The best time to invest in Web3 has arrived—what kind of DApp applications do we need?

TechFlow Selected TechFlow Selected

The best time to invest in Web3 has arrived—what kind of DApp applications do we need?

The best time to invest in Web3 is: now!

Author: XIN, Partner at OFR

If you're a rational and objective investor, you should sense that we no longer need more infrastructure projects—at least not right now.

Current infrastructure is more than sufficient to last through the next bull run, even the one after that (if there is one).

For scalability—we have Solana; for legitimacy—ETH L2 rollups and several major zkEVMs即将上线;for decentralization—there's Ethereum mainnet; for composability—Cosmos or Polkadot are solid choices.

We already possess all essential components needed to build dApps, plus dozens of recently popular RaaS or AppChain services. Whether you want to build an app or a chain, your bottleneck is clearly not insufficient infrastructure or lack of development tools.

But here’s the real question: Where is the killer dApp?

Last cycle, DeFi saved crypto—AMM DEXs, asset pool lending, liquidity mining models, and various tweaks based on these core patterns could be replicated across dozens of new chains over and over again.

Now that every new chain launches with these DeFi suites pre-installed, what's left to play? Will the new cycle just recycle these same old three tricks?

Recently, some applications have given me meaningful inspiration. Let’s dive in:

Meme Coins

Meme coins like $Pepe or $Bitcoin (HarryPotterObamaSonic10Inu) were significant innovations during the bear market.

They sparked a subculture with tokenomics far more favorable to retail investors compared to VC-backed projects valued at billions. Expensive VC tokens often mean dumping positions onto retail.

Of course, some infra projects are also meme coins by definition. If memes like Pepe satisfy retail traders’ dreams of overnight wealth, then infrastructure "memes" alleviate VCs’ investment anxiety—especially those who feel they missed out on major L1s (like Solana, Near, etc.) last cycle and now feel compelled to invest in infrastructure to make up for it.

Sure, ZK is considered hard because it requires strong mathematical expertise—but creating memes isn’t easy either. To create a viral cultural symbol is actually a highly challenging task, as there's no fixed template to follow. To become a successful meme creator, one must deeply understand certain community subcultures—such as degen communities, loser vibes—and possess the ability to craft attention-grabbing content tailored for them.

In my view, meme coins represent another form of rising crypto cultural symbols following profile-picture NFTs.

Friend.tech (hereinafter “FT”)

In most industry analyses, FT is typically labeled a social product. However, I believe it's a financial product built atop Twitter (or X) social networks. It doesn't create new social relationships or introduce any novel communication modes. A true social product would be something like QQ or WeChat—changing how people interact and communicate. Clearly, FT does neither, nor does it intend to.

From first principles, this model can be adapted to design other new products—essentially adding token incentives into Twitter’s social network. In a way, it’s a community-driven token incentive mechanism for Twitter’s social graph before Twitter itself issues a token (which may never happen). Recent projects like "Tip Coin" have captured the essence of FT’s product design and are beginning to gain traction within the community.

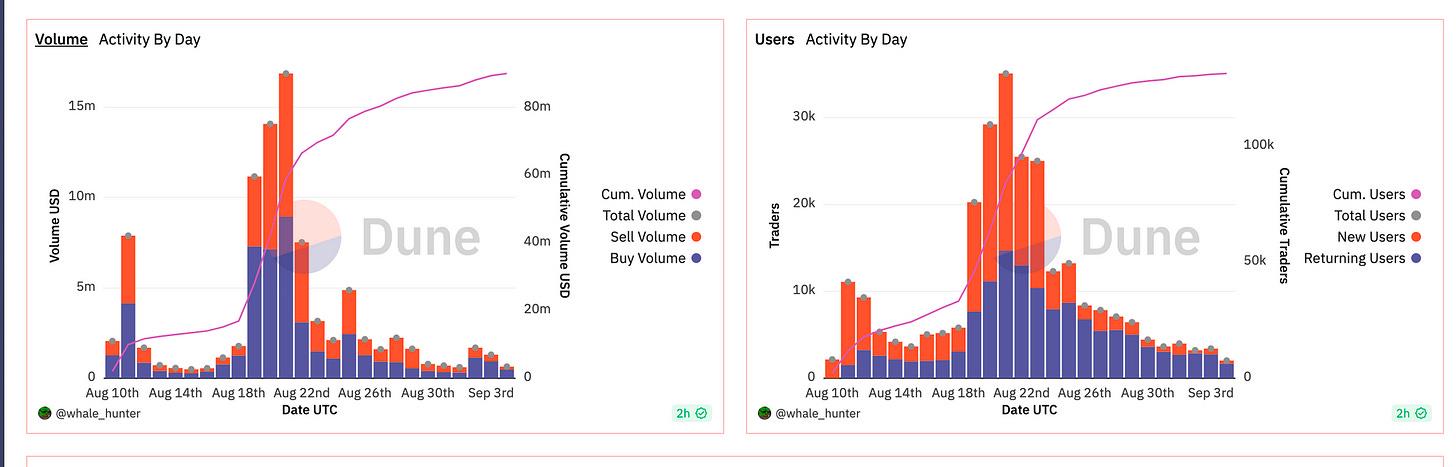

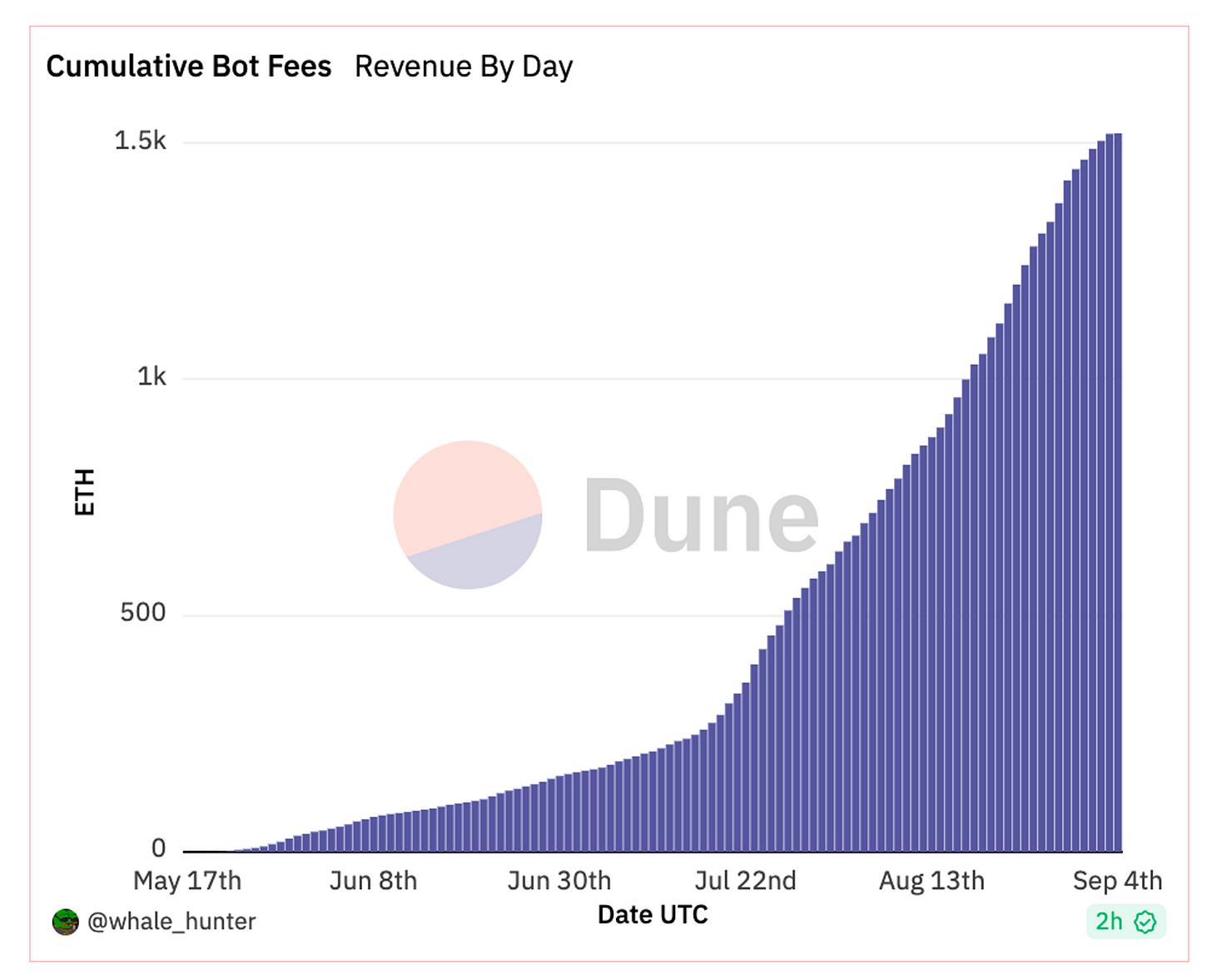

Telegram Bots

The starting point for Unibot—a Telegram bot—is simple and practical. Teams like Uniwhales and WhaleAlert may have explored similar ideas before. But Unibot improves in two key aspects:

First, its features directly address the urgent needs of meme coin traders in crypto. New functions such as limit orders, copy trading, and private transaction routing are particularly valuable. While many teams claim to work on "Intents" lately, Unibot has quietly processed tens of thousands of intent-like requests daily.

Second, Unibot’s token design shows thoughtful consideration—its value is tied to both overall ecosystem prosperity and actual product functionality, with relatively fair token distribution.

Unibot also leverages the massive traffic from Telegram—the essential messaging app for crypto users—building useful tools and redirecting TG’s user base toward its platform.

What conclusions can we draw from these cases?

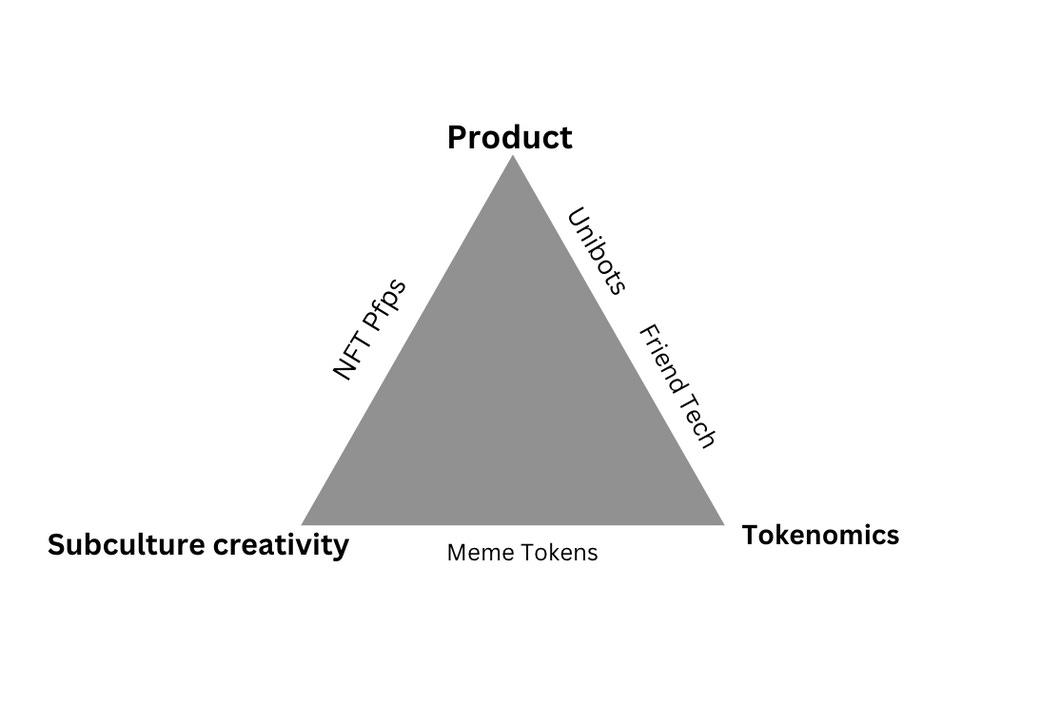

If we treat product strength, subcultural creativity, and sound token model as three points of a triangle (you in crypto love triangular metaphors), successful projects usually possess at least two of them. To acquire users and survive long-term, possessing all three is essential.

Taking our earlier examples: Meme coins ignited subcultural fervor and featured well-designed tokenomics, but currently lack usable products.

FT achieved remarkable success in product launch and token issuance. Despite poor UI/UX, its overall product strategy was effective. Its token model worked well for initial traction, though momentum has since stalled without clear solutions. Culturally, FT hasn’t yet developed a distinct identity.

Unibot excels in product functionality and has a reasonable token model. However, its users haven’t yet formed a cultural attachment to the brand—they care more about the product and token than identifying with Unibot as a cultural symbol. How to cultivate this cultural belonging is a critical challenge for the Unibot team.

What kind of products and builders do I expect?

-

Product & Growth Strategy: From day zero, plan user acquisition carefully—how to leverage Twitter or Telegram traffic for growth, avoid being blocked by Twitter’s parent company, enable rapid iteration, and lower user entry barriers. Kudos to FT for clever tactics like using PWA to bypass Apple Store approval hassles. The product doesn’t necessarily need to be a Twitter plugin or Telegram bot—it’s about finding the right way to tap into these two largest user ecosystems.

-

Token Design: Create a well-balanced token allocation structure that aligns buyers and sellers, links token value to product revenue and utility, and offers profit opportunities for users joining at different stages.

-

Creativity & Subculture Building: The team must understand community subcultures and symbolic languages—Pepe, Doge are veteran memes from Reddit. Creating new memes, possibly enhanced by AI-generated content, can become powerful growth drivers.

Based on these criteria, I hope to see more dApp builders join the ecosystem. I don’t want to label this merely as another hyped term or category. If forced, I might use broader industry terms like “TwitterFi,” “TelegramFi,” or “MemeFi.”

Other earlier-stage areas, such as the much-discussed on-chain gaming or autonomous worlds, remain highly promising. I believe truly successful products will emerge from these spaces—but it takes time. Positive signs are already visible, with many young, creative developers actively contributing to the Onchain Gaming community. The current issue is the scene feels too insular. For non-hardcore gamers, especially those unfamiliar with crypto, the learning curve remains prohibitively steep.

I’m eager to collaborate with Onchain Gaming builders to explore simpler, more accessible user acquisition paths. Another missing piece I see is token design—discussions around tokenomics in the Onchain Gaming community are surprisingly scarce. Yet, I believe robust economic systems are crucial for achieving mainstream adoption and breakout success.

The best time to invest in Web3 is — now!

The signs of bottoming in both primary and secondary markets are very clear:

-

Many projects launched near the peak of the last bull market, unable to build sufficient competitiveness or maintain adequate operating funds, have either failed or pivoted to other fields like artificial intelligence.

-

Hesitant traditional VCs and investment firms who FOMO-ed in at the top of the last bull market have largely exited Web3 and are now fiercely competing for allocations in AI startups.

-

The market is already saturated with ZK and infrastructure narratives. Many application-focused teams have shifted to infrastructure, indicating that infra projects are largely saturated. So how will those large projects funded with hundreds of millions during the last bull market ever launch their tokens? Can they rely solely on data farming by mercenary yield farmers? The problem is, multiple projects have already tried this, and double-digit numbers of others are still waiting to launch—all planning to drain liquidity from the secondary market. Crypto is already lying in ICU—where will all this blood come from?

-

Only innovative applications can bring new narratives, new traffic, and new vitality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News