The False Prosperity of zkSync's Ecosystem Amid a $10 Billion Market Cap

TechFlow Selected TechFlow Selected

The False Prosperity of zkSync's Ecosystem Amid a $10 Billion Market Cap

When the tide goes out, you discover who's been swimming naked.

Author: yyy

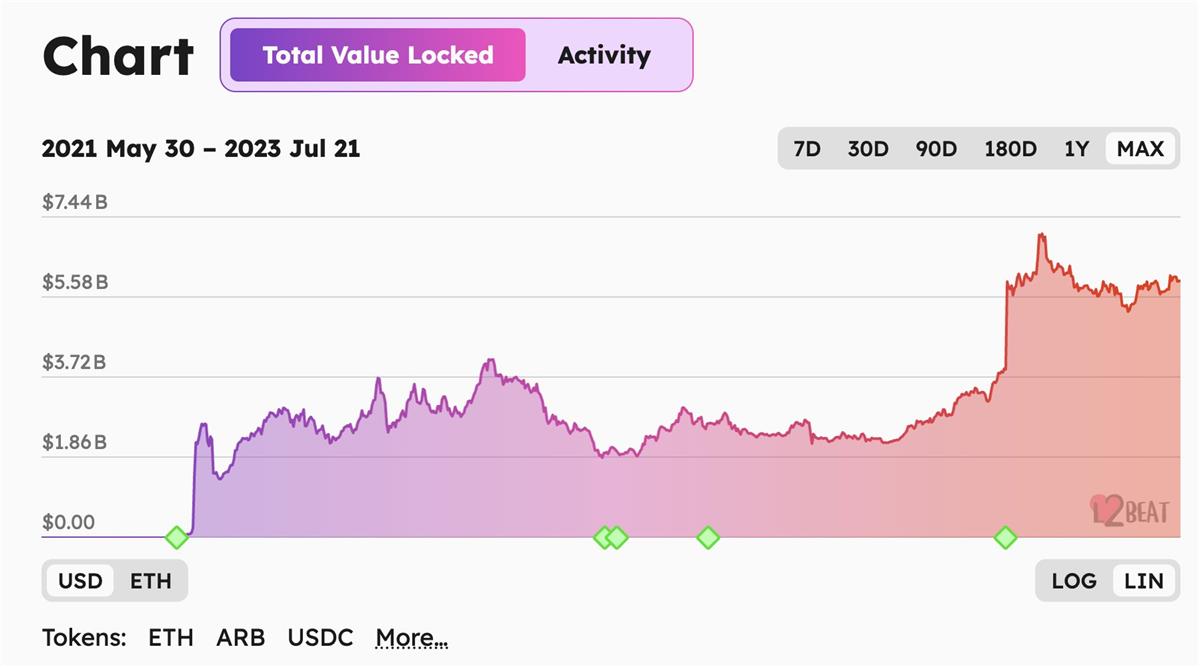

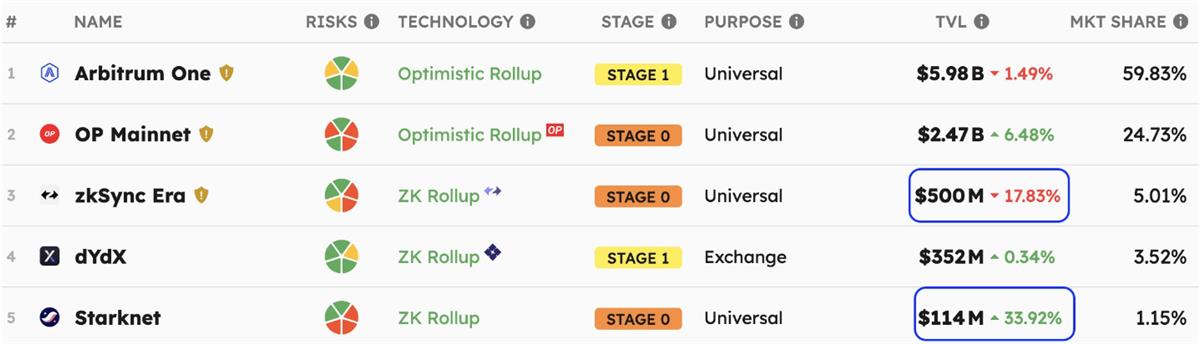

The total TVL of the Layer 2 sector has recently repeatedly approached the $1 billion mark, presenting a seemingly "flourishing" picture across L2 ecosystems. zkSync still ranks third in the L2 race, behind Arbitrum and Optimism, with an on-chain TVL reaching nearly $500 million.

Why do we say zkSync's ecosystem prosperity is fake?

Before answering this question, let's first look at the recent TVL trends of the two established leaders in the L2 space—Arbitrum and OP.

According to data from L2Beat:

-

Arbitrum’s TVL has been fluctuating narrowly around $6 billion;

-

OP has seen frequent positive developments lately, pushing its TVL to new highs, with an all-time high (ATH) surpassing $2.5 billion;

Together, their combined share of the L2 sector’s TVL reaches nearly 85%, indicating absolute dominance.

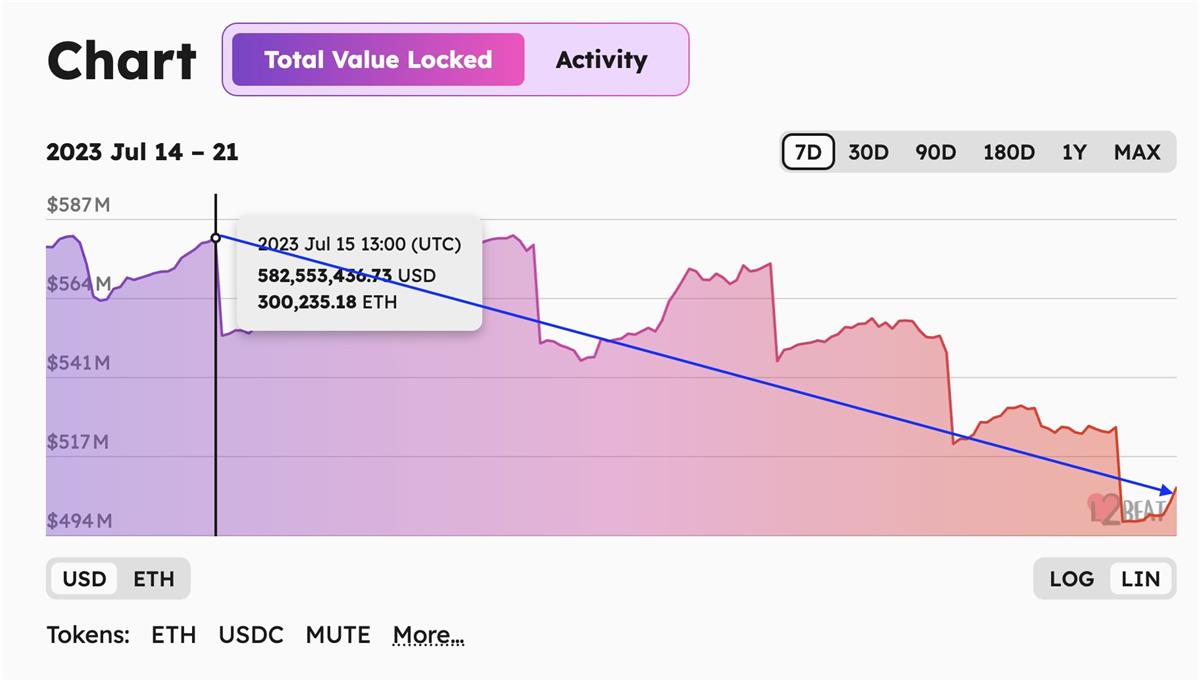

In contrast, zkSync has experienced a cliff-like drop in TVL, fueled by ongoing fallout from its recent community NFT “random” airdrop event. Capital has fled, with most flowing toward another non-tokenized zk-Rollup: StarkNet. StarkNet’s on-chain TVL grew nearly 34% in just one week.

Let’s state the conclusion upfront: zkSync’s on-chain prosperity is driven entirely by potential token airdrop expectations—brought about solely by airdrop hunters. At least for now.

Next, we’ll support this argument through three angles: complexity of the on-chain ecosystem, breadth of infrastructure adoption, and the NFT “random” airdrop incident.

(P.S. The degree of false prosperity in an on-chain ecosystem cannot be quantified, but zkSync’s “pseudo” boom far exceeds that of Arbitrum and OP.)

On-Chain Ecosystem Complexity

The complexity of an on-chain ecosystem reflects innovation capacity, offering users more diverse application scenarios and stimulating demand. For L2s, ecosystem complexity ≈ DeFi complexity. These somewhat Ponzi-like DeFi legos are especially critical to the appearance of ecosystem vitality.

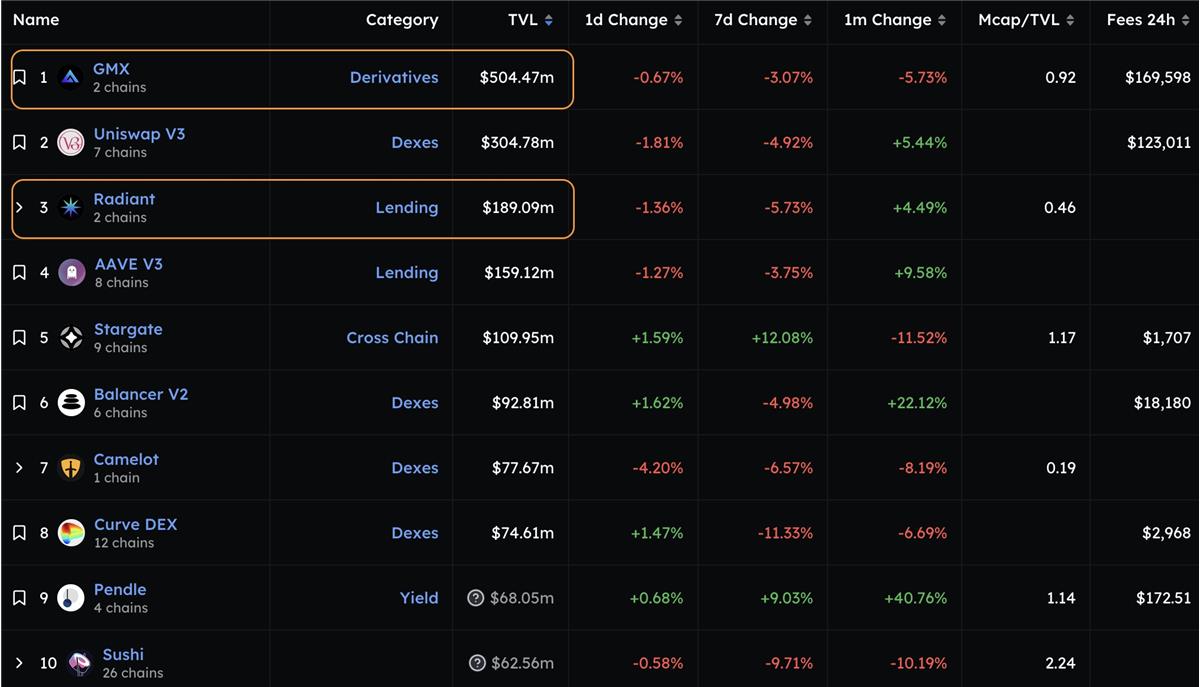

First, consider the leader: Arbitrum:

Its flagship protocol GMX boasts a TVL of $500 million and is one of the best decentralized derivatives trading platforms in the crypto market today. It’s also among the few complex DeFi protocols that have survived long-term. Additionally, Radiant Capital—the lending protocol recently funded by Binance—leverages LayerZero’s cross-chain infrastructure to enable cross-chain lending use cases.

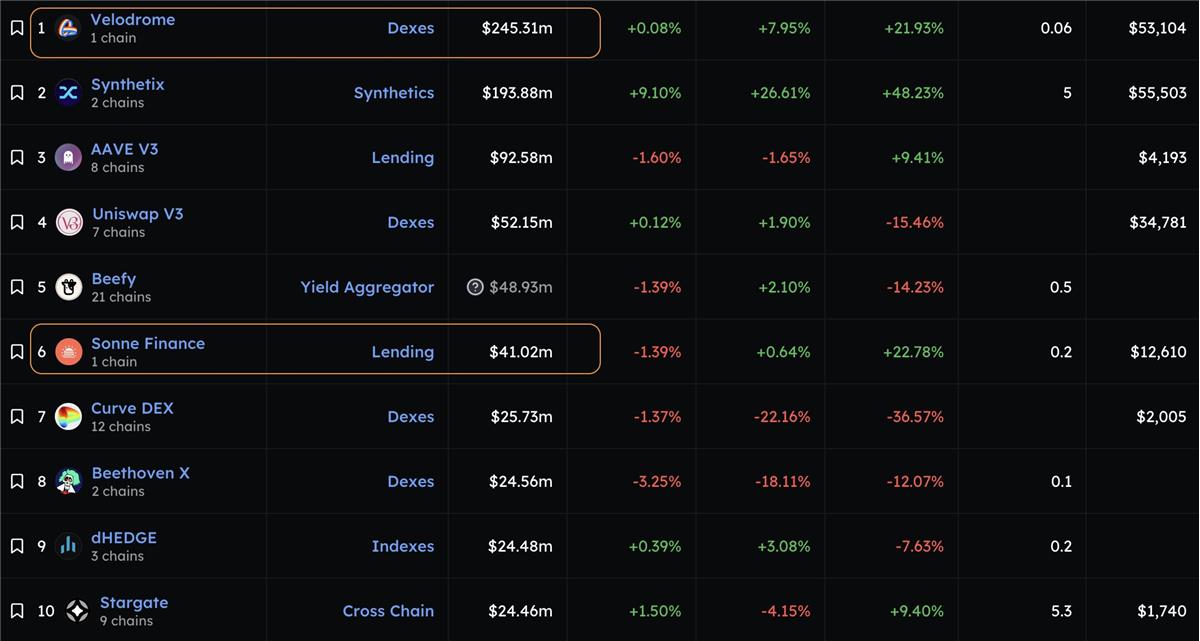

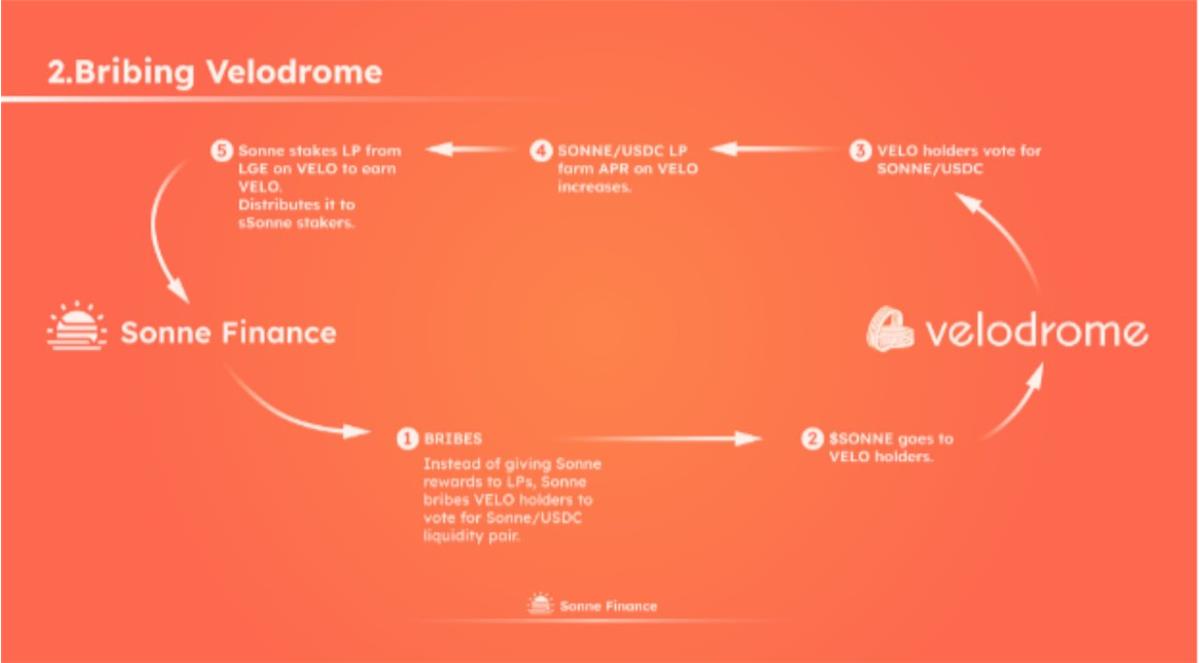

Now, the second-place OP:

Its leading protocol is Velodrome, a 3,3 DEX innovating upon Solidly’s fork model. It has become the central hub of the OP ecosystem, radiating influence to other protocols. Sonne Finance rose to prominence based on Velodrome and is now OP’s largest native lending protocol. Through vote-buying and locking mechanisms, it created a positive economic flywheel that feeds back into the OP ecosystem.

To summarize:

-

Arbitrum: Innovative applications like complex derivatives trading and cross-chain lending;

-

OP: Emulates Ethereum’s Curve-based vote-buying model to create a self-reinforcing economic loop.

We can say that ecosystem complexity is a necessary—but not sufficient—condition for true prosperity. Complex DeFi legos are certainly foundational to a thriving ecosystem.

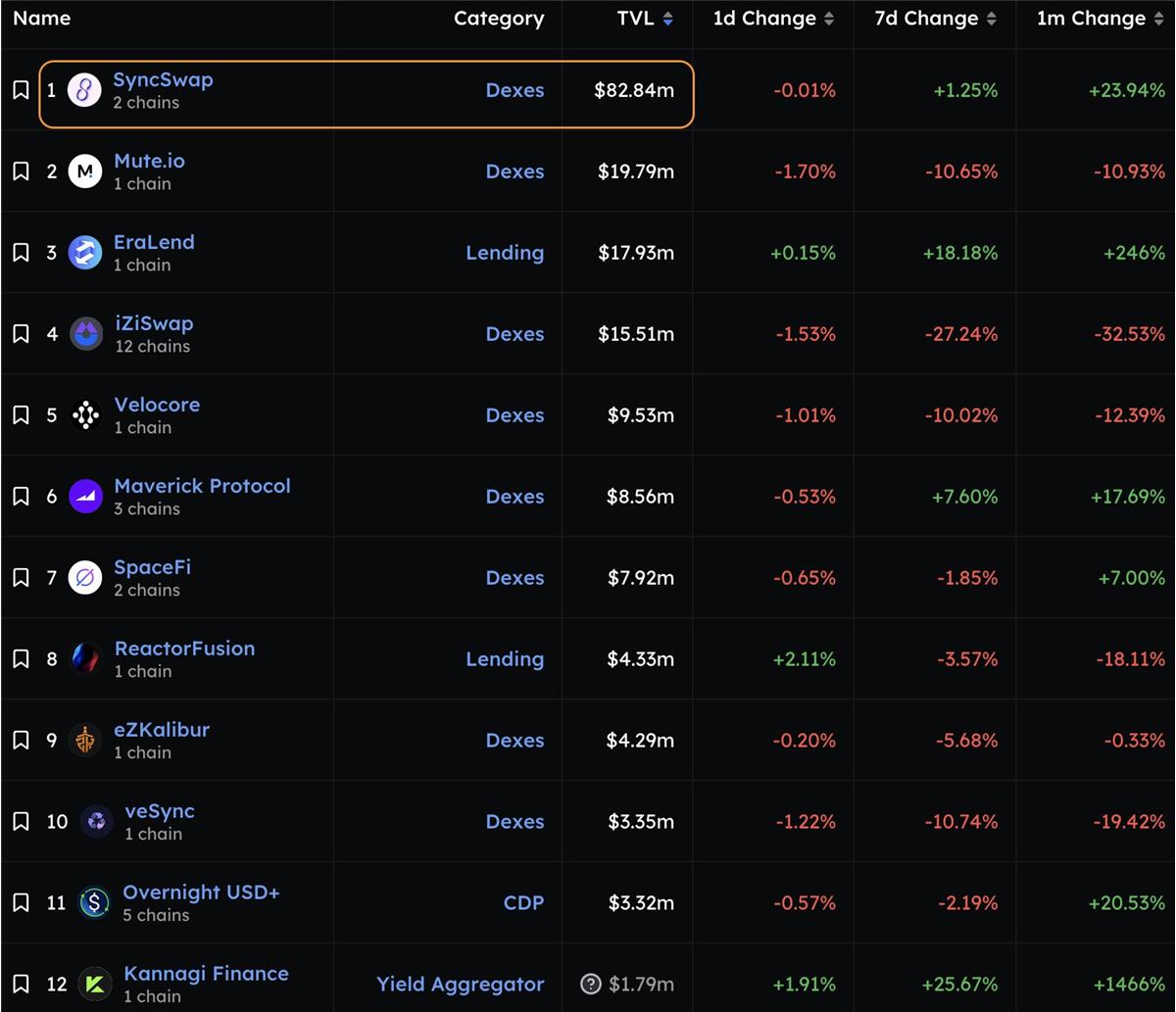

Now, the third-place zkSync:

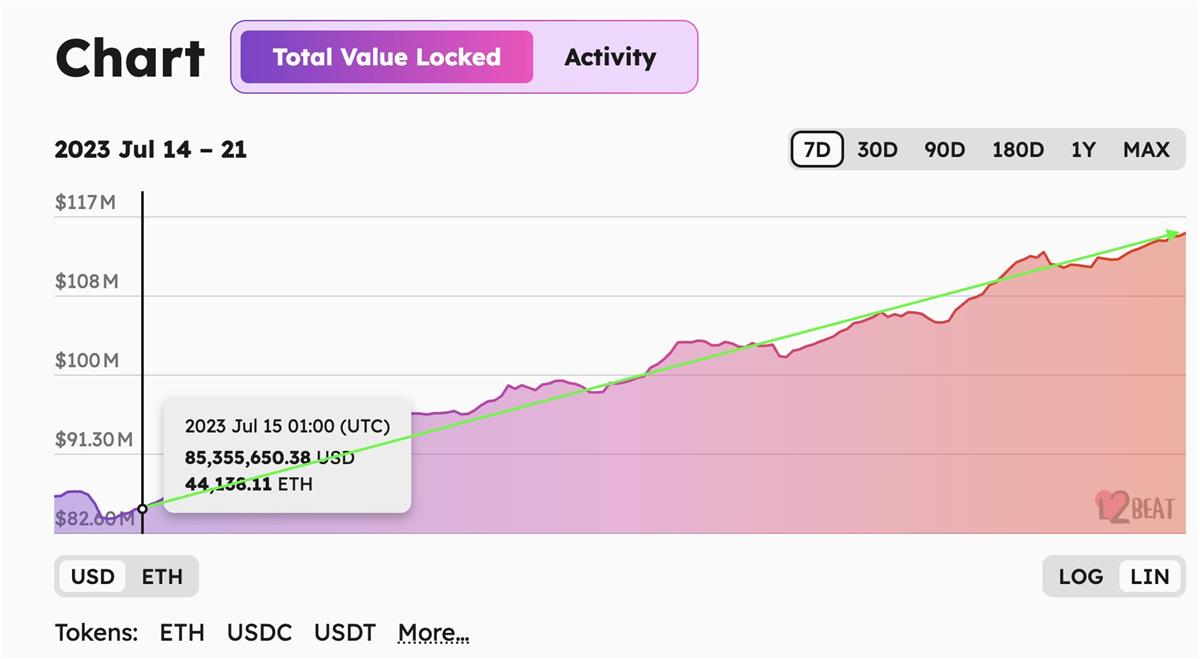

SyncSwap is the undisputed leader, with a TVL of $82 million—nearly half of zkSync’s total TVL.

We won’t dwell on the leading protocol here, given its recent “notoriety.” Scam projects and low-quality meme coins flood the chain; the dominant theme is rug pulls. Airdrop farmers have propped up half of zkSync’s TVL.

Widespread Adoption of Infrastructure

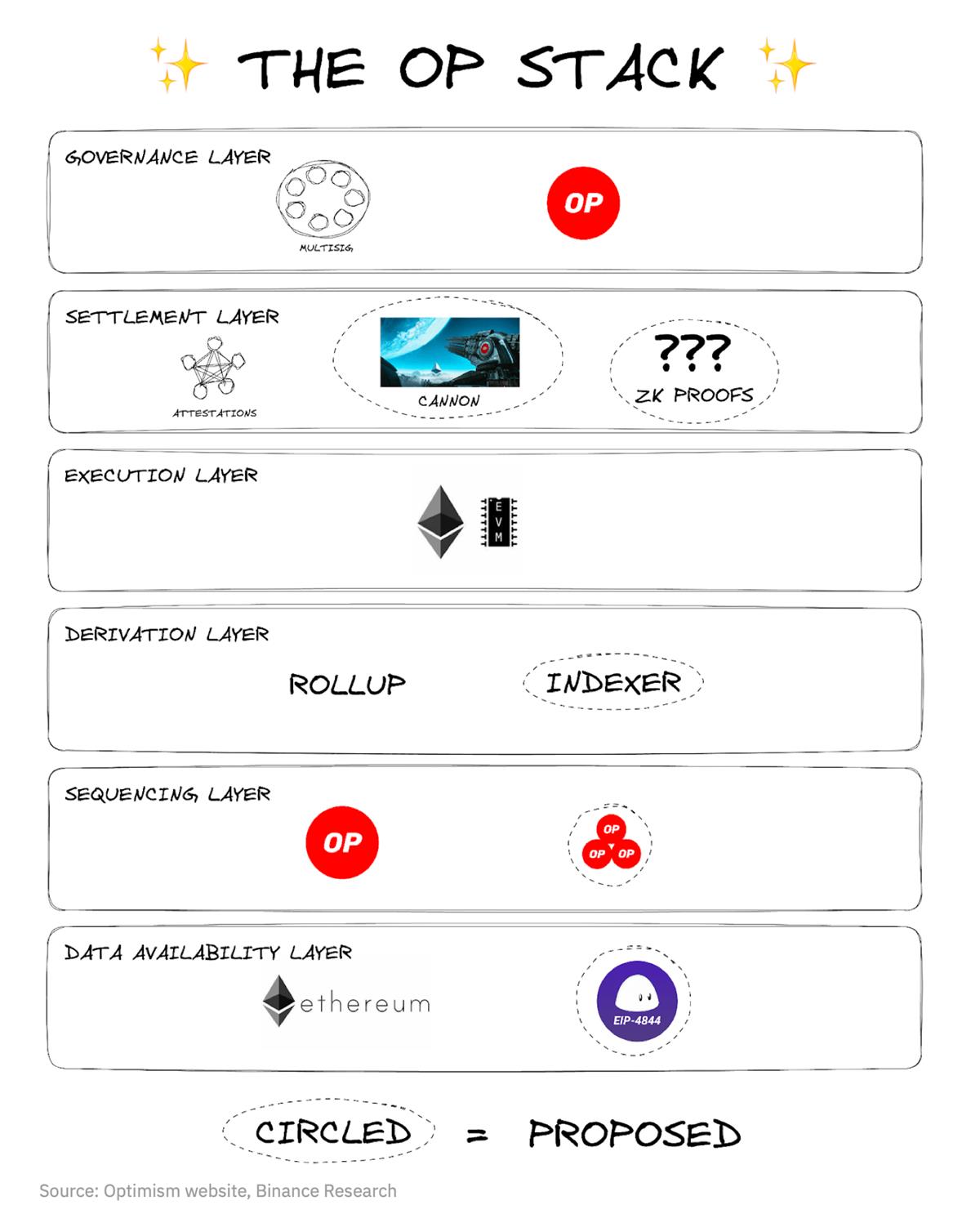

OP, Arbitrum, and zkSync have all launched modular stacks to help developers easily deploy L2s or L3s.

-

OP: OP Stack;

-

Arbitrum: Arbitrum Orbit;

-

zkSync: zkSync HyperChain.

Undoubtedly, OP Stack is currently the most widely adopted.

After Coinbase announced it would build its L2 Base using OP Stack, more and more projects have joined: including Binance’s opBNB, a16z, Worldcoin, Zora, Manta Network, and others.

Derivatives protocol Syndr recently announced building an L3 appchain using Arbitrum Orbit. Relative, OthersideMeta, and other protocols have also expressed interest in building L3s on Orbit.

In contrast, there’s little discussion in the crypto market about zkSync’s L3 architecture, HyperChain—let alone actual projects building zk L3s on it.

NFT “Random” Airdrop

zkSync officially airdropped NFTs to 10,000 “random” addresses within its ecosystem. However, it was later exposed that these “random” addresses were mostly starting with 0x0, including some with zero transactions or only 1–2 non-active transactions. Under public pressure, the team clarified that their definition of “random” was inaccurate—it actually meant the first 10,000 qualified addresses.

This NFT “random” airdrop became the trigger for zkSync’s sharp TVL decline. In just one week, TVL dropped by nearly $80 million—a decrease of over 16%.

Meanwhile, zkSync’s competitor—another potentially tokenized project, StarkNet—saw its TVL rise nearly 35% during the same period.

It’s reasonable to believe that such significant inter-chain capital shifts were largely caused by yield farmers changing strategies.

This further confirms that zkSync has very few users with genuine on-chain demand. Its ecosystem’s prosperity is “fake”—driven purely by expectations of a future token launch.

For the two established players, Arbitrum and OP, both have already launched tokens. While retroactive airdrop expectations still exist, it’s undeniable that Arbitrum and OP host many users with real, diverse trading needs.

Here, I can state quite subjectively: without farming users, zkSync would be nothing.

Faced with such an ecosystem and so-called “active” users, let me boldly ask: Would zkSync dare to launch its token now? Once the token expectation is removed, it becomes immediately clear who truly stands strong.

Finally, as always said: Only when the tide goes out do you discover who’s been swimming naked.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News