Canto's New Chapter: Joining the Ethereum Ecosystem and Onboarding RWA Assets to the Blockchain

TechFlow Selected TechFlow Selected

Canto's New Chapter: Joining the Ethereum Ecosystem and Onboarding RWA Assets to the Blockchain

Canto will bring a large amount of RWA assets on-chain, enabling crypto-native users to access returns from traditional finance.

Canto is a public blockchain led and driven by the crypto community, aiming to build an L1 + DeFi ecosystem offering a suite of free public infrastructure. It launched fairly without VC involvement or fundraising, which has earned it strong favor among native crypto users.

Recently, Canto's official Twitter announced changes to its project roadmap: Canto will migrate into the Ethereum ecosystem through a collaboration with Polygon Labs, leveraging Polygon CDK technology to become a ZK-powered Layer 2 (L2) blockchain on Ethereum. Canto stated this upgrade supports its next-phase vision called NeoFinance, which aims to bring substantial RWA (real-world asset) exposure on-chain, enabling native crypto users to access traditional financial yields. To ensure greater scalability, liquidity, and security, Canto has decided to leave the Cosmos ecosystem and join the Ethereum ecosystem.

NeoFinance

Canto recently announced partnerships with legally registered entities such as Hashnote and Fortunafi to bring yield-generating U.S. dollar assets on-chain, including Treasury bills (T-bills) and private cash management funds.

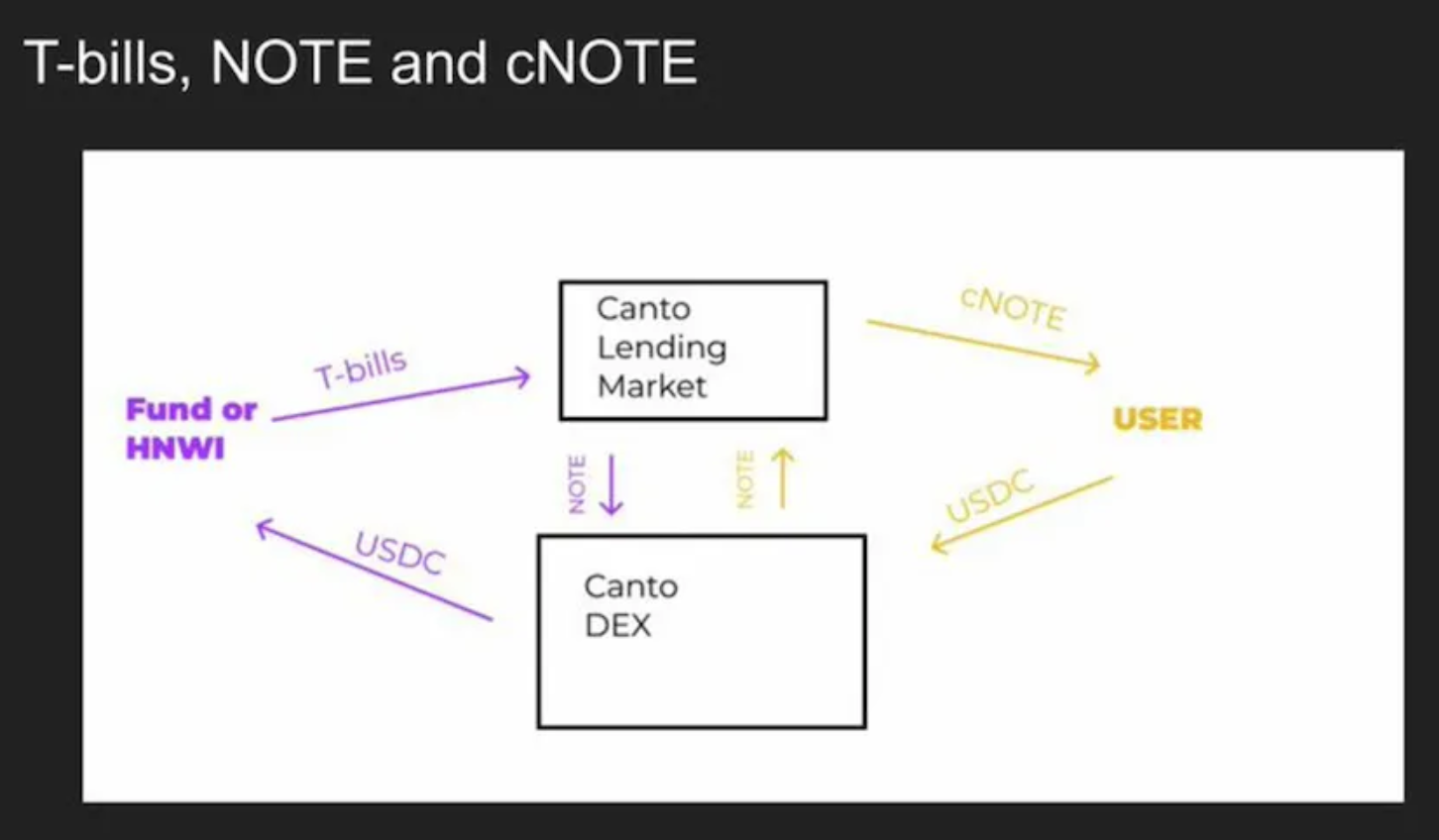

Before explaining how NeoFinance brings RWA assets to users for yield generation, we first need to introduce Canto’s native stablecoin $NOTE. The minting mechanism for $NOTE involves users depositing stablecoins like USDC/USDT or LP tokens into the Canto Lending Market (CLM) as collateral in an over-collateralized manner—similar to Aave’s $GHO model.

The goal of NeoFinance is to use the stablecoin liquidity provided by users to purchase RWA assets and issue tokenized representations of these assets. These tokens will then be introduced into the Canto Lending Market (CLM), enabling the minting of $cNOTE—a yield-bearing version of the $NOTE stablecoin. By holding $cNOTE, users can earn real-world asset yields, such as the ~5% annual return from U.S. Treasury bills.

Thanks to the Canto Lending Market (CLM), users can even employ recursive lending strategies to compound their returns—potentially achieving leveraged yields of nearly 35% on top of the base 5% T-bill yield.

Author's Perspective

Most members of the Canto team are seasoned DeFi OGs and well-known Twitter KOLs, giving Canto a distinctly "crypto-native" identity. I participated from day one when Canto launched and have interacted with Scott Lew (@scott_lew_is), widely recognized as the leading contributor to Canto (though he doesn't refer to himself as a founder). In my view, Canto’s strength lies in its user-centric approach—the team actively listens to community feedback and excels at capturing emerging narratives within the crypto space, responding swiftly and flexibly to market dynamics.

RWA and Ethereum L2s have been two of the few hot sectors in the blockchain space during this bear market. Canto’s latest roadmap update positions it squarely at the intersection of both trends. As a result, its token price—which had nearly hit rock bottom—has rebounded by nearly 300%. Although Canto has not yet officially released detailed announcements about NeoFinance, much of the information has surfaced through indirect community sources. Nevertheless, the market response has already delivered positive validation for Canto’s future direction, making it one of the few cryptocurrencies to rise against the broader downtrend and drawing significant attention across the industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News