CMC, a leading authority in the crypto industry, has released a major research report on TRON's stablecoin.

TechFlow Selected TechFlow Selected

CMC, a leading authority in the crypto industry, has released a major research report on TRON's stablecoin.

Stablecoins have become an integral part of decentralized finance and everyday commerce, enabling users to access assets with stable value amid volatile markets.

Recently, the research report titled "Exploring Stablecoin Applications on Leading Blockchain Networks," produced by TRON DAO, has been officially launched on CoinMarketCap, a leading platform in the crypto industry. The report provides a detailed and in-depth analysis of stablecoins, covering their definitions, types, use cases, and more.

According to the report, data shows exponential growth in stablecoin adoption. Since 2021, the market capitalization of stablecoins has surged dramatically, highlighting their increasing importance in the global economy. Stablecoins have become an essential component of decentralized finance (DeFi) and everyday commerce, enabling users to access value-stable assets amid volatile markets.

The listing of TRON DAO’s research content on CoinMarketCap undoubtedly enhances TRON's credibility and official recognition. TRON is committed to providing the industry with more comprehensive and accurate market data, strengthening its position and influence within the cryptocurrency sector. This initiative will also help investors gain deeper insights into TRON, supporting more informed investment decisions.

Below is the full content of the report:

TRON DAO: Exploring Stablecoin Applications on Leading Blockchain Networks

Table of Contents

What Are Stablecoins?

Are Stablecoins Widely Circulated Across Most Blockchain Networks?

How Are Stablecoins Used?

According to Chainalysis, Nigeria ranks among the countries with the highest cryptocurrency adoption rates globally. Tight monetary policies and lack of currency stability have driven demand for cryptocurrencies. Digital assets have opened unprecedented opportunities for Nigerians to participate in global work and earn income. As global cryptocurrency adoption continues to surge—reaching 420 million users—stablecoin usage has grown significantly alongside it.

What Are Stablecoins?

Stablecoins are cryptocurrencies pegged to stable assets such as offshore Chinese yuan, U.S. dollars, euros, or gold. They combine the stability of fiat currencies with the advantages of digital currencies, enabling fast cross-border transfers and daily transactions. In countries with tight monetary policies or long-term currency instability, stablecoins unlock vast possibilities. For citizens in regions with limited banking access or suffering from hyperinflation, digital assets serve as alternatives to traditional money—and stablecoins offer practical solutions.

Stablecoins can be categorized into the following types:

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by legal tender such as U.S. dollars or euros. Issued by centralized entities, these stablecoins maintain 1:1 parity with their underlying fiat reserves. USDT and USDC are prominent examples of this category.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies like Bitcoin or Ethereum. These may be issued by centralized institutions or decentralized autonomous organizations (DAOs), maintaining value stability through over-collateralization with crypto assets.

Algorithmic Stablecoins

Algorithmic stablecoins maintain price stability through complex algorithmic mechanisms rather than physical collateral. Without backing from fiat or crypto reserves and often without centralized oversight, they are difficult to regulate. As a result, algorithmic stablecoins faced significant criticism and scrutiny in 2022.

Are Stablecoins Widely Circulated Across Most Blockchain Networks?

Yes, but two major stablecoins dominate circulation across all others.

As of June 21, 2023, the total market cap of stablecoins exceeded $128.58 billion. According to DeFiLlama, the top five blockchains by stablecoin volume and related data are:

Ethereum | $70.51 billion | 51.11% USDT

TRON | $43.73 billion | 92.40% USDT

Binance Smart Chain | $5.69 billion | 59.56% USDT

Arbitrum | $1.78 billion | 58.74% USDC

Solana | $1.53 billion | 56.68% USDT

Notably, Ethereum and TRON hold significantly larger market shares compared to the other three chains. Arbitrum has also outperformed expectations, rising rapidly to fourth place. While a separate study might be needed to fully explain Arbitrum’s ascent, this report focuses solely on how stablecoins are used across leading blockchain networks.

How Are Stablecoins Used?

Stablecoins serve multiple purposes, including:

Decentralized Finance (DeFi)

Decentralized finance (DeFi) refers to financial applications that allow users to access services without relying on centralized intermediaries like banks. Many DeFi protocols provide liquidity pools where users can deposit cryptocurrencies and stablecoins to earn interest or swap tokens. Stablecoins play a critical role in the DeFi ecosystem.

According to Bitwise’s Q1 2023 report, stablecoin payments and transfers in DeFi have reached $17 trillion to date, with first-quarter transaction volumes exceeding $2 trillion—surpassing PayPal’s total transaction volume for all of 2022.

Cross-Border Payments

Some stablecoins facilitate cross-border payments with advantages of speed and low cost. Traditional international payment channels are slow and expensive, whereas stablecoin-based transfers avoid these drawbacks. As Forbes noted in an April 2023 article:

“Stablecoins could soon become the new standard for remittances, payments, and cross-border transactions. ISO20022 aims to streamline and standardize financial data exchange between institutions, enterprises, and governments, making it possible to integrate compliant cryptocurrencies and stablecoins into global financial infrastructure.”

Trading

Cryptocurrency exchanges widely support stablecoin trading pairs. In May 2023, trading volume involving stablecoin pairs reached $292 billion. Traders can easily convert holdings into other cryptos or fiat currencies, hedging against market volatility while maintaining liquidity. During periods of market turbulence, users often shift assets into stablecoins on exchanges, waiting for conditions to stabilize. Stablecoin holders can also use cross-chain bridges to transfer assets across different blockchains and exchanges.

Asset Tokenization

Stablecoins enable the tokenization of real-world assets such as real estate and gold. By converting physical assets into digital tokens using stablecoins, users can collectively invest in ventures, companies, or brands. Asset tokenization offers loyal customers enhanced rewards and allows partial ownership without reliance on traditional financial intermediaries. Tokenized stocks are emerging as a new market, enabling fractional investment in high-value equities. Additionally, stablecoins may help calm investor anxiety caused by cryptocurrency price swings.

Lending

Stablecoins are also used in lending. Lending protocols allow users to borrow or lend stablecoins at fixed interest rates, providing liquidity without selling existing crypto holdings. The crypto lending market now exceeds $5.2 billion, with stablecoins driving capital flow and infrastructure development. Analysts believe stablecoins will optimize lending processes across industries, especially mortgage financing, accelerating loan approvals and improving capital allocation efficiency.

Charity

Finally, several blockchains have integrated stablecoins into charitable initiatives. Numerous nonprofits now accept donations in stablecoins like USDT. This is particularly valuable for international charities, as donors can contribute quickly and securely without worrying about high cross-border fees. During disaster relief efforts, stablecoins enable real-time, rapid responses. Cryptocurrencies played a key role in fundraising after the Turkey-Syria earthquakes.

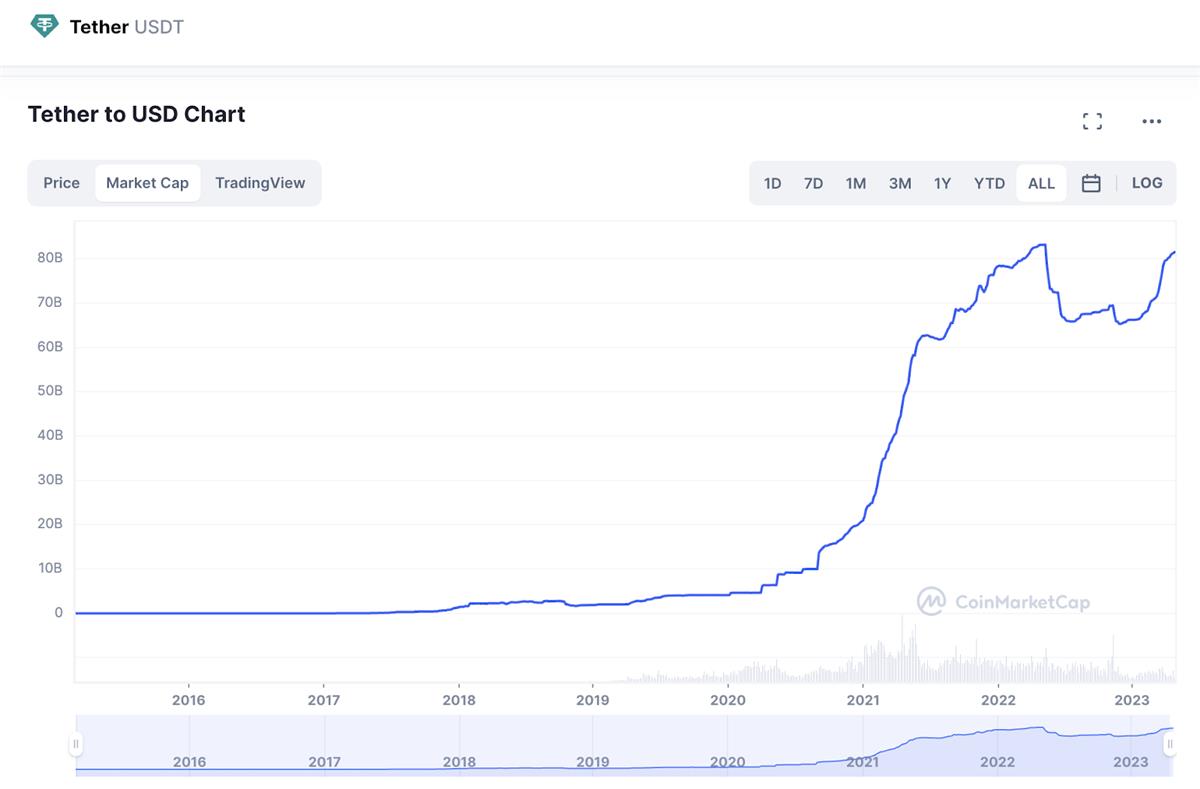

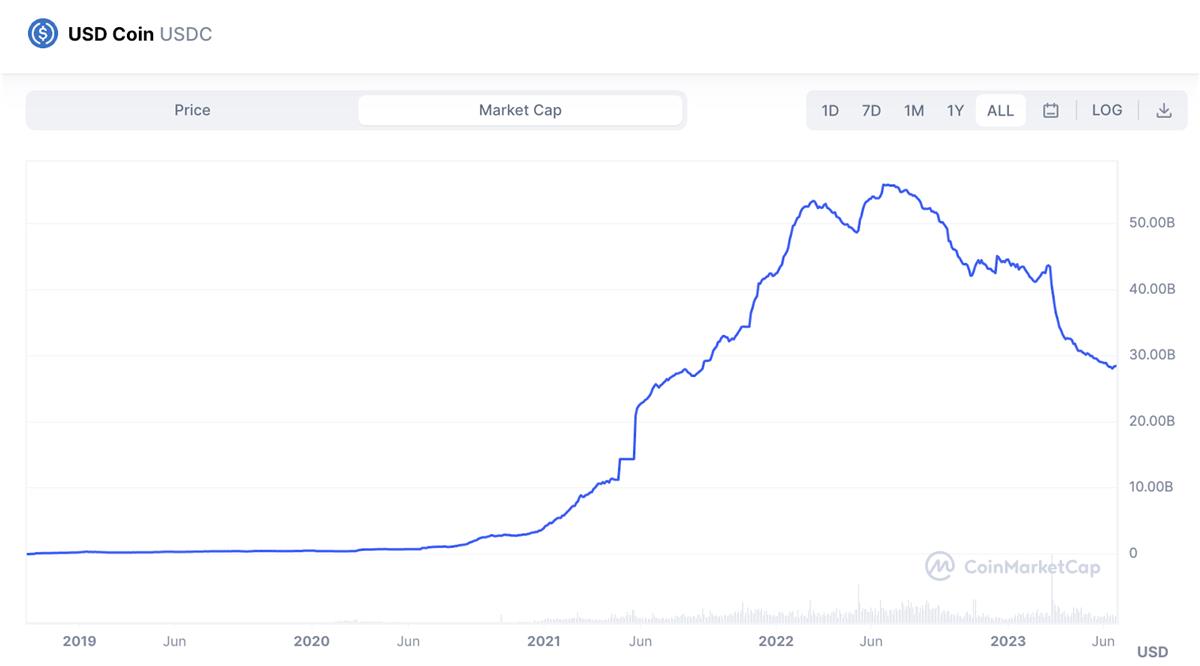

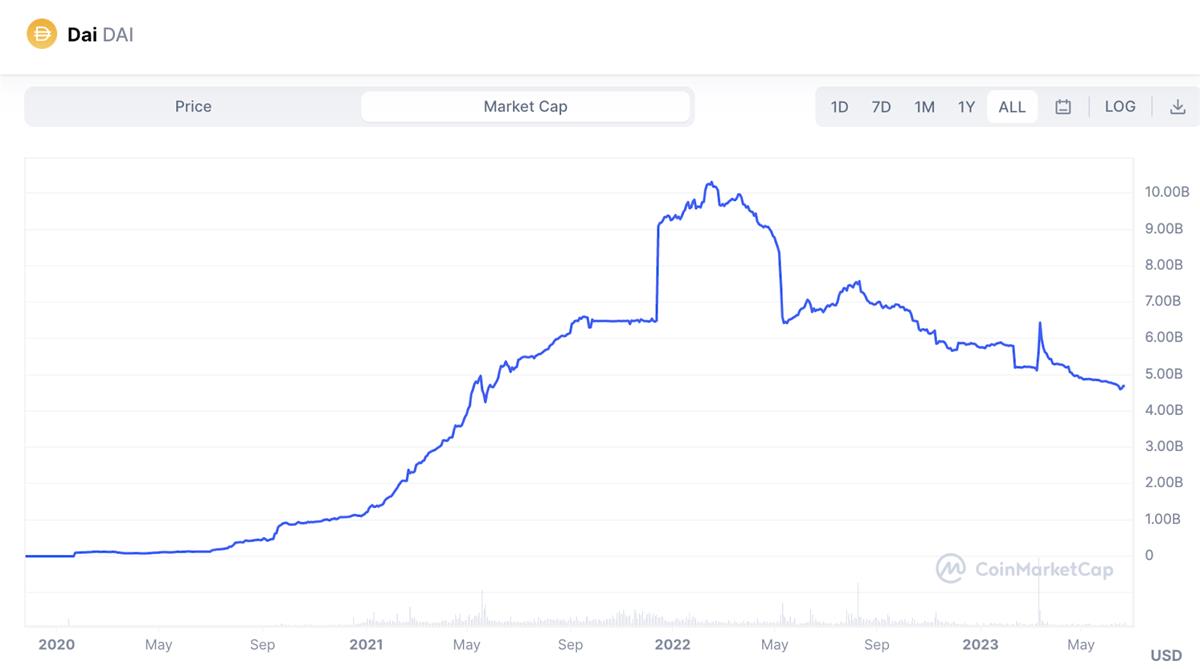

How Do Stablecoins Perform in Data Terms?

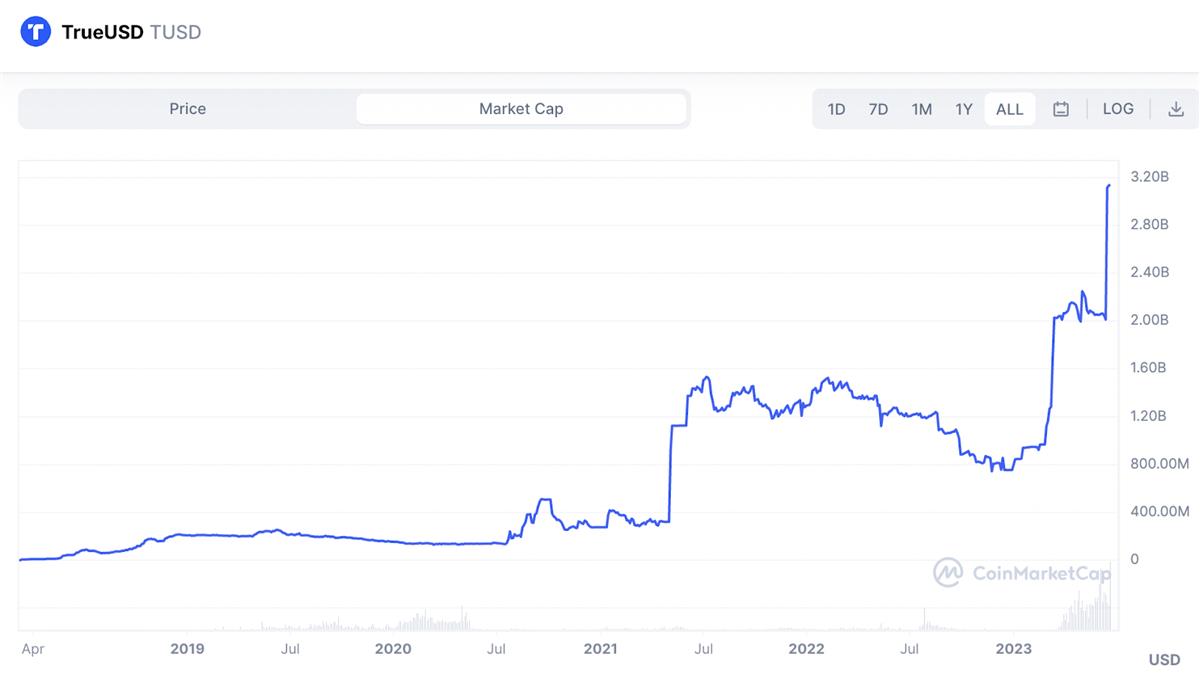

In short, data indicates exponential growth in stablecoin usage. Since 2021, the market cap of stablecoins has risen sharply, underscoring their growing significance in the global economy. Below are market capitalization charts for USDT and other major stablecoins since 2016:

USDT:

USDC:

DAI:

TUSD:

Stablecoins have become a vital part of decentralized finance and daily commercial activities, enabling users to access stable-value assets even in highly volatile markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News