Why Swell Could Be Lido's Strongest Challenger?

TechFlow Selected TechFlow Selected

Why Swell Could Be Lido's Strongest Challenger?

Overturning Lido's dominant position is a daunting task, but if there's one team that can do it, it's the Swell team.

Written by: Blocmates

Translated by: TechFlow

Just a few months ago, anonymous users from around the world stared at their screens, witnessing Ethereum's monumental shift from ETH to ETH 2.0.

This transformation, known as "The Merge," changed ETH’s consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

However, this transition had been in the works since 2015, and every DeFi enthusiast realized that once it happened, one sector would explode with opportunity: liquid staking derivatives (LSDs).

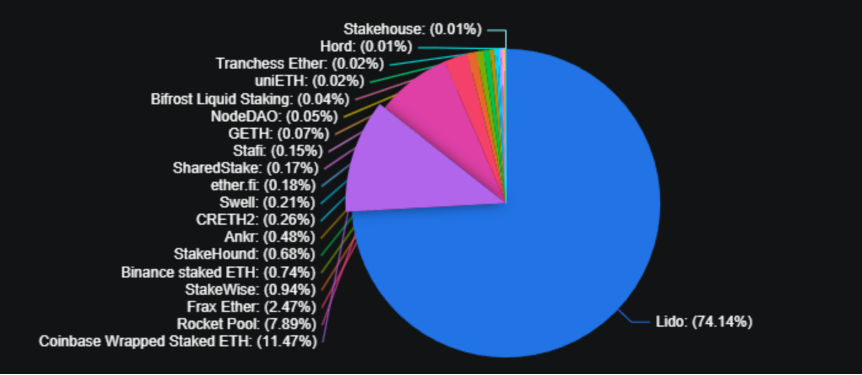

Lido seized early momentum with its stETH product and rapidly grew into the largest DeFi protocol. While Lido’s success is impressive, it also reveals an ugly truth: they hold dominant monopolistic power in the ETH staking market.

While this monopoly may be natural, it contradicts the core principle of the entire industry—decentralization.

Beyond altruistic concerns, due to Lido’s dominance in ETH staking, issues such as MEV abuse and severe censorship could soon become real threats to the Ethereum network.

As you can see, the space is not lacking competitors. There are currently over 20 liquid staking protocols, yet none have effectively challenged Lido’s dominance. This could be due to various factors—from security to familiarity to user experience. But ultimately, who can challenge Lido’s leadership?

A Potential Challenger

Swell, one of the contenders in the LSD space. How can it challenge Lido?

At its core, Swell’s strategy to erode Lido’s market share is simple: focus on what matters most to users—simplicity and profitability.

User interfaces aren’t new, but by offering direct fiat on-ramps and internal vaults (coming soon), Swell elevates simplicity to a whole new level.

Add better yields into the mix, and Swell’s chances of success grow even stronger.

Data doesn’t lie. Since launching at the end of April, Swell has been one of the fastest-growing LSD protocols, increasing its total value locked (TVL) from $58 million to $75 million in just the past two weeks.

Clearly, the developers are doing something right—the market is responding positively. While the journey is far from over, we believe Swell truly has the potential to rise to the top.

What exactly have they achieved so far?

Before diving deeper into Swell, let’s review what they’ve accomplished since we published our in-depth analysis on them a few weeks ago. This should give you solid insight into the team’s capabilities.

Let’s start with growth. Over the past month, Swell has been the fastest-growing LSD platform, now outpacing frxETH in growth rate.

This growth will continue as they are currently running an early adopter campaign called “The Voyage.”

In The Voyage, you dive deep into the Swell ocean and collect as many pearls as possible, which can later be redeemed for $SWELL tokens.

You earn pearls by holding swETH and providing liquidity in eligible pools, including Balancer, Aura, Uniswap V3, Bunni, Maverick, and Pendle. All pools carry equal weight, so there’s no need to split your swETH across different pools. Naturally, higher trading volume means more pearls, but there’s no minimum requirement.

Speaking of other protocols, Swell is also seeding broader DeFi ecosystems. The swETH-ETH pool is the largest on Maverick ($19M TVL), and their Aura pool is among the largest on Pendle.

Additionally, they’ve integrated with Redstone Oracles and launched a new Bunni dashboard.

Protocol updates are also underway. Key UI improvements include a dashboard showing real-time pearl earnings and a portfolio page to track swETH holdings, monitor the swETH-ETH exchange rate, and view other transactions.

You get the idea. Swell is a serious contender. But can it surpass the giants in this space?

Dethroning Lido and RocketPool

Answering such a question is never easy. In the ever-changing world of DeFi, too many variables and assumptions exist. Still, let’s try to envision what a battle for the throne might look like.

As usual, you answer such questions by asking others. First: what defines success for an LSD protocol?

At its core, success is defined by Total Value Locked (TVL). Higher TVL means more people are locking their ETH (or other assets) into your protocol. This leads to the next question: how do you achieve that TVL?

This is where individual differentiation becomes crucial.

Unfortunately, compared to AMMs or lending protocols, LSDs don’t offer much room for product differentiation. Users simply lock assets to earn yield and receive liquid derivative tokens usable across other DeFi protocols.

Yet when you're at the top of the game, small differences matter. For LSDs, these nuances come down to usability, profitability, and security. This gives Swell an opening to break into the upper echelon.

Security

First, let’s discuss security.

All three protocols face similar risks. One is smart contract risk, which is omnipresent. However, steps can be taken to minimize it—audits and bug bounties. Swell was audited by Sigma Prime, one of the best firms in the space and also used by the Ethereum Foundation.

Another shared risk is slashing penalties. If node operators miss attestations or engage in malicious behavior, their ETH gets slashed—meaning ETH staked through Swell or other LSDs could be lost.

The only mitigation depends on the quality of node operators selected by the protocol to delegate underlying ETH.

Swell partners with reputable, experienced node operators, significantly reducing slashing risks. Moreover, they provide insurance to cover unforeseen events.

Still, these security measures are standard across all three protocols. It’s in the other two areas where Swell can truly differentiate itself and potentially challenge for the crown.

Simplicity

When it comes to usability, there isn't much to compare. All three protocols have clean interfaces and decent user experiences. But simplicity goes beyond just intuitive design.

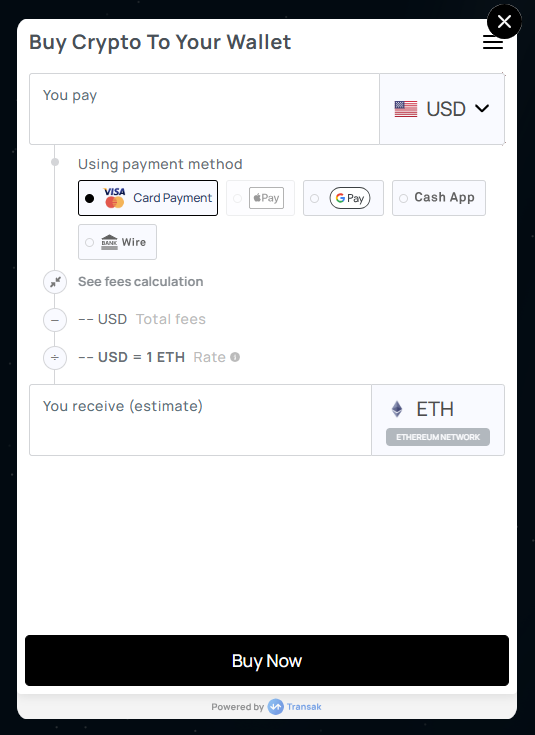

A key differentiator for Swell is direct onboarding. With Rocket Pool and Lido, users must first deposit funds into a hot wallet before transacting.

Considering the influx of new participants expected in LSD protocols—many of whom may not want to deal with the hassle of getting funds on-chain, at least initially—this matters.

You'd need to complete KYC on a centralized exchange, deposit funds, buy ETH, create a hot wallet, transfer ETH into it—then finally interact on-chain.

For us, this process is straightforward. But for regular people living in the real world, it’s a significant barrier.

Swell allows you to deposit directly from its dApp using credit/debit cards, bank transfers, CashApp, GooglePay, or ApplePay. Integration with Transak makes this seamless user experience possible.

Just like that, they’ve opened access to a whole new market of curious newcomers. They offer the same ease as centralized services—but with 100% transparency. Choosing Swell becomes the obvious decision.

Swell’s token model is also highly appealing. It features a simpler rewards structure, making user interaction easier than Lido’s wrapped model.

Combined with this simplicity, swETH enjoys deep liquidity on platforms like Balancer and Maverick. This creates strong LP opportunities and low-slippage exit routes.

These usability improvements have been well-received, as shown by rising numbers of independent stakers.

But it doesn’t stop there—Swell is further streamlining the process with upcoming native vaults.

By integrating liquidity mining partners like Aura, Bunni, and Maverick, users can participate in vaults and earn yield directly within the Swell app. Additional vault versions will roll out, enabling users to maximize swETH utility and consistently earn higher returns than elsewhere.

This serves as the perfect segue into our final differentiator—profitability.

Profitability

Regardless of technical merits, the only question users care about is: “Can I make money?” So how profitable is Swell?

In terms of actual staking APY, there isn’t much difference between the three. All offer 3–5% base staking yield. However, thanks to Swell’s ongoing incentive program, users can currently earn boosted swETH + $SWELL APY of 34.5%.

Still, incentives aren’t true indicators of long-term profitability. They’re temporary and will eventually phase out. Swell’s plan for sustainable profitability has two pillars.

First, fees. Lido charges 10% on staking rewards, Rocket Pool charges 15%. During Swell’s initial incentive phase, all fees were waived. Going forward, fees will be set at 10%, allowing competitive yield offerings.

Second, the mechanics of the swETH token itself. swETH is a reward-bearing token, whereas tokens like stETH and rETH are rebase tokens. Let me explain.

Suppose you stake 1 ETH on Lido and receive 1 stETH, with a 5% APY. After one year, you’d have 1.05 stETH, redeemable for 1.05 ETH.

With swETH, however, the balance stays at 1 swETH, but its value appreciates relative to ETH. At year-end, that 1 swETH can be sold for 1.05 ETH.

Practically speaking, the outcome is identical—you still gain 1.05 ETH. The difference lies in tax implications. In many jurisdictions, receiving additional tokens is considered a taxable event (e.g., income tax). Thus, many users may prefer swETH to minimize tax burdens.

After all, money saved is money earned.

LSDfi

Let’s shift gears slightly and explore a sector born from the success of these LSD platforms—LSDfi.

The best way to understand LSDfi is as a multi-layered ecosystem. At its foundation are leading LSD providers like Lido, RocketPool, Swell, and Frax.

But earning 5% by staking ETH alone isn’t enough for DeFi. A new wave of products leverages these base-layer LSD tokens to generate higher yields.

Projects like Lybra, Raft, and Agility are LSD-backed lending markets. Protocols like Pendle allow trading of LSD yields. Others like unshETH, Asymmetry, and Index enable diversification and yield optimization across multiple LSDs. In essence, this is DeFi built atop LSDs.

Currently, LSDfi’s total value locked (TVL) stands at $770 million and growing. Compared to Lido’s ~$15 billion TVL, the growth runway here is massive.

LSDs effectively eliminate the opportunity cost between ETH staking and DeFi, as you can now use yield-generating tokens in DeFi (or LSDfi). You no longer need to choose one over the other.

swETH won’t just benefit from LSDfi growth—it will fuel it. By offering better rates and native vaults, Swell enables LSDfi protocols to deploy more diverse strategies. This helps break Lido’s monopoly while giving users more ways to diversify and optimize returns.

People love novelty and options. swETH delivers both.

Adoption by LSDfi protocols will boost swETH liquidity, attracting more participants, driving more volume and deeper liquidity—a virtuous cycle.

Swell has already integrated with protocols like Gravita and hinted at partnerships with Lyra, increasing its chances of becoming the preferred collateral in LSDfi.

Adoption across LSDfi is a win-win. Users gain more product choices. Lido’s dominance is challenged. swETH gains more holders, TVL, and liquidity. A match made in heaven.

What’s Next?

The best way to answer this is: the team is actively building.

We won’t share full details yet—many aspects aren’t finalized. Once confirmed, we’ll update you. But watch for:

-

Permissionless node operators;

-

More yield opportunities;

-

CDP integrations;

-

Additional protocol integrations.

Final Thoughts

While we’re clearly bullish on Swell, we won’t let optimism blind us. Lido has first-mover advantage and has grown rapidly since. $15 billion TVL is no joke.

Dethroning Lido is a daunting task. They have a trusted brand name—people prefer familiar, proven experiences. For newcomers, shifting user behavior will be difficult.

Yet if any team can do it, it’s Swell. They’re among the most innovative teams in the space, attracting existing DeFi users with incentives and higher yields, while drawing non-crypto natives with unmatched simplicity.

Someone must challenge Lido’s near-monopoly and ensure a healthier, more decentralized LSD market. Swell is stepping up. The battle will be long and tough—but worth watching. And who doesn’t love a great underdog story?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News