Arbitrum Incentives Program: A Look at the 5 Projects Supported by Wintermute

TechFlow Selected TechFlow Selected

Arbitrum Incentives Program: A Look at the 5 Projects Supported by Wintermute

Wintermute announced plans to support the following applicant projects in the first round of Arbitrum's short-term incentive program.

Written by: Callen

Compiled by: TechFlow

Wintermute has announced its plan to support the following grant applicants in the first round of Arbitrum's Short-Term Incentives Program (STIP).

Incentive Selection Criteria

Our selection process is based on the following core criteria. Selection characteristics:

-

Alignment with STIP goals——Applications should align with the program's objectives;

-

Innovative incentive design——Innovative incentive structures are a plus, as they will provide new data and insights;

-

Reasonable incentive scale——Given the short timeframe, the incentive scale must be reasonable, with a clear token distribution outline;

-

Potential for long-term benefits——The incentive design should have the potential to generate lasting benefits.

However, projects do not necessarily need to meet all of these criteria.

Selected Applicants

We have selected the following five protocols, which we plan to support once voting begins in the first round:

-

Vertex Protocol——1.8M to 3M ARB

-

Balancer——1.2M ARB

-

Socket——1M ARB

-

RabbitHole——1M ARB

-

Angle Protocol——200K to 700K ARB.

Selection Rationale

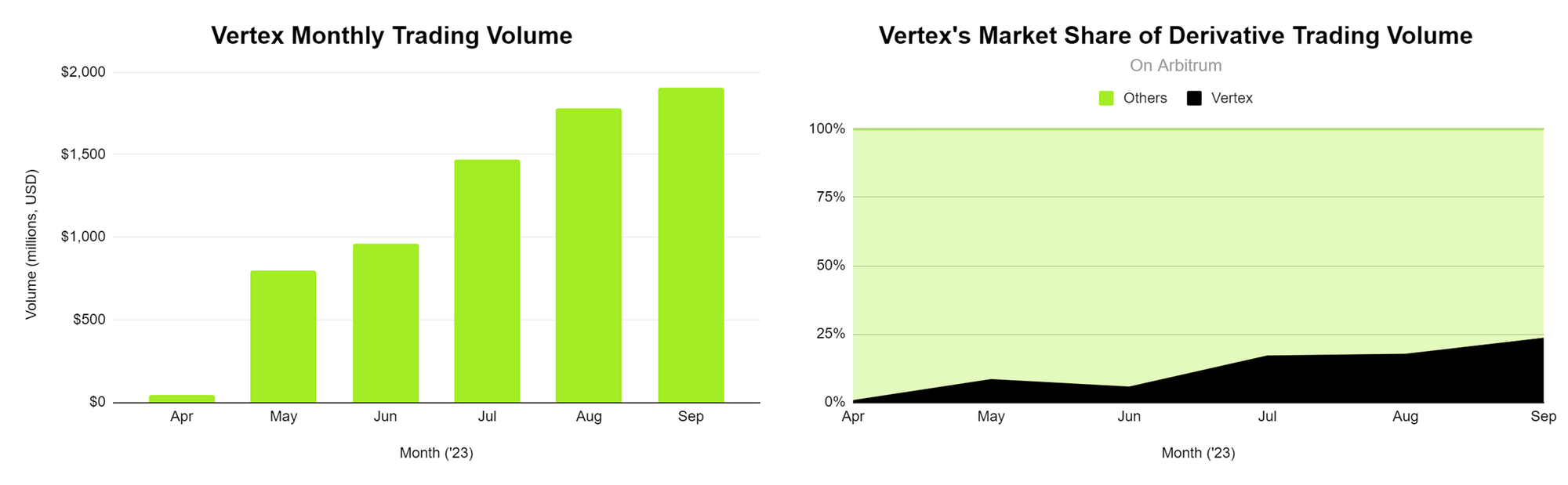

Vertex Protocol

Vertex Protocol has successfully demonstrated its ability to attract users, liquidity providers, and trading volume to Arbitrum through a highly specialized trading experience. The requested incentive amount is substantial, but we appreciate that it scales with the program’s success and any unused funds will be returned. Overall, the incentive goals align with those of the Short-Term Incentives Program; fee reductions would position Vertex ahead of CEX competitors and potentially drive user migration; democratizing order book LPing adds another layer of infrastructure on Arbitrum within an already successful protocol.

We look forward to supporting Vertex’s grant application!

Vertex Protocol summary stats:

-

Fourth-largest derivatives DEX by cumulative trading volume——$8 billion;

-

Eighth-largest protocol by 30-day fees——$485k;

-

Total of 6,203 unique depositors.

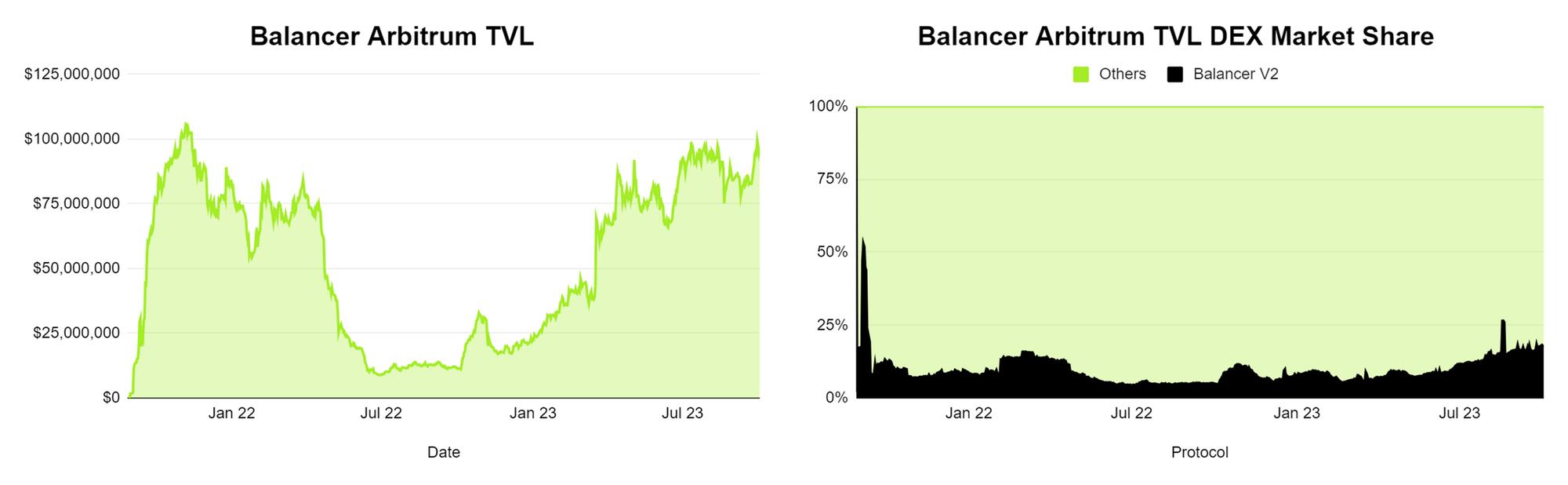

Balancer

As the fifth-largest protocol and third-largest DEX on Arbitrum by total value locked (TVL), Balancer has already proven its value within the ecosystem. We appreciate Balancer’s continued focus on fostering ecosystem-wide collaboration, such as through the ve8020 incentive program, boosted pools, bounties, and the broader value brought by the veBAL economy to Arbitrum. The outlined incentive goals align with the STIP objectives, and we believe that migrating veBAL to Arbitrum and increasing participation could lead to sustained growth in TVL, trading volume, and user base over the long term.

Balancer summary stats:

-

Fifth-largest protocol by TVL——$96.51 million;

-

Second-largest DEX by TVL——$96.51 million;

-

20th-largest entity by 30-day users——386k;

-

16th-largest entity by 30-day transactions——1.88 million.

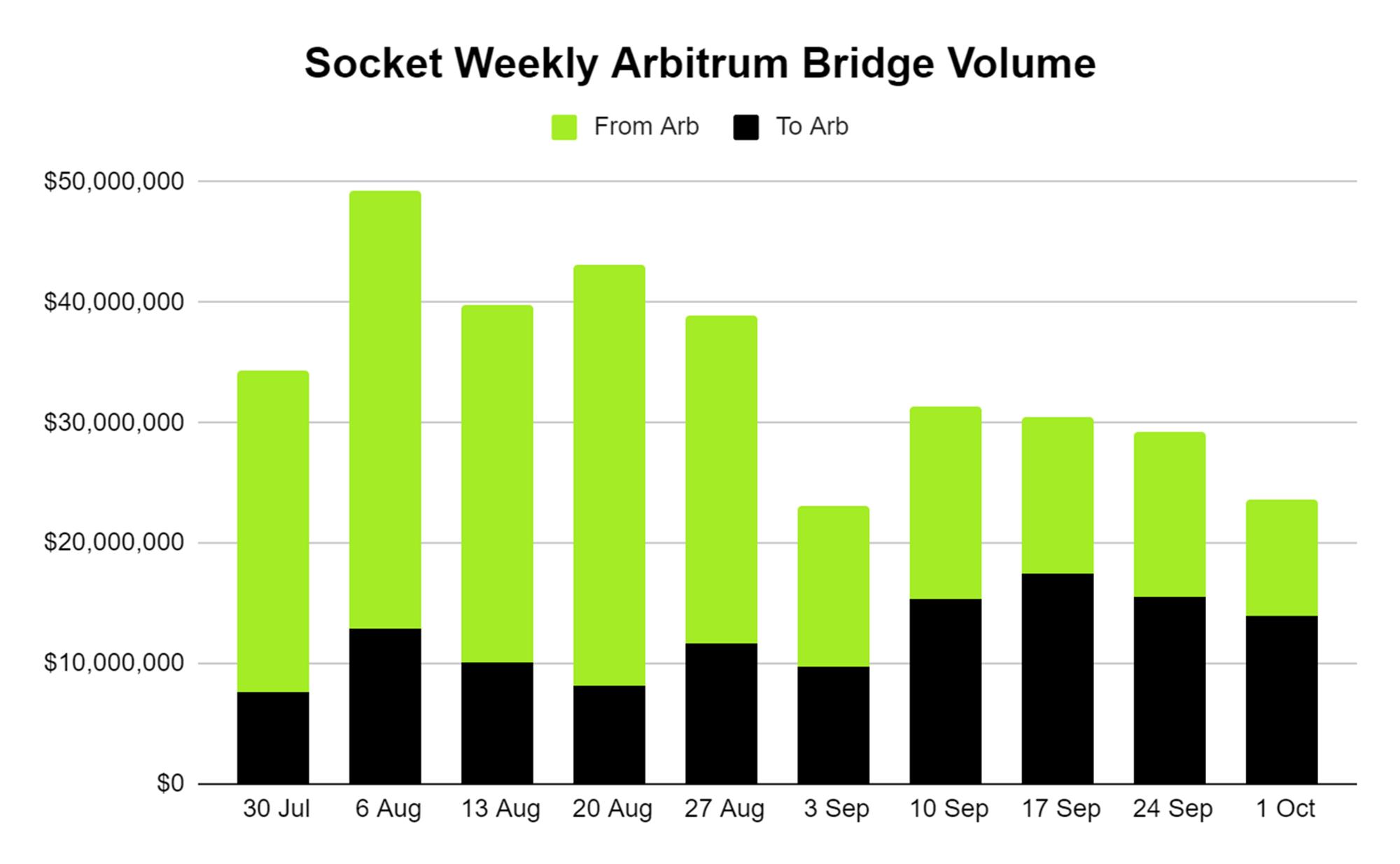

Socket

Socket has proven to be one of the core components of Arbitrum’s infrastructure, ranking among the top protocols in bringing users, transactions, and volume to Arbitrum. The proposed incentive distribution will yield valuable insights into the effectiveness of incentivizing infrastructure projects and the value they bring to the Arbitrum ecosystem. We expect that cross-chain fee rebates, improved user onboarding experiences, and Socket’s integration with partners will drive increased user acquisition and TVL growth on Arbitrum.

Socket Arbitrum summary stats:

-

12th-largest entity by cumulative users——854k;

-

17th-largest entity by cumulative transactions——2.8 million.

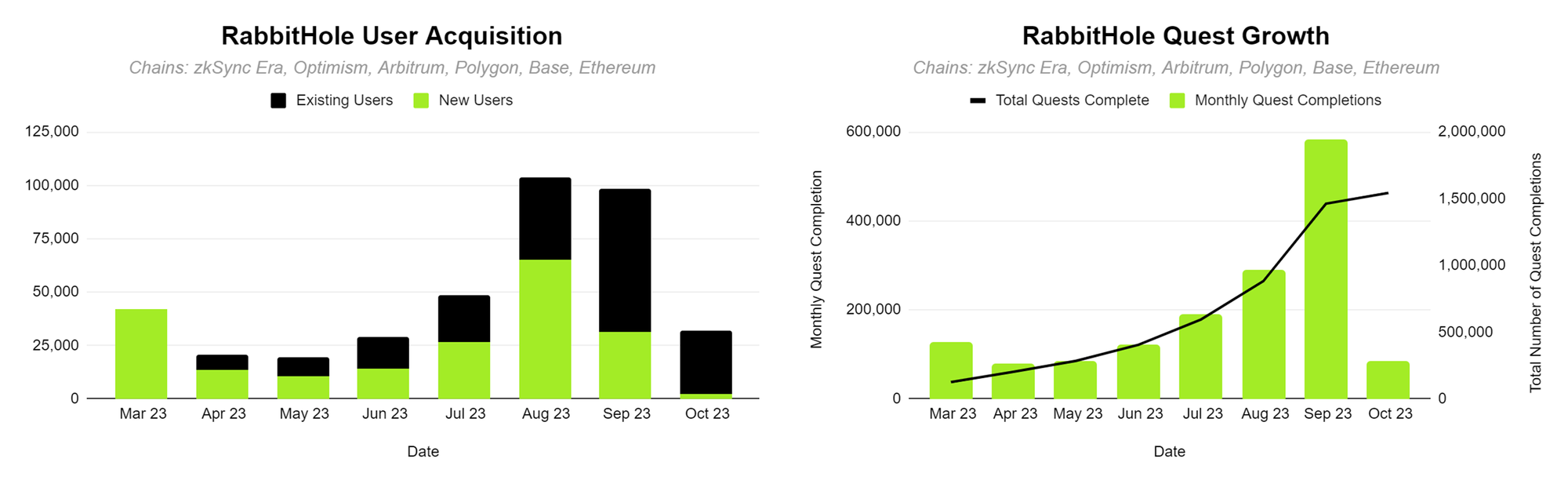

RabbitHole

RabbitHole’s mission directly aligns with the goals of the Short-Term Incentives Program, having successfully driven user acquisition and engagement on Arbitrum. Its gamified tasks encourage users to actively explore the Arbitrum ecosystem and, more importantly, provide new protocols with infrastructure to grow by offering task-based rewards. We appreciate the clearly defined KPIs and the inclusive nature of the incentive program.

RabbitHole summary stats:

-

Total of 1.5 million task completions;

-

Total of 213k unique task wallets;

-

Average of 7.4 tasks completed per wallet.

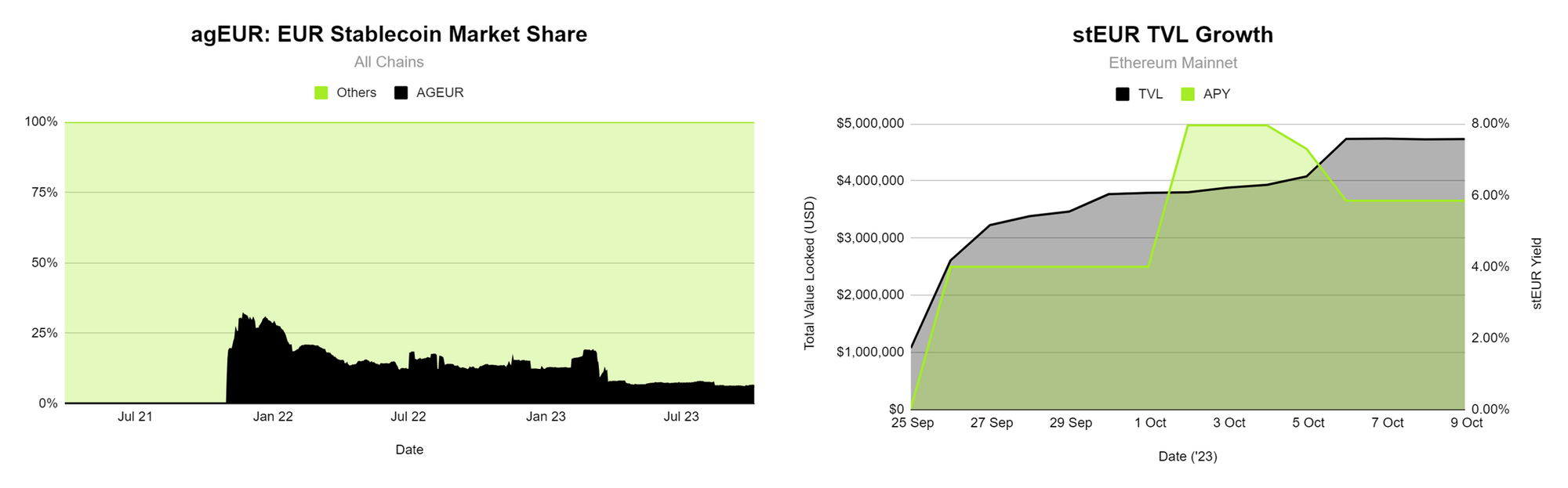

Angle Protocol

Angle Protocol adds diversity to the DeFi ecosystem through its euro stablecoin and advanced liquidity mining via Merkl. The outlined incentive goals align with the STIP objectives, aiming to foster collaboration among native Arbitrum protocols. Furthermore, Angle’s focus on driving stEUR adoption will provide important data and insights into demand for RWA on Arbitrum.

Angle Protocol summary stats:

-

Largest euro stablecoin by DEX trading volume since May 2022——64.4% in September;

-

Fourth-largest by market cap and largest decentralized stablecoin——$20 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News