Stablecoin Competition Landscape: Will LUSD Become the Best Choice Over USDC and USDT?

TechFlow Selected TechFlow Selected

Stablecoin Competition Landscape: Will LUSD Become the Best Choice Over USDC and USDT?

How should users screen among the various different stablecoins?

Written by: Rxndy444

Compiled by: TechFlow

*TechFlow Note: This report was produced in collaboration with Rxndy444 and Liquity Protocol and does not constitute investment advice.

Crypto narratives come and go, but stablecoins as a core component of on-chain financial infrastructure are here to stay. Currently, there are over 150 stablecoins in the market, with new ones seemingly launched every week. How should users navigate this wide array of choices?

When evaluating the pros and cons of different stablecoins, it's helpful to categorize them based on design elements. What are the fundamental variations among stablecoins? The key differences include:

-

Collateral Assets——Are these tokens fully backed by assets? Partially backed? Or unbacked?

-

Centralization——Does the collateral involve government-backed assets such as USD, GBP, or treasury bonds? Or is it composed of decentralized assets like Ethereum?

With these attributes in mind, we can begin building a framework for comparing different stablecoins.

Diving into Decentralized Stablecoins

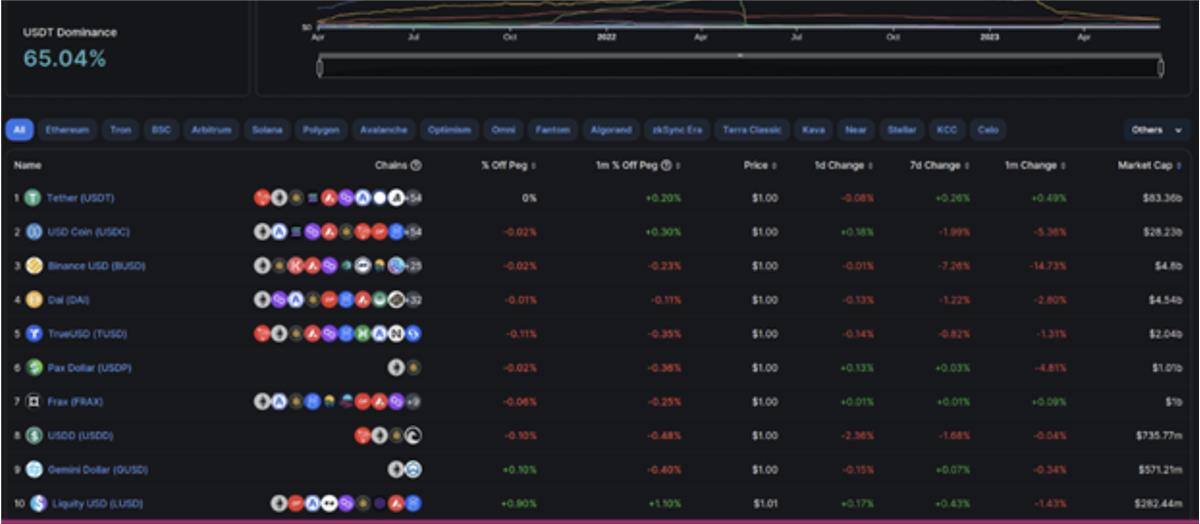

Looking at the top 10 stablecoins by trading volume, we see that centralized stablecoins essentially function as on-chain dollars and are the most widely used. However, they cannot offer censorship resistance nor immunity from traditional financial crises. For example, when Silicon Valley Bank collapsed in March, USDC holders had to worry about its reserves held at that bank. Many rushed to swap their USDC for more reliable alternatives—an instance where decentralized premium once again came into play.

The ultimate goal for stablecoins is to resolve the trilemma of decentralization, capital efficiency, and price peg stability—areas where USDC and USDT clearly fall short. To advance the stablecoin industry, we must look beyond these two options. So what does the current competitive landscape look like?

Among the top 10, only three can be considered somewhat decentralized: DAI, FRAX, and LUSD.

Frax: The Algorithmic Path

Frax is a partially reserved stablecoin that uses an AMO (Algorithmic Market Operations) system to adjust its collateral ratio and maintain its peg. At the most basic level, when the price drops below $1, the AMO increases the collateral ratio; when above $1, it decreases it. For FRAX holders, this means redeeming the stablecoin according to the current collateral level. If the collateral ratio is 90%, then redeeming 1 FRAX yields 0.90 USDC from protocol reserves plus FXS (Frax Shares) worth $0.10 minted by the AMO. Due to the dynamic nature of the collateral ratio, it’s difficult to calculate the actual amount of collateral backing FRAX at any given time.

Recent proposals indicate community support for transitioning toward a fully collateralized model. This shift is largely driven by increased regulatory scrutiny on algorithmic stablecoins following the collapse of Terra’s UST.

Overall, algorithmic stablecoins remain a highly experimental area in the market. Although Frax has successfully grown using its AMO model, it appears to be evolving away from its original approach.

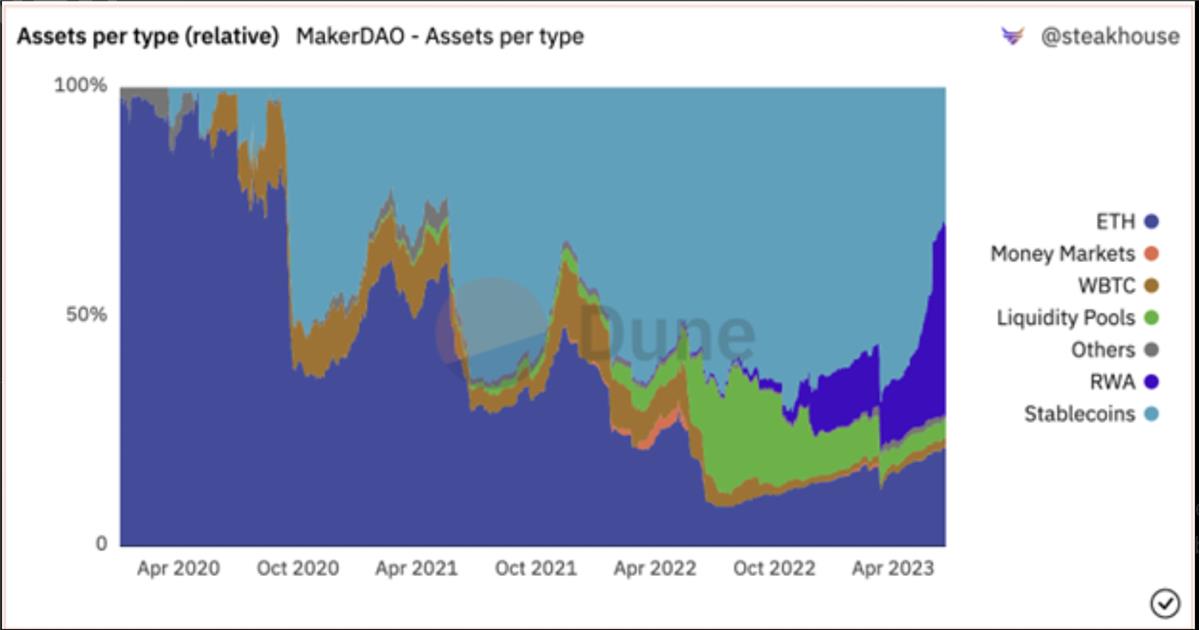

DAI: Partially Decentralized

DAI has proven to be the most successful stablecoin outside of chain-linked dollars like USDC and USDT, thanks to its CDP (Collateralized Debt Position) model. A key limitation many may initially overlook is that DAI borrowing often uses the same centralized stablecoins as collateral, exposing it to similar centralization risks. Since expanding to a multi-collateral model, these centralized stablecoins have become a significant part of DAI’s backing—sometimes exceeding 50%.

Types of DAI collateral by dominance

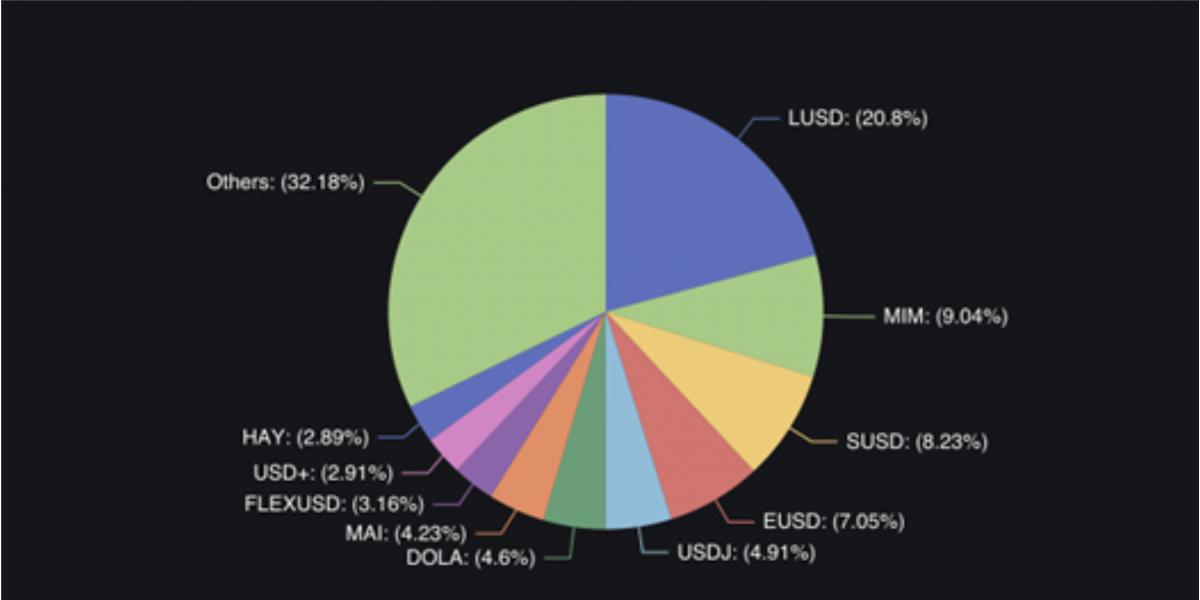

Given the reserve uncertainties identified in both Frax and DAI, let’s examine the rest of the decentralized stablecoin market. Which stablecoins are both decentralized and backed solely by crypto assets?

Market share of crypto-asset-backed stablecoins

LUSD

In the space of stablecoins backed exclusively by crypto assets, LUSD stands out as the most significant so far. It has achieved this position by establishing solid foundations: immutable smart contracts, economically sound peg mechanisms, and capital-efficient features that allow growth without compromising collateral ratios.

Although Liquity’s smart contracts will always remain on Ethereum, LUSD has now been bridged to Layer 2 networks, with over $11 million in total liquidity across Optimism and Arbitrum.

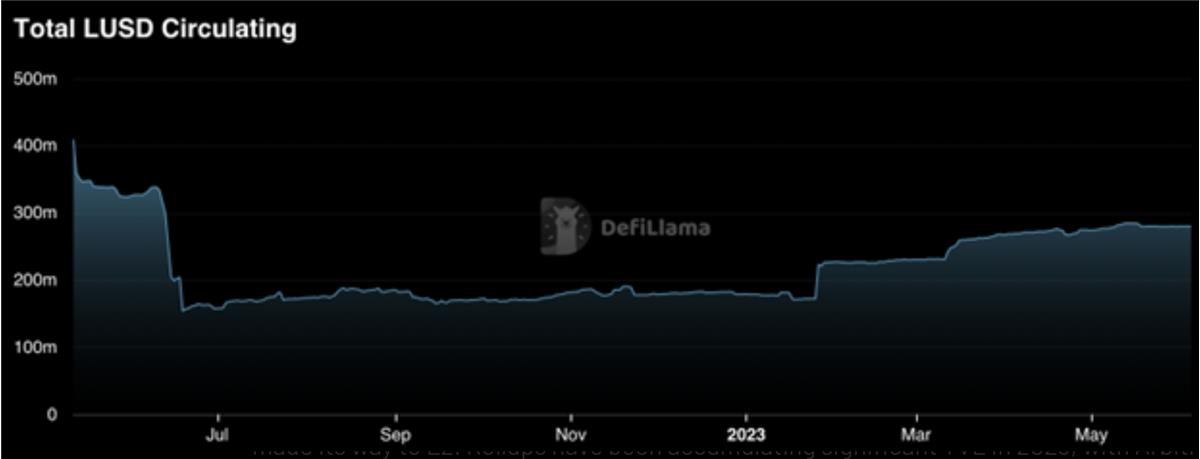

LUSD Circulating Supply

Since the beginning of the year, LUSD’s circulating supply has increased by over 100 million tokens, with more than 10 million flowing into L2 networks.

In 2023, rollup technologies have accumulated substantial Total Value Locked (TVL). Arbitrum’s TVL grew from $980 million to over $2.3 billion, while Optimism’s rose from $500 million to $900 million. Not only do mainnet users value decentralized stablecoin options, but this also presents ample opportunity for LUSD to capture greater market share on L2s.

Beyond circulating supply, the number of Troves has also surged significantly this year, nearing all-time highs. Over 1,200 active Troves haven’t been seen since the 2021 bull market—and this is notable considering Ethereum’s price remains far below those levels. This suggests users are prioritizing stablecoin utility over ETH leverage trading.

Stablecoin Market Trends

Forks

It’s often said that imitation is the sincerest form of flattery, and several new stablecoins are now copying Liquity’s model. Most adopt the same CDP-style structure, using staked ETH as collateral. This makes perfect sense given the attention staked ETH and LSDs (Liquid Staking Derivatives) received in the first half of 2023. With withdrawal capabilities now live, staked ETH has become more liquid and attractive.

Is staked ETH a better collateral asset than ETH? It's hard to say definitively, but there are clear trade-offs to consider. The primary advantage of using LSDs like stETH as backing is their yield-bearing property.

The main drawbacks, however, stem from the combination of slashing risk and potential de-pegging of the LSD itself. As a result, these stablecoins typically require higher minimum collateral ratios compared to LUSD.

Beyond these risks, the contracts of these stablecoins are upgradeable and controlled by multisig, unlike Liquity’s immutable smart contracts. This means parameters like collateral ratios could change over time. Staked-ETH-backed stablecoins are indeed interesting and score high on decentralization and yield generation, but they are less capital efficient than pure ETH due to the added risk exposure.

USD Risk and the Decentralization Premium

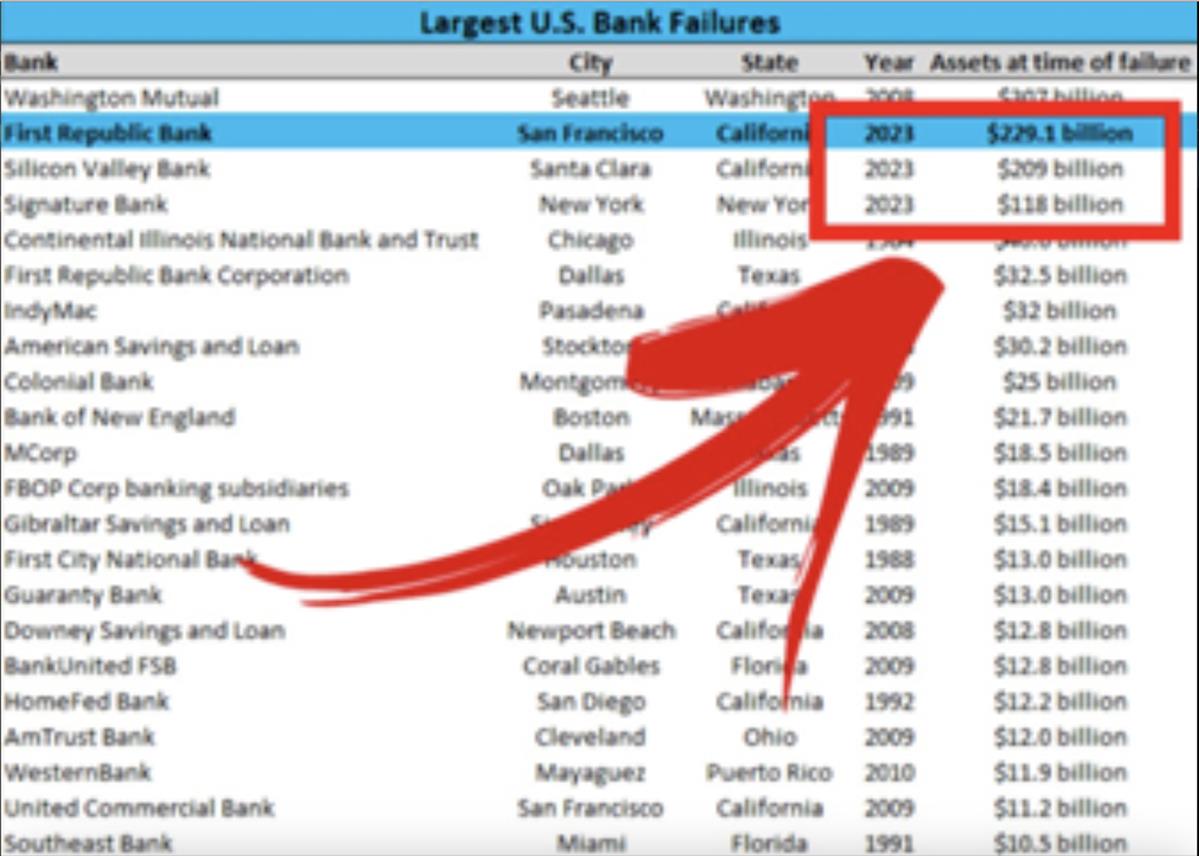

One point raised at the beginning of this article bears revisiting—the recent traditional finance banking crises. Silvergate, SVB, and First Republic represent three of the largest bank failures in U.S. history—all occurring within the past few months.

The real question behind these events is: In times of crisis, where would you feel safest keeping your money?

Not all dollars are created equal—as recent bank collapses remind us, deposits can vanish overnight. While FDIC insurance covers up to $250,000 and governments have shown willingness to bail out failing banks, the fractional reserve system means people still seek safe havens during uncertain times.

This leads to bank runs, and we’ve seen firsthand how this impacts fiat-reserve-backed stablecoins like USDC and those exposed to SVB.

During periods of uncertainty, decentralized stablecoins serve a relevant use case for those focused on asset protection, offering true non-custodial ownership. From a resilience standpoint, which stablecoin would you choose for a horizon longer than five years? If it’s built on immutable smart contracts and can always be redeemed for a fixed amount of decentralized assets, you’ve made the right choice.

This is why LUSD typically trades at a premium during crises: when more centralized stablecoins appear risky, people want to hold it. Prioritizing decentralization in the stablecoin trilemma is what sets LUSD apart from many others—and enabled Liquity to grow its Total Value Locked (TVL) by over $380 million during the bear market.

Conclusion

Each bank failure reaffirms the value of truly decentralized stablecoins, and the market consistently views LUSD as the stablecoin to hold during turbulent times.

The addition of bridges and liquidity venues on L2 networks opens access to LUSD for a broader set of market participants, while preserving the immutability that makes the protocol so resilient. We’ve all witnessed the shortcomings of centralized stablecoins, and while algorithmic stablecoins may promise similar decentralization, they have yet to reach a level of reliability for widespread adoption.

LUSD is designed to withstand the test of time and adverse market conditions—a claim already validated by its consistent growth throughout the bear market. Now that staked ETH has become a dominant asset in crypto, we’re seeing new protocols emulate Liquity’s model using LSDs as collateral, further proving the strength of its design.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News