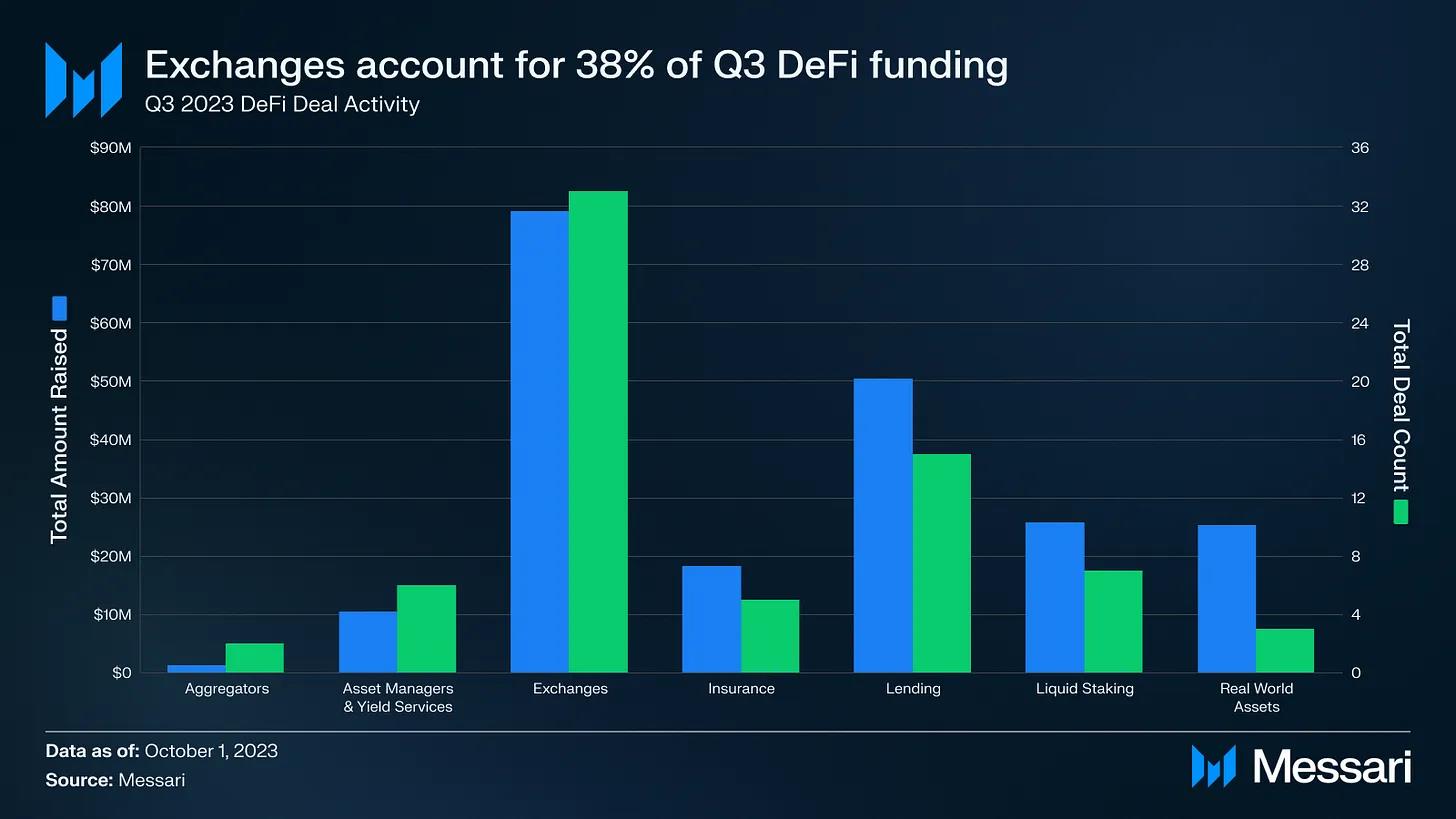

Looking deeper, exchanges dominate DeFi fundraising. They accounted for 38% of all funding in Q3 2023.

Overall, due to capital scarcity, multiple crypto companies are laying off staff. Last week, Yuga Labs, Ledger, and Chainalysis announced significant layoffs.

Despite the bear market, a few protocols have successfully raised substantial funds, giving hope that investors haven’t entirely abandoned crypto and DeFi. In fact, Blockchain Capital recently raised $580 million to invest in DeFi, gaming, and infrastructure projects.

When asked about the current fundraising climate from a DeFi builder’s perspective, Jaimin commented, “It’s as if macro conditions never changed—the market is in its worst state in years.” Sachi from Polygon Ventures echoed similar sentiments:

The overall sentiment in crypto venture capital is bearish. Due to negative sentiment, fewer early-stage projects are receiving capital.

Angel investor Mr. Anon quantified it as “possibly only 10% of the deal flow seen during bull markets.”

Compared to previous bear markets, Etiënne noted, “Unlike 2019, real capital is now sitting idle on the sidelines. In 2019? It was completely zero.”

That’s precisely why the market still presents massive opportunities. Mr. Anon, Etiënne, and Sachi all agree that now is a great time to find deals without crazy valuations. Sachi pointed out that investors “can take time to conduct thorough due diligence on each project, but VCs are now more focused on user metrics and genuine adoption.”

Ironically, this is exactly what makes things hardest for startups. Jaimin said, “Investors want to see exponential growth—whether in revenue, users, TVL, or transaction volume in our case.”

Achieving 'sustainable' growth in this market is extremely difficult. There are few new entrants, low volatility, depressed prices, and poor overall sentiment. Vision alone isn’t enough.

Sachi concluded optimistically: “Now is meaningful to invest because some of these projects will perform well in the next cycle.”

Why Do We Need Crypto Venture Capital?

There is widespread distrust, hostility, and negativity toward crypto venture capital within the crypto community. The main reason is obvious: treating retail investors as exit liquidity.

Algod believes the best projects will be those conducting fair launches without VC involvement, as people realize they don’t want to serve as exit liquidity. In another article, he also shared that VC funding would be a bearish catalyst compared to 2021: “Prioritizing community will become key, as projects begin realizing volume isn’t driven by venture capital, but by ordinary investors.”

Some non-crypto investors share this view.

For example, in an interview with Bloomberg, Jason Calacanis—an angel investor in Robinhood, Uber, and Superhuman—warned about “scam” VCs selling crypto tokens to retail investors, which could lead to serious consequences.

Calacanis argues many of these tokens are securities, and VCs are reselling them to uninformed retail investors. He predicts companies and VCs knowingly selling “worthless” tokens will face major lawsuits, even criminal charges.

So… can we skip crypto venture capital entirely? The biggest concern is how “fair” these “fair launches” really are.

According to Mr. Anon, “Fair launches aren’t fair because teams and insiders know about them before launch and can front-run liquidity.” Jaimin shares skepticism, saying true “fairness” in launches is unlikely today because people can manipulate them in various ways, and “dumping on each other will always exist.”

Etiënne from TRGC agrees: “Whether it’s a fair launch or not, the profit motive remains the same. Retail isn’t innocent. Retail traders are market gamblers with less capital.”

That said, Sachi notes fair launches might work for founders who already have experience running crypto companies. All respondents seem to agree it’s a tough game for first-time founders and those without initial resources.

Personally, I love fair launches. The birth of YFI and INV remain my fondest memories from DeFi Summer 2020. I hope we’ll see truly fair launches in the next bull run.

But I’d argue venture capital plays an important role in crypto—it provides initial funding, guidance, network access, and even boosts the credibility of industry-wide projects.

What Can We Learn From Crypto Venture Capital?

This is the central question that prompted me to write this article.

From the Bitcoin vs. fundraising chart, fundraising appears merely to follow Bitcoin price trends rather than lead them—somewhat disappointing. One would expect savvy VCs to anticipate market moves and increase fundraising toward the end of bear markets to cash out during bull runs.

Sachi offers valuable insight:

Not all VCs follow market trends. Some, especially in the U.S., tend to invest based on market momentum. But this isn’t true for many Asian VCs—they actually become more active during bear markets due to the presence of good opportunities.

Angel investor Mr. Anon adds that projects do raise funds during bear markets, but “they announce it later, when it makes more sense for them.”

Then there are token vesting schedules, which complicate exit strategies. I believe investing during bear markets allows VCs to sell tokens profitably once lockups expire. Conversely, if VCs invest during bull markets, they may need to sell during bear markets, further depressing already weak altcoin prices.

Timing seems tricky. Mr. Anon shares:

There’s uncertainty around TGEs. I think at least large projects will wait for optimal launch timing, and with proper lock structures, profitability remains possible even after cliff periods end.

Sachi from Polygon Ventures told me that when considering unlocks, they evaluate projects differently, often preferring shorter lockup periods—but they assess how native the team is to crypto.

Managing tokens requires skill (e.g., exchange listings, market making). The more native a team is to crypto, the greater the likelihood of long-term project success.

So, what lessons can we learn from VCs?

Etienne’s answer is quite direct:

Haha, no.

Don’t blindly follow VCs. I’ve muted 95% of VCs across all platforms. I strongly recommend learning from old-school legends like Howard Marks, Nassim Taleb, Warren Buffett, Stan Druckenmiller, Ed Thorp, Jim Simons, Mark Spitznagel, etc.

There’s one exception: I only listen to VCs like Mike Moritz or Doug Leone who have 30-year track records. Not those saying, ‘I made money on token XYZ, now let me teach you investing’—they’re the worst. We can’t learn anything from them.

Mr. Anon’s advice is simple: Don’t put all your eggs in one basket. “Even some VCs made this mistake and suffered heavy losses.” And as crypto users, “we should strive to educate others about projects, share feedback and suggestions, etc. This is highly valuable for influential users.”

Sachi offers practical advice: “Asking the right questions and doing your own research is crucial. For example: Are these real user metrics? Is the founder credible?”

Retail investors should understand that when a project makes an announcement (e.g., partnership with a big company or project), things aren’t always as they seem. Many moving parts—like token swaps, grants, incentives—are involved behind the scenes and may not be disclosed. Retail should always consider whether a protocol is organically adopted before investing accordingly.

— Sachi Kamiya, Polygon Ventures

Jaimin also emphasized risk management:

I suggest people learn new things, read, and keep educating themselves. DeFi evolves rapidly, and gaining knowledge in areas you’re interested in brings many benefits—you can reason better and create value for projects.

These aren’t investment recommendations, but it seems retail can indeed perform better in crypto. Of course, like retail, VCs also FOMO into hot trends. My advice is to do your own research and understand the narratives, rather than simply copying trades.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News