Korean Crypto Culture: Why Do Koreans Like Cryptocurrency But Not DeFi?

TechFlow Selected TechFlow Selected

Korean Crypto Culture: Why Do Koreans Like Cryptocurrency But Not DeFi?

Methods to attract Korean users vary depending on the DeFi protocol, and for some protocols, attracting Korean users may be more challenging than for others.

Writer: IGNAS

Translation: TechFlow

In South Korea, almost no one is unfamiliar with Bitcoin.

In 2017, this nation of over 50 million people accounted for 20% of all Bitcoin transactions globally and became the largest market for Ethereum.

South Korean students check Bitcoin prices during school breaks, office workers trade while queuing for coffee, and elderly people participate in the markets from home.

The frenzy peaked when local Bitcoin prices were 40% higher than those on U.S. exchanges. CoinMarketCap even removed South Korean prices from its cryptocurrency data feed. This phenomenon became known as the “Kimchi premium.”

In 2018, when the government cracked down on speculation, the Kimchi premium vanished. First, it mandated real-name bank accounts for cryptocurrency trading, then banned ICOs outright that same year. While the Kimchi premium may have disappeared, the crypto craze has endured.

In 2022, South Korea ranked third in Bitcoin trading volume, capturing 8.7% of the market. The U.S. led with 69.8%, followed by Japan at 11.3%.

One explanation for this surge is South Korea’s rapid adoption of new technologies, but deeper cultural and narrative factors also play a key role.

Understanding Korean Culture: The Miracle on the Han River

From 1950 to 1953, the Korean War left South Korea among the world’s poorest nations. By 2023, it had become one of the wealthiest.

This rapid economic growth was driven by family-owned conglomerates (chaebols), an export-focused economy, hardworking labor, and a distinct Korean mindset—a culture of speed and efficiency.

The “ppalli ppalli” (hurry up) mentality permeates Korean life. Every second counts. Food must be delivered quickly, trains arrive on time, buildings rise within weeks. Whatever you do, do it fast and efficiently. Getting rich quickly is no exception.

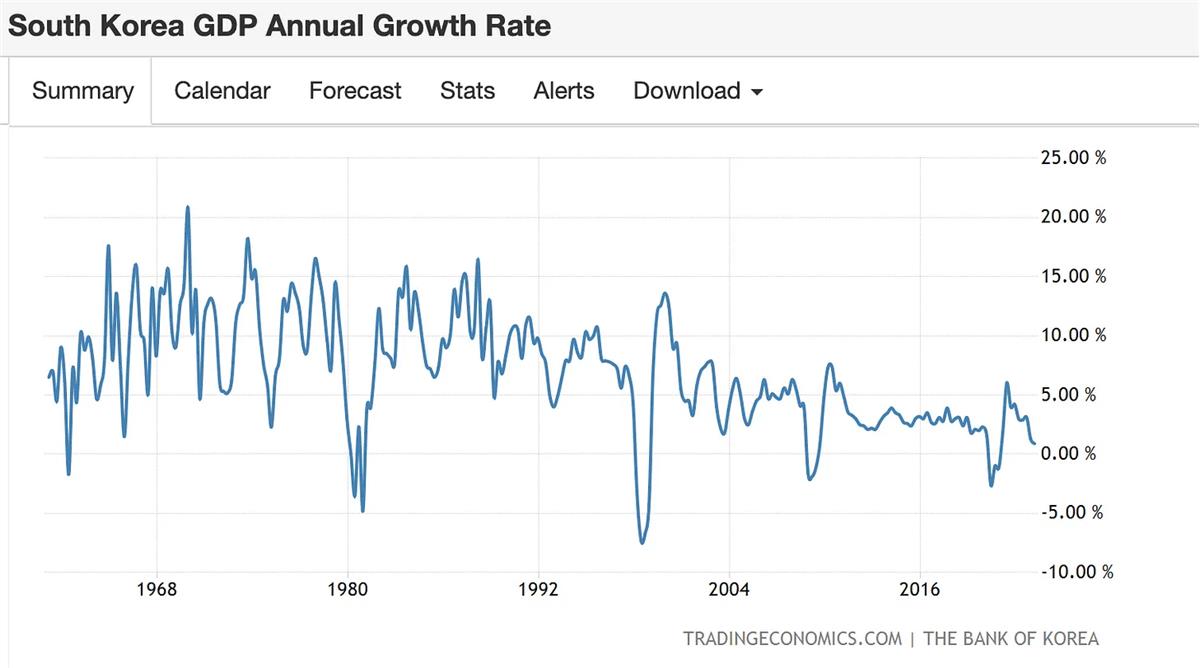

However, getting richer has become harder. Economic growth has slowed from double-digit rates in the 2000s to around 3% since 2012. As a result, paths to wealth—such as investing in stocks or real estate—are not accessible to everyone.

With limited high-risk investment options, real estate and domestic equities have lost appeal amid rising prices and interest rates. Derivatives trading comes with strict certification requirements, and the tech-heavy KOSDAQ index has barely grown since 2011.

For a long time, the alternative has been gambling.

The Fast Route to Wealth—Gambling

The problem? Gambling is illegal in South Korea—even for citizens traveling abroad.

Lotteries, horse racing, boat and bicycle racing, and casino gambling are all prohibited.

According to the Korean Center on Gambling Problems, established by the government in 2012, South Korea’s gambling addiction rate is two to three times higher than in other major countries. While the exact methodology behind these statistics remains unclear, the widespread social belief that Koreans are particularly prone to gambling addiction has influenced legislation.

With traditional investments constrained, cryptocurrencies emerged as a path to quick riches.

Many Koreans treat crypto exchanges like gambling platforms, aiming to make large gains in short periods.

In the West, narratives around “banking the unbanked” or Bitcoin as digital gold dominate. But in South Korea, where trust in financial institutions is high, such stories hold less sway.

After all, the idea of Bitcoin as digital gold isn’t thrilling enough—gold won’t double in price overnight.

But altcoins can.

To keep traders engaged and adrenaline pumping, some local exchanges have mastered the art of meeting this demand.

For example, a listing on a major exchange always draws retail attention—but only in Korea does delisting present an opportunity too.

A delisting window halts deposits, restricting new token inflows. Speculators rush in to push prices up for a final gain before trading ends. Unsurprisingly, delisting announcements now attract as much—or more—attention than listings.

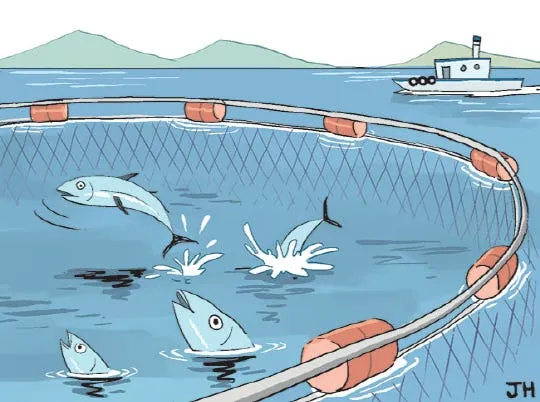

Even more intense is exchange maintenance mode. When deposits and withdrawals are suspended but trading continues, it’s called “gaduri”—a net used to trap live fish. Like fish unable to escape, closed markets operate independently of external prices, preventing arbitrage. For gamblers, it’s a true feast.

To be fair, this type of internal market trading is also popular in Korean stock markets. Cryptocurrencies simply offer a new playground for such tactics.

Some exchanges don’t even allow deposits or withdrawals from the start, focusing purely on internal trading.

But Then Came Crypto Regulation…

Since 2021, exchanges have been required to register with financial regulators.

All exchanges must obtain an ISMS security license and a real-name bank account—only five currently have both. Exchange operators who fail to register face up to five years in prison or fines of up to 50 million Korean won.

Regulation has imposed restrictions: every investor must use a real-name bank account, meaning Koreans must open accounts at banks supported by their chosen exchange.

Koreans must even register withdrawal addresses on local CEXs to report deposits and withdrawals to their own wallets or other centralized exchanges.

The result? Hundreds of crypto exchanges have shut down.

Currently, only five exchanges have real-name bank accounts. One of them, Gopax, was set to be acquired by Binance, but a major Korean newspaper reported that the Financial Services Commission (FSC) is reviewing the deal due to the SEC’s recent lawsuit against Binance.

Why DeFi Isn’t Popular in Korea

Given these changes—and the ongoing crypto bear market—the gambling-as-alternative narrative should drive Koreans toward DeFi.

Yet DeFi hasn’t gained traction in Korea the way it has in the West, despite efforts by major Korean blockchain firms.

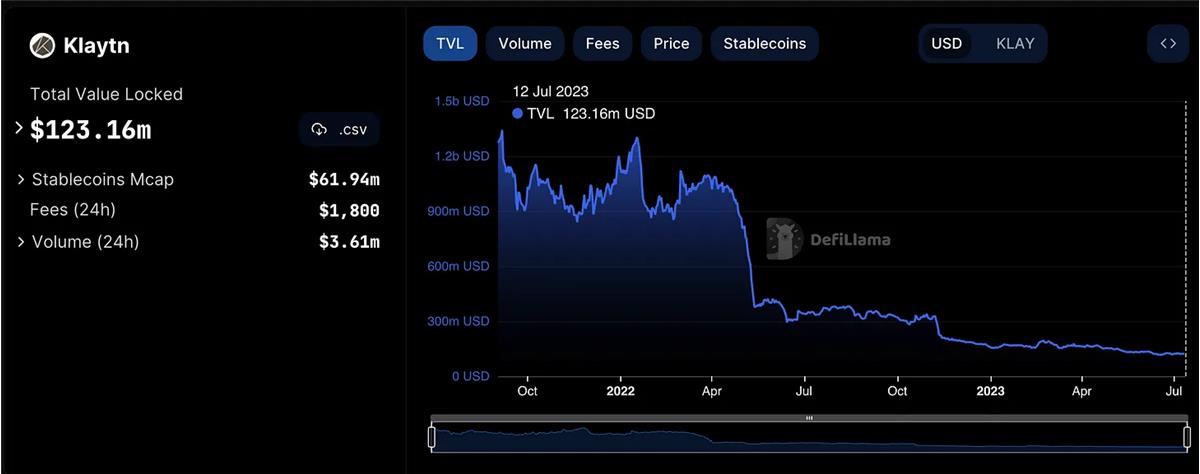

Take Klaytn, South Korea’s largest Layer 1 blockchain, which supports its own DeFi, NFT, and GameFi ecosystem. Backed by Kakao—the Korean equivalent of Facebook, with 53 million active users—it even features a built-in wallet within the Kakao messaging app.

As of this writing, Klaytn hosts 34 DeFi applications (per DefiLlama data) with a total value locked (TVL) of $123 million. That number seems decent, but in reality, DeFi adoption in Korea remains low.

Based on personal conversations with Koreans involved in crypto investing, I’ve noticed only a small fraction show interest in DeFi. Even my colleagues at a crypto exchange express little enthusiasm—few know how to set up a MetaMask wallet.

Their reasons for avoiding DeFi vary, but I believe the main factors are:

-

In a society with high trust in financial systems, the benefits of self-custody aren't compelling enough, especially when major centralized exchanges like Upbit and Bithumb already inspire strong confidence.

-

DeFi is more cumbersome than centralized exchanges: wallets, private keys, deposits, and withdrawals are all seen as “annoying,” and DeFi apps themselves lack user interface and experience tailored to Korean users.

-

For those chasing fast wealth (gambling), centralized exchanges already provide sufficient excitement—there’s no need to gamble on decentralized exchanges.

-

Lack of Korean-language content. DeFi terminology is complex and primarily targets English speakers.

-

Single- or even double-digit annual percentage yields aren’t attractive to speculators who prefer leveraged trading on exchanges (derivatives trading is banned in Korea).

Since I’m not Korean myself, I consulted two friends: Doo, COO of StableLab and Growth AVC member at MakerDAO; and Garlam, Managing Partner at Momentum 6.

Question 1: Why do you think DeFi isn’t as popular in Korea despite crypto’s popularity?

Doo:

Although Korean users show interest in DeFi lending and yield, self-custody tools like Ledger and MetaMask aren’t widely adopted.

Moreover, most DeFi apps and websites are in English—an important barrier for Korean users.

Recent cases like Haru Invest and Delio suspending withdrawals highlight this trend, pushing many users toward Korean-friendly CeFi platforms offering “DeFi-like” lending and yield products.

Garlam:

I see three key factors:

Structure: Traditional banking systems have rigid frameworks and clear guidelines, making the evolving nature of DeFi difficult for some to adopt. For instance, some anti-hacking, key-tracking, and authentication software only works on Internet Explorer—many still struggle to use Chrome for banking. This inflexibility drives users back to familiar platforms like centralized exchanges.

Busy: Koreans’ demanding work and social schedules limit their ability to keep up with DeFi’s rapid evolution. Many are either too busy or too complacent to invest time in learning a constantly changing field—especially when information is in a foreign language and relevant only briefly.

Timing: DeFi participation often starts with high-risk, high-reward projects before moving to safer blue-chip protocols. Due to the time zone difference between Korea and the U.S.—where most project launches and updates occur—many Koreans frequently miss opportunities. Combined with the need to constantly monitor English-language news (not commonly used in Korea), early DeFi experiences tend to be disappointing, hindering sustained engagement.

Question 2: What needs to change for DeFi to gain adoption in Korea?

Doo:

There are two main (non-exclusive) paths: becoming more “Korea-friendly” by providing Korean-language materials and localized websites.

Alternatively, partner with popular centralized entities. For example, Coinone—one of the few major Korean exchanges—is already integrating DeFi yield positions, allowing users to benefit from DeFi returns.

This is a step toward gradually guiding users toward direct, non-custodial DeFi usage.

Garlam:

Very simple: Koreans need to make money from Korean DeFi. Once they taste success, the frenzy will begin.

Question 3: What should DeFi protocols and communities do to engage Korean users?

Doo:

Approaches vary by protocol. Some may find attracting Korean users easier than others.

Product complexity usually determines difficulty. Options and insurance are complex—most Korean users struggle to understand them. Such protocols might succeed better by encouraging token trading rather than product usage.

For simpler DeFi products, marketing and, crucially, accessibility matter. Marketing can be passive or active.

Passive methods include translating websites into Korean and offering Korean guides so users can easily discover and use them. Active methods could involve interviews or speaking at Korean events.

Maintaining a Korean Telegram or KakaoTalk group could also help. For accessibility, protocols should partner with Korean CeFi platforms or crypto mobile wallet providers friendly to Korean users.

Compared to other regions, mobile wallets are the preferred method for accessing crypto in Korea.

Garlam:

Localization—Korea is a highly homogeneous market. Without a genuine Korean team operating locally, it’s extremely difficult to enter.

KOLs and media—they’re the primary channels for information sharing. Identify good and bad actors in Telegram and Kakao groups, and educate group admins (even allocate promotion budgets). This could yield the highest ROI for expansion.

First impressions matter—people revert to defaults in uncertain times. Tokens traded on Korean exchanges let users become familiar with their names and historical prices. Once people derive value from a token, they’re more likely to engage with the entire ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News