User growth plateauing: where is Perp DEX heading?

TechFlow Selected TechFlow Selected

User growth plateauing: where is Perp DEX heading?

On one hand, growth methods are inefficient, unable to acquire genuine user growth through spending money; on the other hand, user experience and entry barriers still cannot be rapidly reduced.

GMX V2 has launched on mainnet, but market reaction has been lukewarm—an epitome of the current bottleneck phase in the Perp DEX sector.

This article analyzes the current state of the Perp DEX sector, its growth challenges and underlying causes, and explores potential solutions and future development paths.

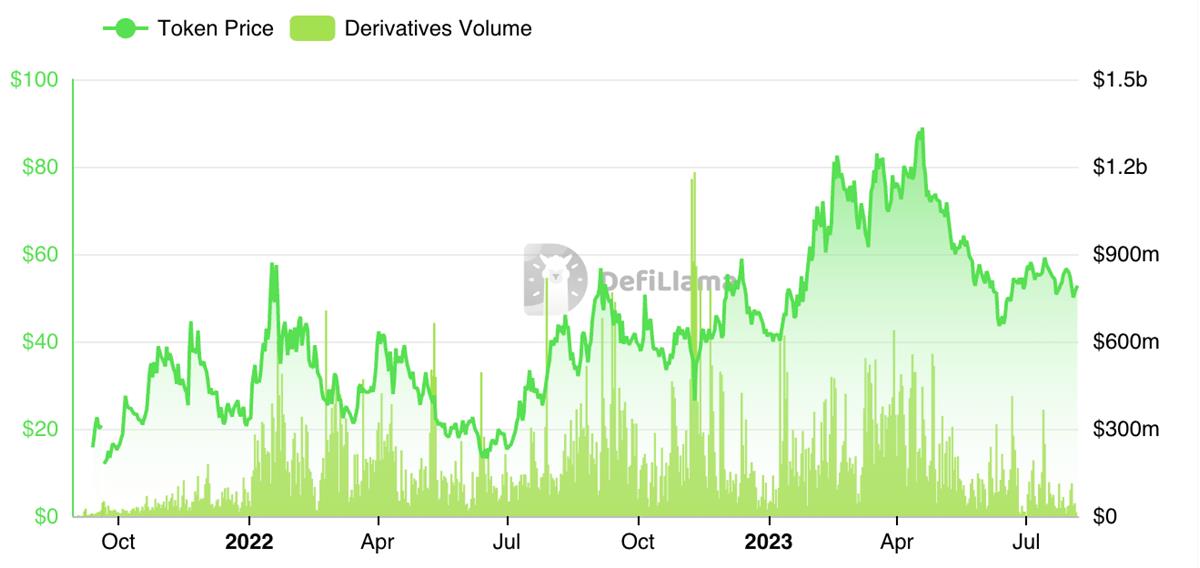

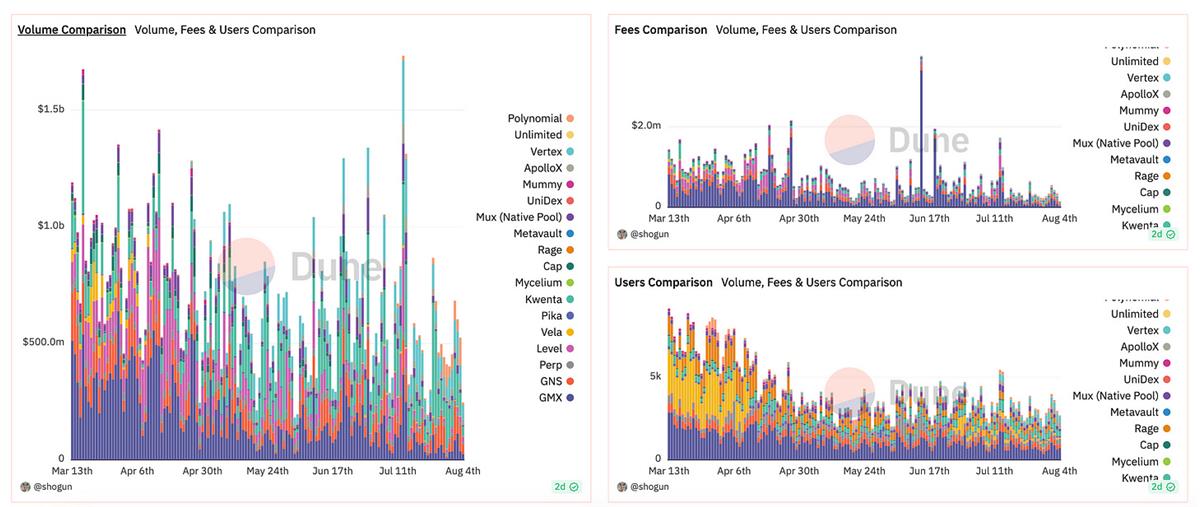

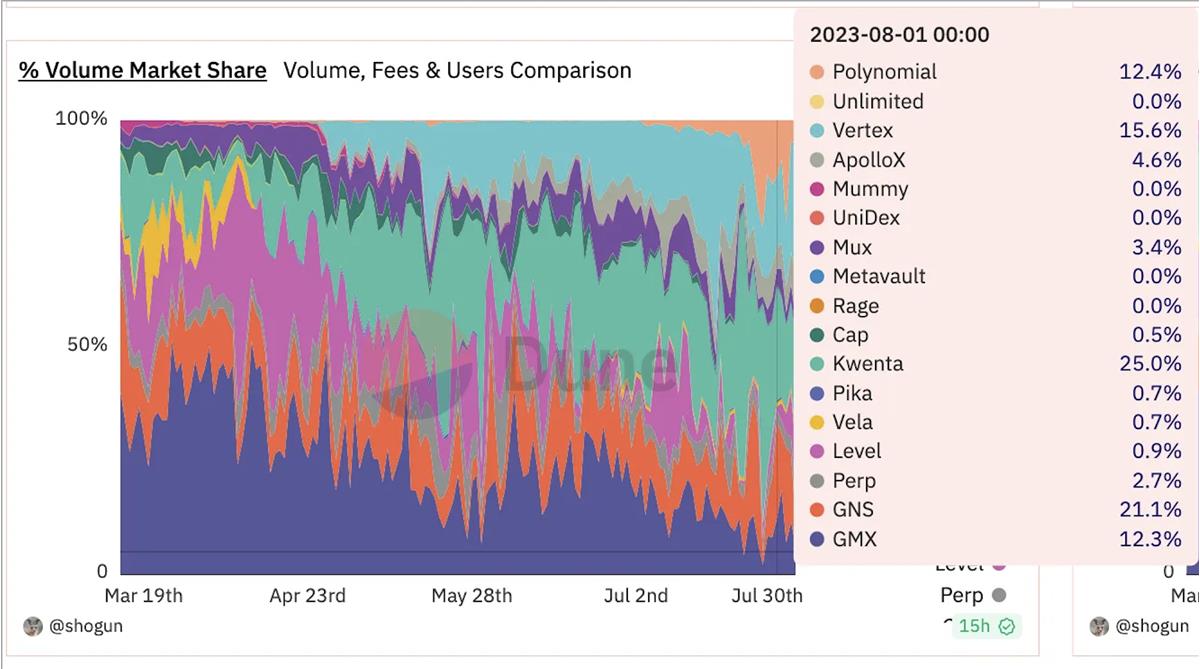

Overall, trading volume in the Perp DEX sector remains around 60% of its peak in March. However, fee revenue and user numbers have declined more sharply—daily active users (DAU) now stand at only about 30% of their peak, collectively comparable to GMX alone at its height.

Trading volume is also heavily reliant on token incentives. Unlike earlier organic growth driven by real user behavior seen with GMX/GNS, transaction incentives now play a significant role across the sector.

For example, Kwenta—the primary trading frontend for SNX—owes much of its dominant trading volume to incentives, including OP's weekly allocation of 300k OP to SNX and 30k OP to Kwenta, plus $Kwenta emissions, amounting to nearly $600,000 per week.

Another recent standout, Polynomial—a second SNX frontend—has grown for the same reason: using OP grants to fund trading incentives. Even Super Jun has recently commented repeatedly on the generosity of SNX-related rewards, though this generosity quietly depends on support (or subsidization) from the OP community.

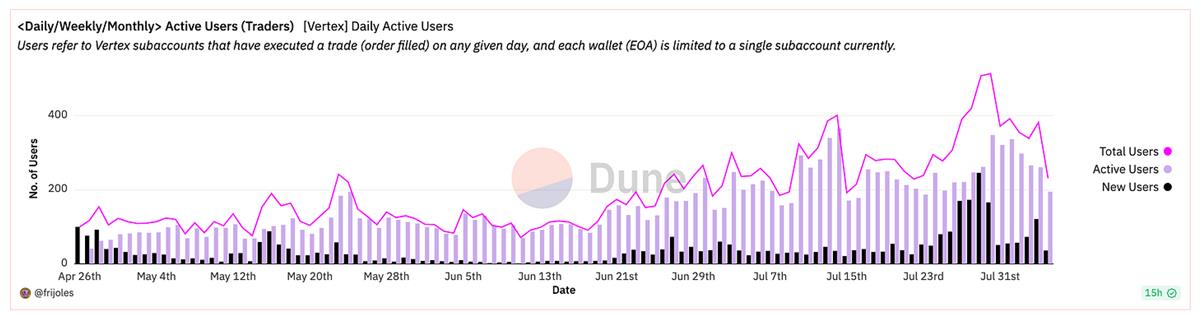

While trading incentives boost volume—with Kwenta directly distributing incentives and Vertex benefiting from airdrop expectations—these platforms alternate as volume leaders, reaching nearly three times GMX’s levels. Yet their number of active addresses is only about one-third of GMX’s, and after filtering out incentive-farming users, it’s unclear how many genuine users remain.

Why do trading incentives fail to attract real users? Because professional teams can inflate trading volume to such high levels that average rewards become minimal. For instance, current incentive payouts in the SNX ecosystem are nearly equivalent to actual fee revenues, leaving little net benefit for retail traders. As a result, large-scale migration of genuine users does not occur.

Without attracting real users, sustainable organic growth becomes impossible. Like other underused dApps, tokens become the primary product. During bull markets, people pump data-driven narratives; when the tide recedes, they’re left exposed.

This stems from the persistent challenge of identifying "real on-chain users." If every address counts as a user, then—as with current L1/L2 metrics—the numbers are dominated by bounty hunters and bot farms. The difference is that the market expects Perp DEX, a sector built on "real yield," to achieve sustainable profitability. When these expectations aren't met, prices plummet rapidly.

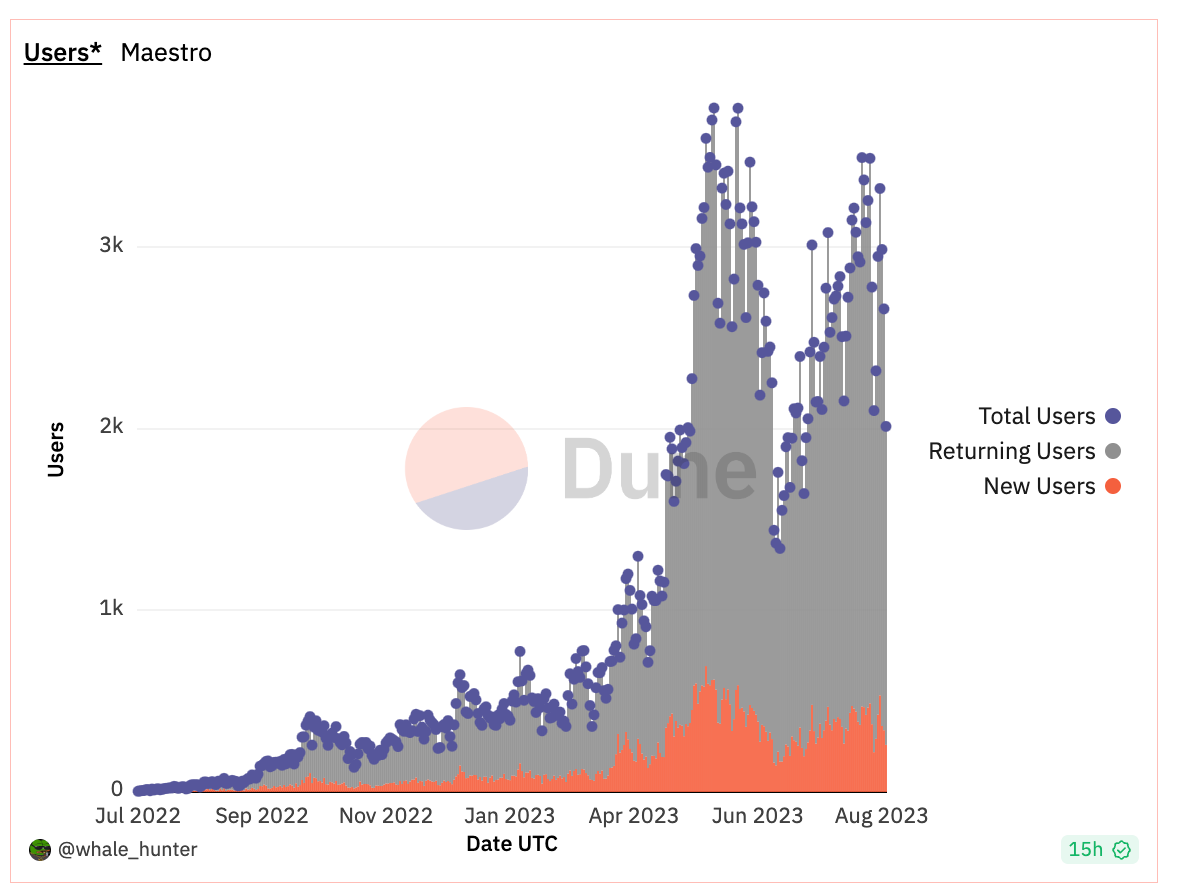

Since trading incentives cannot efficiently drive user migration, improving user experience and lowering entry barriers seem like the only viable alternatives. After all, users capable of interacting with dApps represent only a small fraction of the broader crypto population. Attracting CEX users might be another path forward. For instance, the recently booming bot sector has dramatically improved DEX usability through Telegram-based frontends and custodial models, significantly lowering the barrier to entry and enabling ordinary users to trade meme coins. Maestro Bot, despite not issuing a token, maintains a stable DAU of around 3,000.

However, the current bot sector is dominated by meme/meme coins, which have short trading cycles focused on early alpha. CEXs hold inherent disadvantages in these areas. In contrast, for perpetual futures on major tokens—where DeFi competes with CEXs—DeFi lacks a decisive advantage.

Beyond bots, improvements in DeFi wallet usability may offer another promising direction—such as enhancing trading experiences via account abstraction (AA) wallets. Still, progress here will likely be gradual.

In summary, Perp DEX has hit a user growth bottleneck, with trading volume inflated by incentive-driven activity. Key issues include inefficient growth strategies—token drops failing to convert into real user acquisition—and persistently high user experience barriers. These may improve once infrastructure like bots and AA wallets matures.

These are substantial challenges that GMX V2 alone cannot solve. Moreover, the rise of the bot sector suggests that infrastructure layers (e.g., Uniswap) may not be as profitable as consumer-facing services (e.g., Unibot). When core mechanisms become commoditized, superior user service and operational execution generate greater returns—just as BitMEX invented the perpetual contract, but Binance ultimately emerged as the winner.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News