Compound founder launches new company "Superstate": tokenizing U.S. Treasuries on Ethereum

TechFlow Selected TechFlow Selected

Compound founder launches new company "Superstate": tokenizing U.S. Treasuries on Ethereum

In contrast, Superstate's advantage lies in the founder's access to a substantial number of wealthy individuals within the crypto world.

By 0xmin

AAVE founder Stani Kulechov now emphasizes his new identity even more: founder of the Web3 social protocol Lens Protocol.

Similarly, Robert Leshner, founder of Compound—one of the leading DeFi lending protocols—also appears unwilling to stay idle, embarking on a new entrepreneurial journey targeting today’s hottest narrative—tokenization of real-world assets (RWA).

On June 29, Robert Leshner announced the launch of his new company, Superstate, via Twitter.

"Today, I’m excited to announce the founding of a new company, Superstate, with a mission to create regulated financial products that connect traditional markets and the blockchain ecosystem.

The main limiting factor of DeFi is that crypto-native assets are currently the only interoperable assets. Ultimately, however, hundreds of trillions in 'off-chain' assets will move onto blockchains, and we plan to facilitate this migration.

On Monday, we filed a preliminary prospectus with the U.S. Securities and Exchange Commission (SEC) for the Superstate Short-Term Government Bond Fund—the first step in our long journey to upgrade financial markets."

According to documents filed with the U.S. Securities and Exchange Commission (SEC) on June 26, Superstate will use Ethereum as a secondary record-keeping tool and launch a short-term government bond fund investing in "ultra-short-term government securities," including U.S. Treasury bonds and government agency securities. Additionally, the filing explicitly states that this fund will not directly or indirectly invest in any assets relying on blockchain technology, such as cryptocurrencies.

Superstate has already secured $4 million in seed funding from investors including ParaFi Capital, 1kx, Cumberland Ventures, and Distributed Global.

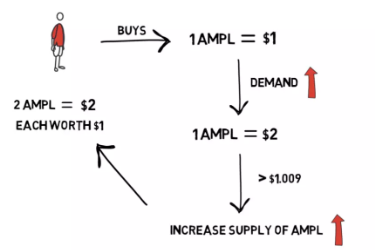

In simple terms, they aim to purchase short-term U.S. Treasuries and tokenize them, using blockchains like Ethereum as secondary ledgers to track ownership shares of the fund, enabling direct on-chain trading and transfer.

If Superstate's product gains approval, crypto millionaires and blockchain-native funds could earn high returns from U.S. government bonds without changing their investment management approach—especially since current risk-free U.S. Treasury yields have clearly surpassed DeFi yields.

In a statement to the media, Superstate stated, "Our vision is to create an SEC-registered investment product that, over time, will compete with stablecoins as a reserve asset and settlement option in crypto."

Starting with tokenized U.S. Treasuries, once this use case becomes real and widely adopted, it could pave the way for tracking and trading real-world assets on blockchains—though this path is fraught with layers of regulatory hurdles.

Founder Leshner also noted that every holder of the asset must be whitelisted, and Superstate will not whitelist smart contracts such as Uniswap or Compound, meaning these DeFi applications cannot access it.

Will Superstate’s on-chain Treasury product gain SEC approval?

Currently, the probability seems quite high, as two similar products have already received approval from U.S. regulators.

Franklin Templeton’s "FOBXX": Launched in 2021, this fund became the first mutual fund registered in the U.S. to use blockchain for processing transactions and recording ownership.

WisdomTree’s "WTSIX": A digital short-term Treasury fund launched in 2022, investing in short-term U.S. Treasuries and using blockchain for secondary record-keeping.

Jarrett, President of WisdomTree, previously said: "We expect all financial assets to eventually migrate to blockchain infrastructure. This is an important step forward, bringing mainstream investments like fixed income, equities, and commodities into the digital world through blockchain-backed funds and tokenized assets."

WTSIX officially launched on January 18, 2023, with a fee rate of 0.41% and a minimum investment of $25, but its total net value currently stands at only $993,600.

By comparison, Superstate’s advantage lies in the fact that its founder has extensive connections among wealthy individuals in the crypto world.

In 2021, Compound Labs launched Compound Treasury in collaboration with Fireblocks and Circle, allowing institutional clients such as fintech companies to convert U.S. dollars into USDC. These USDC tokens were then deployed on Compound at a guaranteed interest rate of 4%, which far exceeded U.S. Treasury yields at the time.

In 2022, SCB 10X, the venture arm of Thailand’s Siam Commercial Bank, announced a deposit into Compound Treasury. However, by Q1 2023, Compound Treasury was shut down, as DeFi yields had become both risky and low.

Then comes the question: if the U.S. enters a significant rate-cutting cycle, causing Treasury yields to drop sharply while DeFi yields surge again, what would be Superstate’s narrative then?

Previously, Compound Treasury helped traditional off-chain institutions profit within the crypto world; now, Superstate helps crypto elites profit in the fiat world. Different paths, same goal.

From Compound Treasury to Superstate, comrade Robert Leshner remains true to his original mission: helping the rich make even more money.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News