The风口 under Regulation: Which Projects Can Help You Capitalize on the RWA Narrative?

TechFlow Selected TechFlow Selected

The风口 under Regulation: Which Projects Can Help You Capitalize on the RWA Narrative?

This article will explore real-world assets and their applications in the crypto space, while introducing three projects related to RWA.

Author: defizard

Translation: TechFlow

The RWA market is projected to reach $350 billion by 2025. In this article, we will explore real-world assets (RWAs) and their applications in the crypto space, while introducing three RWA-related projects.

Real-world assets (RWAs) refer to physical assets that can be tokenized and represented on a blockchain. In traditional finance, RWAs play a crucial role in lending and yield-generating activities.

However, in the decentralized finance (DeFi) space, their potential remains largely untapped.

The most intuitive and widespread example of RWAs is stablecoins, which are tokenized representations of fiat currencies.

Other RWAs can represent tangible assets such as gold or real estate, or intangible assets like government bonds or carbon credits.

Real-world assets constitute a significant portion of global financial value. In 2020, global real estate was valued at $326.5 trillion, while the market capitalization of gold stood at $12.39 trillion.

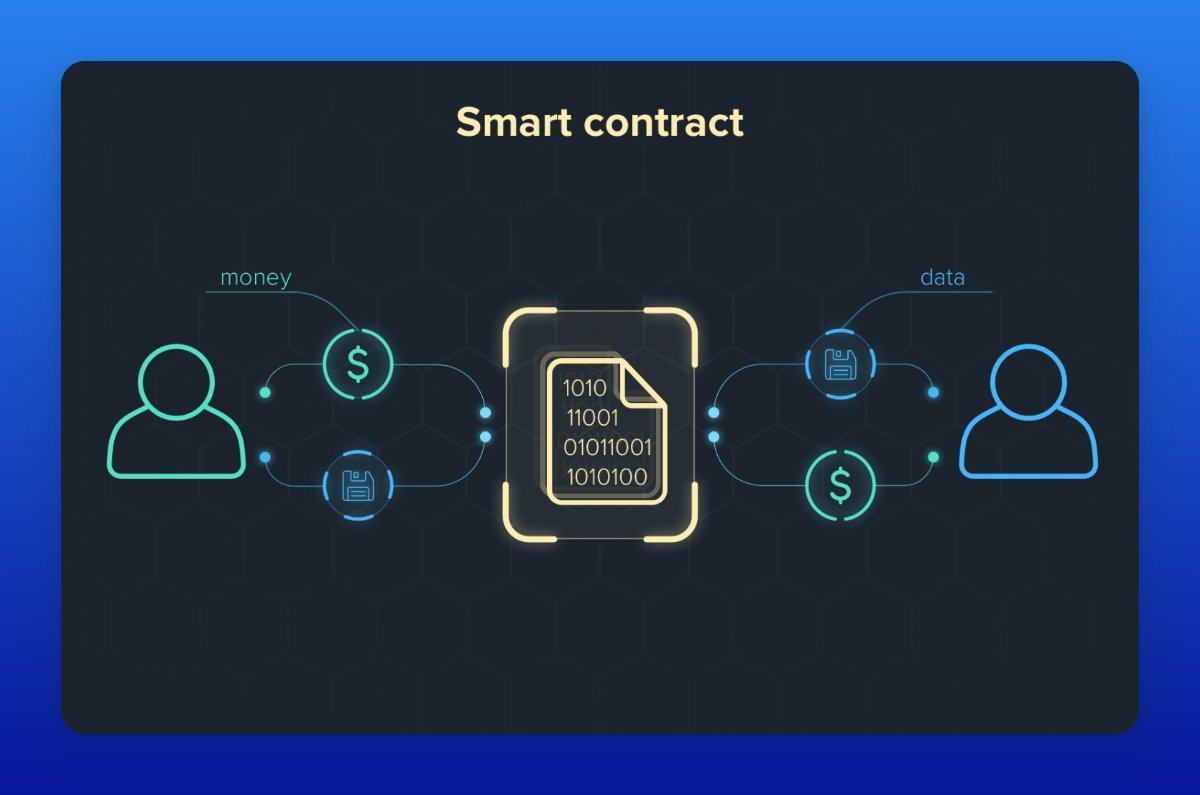

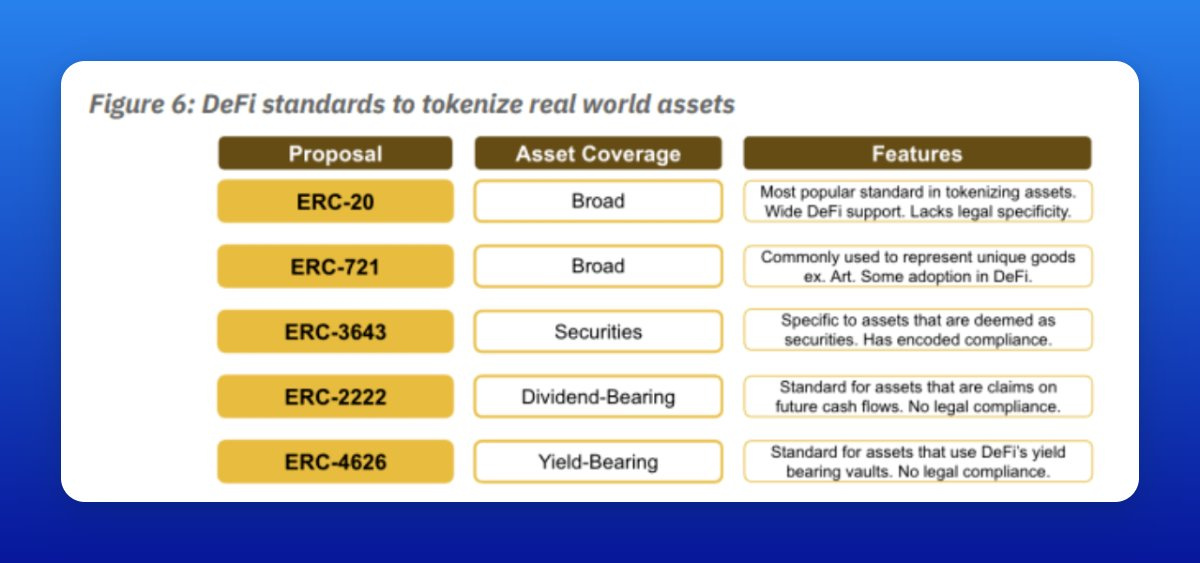

To tokenize an asset, off-chain information must be converted into code and metadata for digital tokens. Developers typically use smart contracts to create these tokens.

The most critical step is identifying or creating a DeFi protocol that tokenizes RWAs into digital assets.

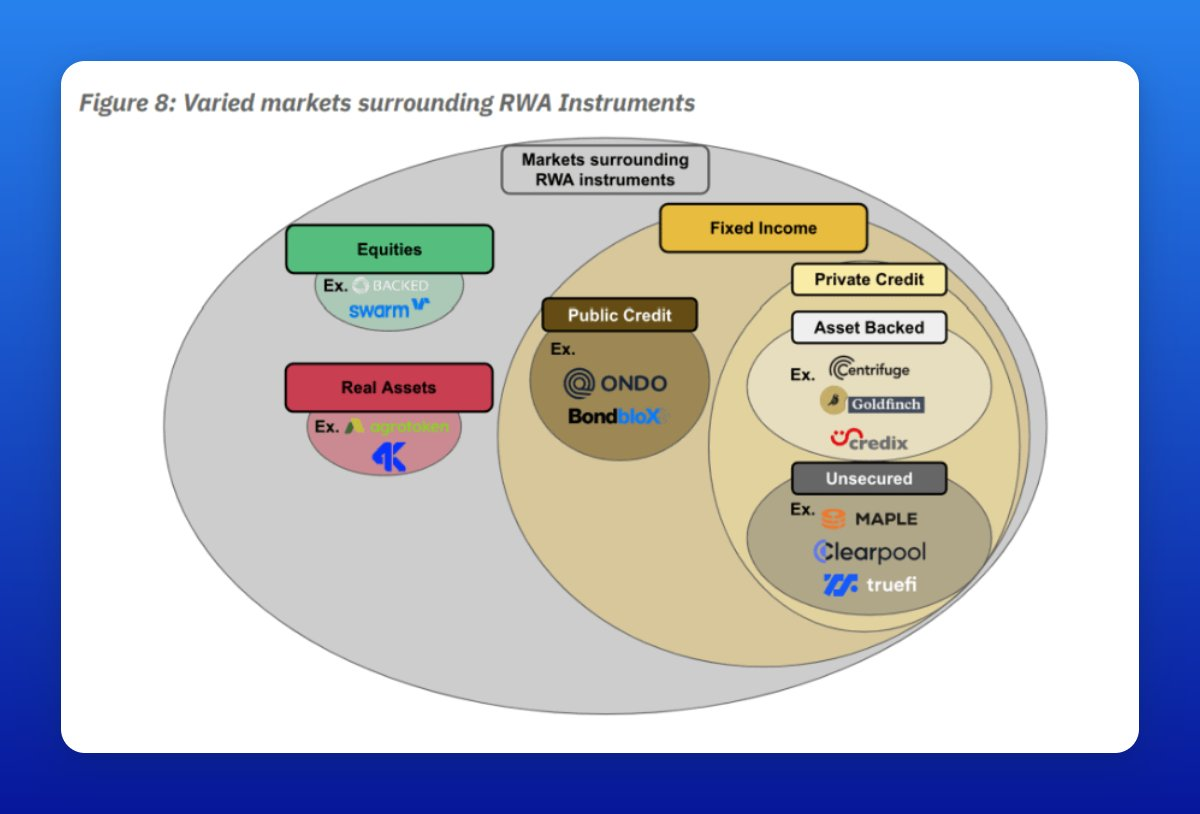

The RWA market in DeFi is small but dynamic. It is divided into equity-based, physical-asset-based, and fixed-income-based DeFi protocols.

Since the RWA sector is still evolving, no single protocol has yet established itself as a dominant player. However, across various research reports, three names consistently emerge: Goldfinch, Centrifuge, and Polytrade Finance.

Goldfinch

Goldfinch enables non-crypto businesses to access crypto-based lending services by using real-world collateral.

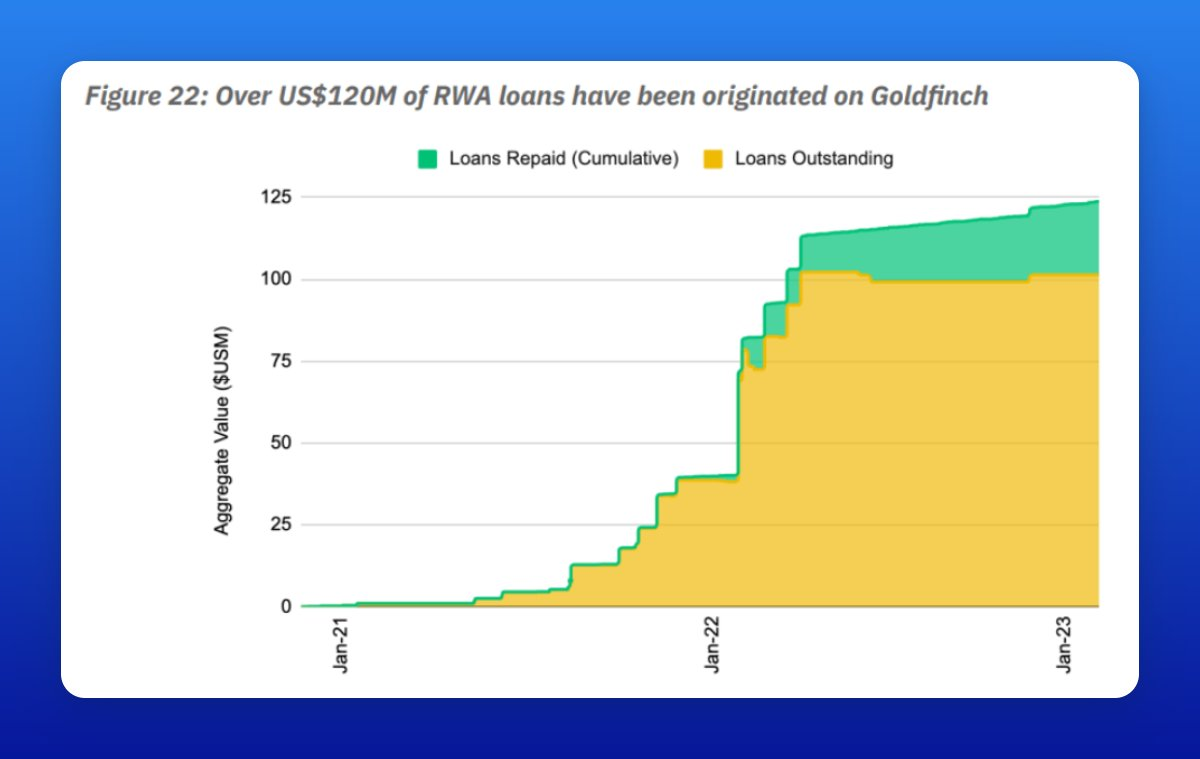

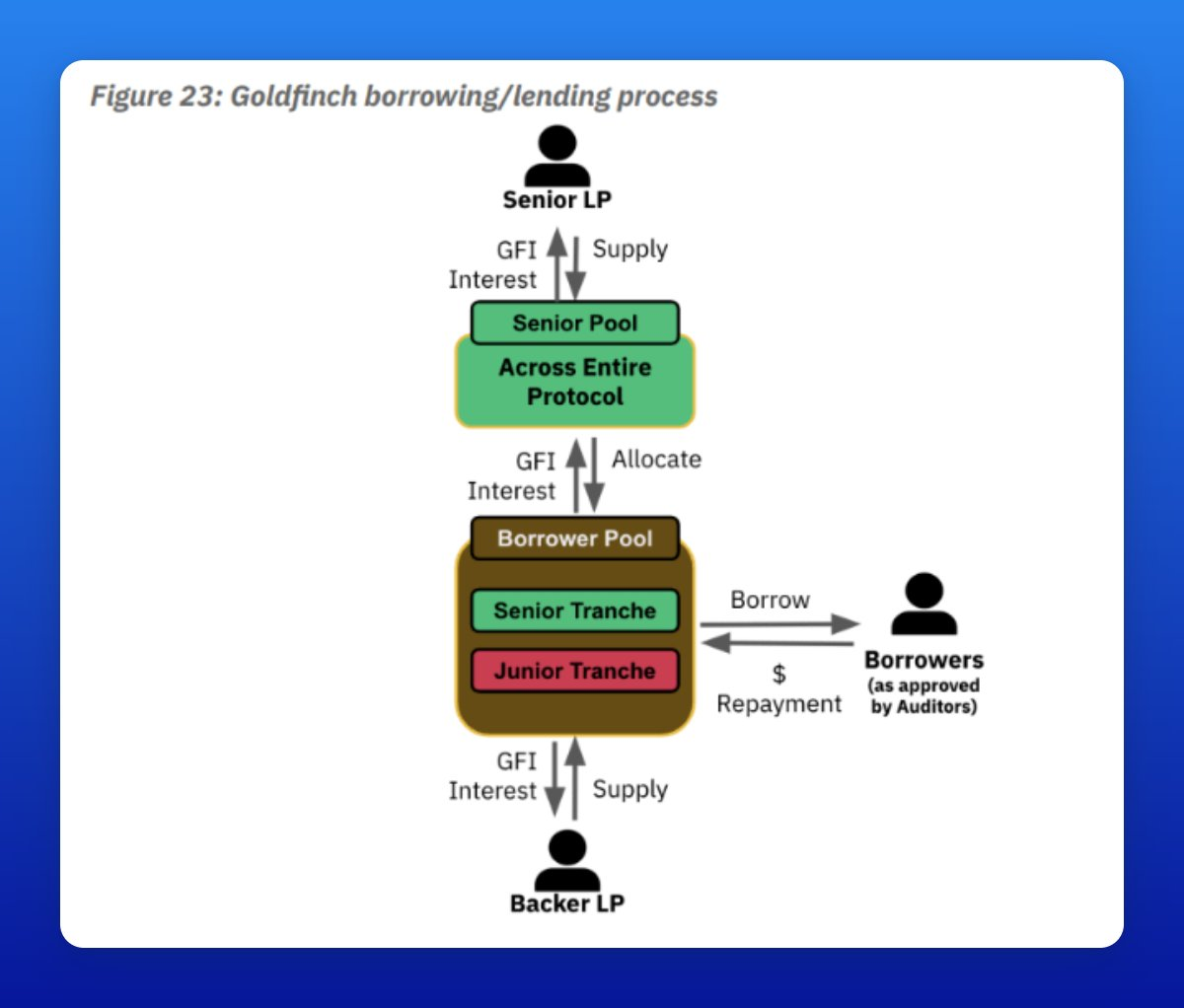

Auditors—holders of the GFI token—vote on creditworthiness and loan approvals. Goldfinch has facilitated over $120 million in loans.

Investors can provide funds to liquidity pools (with lower returns) or take on higher-risk “junior tranches” by directly funding borrowers for higher yields.

Centrifuge

Centrifuge is a decentralized crypto platform that allows users to exchange goods and services without third-party intermediaries. Built on blockchain technology, it uses a unique algorithm to enable secure and fast transactions.

Centrifuge leverages smart contracts to create transparent financing agreements. Users can pledge real-world assets as collateral to obtain funding, bypassing traditional banks. This helps small businesses and individuals who lack access to capital.

Polytrade Finance

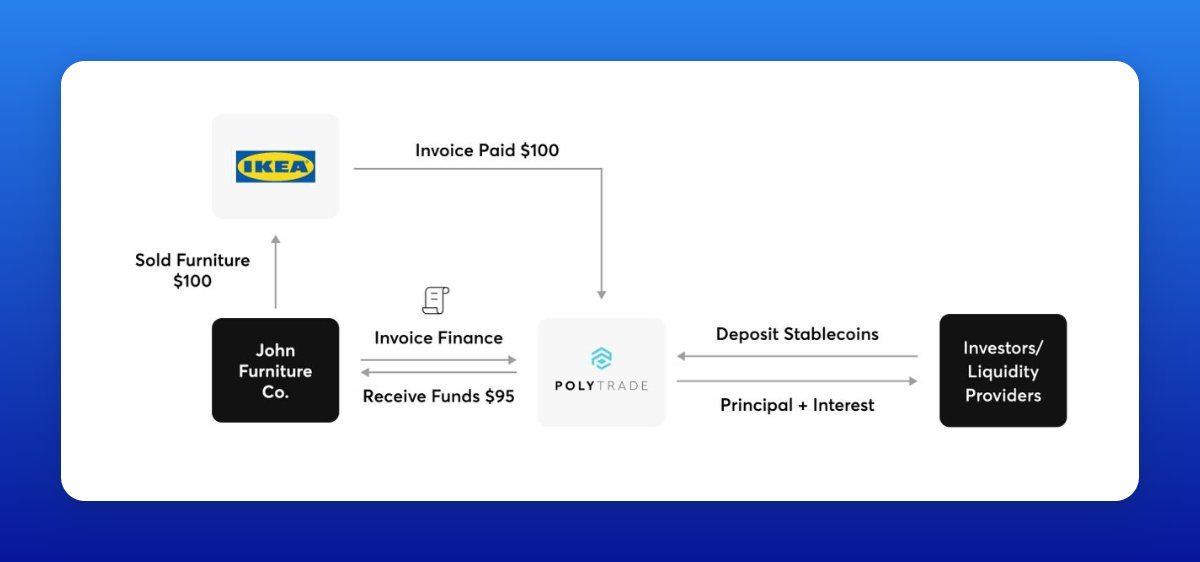

Polytrade Finance is a blockchain-based trade finance platform that supports small enterprises (SMEs) by providing funding to meet short-term financial needs.

The tokens of the aforementioned RWA projects have all declined by approximately 90% from their all-time highs.

-

$GFI - $64.20 → $6.30

-

$CFG - $2.12 → $2.20

-

$TRADE - $1.64 → $0.12

Overall, the tokenization of real-world assets holds immense potential within the cryptocurrency ecosystem.

Projects like Goldfinch, Centrifuge, and Polytrade Finance are actively advancing this domain. By integrating physical assets onto blockchains, we can achieve more efficient, transparent, and decentralized financial services.

Although the prices of RWA project tokens may experience volatility, the underlying technologies and opportunities remain compelling. Over time, we can expect these initiatives—and similar innovations—to play an increasingly significant role in transforming both the financial industry and the global economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News