The Power Game of Token Issuance: From IXO to FTO, From Wild Growth to Fair Launch

TechFlow Selected TechFlow Selected

The Power Game of Token Issuance: From IXO to FTO, From Wild Growth to Fair Launch

Chaos is not an abyss; chaos is a ladder.

The most exciting aspect of Web3 lies in the highly liberalized circulation of financial assets, offering greater freedom and convenience for both individuals and projects. However, in recent years, we've also witnessed numerous issues arising from this very freedom, with the foremost being how to ensure asset security and fairness. Thus, one of Web3’s major current challenges is achieving safety and fairness in financial assets while preserving this foundational freedom.

Tokenomics is a long-standing topic. From various "-Fi" models toward "positive externalities" and real-world value, we continuously downplay the role of tokens within project ecosystems to avoid speculative frenzies driven solely by token price. This approach has proven somewhat effective—certainly, the hype around "-Fi" and "X2Earn" projects has significantly cooled compared to two years ago.

Yet, we must not overlook the critical role of tokens in economic circulation simply because we aim to reduce speculation. True decentralization relies on the combination of smart contract rules and a sound economic system. Crypto practitioners familiar with courses like *Monetary Economics* or *Money and Banking* understand the importance of central banks. In an environment lacking strong centralized institutions to enforce compliance, robust economic design becomes even more crucial for ensuring a project's smooth operation.

Go2Mars has served as a tokenomics advisor for many projects—ranging from DeFi, GameFi, and SocialFi with strong financial investment attributes, to Web3 games, Web3 social platforms, DAOs, and even infrastructure-focused initiatives that de-emphasize speculation. Yet regardless of path, at a certain stage, every project inevitably confronts the same unavoidable issue: tokenomics design and token issuance.

The Evolution of IXO: Mainstream Token Launch Pathways

When discussing token launches, we’ll set aside NFT issuance based on ERC721 or BRC20 for now, focusing instead on fungible tokens (FTs). Given their broader scale and superior suitability for general circulation, FTs hold a more central position in the ecosystem.

In traditional stock markets, companies go public via methods such as IPOs (Initial Public Offerings) or SPACs (Special Purpose Acquisition Companies), which are essentially backdoor listings. Despite differing paths, the core goal remains the same: enhancing stock liquidity. Similarly, in Web3, the primary objective is to boost liquidity for project-issued tokens by establishing liquidity pools, thereby enabling token circulation and value realization.

CEXs (Centralized Exchanges) and DEXs (Decentralized Exchanges) are both trading platforms. CEXs resemble brokerage firms, requiring users to deposit and entrust their assets—introducing significant counterparty risk, as repeatedly exposed during incidents like FTX. In contrast, DEXs function as peer-to-peer marketplaces where users trade and manage token value directly, bypassing intermediaries. They replace traditional financial middlemen such as banks, brokers, and payment systems by using blockchain smart contracts for asset transactions.

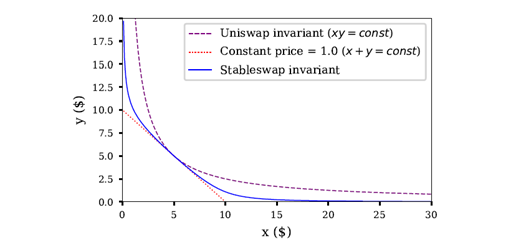

Currently, DEX mechanisms are diverse and constantly innovating, with order-book and Automated Market Maker (AMM) models being the most common:

Order-book DEX model: A matching mechanism where buyers and sellers place orders, executing trades when prices align. Deeper liquidity enables faster order fulfillment. Liquidity primarily comes from traders and market makers, who fill order books and provide bid-ask quotes to profit. Market orders execute immediately at the best available price but consume liquidity, typically incurring higher fees.

Automated Market Maker (AMM) model: An efficient, gas-saving solution for addressing insufficient market liquidity. Prices are determined by mathematical formulas based on token quantities in liquidity pools, eliminating the need for counterparties. Liquidity comes from pooled funds, and anyone can become a liquidity provider (LP), earning rewards through shared trading fees. However, large trades in shallow pools may incur slippage, so matching trade size with available liquidity is essential.

Whether CEX or DEX, both aim to facilitate trading and enhance liquidity. Therefore, after token issuance, most projects choose to list on an exchange—a process analogous to “going public” in traditional finance. Below, we introduce several mainstream listing models.

IEO (Initial Exchange Offering)

An Initial Exchange Offering (IEO) is a fundraising solution where new projects sell tokens via an exchange platform. Verified users (with KYC completed) can purchase tokens before public trading begins. Before launching an IEO, project teams must meet requirements such as having a solid business model, experienced team members, and viable technical use cases. IEOs carry a degree of credibility, as exchanges stake their reputation to endorse them. Nonetheless, thorough due diligence remains essential. For projects seeking capital through exchanges, IEOs offer a trusted pathway, often selling out quickly depending on the project’s vision and utility.

Advantages of IEOs include easier token circulation, faster access for retail investors, expanded reach across the exchange’s user base, reduced listing costs and effort, and increased trading volume and daily activity for the exchange. However, IEOs also have drawbacks, including high issuance costs and strict eligibility criteria. While IEOs perform well in terms of coverage, compliance, and fundraising effectiveness, they remain vulnerable to manipulative price pumps and early exits by initial investors.

ICO (Initial Coin Offering)

An Initial Coin Offering (ICO) was once a dominant fundraising method, involving the sale of tokens to early supporters in exchange for development capital. ICOs gained popularity starting in 2014 and peaked in 2017, becoming a key funding vehicle for many projects aiming to decentralize their ecosystems and attract investors.

ICOs offer simplicity, ease of distribution, and efficient token issuance, successfully fulfilling dual goals of fundraising and token launch. However, ICOs come with notable risks. Most ICO-stage projects are early-phase ventures with low resilience, exposing investors to fraud and loss. Due to weak regulation, some startups exploited the ICO boom by fabricating project details to run scams. Since 2017, governments worldwide have intensified regulatory oversight of ICOs.

IDO (Initial DEX Offering)

An IDO refers to a token’s first launch on a DEX, leveraging smart contracts on the blockchain for token sales, distribution, and transfers. Gaining traction since 2019 due to its low cost and decentralized nature, IDOs have become a preferred fundraising channel beyond private and seed rounds. IDO platforms include established DEXs (e.g., Uniswap, Balancer, SushiSwap), dedicated launchpads (e.g., PolkaStarter, DuckStarter, Bounce, Mesa), DAO-based platforms (e.g., DAO Maker), and novel approaches such as Twitter-based launches.

IDO benefits include decentralization, transparency, strong liquidity, seamless transition from primary to secondary markets, and opportunities for retail investors to join early-stage projects. Nevertheless, IDOs face shortcomings: lack of KYC/AML checks, risks of fake projects and wash trading, mandatory holdings of platform tokens (increasing entry costs), and limited scalability of DEXs.

Beyond ICO, IDO, and IEO, other launch methods exist—including IBO (Initial Bancor Offering), IFO (Initial Fork Offering), IMO (Initial Miner Offering), and STO (Security Token Offering)—each with unique mechanisms. However, due to practical limitations, some models are rarely used and thus not detailed here.

Rug Pulls: The Playbook of Scammers, Backdoors, and Fraud

Token launches are rife with fraud. Whether it’s a classic rug pull—where project teams drain liquidity from DEX pools causing token prices to crash—or outright theft exploiting admin privileges and smart contract loopholes—such incidents occur all too frequently. Anyone active in the “meme coin” space has likely encountered a rug pull. Beyond post-mortem doxxing ("dox") or filing police reports—which are often futile, especially when teams operate across jurisdictions—preemptive due diligence is the only real defense.

In DeFi, common types of rug pulls include liquidity theft, sell restrictions, and massive dumps.

Liquidity theft: The token creator withdraws all funds from the liquidity pool and disappears, rendering LPs’ tokens worthless.

Sell restrictions: Often called a "Pilcoin" scheme, developers code the contract so only they can sell tokens. After luring investors to buy, they dump their holdings, collapsing the price to zero.

Massive dumps: Developers rapidly offload large amounts of tokens, crashing the price and leaving other investors with worthless assets—essentially, insider dumping.

Additionally, for projects with liquidity, issues such as undisclosed team allocations, flash loan exploits, and malicious contracts persist. Secretive token reserves refer to projects allocating large amounts of tokens at low or no cost to insiders outside disclosed budgets—an act of fraudulent issuance. Recent disputes between figures like Sun Zhengyi and Li Lin’s brother highlight such controversies.

Market manipulation, hidden backdoors, and fraudulent practices severely damage Web3’s credibility. Contract audit firms, acting as agents, often fail to detect these backdoors, reducing audits to mere PR exercises. Manipulators and fraudsters often go hand-in-hand. Can we raise the cost of fraud to increase the barrier to entry?

FERC-20 and FTO: An Experiment in Fair Launches

In March, BRC20 tokens launched successfully on Bitcoin via Ordinals, capturing widespread attention. At the time, Pepe and BRC20 were the hottest topics across the crypto community.

Ordinals Protocol: A technology enabling creation and trading of non-fungible tokens (NFTs) on the Bitcoin blockchain by inscribing data onto individual satoshis (the smallest unit of Bitcoin), forming unique Ordinals.

BRC-20 Protocol: A method leveraging the Ordinals protocol to create and trade fungible tokens (FTs) on Bitcoin, using JSON data to deploy token contracts, mint tokens, and transfer them.

In practice, the Ordinals protocol simplifies BRC20 token programming, avoiding security vulnerabilities and backdoors common in Ethereum smart contracts. It ensures equal minting rights—project teams cannot reserve free or discounted tokens for themselves or associates. Additionally, Bitcoin’s UTXO model and low throughput limit bot operations, preventing unfair advantages via automated scripts.

FERC20 is an experimental extension of the ERC20 standard aiming to replicate BRC20-like fairness on Ethereum. However, challenges remain—particularly Sybil attacks and bot exploitation.

To mitigate these, FERC20 implements mechanisms such as:

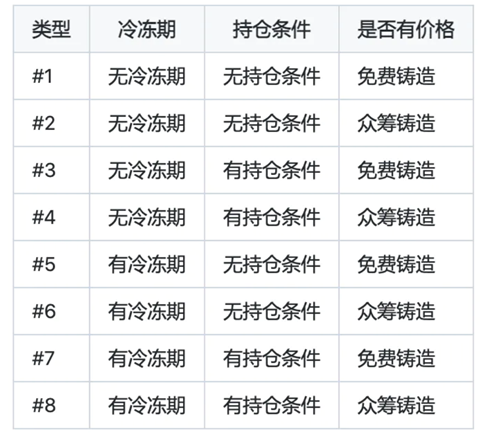

① Frozen Period: After initial minting, users enter a cooldown period. Additional mints require escalating fees—doubling each time. For example: first extra mint costs 0.00025 ETH, second 0.0005 ETH, third 0.001 ETH. Projects with frozen periods disable batch minting (Rollup Mint).

② Holding Requirements: Deployers can set conditions requiring holders to own specific NFTs or ERC20 tokens, preventing Sybil accounts from mass-minting.

③ Pre-sale/Crowdfunding: Deployers can set a price for pre-sales, collecting fees during minting.

By combining these three attributes, eight subtypes emerge (as shown below). Project teams can customize these settings when deploying token contracts.

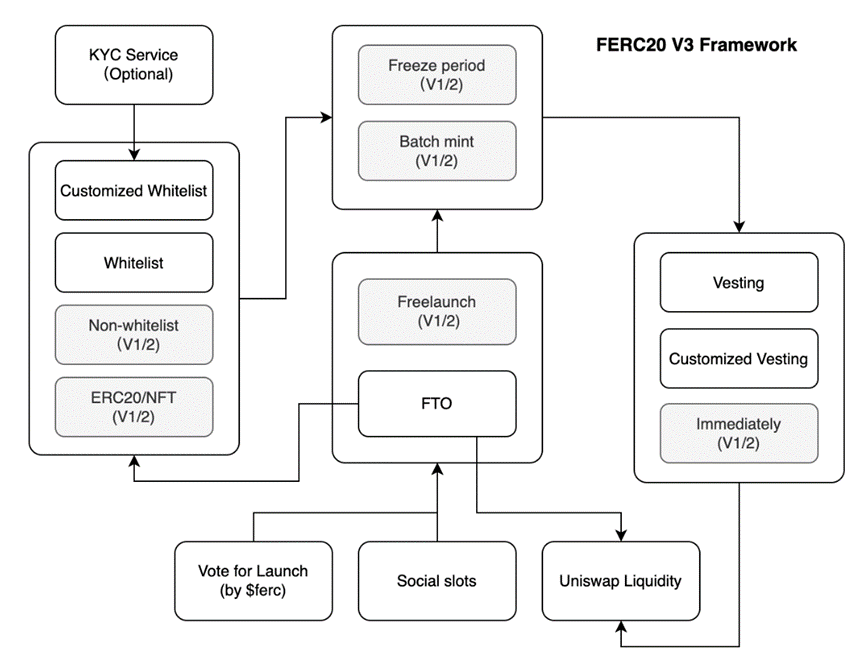

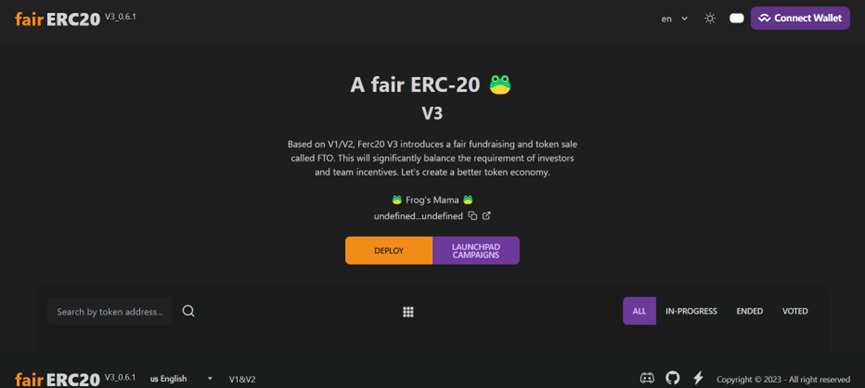

In the latest FERC V3 version, the framework has been further systematized into modules: token deployment, minting, whitelist, vesting, launchpad voting, social sharing, and liquidity pool management.

Under FERC20’s fair launch mechanism, the initial issuance model was originally named IFO (Initial Fair Offering), later renamed FTO (Fair Token Offering) in V3.

To uphold fairness, V3 introduced a Launchpad voting module. As FERC20 is a fully decentralized, ownerless platform built on blockchain and smart contracts, conventional centralized governance methods don’t apply.

The new voting module effectively addresses duplicate token names. On blockchains like Ethereum, multiple projects can deploy identically named tokens at different addresses. Under FERC20 V3, community voting determines whether a name can be reused. Tokens are then differentiated via a "blue badge" and community rating. This protects brand identity and prevents name squatting. Though imperfect, this decentralized approach offers greater reliability than centralized alternatives. We hope the community continues refining such solutions in practice.

The Launchpad voting module aims to build community consensus. Even without approval, a token can still be deployed—but may conflict with a "blue badge"-verified version, risking confusion. Tokens deployed without passing the vote cannot retroactively earn the badge. The badge is permanently recorded on-chain within the token contract at deployment, and since the contract is non-ownable, no changes are possible afterward.

Toward a Fairer Future: Ongoing Experimentation

While FERC20 and FTO ensure project teams pay the same cost as users to obtain tokens—realizing the “ownerless token” ideal often cited with BRC20—they don’t solve all problems, such as market manipulation or mass dumping. Still, they raise the cost of acquiring large token supplies, making it harder for teams to mint and dump worthless tokens with impunity. This represents progress.

From IXO to FTO, we continue striving toward fairer, more equitable mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News